454 Performance Evaluation of the Board of Commissioners and the Board of Directors 458 Diversity Policy. 480 Related relationships between members of the board of commissioners, the board of directors and the controlling shareholder.

Achievements of Financial Year 2022

Maintaining Positive Performance

Sustainability Commitment

Sustainable Action

Sustainable Business

Corporate Social Responsibility

Governance and Risk

Stakeholders Engagement and Advocacy

Sustainability Performance Highlights 2022

Travel Concierge

Investment (Mutual Fund, Bond, etc)

Cardless Withdrawals Scan QRIS

Bill Payment

Comprehensive Digital Banking Features

Our Digital Initiatives

Open-App Experience

OCTO Mobile

Payable Management

SWIFT Global

Payment Innovation

Receivable Management

Online FX Transactions

Liquidity Management

Underlying Document Upload

BI-Fast

Value Chain

Trade Finance

Biometric Login

Secure, reliable, and future-proof

Framework for partnership ecosystem

Regional based platform for non-

BizChannel@CIMB

FINANCIAL AND 01

OPERATIONAL DATA HIGHLIGHTS

Financial Data Highlights

FINANCIAL POSITIONS

PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME

FINANCIAL RATIOS

CASH FLOW STATEMENT

It includes candidates for members of the board of directors, who will be valid after obtaining the approval of the OJK and/or fulfilling the requirements specified in the approval of the OJK.

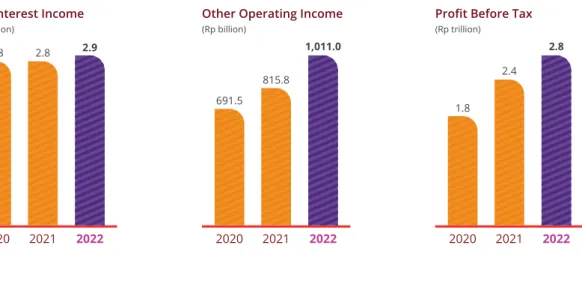

FINANCIAL GRAPHICS

CASA

Business and Subsidiaries Operational Highlights

Share Highlights

INITIAL PUBLIC OFFERING

STOCK TRADING PERFORMANCE

QUARTERLY STOCK PERFORMANCE

CORPORATE ACTION

SUSPENSION OF STOCKS TRADING AND/OR DELISTING

Bonds, Sukuk,

January - November 27 January, 24 February,

January – December

March - October

OJK recognized CIMB Niaga's active participation in supporting students' financial education and involvement with the KEJAR award. CIMB Niaga collaborated with the KEHATI Foundation to plant 10,000 Tabah bamboos in the Rarung Research Forest Area (KHP), Lombok - NTB.

Live an

EPICC Life

MANAGEMENT REPORT

Report of The Board of Commissioners

Didi Syafruddin Yahya

President Commissioner

During 2022, the Board of Directors of CIMB Niaga exercised our duties to oversee the Board, including how they worked on the Bank's Business Plan (RBB) and Sustainable Finance Action Plan (RAKB). We also monitored how they applied the bank's strategy, particularly in terms of risk management, loan disbursement, profit generation, IT implementation, human resource development, corporate governance practices and sustainable finance implementation.

MACRO ECONOMY 2022

Indonesia saw people's mobility increase at a much faster rate in the post-pandemic era, coupled with strong growth in consumer consumption and bank lending. Loans from the Indonesian banking sector also improved in terms of quality, as shown by the December 2022 Non-Performing Loans (NPL) ratio of 2.44% (gross) and 0.71% (net).

OUR ASSESSMENT OF THE PERFORMANCE OF THE BOARD OF DIRECTORS

On the other hand, growth in Customer Deposits showed a rather leveling trend, which is consistent with Bank Indonesia's intention to normalize liquidity to help tame inflation. Increases in the bank reserve ratio (BRR) and interest rates were the main monetary instruments to keep inflation under control.

SUPERVISION OF THE FORMULATION AND IMPLEMENTATION OF THE BANK’S STRATEGY

VIEWS ON THE BUSINESS PROSPECTS PREPARED BY THE DIRECTORS

Going forward, the Bank will respond to the potential slowdown in the global macro economy with prudent strategies. We believe that by embracing and focusing on the Bank's pillars, the Board of Directors will be able to continue to grow the Bank's business in the future.

