Publication of the profile of the candidate members of the Supervisory Board and the Executive Board. Performance assessment of the Supervisory Board, Executive Board and committees under the Supervisory Board.

The Bank is committed to implementing GCG principles in its operations to achieve corporate sustainability. Based on the 2019 self-assessment, the Bank will implement some improvements, including updating the Bank's policies and procedures.

ExtERnAL AssEssmEnts

As of December 2019, the bank's supervisory board consists of 8 (eight) people, of which 4 (50%) were independent supervisory directors. The total number of members of the Supervisory Board does not exceed the total number of members of the Executive Board.

The General Meeting of Shareholders (GMS) is the highest body in CIMB Niaga's corporate governance structure and is the forum where shareholders make decisions. CIMB Niaga GMS consists of an Annual GMS (AGMS) which is held once a year and Extraordinary GMS (EGMS) which can be held anytime based on needs.

Summary of the Minutes (Results) of AGM submitted to OJK and IDX in 1 (one) working day after the AGM (hard copy and e-reporting via SPE-OJK & IDX-Net). 4th agenda reappointment of 1 (one) member of the Board of Directors and 1 (one) Board of Commissioners of the company.

LEGAL BAsis

The Board of Commissioners is one of the management bodies that has tasks and responsibilities for supervising the bank in accordance with the statute and for ensuring that the bank operates in accordance with the set goals, advises the bank. board of directors and ensures that the bank implements the principles of good corporate governance (GCG) at all levels of the organization. The Board of Commissioners is also responsible for overseeing the Bank's policies regarding the Bank's general operations in relation to business strategies and plans approved by the Board of Commissioners and for ensuring compliance with all applicable laws and regulations.

BOARD OF COmmissiOnERs’ ChARtER To support and facilitate the Board of Commissioners in

The Shareholders who can propose candidates for membership of the Supervisory Board will be 1 (one) or more shareholders representing 1/20 (one twentieth) or more of the total number of voting shares. Proposals for the dismissal and/or replacement of the members of the Supervisory Board are submitted to the AGM and take into account the recommendations of the Bank's Nomination and Remuneration Committee.

BOARD OF COmmissiOnERs’

Members of the Board of Commissioners may be dismissed at any time based on the decision of the ABS by stating their reasons. Appointed as Senior Independent Commissioner of the Bank by CIMB Niaga Board of Commissioners Circular Resolution No.

Fit AnD PROPER tEst

A member of the Board of Commissioners, designated by the Board of Commissioners, must chair the ABS. To ensure that the Board of Commissioners acts in accordance with the Charter of the Board of Commissioners;.

All board members must avoid potential conflicts of interest and must not place themselves in a potential conflict of interest position in any situation as set forth in the board's charter. The board of commissioners and their families and other related parties may not borrow money from the bank as stipulated in the board's articles of association.

Provides input on policies and/or training programs for the Board of Directors and Board of Commissioners. In addition, the Board of Directors has granted credit to bank affiliates to meet prevailing regulatory requirements.

DEvELOPmEnt PROGRAm

Evaluation is performed by each member of the Committee on the performance of the Committee under the Board of Commissioners. Individual performance evaluation for each member of the committees under the Board of Commissioners Each member of the Committee provides an evaluation for each other member of the committee under the Board of Commissioners.

3 Has no connection with the bank, members of the board of directors, members of the board of directors or with the bank's ultimate shareholders. 4 Has no financial relationship, management relationship, shareholder relationship, family relationship with other members of the board of directors, the board of directors and/or the ultimate shareholders.

Each member of the Board of Directors performs his/her duties in accordance with his/her respective duties and powers, with the aim of achieving management effectiveness and maximum results. CIMB Niaga's Board of Directors always maintains professional, objective and strategic thinking and prioritizes the interests of the bank to increase stakeholder value and ensure the sustainability of the company.

Shareholders who can nominate a candidate for a member of the board of directors are 1 (one) or more shareholders representing 1/20 (one twenty) or more of all shares with voting rights. The proposal for the dismissal and/or replacement of members of the board of directors has been submitted to the GSD and must receive the recommendations of the Bank's Appointments and Remuneration Commission.

