This is the most important statement to analyze in comparing these two companies. In the first year, Eads lost only $325 in operating activities compared to Glenwood's massive loss of $16,374.

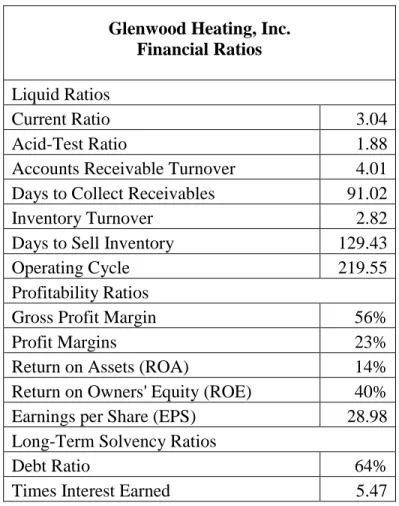

INCOME AND ASSET RATIOS

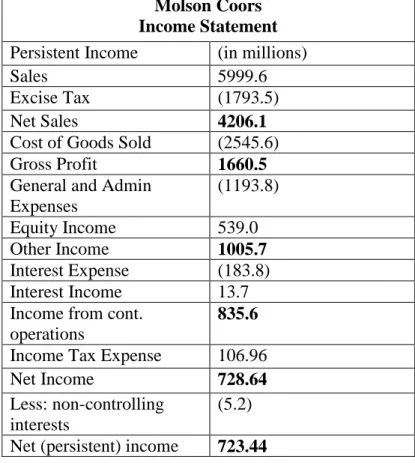

Continuing income for Molson Coors removes non-recurring and non-operating items from the income statement, including discontinued operations, special items and other income. However, they are classified as operating expenses because these items have a major impact on Molson Coors' ability to operate.

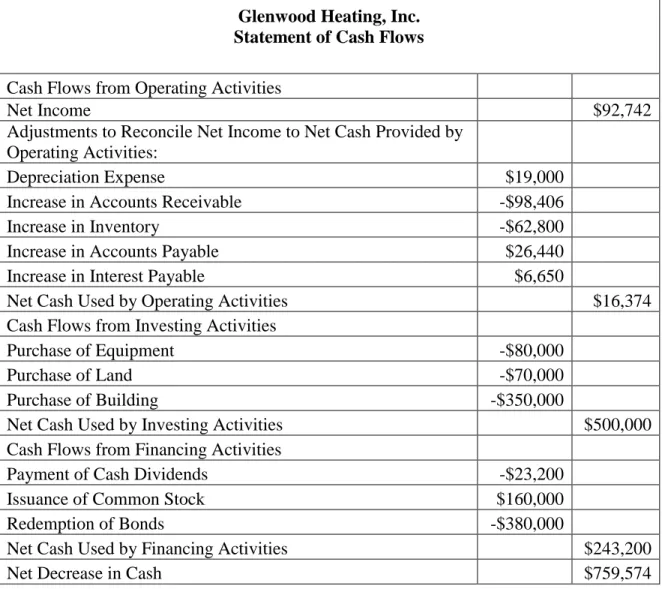

STATEMENT OF CASH FLOWS

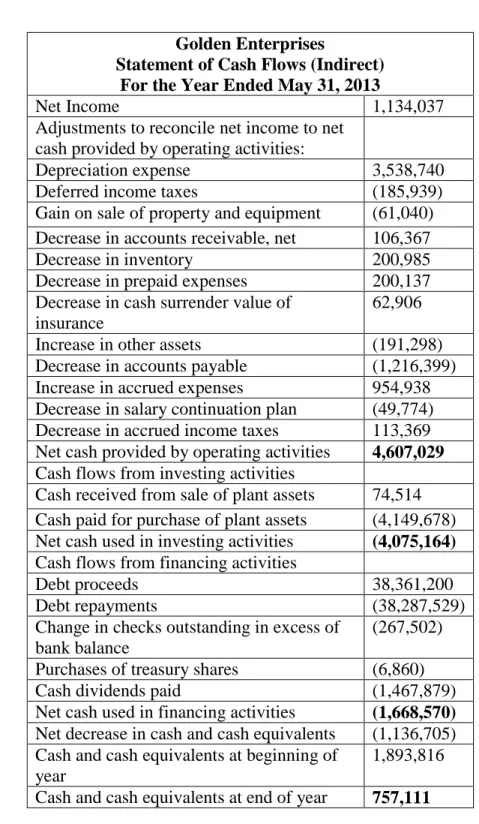

Increases in current liabilities are subtracted from net income (decreases in CA are added), while increases in current liabilities are added to net income (decreases in CL are subtracted). As discussed in point b., Golden Enterprises uses the indirect method when preparing its cash flows. Depreciation expense is added to net income because it is a non-cash expense listed on the income statement.

