AMAL HAZEEM SAEED HAZEEM ALMASAFRI Diploma thesis submitted to the Faculty of Business and Law. I understand that the British University in Dubai may make a digital copy available in an institutional repository.

INTRODUCTION

The chapter begins with an overview of the study which is organized as follows: the background of the study which helps to identify the gaps in existing Fintech literature.

BACKGROUND OF THE STUDY

They are demanding financial institutions that offer Fintech products and services. 2019) reviewed the literature on Fintech and categorized academic articles according to the purpose for which Fintech is developed. This study focuses on the United Arab Emirates (UAE), which is considered one of the leaders in technological advancement and digitization in most of the business world.

RESEARCH PROBLEM

In addition, this research highlights the role of customer satisfaction and customer loyalty in explaining customers' behavioral intentions to use Fintech in the banking sector. It was argued that leveraging technology in the banking sector influenced banks to move away from the transactional nature of customer relationships to more customer service-focused relationships (Zhou et al. 2018; Mohammed & Ward, 2006).

RESEARCH MOTIVATION

Consequently, the banking sector needs to streamline the banking operations similar to the Fintech companies (Gomber, Koch & Siering 2017). According to Truong (2016), experts in the banking sector expect that the banking sector will soon be used for deposits while the rest will be done with the help of Fintech channels.

RESEARCH AIM AND OBJECTIVES

Furthermore, understanding the outcomes of customer experience related to Fintech will enrich the understanding of the impact of customer satisfaction on repurchase intention and customer loyalty through customer confirmation and the overall way all these factors are related with the firm's financial performance. RO4: To investigate the effect of Fintech usage satisfaction on customer loyalty and repurchase intention.

RESEARCH QUESTIONS

SIGNIFICANCE AND CONTRIBUTION OF THE STUDY

Across the GCC, banks in the UAE were among the leaders in Fintech adoption. In the GCC, banks in Saudi Arabia began to initiate cashless payment methods using technology-enhanced digital payment (Deloitte 2019).

RESEARCH CONTRIBUTION

Therefore, this study will provide results from an emerging economy in the Middle East, namely the United Arab Emirates (UAE). Importantly, there is generally little knowledge of Fintech in the Middle East and Central Africa region, with few studies focusing specifically on the banking sector in the United Arab Emirates.

RESEARCH APPROACH

Fintech policymakers in the bank will also benefit from this survey to keep an eye on the terms and conditions of using Fintech among consumers. Although benefits and risk factors that have been selected in the study were tested in Fintech literature.

