CIMB Group Profile (Parent Company) 96 CIMB Niaga Auto Finance Profile (Subsidiary) 97 Cimb Niaga Sekuritas Profile (Subsidiary) 98 Subsidiaries and Joint Ventures 99 Field of Operation or Network Arrangement 100 Supervisory Board Profiles 102. Performance Assessment of the Supervisory Board and the Board of Directors 472 Diversity policy Composition of the Supervisory Board and the Executive Board and its implementation.

Maintained its position as Indonesia’s second largest private owned bank

GCG Optained four prestigious award in Corporate Governance

Top 50 ASEAN Public Listed Companies” and “Top 3 Public Listed Companies” from Indonesia in the event

Top 50” and Rewarded as “The Best Overall”

CAR has consistantly growing every year to 19.66% level in 2018

Number of EDC has consistantly increased every year to 84,314 EDC

CASA has reached new achievement level at above

CASA

Sharia Banking

Sharia Financing

Micro SME Banking

Small Medium Enterprise (SME)

Consumer Banking

Mortgage

Credit Cards

Wealth Management and Bancassurance

Customer Growth

Digital Lounge

Rekening Ponsel CIMB Clicks

Digital LOUNGE

Initiatives

CIMB Niaga introduces Contactless Debit Cards, non-touched payment transactions

Go MOBILE

The Quest for Ultimate Mobile Banking

CIMB Niaga is actively enabling multiple transactions that support the infrastructure that Go Mobile enables to interact with QR technology. The various Go Mobile features introduced in 2018 symbolize CIMB Niaga's commitment to becoming the leading digital bank in Indonesia.

Precious CREDIT CARD

That is why the launch of CIMB Niaga Precious Card started with the “Morning Pound Fit” event with Wirtjes Dance, Pound Master Trainer in Indonesia. Given the many media coverage obtained from the CIMB Niaga Precious Card launch event, it showed that this product received a positive response from media participants.

