With the loyal support of its customers, BCA successfully achieved a year of strong financial performance and maintained its position as a bank of choice in Indonesia. Training and/or education for the Supervisory Board, the Board of Directors, Committees, Corporate Secretary and Internal Audit Unit.

Development

Work EnvironmentAppreciation

Sustainable Performance

Third Party Funds

Net Income

Financial Highlights

Only the parent company, the financial reports are presented based on the Financial Services Authority of Indonesia Circular Letter No.43/SEOJK.03/2016 dated September 28, 2016 regarding Commercial Bank Transparency and Disclosure. CAR is calculated with credit risk, operational risk and market risk based on Bank Indonesia Circular No. 11/3/DPNP dated January 27, 2009 which was later amended to Indonesia Financial Services Authority Circular No. .

Stock and Bond Highlights

BCA Share Price, Volume & Market Capitalization

BCA Dividends History *

However, on a consolidated basis, the bank has liabilities in the form of bonds issued by subsidiary BCA Finance, which were recorded at Rp. 610 billion as of December 31, 2017. Information on the bonds issued by BCA Finance is available in the audited consolidated financial statements on pages 591-594.

Report of The Board of Directors

Customer confidence in the quality of BCA's products and services was the key principle behind this solid performance. Standard & Poor's upgraded Indonesia's sovereign debt to investment grade, while Fitch Ratings upgraded its debt rating from BBB- to BBB.

BCA’s success in maintaining its business results was owed to our customer trust. BCA closely examines the changing needs of

The growth of the Indonesian economy cannot be separated from the impact of the global economy, which saw positive improvements, although the recovery has been slower than expected. The government and regulators implemented a series of efforts and policies to stimulate national economic recovery and maintain stability in the macroeconomic and financial systems.

Respected Shareholders and Stakeholders,

The Bank's profitability was consistent with well-maintained loan quality, as the provision for non-performing loans was higher in the previous year. We expect moderate growth in the banking sector, in line with Indonesia's continued economic recovery.

Jahja Setiaatmadja Jakarta, March 2018

The Board determined that in 2017 the committees performed in accordance with their duties and responsibilities and provided useful advice in support of the duties of the Board. The Board of Directors appreciates the role of the Board of Commissioners in carrying out its oversight function and providing strategic advice, thus enabling BCA to maintain its positive performance in 2017.

Board of Commissioners’

Supervisory Report

In order to get a uniform overview of the bank's business strategy, the board of directors and the board of directors communicate on an ongoing basis. The board implemented prudent strategies in the management of the bank and took advantage of opportunities during the year.

BCA has applied appropriate measures to adapt to increasingly tight competition in the banking sector and changing business

The Board of Commissioners assessed that the Board successfully guided BCA in maintaining business continuity by prioritizing strategic objectives. The Board of Commissioners acknowledges that the bank's solid business results were due to customers' trust, which is the basis for BCA's business development.

Valued Shareholders and Stakeholders,

The advice and recommendations of the Board of Commissioners to the Board of Directors are as follows. In 2017, there was no change in the composition of the members of the Board of Commissioners.

Djohan Emir Setijoso

The Board of Commissioners assesses that BCA's work plan has captured and considered both business opportunities and risks. The Board of Commissioners also thanks all subsidiaries for their important contribution to BCA's overall development.

Name

Legal Basis of Incorporation

Change of Name

Subsidiaries

Company Website

Company General Information

Drafts, including drafts accepted by bank with a validity period not exceeding the normal practice of dealing in such instruments. Promissory notes and other commercial papers, with a term of validity not exceeding the normal practice of dealing in such papers.

Milestones

Corporate actions

To improve the reliability of its banking services, BCA is completing a new Disaster Recovery Center (DRC) facility in Surabaya, which serves as a backup data center in case of disaster recovery, integrated with the current two mirror data centers. BCA strengthens and develops its products and services, especially in electronic banking, by launching Debit BCA, Tunai BCA, KlikBCA internet bank, m-BCA mobile bank, EDCBIZZ, etc.

Business development

BCA has strengthened its transaction banking through the further development of innovative products and services, in particular with mobile banking applications on the latest smartphones, with payment settlement services through e-commerce, and through a new concept of Electronic Banking Center that equips ATMs with additional technology. supported features.