SUSTAINABLE FINANCE

Amid lingering uncertainty, inflationary woes, interest rate trends and geopolitical conflicts in the global macro economy, we believe the country's banking industry will continue to deliver positive results despite a potential slowdown ahead. On the contrary, the Deposit Insurance Company (LPS) predicts that customer deposit growth will slow in 2023.

HUMAN RESOURCES

It will require banks to make additional efforts to respond to the potential slowdown in customer deposits that will come with stronger credit demand.

INFORMATION TECHNOLOGY

Therefore, we will continue to support the bank in further cementing its position as a leader in digital banking services with IT utilization. CIMB Niaga is one of the financial institutions in Indonesia that is actively developing digital banking features to provide convenience and comfort to customers' banking transaction needs.

VIEWS ON THE IMPLEMENTATION OF BANK GOVERNANCE

VIEWS ON WHISTLEBLOWING SYSTEM

FREQUENCY AND METHOD OF GIVING ADVICE TO THE BOARD OF DIRECTORS

VIEWS ON THE PERFORMANCE OF THE COMMITTEES UNDER THE BOARD OF

The risk monitoring committee did an excellent job of overseeing and advising the board of directors to ensure that the bank's risk management met the elements of the adequacy of risk management procedures and methodologies that govern the bank's business activities within the confines of the bank. risk appetite, and within limits favorable to the Bank. Finally, the Integrated Governance Committee fulfilled its duties and responsibilities in overseeing the implementation of Governance at each Financial Services Institution (LJK) within the CIMB Indonesia Financial Conglomerate to ensure that they continue to adhere to the Integrated Governance Guidelines.

SOCIAL AND ENVIRONMENTAL RESPONSIBILITY

The Audit Committee performed well in its duties and responsibilities in overseeing several matters related to the quality of financial information, the effectiveness and adequacy of the internal control system, the effectiveness and adequacy of risk management, the effectiveness of audits performed by external and internal auditors, and compliance with laws and regulations. Respectively, the nomination and remuneration committee has also performed well in the area of nomination and remuneration of members of the board of commissioners, Sharia supervisory board, directors and members of committees under the board of commissioners, including total employee remuneration.

CHANGES IN THE COMPOSITION OF THE BOARD OF COMMISSIONERS

APPRECIATION AND CLOSING

Board of Commissioners

Appointed Senior Independent Bank Commissioner by CIMB Niaga Board of Commissioners District Ordinance No.

Lani Darmawan

Report of The Board of Directors

While our key focus is on how to grow the business, we have also prioritized the sustainability of our business by incorporating environmental, economic, social and governance aspects into the operational banking process. Passionate about this year's Anda#YangUtama approach, we have always strived to provide the best for our customers.

MACROECONOMIC DEVELOPMENT

With an eye on the nation's economic recovery and its subsequent expansive path, we have continued to seize every opportunity to do so. We achieved this by improving the quality of our services, products, digital technology and innovations, which enabled us to bring to life CIMB Niaga's aspiration to become the bank of choice for the Indonesian people and businesses.

BANK PERFORMANCE ANALYSIS 2022 STRATEGIES AND POLICIES

- Playing to Our Strengths

- Expanding the CASA Franchise

- Discipline in Cost Management

- Preservation of Capital and Balanced Risk Culture

- Leverage Information Technology

The bank's 2022 strategy and strategic policies are formulated in accordance with the mandate in the board's charter. Total customer deposits reached Rp 227.2 trillion from Rp 241.3 trillion the previous year, allowing us to maintain the bank's liquidity position.

OTHER PERFORMANCE ORGANIZATIONAL STRUCTURE

BUSINESS PROSPECTS, ECONOMIC DEVELOPMENT, AND TARGET MARKET

Domestically, the government's recent lifting of restrictions on community activities is expected to positively impact economic growth and the banking industry. Overall, Bank Indonesia estimates that economic growth in 2023 will remain strong, although it will slow slightly to the middle of the 4.5-5.3% range, before returning to 4.7-5.5% in 2024.

IMPORTANT THINGS IN THE FUTURE

The latest BI survey provides various indicators of the ongoing recovery process of the domestic economy, such as the consumer confidence index, the retail sales index and the manufacturing purchasing managers' index (PMI). Along with the end of the COVID-19 restructuring in March 2023, the total balance of the restructured COVID loans decreased.