Leverage Information

Playing to Our Strengths

Expanding CASA

Franchise

Discipline in Cost Management

Preservation of Capital and

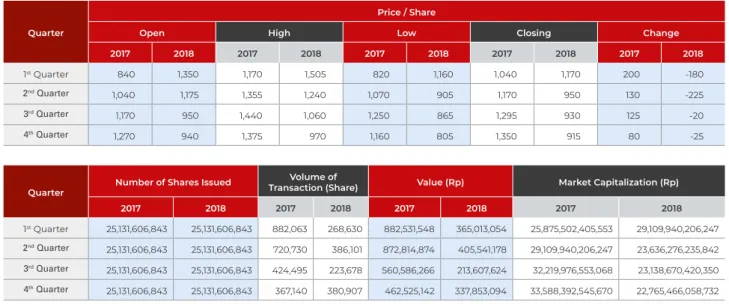

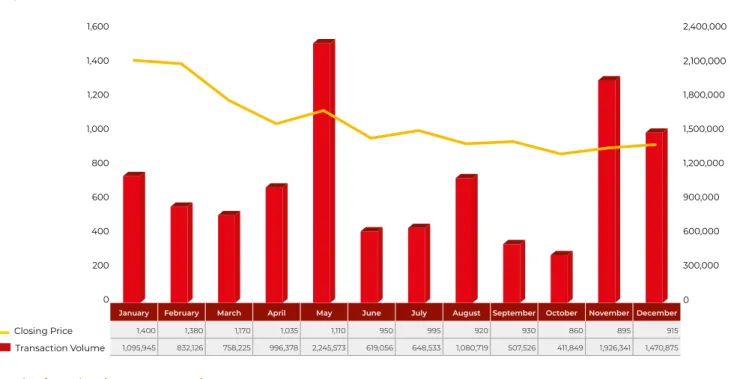

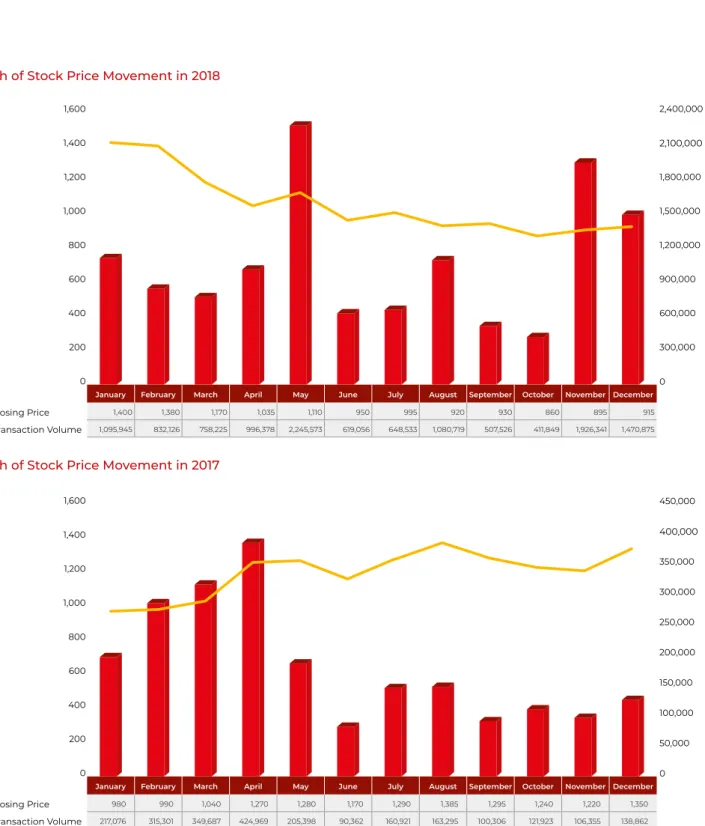

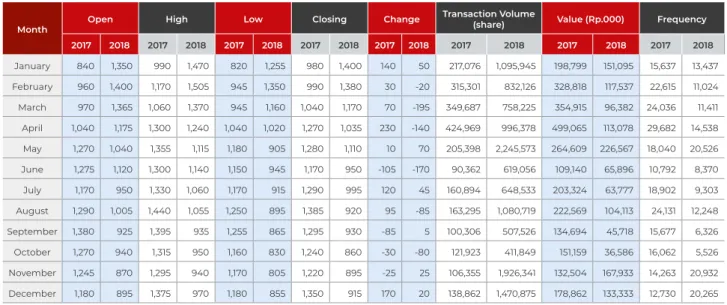

In 2018 and 2017, CIMB Niaga was never subject to suspension and/or delisting of its shares. Shareholder composition of PT CIMB Niaga Securities is 99% owned by CIMB Niaga and 1% owned by PT Commerce Kapital.

January

CIMB Niaga hosted the ASEAN Stock Challenge Grand Finals at the Indonesia Stock Exchange and Financial Club in Jakarta on 15 January 2018. Siahaan, CEO of CIMB Niaga, and Hedy Lapian, Director of Human Resources of CIMB Niaga, and around 100 other participants, consisting of finalists, academics, sponsors, also attended.

MarchOctober

ASEAN Stock Challenge is a CIMB Group regional event organized to create young, talented stock traders among undergraduate students in Malaysia, Indonesia, Singapore, Thailand, Cambodia and, for the first time this year, Brunei.

March -

Country Town Hall – Quarterly 2018 was held on April 5, 2018 at Graha CIMB Niaga, Jakarta and was attended by the senior leaders of BMC and CIMB Niaga. Siahaan, CEO CIMB Niaga and attended by Tengku Dato' Sri Zafrul, CEO of CIMB Group, who provided the updated regional performance and information of CIMB Group.

May June

Siahaan, CEO CIMB Niaga and was attended by BMC of CIMB Niaga and more than 1,000 top clients with their families. Siahaan, CEO and BMC CIMB Niaga as well as more than 2,800 employees of CIMB Niaga, CNAF, CPAM and CGS-CIMB Securities Indonesia.

July

At Graha CIMB Niaga Jakarta, all the Bank's Board of Directors (BMC), Board of Commissioners (BOC) and employees attended the anniversary. The 2018 CIMB Niaga Namaste Festival (CNNF) was held on 26-28 October 2018 at Bimasena Club, Dharmawangsa Hotel, Jakarta, and was attended by over 4,000 yogis.

October

Bekerja sama dengan Master Card Indonesia, CIMB Niaga meluncurkan “Kartu CIMB Niaga Syariah Platinum” pada 17 Oktober 2018 di Rumah Maroko, Jakarta, dalam acara yang dihadiri oleh Pandji P. Siahaan, CEO, Lani Darmawan, Direktur Perbankan Konsumer CIMB Niaga dan Anita Boentarman, ketua Festival Namaste pada 26 Oktober 2018.

