It presents general information on the risk management system, types and management of risks and an overview of CIMB Niaga's risk management effectiveness. Presents information on CIMB Niaga's business performance support functions, including human resources and information technology.

672 CORPORATE SOCIAL RESPONSIBILITY

708 OTHER CORPORATE DATA

722 CONSOLIDATED FINANCIAL STATEMENTS

1063 REFERENCE AND INDEX RULES/CRITERIA

CIMB Niaga will continue to provide comprehensive and innovative banking solutions to enhance their journey of fulfilling their dreams. CIMB Niaga will continue to support customers and other stakeholders in fulfilling their dreams through innovations in products and services.

FINANCIAL PERFORMANCE

OPERATING

EXPENSES * PROFIT *

ASEAN Corporate Governance Scorecard 2019 (ACGS): The country's top 3 publicly listed companies and publicly listed companies of the ASEAN asset class.

The Rise of The Super App

Started as GO Mobile, it was reintroduced in May 2020 as OCTO Mobile with further aspiration to transform

These are the main features of OCTO Mobile

Deposit and Investment

LoanServices

Transactions

Powerful tool for your business and personal finance

Previously known as CIMB Clicks, OCTO Clicks is CIMB Niaga’s internet banking services complementing its full range of digital product offerings

Targeting users with more complex transaction needs, OCTO Clicks offers a variety of sophisticated features and services, including

Financial

FINANCIAL HIGHLIGHTS

FINANCIAL POSITIONS

INCOME AND OTHER COMPREHENSIVE INCOME

CASH FLOW STATEMENTS

FINANCIAL RATIOS

INITIAL PUBLIC OFFERING

STOCK TRADING PERFORMANCE

CORPORATE ACTION

With regard to the share repurchase that has received OJK approval through the letter no.

SUSPENSION OF STOCK TRADING AND/OR STOCK DELISTING

BONDS, SUKUK AND CONVERTIBLE BONDS HIGHLIGHTS OUTSTANDING BONDS AND SUKUK

Rakregistrasie vir Sukuk Mudharabah I Bank CIMB Niaga Fase II Jaar 2019 Reeks C. PEFINDO) PT Bank Permata Tbk. Rakregistrasie Sukuk Mudharabah I Bank CIMB Niaga Fase II Jaar 2019 Reeks A. PEFINDO) PT Bank Permata Tbk.

Report

Dear Shareholders and Stakeholders,

Unprecedented government measures, together with the introduction of vaccines against covid-19 at the end of the year, have instilled new optimism and hope that we will again witness economic growth in the future. Going forward, the success of the COVID-19 vaccination program, along with rising consumer demand and rising business activity, should drive economic recovery.

ASSESSMENT ON THE PERFORMANCE OF THE BOARD OF DIRECTORS IN MANAGING THE

Considering the difficult environment, the board of commissioners believes that the board of directors performed well in the management and management of the bank in 2020. In performing its supervisory tasks, the board of commissioners continues to give guidelines, advice and recommendations to the board of directors in relation to the management and management of the bank, with special focusing on maintaining high liquidity, good asset quality and adequate cost control.

OVERSIGHT ON THE FORMULATION AND IMPLEMENTATION OF THE STRATEGIES AND

With the help of the commissions, the board of commissioners also assessed other key areas and submitted reports and recommendations to the board of directors. The commissioners continue to remind the board to adhere to the bank's principles of prudent and prudent operations while striving to achieve the bank's growth objectives.

OPINION ON THE BUSINESS PROSPECTS OF THE BANK AS FORMULATED BY THE BOARD

INITIATIVES ON SUSTAINABILITY FINANCE

The Board of Commissioners has observed that the implementation of sustainable finance at CIMB Niaga continues to improve. In late 2020, the Bank entered a new chapter in the implementation of sustainable finance by issuing sector guidelines for the financing of palm oil plantations.

HUMAN RESOURCES

In 2020, the Bank applied sustainable finance policies and procedures to financing activities in the corporate banking segment, established a list of high sustainability risks and conducted ongoing training programs. Not to be outdone, CIMB Niaga's Sharia Business Unit (SBU) also launched the Abhipraya Project to accelerate the development of sustainable financial products and services and augment CIMB Niaga's sustainable finance portfolios.

