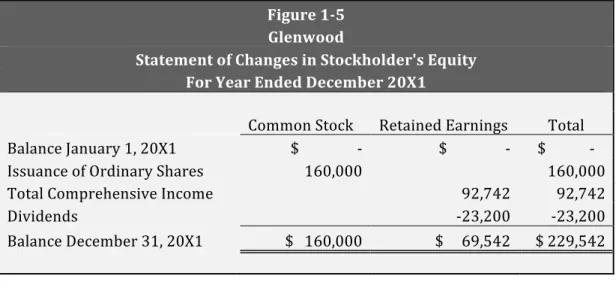

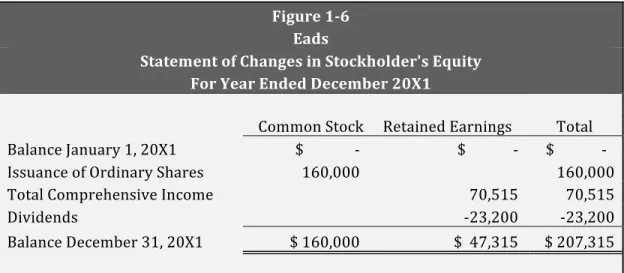

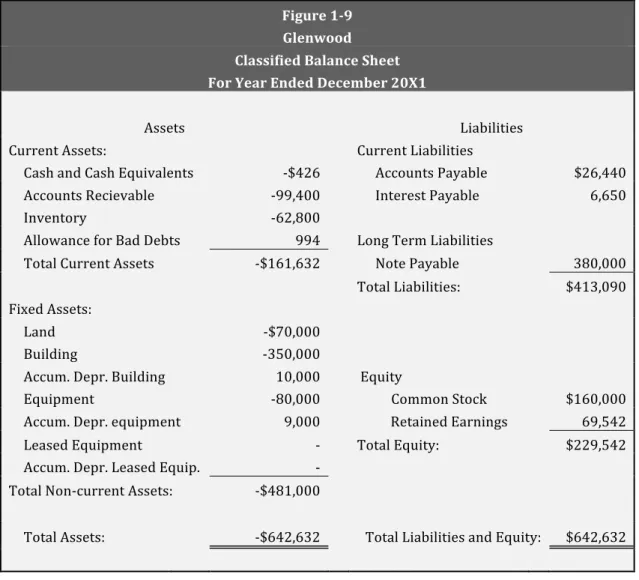

Therefore, with unchanged sales next year, Glenwood would report a higher cost of goods sold for that year. For Glenwood, retained earnings increase significantly due to the above reasons in the income statement analysis - low cost of goods sold and low depreciation expense increased net income, which increased profits.