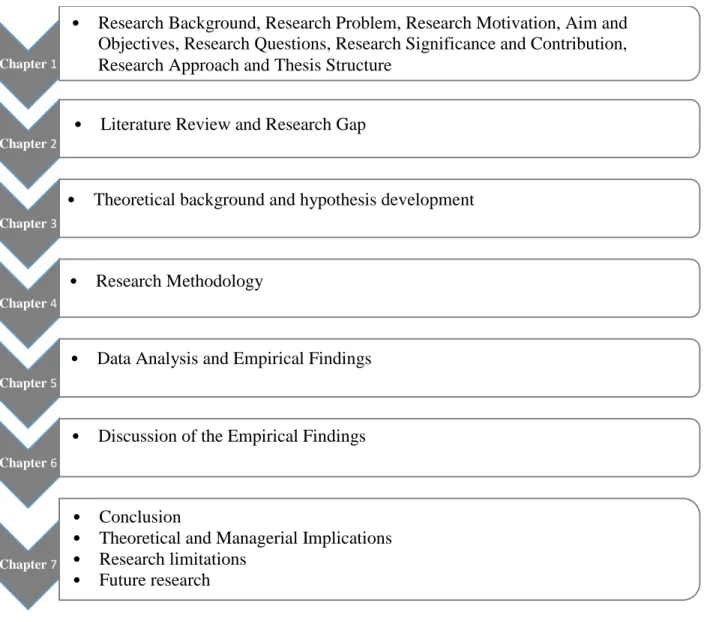

THESIS STRUCTURE

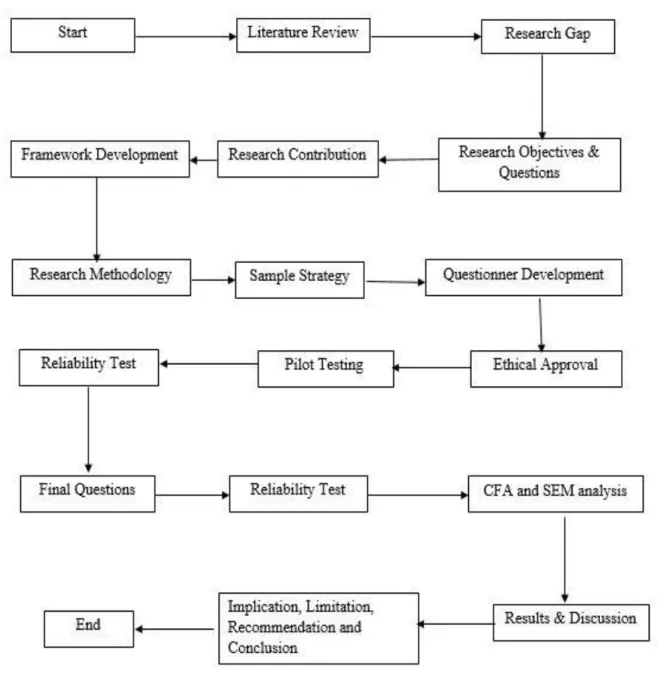

The researcher collected data through a questionnaire survey, Statistical Package for Social Sciences (SPSS) was used to analyze the data by evaluating the proposed hypothesis and then illustrating the findings. In addition, it elaborates on the theoretical and managerial implications and highlights the summary limitations of the research study.

SUMMARY

It is therefore evident that the financial performance of the company was highlighted as part of the research problem worth investigating to link the service growth factor with the profitability generated. The following chapter will provide an overview of the important literature for the study, along with the gap in research that has led this research to the current endeavor.

INTRODUCTION

HISTORICAL ORIGIN OF FINTECH

On the other hand, Arner, Barberis and Buckley (2015) underlined that the term Fintech originated in the scientific literature in the 1970s, by Abraham Leon Bettinger. Since then, the meaning of Fintech has been reinterpreted by many researchers; however, until now there is a lack of a unified definition of the Fintech term in the scientific literature (Milian, Spinola & . Carvalho 2019).

FINTECH DEFINITION

Williams (2017) "'Fintech' is an economic industry composed of companies that use technology to make financial systems more efficient." Fintech is a neologism describing the contracting words for finance and technology, it can be spelled as "FinTech", "Fin-Tech".

THE SIGNIFICANCE OF FINTECH

THE IMPACT OF WEB3 DEVELOPMENT ON FINTECH TECHNOLOGIES

Second, trusted and permissionless, in web 3.0 users will be able to interact directly without the need for trusted intermediary or permission from the governing body. In web 3.0, computers and technologies provide useful and relevant insights with intelligent interpretation of data and transactions.

AREAS OF FINTECH IN THE FINANCIAL INDUSTRY

In addition, Glodsten et al. 2019) described blockchain technology as enabling many applications in finance such as money transfer, cryptocurrency technology (e.g. Bitcoin) and digitization of assets that enable and secure transactions. Additionally, Chuen (2017) singled out blockchain as a “major game changer” used in the fourth industrial revolution, detailing its ability to lower transaction costs and efficient ways compared to.

DEFINITION OF CONSUMER PERCEPTION

In the financial industry, it is common for customers to make investments and transactions that have benefits and returns with a positive impact on consumer welfare (Pudaruth 2017). Previous research on the use of technology in the banking sector has found that the strength of technological advancement and digitization are key factors influencing customers' thinking about the use of technology in services (Ryu 2018; Arner, Barberis & Buckley 2015; Yoo, Kim & Lee 2015 ; Stewart & Jürjens 2018).

SERVICE DELIVERY

However, Ehrnrooth and Gronroos (2013) pointed out that the value of using a service is more defined in service marketing. Whereas in the banking sector, where service is more service-centric, service performance measurement is more appropriate.