INFORMATION TECHNOLOGY

OBSERVATION ON IMPLEMENTATION OF BANK GOVERNANCE

THE FREQUENCY AND METHOD OF ADVISING THE BOARD OF DIRECTORS

OBSERVATION ON THE IMPLEMENTATION OF THE WHISTLEBLOWING SYSTEM

The Board of Commissioners considers the appointment of a third party to manage the whistleblower reports as the right policy to ensure the independence and professionalism of the system, whereby the whistleblower can be sure that there will be no conflict of interest in the resolution of complaints. , and that in the long term it will increase the confidence of the stakeholders in the management of the bank's whistleblowing system. The Board of Commissioners' role in managing the whistleblowing system is, among other things, to ensure that each report is followed up properly.

ASSESSMENT OF THE PERFORMANCE OF COMMITTEES UNDER THE BOARD OF

CORPORATE SOCIAL RESPONSIBILITY

In the opinion of the Board of Commissioners, in over six decades of operation, CIMB Niaga has had the moral duty to develop businesses and promote the national economy sustainably by continuously serving our clients and other stakeholders with integrity, by complying with all prevailing laws and regulations, and maintaining good business ethics. Our CSR focus on these four aspects is in line with the vision and mission of the Sustainable Finance of the Bank.

CHANGES IN THE COMPOSITION OF THE BOARD OF COMMISSIONERS

To this end, we fully support the CSR programs and activities of the Bank which focus on four key aspects, namely education, development and empowerment of communities, philanthropy and environment.

A CLOSING WORD OF APPRECIATION

To Our Valued Shareholders and Other Stakeholders,

MACRO ECONOMIC TRENDS IN 2020

CIMB Niaga focuses on growing market share in the segments that constitute the Bank's key strengths and well-understood target markets, namely consumer and SME. This was characterized by the decrease in the average loan to deposit ratio (LDR) to a level of 82.24%.

BANK PERFORMANCE ANALYSIS 2020 STRATEGY AND POLICY

- Playing to Our Strengths

- Expanding the CASA Franchise

- Discipline in Cost Management

- Preservation of Capital and Balanced Risk Culture

- Leveraging Information Technology

At the same time, the risk culture is instilled in all CIMB Niaga staff at all levels of the bank's operations. The use of the digital platform remains the bank's main focus to provide the best customer experience and safest banking transactions.

BUSINESS PROSPECTS

Share ownership of members of the board of directors, board of commissioners and shareholders within the bank's business group Share ownership (either directly or indirectly) of members of the board of directors and the board of directors who are currently active and/or appointed in 2020 within the business group of CIMB Niaga or the CIMB Group is in in accordance with the information presented in the corporate profile section of this annual report. All members of the board of directors and the board of directors do not have any ownership interests in subsidiaries.

SUSTAINABLE FINANCE INITIATIVES

Community Link, Women Empowerment, Financial Literacy and Inclusivity and the Bamboo Conservation Program implemented holistically. By the end of 2020, the CIMB Niaga Sharia Business Unit had commenced the launch of the Abhipraya project, which includes a number of initiatives to accelerate the development of products and/.

HUMAN RESOURCE MANAGEMENT

OPTIMIZING INFORMATION TECHNOLOGY

BANK GOVERNANCE

ASSESMENT ON THE PERFORMANCE OF COMMITEES UNDER THE BOARD OF

Throughout 2020, CIMB Niaga contributed a total of Rp 28.0 billion to its CSR programs, which were allocated to the bank's four main CSR focus areas, namely Education, Development and Empowerment, Philanthropy and Environment. Other social activities of the bank were carried out through the Qardhul Hasan fund worth Rp 16.4 billion.

CHANGES IN THE COMPOSITION OF THE BOARD OF DIRECTORS

In response to the challenges of the COVID-19 pandemic, the Bank has taken an innovative initiative by implementing its CSR activities through online training programs for bamboo farmers, financial literacy and inclusion through Tour the Bank and Ayo Menabung dan Berbagi (Let's Save and Share), and disability empowerment training. CIMB Niaga is committed to advancing CSR programs with thorough planning, accountability and in compliance with applicable policies and regulations, to provide added value to shareholders and all other stakeholders.

A WORD OF APPRECIATION

Statement of Responsibility of the Board of Commissioners for the 2020 Annual Report of PT Bank CIMB Niaga Tbk. Statement of Responsibility of the Board of Directors for the 2020 Annual Report of PT Bank CIMB Niaga Tbk.

