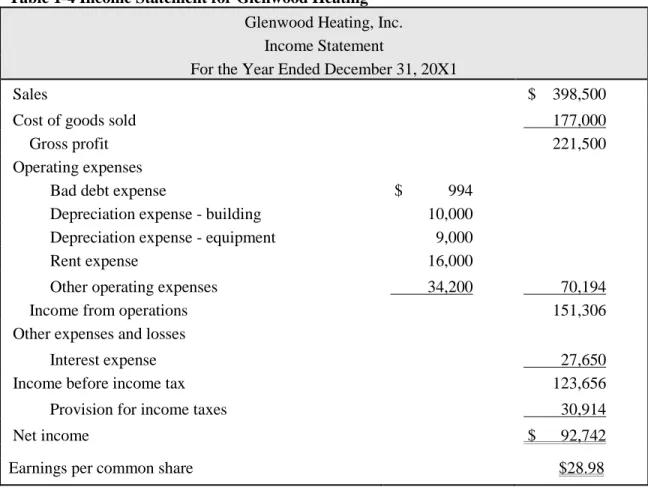

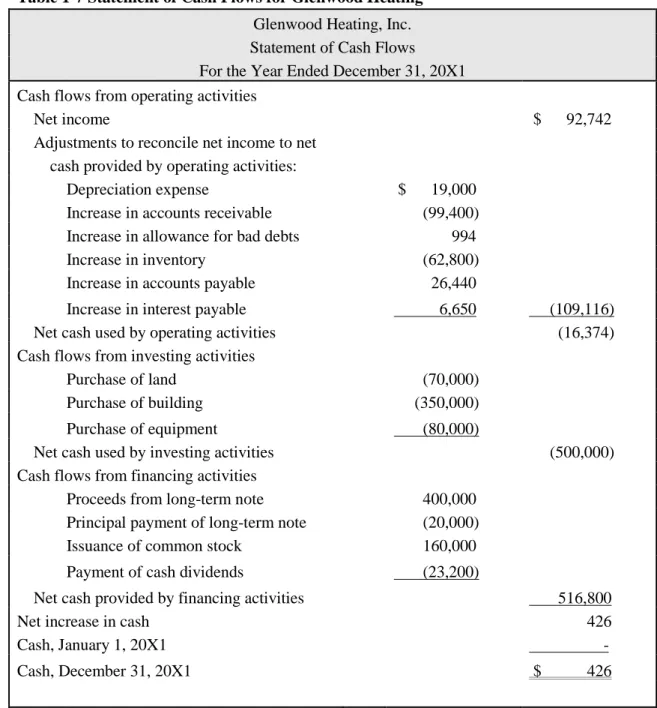

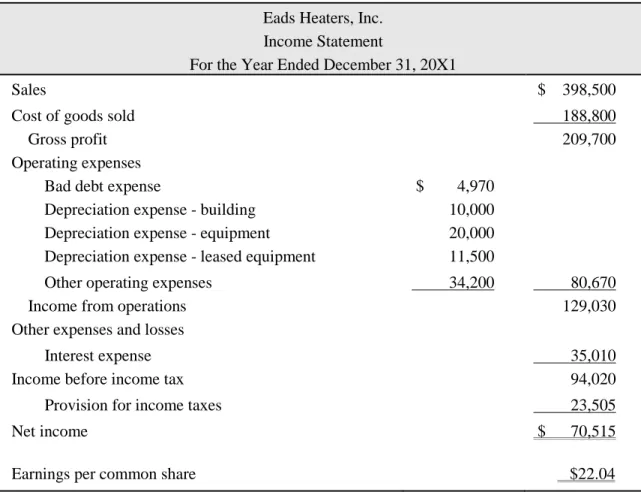

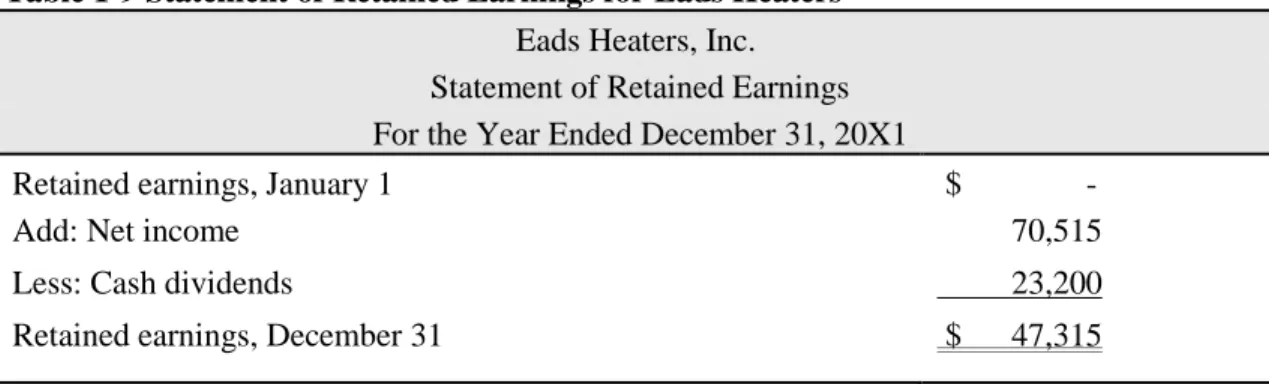

Although the companies engaged in the same transactions during the year, the managers of each company made different accounting choices and estimates for adjusting year-end entries. Different accounting choices and estimates thus affect the amount of expense recorded in the accounts.

Analysis of Additional Transactions (Part B)

