This study will focus on the optimal lending rate of commercial BPR given the exit policy, and assume the monopolistic market structure to reveal the mechanism of BPR's interest rate. This study focuses on finding the BPR optimal lending rate based on the monopolistic model assumption where the BPR maximizes its profit. Exclusion is made for the crisis years of 1997 and 1998 to avoid structural breaks that disturb the proper calculation of the optimal lending rate.

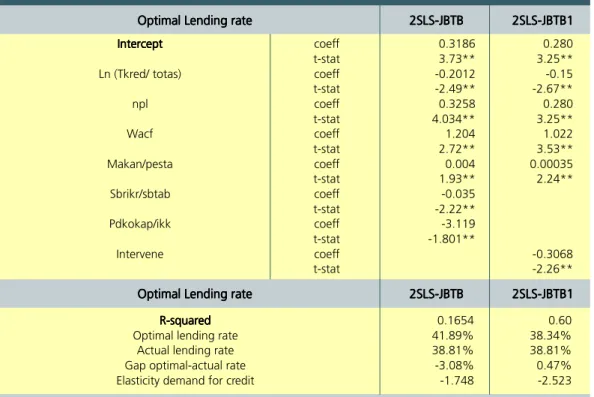

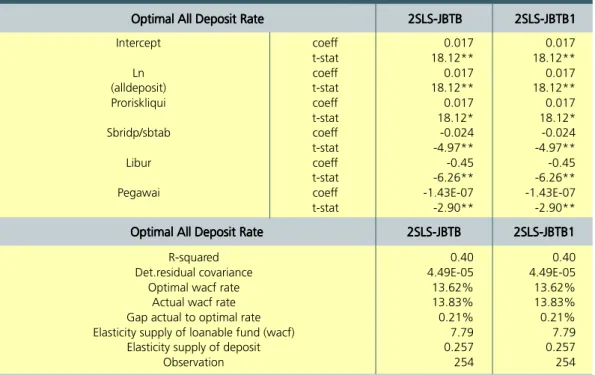

10 The system has also been developed by using SUR to find the optimal lending rate for individual BPR in Jabotabek as well as the aggregated BPR in KBI. In this case, SEROWCL is the lending rate from a state-owned bank (BANK PERSERO) for working capital. The existence lending rate of BRI as a competitor compared to the savings rate of BPR (sbritb/sbtab) is seen as the negative sign shown in Table IV.2 of the 2SLS-JBTB model.

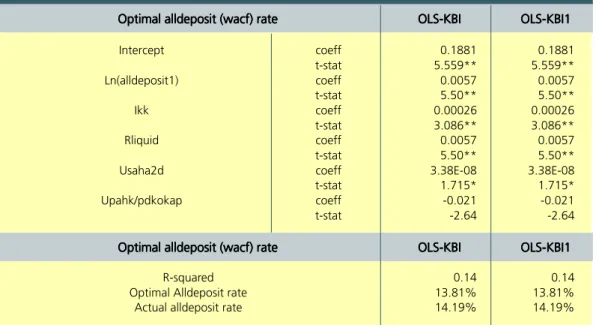

From the size of the optimal borrowing rate shown in Table IV.2, the 2SLS-JBTB1 model has a small deviation from the optimal borrowing rate compared to the actual borrowing rate, or. Optimal Loan Rate 2SLS-JBTB2SLS-JBTB2SLS-JBTB2SLS-JBTB2SLS-JBTB 2SLS-JBTB12SLS-JBTB12SLS-JBTB12SLS-JBTB12SLS-JBTB1. 13 Both models have similar equations for the optimal wacf interest rate, but differ for the optimal loan interest rate.

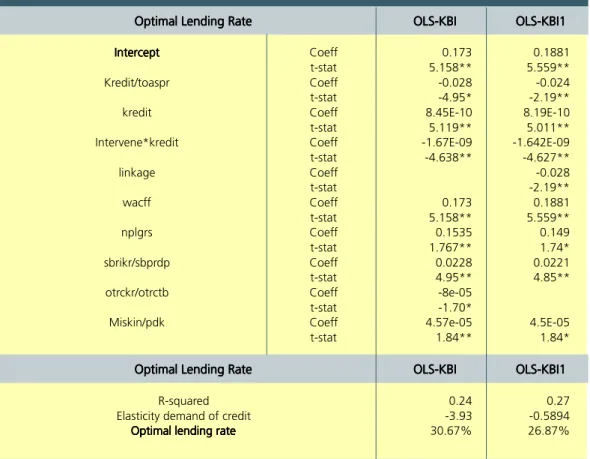

Optimal loan interest rate OLS-KBIOLS-KBIOLS-KBIOLS-KBIOLS-KBI OLS-KBI1OLS-KBI1OLS-KBI1OLS-KBI1OLS-KBI1.

This strengthens the monopolistic competition and loyalty of the BPR debtors for those located in the big cities. It is seen that small and economically weak group in poor areas have to pay higher interest rates because BPR considers them as the riskier customers. The proponents of the old paradigm17 often use this finding to criticize BPR because it is merciless towards the poor.