Profile

In 2008, before the merger, PT Bank Niaga Tbk changed its name to PT Bank CIMB Niaga Tbk (rebranding) based on Charter No. CIMB Niaga also offers commercial and Shariah products and services through the Shariah Business Unit of CIMB Niaga.

NAME CHANGES INFORMATION

Committed to integrity, insistence on putting customers first and the spirit to continue to excel, CIMB Niaga will continue to use all its resources to create synergy between business units and the CIMB Group. The bank believes that it can continue to grow to be the leader and the best in providing banking services to the community.

BANK NAME CHANGES CHRONOLOGY

These are the core values of CIMB Niaga and are commitments that must be fulfilled for a very promising future.

MEMBERSHIP IN ASSOCIATIONS

Became the first public company in Indonesia to vote shareholders electronically (e-voting) at the General Meeting of Shareholders. Added Go Mobile features with eWallet Top Up, QR code, withdraw and deposit without a card, and improved the Go Mobile look and feel and user experience.

Launched Virtual Card Number (VCN) and BizChannel@CIMB Mobile for corporate customers

Opening of Digital Lounges in 6 new locations

The Go Mobile app transformation into OCTO Mobile with full features

MISSION

VISION

VISION AND MISSION REVIEW

3 Critical Behaviors

Go the extra-mile to delight customers

Respect each other, engage openly and work together

Recognize each other’s efforts and always back each other up

Customer Obsessed

High Performance

Integrity

Diversity and Inclusion

Agility

BUSINESS ACTIVITIES PURSUANT TO ARTICLES OF ASSOCIATION

BUSINESS ACTIVITIES CONDUCTED IN 2020

CIMB NIAGA PRODUCTS AND SERVICES SAVINGS PRODUCTS

TOTAL

Office Network 451 *

CASHPAYMENT

POINT &

Last appointment as a member of the Bank's Sharia Supervisory Board was based on the AGM decision 15 April 2019. Last appointment as a member of the Bank's Sharia Supervisory Board was based on the AGM decision on 15 April 2019.

INFORMATION ON CHANGES OF MANAGEMENT MEMBERS AFTER THE FISCAL YEAR 2020

LARGEST SHAREHOLDERS

SHAREHOLDER WITH MORE THAN 5% SHARES

SHAREHOLDERS WITH LESS THAN 5% SHARES

NUMBER OF SHAREHOLDERS AND PERCENTAGES BASED ON CLASSIFICATION

SHARE OWNERSHIP (DIRECT AND INDIRECT) OF THE BOARD OF COMMISSIONERS AND BOARD OF DIRECTORS

Appointed as Vice President Commissioner (Independent) in the AGM on 9 April 2020 and effective from 16 September 2020. Appointed as a Commissioner in the AGM on 25 September 2020 and effective upon obtaining OJK approval and/or meeting the requirements as determined in the AGM. OJK approval.

PURCHASE/SALE TRANSACTIONS OF THE BOARD OF COMMISSIONERS AND BOARD OF DIRECTORS

Appointed Senior Independent Bank Commissioner by CIMB Niaga Board of Commissioners District Resolution No.

CIMB NIAGA SHARE OWNERSHIP BY SENIOR EXECUTIVES

DEVELOPMENT OF CAPITAL STRUCTURE AND NUMBER OF OUTSTANDING SHARES IN THE LAST 5 (FIVE) YEARS

To strengthen its capital structure and support business expansion, CIMB Niaga has issued several Rupiah bonds and sukuk. All securities issued by CIMB Niaga and outstanding securities are listed on the Indonesian Stock Exchange.

OUTSTANDING BONDS AND SUKUK

The bonds and sukuk include Bank CIMB Niaga Subordinated Bonds I, II and III, Shelf Registration Bonds I, II and III Bank CIMB Niaga and Shelf Registration Sukuk Mudharabah I Bank CIMB Niaga.

MATURED AND SETTLED BONDS IN THE LAST 2 (TWO) YEARS

NEGOTIABLE CERTIFICATES OF DEPOSIT (NCD) ISSUANCES

The ultimate beneficial owners of CIMB Niaga are Khairulanwar Bin Rifaie and Rossaya Binti Mohd Nashir.

