The benefits of intra-industry diversification are limited when non-technological firms expand into traditional industries where competition is strong. We further argue that the benefits of intra-industry diversification for start-up firms in developing economies are higher than those in advanced economies. Due to institutional gaps in developing economies, start-up firms can expand into new market space, enhancing the benefits of diversification within the industry.

INTRODUCTION

- Background

- Research question

- Methodology

- Research contributions

- Structure of the thesis

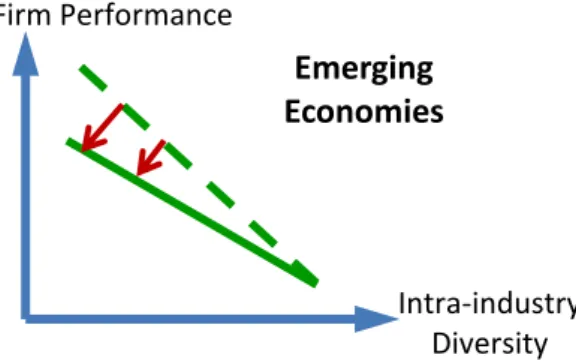

We also find that origin in emerging markets can weaken the negative relationship between intra-industry diversification and firm performance. Taking into account the degree of competition and non-technology industry, the benefits of intra-industry diversification disappear. Second, taking into account the stage of firm development and institutional gaps, emerging market start-ups that have used intra-industry diversification tend to outperform those from advanced economies.

LITERATURE REVIEW, AND HYPOTHESES DEVELOPMENT

Literature review

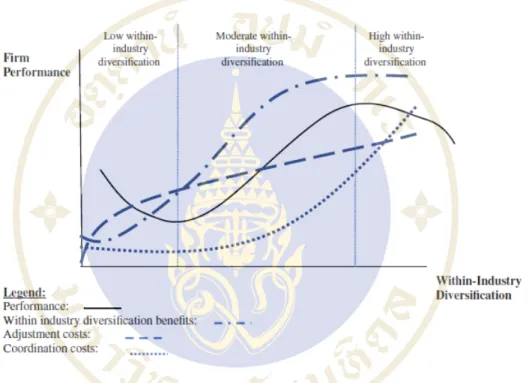

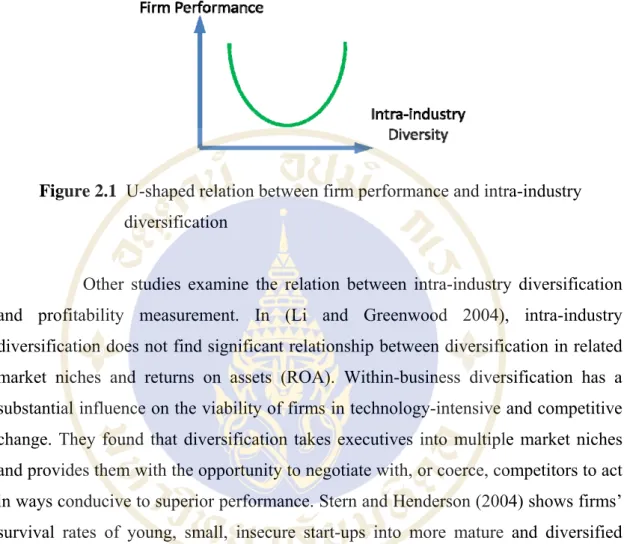

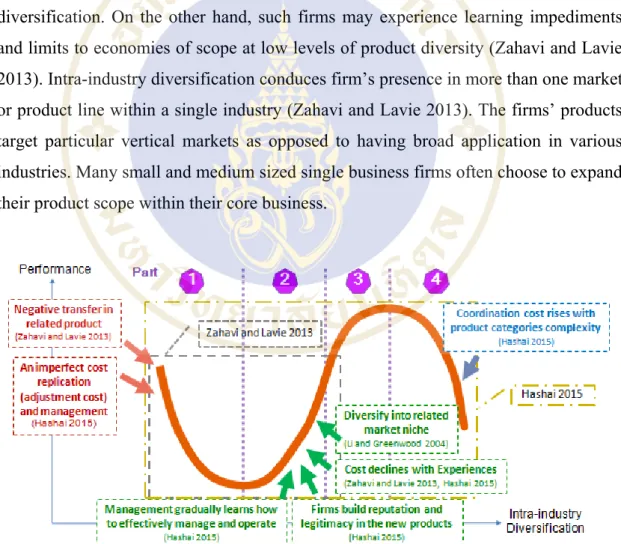

In (Hashai, 2015), the result presents the relationship between intra-industry diversification and firm performance at different levels and rates of change of intra-industry diversification. The study examines how adjustment and coordination costs affect the firm's performance along with the rates of change of intra-industry diversification. The performance is low at a low level of diversification as adjustment costs are likely to increase faster than the modest increase in the benefits of diversification within the industry.