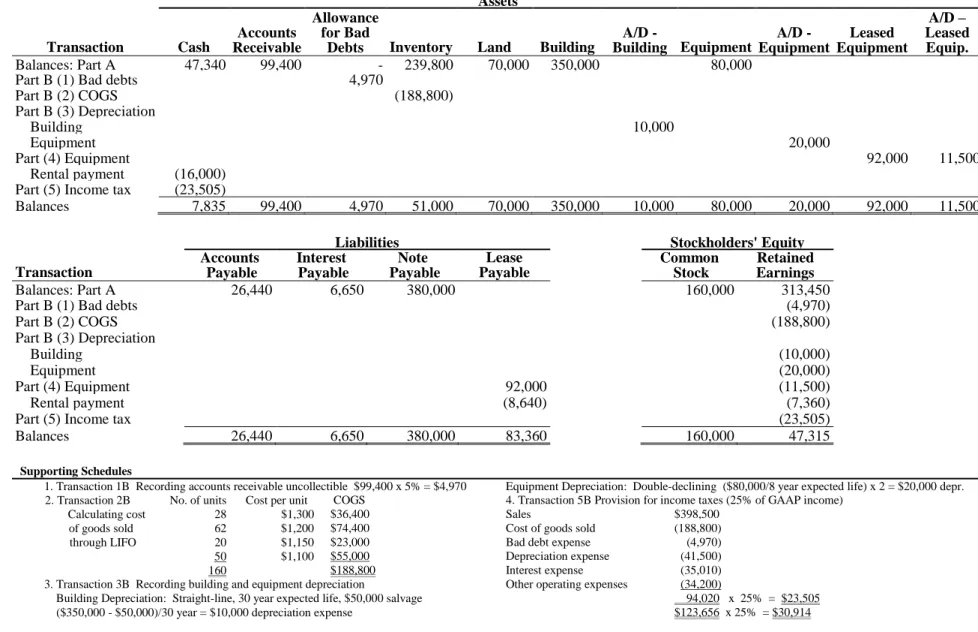

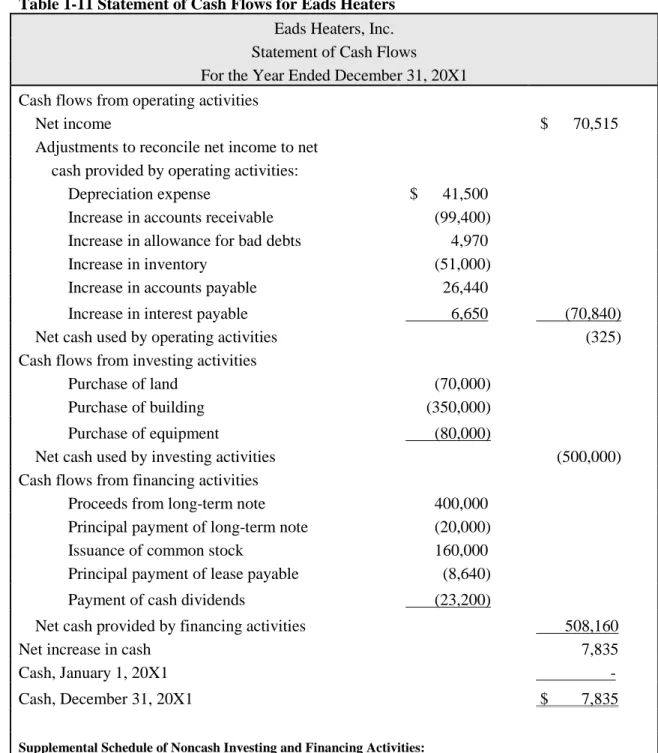

Capitalization of the equipment results in higher charges against income in the early years of the capital lease agreement, as Eads must record the depreciation expense of the equipment as well as the interest expense payable on the lease. Thus, Eads will have lower revenue and lower retained earnings than Glenwood during the early years of the lease.

Financial Statements

Conclusion

Executive Summary

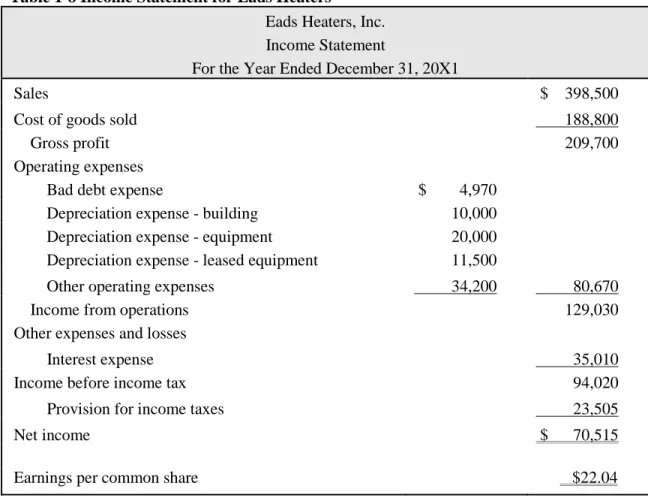

Income Statement Presentation

Totz should report the income from these activities under the sales section of the income statement, but must distinguish between the different sources of income. Thus, the expenses incurred by Totz to purchase and produce inventory are part of the cost of sales section of the income statement. Since the sales section of the income statement distinguishes between product revenue and service revenue, ASC-225-10-S99-2 requires Totz's related expenses to be allocated between the cost of tangible goods sold and the cost of services.

Thus, transportation and import costs are included in sales costs as acquisition costs, while direct labor and product costs are part of production costs included in the income statement. This profit from the sale of the company's headquarters should be treated as a capital gain and classified as operating income. Detailed rules in the Codification explain the correct presentation of revenues from the sale of products and services in the sales section of the profit and loss account.