ULTIMATE SHAREHOLDERS AND CONTROLLING SHAREHOLDERS

SUBSIDIARIES

INVESTEE COMPANIES

The total assets for 2020 are unaudited until the finalization process of this annual report, and according to the management policy of the related entity, such information cannot be disclosed accordingly.

ASSOCIATED ENTITIES, JOINT VENTURES AND SPECIAL PURPOSE VEHICLE (SPV)

- Home

- About Us

- Investor Relations

- Corporate Governance

- CIMB Niaga Care (CSR)

Employment Ethics and Conduct Code, which can be accessed at the link: https://investor.cimbniaga.co.id/. Corporate governance policy, which can be accessed through a link: https://investor.cimbniaga.co.id/misc/.

CORPORATE SECRETARY AND INTERNAL AUDIT UNIT

EDUCATION AND/OR TRAINING OF THE BOARD OF COMMISSIONERS

Head, Non-Financial Risk Management CIMB Group May 15, 2020 Online Group Risk (Malaysia) City Hall with regional. Sustainability Leadership Training 2020 CIMB Group December 2, 2020 Kuala Lumpur, Malaysia Moody's Inside ASEAN: Indonesia I Credit After.

BOARD OF DIRECTORS EDUCATION AND/OR TRAINING

Realization of MSME as a new power of the national economy; Synergy of the MSME transformation program to enter the digital ecosystem. Name Title Training/Workshop/Conference/Seminar Organizer Time and Place YPO Southeast Asia FY21: Regional Committee Q2.

SHARIA SUPERVISORY BOARD EDUCATION AND/OR TRAINING

AUDIT COMMITTEE EDUCATION AND/OR TRAINING

NOMINATION AND REMUNERATION COMMITTEE EDUCATION AND/OR TRAINING

Name Position Training/Workshop/Conference/Seminar Organizer Time and Place Accelerate economic recovery through Financial. Name Position Training / Workshop / Conference / Seminar Organizer Time and Place CIMB Niaga Senior Leaders Meeting: Future.

RISK OVERSIGHT COMMITTEE EDUCATION AND/OR TRAINING

INTEGRATED GOVERNANCE COMMITTEE EDUCATION AND/OR TRAINING

CORPORATE SECRETARY EDUCATION AND/OR TRAINING

INTERNAL AUDIT WORK UNIT (IA) EDUCATION AND/OR TRAINING

RISK MANAGEMENT UNIT (SKMR) EDUCATION AND/OR TRAINING

Management

MESOP)

GLOBAL MACRO ECONOMIC CONDITIONS

THE INDONESIAN ECONOMY

THE BANKING INDUSTRY

THE POSITION OF CIMB NIAGA IN THE INDONESIAN BANKING SECTOR

A business segment constitutes a group of assets and operations engaged in the provision of products and services that are subject to risks and returns that are different from those of other business segments.

OPERATING SEGMENT

Treasury - it undertakes Bank CIMB Niaga's treasury activities which include foreign exchange, money markets, derivatives and investments in placements and securities transactions;. Other - includes all back office activities and non-profit center departments in Bank CIMB Niaga.

GEOGRAPHICAL SEGMENT

BUSINESS SEGMENT OF CIMB NIAGA

CIMB Niaga has 7 (seven) business segments namely corporate, business, retail, treasury, sharia, other and subsidiaries. Information regarding the operating segments of CIMB Niaga and its subsidiaries is presented in Note 51 to the Consolidated Financial Statements.

GEOGRAPHICAL SEGMENTS

The Corporate Banking business segment is a service offered by CIMB Niaga specifically to corporate clients as well as banking and non-banking financial institutions. Through such cooperation, CIMB Niaga is committed to creating banking services and products tailored to the needs of its customers.

STRATEGIES AND POLICIES

Corporate Banking continues to deliver innovative banking services and products to meet customer needs through collaboration with the Transaction Banking unit and the Financial Institutions & Non-Bank Financial Institutions unit.

FINANCIAL INSTITUTIONS

FI provides special expertise to support the Bank's business development in accordance with the variety of industries in accordance with OJK regulations. Account planning improving strategic synergy and cross-selling coordination with other CIMB Niaga business units to expand customer base and cross-sell product opportunities.