Event Highlights 2017

BCA mendukung Bali Run di Tol Bali Mandala yang menghubungkan Benoa, Bandara Internasional Ngurah Rai, dan Nusa Dua. BCA menyalurkan pinjaman sindikasi sebesar Rp1,5 triliun kepada PT Hutama Karya untuk pembangunan Tol Trans Sumatera Bakauheni – Terbanggi Besar.

Corporate Culture

To be the bank of choice and a major pillar of the

The vision and mission statements were approved by the Board of Directors and the Board of Commissioners of PT Bank Central Asia Tbk by decree no.

Continuous Pursuit of

Integrity

Focus

Products and Services

Fixed Income Mutual Fund (USD) BNP Paribas Prima USD Schroder USD Bond Fund Hybrid Mutual Fund. BNP Paribas Spektra Schroder Dana Terpadu II Schroder Syariah Balanced Fund Equity Mutual Fund (IDR).

Organization Structure

GENERAL MEETING OF SHAREHOLDERS

BOARD OF DIRECTORS

PRESIDENT DIRECTOR Jahja Setiaatmadja

DEPUTY PRESIDENT DIRECTOR Armand Wahyudi Hartono

BOARD OF COMMISSIONERS

Subur Tan

DEPUTY PRESIDENT DIRECTOR 2) Eugene Keith Galbraith

Appointed as Chairman Director of BCA at the 2011 Annual General Meeting of Shareholders and approved by Bank Indonesia on 17 June 2011. Chairman Director of BCA responsible for the overall coordination and supervision of the Internal Audit Department, Corporate Social Responsibility Task Force and Anti-Fraud Office .

Board of Directors Profile

Appointed as Vice President Director of BCA at the 2011 Annual General Meeting of Shareholders and approved by Bank Indonesia on August 25, 2011. Appointed as Director of BCA at the 2002 Annual General Meeting of Shareholders and approved by Bank Indonesia on August 13, 2002.

Board of Commissioners Profile

Simultaneously serves as chairman of the audit committee of PT Bank Central Asia Tbk and as an independent commissioner of PT Unilever Indonesia Tbk. Also serves as Chairman of the Remuneration and Nomination Committee for PT Bank Central Asia Tbk and as an Independent Commissioner for PT Adaro Energy Tbk.

Audit Committee Profile

His last reappointment took effect on 2 June 2016 according to the Decision of the Board of Directors No. Appointed as a member of the Audit Committee of BCA on 2 June 2016 according to the Decision of the Board of Directors No.

Risk Oversight Committee Profile

Djohan Emir Setijoso has accepted the position as a member of the Remuneration and Nomination Committee of BCA since 2011. Appointed as a member of the Remuneration and Nomination Committee of BCA on 10 August 2016 according to the Decision of the Board of Directors No.

Profile of the Integrated Corporate Governance Committee

He is also currently the Independent Commissioner and Chairman of the Audit Committee of PT Asuransi Jiwa BCA since November 2014. He is also currently a member of the Syariah Supervisory Committee of PT Bank BCA Syariah.

Senior Officers

Tan Tesien Tanudjaja was appointed as Head of Credit Risk Analysis and reports to Executive Vice President - Deddy Muljadi Hendrawinata 3. Helena Maria Atmodjo was appointed as Head of Credit Risk Analysis and reports to Executive Vice President - Deddy Muljadi Hendrawinata.

Number of Employees

Number of Employees and Competence Development

Employee Competence Development

BCA Ultimate Shareholder

Shareholder Composition

Details of 20 Largest Shareholders

Share Ownership Percentage of Commissioners and Directors

Public Shareholders with Less than 5% Shares Ownership

Details of Shareholders with More than 5% Share Ownership

Subsidiaries Business

BCA Group Structure and Subsidiaries Ownership

Record of BCA Share Listing at the Indonesia Stock Exchange

Record of Other Securities Listing

BCA Finance Limited PT Bank Central Asia Tbk: Pengiriman Uang dan Pinjaman 100% BCA Finance Limited didirikan pada tahun 1975, dan unit 4707, 47/F, The Centre,. PT BCA Sekuritas (dahulu PT Dinamika Usaha Jaya) Menara BCA, Lantai Grand Indonesia, Suite 4101 Jl.

Information on Subsidiaries

PT BCA Sekuritas (formerly PT Dinamika Usaha Jaya) was established in 1990 with business lines such as securities brokerage and investment banking. PT Central Santosa Finance was established in 2010 and currently provides consumer financing, factoring and financial leasing business.