November

On the 8th, CIMB Niaga Syariah organized a business lunch meeting on the topic “Syariah Business Opportunity and Potential in Indonesia”. CIMB Niaga Syariah conducted a media training on Syariah banking for journalists on 6-8 December 2018 at the Ibis Style Hotel in Bogor.

Desember

The event was opened by John Simon, Head of Treasury and Capital Market CIMB Niaga and speakers featured Yoga Affandi from Bank Indonesia and Dr. Sanrego, Member of Dewan Pengawas Syariah CIMB Niaga and Sapta Nirwandar, Chairman of Indonesia Halal Living Center, and attended by 22 business journalists from various news media.

November November

CIMB Niaga menyelenggarakan CIMB 3D Conquest – Indonesia and Country Hackathon pada 7-8 Desember 2018 di Gelora Bung Karno Hall (GBK), Senayan, Jakarta. Siahaan, CEO CIMB Niaga dan juga dihadiri oleh CIMG group, partner, akademisi dan manajemen senior CIMB Niaga.

December

Digital Touch Points Customer Engagement Award 2018 Majalah Marketing, Service Excellence Magazing & Carre- Service Quality Monitoring (Carre-CSSL). Karim Consulting Indonesia Top Bank Award - 2018 Business News Infobank Awards 2018 Zeer go predikaat Majalah Infobank.

Board of Commissioners

The Supervisory Board will continue to closely monitor CIMB Niaga's RAKB programs in the future. In the Extraordinary General Meeting of Shareholders (EGM) 2018, the Bank approved changes to the composition of the Supervisory Board.

Board of Directors

- Playing to Our Strength

- Expanding our CASA

- Focus on Cost Discipline

- Strengthen Risk Management culture

- Leveraging of Information Technology and Digital Platforms

The implementation of Corporate Social Responsibility (CSR) is the foundation of CIMB Niaga's contribution to the banking industry. On the basis of the Extraordinary General Meeting (EGM) held on 19 December 2018, it approved changes in the composition of the Board of Directors of CIMB Niaga.

Annual Reporting

Company Profile

Amrul Partomuan Pohan, SH, LLM, the company name was changed from PT Bank Niaga Tbk to PT Bank CIMB Niaga Tbk. Approval of the merger of PT Bank Lippo Tbk into PT Bank CIMB Niaga Tbk", as well as the Letter of the Ministry of Justice and Human Rights of the Republic of Indonesia No. PT Bank CIMB Niaga Tbk June 13, 2008 Ministry of Justice and Human Rights Republic of Indonesia Letter No.

Milestones

KPR MMQ – KPR Syariah

Took over %

MISSION

To be The

Leading ASEAN Company

3 CRITICAL BEHAVIOURS

Customer-centric

We exist to serve our customers and we sell products and services that our customers understand and value,

High Performance

We work hard and we work strategically for customers, staff and other stakeholders,

Enabling People

We encourage our people to think big and look wide and ensure that they are appropriately empowered to

Strength in Diversity

We have respect for different cultures, we value varied perspectives and we recognise diversity as a source of

Integrity

We are honest, respectful and professional in everything we do because integrity is the founding

The official logo of CIMB Niaga consists of 2 main elements, namely the logo mark and the logotype, the two elements of which are an integrated logo that must not be separated. The CIMB Niaga logo is specially designed to capture the company's identity and values.

Logo

As of December 31, 2018, CIMB Niaga was conducting all business activities set forth in its most recent bylaws. CIMB Group is one of the leading universal banking institutions in the ASEAN region and is one of the world's leading major players in sharia finance. Currently, CIMB Group is the fifth largest banking group in ASEAN by assets with approximately 36,000 employees and approximately 14.0 million customers at the end of 2018.