2020 PERFORMANCE

Maintain and grow the Securities Services business by investing in new systems, raising funds from both existing and new clients and identifying potential clients. Continue optimizing remittance business through a digital platform capable of transferring money in a variety of foreign currencies at competitive rates, and leverage the SWIFT GPI (Global Payment Innovation) feature for faster, more secure and trackable real-time money transfers to Abroad.

LOAN DISBURSEMENTS

LOANS QUALITY

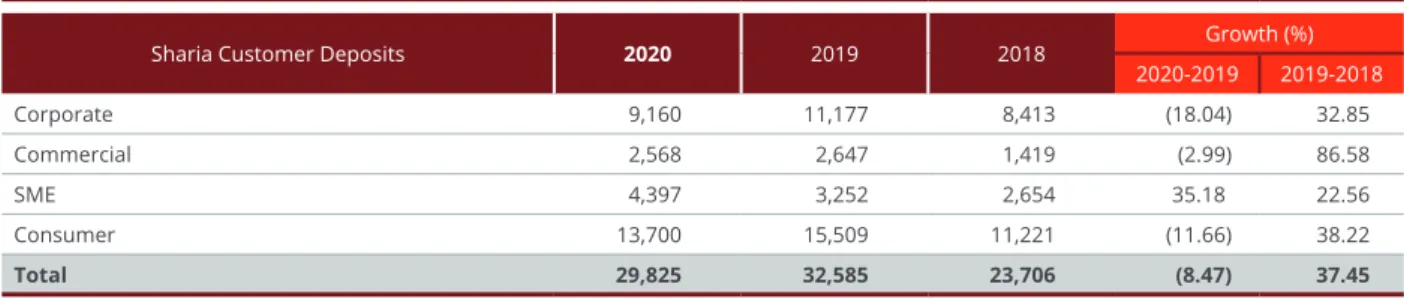

CUSTOMER DEPOSITS

CUSTOMER TESTIMONY

Doddy Sulasmono Diniawan

PLANS, STRATEGIES AND POLICIES IN 2021

Teguh Widhi Harsono

This decision is in line with the requirement to maintain macroeconomic stability amid low inflation and a relatively stable Rupiah. In addition to lowering interest rates, Bank Indonesia also offered stimulus programs to maintain market liquidity.

STRATEGY AND POLICY

Under these conditions, Treasury Banking and Capital Markets has emphasized its strategies by focusing on trading and. In 2020, Treasury Banking and Capital Markets achieved excellent results, where the implemented strategy managed to optimize opportunities amid uncertain economic conditions during the COVID-19 pandemic, leading to better achievements compared to the previous year.

TREASURY BANKING AS LIQUIDITY MANAGEMENT

TREASURY BANKING PRODUCTS AND SERVICES

A structured product related to derivative transactions in the form of currency options with a strike price. Clients investing in this product have the opportunity to benefit from rising bond reference prices by exercising the Option if the fix price is higher than the strike price.

SUPPORT FOR THE GOVERNMENT PROGRAM

Bond-linked investment, an investment whose return value is linked to the price of government securities (SBN).

Rony Tan Tiek Bing

NETWORKS AND SERVICES

OPTIMIZATION OF INFORMATION TECHNOLOGY

Tjandra Karya Hermanto

PLAN, STRATEGY AND POLICY IN 2021

Transaction Banking continues to strengthen its product portfolio and focuses on providing better services to customers, supported by a modern digital banking platform. The Securities Services unit is continuously enhanced as an anchor product of Transaction Banking to grow CIMB Niaga's fees and customer deposits from current accounts.

STRATEGIC COOPERATION

Lynda Dini Gunawan

PLAN, STRATEGY AND POLICY FOR 2021

Since 2020, Commercial Banking has established a strategic partnership with Micro Linkage, Koperasi Unit Desa (KUD) under a Core-Plasma Partnership, Rural Credit Banks (BPR) and Regional Development Banks (BPD) through a Linkage program, respectively Channeling, Executing and Joint Financing. Commercial Banking together with Transaction Banking and Treasury Banking continuously strive to provide solutions and services offering transaction convenience to customers.

MICRO LINKAGE

PERFORMANCE 2020

LOAN DISBURSEMENT

LOAN QUALITY

Such a moment was special and historic for us because CIMB Niaga was here when we really needed financial support. CIMB Niaga continues to offer and provide financing and savings products with competitive advantages that provide us with more profitable added values.