Public Accounting

Tanudiredja, Wibisana, Rintis & Rekan (a member firm of PwC global network)

Share Registrar

PT Raya Saham Registra Gedung Plaza Sentral, 2 nd Floor

Moody’s Singapore Pte Ltd 50 Raffles Place #23-06

Notary

Hadiputranto, Hadinoto & Partners (HHP) The Indonesia Stock Exchange Building

Capital Market Supporting Institution

Social Media, Recruitment Campaign, Green Contact Center, Customer Loyalty Program, Outbound Campaign, CC Sales Pro. Gold: Social Media, Recruitment Campaign, Helpdesk, Best in Customer Service, Mega Contact Center - Silver: Incentive Scheme, Outsourcing.

Branches

Information on Company Website

Training and/or Education for the Board of

Commissioners, Board of Directors, Committees, Corporate Secretary, and Internal Audit Unit

Corporate Secretary

Halo BCA 150088

The Bank’s strategy is to fulfill the evolving financial needs

Transaction Banking

Business Review

The development of BCA’s transaction banking business

The outstanding feature of the Bank's franchise is its wide customer base, linked to its integrated and multi-channel network. BCA continues to develop its electronic banking network as one of the main pillars of its franchise.

Solid Transaction Banking Franchise

The Bank continues to build partnerships with leading international networks such as Visa, Mastercard and American Express. In addition to non-cash top-up through BCA ATMs, cash and non-cash top-up can now be done in a number of retail networks such as Indomaret, Alfamart and Gramedia.

Integrated Multi-Channel Network

BCA's co-branding partnerships with its business partners and other banks allow customers of other banks to make payments via Flazz cards at BCA merchants, while also benefiting from attractive offers. The branch network also plays a vital role in building customer relationships through direct interaction and in accommodating high value customer transactions, and is focused on marketing BCA's products and services and meeting the needs of customers who prefer face-to-face service.

Adapting to Customer Needs for Digital Services

In addition to the mobile service based on the BCA Mobile application, the bank also offers Sakuku, an e-money server application available on smartphones for QR code payments, phone credit and other transactions. Laku and Duitt branchless banking services extend the bank's services to the wider community in support of regulatory financial inclusion programs and can be accessed through independent agents or SMS.

Looking Ahead

Changes in customer lifestyles, such as the growing preference for online shopping, offer opportunities for the bank. Communication through digital and social media will become increasingly important in marketing the Bank's transaction products and services.

Corporate Banking

Supported by its solid liquidity and capital position, BCA was

A prudent approach has enabled Corporate Banking to maintain the quality of the corporate loan portfolio with a relatively low NPL ratio, despite the ongoing recovery in loan demand. In 2017, the Bank realigned the Corporate Banking group's organizational structure with the establishment of the Corporate Transaction Group to develop corporate cash management services, one of the focal points of its Corporate Banking.

Quality Corporate Lending

The Bank's corporate loan portfolio was the main driver of total credit growth in 2017 at Rp 177.3 trillion, compared to Rp 154.9 trillion the year before, representing a growth of 14.5%. The majority of BCA's corporate loans are denominated in rupiah, accounting for 86.8% of the corporate loan portfolio, while foreign currency loans account for 13.2%.

Syndicated Loans

Corporate Loan Portfolios by Industry Sectors

Joint financing in the infrastructure sector in 2017 included construction financing for the Semarang-Batang and Manado-Bitung toll roads, working capital financing for the Jakarta-Cikampek toll road, and PLN Persero for capital expenditures.

Developing Services Focusing on Customers

Looking Forward

Commercial and SME Banking

BCA continues to enhance capabilities in working capital

Medium Enterprise (SME) customers

The Bank adjusted its interest rates, including for commercial and SME loans, to maintain lending competitiveness, in line with market competition and changes in the benchmark interest rate. To facilitate better cash management for its commercial and SME customers, BCA continues to strengthen its cash management services, refining solutions to customer needs using the latest technology.

Commercial and SME Loans

BCA remains in a solid position to provide working capital and investment loans, along with cash management services for commercial and SME clients, supported by a broad and strategically located network of branches in major trading centers in Indonesia. BCA faces stiffer competition in the commercial and SME segments compared to other credit categories.

Cash Management

BCA continues to monitor the progress of Indonesia's economic recovery and explore opportunities in sectors with positive prospects and measurable levels of risk. BCA continues to improve its credit facilities and infrastructure by strengthening the role of commercial business and SME centres, and increasing the number and productivity of account and relationship officers through recruitment and training programmes.