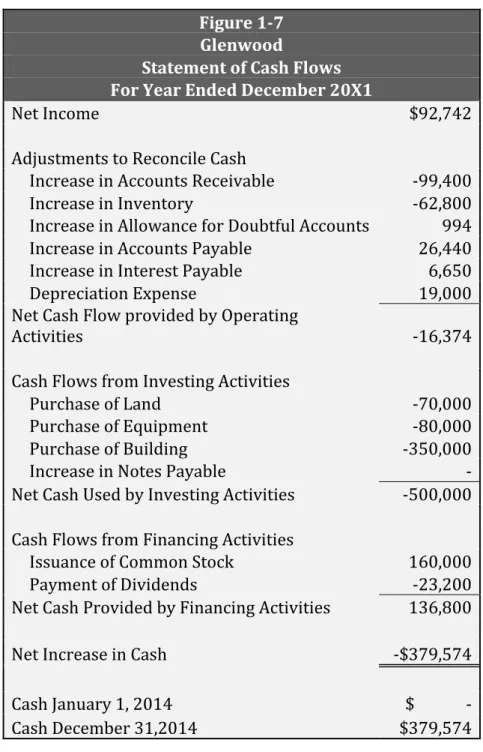

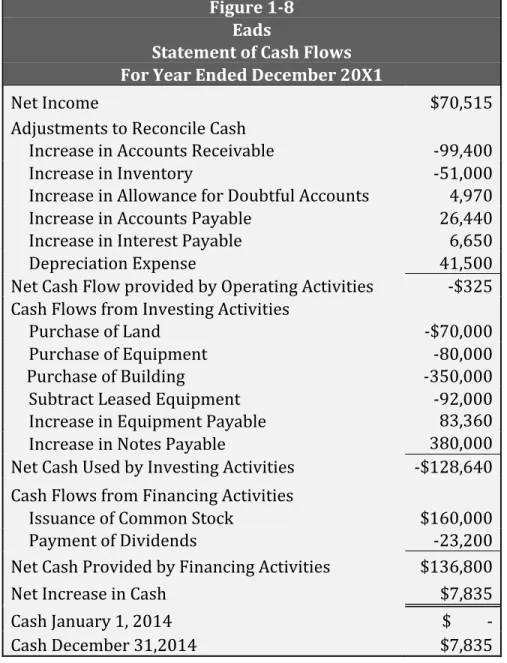

Statement of Cash Flows

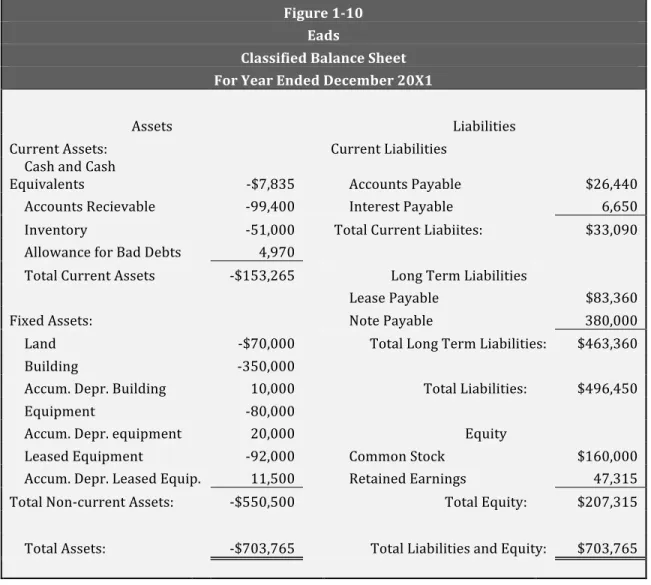

Furthermore, higher write-off costs and higher allowance for doubtful accounts allow Eads to add back these non-cash expenses, further increasing its cash flow. More will be discussed about this in the next section, but in terms of the statement of cash flows, this decision causes an increase of $8,640 in new cash used in investing activities for Eads compared to Glenwood.

Balance Sheet

Financial Analysis—Molson Coors Brewing Company

Executive Summary

Income Statement Analysis

Digging deeper into the Income Statement, the treatment of Special Items and Other Income is a gray area. However, continuing income can be calculated: Income from continuing operations before tax – Other income + Special items expense = Continuing income from continuing operations before tax – income tax = Continuing income.

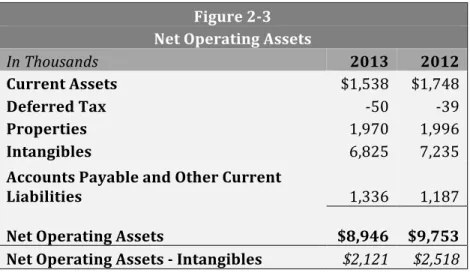

Balance Sheet Analysis

However, because most of this revenue comes from investments in MillerCoors, net operating profit is a better determinant of the company's revenue from beer sales. At the bottom of this table you will find the calculation of the net operating assets excluding intangible assets.