BOARD OF DiRECtORs’ stRuCtuRE, numBER OF mEmBERs AnD

Members of the Board of Directors, the Board of Commissioners and/or Shareholders of the Bank may present proposed candidates to the Bank. Members of the Board of Directors may be dismissed at any time based on the ABS' decision by stating the reasons.

COmPOsitiOn in 2019

Acting as a liaison between the Supervisory Board, the Nomination and Remuneration Committee and the candidates during the nomination and evaluation process; Members of the Board of Directors have the right to resign from their position by giving written notice of their intentions and reasons for dismissal to the Bank no later than 90 (ninety) days or 3 (three) months prior to the actual resignation.

BOARD OF DiRECtORs’ tERm OF OFFiCE 1. The term of office of members of the Board of Directors

The Board must implement the principles of Good Corporate Governance in every business activity of the Bank at all levels of the organization. Detailed information on the duties, responsibilities and authorities of the Board of Directors is stipulated in the Bank's Statutes and the Board of Directors' Charter which are uploaded on the CIMB Niaga's website www.cimbniaga.co.id.

Follows, implements and executes all instructions from regulators regarding the Bank's risk management. Manages the Bank's funds, liquidity and liabilities to ensure that the Bank operates prudently.

BOARD OF DiRECtORs’ inDEPEnDEnCy No members of the Board of Directors have financial,

ORGAnisAtiOns

Hedy Lapian Human Resources Director • Board members of Management, Education and Human Resources Development Sector of PERBANAS.

BOARD OF DiRECtORs’ COnFLiCts OF intEREst

BOARD OF DiRECtORs’ LOAn POLiCy The Bank may provide loans to the members of Board of

The bank won the Mid-Term Immediate Team and implemented a comprehensive transformation across every segment of the bank, starting with internal improvements to improving customer service by leveraging technology and analytics. The 2019 and 2020 are a crucial transformation phase for the bank and are expected to be a momentum that can take CIMB Niaga to a better level.

BOARD OF DiRECtORs’ DEvELOPmEnt PROGRAm

The evaluation of the performance of the board of commissioners is carried out annually (at least once a year) and includes: In more detail, the result of the collegial evaluation of the work of the board of directors was 3.7.

Member of the board of directors of national and multinational financial and non-financial institutions 2. Gender Out of a total of 11 (eleven) members of the board of directors, 6 (six) are female directors.

PuRPOsE AnD BACkGROunD

40/SEOJK.03/2016 regarding the implementation of governance in the provision of remuneration for commercial banks, the bank has established and implemented a risk-based remuneration policy. Minister of Personnel Ordinance No.

DEtERminAtiOn OF mAtERiAL Risk tAkER Determination of Material Risk Taker (MRT) is categorized as follows

The Board of Commissioners' remuneration structure consists of an honorarium, meeting allowances, transport allowances, holiday allowances, year-end benefits and other facilities such as medical, communication and club membership. Person rp (million) Person rp (million) Remuneration (salary, routine allowance, royalty and other non-natural facilities).

BOARD OF DiRECtORs’ REmunERAtiOn

The GSD determines the remuneration of the Sharia Supervisory Board, which is further implemented by the Board of Directors. All members of CIMB Niaga's Shariah Supervisory Board have not received any variable remuneration (shares or bonuses).

Note: Explicit adjustment was due to malus and termination of employment (MRT) during the reporting period, while implicit adjustment was due to share price decline between grant date and report end date.

PROvisiOns FOR BOARD OF

Meetings of the Board of Directors are held periodically at least 1 (one) time per month or at any time if deemed necessary, or altogether at least 12 (twelve) times per year. Related relationships between a member of the Board of Directors and members of the Board of Commissioners.

BOARD OF COmmissiOnERs

Related relationships between a board member and other board members. Affiliate relationships between a member of the board and other members of the board; and 5.

BOARD OF DiRECtORs

The Board of Commissioners and the Board of Directors of CIMB Niaga are fair and independent and have no conflicts of interest that could compromise their ability to perform their duties in a professional and objective manner. All committees within the Board of Commissioners are chaired by independent commissioners who have no financial resources.