SUSTAINABLE FINANCE INITIATIVES AND ESG IMPLEMENTATION

Regarding the financing portfolio, this year the bank was appointed by OJK to participate in a pilot project related to reporting based on the Indonesian Green Taxonomy (THI). Conversely, the bank's sustainable financing portfolio classified according to the Sustainable Business Finance Category (KKUB) from December 2022 reached 26% of the bank's total loan portfolio.

HUMAN RESOURCE DEVELOPMENT

Regarding sustainability products and services, the Bank launched Sustainability Market Linked Deposits and Giro Kartini, which support women entrepreneurs, and continued the Sustainability Linked Loan/Financing (SLL/F) and Sustainable Finance (SF) programs. for wholesale banking customers. The December 2022 THI identification and reporting results for the YTD financing portfolio in November 2022 showed that 36% of our top 350 debtors fell under the green or yellow category, or equivalent to Rp 28.35 trillion.

INFORMATION TECHNOLOGY OPTIMIZATION

As one of the important issues in the banking industry, we continue to strengthen the capability and capacity of Cyber Security to make it more proactive in improving IT security in anticipating virus and malware threats and mitigating digital risks by updating the platform incident management and automating security. testing in applications.

BANK GOVERNANCE IMPLEMENTATION

ASSESSMENT OF THE PERFORMANCE OF COMMITTEES UNDER THE DIRECTORS

CIMB Niaga implemented TJSL activities through the implementation of the Scholarship Program, Ayo Menabung dan Berbagi (Let's Save and Share) Program (AMDB), Tour de Bank (TDB), Community Link Program, Bamboo Conservation Program, Blood Donation and Religious Donations. to help with natural disasters. In 2022, CIMB Niaga expended a total TJSL fund of Rp 24.2 billion, distributed across the four pillars of the bank's TJSL, including education, community health and well-being, economic empowerment, and climate and environment.

CHANGES IN THE COMPOSITION OF MEMBERS OF THE BOARD OF DIRECTORS

TJSL is a concrete expression of the Bank's commitment and policies to achieve the Bank's Vision and Mission of Sustainable Finance and in accordance with the Financial Services Authority Regulation No. CIMB Niaga's TJSL implementation has a clear goal: to provide positive impacts and the social and economic well-being of the people with whom the Bank has links, by progressively implementing the right long-term impact programs and then developing those programs on an ongoing basis.

Board of Directors

Report of The Sharia Supervisory Board

Sharia Supervisory Board

ANNUAL REPORT

RESPONSIBILITY STATEMENT

Statement of Responsibility of the Board of Directors for the 2022 Annual Report of PT Bank CIMB Niaga Tbk. We, the undersigned, the Board of Directors of PT Bank CIMB Niaga Tbk, declare that all information in the 2022 Annual Report of PT Bank CIMB Niaga Tbk is presented in its entirety and that we take full responsibility for the correctness of the content of this Annual Report.

Banking Solutions in Your Hands

Speed, accuracy and convenience in transactions are CIMB Niaga’s commitment for innovation as we continue to

COMPANY PROFILE

General Company Information

CIMB Niaga At a Glance

BRIEF HISTORY

In 2008, before the merger, PT Bank Niaga Tbk changed its name to PT Bank CIMB Niaga Tbk (rename) based on act no. CIMB Niaga also offers commercial and Shariah products and services through the CIMB Niaga Shariah Business Unit.

Name Change Information

Association Membership

Launch of the Self-Service Banking engine with new features, namely card replacement and fast data update in just 5 minutes. The transformation of the Go Mobile app to OCTO Mobile with all the features like the Super app.

Milestones

Became the first public company in Indonesia to conduct shareholder electronic voting (e-voting) at the general meeting of shareholders.

