A thesis submitted in fulfillment of the requirement for the degree of Entrepreneurship (Commerce) with honors. I hereby declare that the work in this dissertation is the result of the original research and has not been submitted for a higher degree at any other university or institution.

Background of the study

In some sectors of the economies of different countries, savings are seen as the main source of financing. As an illustration, in Azerbaijan, domestic savings are seen as more important for the development of the country's non-oil industry than foreign investment in the extraction of the country's oil and gas reserves (Jamal et al., 2015).

Problems Statement

Schagen, Lines (1996) defined financial literacy as "the ability to make informed judgments and make effective decisions about the use and management of money." According to (Benartzi, 2012), the general public does not have easy access to information about saving behavior in their daily lives.

Research Question

It is clear from these and other studies that more research is needed to fully characterize the saving patterns of new students aged 18 and over. The general purpose of the research is to identify the determinants that influence saving behavior among UMK students.

Scope of the Study

Significance of Study

The purpose of this research is to increase financial awareness among students who are interested in saving. The purpose of this study is to discover the factors that influence students' saving habits.

Definition of Term

The background, problem statements, research objective, research question, scope of the research, significance of the research, definition of terms and organization of the proposal are all discussed in Chapter 1 of this study. The chapter includes the underlying theory, previous research, hypothesis statements, a conceptual framework, and a summary of the literature review.

Underpinning Theory

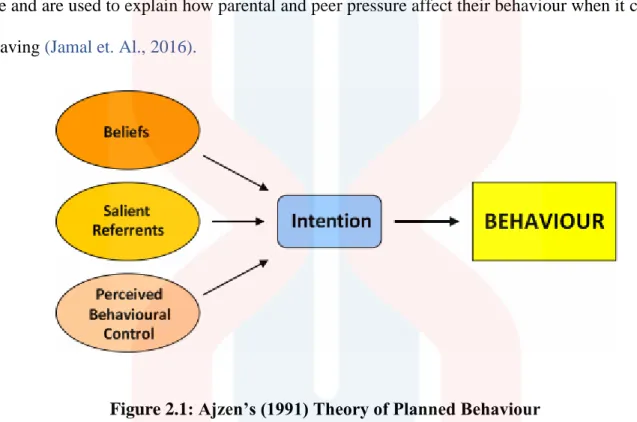

Planned Behaviour Theory

Because of this behavioral concept, students will be encouraged to spread an optimistic outlook to save money. But those who have a greater degree of money literacy are more likely to save because they feel they can manage their finances well.

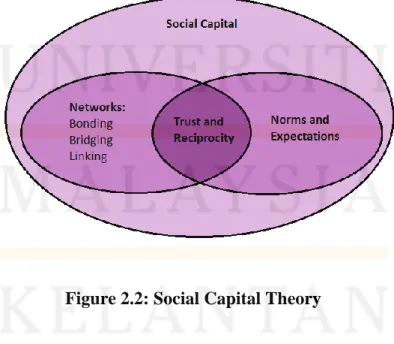

Social Capital Theory

Social capital has been used to characterize a wide range of phenomena, including voting behavior, well-being, and national economic outcomes. The shared memory, understanding, norms, rules and expectations of the patterns and interactions that various people contribute to a repetitive activity is referred to in Ostom's study as social capital.

Previous Study

Saving Behaviors - (Dependent Variables)

Financial literacy is described as having a sufficient understanding of personal finance facts and terminology to manage one's finances successfully (Tharanika and Andrew, 2017). As a result, financial literacy is a critical element of financially sound financial behavior now and in the future.

Parental Socialization- (Independent Variable)

Several literatures recognized the role of parents as key to their children's economic socialization, see (Cude et. al., 2006; Sam et. al., 2012), where parents have a great influence on developing their children's economic behavior and they should be role model for their children in handling their financial affairs.

Self Control - (Independent Variable)

The more self-control a person has, the more likely they are to change their own savings practices. The student's own saving actions are worse, the less self-control a person has. However, (Esenvalde (2010) found observational evidence in his study showing that self-control is positively related to saving behavior.