Implementation of the Committees under the duties and responsibilities of the Board of Commissioners CIMB Niaga refers to the Committee Charter, compiled based on the regulations applicable in Indonesia, especially the GCG regulations of Bank Indonesia, and best practices that are reviewed regularly.

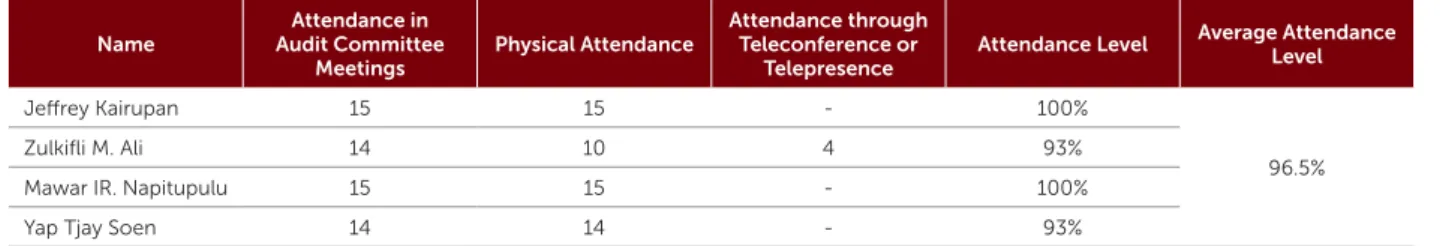

AuDit COmmittEE’s numBER OF

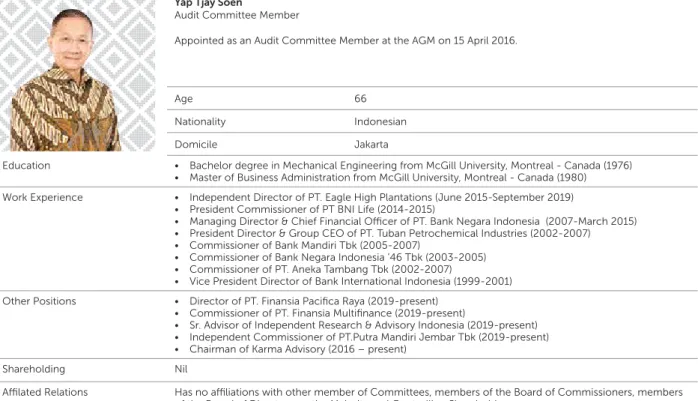

PROFiLE OF AuDit COmmittEE mEmBERs

Related relationships Has no relationship with other members of committees, members of the board of directors, members of the board of directors or majority and controlling shareholders.

Make recommendations to the Supervisory Board on the appointment of an independent external quality controller to review the performance of the Internal Audit Unit (IAU). Make recommendations to the Supervisory Board on the IAU's general compensation and incentives.

Discuss the audit plan, scope and audit findings, follow-up recommendations regarding audit results and the adequacy of the internal control system. Meetings with the Public Accountant to discuss audit plan, the scope of the audit, audit findings, recommendations regarding audit results and the management letter submitted.

WORk PLAns FOR 2020

Discussed the recommendations and progress of following up on the audit results from the Financial Services Authority, Bank Indonesia and Bank Negara Malaysia. Meetings with the relevant directors and work units to ensure the adequacy of the internal control system in the management of problem assets, non-performing loans (NPL) of the Corporate Bank and the Commercial Bank, as well as the status of important projects in 2019.

R. NAPITUPULU

CIMB Niaga's articles of association relating to the duties and powers of the commissioners. NRC members are appointed by the board with the approval of the board and based on the recommendation of the nomination and remuneration committee.

