Transaction Banking continues to evolve, enabling customers to make safer, faster and more convenient transactions. As the main source of information about BCA's products, services and marketing programs, BCA's website, www.bca.co.id, continues to be developed.

COMPREHENSIVE SOLUTIONS FOR CORPORATE CUSTOMERS

SYNDICATED LOANS TO SUPPORT INFRASTRUCTURE DEVELOPMENT

BUSINESS REVIEW

Corporate Banking

FUTURE PLAN

Commercial and Small &

Medium Enterprise (SME) Banking

BCA provides comprehensive solutions for Commercial and SME customers in the form of

Commercial & SME Banking in 2022

Commercial & SME Loan Portfolio

GROWTH IN QUALITY CREDIT

FOCUS ON CUSTOMER ENGAGEMENT

INNOVATIONS IN CASH MANAGEMENT

Commercial and Small & Medium Enterprise (SME) Banking

BCA will implement the plans and strategies of the Commercial Bank and SMEs through selected key initiatives such as increasing the quantity and quality of relationship managers, accelerating the penetration of debtors to business customers and channeling credit to key economic sectors in each region. BCA will also increase BCA's payroll penetration by developing the integration of BCA's payroll features with strategic partners' digital platforms, as well as offering payroll benefit programs to companies and employees of BCA's payroll clients. BCA.

Individual Banking

BCA remains a reliable and trusted bank for customers, as reflected in the performance of

Individual Banking that serving more than 27 million customers

Individual Banking in 2022

Consumer Loans Portfolio

BCA SOLITAIRE & PRIORITAS

MORTGAGES

VEHICLE LOANS

BCAF and BCAMF have also developed a mobile app to provide vehicle finance information which is integrated with the Halo BCA call centre. Going forward, BCA will continue to develop vehicle financing through strong synergies and partnerships with subsidiaries and key industry players.

CREDIT CARDS

WEALTH MANAGEMENT

Treasury and International Banking

BCA manages to optimize liquidity with calculated risks, as well as provides

Treasury and International Banking in 2022

TREASURY BANKING

LIQUIDITY MANAGEMENT

Treasury Portfolio

Throughout 2022, Bank Indonesia increased the Rupiah Reserve Requirement (GWM) for conventional commercial banks by 550bps to 9.0%. Given the trend of rising interest rates, BCA Treasury prioritized investments that offer the best returns with calculated risks, such as Bank Indonesia instruments, government securities and corporate bonds.

TREASURY BANKING SOLUTIONS

Responding to the Fed's interest rate hike, Bank Indonesia took the first preemptive and proactive step to increase the BI-7 Daily Reverse Repo Rate (BI7DRR) by 200 bps during 2022. In 2022, the total assets managed by BCA Custodian reached Rp 265 trillion, with more than 202,000 securities accounts.

INTERNATIONAL BANKING

BCA also offers custody services to clients whose assets are managed in the form of stocks, government and corporate bonds, and mutual fund deposits, as well as fund management contracts in Rupiah and foreign currency.

TRADE FINANCE SERVICES

REMITTANCE SERVICES

FINANCIAL INSTITUTIONS GROUP

Keeping an eye on market developments and technological advancements, Treasury Banking will also continue to innovate by offering a wide variety of solutions and products to meet the dynamic needs of customers. Meanwhile, International Banking is committed to improving fund transfer services and offering a range of solutions to suit the current needs of customers.

BUSINESS SUPPORT

Risk Management

Disciplined risk management practices

RISK MANAGEMENT FOCUS IN 2022

As of December 2022, BCA's total LAR stood at Rp 69.4 trillion, or 10% of total loans, an improvement from Rp 90.8 trillion the previous year, with decreases seen across all segments. In December 2022, the corporate segment's LAR decreased by Rp 5.6 trillion or 17.0% to Rp 27.3 trillion, mainly from the tourism sector.

Liquidity

The Bank continuously evaluates the implementation of credit disbursement and credit monitoring to ensure that there are no limit violations and that the credit is of good quality. The Bank offers a comprehensive solution to satisfy customers' credit needs and carries out continuous credit monitoring.