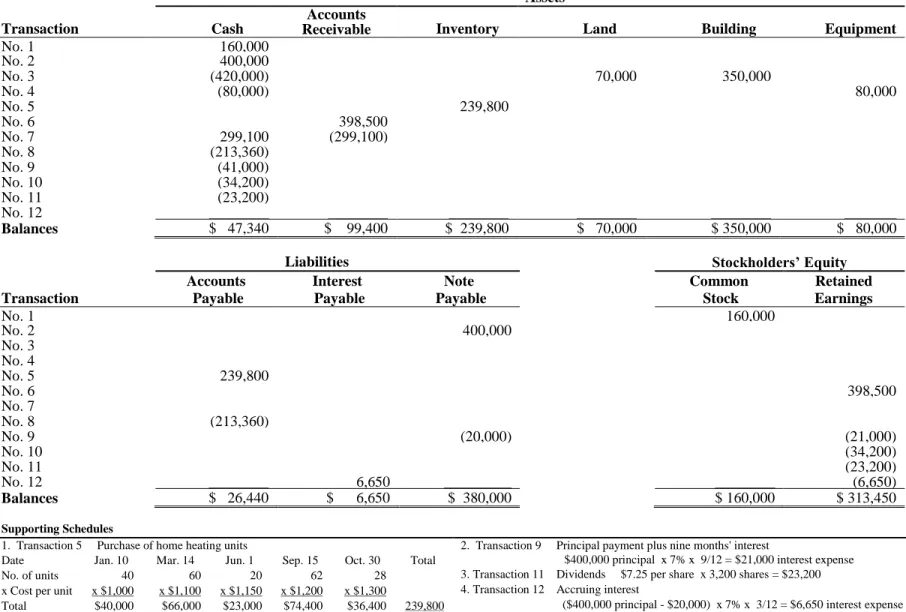

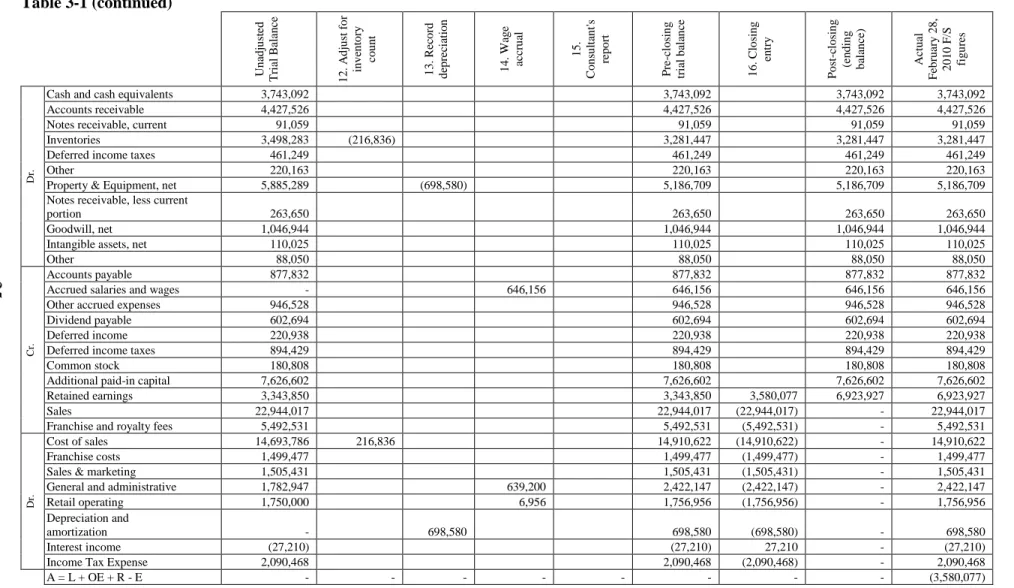

While the changes in each account for each transaction can be inferred from the data sheet, Table 3-2 provides a more formal presentation of the journal entries, including adjusting entries, for Rocky Mountain's fiscal year 2010 transactions. The previous trial balances and annual accounts illustrate the connection between the different stages of the accounting cycle. Rocky Mountain Chocolate Factory's transactions were recorded in journal entries, and changes in each account were accumulated in the unadjusted trial balance.

Rocky Mountain Chocolate Factory's data sheet, journal entries, trial balances, and financial statements highlight the relationships between each step of the accounting cycle and between the various financial statements. With the close of entries completed, Rocky Mountain Chocolate Factory is prepared to begin the financial reporting process anew in the following year.

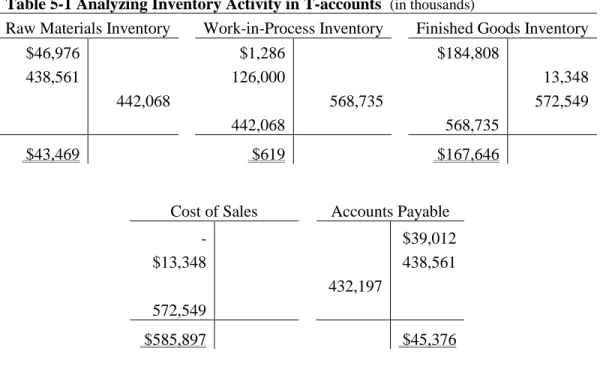

Inventory Analysis

The account for the allowance for obsolete or non-tradable inventory does not appear directly from the company's accounts. The company may not be able to sell the finished goods as they are no longer wanted by customers. The company could also have overproduced and failed to sell the remaining finished goods.