REmunERAtiOn COmmittEE mEmBERs Training data for the Nomination and Remuneration Committee

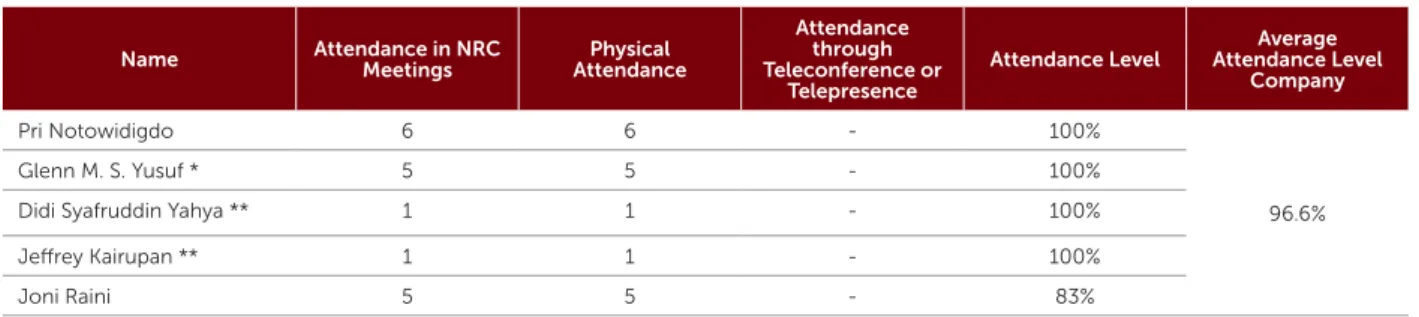

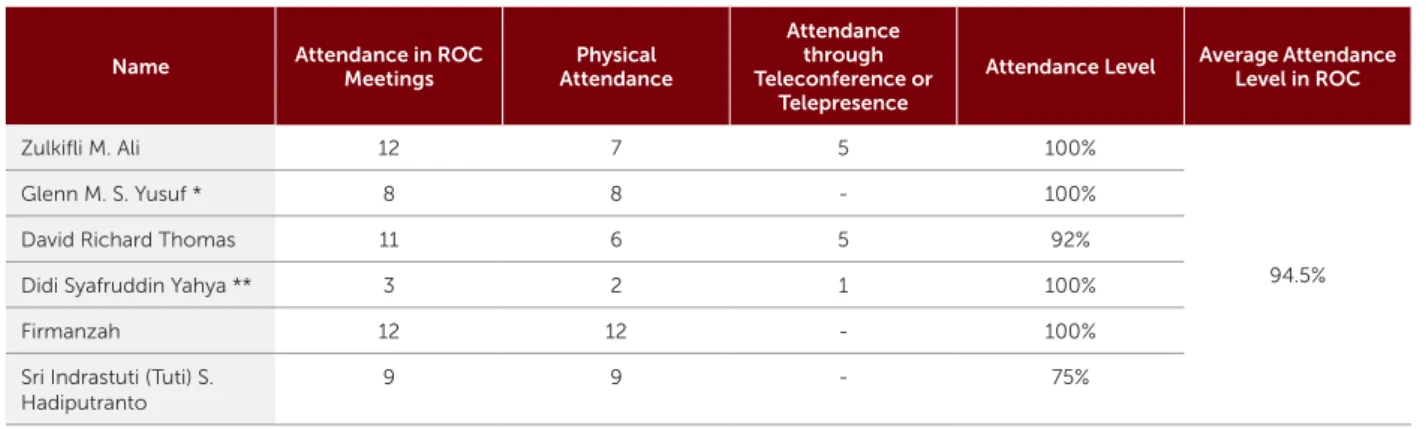

AttEnDAnCE

Provided direction and input regarding the 2019 Board of Directors Key Performance Indicator (KPI) framework and important aspects requiring the attention of the Board of Directors. Periodically provided evaluations and guidance on the performance achievements of the Board of Directors (KPI) and provided information on units whose performance achievements are still below the established targets to ensure performance improvement.

WORk PLAns in 2020

Guidance and input provided regarding the competency development program for the Board of Commissioners and the Board of Directors to be formulated in a structured, integrated manner and in line with the Bank's long-term strategy and industry development. Talented employees identified as potential successors as members of the Board of Directors are evaluated and identified and must meet the criteria for candidates for the Bank's Board of Directors.