Theoretical Development and hypotheses

- Benefit of intra-industry diversification

- Intra-industry diversification: Positive and negative effects and firm performance

- Strategic posture of start-up firms and the combination concepts between intra-industry diversification and institutional voids

- Institutional voids in Developing Economies

Limited research on intra-industry diversification has not been explored as a strategy for young startups. As the degree of product variety within an industry increases, economies of scale are expected to increase more rapidly (Jones and Hill 1988). However, the benefits of economies of scale are limited at low levels of product diversity within an industry (Jones and Hill 1988) given the limitation of exploring opportunities to exploit a firm's resources in distinctive market niches.

Diversification within an industry allows the benefits of economies of scale, as noted above, to share resources between product markets (Tanriverdi and Venkatraman 2005, Tanriverdİ and Lee 2008). As a result, there are limits to the benefits of diversity due to economies of scale at a low level of diversification within an industry. The negative transfer is more at a low level of diversification within an industry (Zahavi and Lavie 2013), where the differences of related products are subtle and therefore managers are unlikely to take them into account.

In summary, negative spillover is an important factor for the negative performance of firms at low levels of intra-industry diversification, Figure 2.3, Part 1. The increase in the benefits of intra-industry diversification is greater than the increase in adjustment costs. In summary, the relationship between intra-industry diversification and firm performance is slightly positive at a given level of intra-industry diversification, Figure 2.3, Parts 2 and 3.

Furthermore, (Hashai 2015) further discusses at a high level of diversification within the industry, the firm's performance is likely to decline. These lead to a positive relationship between within-industry diversification and firm performance in the software industry at some level of within-industry diversification. In (Li and Greenwood 2004, Stern and Henderson 2004), intra-industry diversification is the way of reallocating resources in a single industry across multiple market niches.

RESEARCH METHODOLOGY

Sample selection

Variable measurement

- Dependent Variable Firm Performance

- Independent Variable Intra-Industry Diversification

- Moderating Variables Start-up Firm

- Control Variables

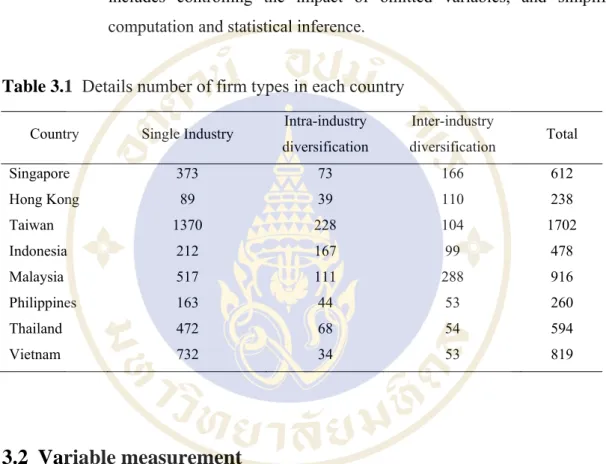

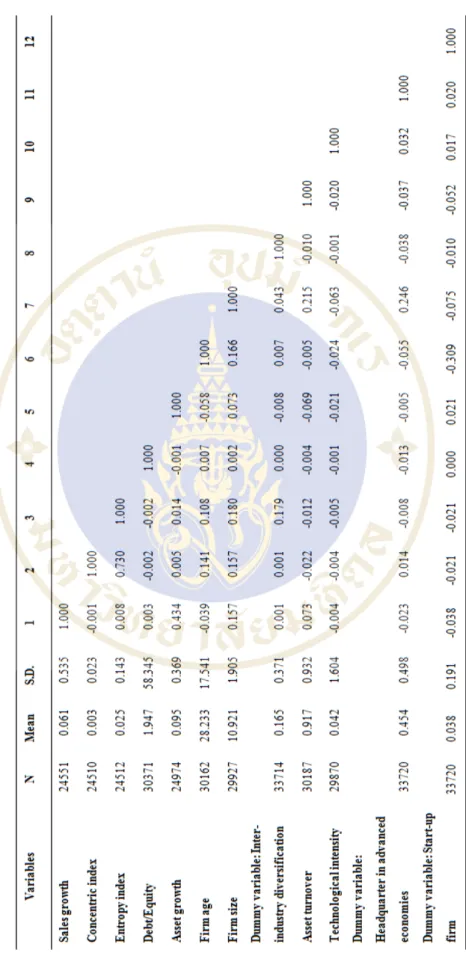

On the other hand, entropy is also one of a popular index in intra-industry diversification research. In order to test the robustness of our findings by performing several auxiliary analyses, both concentricity and entropy were performed as the intra-industry diversification variables. In our literature, to decide whether a company applies intra-industry diversification or not, Primary SIC (P-SIC) is defined as a firm's core business and Secondary SIC (S-SIC) is defined as a firm's diversification .

