One of the most appealing features of Python is its purpose; programmers use python for web and internet development, software development, data analysis, and business applications. To do this, I will use python to retrieve all the revenue records relevant to my needs from the company's database and cross-reference this information with the financial statements.

CASE STUDY 2: RITE AID CORPORATION

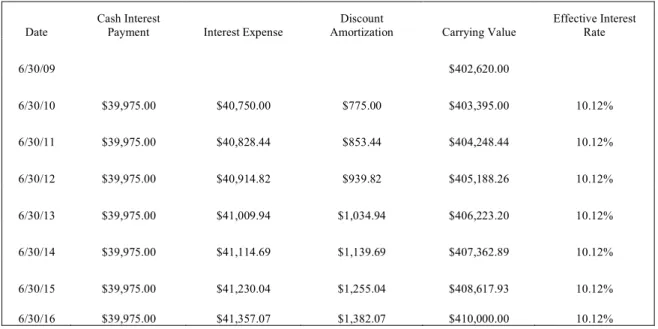

This number can be reconciled by adding up all of Rite Aid's debt components on the balance sheet. Since the banknote was issued at face value, the amount of cash received is equal to the face value of the banknote.

CASE STUDY 4: STATE STREET CO

Trading, available for sale and held to maturity securities each have their own nuances in the presentation and preparation of the balance sheet. In addition, held-to-maturity securities are recognized at amortized cost, although their unrealized gains and losses are also disclosed in the notes. Held to maturity securities are strictly debt investments that a company intends to hold until the debt matures on a predetermined date in the future.

If the market value of these securities increased by $1, no journal entry would be necessary because held-to-maturity securities are never adjusted to fair value. However, the market value of securities held to maturity is not shown on the balance sheet. The difference between the market value and the amortized cost represents any unrealized gains on the debt security.

These securities have already been recorded at amortized cost and subsequently adjusted to fair value for presentation in the balance sheet. The amount of net realized gains from the sale of securities available for sale is shown in the table in note 4, which describes the realized gains and losses for the past three years.

CASE STUDY 5: ZAGG INC

More specifically, these differences arise when a company accounts for deferred tax liabilities and assets. According to ASC-740, a deferred tax asset is a taxable amount that actually reduces a company's future tax liability. On the other hand, ASC-740 defines a deferred tax liability as a temporary difference between the income tax expense and income tax payable that creates a future liability that will be reversed in subsequent years.

Therefore, the company recognizes a deferred tax liability that will be reversed over the useful life of the machine. A deferred tax valuation allowance is a valuation allowance account created to reduce the value of a deferred tax asset. Therefore, the total income tax expense is the difference between the two and represents the amount that is actually an expense in the period. ii) Breakdown of net deferred tax asset (in millions).

However, deferred tax liabilities decreased by $291 due to some of the deferred tax liabilities reversing. So the difference is the deferred tax assets. iv) Net deferred income tax asset balance.

CASE STUDY 6: APPLE INC

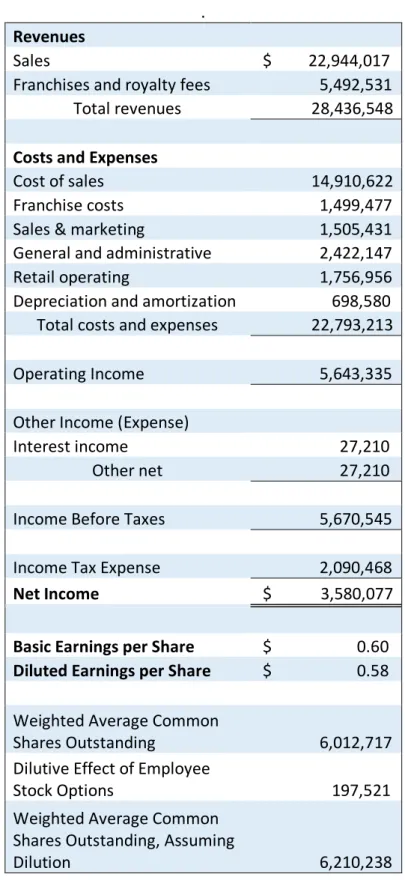

Once the contract is identified, four other criteria must be met before the company can recognize revenue. Profits arise from the secondary functions of the business such as a sale of an asset or an increase in the value of an investment. So, once all these criteria are identified and accounted for, a business can recognize revenue when that contract is terminated and consideration is received, the party no longer has obligations to transfer goods or services, or when control of goods or services is transferred to the other party.