Risk OvERsiGht COmmittEE ChARtER The ROC established a Charter governing the membership,

The Risk Oversight Committee (ROC) is a committee established by and accountable to the Board of Commissioners to support the implementation of the Board of Commissioners.

PROFiLEs OF Risk OvERsiGht COmmittEE mEmBERs’

Affiliated Relationships He has no affiliations with other board members, board members, board members, or majority and controlling shareholders. Member of the Board of Directors of the Indonesia Stock Exchange ('IDX') from 2001 to 2004.

In 2019, there were 25 (twenty-five) additional agenda items from the work plan established at the beginning of the year to ensure that ROC meetings discussed the most current and relevant topics related to the bank. Mandatory reports to be submitted to the Bank Supervisor consisting of the Risk Profile Report, the Risk Based Bank Rating Report and other reports to ensure that the information passed to the Bank Supervisor reflects the actual risks faced by the Bank accurately displays.

Risk OvERsiGht COmmittEE’s

Asset quality status and projection for each loan segment to ensure that each business unit has taken the necessary measures to maintain and improve the Bank's asset quality in accordance with the established risk posture and risk appetite. The results of the Credit Underwriting Test evaluation are presented every 3 months in an effort to improve the underwriting process.

WORk PLAn FOR 2020

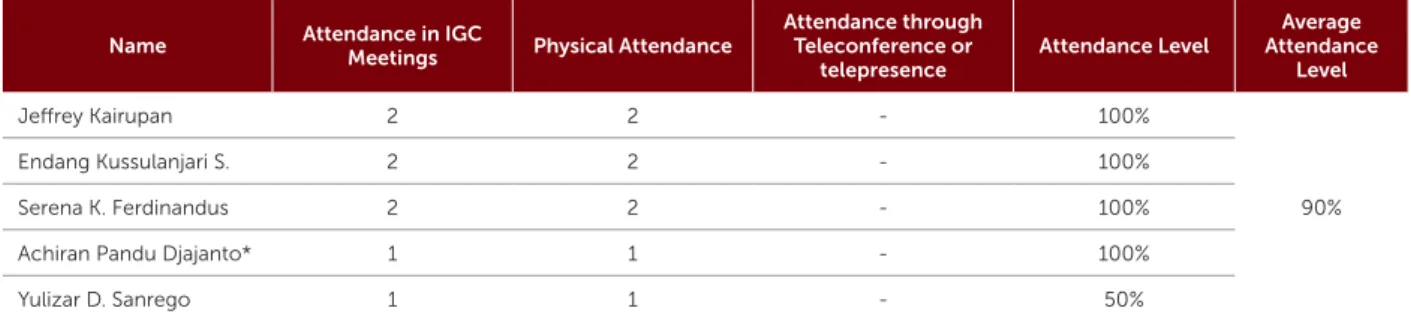

CIMB Niaga as the main entity of the Indonesian financial conglomerate CIMB (CIFC) has established an Integrated Governance Committee (IGC) to assist in the performance of the duties of the Board of Commissioners as the ME Board of Commissioners, in particular to exercise their oversight function on the implementation of integrated governance in the Indonesian financial conglomerate CIMB in accordance with all applicable regulations and legislation. Otoritas Jasa Keuangan (OJK) regulations and OJK circulars regarding the implementation of integrated management for financial conglomerates.

PROFiLEs OF intEGRAtED GOvERnAnCE COmmittEE mEmBERs

Risk mAnAGEmEnt COmmittEE (RmC)

Establish and recommend risk management policies and frameworks, including the bank's risk strategy and risk appetite statement (RAS). Assess asset quality to match the bank's overall risk appetite.

The IT steering group also determines the priority status of critical IT projects that will have a significant impact on the bank's operational activities. Recommendations regarding adaptation of IT and management information systems to the bank's business activities.

CREDit POLiCy COmmittEE (CPC) main FunctionS anD authoritieS

Oversee the implementation of the credit policy to ensure that the bank is in compliance with the credit policy management and applicable regulations. All CIMB Niaga Exco are chaired by the Chief Executive Officer of the Bank, whose appointment, dismissal and term of office are determined through the AGM, as explained in the Board of Directors section of the GCG Report of this Annual Report.