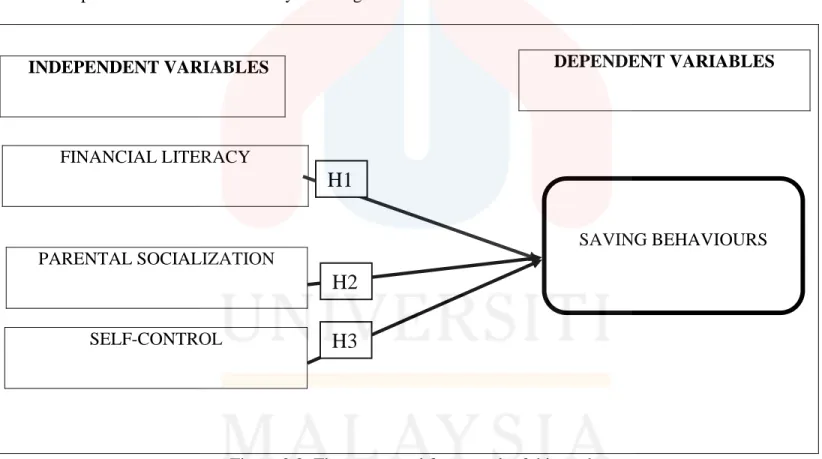

According to (Baumeister (2002), self-control is defined as the ability to monitor and control one's feelings of lack. From the framework, there are three independent variables which are financial education, parental socialization and self-control.

Research Design

Using a questionnaire survey, information was collected on the factors influencing saving behavior among UMK students. The pilot test was also explained in this chapter to test the robustness of the investigation. The explanation includes the rationale and justification for the chosen technique, as well as a full description of the methodologies used.

The chapter also explains the actions used to guarantee that the study is conducted in accordance with ethical research practices. The factors that influence saving practices among UMK students will be investigated in a quantitative way in this study.

Data Collection Methods

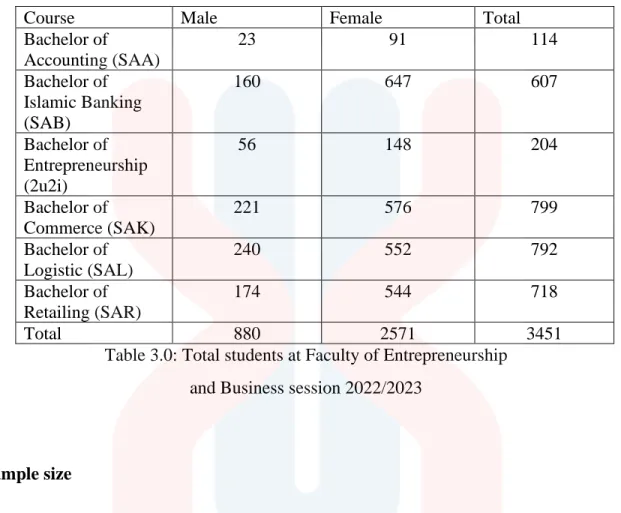

Study Population

Sample size

Sampling Techniques

The approach most suitable for the study of this research paper is the subject convenience sampling. The primary purpose of this method is to obtain information from the respondents which is not difficult to obtain and generally the respondents were selected because they happened to be present at the appropriate place at the appropriate time. This sampling strategy is therefore acceptable for this research and will enable researchers to produce reliable survey results.