PT CIMB Niaga Auto Finance

PT CIMB Niaga Sekuritas *)

North SumateraDI Aceh

Central Sulawesi

South SulawesiNorth Sulawesi

East Kalimantan

South Kalimantan Central Kalimantan

Riau Batam

Jakarta

Yogyakarta Central Java

East JavaBali

West Nusa Tenggara East Nusa TenggaraWest Java

BantenWest Sumatera

South Sumatera

Lampung

Maluku

South Sulawesi

PapuaEast Kalimantan

East Nusa Tenggara

Phone

Banking PreferredPhone

Appointment Appointed as a Director of CIMB Niaga pursuant to a resolution of the AGM dated 15 April 2016 with effect from 16 August 2016. Appointment Appointed as the Chairman of the Shariah Supervisory Board of CIMB Niaga since 2009, with the last re-appointment held at the AGM on 15 April 2016. Appointment Appointed as a member of CIMB Niaga's Shariah Supervisory Board since 2009 and last re-appointed at the 15th April 2016 AGM.

Corporate Secretary and Internal Audit

LARGEST SHAREHOLDERS

As at 31 December 2018, there were no institutional shareholders with shares above 5% with CIMB Niaga shares other than CIMB Group Sdn Bhd, which is the controlling shareholder of the Bank. However, CIMB Niaga still guarantees the rights of the shareholders as stipulated in Article 11 Paragraph 3. The Shareholdings (Direct and Indirect) of the members of the Board of Commissioners and the Board of Directors in 2018.

Percentages Based on Classification

Information on the chronology of CIMB Niaga's securities issued and listed are as follows: years) Nominal coupon currency (In billion Rp). Shelf Registration Sukuk Mudharabah I Bank CIMB Niaga Phase I Year 2018 Series A. Shelf Registration Sukuk Mudharabah I Bank CIMB Niaga Phase I Year 2018 Series B. Subordinate Bank III CIMB. In the midst of a competitive environment and to ensure the Bank's optimal level of performance, CIMB Niaga has developed partnerships with various business partners, local and overseas.

Management Discussion and Analysis

Significant changes in the Bank and the Group in 2018 234 Financial information reported and containing extraordinary and rare events 234 Information that material transactions with conflict of interest and/or. Spot and derivative transactions and hedging facilities 237 Regulatory changes with significant impacts on the bank 239 Changes in accounting policies implemented in 2018 and the impacts 241 The Implementation of Foreign Account Tax Compliance Act (FATCA) & Common.

GENERAL OVERVIEW: ECONOMY AND THE BANKING INDUSTRY

2018 was a year full of challenges

The Global Economy was influenced by a number of factors in 2018: the Fed Fund benchmark rate being increased four times, the economic protectionist

Meanwhile, the Indonesian economy, despite experiencing pressure with the rise of the BI 7-Day Repo Rate to 6% together with a large Current Account

Nevertheless, the banking industry in Indonesia is facing the challenge of slowing third-party fund (TPF) growth in 2018. CIMB Niaga's CASA ratio improved to 52.61% in 2018, in line with the rising trend in the banking industry. CIMB Niaga's ROA ratio improved to 1.85% in 2018 in line with the rising trend of ROA ratio in the banking sector.

OPERATIONAL REVIEW PER BUSINESS SEGMENT AND OPERATING SEGMENT

All operating segments used by CIMB Niaga meet the definition of a reportable segment under SFAS 5 (Revised 2014). Treasury and Capital Markets - undertakes the treasury activities of CIMB Niaga Bank, which include foreign exchange transactions, money market, derivatives and investment in placements and securities;. CIMB Niaga's business segment is mainly divided into 6 (six) main geographical areas, excluding the Subsidiary, which are Jakarta, West Java, Central Java, East Java, East Indonesia and Sumatra.

CORPORATE BANKING

In 2018, amidst tight competition and

The increase in PBT was accompanied by an improvement in asset quality, with the non-

Throughout 2018, Corporate Banking worked to optimize business expansion by focusing on CIMB Niaga's priority sectors. CIMB Niaga has a dedicated unit called Financial Institutions (FIs) that serves clients in the Non-Banking Financial Institutions (NBFI) segment, which includes insurance companies, pension funds, investment managers, self-regulatory organizations (SROs) and multi-finance companies. In 2018, CIMB Niaga Corporate Banking promoted Sharia banking services as one of its strategic target areas.

TREASURY AND CAPITAL MARKETS

CIMB Niaga also supports Bank Indonesia policies in order to stabilize Rupiah exchange

Despite domestic and global economic conditions in 2018, Treasury Banking and Capital Markets continued to perform well. Treasury Banking and Capital Markets also used information technology to obtain domestic and foreign data to develop trading strategies. Treasury Banking and Capital Markets will continue to expand their markets through an extensive portfolio of currency and credit products.