CORPORAtE sECREtARy PROFiLE

Organized and participated in meetings of the board of commissioners 8 (eight) times, meetings of the board of commissioners together with the board of directors or participated in them 4 (four) times and committees within the meetings of the board of commissioners, consisting of: meetings of the audit committee 15 (fifteen) times; Risk monitoring committee meetings 12 (twelve) times; Appointments and Remuneration Committee meeting 6 (six) times;. organized and participated in 38 (thirty-eight) meetings of the board of directors and 4 (four) meetings of the board of directors together with the board of directors or participated in them, prepared minutes of the meetings and lists of those present and led and participated in the meetings of the executive committee (Exco) of directors.

54 November 4, 2019 Submission of Proof of Release of Funds for First Distribution of Sukuk Profit. 57 November 8, 2019 Submission of release evidence of CIMB Bank Niaga Phase I 2019 Sukuk Mudharabah I 4th Dividend.

The IA's role is to provide independent and objective assurance and advisory services that will add value and improve the bank's operations. IA assists the bank in achieving its objectives by evaluating and improving the effectiveness of risk management, internal control and governance processes.

PARtiEs WhO APPOint AnD

As the third line of defense, the IA's main tasks are to ensure that the bank's management and operations comply with all applicable rules and regulations and support the bank's interests and objectives. IR is also responsible for ensuring the adequacy and proper implementation of the internal control process.

Dismiss thE hEAD OF thE iA (ChiEF AuDit ExECutivE)

1/POJK.03/2019 of January 28, 2019 regarding the implementation of the Internal Audit Function in Commercial Banks (PPFAIB) and POJK No. In terms of implementation of integrated governance and the role of CIMB Niaga as the primary entity with an already established Internal Audit Unit.

AuDit mEthOD

Following the development of the organization and its needs, IA performed feature developments in NAMS and implemented the CIMB Niaga Audit Management System (CNAMS) in 2009, which was later replaced by TeamMate in 2010. Until now, TeamMate is still used as an audit management system. Information system and it is being further developed to meet the continuous demand and support the activities of IA.

The CIMB Niaga Compliance Unit fulfills a compliance function as one of the most important factors in improving the implementation of Corporate Governance. Realize the implementation of a compliance culture at all levels of the Bank's organization and business activities;

COmPLiAnCE unit WORk PLAn FOR 2019

Acting as the Bank's liaison officer when dealing with regulators, particularly in relation to compliance enforcement and regulatory audit. Integrated Compliance Reporting on the implementation of compliance in the financial conglomerate CIMB Indonesia periodically to the Directors and Board of Commissioners of the Bank as the lead entity.

COmPLiAnCE inDiCAtORs 2019

The Compliance Unit monitored the implementation of compliance in the business units through its RCSA (Risk Control Self-Assessment) conducted by each RCU/DCORO (Risk Control Unit/ Designated Compliance and Operational Risk Officer) and the results from other independent units (including the Internal Audit Unit and the Risk Management unit) and the results of the examination by the regulator. The Compliance Unit also conducted compliance implementation reviews (unit reviews, periodic reviews and thematic reviews) in business units.

PROFiLE & tRAininG OF hEAD OF AmL

POJK and SEOJK regarding the Implementation of the APU-PPT Program and the Instructions for Immediate Freezing of Client Funds in the Financial Services Sector, whose identity is listed in the List of Suspected Terrorists and Terrorist Organizations as well as in the Arms Proliferation Registry Mass destruction. The head of the LPP is appointed and dismissed based on the director's decree and is reported to the ZJK.

AML and CFT Risk Control and Management carried out through the implementation of Customer Due Diligence (CDD) or Enhanced Due Diligence (EDD) processes to identify customer profiles and analysis of transactions' compliance with customer/WIC profiles and dissemination of policies and procedures, training for all the bank's employees, assessments of the AML and CFT implementation in branches through a Risk Control Self-Assessment (RCSA). Assessment process for implementing AML and CFT on business units/branches and subsidiaries with a higher risk.