The investing activities section of the statement of cash flows is the shortest and easiest to construct in the case of Golden Enterprises. In fiscal year 2013, there was a decrease in Golden Enterprises' ability to generate cash and their net income. As detailed in their 2013 cash flow statement, Golden Enterprises' net cash provided by operating activities is already significantly lower than it was in 2012.

ACCOUNTS RECEIVABLE

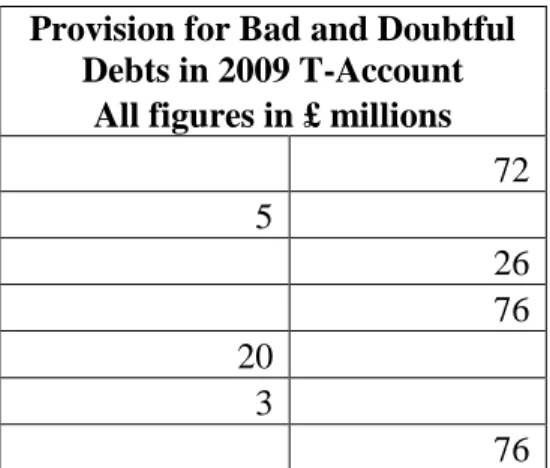

Sales Returns Provision” reflects the effect of Pearson's goods and services that a customer may return for a number of reasons. The debited items to the Bad and Doubtful Debts account are as follows: £5 million for “exchange differences” acquired through currency conversions, and £20 million for accounts written off (or “used”). This amount is debited to the bad debt account and should no longer count toward Pearson's bad debt expense because those accounts have also been credited to the accounts receivable account, removing them from the books.

The items credited include £26 million for "income statement movements", or bad debt expense estimated for this period. Based on this estimate, an auditor can be comfortable that the balance of the provision for bad and doubtful debts reported in Note 22 (£76 million) is "adequate", although the estimates do not match exactly. Pearson may have introduced stricter credit policies and credit checks, or they may have stopped selling to customers who had a history of bad credit.

REVENUE AND INVENTORY RECOGNITION

Damage to the building was minimal, but the water stained more than half of GAC's plain shirts. The current GAC policy also violates the matching principle because the revenue from custom shirt orders does not match the production costs from those custom orders during the same periods. Using GAC's financial statements, if Nicki had recorded $10,000 of custom shirt orders as unearned revenue instead of sales revenue, her current ratio would have decreased to 1.11.

With little experience in handling these customers, it may be time to change GAC's method of calculating bad debts. This further suggests that new GAC customers may be less likely to pay than old customers who have lapsed. Nicki and GAC can take some simple steps to benefit their operations and strengthen GAC's financial position.

DEPRECIATION AND FRAUD a. Airlines

Northwest may want to report lower revenues for a reason; therefore, they use a lower useful life to increase depreciation costs. The motivation behind these actions was driven by executives' greedy desire to achieve the company's profit targets and thus maintain their position at the top of Waste Management's corporate structure. Waste Management was then able to (falsely) report an increase in revenues without disclosing the accounting changes to the public.

Waste Management also failed to properly depreciate its landfills, which are the second largest asset category on its balance sheet. Waste Management managers did not want to risk losing their positions and all the benefits they were entitled to, so they falsely reported higher earnings and profits that would provide them with the greatest job security. The management teams of both Waste Management and Arthur Andersen entered into an agreement to write off the accumulated errors over a period of ten years.

GAAP VS. IFRS

Recording of potential environmental liabilities in 2009. GAAP: When Construct receives results from a third-party agency, a 60% chance of receiving penalties of $250,000) should record an environmental liability of $250,000 (ASC. GAAP: Construct should record a liability for potential environmental remediation of at least $400,000 in accordance with (ASC c).This amount is related to the RI/FS costs that EPA ordered from Construct.