Individual Banking

BCA is committed to being the customer bank of choice

BCA meets the needs of customers by offering individual banking products and services, such as mortgages, auto loans, credit cards, banking and investment products. Priority Banking and Wealth Management Services BCA's specialized services, 'BCA Prioritas', have met the needs.

Priority Banking and Wealth Management Services BCA specialized services, ‘BCA Prioritas’, have met the needs

Amid Indonesia's modest economic recovery, which resulted in stagnant consumption levels, BCA successfully stimulated demand for consumer loans through a series of arrangements, offering individual banking products with attractive interest rates and promotional programs. Continuous improvements are made to individual banking products and services based on assessment of customer behavior and needs, enabling the bank to provide appropriate financial solutions.

Consumer Financing Leader

Through BCA Finance, the bank provides car financing on the secondary market to achieve higher interest income. In 2017, the bank managed 3.3 million credit cards with a transaction value of Rp 60.9 trillion, a growth of 13.3% and one of the largest in Indonesia.

Treasury and International Banking

BCA Treasury manages the Bank’s financial assets by

Through International Banking, BCA continuously enhances

TREASURY

Optimizing Opportunities with Careful Risk Management Indonesia’s financial market’s liquidity position was relatively

Since June 2017, BCA has gradually lowered its time deposit rate on the funding side in response to falling market interest rates and increased liquidity in the banking sector. The maximum interest rate for time deposits with a maturity of one month decreased by 275 basis points to 4.0% at the end of 2017.

Facilitating Customer Financial Solutions Needs

INTERNATIONAL BANKING

Trade Finance Services

Remittance Services

BCA will continue to monitor the business environment and take advantage of opportunities from treasury and international trade activities. Treasury and International Banking will strengthen synergy with other business units to adapt to the needs of customers as a whole and expand the bank's customer base.

Risk Management

The implementation of risk management

Business Support

Faced with the risks inherent in the banking sector, BCA continuously implements an Integrated Risk Management Framework across all its business units and activities. The Integrated Risk Management Framework includes the strategies, organization, policies and procedures, as well as the Bank's risk management infrastructure, to ensure that all risks faced by the Bank are effectively identified, measured, monitored, managed and reported.

RISK MANAGEMENT FOCUS IN 2017

The solid capital position can support the Bank's business expansion plan, which is balanced by its ability to anticipate risks. In accordance with legal provisions, BCA, together with its subsidiaries, conducts integrated stress tests to assess their impact on the Bank's capital (credit and market risk) and liquidity position (liquidity risk).

INTEGRATED RISK MANAGEMENT

- Active Supervision of BCA Financial Conglomerate by the Board of Directors and the Board of

- Adequacy of Policies, Procedures, and Determination of Integrated Risk Management Limits

- Adequacy of Identification, Measurement, Monitoring and Control of Integrated Risks, as well as the

- Comprehensive Internal Control System concerning the Implementation of Integrated Risk Management

Thorough risk management is able to protect BCA from cybercrime such as customer data theft, duplication of ATM cards and other cards that can damage the bank's reputation. In addition to the two data centers, BCA also manages a Disaster Recovery Center (DRC) in Surabaya.

INTERNAL CONTROL

RISK ASSESSMENT OF BCA RISK PROFILE AND SUBSIDIARIES

DISCLOSURE OF RISK MANAGEMENT

BCA’s Application of Risk Management

- In carrying out the risk management function, the Board of Directors has defined duties and

- Active supervision by the Board of Commissioners and the Board of Directors

- BCA’s risk management policy, as detailed in the Bank Business Plan and the Annual

- Policies, procedures, and determination of risk management limits, have been fully

- In conducting its business activities, BCA has developed a Bank Business Plan and

- BCA’s lending and operational procedures are clearly outlined in the Bank’s operating

- Risk exposure is monitored regularly by SMKR by comparing the actual risk against

- Reports on risk trends, including Risk Profile Reports, Credit Portfolio Reports and Business

Responsible for the implementation of the risk management policies, strategies and frameworks approved by the Supervisory Board; and evaluating and providing guidance based on reports submitted by the Risk Management Unit, including risk profile reports. The Board of Directors is assisted by the Asset and Liability Committee (ALCO), the Credit Policy Committee, the Credit Committee, the Risk Management Committee, the Information Technology Steering Committee and the Integrated Risk Management Committee.