PERiOD OF sERviCE FOR PuBLiC ACCOuntAnt AnD PuBLiC

13/POJK.03/2017 dated March 27, 2017 regarding the Procedures for the Use of Public Accounting Services and Public Accounting Offices in Financial Services Activities, the auditors for the Bank's financial statements for the fiscal year 2019 have been determined through AGMS based on recommendations . by the Board of Commissioners and the Audit Committee. OTHER NON-AUDIT SERVICES PROVIDED BY FIRM PUBLIC AUDIT AND OTHER PUBLIC ACCOUNTANT FOR THE LAST FINANCIAL YEAR (2019) ANNUAL PUBLIC ACCOUNTANT 019) ANNUAL AUDIT SERVICES OF FINANCIAL STATEMENTS.

A healthy, safe and good organization is the result of the implementation of an effective risk management system. The risk management system can also reduce systemic risks, which can damage the bank both materially and immaterially.

The risk management system will guide activities for the bank's strategies and goals, resulting in optimal returns, healthy and sustainable business growth, and maximizing added value for shareholders. The risk management system will support management in monitoring regulations and applicable laws, policies, plans, regulations and internal procedures.

Risk mAnAGEmEnt unit

Monitor the implementation of the risk management strategy recommended by the Risk Management Committee and approved by the Board of Directors. PERFORMANCE ASSESSMENT BY THE BOARD OF DIRECTORS RISK MANAGEMENT UNIT CIMB Niaga continuously reviews the performance of the RMU.

Risk mAnAGEmEnt

The main objectives of the Internal Control System, in addition to efforts to support the vision and achievement of the Bank's mission, are to increase value for stakeholders, minimize the risk of losses and maintain compliance with applicable laws and regulations. CIMB Niaga's Internal Control System is an important monitoring component in the Bank's management and has become a reference for a sound and controlled banking operation.

COntROL systEm AnD COnFORmity With COsO – intERnAL COntROL

Monitoring of the implementation of internal control system should be monitored to ensure that the system is working well. The Board of Directors, Bank's officers and Internal Audit continuously monitor the effectiveness of the overall Internal Control implementation.

The bank has made maximum efforts and is currently awaiting an official copy of the decision. The bank has made maximum efforts and is currently awaiting an official copy of the decision from the Jakarta Timur District Court.

26 CIMB Niaga won The Asian Banker Award for Best Implementation of Credit Risk Technology on 11 June 2019. 53 Color match presented by CIMB Niaga Spread the Spirit of Love in Color on 13 October 2019.

CODE OF EthiCs AnD

Each year, all employees must sign a statement of commitment to the Code of Ethics & Conduct. CIMB Niaga continuously monitors the implementation of the Code of Ethics & Conduct and imposes strict sanctions on employees who violate its provisions.

Therefore, the Bank has imposed an obligation on all employees, including the Executive Board and the Supervisory Board, to comply with the Code of Ethics. In addition, CIMB Niaga's Code of Ethics & Conduct has been uploaded to the bank's internal website (e-Manual) to make it easily accessible to employees.

Corporate Culture plays an important role in the achievement and success of the Bank's plans and strategies. Sourcing reliable and excellent suppliers of goods and/or services from the Bank effectively and efficiently.

The policy is also supported by the Standard Operating Procedures (SOP) approved in 2018 for the procurement of goods and services. Creating a fair, solemn and controlled competitive environment by increasing transparency in determining the goods and/or services suppliers.

As a form of the Bank's commitment to support anti-corruption practices, the Bank has created an Anti-Corruption Policy No. Monthly financial reports are also published on the Bank's website based on the prevailing OJK regulations.

POLiCy

Therefore, the bank provides funds for social activities through its Corporate Social and Responsibility (CSR) programs and activities. The bank continues to give all employees the freedom to channel their wishes into political activities.

PROCEDuRE

In relation to politics, in 2019 the Bank did not provide funding for political activities or to any political parties. This policy has been implemented to maintain the independence and professionalism of the Bank and its employees.