Research Instrument Development

- Questionnaire

- Pilot Test

- Descriptive Analysis

- Nominal Scale

- Interval Scale

- Descriptive Analysis

- Reliability Test

- Spearman correlation coefficient

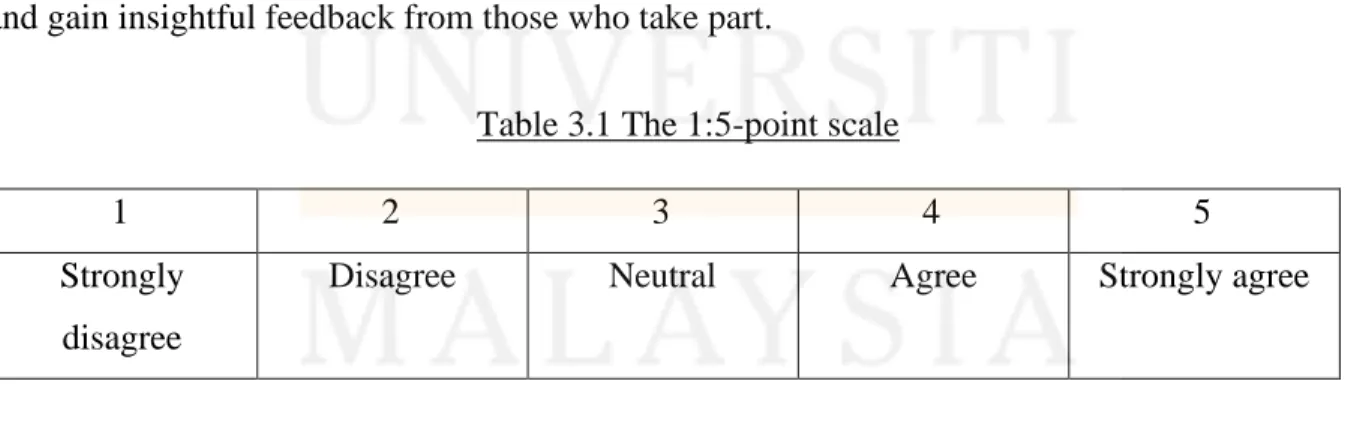

Some of the items in the questionnaire were changed by the researcher to make them more relevant to the study's applicability from the original sources. In most cases, a trial run of the questionnaire was carried out beforehand to ensure that it was suitable for processing. Finally, if any problems are found, the questionnaires for the actual research will be distributed after they are revised based on the findings of the pilot test.

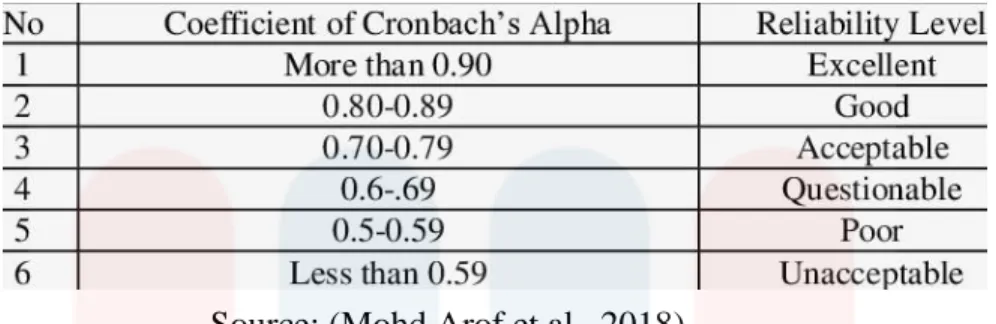

The validity and reliability of the scale is assessed and determined by the reliability test. Spearman's Rank Correlation is a measure of the correlation between two ranked (ordered) variables (Karthik Patel, 2021).