VISION

MISSION

Corporate Vision, Mission, Culture and Core Values

Corporate Values and Culture Corporate Identity (Logo)

ENABLING TALENT

PASSION

INTEGRITY & ACCOUNTABILITY

COLLABORATION

CUSTOMER CENTRICITY

Organization Structure

Business Activities

BUSINESS ACTIVITIES PURSUANT TO ARTICLES OF ASSOCIATION

BUSINESS ACTIVITIES CONDUCTED IN THE 2022 FINANCIAL YEAR

CIMB NIAGA PRODUCTS AND SERVICES SAVINGS PRODUCTS

Business Network and Operating Areas

Riau

Riau Islands

Jambi

Bangka Belitung Islands

East Kalimantan North Kalimantan

West Kalimantan

West Sumatera

South Sumatera

Lampung

Banten West Java

Jakarta

Yogyakarta East Java

South Kalimantan Central Java

Bali

West Nusa TenggaraNanggroe Aceh

Darussalam

North Sumatera

417 Office Network TOTAL *

North

Sulawesi Maluku

South Sulawesi

East Nusa Tenggara

328 Branches 37

Digital lounges

34 Cash Mobiles

18 Kiosks

Board of Commissioners’ Profiles

Commissioners and members of the Board of Directors, but she is affiliated with the Ultimate and Controlling Shareholders. Commissioners and members of the Board of Directors, but he is affiliated with the Ultimate and Controlling Shareholders Education and.

Board of Directors’ Profiles

Education in 2022 Education and training in 2021 are presented separately in the Education and/or Training of the Executive Board chapter of this annual report. Education in 2022 Education and training in 2021 are presented separately in the Education and/or Training of the Executive Board chapter in this annual report.

Sharia Supervisory Board Profiles

Undergraduate in Sharia from UIN Syarif Hidayatullah (1981) Work Experiences • Member of the Sharia Supervisory Board at LB Salam. Vice Chairman of the National Sharia Council (DSN-MUI) and Vice Chairman of the Fatwa Committee of the Indonesian Cleric Council (MUI) (2005-present).

Information on the Changes in Management Members After the 2022 Financial Year

Senior Executives’ Profiles

Antonius Pramana Gunadi

Budiman Tanjung

Megawati Sutanto

Adeline Hendarto Tjong

Affianti Suwita

Agus Setiono

Ahmad Nasihi Ulil Amri

Albert Agustius

Albert Suhandinata

Alip Hanoky

Amir Mirza

Andi Irawan Dalimunthe

Andiko S Ben Asa Manik

Angelica Permatasari

Antonius Sukriswanto

Aris Susanta

Ariteguh Arief

Aulia Mochtar

Aurelia Mulyono

Bambang Karsono Adi

Banar Yuniarta

Banyon Anantoseno

Bung Aldilla

Chialmi Dialdestoro Rosalim

Daniel Edison Hutapea

Dedy Sahat Tupal Parulian

Diva Mahdi

Djojo Boentoro

Elisa Gunawan

Eric Augie Saputra

Eric Gunawan Kosasih

Evita Barliana

Ferdinand Renaldi Wawolumaya

Fransiska Liminda Halim

Gerry Sarent Tenges

H Ahmad S Ilham

Hadi Soedarso

Hartono Agus

Heintje Mogi

Hernaman Tandianto

Hotamawaty

I Gusti Ngurah Dwi Sapta

Iwan Pujiharto

Joni Hermanto

Juliana

Julius Wiantara Tjhioe

Juto Budihardjo

Ketut Meliana Saputra

Koei Hwei Lien

Lena

Lina

Linda Marshelia

Liston Siahaan

Livia Sutanto

Lusiana Saleh

Lydiya Widjaja

Magdalena

Maya Latif

Maya Sartika

Mika Martumpal

Miranty Supardi

Muhammad Shodiq

Nora Joice Kimbal

Paskalina Purwa Ndadari Singara

Patricia Hendrawirawan

Peter Gunawan

Pribadi Wijayanti Kusumodewi

Ratri Setyorini

Ria Yohanita

Riboet Budiono

Roy Bahren Siregar

Rudy Hutagalung

Rusidi

Sandi Maruto

Santori Malinton

Sjarif Hartady Gunawan

Solihin Hakiekie

Stella Fiona

Sudono Salim

Suherman Onihana

Surya Kirana Sulistiyo

Syamsul Aidi Bachtiar

Tajindra Pal Singh

Teguh Sunyoto

Tjahjadi Yapeter

Toni Darusman

Tony Tardjo

Trisna Lucia Mauliaty Siahaan

Wahdinie Musmar

Waskin

Widodo Suryadi

Yulius Setiawan

Number of Employees and Competency Development Data Statistics

To improve the competences and skills of employees in the performance of business operational activities and the development of the information technology capabilities of the company. Banking To improve the competencies and skills of employees to effectively and efficiently carry out financial transaction activities.