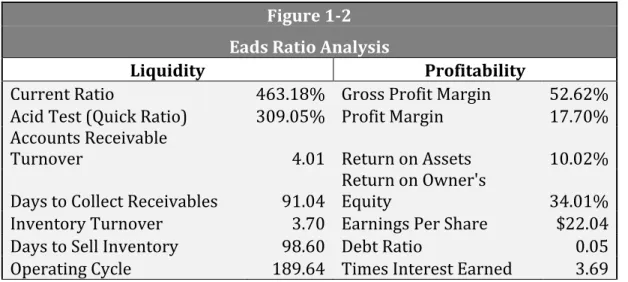

Ratio Analysis

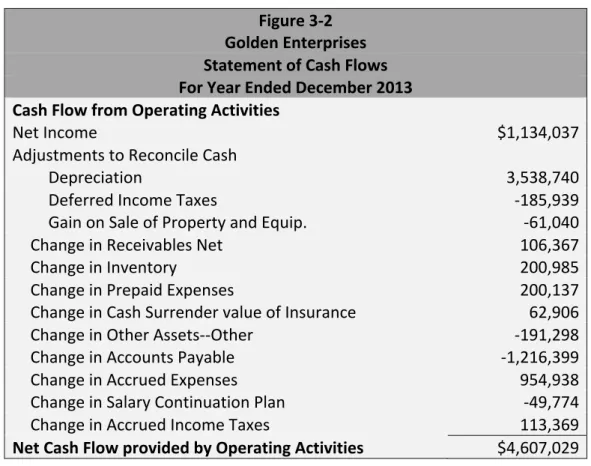

Statement of Cash Flows—Golden Enterprises

Statement of Cash Flows Introduction

Ideally there will be a net increase in cash, but for this company, the example we will use to explain the cash flow statement, there will be a net decrease in cash. Another important feature of the cash flow statement is the posting of the beginning and ending cash balances for the year.

Two Methods—Direct and Indirect

In the direct method, you would simply state the cash inflows and outflows from business activities, ie. Since this is the method chosen by our eligible company, Golden Enterprises, it will be the method discussed in the next section: Business Activities.

Operating Activities

Net Cash Flow Provided by Operating Activities Next, we must adjust for changes in current assets and current liability accounts that occur from operations. As you can see, most of the accounts used in this section are classified as current, as they are the ones that change most frequently with operating activities.

Investing Activities

Financing

Golden Enterprises is able to pay off almost as much debt as they earn, along with buying back stock, which they hope to sell at a higher price and generate more cash flow. They are also able to pay dividends to their investors, which can serve as an attraction for new investors.

Statement of Cash Flows Analysis

Accounts Receivable—Pearson

Another method that Pearson could use would be to penalize those who do not pay within the specified period. By implementing some of these small changes, Pearson is likely to lower its DSO to an industry-standard level within two to three years.

Accounts Receivable

For this reason, GAAP requires accounts receivable to be reported at Net Realizable Value, or the amount you reasonably expect to collect. Using Pearson as an example, we will discuss the two most important offset accounts for accounts receivable in the following paragraphs.

Provision for Bad Debts

That's why offset accounts exist to offset the bad debt or sales proceeds you're likely to encounter. The journal entry for the £26 million credit in this account was to replenish the provision and record the cost of any further bad debts expected to occur for that period.

Provision for Sales Returns

GAAP Reporting—Graphic Apparel Corporation

To serve as a realistic interaction between client and firm, this chapter is in email format.

Subject: Getting Back On Track

Journal Entries

- Depreciation Methods—Airplane Industry &

To reduce sales revenue from unfulfilled custom order, determine unearned revenue corresponding to cash received, and to reduce accounts receivable from sales not yet made. To reduce sales and accounts receivable by amount in which returns are expected but unknown.

Waste Management

Depreciation

These include even, double-declining balance, sum of year digits, and the activity method. Each of these methods, in addition to double-declining balance, uses the asset's depreciable basis (cost minus residual value) and then divides that number by the useful life, estimated units of production, or another depreciation rate, depending on the method.

Airline Industry

A plan like this would also encourage the companies to use a method like double declining balance, where the majority of the depreciation charges come in the first few years of the asset's useful life. The former will therefore not estimate an extended useful life if they know that they will dispose of the asset in a few years.

Earnings Management

Recording Liabilities—GAAP vs. IFRS

Under IFRS, the liability would have been included because it was more likely to happen than not. Some of these differences would have significant implications for a company's financial reporting if they were to use one instead of the other.

2007- Indemnification Provision at time of purchase

Furthermore, the resolution of the uncertainty and cash flow effects of the loss conditions often occurs over a span of many years. Accordingly, this subtopic encourages, but does not require, additional specific information regarding unanticipated risks of loss of environmental remediation that would be useful in furthering users' understanding of the company's financial statements.

2009 – Contingent Liabilities and their probability

2010 – Environmental Obligations

However, according to the codification, these cannot be considered part of the costs of the effort. The costs of services associated with routine environmental compliance issues and the litigation costs associated with potential recoveries are not part of the remediation efforts.

2011 – Environmental Obligations (cont.)

The amount recognized as a provision should be the best estimate of the expenditure required to settle the current liability at the balance sheet date, that is, the amount that an entity would rationally pay to settle the liability at the balance sheet date or transferred it. to a third party. IFRS: As with GAAP, IFRS would also add this new $1.5 million repair plan cost to the total repair provision.