DisCLOsuRE

In addition, CIMB Niaga encourages employees to play an active role in assisting and supporting social activities organized by the bank as stipulated in the Bank's Code of Ethics and Conduct no. To achieve this goal, the bank has increased the role of the Customer Resolution Unit (CRU), which is responsible for handling customer complaints related to the bank's products and services.

COmPLAints hAnDLinG in 2019

In particular, this Policy also regulated for a certain period of time a Blackout Period during which all employees and management are prohibited from transacting in the Securities of the Bank. Even if an employee and/or management has carried out a transaction, a report must be made to the Bank's Control Room (Corporate Affairs unit) no later than 2 (two) days after the transaction has taken place.

DAtA OF intERnAL FRAuD ExCEEDinG RP100 miLLiOn

The nominal value did not take into account any recovery received during the efforts to save the Bank's assets. Of course, both of these are expected to be a reflection that employees in particular have faith in the Reporting System implemented by the Bank.

REPORtinG mEthOD & ChAnnELs

Bank CIMB Niaga is committed to implementing GCG principles in the bank's operations to support the achievement of the bank's vision and mission. With the whistleblowing system, CIMB Niaga employees are required to report when they see, see or find indications of deception, violations or fraud that could potentially harm the bank, both financially and non-financially.

WhistLEBLOWER PROtECtiOn

Therefore, the bank is determined to take steps to prevent fraud, violations or fraud in order to create a clean and responsible work culture. As such, the application of the whistleblowing system is one of the key elements for the bank to maintain or improve the bank's transparency and combat practices that may damage the bank's activities and reputation.

WhistLEBLOWinG REPORt hAnDLinG Information submitted by the whistleblowers will be treated as

Whistleblowing Coordinator Unit consists of D-1 officers responsible for Anti Fraud Management, AML and Human Resources in accordance with the scope/type of reports managed by the Whistleblowing system. The Chief Audit Executive (CAE) performs an independent oversight function related to the management of the whistleblowing system's handling process.

WhistLEBLOWinG numBER AnD FOLLOW-uPs

480 A.3.8 Does the company disclose that all members of the management board and the general manager (if he is not a member of the management board). Does the company disclose the process of how the board of directors/commissioners plan the succession of the CEO/CEO/chairman and key management.

Provide recommendations and approval regarding the Management Policy prepared by the Board and ensure that the Management Policy is in accordance with IG charter;. Follow up the directions and advice of the Board of Commissioners to improve the Management Policies, IG and Management Implementation based on the IG committee recommendations; and.

2/Low Moderate After reviewing CNAF's business activities, the possibility of losses encountered by Compliance Risk was classified as low for the foreseeable future. CIMB Niaga Sekuritas (CNS) 3/Moderate After reviewing CNS's business activities, the possibility of losses encountered by Compliance Risk was classified as low for the foreseeable future.

The members of the ME and CIMB Indonesia Financial Conglomerate conducted self-assessments of the Compliance Risk Management implementation in accordance with internal provisions and methodologies. The integrated risk management is carried out by considering the business characteristics and complexity of each member of the CIMB Indonesia Financial Conglomerate.

Coordinate the integrated risk management implementation by the ME to the CIMB Indonesia Financial Conglomerate FSI members through periodic meetings with the RMU in each CIMB Indonesia Financial Conglomerate FSI member. Intra-group transaction risks within the CIMB Indonesia Financial Conglomerate are identified, managed and periodically reported together with the integrated risk profile reporting.

GCG PRinCiPLEs

With the growing community demand for Shariah financial products and services, more and more financial institutions are providing financing and financial services based on Shariah principles. CIMB Niaga SBU continuously improves the quality of its services, products and operations, including Shariah governance, which encompasses the implementation of Good Corporate Governance (GCG) and its compliance with Shariah principles.

As stipulated in the SSB Charter, the minimum number of members of the SSB is 2 (two) persons and a maximum of 3 (three) persons, led by the president, appointed from one of the members of the SSB. No member of SSB banka has shares in the bank, other financial institutions or other companies.