POLICY ON OCCUPATIONAL HEALTH AND SAFETY

The number of training participants increased by 74% and the number of training days increased by 99% compared to the previous year. This was due to an increase in the number of participants for the development program, The Complete Banker, Apprenticeship and mandatory certification in the payment system and Rupiah Money Management (SPPUR).

Shareholder Composition

The Statute of the Association stipulates that shareholders, individually and together, representing at least 1/10 of the total number of shares with valid voting rights, may propose agenda items to the GMS, including the appointment of members of the Bank's Board of Directors and the Board of Commissioners. . SHARE OWNERSHIP (DIRECT AND INDIRECT) OF THE BOARD OF COMMISSIONERS AND BOARD OF DIRECTORS.

SHARE PURCHASE/SALE TRANSACTIONS OF THE BOARD OF COMMISSIONERS AND THE BOARD DIRECTORS

Number of shares including 1 MESOP share and 10,000 share purchase transactions made prior to effectively serving as director.

CIMB NIAGA SHARE OWNERSHIP BY SENIOR EXECUTIVES

DEVELOPMENT OF CAPITAL STRUCTURE AND NUMBER OF SHARES OUTSTANDING IN THE LAST 5 (FIVE) YEARS

Chronology of

Issuance and/or Listing of Shares

Chronology of Other Securities Listings

OUTSTANDING BONDS AND SUKUK

MATURED AND SETTLED BONDS IN THE LAST 2 (TWO) YEARS

NEGOTIABLE CERTIFICATES OF DEPOSIT (NCD) ISSUANCES

Corporate Group Structure

ULTIMATE SHAREHOLDERS AND CONTROLLING SHAREHOLDERS

Subsidiaries, Associations, and Joint Venture Companies

ASSOCIATED ENTITIES, JOINT VENTURE AND SPECIAL PURPOSE VEHICLE (SPV)

SUBSIDIARIES PROFILE

2018 dated 20 April 2018 and has been announced in the Government Gazette of the Republic of Indonesia No. To be a leading ASEAN company and a major player in the markets of underwriting and financial advisory in the Indonesian capital market.

List of Business Partnerships

Capital Market Supporting Institutions and Professions

PUBLIC ACCOUNTANT AND PUBLIC ACCOUNTING FIRM

ACCESS TO BANK DATA AND INFORMATION

Website Information

- Home

- About Us

- Products and Services

- Investor Relations

- Corporate Governance

- CIMB Niaga Cares (CSR)

- Sustainability

This menu bar contains general information options related to Investor Relations, Corporate Governance and CIMB Niaga Cares, which can be directly accessed through the integration microsite (investor.cimbniaga.co.id). This menu bar contains options for financial information, dividend information, stock/bond information, news and events, and information requests that can be accessed through the microsite integration (investor.cimbniaga.co.id).

Education and/or Training of

The Board of Commissioners, Board of Directors, Committees, Corporate

FEKDI 2022) "Advancement of Digital Economy and Finance: Synergistic and Inclusive Ecosystem for Accelerated Recovery: Digital Currency". FEKDI 2022) "Advancing Digital Economy and Finance: Synergistic and Inclusive Ecosystem for Accelerated Recovery: Inclusive and Sustainable Economic Activities".

Strategic Partner

CIMB Niaga as a business partner, is dedicated to supporting your business goals, as well as inclusive and sustainable economic growth

MANAGEMENT DISCUSSION

AND ANALYSIS

Profit and loss and other comprehensive income 213 Statements of cash flows 214 Key financial ratios 215 Prime lending rate. The bank's assets reached Rp 306.8 trillion, with customer deposits at Rp 227.2 trillion, a CASA contribution of Rp 144.4 trillion, or 63.57% of total customer deposits.

Review of 2022 Macro Economy

GLOBAL AND NATIONAL ECONOMIC OVERVIEW

Pressure on the Rupiah exchange rate eased in November-December 2022 due to foreign capital inflows into the SBN market and Bank Indonesia's stabilization measures.

BANKING REVIEW

Bank capital remains strong, with the capital adequacy ratio (CAR) remaining high in November 2022 at 25.45%, reflecting the growing capital component of accumulated profits and risk-weighted assets (RWA). As the economy improves and community activity restrictions (PPKM) are phased out, digital economic and financial transactions will continue to grow, supported by increasing public acceptance and preference for online shopping, the convenience of digital payment systems and the development of digital banking.