2012 – Gain Contingencies

Long-term Liabilities—Rite Aid

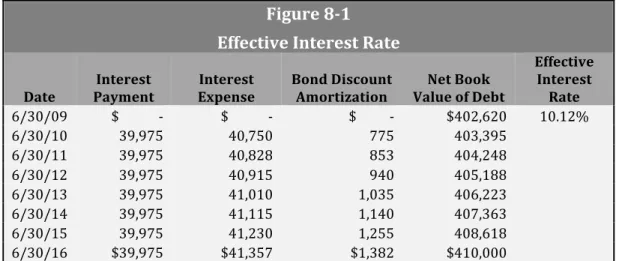

In addition, we explain the process of discount depreciation, the difference between straight-line depreciation and effective interest, and how it affects a company's books. Here we see that Rite Aid's debt ratio far exceeds the pharmacy industry average, as the company's equity has a debit balance.

Debt and Indebtedness

When these two rates are equivalent, the debt is said to be sold at par. Conversely, when the coupon rate is less than the market rate, it is said to be selling at a discount.

Rite Aid’s Many Forms of Debt

This note is sold at par, as there is no premium or discount recorded, and no difference between cash received and the face value of the note. This note is sold at a discount, meaning the coupon rate is lower than the effective yield.

Retiring Debt Before Maturity

Here we can see that the current market rate is higher than the coupon rate, hence the discount. Also, the current market price is higher than the effective yield, which is the reason why Rite Aid recorded a profit on the repurchase.

Ratio Comparison with Industry

In Rite Aid's favor, their current debt maturities are less than one percent of total debt, compared to the industry average of over six percent. Due to high debt ratios, persistent net losses and negative shareholders' equity, Rite Aid's credit rating is likely to range from C to CCC-.

Shareholders’ Equity

Due to the different methods, the two exhibit some discrepancies when entering some of the same types of transactions in their respective journals. These are discussed in detail before providing an analysis of the company's dividend performance for FY2007.

Merck & Co., Inc

GSK plc

This means that the total number of common shares would be equal to 1000 x $1 or $1000, while the remaining $9000 from the transaction would be recorded in paid-in capital above Par. It is clear from this example that this paid-in capital account is simply a place to record the difference in income between face value and market value.

Dividends

It is also worth noting that this Dividend declared account will be closed at the end of the year by crediting dividends declared and debiting retained earnings. In fact, it is acceptable to initially debit retained earnings without ever running the money through a dividend account.

Treasury Stock

Marketable Securities—State Street Corporation

Instead of increasing (decreasing) net income, the adjustments to the fair value of these securities are reported as other comprehensive income. Finally, any gains (losses) on the sale of any of these securities will have an effect on the statement of cash flows.

State Street Bank

Since these three securities are classified as investments, they have an effect on the investment portion of a company's statement of cash flows. Gains (losses) on fair value adjustments for available-for-sale securities will have no effect on the cash flows as they are reported in other comprehensive income.

Trading Securities

This fair value adjustment account would be a temporary account that would serve as an additional or opposite asset account depending on market movements. Given that these securities have a market value of $637 million, the required entry would be as follows.

Held for Sale Securities

The unrealized holding gain would be held in the equity section until the asset is sold, in which case the unrealized gain account would be debited and a gain on disposal account would be credited for the difference between the purchase price and the disposal price. sale. Securities held for sale may provide dividend or interest income that would be recorded identically to that of trading securities.

Securities Held to Maturity

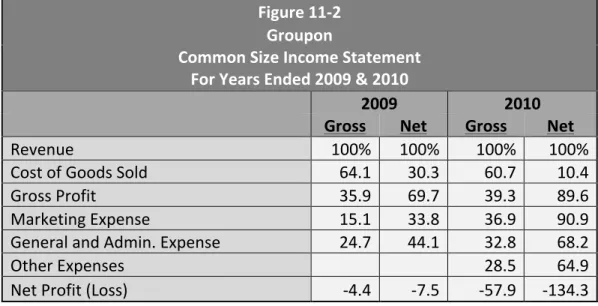

Revenue Recognition—Groupon

In this analysis, we discuss the main implications of revenue recognition and the risks associated with this topic. We show Groupon's faulty reasoning regarding this topic and how it affected their financial statements.

Revenue Recognition

Industry-wide Risks

Under GAAP, whose official standards will be discussed later, companies must account for the returns of their products and include this reimbursement in a reduction in their revenues. In other words, these companies cannot record 100% of their sales as profits if they have a proven history of receiving, say, 15% of their returned items.