This can create problems with revenue recognition as it may be inappropriate for a company to recognize all the revenue from the contract if certain parts of the contract have standalone value. In a highly competitive market, managers are incentivized to recognize revenue in order to bolster net income. These choices will benefit the managers at the expense of the quality and reliability of the company's earnings.

If products are purchased online, Apple will recognize revenue when the items are shipped to the customer. As long as the items are not co-signed for, Apple will recognize revenue when the items are shipped to the third-party seller in India.

CASE STUDY 7: MICROSOFT POWER BI

During my internship this summer, the firm I worked for used Microsoft Power BI for financial analysis. In addition, I used this information obtained to apply Microsoft Power BI to hypothetical business scenarios. Because of its multi-functionality, Microsoft Power BI serves as an excellent vertical business tool for a firm.

Using Microsoft Power BI, I am able to seamlessly pull revenue figures from both Microsoft Access and Excel and analyze those figures. In the last audit scenario, I use Microsoft Power BI to link sales revenue to specific customers. Due to the diverse nature of my clients' investments, I can use Microsoft Power BI to effectively construct portfolios.

Therefore, I suggest that we invest in the acquisition of and training in Microsoft Power BI. Using Microsoft Power BI's data analysis, we can create advanced financial models that are sure to win the future.

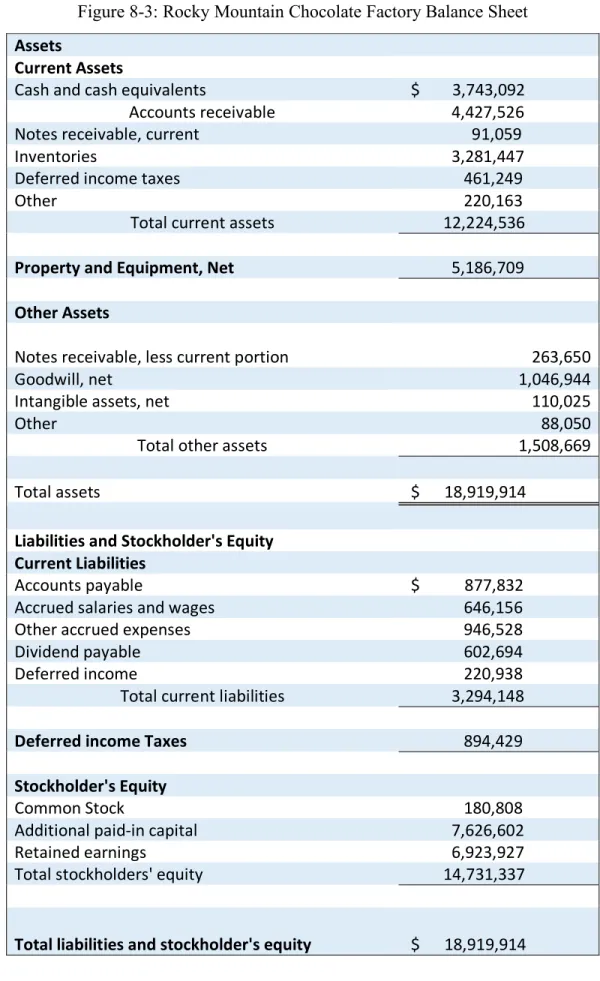

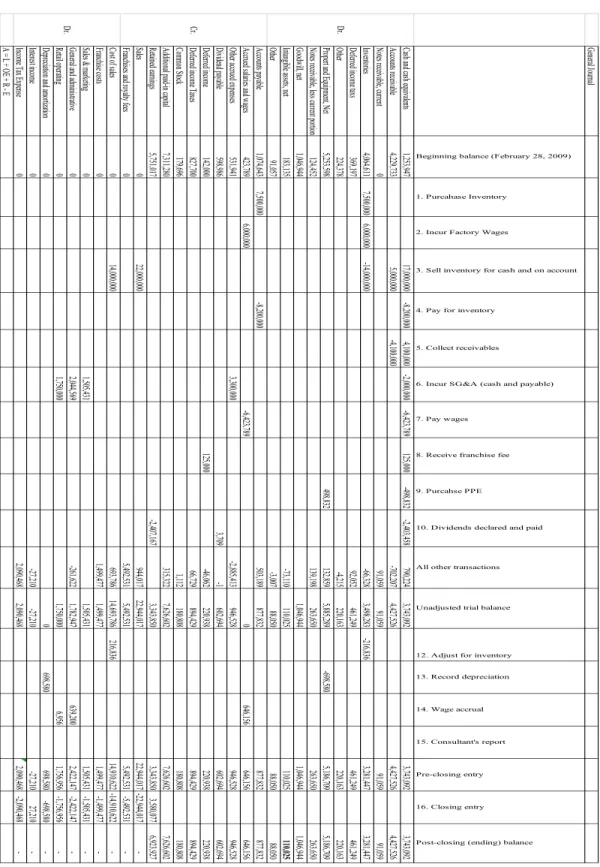

CASE STUDY 8: ROCKY MOUNTAIN CHOCOLATE FACTORY

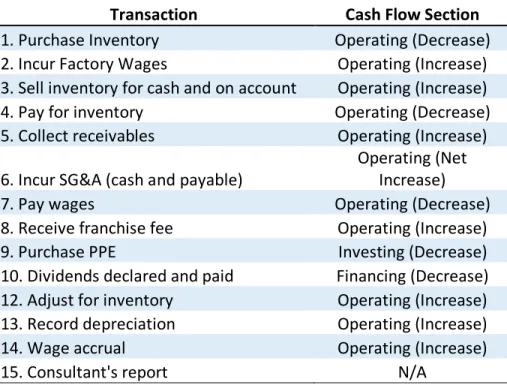

By starting with the journal, you can see how these transactions affect the general ledger accounts during the accounting period. However, in this case, you must first prepare an income statement using the income and expenses to find the correct net income that is close to the retained earnings. Finally, the case requires you to prepare a balance sheet using the post-closing balance sheets in your journal.