THE POSITION OF THE INDONESIAN BANKING SECTOR

CIMB Niaga always applies prudential principles in line with the bank's risk appetite in lending so that loan quality can be properly maintained. This effort is supported by the continued implementation of the 5 Strategic Pillars policy to sustain the Bank's performance and take advantage of growth opportunities.

Business Segment Review

Corporate Banking

STRATEGIES AND POLICIES

FINANCIAL INSTITUTIONS

PERFORMANCE IN 2022

LOAN DISBURSEMENTS

LOAN QUALITY

CUSTOMER DEPOSITS

HR IN CORPORATE BANKING

Juliawati Gunawan

As part of the regional bank, CIMB Niaga can provide solutions not only from within the country, but also from abroad by leveraging the regional presence of the CIMB Group. For the final syndication deal in 2022, CIMB Niaga has proven itself in providing a loan structure that can be executed and successfully closed within a tight timeline.

Anthony Prabowo Susilo

In the future, I hope that CIMB Niaga continues to be the best partner for its customers, offering more innovative financing solutions that suit customers' needs.

PLANS, STRATEGIES AND POLICIES FOR 2023

Treasury and Capital Markets

STRATEGY AND POLICY

In line with efforts to increase foreign exchange transactions in all business segments, sales of investment products became one of the focal points in the Consumer Banking segment in 2022. Furthermore, marketing and promotional efforts were continued to increase customer and prospective customer awareness of the benefits and convenience of conducting foreign exchange transactions and investing at CIMB Niaga.

2022 PERFORMANCE

Treasury and Capital Markets have responded optimally to the trend of rising interest rates and market volatility by releasing new products, including in support of CIMB Niaga's environmental, social and governance (ESG) initiatives.

TREASURY AND CAPITAL MARKETS AS LIQUIDITY MANAGEMENT

TREASURY AND CAPITAL MARKETS PRODUCT AND SERVICES

Strike Currency is a structured product related to derivative transactions in the form of currency options using a target price (strike price). Ten-year MLD is available in Rp and USD, and it provides a 100% guarantee of principal if held until maturity or if the bank makes a recall.

SUPPORT FOR GOVERNMENT PROGRAMS

Bond Linked Investment is a structured product that combines non-derivatives (deposits) with derivatives (bond options) and is denominated in rupiah. Market-Linked Deposit for Sustainability (MLD) is issued as a form of bank participation in the ESG (Environmental, Social, and Governance) movement.

Lim Jia Wei Andrew

CIMB Niaga is the counterparty for government bond transactions such as Indonesian retail bonds (ORI) and Indonesian retail sukuk (SRI) and corporate bonds. The 10-year MLD is the latest tenor (ten-year) version of the X-Tra Fixed Rate MLD, which was previously available in three- and five-year tenors.

NETWORKS AND SERVICES

OPTIMIZATION OF INFORMATION TECHNOLOGY

PLANS, STRATEGIES, AND POLICIES FOR 2023

Wong Liong Tje

Transaction Banking

CIMB Niaga Transaction Banking provides trade finance services to support clients' export-import activities. CIMB Niaga is developing collaboration within the CIMB Niaga customer ecosystem by providing trade finance and supply chain finance support.

Chuang Lie

The focus of CIMB Niaga's trade finance strategy during 2022 was to provide solutions for clients through the ease of disbursement of trade facilities. Overall, we also hope that CIMB Niaga can continue to grow and make a positive contribution, especially in the banking industry in Indonesia.

STRATEGIC COOPERATION

Fendra Hartanto

PLAN, STRATEGY AND POLICY FOR 2023

Commercial Banking

Total loans from Commercial Banking in 2022 amounted to Rp 31.6 trillion, of which working capital loans contributed Rp 21.6 trillion of this amount. In 2022, the total deposits of Commercial Banking customers amounted to Rp 18.8 trillion, an increase of 9.82% from Rp 17.1 trillion in the previous year.

LINKAGE COOPERATION SCHEME

TARGETS, STRATEGY, AND POLICY IN 2023

Emerging Business Banking (EBB)

Working capital loans contributed Rp 20.4 trillion to EBB's total loan disbursements, an 8.69% increase from Rp 18.8 trillion in 2021. In addition, other operating income was recorded at Rp 0.3 billion , which is a 32.84% increase over the previous year's level of Rp.0.2 trillion.