Preliminary Analysis

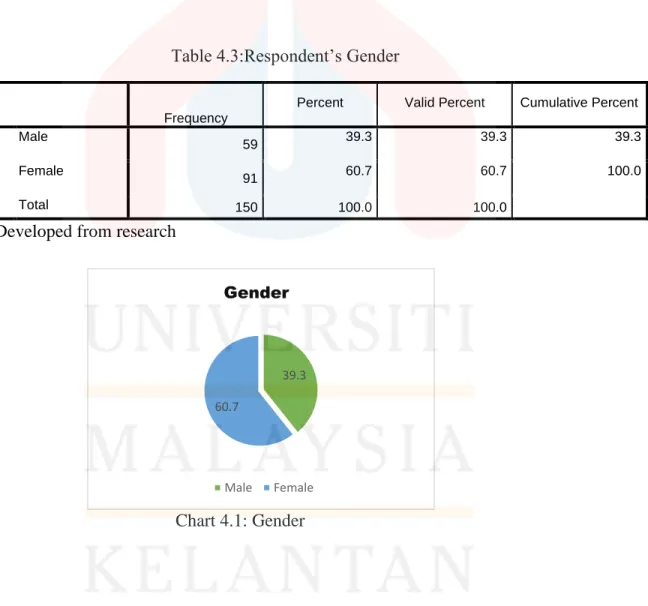

Gender

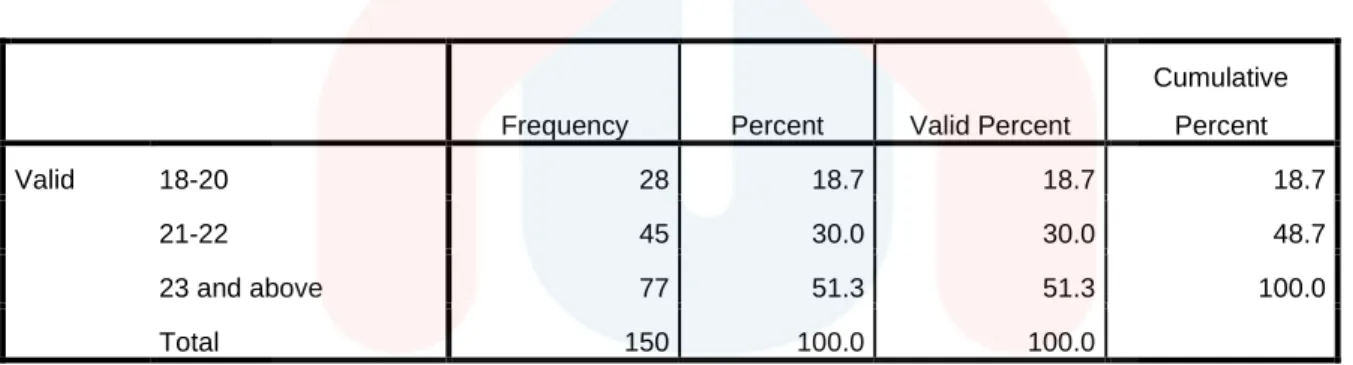

Based on table 4.4, it is shown that the age range of our respondents that is they are of different ages in UMK. Based on table 4.5 shown below, show that most of the respondents fall in fourth year students were 62 respondents (41.3%). Followed by third year students 48 respondents (32%) and second year students were 21 respondents (14%). .While the respondents of the first year were only 19 respondents (12.7%) who answered. Based on table 4.6 it shows that most of the respondents are from SAK (Bachelor of Commerce) there were 48 respondents (32%). Followed by SAL (Bachelor of Logistics) 29 respondents (19.3%) while SAB (Bachelor of Islamic Banking) 22 respondents (14.7%). In addition, SAE (Bachelor of Entrepreneurship) 21 respondents (14%). There is the same percentage of respondents from MSA (Bachelor of Accounting) and SAR (Bachelor of Retail Trade) were 15 respondents (10%).

Based on table 4.7, the majority of respondents 61(36%) get allowances between R201-RM500 per month from their parents. Based on 4.8, the results show that 90 respondents (60%) were not involved in any part-time work, while 60 respondents were involved in 40% part-time work.

Dependent Variable and Independent Variable

The highest mean is in number 9 which is 4.37 where this shows that the respondents agree that my parents rarely spend on unnecessary things, so it leads me down the same path. While the lowest average is 4.12, my parents have always been great role models when it comes to handling money. The standard deviation for this category indicates that the value was more reliable due to less than 1.

My parents taught me early on the value of saving, and I continued the habit into adulthood. My parents rarely spend on unnecessary things, so this leads me down the same path.

