The development of Islamic economics and finance is not only about commercial matters, but also about social finance (such as zakat, infaq and waqf). On behalf of the IIUM Institute of Islamic Banking and Finance (IIiBF), the International Islamic University of Malaysia, I would like to congratulate the University of Darussalam, UNIDA Gontor, for successfully organizing and hosting the 7th ASEAN International Universities Conference on Islamic Finance of Islam. (AICIF 2019). The theme of the conference "Revival of Islamic Social Finance to Strengthen Economic Development Towards a Global Industrial Revolution" highlights the outstanding contributions and guidance of our beloved Prophet Muhammad (pbuh) on his various endeavors for social welfare and sustainable development policies. social.

These efforts have led to the remarkable economic development of Islamic societies, which today's leaders in the Islamic banking and finance industry must emulate. While there is tremendous growth and expansion of the Islamic finance industry today, an important issue to highlight is the role and contribution of Islamic finance in achieving the socio-economic goals of society. It is high time that this wealth of experience is shared with other parts of the world with more universities joining this consortium in an effort to stay abreast of the dynamic field of Islamic banking and finance.

This event will address a theme that highlighted the revival of Islamic social finance to enhance economic development towards the global industrial revolution. Hopefully, by enhancing his knowledge of Islamic social finance, he will be able to improve analytical skills to improve the welfare of Muslims. On this occasion, the 7th AICIF highlighted the theme of Revival of Islamic Social Finance to Strengthen Economic Development in the Direction of Global Industrial Revolution.

The theme of the conference "Reviving Islamic Social Finance to Strengthen Economic Development Towards a Global Industrial Revolution" could not be more timely and auspicious. It is a privilege for Tazkia University College of Islamic Economics to co-host the 7th ASEAN Universities International Conference on Islamic Finance which was held on December 3 and 4, 2019 at the University of Darussalam Gontor. Tazkia University College of Islamic Economics is a pioneer of the development of Islamic economics and finance in Indonesia.

Tazkia University College of Islamic Economics has contributed to the development of Islamic economics and finance in Indonesia since twenty years ago. We congratulate the University of Darussalam Gontor for hosting this conference and wish a smooth conduct of this event so that the 7th AICIF theme "Revival of Islamic Social Finance to Strengthen Economic Development towards a Global Industrial Revolution" can be achieved together. Annas Syams Rizal Fahmi1 and Fikri Muhammad Arkhan2 ..40 DEFINITION OF ISLAMIC MANAGEMENT FUNDS AS INDICATOR OF THE.

Abdelrahim El-Brassi1, Syed Musa Alhabshi2, Anwar Hasan Abdullah Othman3 ..48 THE ESTABLISHMENT OF ISLAMIC FINANCE AND ITS IMPACT ON. Azi Haslin Abdul Rahman1 and Rusni Hassan2 ..54 ACHIEVING THE MAQASID OF ISLAMIC FINANCE WITH SOCIAL IMPACT BONDS (SIB) AND SUSTAINABLE AND RESPONSIBLE INVESTMENT (SRI) SUKUK. Rahma Yudi Astuti ..68 BUILDING THE OPTIMAL PRESSURE LEVEL FOR THE RESILIENCE OF ISLAMIC BANKING IN INDONESIA.

Hendar1 ..93 ENABLING SUSTAINABILITY THROUGH KNOWLEDGE MANAGEMENT OF ISLAMIC SOCIAL FINANCE: THE EXPERIENCE UNIVERSITAS DARUSSALAM GONTOR, INDONESIA.

ISLAMIC SOCIAL REPORTING DISCLOSURE : SHARIA ENTERPRISE THEORY (SET) PERSPECTIVE

Hani Werdi Apriyanti

Abstract

Introduction

The concept of ISR is used as a form of accountability or responsibility for corporate social activities that operate on the basis of Shariah principles. Islamic financial institution reveals social responsibility as a form of responsibility vertically to God and horizontally to customers, investors, community, word and employees as a form of responsibility (Uun Sunarsih1, 2017). Islamic social revelation should be able to describe the principles of Islam such as free transactions of Riba, Ghahar and other haraam transactions.

Disclosure of social responsibility in Islamic Financial Institution or Islamic Social Reporting (ISR) is a development of social responsibility that complies with the principles of Shariah. The company should measure the implementation of Islamic social activities by calculating the item disclosed in the ISR. The ISR Index is the benchmark for the social responsibility of Sharia financial institutions, consisting of standard CSR items based on Sharia compliance.

The ISR index is a limitation in measuring CSR disclosure in accordance with Islamic perspective. The ISR is divided into six theme disclosures, namely the company's products or services, the community around the company, employees of the company, the environment, corporate governance as well as the financial and investment company, which consists of 51 items.