SERVICE DELIVERY AND CUSTOMER SATISFACTION

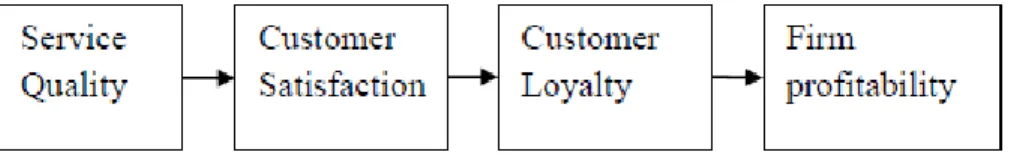

The service management literature describes customer satisfaction as a result of customer perception of the perceived value when using the service. Consequently, service quality is the determinant of service that can affect customer satisfaction and loyalty, leading to the re-use of the internet website to conduct banking transactions.

CUSTOMER EXPERIENCE

Therefore, when customers believe in the service value over time, they will exhibit satisfaction and loyalty behavior (Chi & Gursoy 2009). Previous research on customer experience focused on the hedonic values of using the service (Schmitt 1999), but recent studies in service marketing; focus on the utilitarian service value and quality dimensions (Vargo & Lush 2004); and also suggests that customer experience is a crucial indicator for evaluating service quality that measures consumer behavior (Vargo and Lush 2006).

PRIOR RESEARCH ON ONLINE CUSTOMER EXPERIENCE

Therefore, the main role of a successful customer experience is to create emotional attachment, novelty, which leads to customer satisfaction, loyalty and repurchase behavior (McCole 2004). Researchers believe that the customer experience of online services is an important and critical area as customer satisfaction, loyalty and repurchase intent are the consequences of a positive OCE cognitive behavior (Fang et al. 2014).

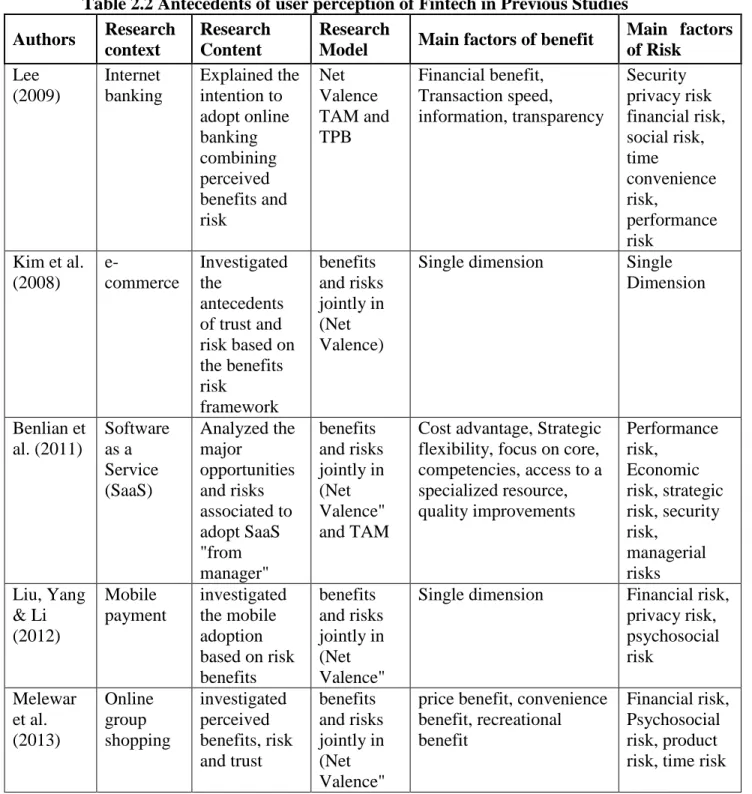

THEORETICAL BACKGROUND OF FINTECH CUSTOMER PERCEPTION

THE VALENCE FRAMEWORK

The study adopted eight factors, namely convenience, trust, difficulty, lifestyle, physical contact, complexity, reference group, and third party concern. According to the research, the low customer response rate was highlighted as the main limitation, while the number of banks included in the study may be another limitation.