PLANS, STRATEGIES, AND POLICIES IN 2023

Hadi Gunawan

Consumer Banking

Implementation of a Customer Centricity culture that always places customers in the hearts of staff in every activity. It then made adjustments to loan granting policies to reduce loan risks, conduct regular reviews and re-lend based on the results of the review, while still prioritizing the precautionary principle.

PRIVATE BANKING

So far, CIMB Niaga offers a very convenient app, helpful customer service and a very user-friendly OCTO Mobile app. I hope that the quality, trust and personal touch of CIMB Niaga will be maintained and improved.

Sugianto Osman

As a digital bank pioneer, the digitization technology employed by CIMB Niaga always makes it easier for customers to conduct banking transactions.

CONSUMER BANKING SEGMENT OPERATIONAL PERFORMANCE

CIMB Niaga has managed to maintain its position as one of the top three players in the credit card business. CIMB Niaga assists in the planning, development and protection of client-owned assets through Wealth Management.

Mario Ginanjar

In the Sharia segment, CIMB Niaga can maintain its position as the largest Sharia credit card provider in Indonesia. Consumer Banking also uses collection tools such as Mobile Collection & 2-Way WhatsApp to increase customer contact and speed up the auction process by posting assets on the CIMB Niaga auction website.

BRANCH OFFICE NETWORK AND

Currently, Consumer Banking continues to enhance OCTO Mobile's digital banking capabilities by introducing innovative transactional features such as QRIS, cardless cash withdrawals/deposits, converting credit card transactions to fixed rates and updating information without going to a branch office. In addition, Consumer Banking continues to optimize the 'API Banking' business to achieve the goal of becoming the leading digital banking service provider.

DEVELOPMENT OF BRANCHLESS BANKING

The CIMB Niaga Digital Lounge combines the latest technology to provide a fast banking experience for customers. The Digital Lounge service is CIMB Niaga's effort to support the digital development strategy for consumer banking.

QUALITY OF SERVICE AND MANAGEMENT OF CUSTOMER COMPLAINTS

CIMB Niaga's innovative efforts in the banking industry can be seen in the CIMB Niaga Digital Lounge. CIMB Niaga manages the Digital Lounge through the Digital Banking Manager who provides solutions for individual banking customers.

PERFORMANCE IN 2022 CONSUMER BANKING LOANS

PLAN, STRATEGY, AND FOCUS IN 2023

Sharia Banking

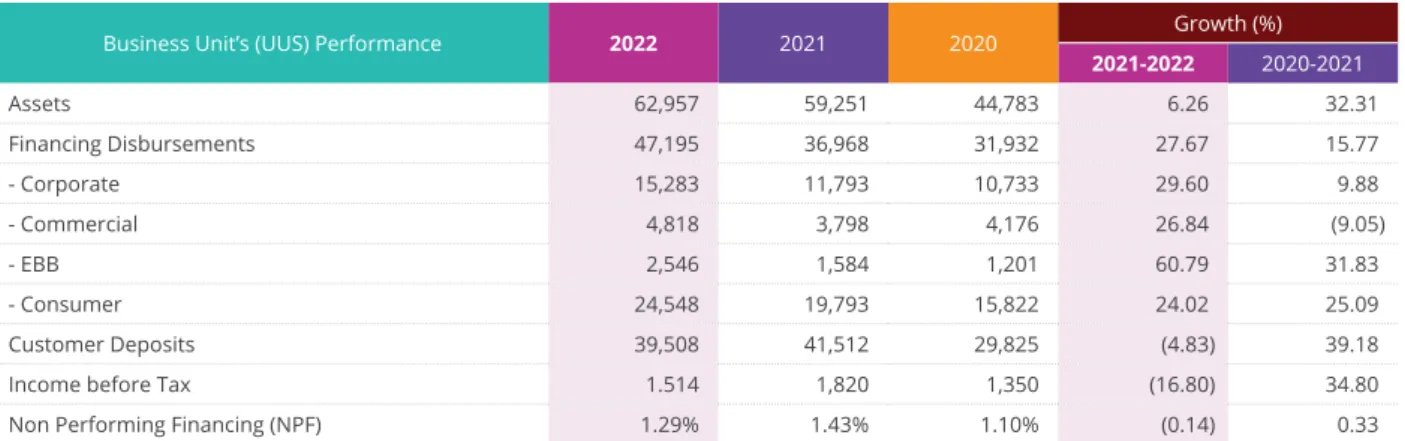

In 2022, CIMB Niaga UUS's total assets were recorded at Rp 63.0 trillion, a growth of 6.26% compared to the previous year's position, which was recorded at Rp 59.3 trillion. In managing the financing payout portfolio, CIMB Niaga UUS continues to prioritize the principle of prudence.