GAAP: Yes, upon completion of the RI/FS, Construct must record additional liability for the estimated cost of the $1.5 million plan they must implement to clean up the contaminated water. GAAP: As stated in the FASB Codification (ASC Construct may record as a contingent asset the probable recovery of environmental remediation costs from their lawsuit against BigMix. IFRS: International standards do not allow Construct to recognize the profit because the realization is not certain is.

DEBT

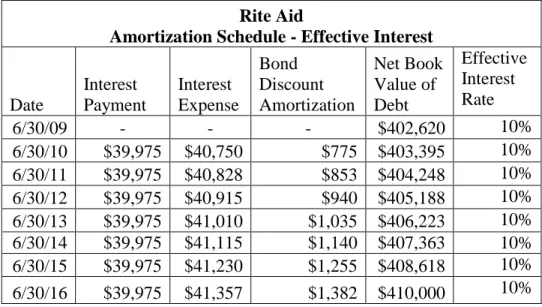

The effective interest method saves Rite Aid more than $750,000 over the life of the note in interest expenses. These are callable bonds; therefore, Rite Aid is allowed to buy them back at any time. Because they were repurchased before maturity, Rite Aid is able to avoid paying a $3,750 discount on the bonds and can repurchase them below par.

The market rate is lower than the 9.5% coupon rate and the effective rate, so Rite Aid is able to repurchase these notes and recognize a gain. Rite Aid's balance sheet would experience a decrease in liabilities if the bonds were converted to stock. Rite Aid struggles mightily to keep up with industry standards in virtually every category.

SECURITIES

If the market value of available-for-sale securities increased by $1 during the reporting period, what journal entry would the company record. If the market value of held-to-maturity securities increased by $1 during the reporting period, what journal entry would the company record. What is the amount of net unrealized gains or losses on the available-for-sale securities held by State Street at December 31, 2012.

What was the amount of net realized gains or losses on sales of available-for-sale securities for 2012. What was the amount of net unrealized gains or losses during 2012 on available-for-sale securities available on December 31 2012. Indicate the journal entry that State Street would have made to mark the available-for-sale securities portfolio at market value at the end of the year.

REVENUE GROWTH AND REGULATORY ISSUES

The gross margin percentage for Groupon is much higher under the net method due to the much lower cost of goods sold accounted for under this method. Under the gross method, higher asset turnover is recorded in both years due to the higher amount of revenue recognized compared to the net method. As mentioned in the case, these astonishingly high sales figures were the driving force behind Groupon's early success, so management would clearly prefer this method.

Groupon justified its use of the gross method by emphasizing to the SEC that they were the primary debtors in Groupon's arrangements. They argued that the specific Groupon vouchers, which Groupon provides, were sufficient to be considered a good or service in and of themselves, as opposed to the actual goods and services for which the vouchers are. Operating cash flow is unaffected because Groupon recognized an increase in operating expenses for this period as a result of the revision, which is added back to net income when calculating OCF.

TAX LIABILITIES

A deferred tax asset (DTA) represents the increase in taxes saved in future years as a result of deductible temporary differences at the end of the current year. For tax purposes, the loss is only recognized when it has been paid, which is why a company will recognize this temporary difference as a deferred tax asset. A deferred tax liability (DTL) represents the increase in tax payable in future years as a result of temporary differences that exist at the end of the current year.

The difference between the two depreciation amounts represents a deferred tax liability that the company will pay for over the coming years. This $713 thousand is related to a deferred tax asset generated by a loss on an equity investment in a start-up business. ZAGG's management has little faith in the operations and management of the startup, so they determined that the deferred tax asset will most likely not be realized and created a full valuation allowance for the entire deferred tax asset amount.

PENSIONS AND RETIREMENT PLANS

Service costs increase the pension liability because the company records the services rendered by employees for the year in terms of the provisions of the pension plan. Benefits paid to retirees reduce the pension liability because upon payment the company is no longer liable for that amount owed to retirees under the terms of the plan. Benefits paid to retirees reduce the value of the plan assets because the payments are made out of the plan fund.

The actual return on the scheme's assets is subject to market fluctuations during the year, so a "smoothing technique" was used to have the pension costs affected by expected return, which is the fair value of the scheme's assets multiplied by an expected return. This represents the total value of the investments in the pension fund that will be used to pay benefits to retirees as they fall due. The expected return is likely to be a better reflection of the company's pension costs because it will "smooth out" the annual fluctuations in the scheme's actual return.