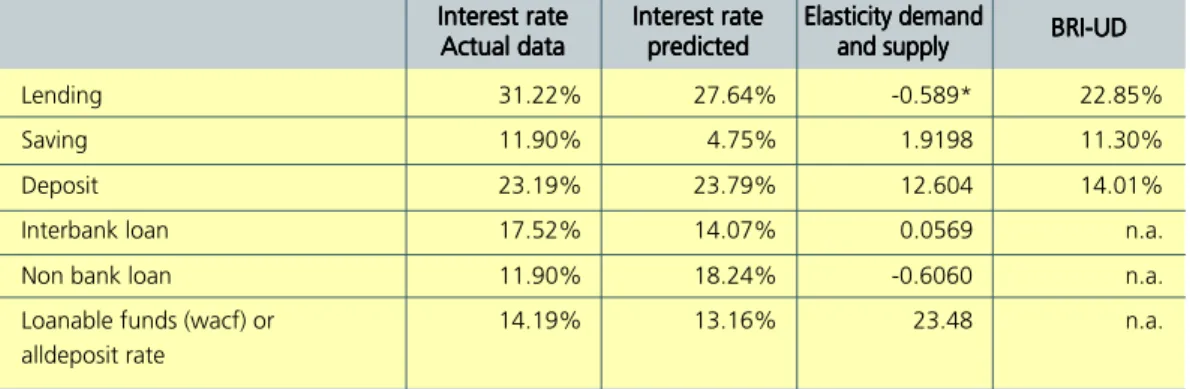

This figure is also more inelastic compared to the Philippine rice farmer's demand for informal loans, which is -5.7919. This elasticity of demand for credit is the same as our assumption about the monopolistic nature of BPR customers. Monopolistic competition lies between perfect monopoly and perfect competition in which there is a negatively sloped demand curve.

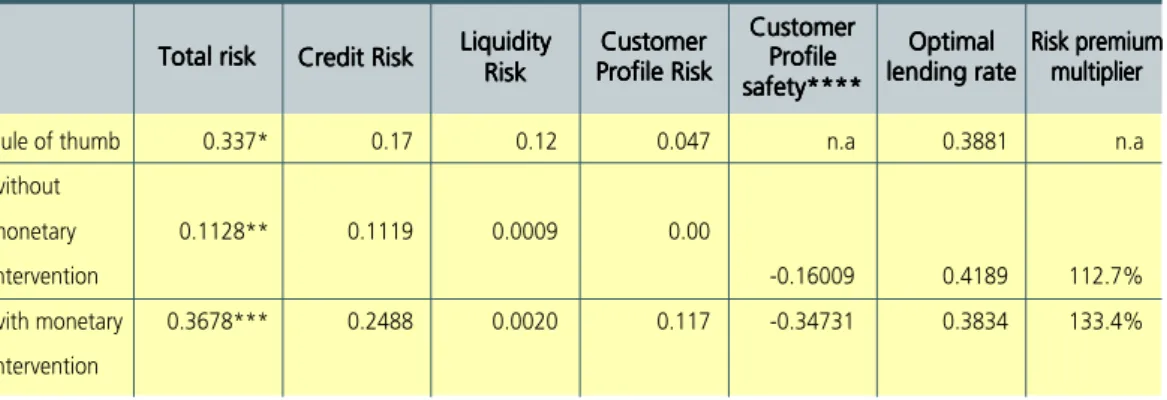

The slope is not exactly equal to zero as in perfectly inelastic demand or equal to ~ (infinity) as in perfect competition. Thus, the 2SLS1-JBTB model is the best model in Jabotabek in terms of representing the most inelastic credit demand -1.748 which reflects the more loyal customer compared to the other models. In optimal lending rate comparison of 2SLS-JBTB1 model as seen in table IV.4, the sizes of credit risk (npl) parameter as well as the weighted average cost of fund (wacf) rates are respectively 0.280 and 1.022, which means that the higher the credit risk ( npl) and the weighted average cost of fund (wacf), the higher the optimal lending rate.

The interesting thing is the existence of the ratio of BRI loans to BPR savings rate (sbrikr/.sbtab) in 2SLS-JBTB, which creates a negative parameter in the BPR loans, with a significant level below 5%. Every time BRI increases the lending rate compared to the BPR savings rate, BPR decreases the lending rate. But in the 2SLS-JBTB1 model, when the variable BI liquidity program steps into the equation, this BRI loan rate variable is not significant; therefore it is omitted.

The richer the area reflected by GDP per capita divided by the consumer price index (pdkokap/ikk), the smaller the lending rate in the 2SLS-JBTB model. This means that the more the economically weak group that works in the service sector, or is able to take a break, or works in more affluent areas, the lower the BPR lending rate. This lower predicted rate compared to actual data is due to the lack of positive variables.

