IOI Corporation Berhad ("IOI" or "the Group") has embarked on an integrated reporting journey since 2019. Progress on the Group's Strategic Priorities is further detailed on pages 44-49 of this Annual Report.

The Group expects our overall financial

CORPORATE SUSTAINABILITY AND SOCIAL RESPONSIBILITY The safety and health of all employees and stakeholders remains a top priority for the Group amid the COVID-19 pandemic. The Group's new commitments, progress and initiatives on sustainability are further detailed in our Sustainability Report 2021 which is based on the Global Reporting Initiative ("GRI") standards as well as the Task Force on Climate-related Financial Disclosure ("TCFD") guidelines.

Having strengthened the IOI Group's sustainable palm oil policy last year with clearer environmental management guidelines regarding biodiversity, peat and fire management, as well as more rigorous guidelines for building greater traceability within chains our supply chain, we continued to introduce more specific guidance regarding the rights and protection of the Group's workforce this year. At the same time, we introduced more greenhouse gas reduction activities and risk mitigation measures in the Group's operations, which are integral to the Group's holistic approach to climate change and form the basis of the Group's way forward for businesses and operations climate resilient.

GROUP MANAGING DIRECTOR AND CHIEF EXECUTIVE’S STATEMENT

The Group's charitable arm, Yayasan Tan Sri Lee Shin Cheng ("Yayasan TSLSC") undertakes corporate social responsibility activities and has awarded more than 300 students with university scholarships and adopted more than 1,000 students under its Adoption Program of Students. While many of the advanced economies have been quick to vaccinate their populations against COVID-19, vaccination rates among lower-income countries are progressing at a slower pace due to a short supply of vaccines.

Revenue

For our plantations segment, FFB production is expected to be stable in FY 2022 as higher production of young palms in our Indonesian plantations offsets the production loss from our accelerated replanting program in Sabah. We have accelerated our mechanization program on various field operations to mitigate the challenge of labor shortages on our properties.

Net Profit

The Malaysian government is ramping up COVID-19 vaccination rates while containing a third wave of COVID-19 infections through a reintroduced Movement Control Order. Partner with HUMANA to provide primary education to children of our employees and rural communities in Sabah Value for Suppliers.

Natural

Financial

Manufactured

Social & Relationship

Human

Intellectual

Capital Inputs

VALUE CREATION MODEL

In alignment with our three pillars of sustainability (People, Planet, Prosperity) + Partnership, together with the six adopted relevant United Nations Sustainable Development Goals (“UN SDGs”)

Strategic Priorities

Risks

3 Enablers

Competitive Edge

Strategic Priorities

GLOBAL TRENDS

ACCELERATING CLIMATE RESILIENCE ADAPTION

We view climate-related risks and implications as one of our biggest challenges in the agribusiness sector

GLOBAL TRENDS

Lignocellulosic biomass from plantations is in the form of oil palm leaf (“OPF”) and oil palm trunk (“OPT”). IOI has 176,926 hectares of mature and unripe oil palm planted (excluding associated companies), as of June 30, 2021.

ACCELERATING ADVANCEMENT IN CIRCULAR ECONOMY

Since oil palm trees are cut down annually for replanting, there are large quantities of solid OPT waste available for repurposing. Research on oil palm waste, especially OPT, is important to reduce waste management problems and as an alternative raw material for wood products.

ACCELERATING AGRICULTURAL TECHNOLOGY AND DIGITALISATION

Our subsidiary, IOI Palm Wood, aims to be the first and only multinational in the world to sustainably and commercially produce engineered wood panels from unused OPT. The amount of waste currently being produced poses a growing threat to our ecosystem and economies, and repurposing is a smart way to keep waste materials in the economy and out of landfills.

EXTERNAL ENVIRONMENT

IOI has identified the following key trends

Our strategy positions our businesses to seize

Palm oil companies are expected to implement fair labor practices and audits in their operations to meet customer expectations. Our RSPO SG grade products manufacturing facilities will support IOI to meet increasing customer demand, achieve economies of scale and improve our market position.

STAKEHOLDERS’ ENGAGEMENT

We honor our employees with competitive compensation as well as equal opportunities for learning and development through both online and offline training programs. As a leading global integrated palm oil player, we are able to create economies of scale as well as support our suppliers in building a sound supply chain management system to accommodate wider market access.