Capital Position

Exchange Rate Risk

Operational Risk

INTEGRATED RISK MANAGEMENT

Active supervision of the BCA Financial Conglomerate by the Board of Directors and the Supervisory Board of the main entity; Adequacy of identification, measurement, monitoring and control of the integrated risk management, as well as the integrated risk management information system;

INTERNAL CONTROL

RISK PROFILE ASSESSMENT OF BCA AND SUBSIDIARIES

DISCLOSURE OF RISK MANAGEMENT

BCA’s Application of Risk Management

A. Active Supervision by the Board of Commissioners and the Board of Directors

In emergency situations, control of authority is under the direct coordination of the Board of Directors. The supervisory duties of the Board of Commissioners are assisted by the Audit Committee, Risk Review Committee, Remuneration and Nomination Committee and Integrated Management Committee.

Procedures, and Determination of Risk Limits The adequacy of risk management policies and

D. Comprehensive Internal Control System BCA’s Internal Control consists of five main

These committees meet regularly to discuss and provide input and recommendations to the Board of Directors and the Board of Directors. The evaluation of the effectiveness of risk management is also carried out through regular reports, which are forwarded to the board of directors and the board of directors.

BCA Capital Capital Structure

The risk appetite determined by the BCA is reflected in the bank's business strategies and objectives. The results of the bank's stress testing for credit, market and liquidity risks are satisfactory, and the bank's capital and liquidity are sufficient to anticipate the estimated potential losses based on built-in scenarios.

Management Policy on Capital Structure

Basis for Management Policy on Capital Structure BCA’s capital policy is regularly adjusted with reference

- Disclosure of Risk Exposure and Implementation of Risk Management

- A. Disclosure of Credit Risk Exposure and Implementation of Credit Risk Management

- B. Disclosure of Market Risk Exposure and Implementation of Market Risk Management

- C. Disclosure of Operational Risk Exposures and Implementation of Operational Risk

- E. Disclosure of Legal Risk Exposure and Implementation of Legal Risk Management

- F. Disclosure of Strategic Risk Exposure and Implementation of Strategic Risk

- G. Disclosure of Reputation Risk Exposure and Implementation of Reputation Risk

- H. Disclosure of Compliance Risk Exposure and Implementation of Compliance Risk

- General - Key Metrics - Bank as Consolidated with Subsidiaries

Ensure that the risk management framework provides adequate protection against risks faced by the bank. Examining and assessing the adequacy and effectiveness of risk management processes, internal controls and the bank's corporate governance.

Leverage Ratio

Risk Management Table

General - Differences between book value in accordance with Indonesian accounting standards with exposure value in accordance with the Financial Services Authority (LI2) - per 31 December 2022.

General - Explanations of differences between accounting and regulatory exposure amounts (LIA)

Directly issued qualified ordinary shares (and equivalent for limited companies) capital plus related surplus shares 7,252,306 f. Direct issued capital subject to CET1 phase-out (only . applies to private companies) N/A.

Common Equity Tier 1 capital before regulatory adjustments 223,830,416 Common Equity Tier 1 capital: Regulatory Adjustments

- Common Equity Tier 1 (as a percentage of risk weighted assets) 25.85%

- Total capital (as a percentage of risk weighted assets) 26.84%

- Capital - Composition of Capital (CC1) - as of December 31, 2021

- Common Equity Tier 1 capital before regulatory adjustments 205,388,629 Common Equity Tier 1 capital: Regulatory Adjustments

- Common Equity Tier 1 (as a percentage of risk weighted assets) 25.86%

- Total capital (as a percentage of risk weighted assets) 26.85%

- Capital - Reconciliation of Capital (CC2) - as of December 31, 2022

- Capital - Reconciliation of Capital (CC2) - as of December 31, 2021

- Capital - Main Features of Capital and TLAC - Eligible Instruments (CCA) - as of December 31, 2022

- Leverage Ratio Calculation Report

- Disclosure of Off Balance Sheets Commitment/Contingency Receivables Exposures

- Counterparty Credit Risk Exposures

- Securitization Risk Exposure

- Derivative Credit Risk Exposures

- Total Credit Risk Measurement

- Securitization Risk Exposures

- Balance Sheet Assets Exposures

- Credit Risk - Counterpary Credit Risk (CCR1) Exposure Analysis - consolidated - as of December 31, 2022

- Credit Risk - CCR Exposure based on Portfolio Category and Risk Weighting (CCR3) - consolidated - as of December 31, 2022