TRANSACTION BANKING

In 2018, Transaction Banking presented a satisfactory performance and achievements,

CIMB Niaga Transaction Banking offers a wide range of trade finance services to support clients' export-import activities. For 2018, CIMB Niaga Trade Finance's strategy was aimed at business growth by increasing the volume of trade loans. In the domestic market, CIMB Niaga Transaction Banking introduced new supply chain solutions to support the growth of clients' businesses.

COMMERCIAL BANKING

CIMB Niaga’s Commercial Banking seeks to strengthen the Bank’s brand by offering

Based on these circumstances, the Commercial Bank focused credit growth in regions with good GDP potential and potential sectors. Commercial Bank's working capital loan increased by 4.39% to Rp 21.6 trillion compared to the previous year's Rp 20.7 trillion. New loans accounted for 23.37% of the total loan portfolio in Commercial Banking in 2018, which resulted in improved loan quality in general.

MSME BANKING

Throughout 2018 that focus on strengthening the potential and quality of the customer base

SME Banking

Through loan process approach or direct approach strategy, SME Banking Unit handles small and medium business customers that are spread all over Indonesia. The SME banking unit increases business growth and speeds up the lending process while maintaining the principle of lending (prudential principle). In addition, SME Banking is expected to maintain loan process improvements to achieve a higher level of customer satisfaction.

Micro Linkage

Since 2017, I have started partnership with CIMB Niaga and have working capital loan facility, current account facilities and Internet Banking from CIMB Niaga. Some banking facilities I use from CIMB Niaga are SME Loan, Savings Accounts, Current Accounts, Credit Card and BizChannel@CIMB. I hope that in the future CIMB Niaga will be able to offer more competitive interest rates and expand its branches.

CONSUMER BANKING

In 2018, Consumer Banking provided

The car loan portfolio (KPM) is the third largest in CIMB Niaga Consumer Banking's overall loan portfolio. In addition, CIMB Niaga has a Shariah-linked savings offering that offers a gift in the form of waqf. I hope that CIMB Niaga will strengthen its connection in international networks in the future.

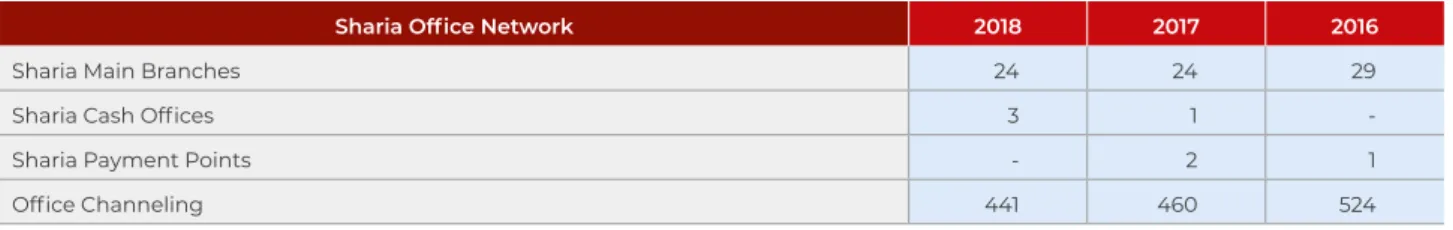

SHARIA BANKING

To strengthen its position in the Sharia Banking industry, CIMB Niaga Syariah has

To strengthen its position in the Sharia banking industry, in 2018 CIMB Niaga Syariah made great efforts to promote the implementation of the Dual Banking Leveraging Model (DBLM). CIMB Niaga Syariah Supervisory Board (Dewan Pengawas Syariah), actively oversees the Sharia unit's adherence to Sharia principles. CIMB Niaga Syariah remains aware of the importance of keeping productive assets healthy.

CIMB Niaga’s credit quality improved with NPL-gross ratio 3.11% compare to 3.75%

16.95% yoyNet profit (Rp trillion)

CIMB Niaga also recorded an increase in non-interest income from Rp0.5 trillion to Rp3.8 trillion in 2018. In response to this condition, CIMB Niaga actively invested in government bonds of Rp24.0 trillion in 2018 compared to last year's position of Rp25 0.0 trillion. This improvement in the ratio is in line with the decline of CIMB Niaga's non-performing loans to Rp 5.8 trillion in 2018 from Rp 6.8 trillion in the previous year.