D. Comprehensive Internal Control System

- BCA’s internal control systems guideline consists of five components

- All management and employees of BCA have roles and responsibilities to implement,

Adequacy of risk management policies, procedures and determination of risk limits Procedures and determination of risk limits. To support the implementation of risk management, BCA has detailed risk management policies, procedures and limits.

PRESIDENT DIRECTOR

Internal control is performed by the Risk Management Unit and the Compliance Unit which together form the second line of defense of risk management. All BCA management and employees have roles and responsibilities to implement, roles and responsibilities to implement, comply with and improve BCA's internal control systems.

DEPUTY PRESIDENT

These units are charged with risk monitoring by their Internal Control Units in branches, regional offices and headquarters.

DIRECTOR # DEPUTY PRESIDENT DIRECTOR

EFFECTIVENESS OF BANK RISK MANAGEMENT SYSTEMS

- BCA Capital

- Disclosure of Risk Exposures and Implementation of Risk Management

- A. Disclosure of Credit Risk Exposure and Implementation of Credit Risk Management

- B. Disclosure of Market Risk Exposure and Implementation of Market Risk Management

- C. Disclosure of Operational Risk Exposures and Implementation of Operational Risk Management

- D. Disclosure of Liquidity Risk Exposure and Implementation of Liquidity Risk Management

- F. Disclosure of Strategic Risk Exposure and Implementation of Strategic Risk Management

- H. Disclosure Of Compliance Risk Exposure And Implementation Of Compliance Risk Management

- Active supervision of FC BCA by the Board of Directors and the Board of Commissioners of the

- Adequacy of Policies, Procedures, and Determination of Limits for Integrated Risk

- Adequacy of Identification, Measurement, Monitoring, and Mitigation of Integrated Risk, as

- Comprehensive Internal Control System for the Implementation of Integrated Risk Management

- Appointing the Director in charge of risk management at BCA as the Director in charge

- Forming an Integrated Risk Management Committee to ensure that the risk management

- Adjusting the organizational structure of the Risk Management Unit to ensure that the integrated

- Identifying the Main Entity and subsidiaries included in the Financial Conglomerate for

- Finalizing the compilation of Basic Integrated Risk Management Policies for the implementation of

- Compiling and submitting Integrated Risk Profile Reports;

- Review on the implementation integrated risk management;

- Conducting integrated stress testing (for capital and liquidity);

- Socialization, coordination, and communication with the subsidiaries

Risk Management Committee, Funding Policy Committee, Information Technology Committee and Asset Liability Committee (ALCO) at the level of the Board of Directors. Product Development Committee, Investment Committee and Risk Management Committee at the level of the Board of Directors.