- Credit Risk - Net Credit Derivative Claims (CCR6) BCA has no exposure to net credit derivative receivables

- Credit Risk - Securitization Exposure in the Banking Book (SEC1) - as of December 31, 2021

- Credit Risk - Securitization Exposure in the Banking Book and related to its Capital Requirements Bank Acting as Investor (SEC4) - as of December 31, 2022

- Credit Risk - Securitization Exposure in the Banking Book and related to its Capital Requirements - Bank Acting as Originator or Sponsor (SEC3)

- Market Risk Disclosure Using Standard Methods - 2022

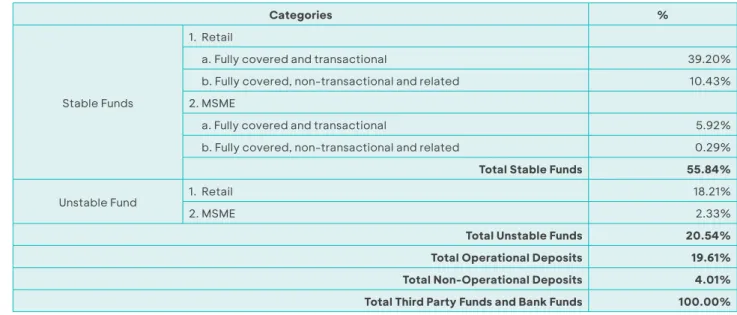

- Report on Calculation for Quarterly Liquidity Coverage Ratio

- Net Stable Funding Ratio (NSFR) (Individu)

- NSFR CALCULATION

- Net Stable Funding Ratio (NSFR) (Consolidated)

- QUALITATIVE ASSESSMENT ON NSFR

- UMKM

- MSME

- Report On Asset Encumbrance - ENC - as of December 31, 2022

4 Explanation of the scope of the Operational Risk reporting framework for directors and officers of the Bank. The Bank has a procedure that is a derivative of the operational risk management policy of general control and specific control.

BCA is committed to developing human

Human Capital Management

BCA is committed to developing human resources with digital capabilities, while continuing to instill BCA values and culture.

RECRUITMENT OF BEST TALENTS

FUTURE COMPETENCY DEVELOPMENT AND INNOVATION CULTURE

DEVELOPING HR INFRASTRUCTURE THROUGH AN INNOVATION CULTURE

CAREER DEVELOPMENT AND PREPARATION OF FUTURE LEADERS

OPTIMIZING PRODUCTIVITY THROUGH A CONDUCIVE WORKING ENVIRONMENT

Digital transformation at BCA branch offices integrates digital devices with human services

Network and Operation

BCA does its best to meet customer needs by leveraging the reliability of the bank's branch network.

ACCELERATION OF DIGITAL BANKING

SELECTIVE EXPANSION OF PHYSICAL NETWORKS

QUALITY SERVICES AND OPERATIONS FOR CUSTOMERS

Banking transaction services through branches and digital channels are supported by Halo BCA as a solution service center. These various communication channels provide choices for customers to interact with Halo BCA according to their convenience and preference.

FUTURE PLAN

Halo BCA plays a key role in enabling customers to access online customer services, both in Indonesia and abroad through Voice Over Internet Protocol (VOIP) technology. The Halo BCA app complements Halo BCA's existing contact channels, including social media, WhatsApp, online chat, email and twitter.

BCA has made a number of innovations in the field of information technology to

Information Technology

BCA continuously adds new features to enhance the convenience and convenience of transactions, maintains the reliability and security of transactions, and develops digital and electronic banking ecosystems with a focus on mobile and online banking. With this high level of commitment to technology development, BCA is well placed to face the digital evolution in the banking industry.

Innovations in 2022

Utilization of Technology to Drive Innovation and Increase Productivity

Improving Digital Services and Applications

Cyber Security

BCA will continue to improve its existing applications, BCA Mobile and Klik BCA Bisnis, developing new features to facilitate a wider range of customer transactions. The digital workspace, BCA's new work standard, will continue to be supported by security standards in terms of connectivity, data and work device security, in addition to IT system performance that will be maintained to support processes existing business.

BCA managed to deliver a strong all-round

Economy, Banking Sector and BCA Financial Review

The US central bank, the Fed, has raised its benchmark rate by 425 bps in 2022, significantly reducing global liquidity. Strong growth, combined with the ballooning trade balance, helped support the Rupiah during a period of rapid appreciation of the US dollar.