Literature rivew

Sharia Enterprise Theory

Islamic law) and in the proper manner in accordance with the manner modeled by the Prophet Muhammad. To achieve accountability, accounting information must fulfill its proper purpose, which is to fulfill its obligations to God, man and the environment. The obligation to Allah (vertical responsibility) is the same as the activity of recording accounting information is a form of worship to Allah SWT.

Therefore, all forms of worship must meet the criteria or conditions of iklas or with the intention of Allah without the hope of reward from man, and follow (away) According to the examples of the Muhammad, so that worship is accepted by God. Fulfillment of obligations towards this person (horizontal accountability), that is to balance between the goals that the company will achieve by still paying attention to the welfare aspects of the related parties (whether employees, communities and Others). The achievement of company goals is to achieve corporate value or value of the company, one of which is in the form of achieving profit, must be in accordance with Sharia provisions and should not contain ways that are contrary to Sharia.

In addition, by achieving the profit, the company must also pay attention to the welfare of the employees and society by providing justice. Fair behavior can be modeled after providing pay and bonuses to employees that are tailored to the human aspect as an asset to the company, not a burden. This kind of perspective can avoid unfair treatment of the employees, because if it is seen as an asset, the company will not try to minimize the expenses for the employees (including wages) based on the western way of paying wages.

Fulfilling obligations to the environment (horizontal accountability) is achieved by fulfilling the company's environmental rights, which requires consideration of environmental aspects in the company's business activities.

Islamic Sosial Reporting (ISRs)

Using the concept of Sharia company theory, it is necessary to reveal the characteristics of disclosures that comply with Sharia rules and include all the necessary information (Indonesian Accountants Journal, Issue 2 is important). Accounting information must meet the aspect of transparency in terms of providing information related to halal and illegal activities, information on financial and investment policies, information on company compliance to employees, communities and the environment (Apriyanti, 2018). According to Shariah corporate theory, Shariah financial reporting includes socio-economic and value-added reporting and employee reporting.

This report covers the disclosure of corporate social responsibility, in the concept of Shariah Enterprise Theory, God is the main trustee who owns the resources of the company, the stakeholders are the trustee of Allah in such resources. In such trust is a responsibility to be used in the manner and purpose determined by the Supreme Administrator. Therefore, in accordance with the concept in Sharia Enterprise Theory, to fulfill vertical and horizontal accountability there are several stakeholders, namely Allah, direct stakeholders and indirect stakeholders (human) and nature.

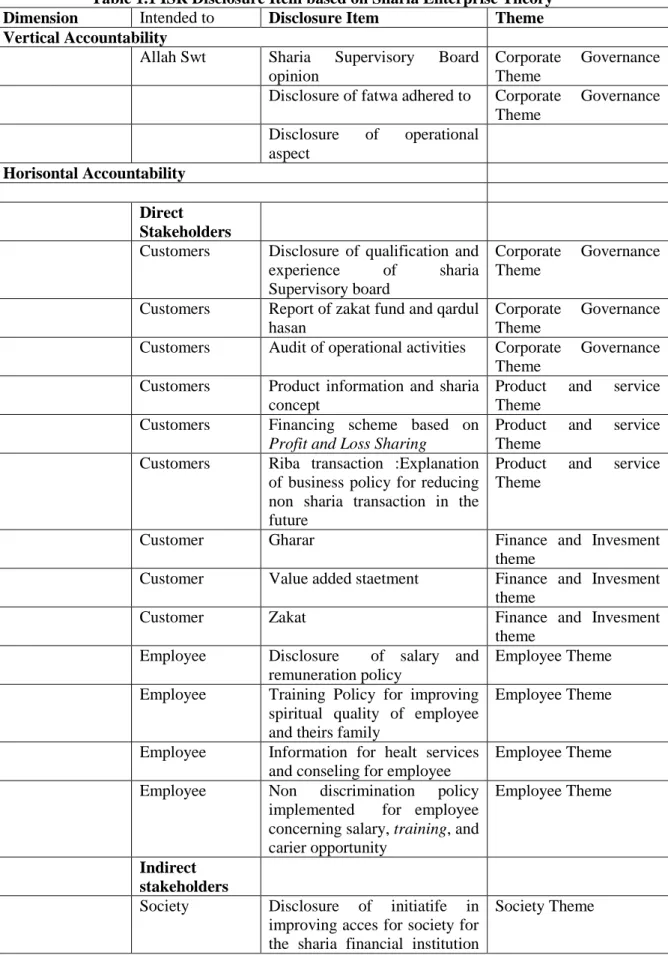

ISR Disclosure Item based on SET (Sharia Enterprise Theory)

Vertical Accountability

Horisontal Accountability

Direct Stakeholders

Indirect stakeholders

Conclusion

Bibliography