Eko Budiyono

BPR Eka hopes that CIMB Niaga will always be managed by reliable and friendly bankers who are able to meet the needs of customers amidst dynamic business challenges.

TARGET, STRATEGY, AND POLICY 2021

However, MKB Banking continued to selectively support new and existing clients for working capital and investment credit, citing prudential principles. The NPL ratio of CIMB Niaga's SME banking portfolio outperformed the NPL in the SME sector based on OJK data, which was 4.0%.

I Made Marjana, SE

Overall, SME Banking unit posted profit before tax of Rp1.1 trillion in 2020, the largest contribution of which came from net interest income of Rp1.5 trillion compared to Rp1.6 trillion in the previous year. In addition, the non-operating income of SME Banking unit achieved a positive result of Rp0.16 trillion in 2020, compared to Rp0.48 trillion in 2019.

TARGET, STRATEGY AND POLICY IN 2021

Lily Sutejo

In terms of marketing and distribution, Consumer Banking therefore focuses on improving digital banking services with OCTO Mobile & OCTO Clicks, as well as differentiating CIMB Niaga from other banks. The COVID-19 pandemic has resulted in a 26.77% decrease in Consumer Banking pre-tax income compared to 2019.

PRIVATE BANKING

To enhance CIMB Niaga's performance and excellence, Private Banking implements a stronger portfolio distribution strategy and maintains good customer relationships. As a result, Private Banking was able to maintain business growth in 2020, with Assets Under Management (AUM) increasing by 6.03% from 2019.

OPERATIONAL PERFORMANCE OF CONSUMER BANKING SEGMENTS

In addition, CIMB Niaga has managed to become Indonesia's largest sharia credit card provider. Sinarmas Land has been cooperating with CIMB Niaga in several strategic areas for over 10 years.

Alim Gunadi

In 2020, CIMB Niaga managed to increase sales of Wealth Management products, especially investment products. CIMB Niaga offers credit facilities to CIMB Niaga customers with a good track record through cross-selling.

Rannia Tanudjaja

The main philosophy that drives branchless banking is to provide services and convenience to CIMB Niaga customers. In addition, CIMB Niaga also manages the Digital Lounge through the Digital Bank Manager, which provides solutions for individual banking customers.

STRATEGY AND FOCUS IN 2021

CIMB Niaga SBU conducts business in accordance with Sharia principles and its benefits and can compete with conventional products. Under the DBLM, CIMB Niaga SBU may use and optimize the human resources and infrastructure owned by CIMB.

James Firdaus Resman

Tokopedia's success so far has also been supported by a good partnership with CIMB Niaga Syariah, established in 2018. CIMB Niaga Syariah is also Tokopedia's first sharia giro account, with CIMB Niaga Syariah maintaining a sound cash management system and competitive rate indicators.

COMPLIANCE AND IMPLEMENTATION OF THE SHARIA GOVERNANCE FRAMEWORK

CIMB Niaga SBU is also implementing the Syariah First program in its Business Support (Middle, Back End) to enable better efficiency in the reservation process for Sharia accounts. In addition, CIMB Niaga SBU has also launched a number of COVID-19 stimulus programs to help its customers during the COVID-19 pandemic.

REALIZATION AND PROFIT-SHARING CALCULATION METHOD

In 2020, CIMB Niaga UUS recorded a gross non-performing finance (NPF) ratio of 1.1%, a slight increase from 1.0% in the previous year. To maintain productive asset quality, CIMB Niaga SBU has increased its collaboration with the Loan Work Out (LWO) team to ensure restructuring and collectability of the problematic or non-performing financing and marginal accounts.

COLLECTION AND DISBURSEMENT OF ZAKAT, INFAQ, AND SEDEKAH (ZIS)

Only CIMB Niaga Syariah could meet these needs, with the best service. The CIMB Niaga Syariah team finds suitable products and still adheres to the principles of Sharia in which I believe.

Trisha Chas

CIMB Niaga Syariah is a bank with a strong foundation and banking experience that deserves to be recognized internationally. I believe CIMB Niaga Syariah can maintain its service quality and become the leading Sharia bank in the country so that Muslims have their own trusted place to conduct banking activities in accordance with the principles of Sharia they believe in.

SOURCE AND UTILIZATION OF THE BENEVOLENCE FUND