Hasan Arifin

CIMB Niaga UUS also ensures that all financing offered is of high quality and has adequate reserves. Compared to other major players in the Islamic banking industry, CIMB Niaga UUS's NPF ratio remains relatively conservative.

COLLECTION AND DISBURSEMENT OF ZAKAT, INFAQ, AND SEDEKAH (ZIS)

CIMB Niaga UUS also plays the role of LKS PWU (Sharia Financial Financial Receiving Cash Waqf) in partnership with 20 waqf (nazhir) institutions. The received waqf money funds are directly loaned to the waqf institution's account at CIMB Bank Niaga Syariah.

SOURCES AND UTILIZATION OF THE BENEVOLENCE FUND

Based on this role, CIMB Niaga UUS has an obligation to receive cash waqf from the public through waqf money fund products and channels and waqf through money. In 2022, the value of waqf cash receipts used directly by waqf institutions will increase by 84.36%, or to Rp 20.1 billion from last year's Rp 10.9 billion.

COMPLIANCE AND IMPLEMENTATION OF THE SHARIA GOVERNANCE FRAMEWORK

OFFICE NETWORK AND DISTRIBUTION

PLAN, STRATEGY, AND POLICY IN 2023

Ibu Aina Ainaul Mardliyah

Operational Review Per Business Segment

OPERATING SEGMENTS

GEOGRAPHICAL SEGMENTS

BUSINESS SEGMENTS OF CIMB NIAGA

Profitability of Each Business Segment

Based on the consolidated financial statements of PT Bank CIMB Niaga Tbk and its subsidiaries for the fiscal year ended December 31, 2022, CIMB Niaga has prepared the financial review. The consolidated financial statements have been prepared in accordance with the Indonesian Financial Accounting Standards and have been audited by KAP Tanudiredja, Wibisana, Rintis & Partners, a member firm of the global PwC network (Drs. Irhoan Tanudireja, CPA, as responsible partner), an independent auditor on based on auditing standards established by the Indonesian Institute of Certified Public Accountants, the accompanying consolidated financial statements present fairly, in all material respects, the consolidated financial position of the Group as of December 31, 2022 and its consolidated financial performance and consolidated cash flows for the year ended that time ended, in accordance with Indonesian Financial Accounting Standards.

OVERVIEW OF FINANCIAL PERFORMANCE

Based on the consolidated financial statements of PT Bank CIMB Niaga Tbk and its subsidiaries for the financial year ended 31 December 2022, CIMB Niaga has prepared.

Financial Review

In its income statement, CIMB Niaga reported net interest income and non-interest income of Rp 13.5 trillion and Rp 5.4 trillion respectively, up from Rp 13.1 trillion and Rp 4.5 trillion in the previous year. Net interest income and non-interest income contributed to operating income of Rp 18.9 trillion.

Strategy in 2022

Total operating expenses increased by 2.47%, while provision for impairment losses on financial and non-financial assets decreased to 8.54%.

Electronic Network Coverage Expansion

ATM AND MFD

CDM AND CRM

OCTO CLICKS

OCTO MOBILE

CELLULAR TELEPHONE ACCOUNT

BIZCHANNEL@CIMB

EDC AND QR

Statements of Financial Position

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

ASSETS

This increase was mainly due to Bank Indonesia's foreign currency time deposits of Rp 14.3 trillion and FASBI - Rupiah of Rp 799.0 billion. Deferred tax assets increased by Rp 512.2 billion to Rp 1.7 trillion in 2022 from Rp 1.2 trillion last year.

LIABILITIES

In 2022, CIMB Niaga's investments remained the same as the previous year for an amount of Rp3.7 billion. Prepaid expenses decreased by Rp19.1 billion to Rp1.12 trillion from Rp1.14 trillion the previous year.