Revenues and Stock Prices

There will always be customers who buy goods on credit and fail to pay for them, just as there are always malfunctions in the technology that can cause an item that should have been counted as sold not to be registered.

Groupon’s Dilemma

In other words, although both methods lead to the same net income, starting the income statement with the higher income makes it appear that the company's expenses and losses were much less severe than they really were. This means that the company may have had a lower cost of sales, but they were using their assets to generate income in a very inefficient way.

Questioning by the SEC

The Company believes that, because of the credit risk it carries and the Groupon Promise, it is both a seller and an issuer of coupons. When evaluating Groupon's business model and their method of operation, it is clear that they do not change the product or perform a part of the service, nor do they choose the supplier, get involved in the service specifications, or assume the physical risk. loss of inventory.

Other Reporting Issues

Here, Groupon argues that the risk they take on by offering a wide-ranging return policy should give them the right to claim all revenue as their own. When it was discovered that many of the customers who bought this voucher were physically unfit for surgery, they all wanted their money back.

Unchanging Cash Flows

Current and Deferred Income Taxes— ZAGG Inc

We then work from an opposite angle by showing methods to calculate cumulative differences using the deferred tax balance and the tax rate. We also show how to adjust the deferred tax accounts according to these tax rate changes to accurately report the expected benefits or expenses from these DTAs and DTLs.

Book Income vs. Taxable Income

Key Terms for Understanding Deferred Taxes

Temporary tax differences—arise when the tax basis of an asset or liability differs from the reported amounts in the financial statements. In other

Statutory tax rate-- Under the federal income tax, the statutory corporate tax rate ranges from 15 percent on the first $50,000 of taxable income to 35

It is simply a contra asset account that takes into account the fact that some of these tax assets will remain unused, as they often expire before the company has enough taxable income to realize them.

ZAGG Inc

Since the balance in the previous year was $5,214, the change in this account, and therefore the amount stated above, is $8,293. The difference between the statutory tax rate of 35% and this effective rate of 39.3% is caused by a number of adjustments, including the state tax, non-deductible costs, the adjustment of the refund to the provision and an increase in the valuation surcharge.

Using Deferred Taxes to Find Cumulative Differences

To show how this works for DTAs, we can consider ZAGG's cumulative difference related to allowance for doubtful accounts. Calculating the total dollar amount for the cumulative difference associated with this allowance account works exactly the same as the previous example.

Adjusting for Changes in Tax Rates

Pension Liabilities—Johnson & Johnson

In this analysis, we discuss the various elements involved in accounting for pension obligation plans. Finally, we discuss how each of these factors affects Johnson & Johnson's financial reporting and related schedules.

Retirement Obligations

Why Retirement Plans are Liabilities

Using historical data and certain requirements such as a minimum retirement age, the companies can obtain some certainty of these future obligations. With that established, let's look at the key components of these retirement funds: pension benefit obligations and plan assets.

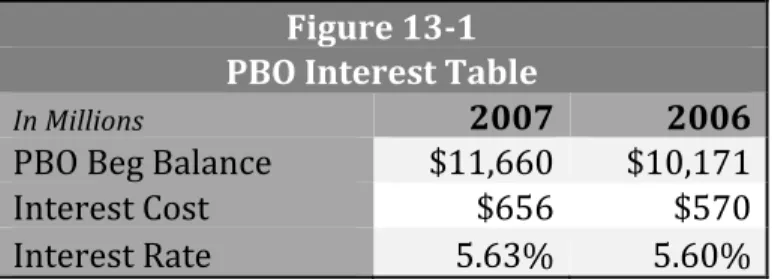

Pension Benefit Obligations

For example, Johnson & Johnson must calculate not only how long they think one of their accountants will work until he or she retires, but also what his or her salary will be at that time and how long they will have until his or her retirement to fund. Changes in market interest rates and the general economy may give rise to the need for a reduction or addition of obligations to the PBO.

Plan Assets

Reporting Retirement Obligations on the Balance Sheet

Pension Expense

For example, if the company expects the plan assets to yield an 8 percent return based on expected dividend and interest income, then their expected return is $80,000. However, if due to changes in fair value the plan's assets increase by $100,000, the resulting difference of $20,000 will be considered an actuarial gain.

Johnson & Johnson

Instead, those benefits come from the funds set aside for those pension obligations—the plan assets. Thus, these benefits do not directly affect the funded status balance, as both the PBO and plan assets are reduced by the same amount.