If a company diversifies within the same business product line among its secondary product lines (S-SIC), the company is not considered to have intra-industry diversification. Company age is calculated from the "Date of Company Established" value in the Osiris database. If the company's founding date value is between 2005 and 2015, it is considered to be in the startup age. Firm solvency captures the free resources available to support the firm's activities (Nohria and Gulati 1996), as measured by the log-transformed ratio of cash to long-term debt in the previous year.

Technology intensity was measured as the firm's R&D investments divided by sales in the given year. Therefore, the inter-industry diversification dummy was coded 1 if a company only diversifies between industries, and 0 otherwise. To determine whether a company has inter-industry diversification or not, this is measured by the Primary SIC (P-SIC) control, which is defined as the core business of a company, and the Secondary SIC (S-SIC), which is defined as the diversification of a company.

Our average of inter-industry diversification is for a company that diversifies its product line (S-SIC) into different industries than its core product line (P-SIC) with different 2-digit SIC businesses.

Estimation

- Panel Data

- Static Model

According to Janoski and Hicks, panel data models can be difficult to estimate because "errors for regression equations estimated from panel data using OLS (ordinary least squares regression) procedures tend to be (1) temporally autoregressive, (2) cross-sectional heteroskedastic, and (3) cross-sectionally correlated, as well as (4) masking unit and period effects and (5) reflecting some causal heterogeneity across space, time or both.” To deal with causal heterogeneity in space, the most common assumption is that vi is the unknown fixed variable that allows country fixed effects to be correlated with the explanatory variables. This is a reasonable assumption in our case since the effects individual represent omitted variables and it is very likely that the characteristics of these countries are related to the other regressors. To confirm that fixed effects (FE) estimation is more appropriate than random effects (RE) in our case, we will perform the Hausman test for the statistical significance of the difference between the coefficient estimates obtained by FE and by RE.

Another important issue that we have to deal with in our estimation is the autocorrelation, heteroscedasticity and simultaneous correlation in the error terms. Since our results rely mainly on the interpretation of the estimated coefficients, special attention will be paid to the calculation of robust standard errors that affect the significance of our results. Accordingly, we will test for all three problems and calculate robust standard errors accordingly.

However, the literature does not provide a clear and consistent approach on how to calculate standard errors in panel data. Petersen 2009) examined different methods of addressing potential biases in standard errors when studying panel data in corporate finance and asset pricing. He concludes that many of these methods are flawed also because of the lack of good advice in the literature.

He shows that, when the data contain a firm effect, White and Fama-MacBeth standard errors are too small and that the magnitude of the bias can be quite large.