Descriptive Statistics for Self Control

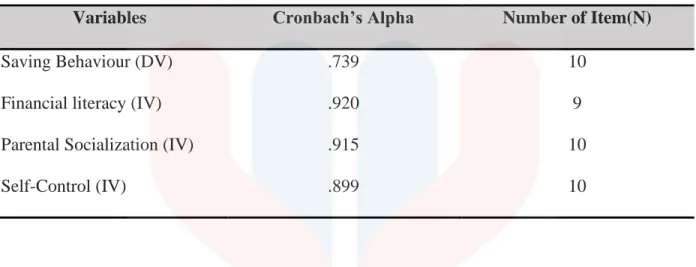

Validity and Reliability Test

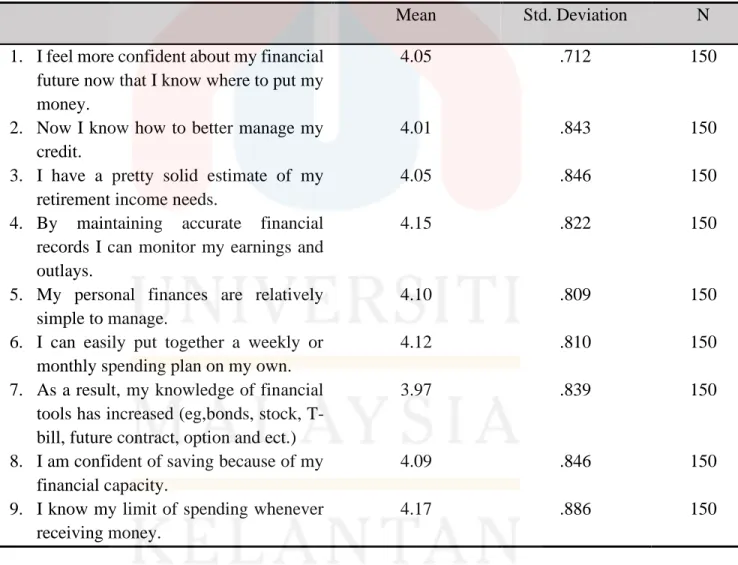

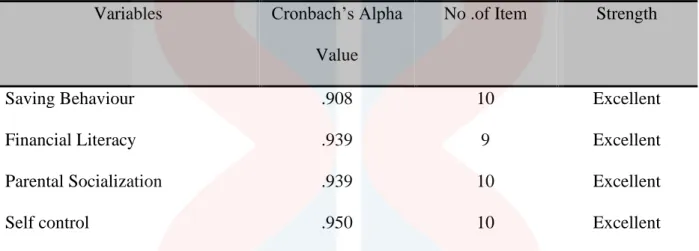

The reliability analysis report generated by SPSS for all items in the questionnaire is shown in Table 4.13 below. When calculating the savings behavior among the UMK students, 10 questions were used and the Cronbach's Alpha result for the question of this section was 0.908, which is an excellent result. Then, to measure the variable of financial literacy and saving behavior among UMK students, a question of 9 was used and the Cronbach's Alpha result for the question of this section was 0.939, which is an excellent result.

10 questions were used and the Cronbach's Alpha score for this section's questions was 0.939, which results are excellent. Finally, to measure the self-control variable of saving behavior among UMK students, 10 questions were used, and the Cronbach's Alpha result for this section's questions was 0.950, which results are excellent.