The cost of finished goods transferred from work in process is $568,735 for the current year. The company's inventory turnover ratio for the current year is 2.63 times, and the inventory turnover ratio for the previous year was 2.29 times. The inventory holding period is how many days the company needed to manufacture and sell its inventory.

An analyst may also want to know whether the company can increase sales while reducing the amount of obsolete or unsaleable inventory. In addition, the company uses a provision for inventory that may be obsolete or unsaleable. Through these specialized inventory accounts, the company can calculate ratios for inventory turnover and inventory holding period that reveal both increased efficiency and opportunities for improvement.

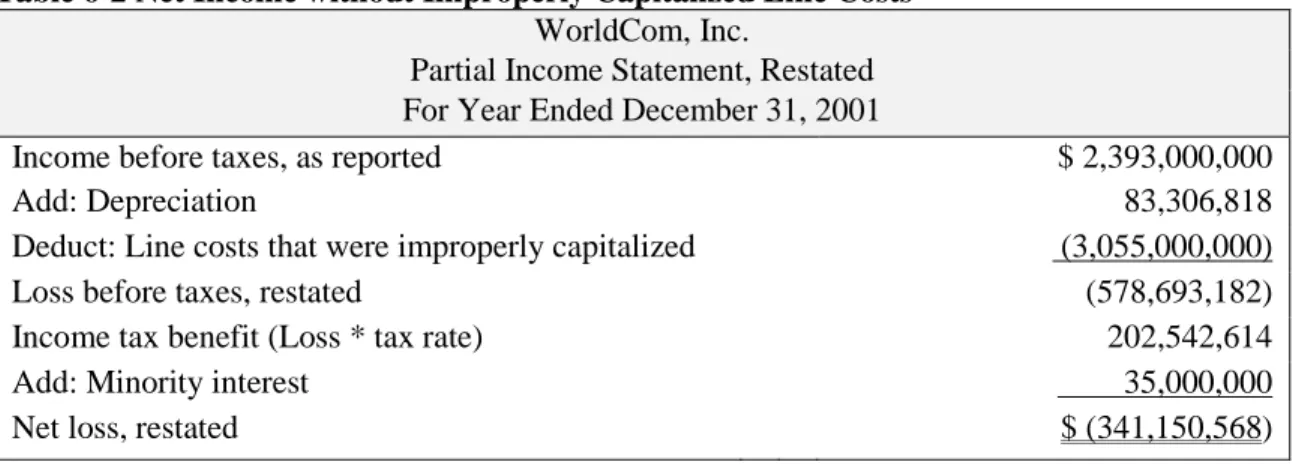

Analysis of Financial Reporting of Line Costs

The company categorized a significant portion of the costs as capital rather than operating expenses, and this one accounting decision, which represented millions of dollars, turned a loss into a profit on the company's income statement. The decision to capitalize a specific cost therefore initially prevents the income statement from experiencing a significant reduction in profit and instead spreads the costs over several periods. These line charges are costs paid to local telephone networks for using their lines to make calls.

WorldCom declassified the line cost to capitalize the expense in the property, plant and equipment accounts. These costs appear in the assets section of the balance sheet under property, plant and equipment. If WorldCom had not improperly capitalized line costs, the 2001 income statement would have shown a net loss calculated in Table 6-2 assuming an income tax benefit was realized.

This net loss differs materially from the positive profit reported in WorldCom's 2001 income statement. This accounting choice allowed the company to defer costs so that current year revenues were not reduced by the total amount of costs. In preparing financial statements for the year ended December 31, 20X1, Targa must determine how to account for these new costs in accordance with generally accepted accounting principles of the United States (U.S. GAAP).

Employee Benefits

In accordance with this plan, Targa will lay off certain employees and provide them with severance packages. The plan shall establish the terms of the benefit arrangement, including the benefits that employees will receive upon termination (including but not limited to cash payments), in sufficient detail to allow employees to determine the type and amount of benefits determine what they will receive if they are involuntarily dismissed. ended. The memorandum also shows that the expected completion date of the termination process is January 31, 20X2.