The biggest takeaway from this case is the reliance on interconnected financial statements within the accounting cycle. To be a top accountant, you can't focus solely on one or two financial components of a business. I would also expect accounts payable and accrued salaries and expenses to be the two most important liability accounts.

CASE STUDY 9: SCENARIO REFLECTION

The class split into two sides consisting of those who sympathized with the student's aspirations to attend law school and those who did not. However, I sympathized with the student's aspirations to attend law school for two main reasons. Finally, one of the biggest concerns raised from across the class was the fact that the student would have to take a spring internship with the Big Four and ultimately take that spot from someone else.

Therefore, I can certainly see the disdain and disagreement with the student's decision to do an internship with the big four companies with the sole purpose of boosting his CV. As previously mentioned, I believe that the student's plans are most closely aligned with what I think is the right decision. Once again, the class split into those who agreed or disagreed with the student's point of view.

I firmly support the student's right to intern at an accounting firm to see if that career is suitable. I do believe that the student should at least be able to politely request a transfer to the other office, but that he or she should be aware that patience may be required.

CASE STUDY 10: GENERIC BANK

Therefore, Generic Bank certainly has the option to hold these securities until the losses are recouped; the bank has other ways to raise capital and doesn't have that. Nevertheless, Generic Bank has an impairment loss on these five securities due to the lack of intention to hold these securities. If the bank sells securities for trivial reasons, such as employee bonuses and potential takeovers, the intention to hold other securities in the portfolio is not substantiated.

The remaining securities are associated with the lack of intention to keep from the bank's actions in relation to the sold securities. From a rigorous regulator's perspective, I would give Generic the bank the green light on the ability to hold these securities by examining their balance sheet to determine if their capital ratios are in good shape. Ultimately, Generic Bank's ability to hold these securities does not alter its lack of intent to hold; an impairment loss would still occur.