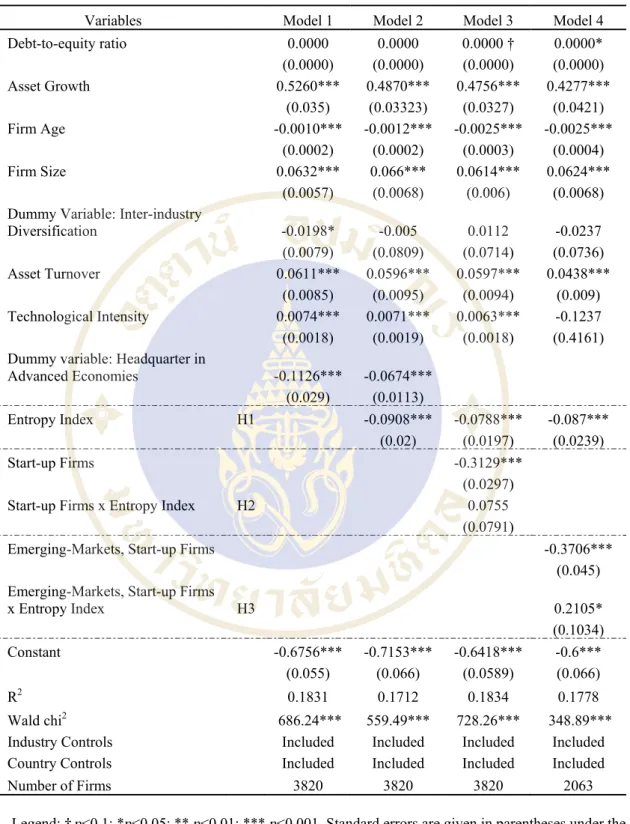

EMPIRICAL RESULTS

Correlations

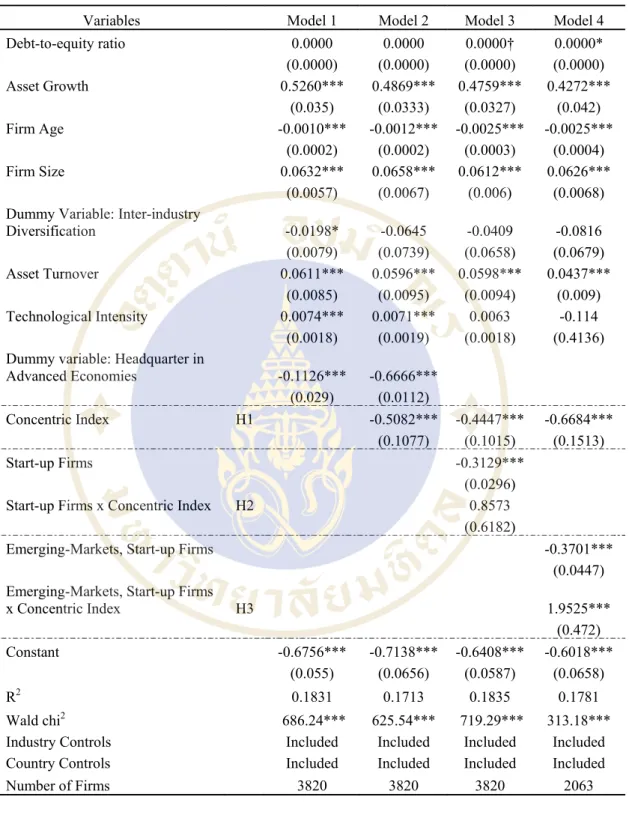

Static analysis

However, to enter new product categories, resources must be transferred or shared which creates costs, i.e. the average firms operating in developed capital markets, the costs of diversification outweigh the benefits (Lins and Servaes 2002) which in contrast to developing economies is. According to Model 4, the coefficients of the interaction effect in developing economies are positive, and statistically very high and highly significant in concentric index and in entropy index respectively (βC p <0.001; βE p <0.01), which supports Hypothesis 3.

We conducted a robust test with Model 4, the coefficients of the interaction effect in advanced economies are not significant (βC = 0.0325, p > 0.1; βE p. > 0.1), Table 4.4, which provides that intra- industry diversification benefits are undermined in advanced economies. Therefore, start-ups in advanced economies are unlikely to gain benefits from intra-industry diversification when entering the markets. Market competition tends to be strong in advanced economies, undermining firm performance as they expand into new, related market space.

CONCLUSION

Discussion

- Synthesis of Findings

- Contributions

- Managerial Implications

- Limitations and Future Research

However, inter-industry diversification benefits found both positive and negative relationship with firm performance based on level of diversity as U-shape and S-shape (Zahavi and Lavie 2013, Hashai 2015), but it is only limited in high-tech industries. These characteristics that give enterprises are able to discover problems in more specific areas, so that the negative transfer can be limited at some level of intra-industry diversification. We found that intra-industry diversification strategy for young and small firms in non-technology sectors is more likely to be profitable in developing economies than in first world countries.

On the other hand, in the advanced economy, the result shows that the relationship between firm performance and intra-industry diversification is insignificant. It extends and emphasizes existing research on this topic by integrating the degree of competition and the non-technical industry into consideration, finding that the benefits of within-industry diversification fade. Second, the research has further concern about the benefits transferred from within-industry diversification, which is one of the strategies to pursue niche markets that is suggested as a strategy for start-up firms.

They can implement diversification within the industry to seek niche markets aimed at satisfying specific customer needs. Furthermore, by developing diversification within the industry that is the extension to the firms' core competencies, the risk of failure is low and existing resources can be used giving low cost for market expansion that gains economies of scope. The benefits of interindustry diversification can be further studied in the same context study to investigate whether it moderates or moderates the performance of start-up firms.

In addition, it could be interesting to measure the effect of diversification benefits within an industry in other stages of an organization's life cycle, for example growth rate, stable rate, etc.

Conclusion

Further research can take into account the intensity of competition and competitors' product portfolios to monitor the effect that can enrich our understanding of the shift affecting the relationship.

Independent and joint effects of ability and the physical basis of connectivity on diversification. The effect of intra-industry diversification on firm performance: synergy creation, multi-market exposure and market structuring. A resource-based perspective on the strategic dynamic-performance relationship: An empirical examination of focus and differentiation strategies in entrepreneurial firms.

ORGANIZING TO OBTAIN POTENTIAL BENEFITS FROM INFORMATION ASYMMETRIES AND ECONOMIES OF APPLICATION IN RELATED DIVERSIFIED BUSINESSES. THE MEASUREMENT OF BUSINESS PORTFOLIO STRATEGY: ANALYSIS OF THE CONTENT VALIDITY OF RELATED DIVERSIFICATION INDEXES. Intra-industry diversification and robust performance in the presence of network externalities: Evidence from the software industry.