Our genuine

Statutory reporting and compliance and regulatory compliance matters relating to listing requirements, the Companies Act, the Public Limited Company Governance Code and their practice notes or guidelines. We improve rural livelihoods through employment opportunities, proactive investment in the community (road repair, waste disposal, etc.) and the provision of financial and health assistance (education, human capital development, etc.).

Ongoing routine meetings and dialogue sessions, open feedback channels and annual trade forums and exhibitions have enabled us to better meet our customers, which has also led to the creation of innovative products such as additive-free soap, chemical-free processing of glycerin, oleic acid and layer 3 -MCPD products. To provide targeted disclosure to our shareholders and investors, we respond accordingly to inquiries on matters related to our operating performance and financial management, within an appropriate time frame given.

We collaborate and regularly form alliances with industry associations and civil society to drive change, leading to positive impacts in the palm oil industry. To improve the reputation of the oil palm industry and create a sustainable palm oil product, we strive to create value through open engagement and active participation with all our.

We have identified, reviewed and analysed 13 most material issues under the ESG (Environmental, Social and Governance) sustainability dimension

MATERIAL MATTERS

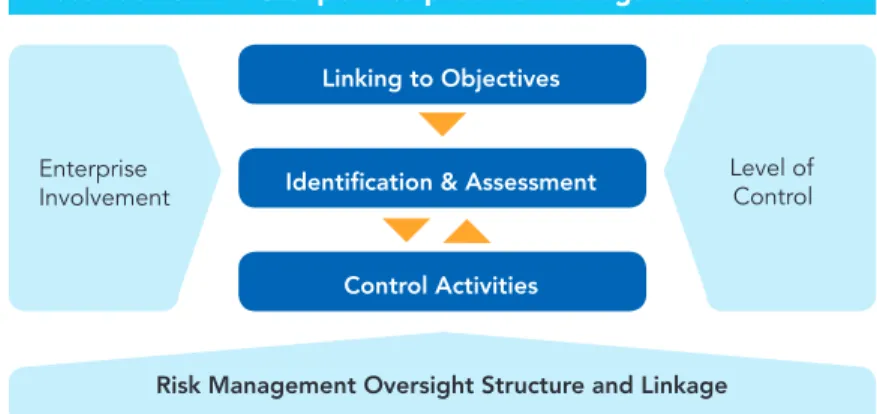

RISK MANAGEMENT

IOI identifies the

Here we present a summary of the key

STRATEGIC ENABLERS

Human Capital

Development

STRATEGIC FRAMEWORK

OUR GROUP’S 5-YEAR PLAN

OUR PURPOSE

Sustainability

Technology &

Digitalisation

Improved Planting Materials: Produce more high yielding and superior clonal planting materials for high yields and high returns. We planted high-yielding planting material, including third-generation hybrid palm seedlings and elite clonal palms in suitable areas and terrains.

STRATEGIC PRIORITIES

We strive to achieve consistently high yields through improved planting materials and increased crop removal efficiency to optimize business returns and maintain IOI's competitiveness locally and globally. Introduce new progeny of planting material that will tolerate Ganoderma infection and investigate Virescens oil palm to reduce the tendency to harvest immature clusters.

To maintain our focus on sustainable value

Agricultural and field management practices: Use best agricultural practices, improve field conditions and optimize land use on our palm oil plantations. We managed pests and diseases through extensive research and development ("R&D") and implemented precision agriculture with timely applications of fertilizers and herbicides.

We intend to diversify our planting of crops from 99% dependence on oil palm to other higher value crops. We strive to transform oil palm by-products and processing waste into value-added products at a competitive cost.

GROUP FINANCIAL OVERVIEW

GROUP PERFORMANCE HIGHLIGHTS GROUP QUARTERLY RESULTS

FINANCIAL CALENDAR

GROUP FINANCIAL REVIEW

Similarly, free cash flow decreased from RM466.7 million to RM266.8 million mainly due to the increase in net working capital. The move during the financial year included net profits of RM1.4 billion, offset by a total dividend payment of RM0.5 billion and share buyback of RM73.1 million.

GROUP BUSINESS REVIEW

Who We Are & What We Do

Top 5 Largest

Companies*

Hectares*

14 Malaysian Mills

GROUP BUSINESS REVIEW Plantation

Produce low 3-MCPD and GE refined petroleum products through in-house development to meet new market demands. Collective knowledge and experience in fields related to palm oil by submitting four articles in three.