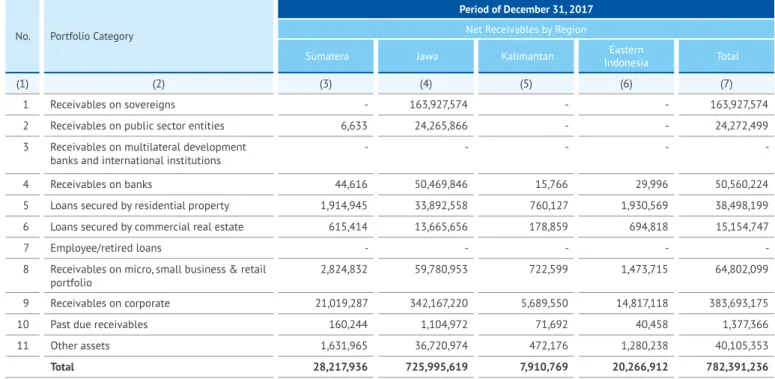

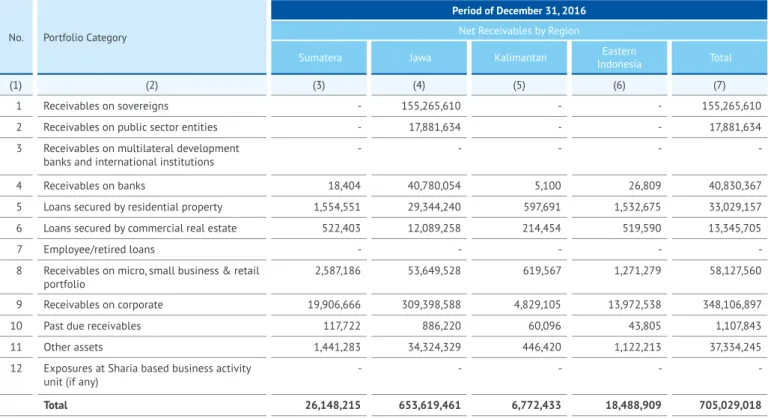

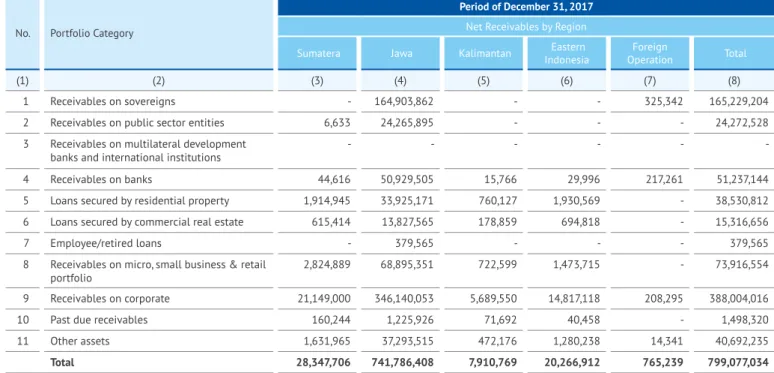

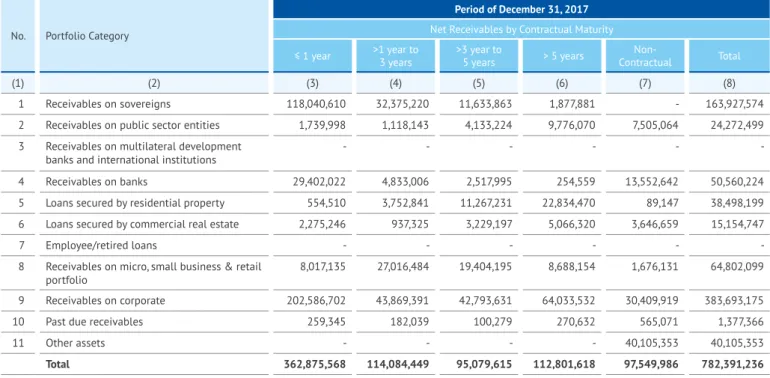