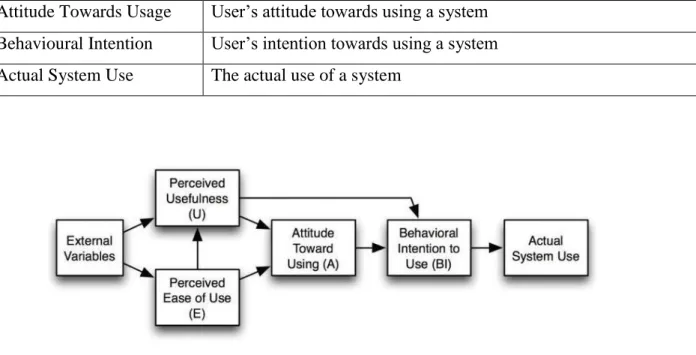

TECHNOLOGY ACCEPTANCE MODEL -TAM

They found that usefulness, ease of use and trustworthiness significantly affect users' intention to use Fintech. Self-efficacy was found to be a moderating variable for the relationship between variables and users' intention to use Fintech.

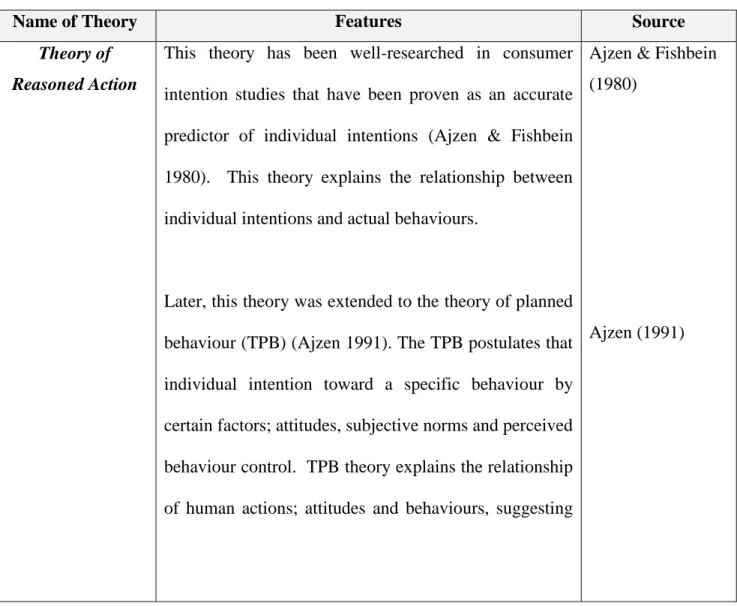

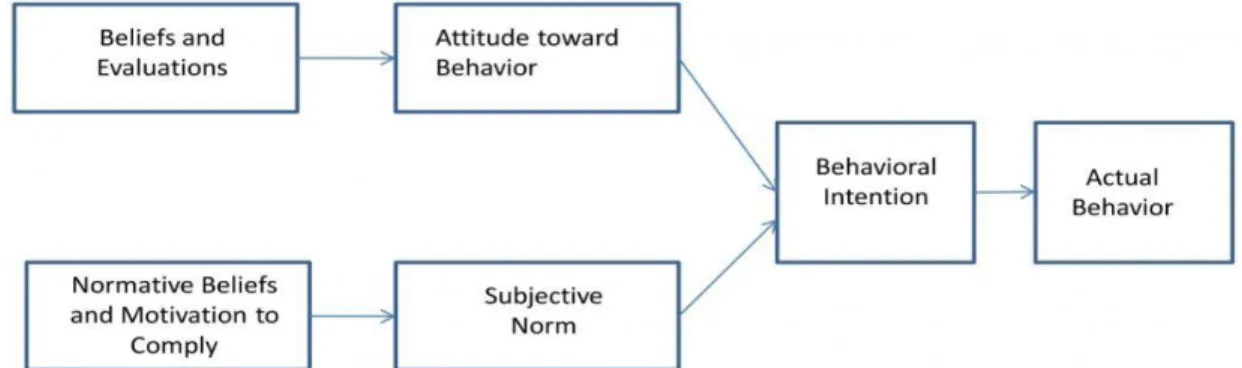

THEORY OF REASONED ACTION (TRA)

Jürjens (2018) argued that the TRA model falls short of predicting users' intention, as it predicts behavior based on voluntary control by the individual. However, Ryu (2018) integrated the TRA model with the benefit-risk framework to study factors influencing users' continuous adoption of Fintech.