BANKING SECTOR REVIEW IN 2022

Total provision for loan impairment losses reached Rp 33.9 trillion with a LAR coverage ratio of 53.8% and an NPL coverage ratio of 287.3%. BCA's capital and liquidity remain solid as reflected in a capital adequacy ratio (CAR) of 25.8% and a loan-to-deposit ratio (LDR) of 65.2%.

FINANCIAL POSITION ASSET

Current account at BI grew by 58.3% from last year to Rp.104.1 trillion, mainly driven by the increase in Rupiah RR complying with BI rules. Meanwhile, demand accounts with other banks reached Rp4.8 trillion, down 59.1% from Rp11.6 trillion last year.

SECURITIES

Majority of the placements at BI and other banks are placements with a duration of less than 3 months.

LOANS

Loans by Segment

Loan by Type of Usage

Loans by Industry Sector

Note: These categories are based on the BCA's internal industry classification and are defined differently from those in the Financial Audit Report, which refers to the classifications in commercial bank reports as determined by the regulator.

Loan Quality

The decrease is mainly due to borrowers whose loans have returned to the normal category, mainly in the construction and real estate, automotive and building materials and textiles sectors. BCA announced a loan write-off of Rp 3.1 trillion (last year it was Rp 3.9 trillion), equivalent to 0.5% of BCA's outstanding loan portfolio.

FIXED ASSETS

LIABILITIES

Third Party Funds

Current Accounts and Savings Accounts (CASA)

Throughout 2022, digital transactions (via mobile banking, internet banking and ATMs) accounted for 99.5% of all transactions, with the remaining 0.5% conducted through branches. Mobile banking generated 68.1% of total transactions, while internet banking contributed 21.8% and ATM transactions accounted for 9.7% of total transaction volume.

Deposits

Branch transactions still make a significant contribution at 35.8% of the total transaction value, primarily supported by the business segment.

EQUITY

PROFIT AND LOSS STATEMENT

Interest expense decreased by 13.1%, in line with the gradual reduction in interest rates on third-party funds in 2021 and early 2022. The cost of term deposits (rupiah) was recorded at 1.90%, or reduced by 90 basis points year-on-year on-year. year and one of the lowest in the sector.

Operating Income other than Interest

Customer deposit revenues increased by 12.7%, mainly due to administrative revenues from payment activities within our ecosystem. Based on the same classification, credit card revenues showed positive growth due to the increase in tourism activities at the border.

Operating Expenses

Income from loans receivable grew by 9.9% to Rp.2.0 trillion, mainly attributed to management fees and loan income, in line with solid loan growth in 2022. Overall, we were able to manage the cost-to-income ratio (CIR) , registered at 33.9% compared to 34.9% the previous year.

Impairment Losses on Financial Assets

Earnings Before Income Tax and Net Income

BCA recorded an “unrealized loss for available-for-sale financial assets” of Rp5.3 trillion, higher than last year's loss of Rp1.1 trillion. This was due to the high composition of placements in 'available-for-sale financial assets' in 2022, while this portfolio had a lower market value compared to last year.

Profitability by Operating Segments

CASH FLOW

Cash Flow from Operating Activities

Cash Flow from Investment Activities

Cash Flows from Financing Activities

Presented with the calculation of profits from trade and foreign exchange transactions as operating income; and losses from trading and foreign exchange transactions as operating expenses, in accordance with SE OJK No. 9/SEOJK.03/2020. Presented with the calculation of profit and loss from trade and foreign exchange transactions on a net basis as operating income, in accordance with the accounting standard.

PT BCA Finance

BCA and its subsidiaries continue to build synergies to provide comprehensive financial solutions and meet the increasingly diverse needs of the Bank's customers. Overall, the performance of subsidiaries throughout 2022 continues to improve, in line with the gradual recovery of the domestic economy after the Covid-19 Pandemic.

PT BCA Multi Finance

The business lines of our subsidiaries offer a wide range of financial solutions in various fields, including vehicle financing, remittances, Sharia banking, digital banking, securities, general insurance and life insurance, as well as venture capital. For its commitment to improving its performance and services, BCA Multi Finance received the "Indonesia's Best Multifinance 2022 with Gold Financial Performance and Strategic Digital Platform Innovation" award from Warta Ekonomi and "The Best Performance Multifinance Company" from Infobank Magazine.