The bank therefore fails to fulfill both the intention and ability to hold these securities. Generic Bank has proven that it lacks this ability to hold with respect to its entire portfolio; an impairment loss will occur for all the applicable securities.

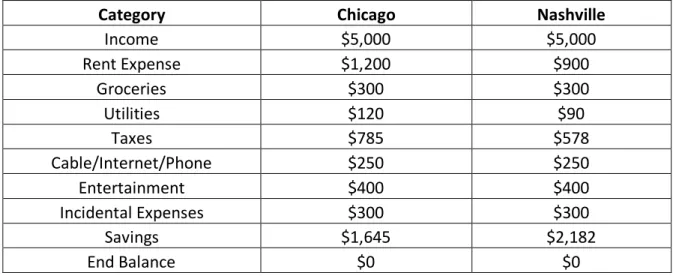

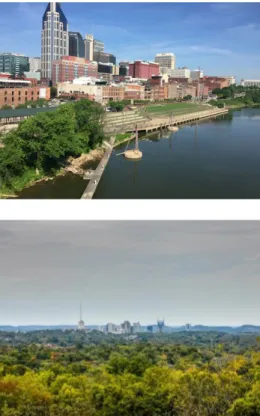

CASE STUDY 11: ANALYSIS OF CITIES

Describe the city's topography, scenery and other geographical or geological features of the area in which the city is located. Chicago: Chicago's most notable geographic feature is Lake Michigan; the lake also played a major role in the city's flat topography. To the east of downtown, Lake Michigan borders a beautiful and vibrant backdrop for the city.

What are the city's individual tax rates (e.g., consider federal, state, and local income tax, property tax, and other taxes you would likely pay. Chicago is known for its high homicide rates in the city; this fact is understandable. The only areas in places to avoid are near Antioch and Hickory Hollow.

What sports, entertainment or recreational activities would you most likely take part in in the city. In addition, I want to join a running club in the city, as running is one of my favorite recreational activities.

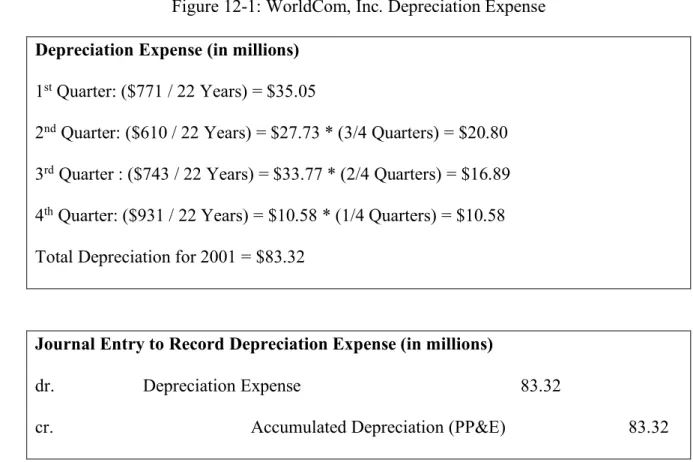

CASE STUDY 12: WORLDCOM, INC

This case not only served as an interesting analysis of the balance sheet and income statement implications of materially significant accounting. The CFO's decision to improperly account for line costs played an extremely decisive role in the downfall of the company. The lessons learned in this case therefore went beyond the typical analytical angle by indirectly emphasizing the importance of ethics in the accounting field.

If these costs are not expected to produce economic value in the future, the costs should be recognized as expenses in the income statement in the current period. Typically, the total value of the balance sheet will remain the same, as the increase in the value of this new asset is accompanied by a decrease in another asset, such as cash. On the cash flow statement, these costs appear as an outflow of cash in the investing section rather than in the operating section.

Therefore, these large sums of money are hidden in the inappropriate part, and a large outflow of money in the investment part is much more favorable than a large outflow of money in the business part. By classifying the costs as an investment, WorldCom once again misled investors into expecting future cash flows from these "investments."