In OLS-KBI and OLS-KBI1 models we find that the customer profile risk is expressed by the number of people below the poverty line per total population or miskin/pdk as seen in the last components of optimal lending rate (shown in table IV.4) ) which increasing impact create on the lending rate. This means that the economically weak group and the small and medium entrepreneur in poor area create higher BPR interest rate. In OLS-KBI1 model, we are able to prove that the BI liquidity program intervenes*credit variable as the policy intervention24 of the monetary authority can reduce the lending rate based on the negative parameters of the model.

The only different elements between the OLS-KBI model and the OLS-KBI1 model are the linkage elements such as BPR's network effort to achieve greater economies of scale and reach, and is able to reduce the lending rate of BPR to 26.96% than creates inelastic demand for credit -0.5894.

The Elasticity

In Jabotabek

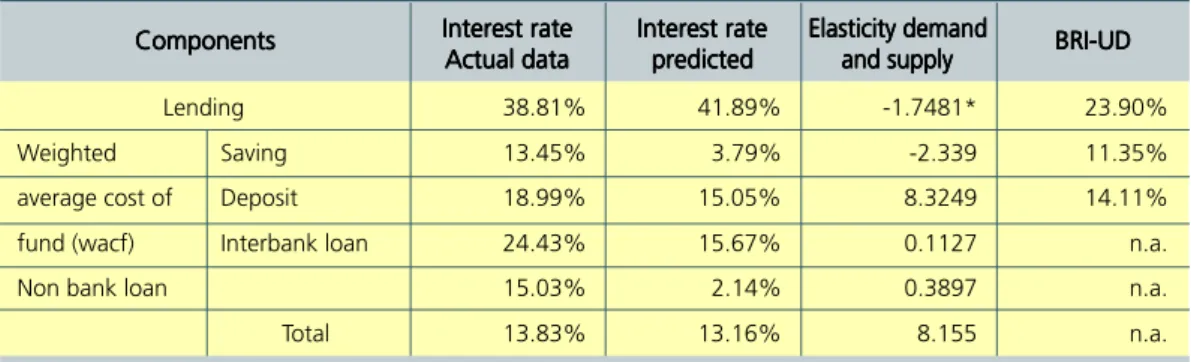

These figures confirm the fact that BPR mostly attracts the bank and non-bank loan more than the depositors and savers. This is evident from the more inelastic supply of bank and non-bank loans compared to the elastic supply of savers and depositors. This may be because the image that BPR names (as Bank Perkreditan Rakyat) reflects more credit institution instead of savings institution.

Different optimal average rates and its elasticity Demand and supply in Jabotabek using model 2SLS-JBTB126. Interest rate Interest rate Interest rate Interest rate Interest rate Current data Current data Current data Current data Current data.

Location: 5 major German banks: Bayerische Vereinsbank, Deutche Bank, Dresder Bank and WestLB Focus: small and medium-sized enterprises, 1992-1996. For the average rating category, the multiplier is 32.3% from the good and excellent credit category.

Simulation to Reduce Risk

CONCLUSION

Lowering the loan interest rate under the new paradigm can only be done indirectly, for example by getting cheaper cost of funds. This means that attracting banks and other non-banks to channel their funding through BPR is easier and more reliable compared to funding savers and depositors. The low interest rate of bank and non-bank borrowing of BPR41 may be reduced.

It is found that the interest rate is the 11th factor among 12 alternatives when the debtor's candidate borrows from BPR. Because the Tjina Mindrings were more numerous compared to the Arab moneylenders, it gave the Tjina Mindring a more terrible image. If the BPR belongs to a group, the interest rate will be lower because the risks are lower due to the spread of risk.

If suspicious group ownership of BPR exists, the blame can be placed on the adverse selection due to the weak regulation and oversight as asymmetric ex post information45. In fact, all efforts to lower the borrowing rate are transferred to the market mechanism to determine the final rate. Moral risk, such as a non-performing loan, is often found due to the misconception that this credit is seen as the good cause51.

This is considered the particular challenge due to the limited capacity and quality of human resources in BPR55. BI seems to place more emphasis on the behavior of BPR rather than the BPR structure. Behavior is related to monitoring the permitted activity56, for example using the CAMEL formula to evaluate the performance of BPR.

On the other hand, the bankruptcy of a large bank is viewed as the opposite due to the ≈too big too fail∆ theory, according to which BI, as a lender of last resort, fears that there will be systemic risk if a large bank goes bankrupt. 58 This is a consequence of the fact that the supervisory body of financial institutions (LPJK) will be established in 2010 in accordance with Act no. 3 from 2004. Although this research strengthened the conclusion that micro assessment in banking can be very useful to support monetary policy, but the weakness of the research is that the theory of interest rates is the weakest theory among others in the economy61, and this is exaggerated due to the limitation of individual data.

From the loan amount in rupees LLLLL , in this case rrrrrL is the interest rate charged by BPR to its borrowers. The BPR has to pay a proportional non-monetary penalty of rrrrrPEN to the central bank only if there is a liquidity shortage, which is reflected in the low soundness of the BPR based on the CAMEL (Capital, Assets, Management, Earnings, Liquidity) formula. ).