To meet the criteria, management sets the terms for the twelve weeks of salary benefits, some of which are dependent on employment. Furthermore, ASC states that “an entity's communication of a promise to provide one-time severance benefits for employees is a promise that, on the date of communication, creates an obligation to provide the severance benefits if employees are laid off.”. If employees are required to provide services until they are terminated to receive the severance benefits and will be retained to provide services beyond the minimum retention period, a liability for the severance benefits should be initially measured at the date of communication on a fair value basis . of the obligation from the end date” (ASC.

Therefore, because the benefit is contingent on the continued employment of the employees through the closure of the facility, Targa's liability for the termination benefits will be based on the fair value of $2.5 million, and if the liability is recognized pro rata, part of the $2.5 million will be included in the 20X1 financial statements. Targa will therefore recognize the liability and costs for the two-week severance payment in the 20X1 financial statements as the costs can be estimated at $500,000 and payment of the severance payment in 20X1 became probable with the announcement of the restructuring plan. The existence of a provision for the one-off payment in the manager's employment contract suggests that this severance payment is part of an ongoing benefit scheme.

Retraining and Relocation Costs

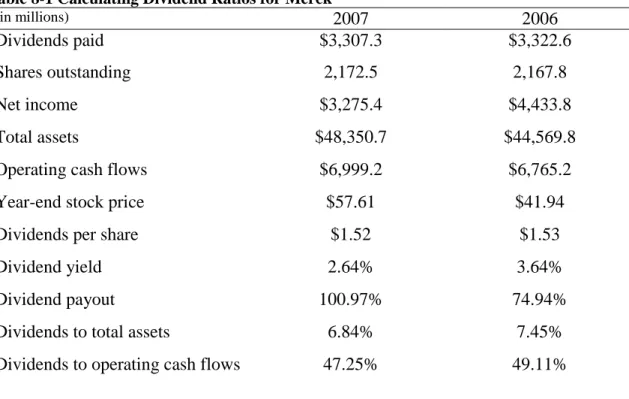

Through the guidance provided by FASB standards, Targa's accountants can prepare 20X1 financial statements that reflect the current restructuring plan. Company financial statements present shareholders' equity disclosures through which individuals can gain insight into the company's share issuance, share repurchases, and dividend payments.

Concepts, Process, and Analysis

Grant Date – The grant date is the start date of the stock plan or contract. Vesting Period - The vesting period is the time between the grant date and the vesting date. The excess tax benefit from stock-based compensation is reflected in the financing section of the statement of cash flows.

The contract is thus to deliver beer against the customer's payment, and the contract is entered into when the customer agrees to the price. Thus, $5 is fully allocated to the performance obligation to provide a cup of beer in return for payment. Bier Haus thus fulfills its performance obligation at the time the bartender is paid and delivers the beverage to the student.

After the bartender declares that the business is out of pretzels, the customer and the Bier Haus make a contract for the student to get a large beer and a. Also, the company has the obligation to provide two pretzels if the coupon is redeemed in the future. Bier Haus has met the performance obligation to provide beer to the customer, so it can recognize beer revenue.

However, Bier Haus has not yet provided the customer with two pretzels, the value of the coupon. Thus, the transaction price for redeeming the coupon is $2.88, as this is the amount that Bier Haus receives.

Concepts and Process

A company reports deferred tax as part of the total income tax expense to give a better picture of the company's current tax liability as well as future liabilities. A deferred tax valuation allowance is an account that reduces a deferred tax asset and must be recorded when it is more likely than not that at least a portion of the deferred tax asset will not be realized. For an operating lease, the leased asset does not become part of the lessee's balance sheet, but remains a capitalized asset on the lessor's balance sheet.

At the end of the lease, there is no option to purchase at a bargain price and ownership is not transferred at the end of the lease. In addition, the lease term of five years does not exceed 75 percent of the useful life of the asset. Finally, the present value of the minimum rents is not greater than or equal to 90 percent of the asset's fair value.

The present value of the future minimum lease payments is $219,643 thousand, as calculated in Table 12-2. If the leases were capital leases, Build-A-Bear Workshop would have recorded one journal entry to record interest expense and lease payments, and one journal entry to record depreciation of the leased asset in fiscal year 2010. The current capital lease ratio for Build-A-Bear is lower than the operating lease ratio because the current portion of the long-term lease obligation increases.