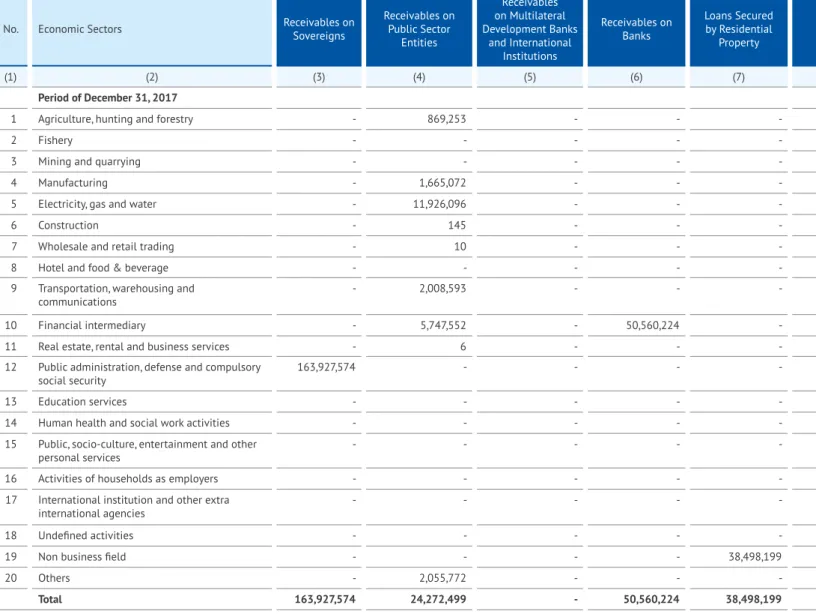

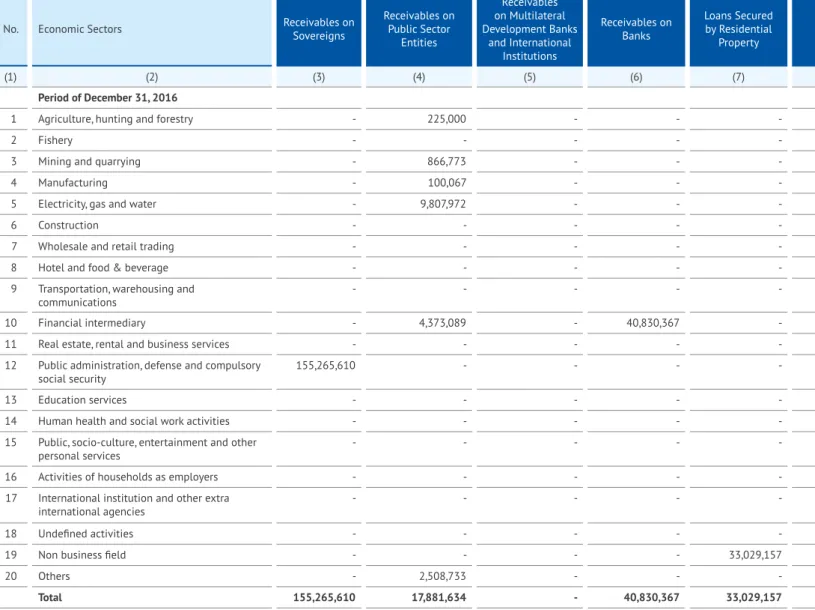

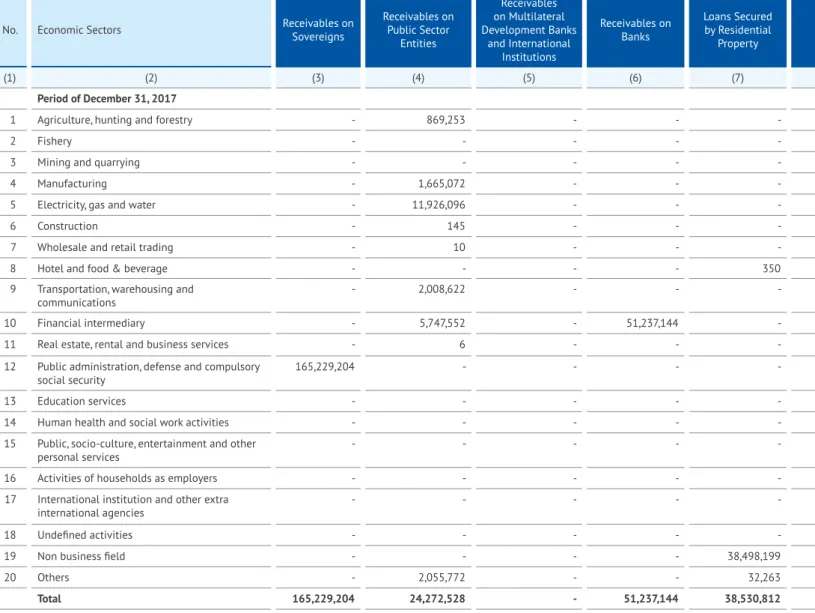