PT Bank BCA Syariah

PT Bank Digital BCA

PT BCA Sekuritas

PT Asuransi Umum BCA

BCA Life markets traditional life insurance products for individuals and modified or combined products with health insurance within the bancassurance cooperation scheme with BCA. In 2022, BCA Life received awards including "Life Insurance Company with Very Good Performance" in the category of gross premiums from Rp 1 trillion to Rp 5 trillion from Infobank magazine and "Investor Awards - Best Insurance 2021".

BCA Finance Limited

Taking advantage of technological developments, BCA Life provides facilities and services through mobile applications that can be used by policyholders, including provision of policy information (individual and group health) and electronic claims facilities.

PT Central Capital Ventura

Other Material Information

ACHIEVEMENTS OF 2022 TARGET

MARKETING ASPECT

DEBT REPAYMENT CAPACITY AND LOAN RECEIVABLES COLLECTIBILITY

CAPITAL STRUCTURE AND MANAGEMENT POLICY ON CAPITAL STRUCTURE

Capital Structure

Basis of Management Policy to Determine Capital Structure

DIVIDEND POLICY

Dividend Payout Ratio

MATERIAL CAPITAL EXPENDITURE COMMITMENTS

Purpose of Material Capital Expenditure Commitments

Fund Sources for Capital Expenditures

Currency and Exchange Risk Mitigation Related to Capital Expenditures

REALIZED CAPITAL EXPENDITURES

MATERIAL INFORMATION AND FACTS SUBSEQUENT TO THE ACCOUNTANT’S

MANAGEMENT AND/OR EMPLOYEE SHARE OPTION PROGRAM (MSOP/

ESOP)

UTILIZATION OF PROCEEDS FROM PUBLIC OFFERINGS

MATERIAL INFORMATION ABOUT INVESTMENT, EXPANSION,

DIVESTMENT, AND ACQUISITION

INFORMATION ABOUT MATERIAL TRANSACTIONS WITH CONFLICTS OF

DISCLOSURE OF TRANSACTIONS WITH RELATED PARTIES

As this provision is implemented, the BCA should make adjustments to the internal regulations regarding foreign exchange transactions and domestic pre-delivered transactions (DNDF), especially those related to basic documents and those not included in the permitted scope. of basic documents. BCA should also make channel changes regarding the threshold for foreign exchange transactions at USD 100,000 or equivalent.

PROVISION OF FUNDING, COMMITMENTS OR OTHER SIMILAR FACILITIES BY A BUSINESS OR LEGAL ENTITY WITHIN THE SAME BUSINESS GROUP AS THE BANK,

This regulation covers the threshold for buying DNDF transactions of USD 100,000 or the equivalent per month per transaction lot and selling DNDF transactions of USD 5,000,000 or the equivalent per transaction. 24/20/PADG/2022 dated December 28, 2022, effective from December 28, 2022 regarding the implementation report of the Ethical Market Code and the implementation of Treasury certification.

IMPACT OF REGULATORY CHANGES

This regulation relates to the provisions of implementation procedures and report submissions related to share splits and share mergers. 27 Year 2022 dated 26 December 2022 effective 28 December 2022 in relation to the Second Amendment to the Financial Services Authority Regulation Number 11/POJK.03/2016 Concerning the Minimum Capital Adequacy Requirement for Commercial Banks.

CHANGES IN ACCOUNTING POLICIES

Press Release “Employee Benefits”

With regard to the DSAK IAI press release “Compensation Attribution in the Service Period” of April 2022, the Group has amended the policy regarding the attribution of pension compensation in the service period in accordance with the provisions of SFAS 24 for the general fact pattern of pension programs. based on the UU Cipta Kerja No. The impact of the change in the calculation is not material for the Group, therefore the impact of the changes is fully recognized in the consolidated financial statements of the Bank for the current period.

BUSINESS CONTINUITY INFORMATION

PRIME LENDING RATE

PROSPECTS, STRATEGIC PRIORITIES AND PROJECTION FOR 2023

Prospects of the Economy and Banking Sector for 2023

BCA Strategic Priorities and Projections for 2023