GROUP BUSINESS REVIEW Resource-Based Manufacturing

Successfully executed 24 shipments for the United Nations World Food Programme, increasing sales to Nigeria and Dubai. Both our Pasir Gudang and Sandakan refineries started selling low 3-MCPD and GE products.

Countries Worldwide

As a result, the margin achieved in the last quarter was the highest of the year. However, the margin was lower due to the drop in sales of API groups and personal care products.

CORPORATE INFORMATION

BOARD OF DIRECTORS

BOARD OF DIRECTORS

PROFILE OF DIRECTORS

Lee Yeow Seng

Tan Sri Dr Rahamat Bivi binti Yusoff

Tan Sri Peter Chin Fah Kui

Dato’ Lee Yeow Chor

Dr Nesadurai Kalanithi

Datuk Karownakaran @ Karunakaran a/l Ramasamy

Cheah Tek Kuang

SENIOR MANAGEMENT TEAM

Kong Kian Beng

Farah Suhanah binti Ahmad Sarji

Dr Surina binti Ismail

Tan Choong Khiang

Amir Mohd Hafiz bin Amir Khalid

Ling Kea Ang

Lee Chin Huat

Sudhakaran a/l Nottath Bhaskaran

Ragupathy a/l Selvaraj

Subramaniam a/l Arumugam

Lim Jit Uei

Tan Kean Hua

Koo Ping Wui

Lai Choon Wah

Thomas Kummer

CORPORATE GOVERNANCE OVERVIEW STATEMENT

The terms of reference of each of the Board Committees are also available on our website. Material violations of the Policy are reported to the Board by the Group's Legal Counsel.

AUDIT AND RISK MANAGEMENT COMMITTEE REPORT

MEMBERS

During FY2021, IOI Pelita initiated a 3-phase solution plan, which was endorsed by the Roundtable on Sustainable Palm Oil ('RSPO'). IOI Pelita's offer is conditional on all parties to the dispute reaching an agreement on the exact terms of the final settlement of the dispute.

SUMMARY OF KEY SCOPE OF RESPONSIBILITIES Our ARMC operates under a written Terms of Reference

Since then, IOI Pelita has closely monitored the rescue plan with the cooperation and assistance of the RSPO, Land Custody and Development Authority, Sarawak State Government and two NGOs, namely Grassroots and Communities Information and Communication Center. The dialogue session was chaired by the Acting Resident of the City of Miri, and was attended by, among others, the Assistant Minister of State for Local Government and Housing and representatives of IOI Pelita.

HOW OUR ARMC SPENT ITS TIME DURING FY2021 The table below provides an overview of how our ARMC

- Financial statements and reporting

- Going concern assessment

- Internal audit

ARMC reviewed the Group's unaudited quarterly financial results and audited financial statements before recommending them to our Board for approval. During the year, the ARMC also reviewed the adequacy of the scope, functions, powers and resources of the internal audit function.

AUDIT AND RISK MANAGEMENT COMMITTEE REPORT

- Risk management

- Assessing the effectiveness of external audit process The ARMC places great importance on ensuring that

- Auditors’ re-appointment review

- Other matters considered by our ARMC Our ARMC also

- ATTENDANCE

- ANNUAL REVIEW AND PERFORMANCE EVALUATION

The process involved reviewing the Group's ERM framework, the respective divisional risk management documents and minutes of the ARMC meetings. As part of the independence review process, BDO formally confirmed their independence to the ARMC.

STATEMENT ON RISK MANAGEMENT AND INTERNAL CONTROL

INTRODUCTION

RESPONSIBILITIES AND ACCOUNTABILITIES The Board

KEY RISK AREAS

STATEMENT ON RISK MANAGEMENT AND INTERNAL CONTROL

INTERNAL CONTROL SYSTEMS The Group’s Core Values

The external auditors, BDO have reviewed this Statement on Risk Management and Internal Control for inclusion in the Company's Annual Report for the financial year ended 30 June 2021. The Board is satisfied with the adequacy and effectiveness of risk management and internal control. internal Group system.

