Additional Tier 1 instruments (and CET1 instruments not included in row 5) issued by subsidiaries and held by third parties (permissible amount in AT1 pool). Leverage Ratio - Exposure in the Leverage Ratio Report and Leverage Calculation Report - Bank A only. Exposure in the Leverage Ratio Report. 31 Leverage ratio (including the effect of any applicable temporary exemption of central bank reserves), which includes.

31a Financial leverage coefficient (without the effect of any applicable temporary exemption of central bank reserves), which includes the mean values from line 28 of the gross assets of the SFT. Leverage Ratio - Exposure in the Leverage Ratio Report and the Leverage Calculation Report - Consolidated A. Exposure in the Leverage Ratio Report. 31 Leverage ratio (including the effect of any applicable temporary exemption of central bank reserves), which includes the average.

31a Rasio leverage (tidak termasuk dampak pengecualian sementara cadangan bank sentral yang berlaku) mencakup rata-rata. Risiko Kredit - Pengungkapan Tagihan Bersih dan Teknik Mitigasi Risiko Kredit - Bank secara konsolidasi dengan Perusahaan Anak Pengungkapan Tagihan Bersih dan Teknik Mitigasi Risiko Kredit - Secara Konsolidasi. Risiko Kredit - Pengungkapan perhitungan ATMR untuk risiko kredit dengan menggunakan Pendekatan Standar - Bank secara individu 1.

Credit Risk - Counterpary Credit Risk (CCR1) Exposure Analysis - consolidated

- Credit risk - Capital Charge for Credit Valuation Adjustments

- Credit Risk - CCR Exposure based on Portfolio Category and Risk Weighting (CCR3) - consolidated

- Credit Risk - Net Credit Derivative Claims (CCR6) BCA has no exposure to net credit derivative receivables

- Credit Risk - Securitization Exposure in the Banking Book (SEC1)

- Credit Risk - Securitization Exposure Components in the Trading Book (SEC2)

- Credit Risk - Securi za on Exposure in the Banking Book and related to its Capital Requirements - Bank Ac ng as Originator or Sponsor (SEC3) BCA does not act as the originator or sponsor of Securitization Exposure

- Credit Risk - Securitization Exposure in the Banking Book and related to its Capital Requirements - Bank Acting as Investor (SEC4)

- Disclosure of Market Risk Using Standardized Method

- Presently, Bank does not have sufficient long-term financial resources to fund fixed-rate loans and banking book securities

- Measurements of IRRBB individual are carried out on a monthly basis by using two (2) methods as follows

- parallel shock up, 2) parallel shock down,

- steepener shock (short rates down and long rates up), 4) flattener shock (short rates up and long rates down),

- short rates shock down

- parallel shock up, 2) parallel shock down

- Average repricing maturity applied for NMD is 2.9 years

- The longest repricing maturity applied for NMD is 5 Years

Credit Risk - Net Credit Derivative Claims (CCR6) BCA has no exposure to net credit derivative receivables. BCA has no exposure to net credit derivative receivables. Traditional Synthesis Subtotal Traditional Synthesis Subtotal Traditional Synthesis Subtotal Retail (total) - among others. Credit Risk - Securi za on Exposure in the Banking Book and related to its Capital Requirements - Bank Ac ng as Originator or Guarantor (SEC3) BCA does not act as the originator or guarantor of Securitization Exposure BCA does not act as the originator or guarantor of Securitization Exposure.

Credit risk - Securitization exposure in the banking book and related to its capital requirements - Bank acting as investor (SEC4). Exposure value (Based on the regulator's approach). Based on regulator method) Capital collection according to ceiling per 30 June 2021. Interest rate risk in the bank book (IRRBB) refers to the current or future risk to the bank's capital and earnings arising from interest rate movements in the market as opposed to the bank book positions.

The IRRBB calculation uses two perspectives: interest rate movements on the market and not the positions in the banking book. Currently, the Bank does not have sufficient long-term financial resources to finance fixed-rate loans and bank securities. With regard to these conditions, the sources of financing of fixed rate loans and bank securities are calculated based on the Core Deposit.

To mitigate risks, Bank has set nominal limits on fixed rate loans and bank book securities, limits on IRRBB and pricing strategies. Economic Value of Equity (EVE) Methods use six (6) interest rate shock scenarios, as follows: .. 3) steeper shock (short rates down and long rates up), 4) flatter shock (short rates up and long rates down), 4) flattening shock (short rates up and long rates down), 5) short rates shock up,. Net Interest Income (NII) Methods use two (2) interest rate shock scenarios, as follows: .. 1) parallel shock up, 2) parallel shock down.

The interest rate shock scenario used by the bank in measuring IRRBB is in accordance with the standard interest rate shock scenario stated in Financial Services Authority Circular no. An approach to interest rate risk in the banking book for commercial banks.

RISK MANAGEMENT IMPLEMENTATION REPORT FOR INTEREST RATE RISK IN THE BANKING BOOK

Measurements of IRRBB consolidated are carried out on a quarterly basis by using two (2) methods as follows

The bank performs additional calculations for automatic rate options for variable rate mortgages with built-in caps using the Black-Scholes model. This resulted in an increase in assets with a modified price in 1 year (6.61%), which was greater than the increase in core deposits in 1 year (3.83%). The EVE method calculates principal cash flows and interest payments on balance sheet positions that are sensitive to interest rates, which are then discounted at the appropriate interest rates.