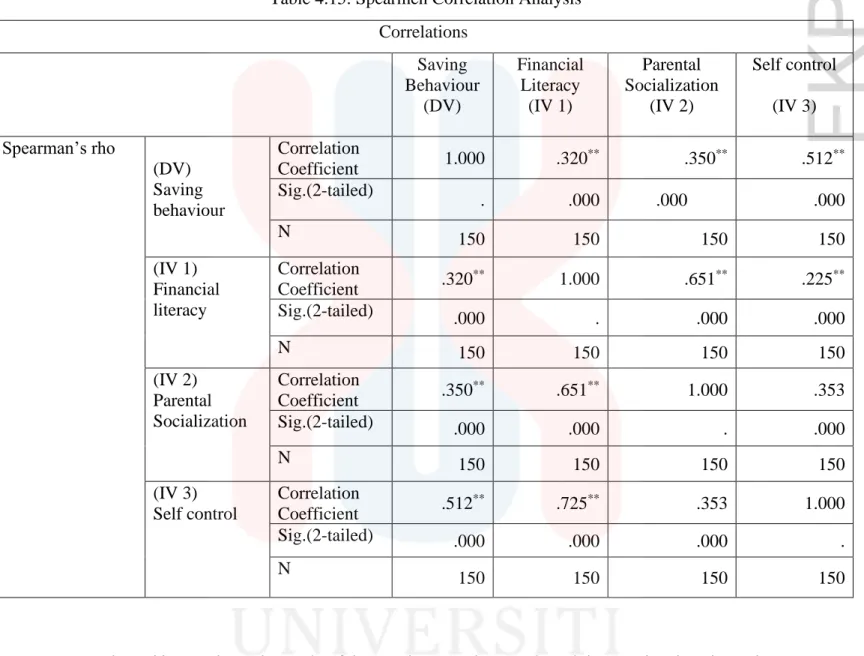

Spearman Correlation Analysis

The findings show that the moderate relationship between financial literacy and saving behavior recorded a value of p = 0.320. The results show that there is a relationship between Saving Behavior and financial literacy with a recorded value of p = 0.023. The results show that there is a relationship between Saving Behavior and parental socialization with a recorded value of p = 0.038.

The results show that there is a relationship between saving behavior and self-control with the recorded value p = 0.006. Table 4.20 shows the result of the Spearman Correlation score which was run to determine the relationship between saving behaviors and parental socialization.

Summary

Table 4.21 shows the outcome of the Spearman Correlation, which was run to determine the relationship between saving behavior and self-control. In this chapter, the most important conclusions from the previous chapter will be reviewed, which dealt with the demographic profile, independent variables and dependent variables. The explanation of the study's hypotheses should then come afterwards. This chapter will introduce the descriptive and inferential studies that make up the research on the effects of data analysis.

Based on the problem and previous research in Chapter 2, a summary of findings was created. After testing the hypotheses, the researchers also talked about their assumptions about whether the study hypothesis was accepted or rejected.

Key Findings

Hypothesis 1: There is a relationship between financial literacy and saving behaviors

From the previous chapter, the first objective of this research is to investigate the relationship between financial literacy and saving behavior among UMK students. This study's findings showed a moderate relationship between financial literacy and saving behavior with a correlation coefficient of 0.320 and a P-value of 0.000 which is a P < 0.005. This discussion indicates that this research objective has been achieved, and hypothesis 1 (H1) is accepted. Other studies, such as (Delafrooz et al. 2012), have shown that financial literacy has a significant impact on people's saving habits.

As a result, children with a better level of financial knowledge are more likely to save because they see the value of doing so.

Hence, parental socialization is needed to guide and encourage their children to save money.

Hypothesis 2: There is a relationship between self control and saving behaviors

Implications of the Study

Limitations of the Study

Sample size and geographical constraint

Cross-sectional study

Lack of cooperation

You can only contact the respondent through direct messaging applications such as WhatsApp, Telegram, Facebook and others. On the other hand, some respondents may have been careless in the questions asked, which spoiled the data and forced the researcher to resort to obtaining information from other sources.

Recommendations/ Suggestion for the Future Research

Use different, alternate data collection techniques

Extend the sample size and cover a wider range of areas

Provide mediating factors

Overall Conclusion of the Study

In addition, with a value of 0.320, financial literacy revealed the weakest relationship between students at Universiti Malaysia Kelantan and their saving habits. Scribbr.Retrieved November 19 fromhttps://www.scribbr.com/methodology/questionnaire BRYCE L. Financial Literacy of Young Adults: The Importance of. The Impact of Financial Literacy on Individual Saving: An Exploratory Study in the Malaysian Context.

The financial literacy of young American adults: Results from the 2008 national JumpStart coalition survey of high school and college students. Saving behavior and financial problems among students: The role of financial literacy in Malaysia.