STATEMENT OF DIRECTORS’ INTERESTS

REVIEW OF RISKS FOR THE BUSINESS YEAR For the considered business year, a half-yearly review of the adequacy and effectiveness of the risk management system and internal controls was carried out. This risk management and internal control statement does not cover associated and jointly controlled entities where the internal control systems of these companies are managed by the respective management teams.

IN THE COMPANY AND ITS RELATED CORPORATIONS AS AT 30 AUGUST 2021 (BASED ON THE REGISTER OF DIRECTORS’ SHAREHOLDINGS)

Their review was conducted in accordance with Assurance Practice Guide 3 (“AAPG 3”) Guidance for Auditors on Engagements to Report on the Statement of Risk Management and Internal Control, issued by the Malaysian Institute of Accountants. The board has received assurances from GMD and Group CFO that the group's risk management and internal control system in all significant aspects functions sufficiently and efficiently.

SHAREHOLDINGS OF SENIOR MANAGEMENT TEAM

OTHER INFORMATION

PLANTATION ESTATES

Bukit Dinding Estate, Bentong Pukin Estate, Pekan Rompin Mekassar Estate, Pekan Rompin Detas Estate, Pekan. Leasehold descending 2075 Leasehold descending 2081 Leasehold descending 2088 Leasehold descending 2075 Leasehold descending 2067 Leasehold descending 2067 Leasehold descending 2062 Leasehold descending 2062.

PLANTATION ESTATES (continued)

Bukit Leelau Estate, Pekan Merchong Estate, Pekan Leepang A Estate, Rompin Laukin A Estate, Rompin Shahzan IOI Estate 1, Rompin Shahzan IOI Estate 2, Rompin. Gomali Estate, Segamat Paya Lang Estate, Segamat Tambang Estate, Segamat Bukit Serampang Estate, Tangkak Kahang Estate, Kluang.

GROUP PROPERTIES

- INVESTMENT PROPERTY

- INDUSTRIAL PROPERTIES

- INDUSTRIAL PROPERTIES (continued)

- OTHER PROPERTIES

- OTHER PROPERTIES (continued)

PT 80565, Jalan Timah PT 101367, Jalan Tembaga Pasir Gudang, Johor Bahru Johor Darul Takzim Dusun Arang-Arang Air Hitam Hulu.

NOTICE OF ANNUAL GENERAL MEETING

Resolution 3

- Continuation in Office as Independent Non-Executive Directors

- Authority to Directors to allot and issue shares pursuant to Section 76 of the Companies Act 2016

- Proposed Renewal of Existing Share Buy-Back Authority

- Remote Participation and Electronic Voting (“RPEV”) 1 The 52 nd AGM of the Company will be held virtually through

- Appointment of Proxy

- Explanatory Notes to the Agenda

- To receive Audited Financial Statements for the financial year ended 30 June 2021

- Re-election of Directors

- Directors’ fees and benefits payable

- Re-appointment of Auditors

- Continuation in Office as Independent Non-Executive Directors

- Authority to Directors to allot and issue shares pursuant to Section 76 of the Act

- Proposed Renewal of Existing Share Buy-Back Authority Ordinary Resolution 10 is to seek a renewal of the authority

- Proposed Renewal of Shareholders’ Mandate for Recurrent Related Party Transactions (“RRPT”) of a Revenue or Trading

The directors believe that all resolutions are in the best interests of the company and our shareholders as a whole. This authorization will expire at the conclusion of the next general meeting of the company, unless it is revoked or amended at a general meeting of shareholders.

SHAREHOLDERS’ INFORMATION

PROXY FORM

The proxy form must be filed with Boardroom Share Registrars Sdn Bhd, 11th Floor, Menara Symphony, No. Follow the procedures in the Administrative Guide for the 52nd General Meeting to electronically file the proxy form.

THE ADMINISTRATION AND POLLING AGENT OF IOI CORPORATION BERHAD

3 If an instrument appointing a proxy is lodged in hard copy, it must be in writing under the hand of the appointor or of his or her attorney duly authorized in writing, or, if the appointor is a corporation, either under seal or under the hand of two (2) authorized officers, one (1) of whom shall be a director, or of his attorney duly authorized in writing. 5 An instrument appointing a proxy may specify the manner in which the proxy must vote in respect of a particular resolution and, where a proxy instrument so determines, the proxy is not entitled to vote on the resolution, except as specified in the instrument.

STAMP