The EVE calculation uses theoretical cash flows multiplied by the reference rate (base rate) on the transaction date and then discounted by the risk-free rate on the reporting date. The IRRBB calculation uses a Core deposit, which is part of a stable Non Maturity Deposit with a very small interest rate change despite significant changes in interest rates in the market. The bank identifies core deposits and non-core deposits from stable funds (retail transactions, retail non-transactional and wholesale).

Posting of core deposit cash flows carried out using uniform distribution on time bucket over 1 (one) year with the length of period for each category refer to FSA Circular No. 12 / SEOJK.03 / 2018 on the Implementation of Risk Management and Risk Measurement Standard Approach for interest rate risk in the bank book (interest rate risk in the bank book) for commercial banks. The methodology to estimate prepayment rate for loans and early withdrawal rate for time deposits uses historical data within a year.

IRRBB REPORT

HQLA after deduction of outstanding liabilities and payables times outflow rate or contract receivables times inflows. 1 Adjusted values are calculated after the introduction of depreciation (deduction), outflow rate and inflow rate and caps for HQLA components, for example the caps for HQLA Level 2B and HQLA Level 2 and the cap on cash inflows can be taken into account in the LCR. The above calculation of the liquidity coverage ratio is based on POJK no. 42/POJK.03/2015 on the obligation to meet the liquidity coverage ratio for commercial banks and POJK no. 37/POJK.03/2019 on transparency and publication of bank reports and presented in accordance with SE OJK no. 9/SEOJK.03/2020 on transparency and publication of the first quarter of 2021.

QUARTERLY LIQUIDITY COVERAGE RATIO (LCR) REPORT Analysis for Bank Only

Total Rp & Va Current Account 28.40%

Time Deposit 22.02%

Analysis on a Consolidated Basis

Time Deposit 22.36%

Non-specified

Maturity < 6 Months ≥ 6 Months - <

1 Year ≥ 1 Year 1

TOTAL ASF

Net Stable Funding Ratio (NSFR) - Bank Only

ASF Component

Reporting Position (June 2021) Carrying Value Based on Residual Maturity (in million Rp)

Weighted Value

Carrying Value Based on Residual Maturity (in million Rp)

1 Year ≥ 1 Year

Net Stable Funding Ratio (%)

RSF Component

ValueReporting Position (March 2021)

QUALITATIVE ASSESMENT ON NSFR

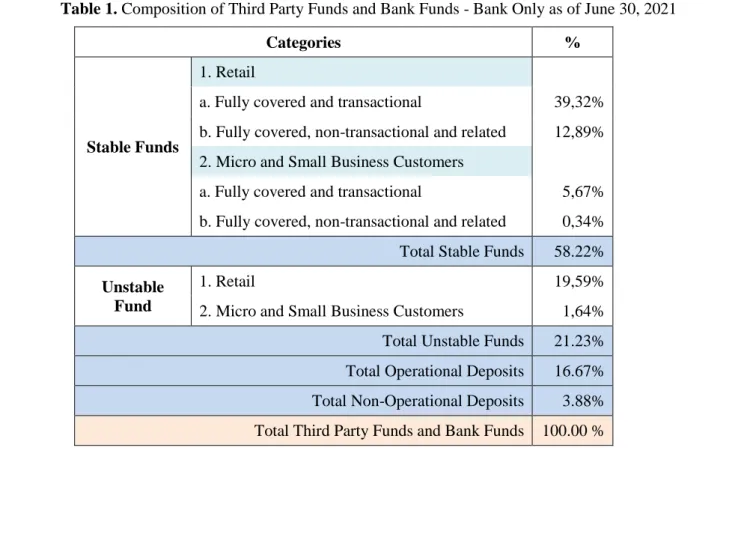

Analysis on Bank Only Financial Statement

Stable Funds

Unstable Fund

Micro and Small Business Customers 1,64%

Net Stable Funding Ratio (NSFR) - Consolidated

Reporting Position (June 2021)

Reporting Position (March 2021) Carrying Value Based on Residual Maturity (in million Rp)

287.557.815 TOTAL RSF

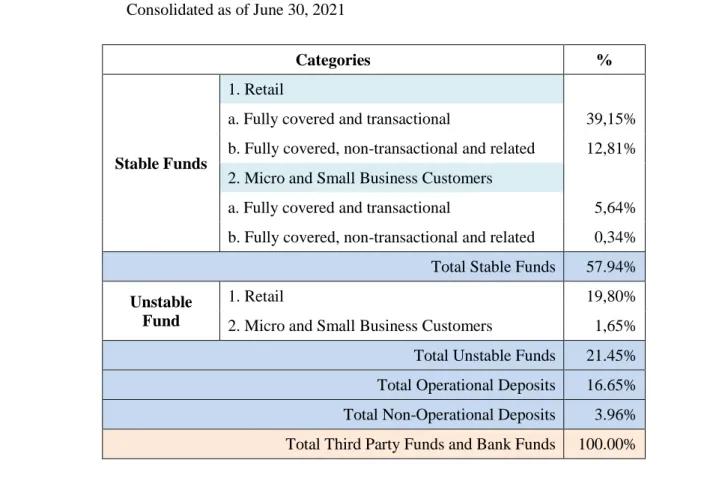

QUALITATIVE ASSESMENT ON NSFR Analysis on Consolidated Financial Statement

Micro and Small Business Customers 1,65%

Report On Asset Encumbrance - ENC as of June 30, 2021