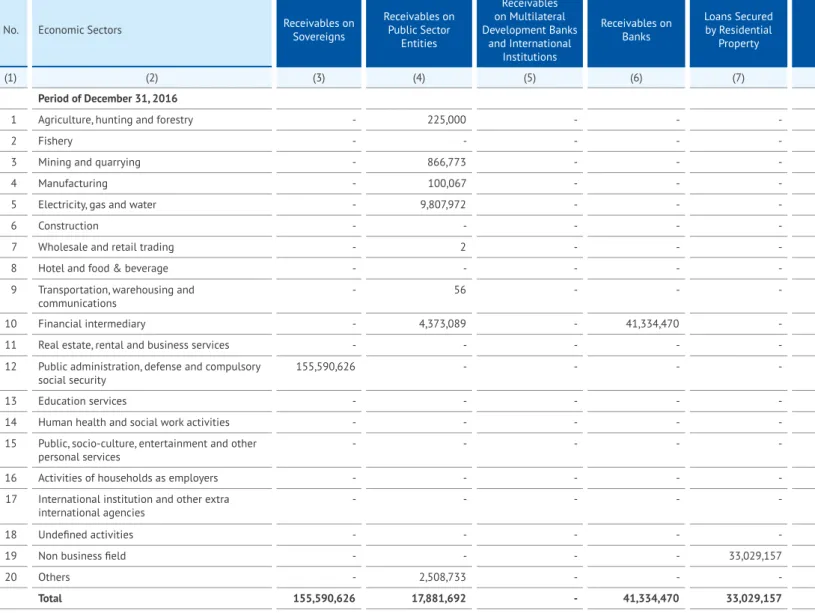

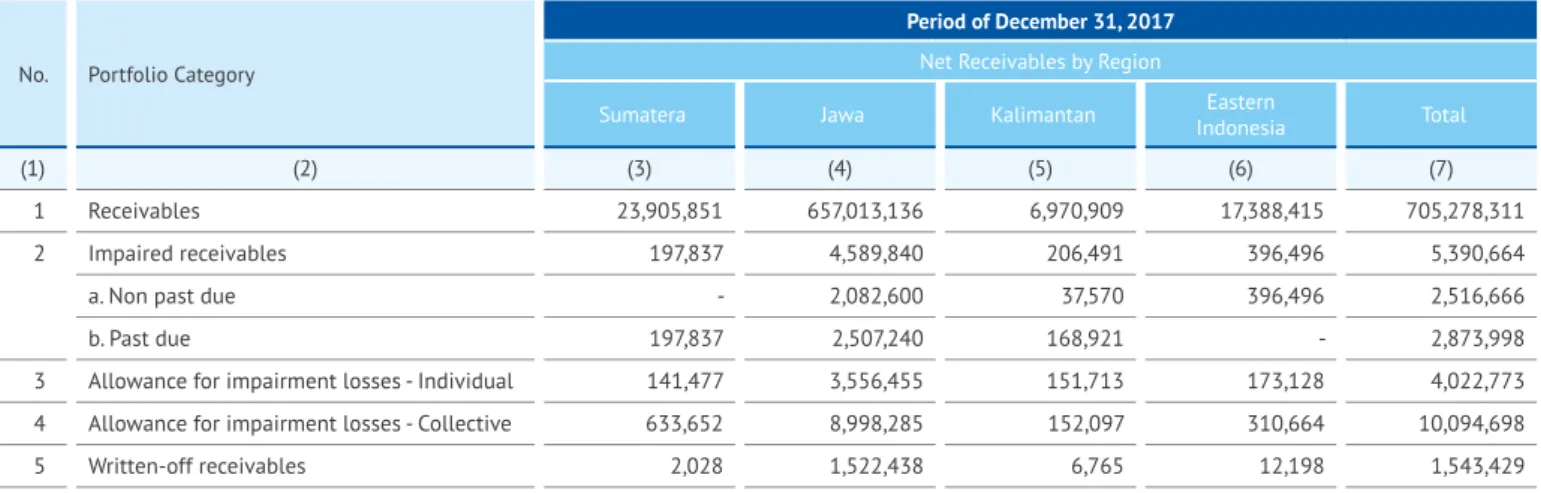

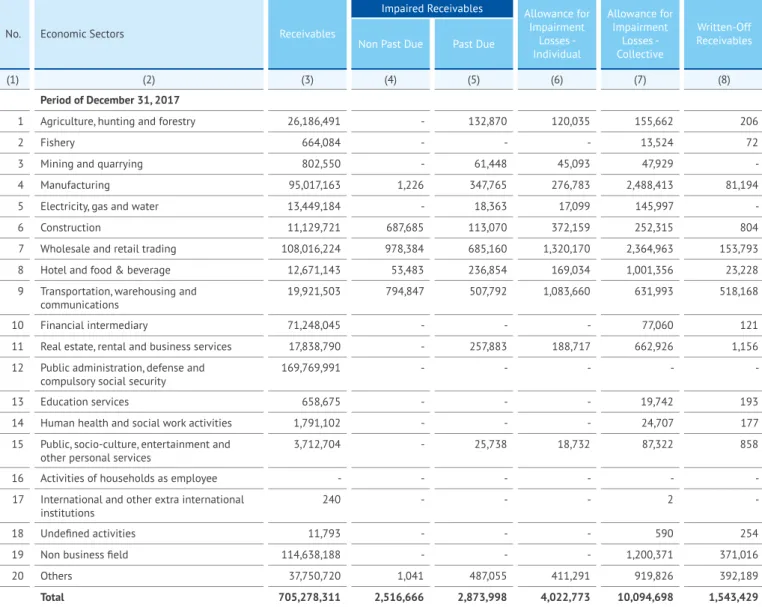

Risk Management Table *