OUTCOMES OF FINTECH CUSTOMER EXPERIENCE

- USER CONFIRMATION OF EXPECTATION

- CUSTOMER SATISFACTION

- CUSTOMER LOYALTY

- REPURCHASE INTENTION

- LEVEL OF FAMILIARITY

Prior studies stated that customer satisfaction had a positive effect on customer loyalty (Islam et al. 2021; Khan et al. 2022). Repurchase intention is difficult to determine if the customer was not satisfied (Durvasula et al. 2004).

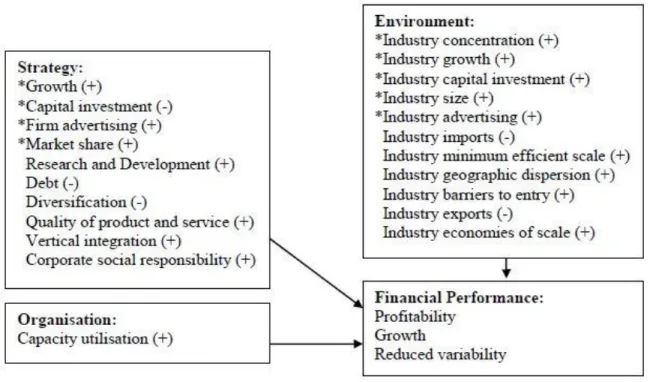

FINANCIAL PERFORMANCE

This is essential to examine the impact of products and services offered on a firm's financial performance. Fintech studies have suggested exploring the impact of Fintech on bank financial performance (Sangwan et al. 2019).

RESEARCH GAP

The result of their study showed that customer satisfaction and loyalty are special factors in the bank's financial performance. The result of their study showed that customer satisfaction and loyalty are special factors in the bank's financial performance.

CONCLUSION

The purpose of this chapter is to explain the theoretical framework of the study and develop related hypotheses regarding Fintech customer experience through confirmation of expectations and its relationship with customer satisfaction, customer loyalty and financial performance, by relating customer expectation to the service experience. evaluate and level of familiarity. Three sections will appear in this chapter: in the first section, the researcher will explain the study's theoretical framework, and the second section will present the developed hypotheses of the study, followed by the proposed conceptual framework.

THEORETICAL BACKGROUND

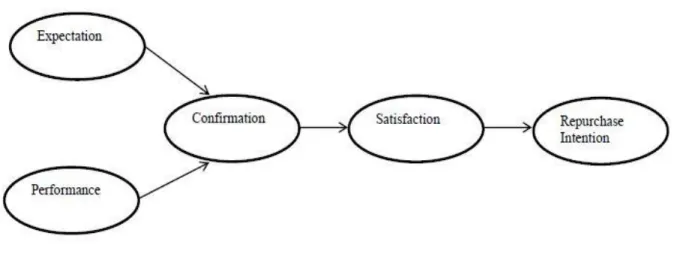

Only a major impact on the fit level will change the final tone of the subject's assessment. It was noted that this theory is one of the most widely used in customer satisfaction studies and determines the repurchase intention behavior of consumers (Anderson, Fornell & Lehmann 1994).

THEORETICAL FRAMEWORK DEVELOPMENT

EXPECTATION CONFIRMATION THEORY (ECT)

The ECT model has proven the ability to demonstrate consumer repurchase intentions for many products and services. Several studies have applied the ECT model, seeking to understand customers' behavioral intentions and the level of satisfaction by extending the expectation confirmation model in the service industry (Halilovic & Cicic 2013;.

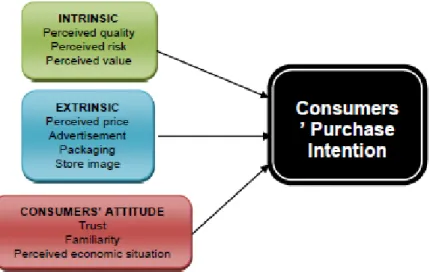

THE VALENCE FRAMEWORK

Therefore, this study is developed based on the net valence framework theoretically based on expectancy confirmation theory (Oliver 1980), to examine the specific benefit and risk factors to explain the evaluation of customers' behavior based on their usage experience. of Fintech.

PERCEIVED BENEFIT THEORETICAL BACKGROUND

Convenience refers to flexibility in performing the transaction anytime and anywhere (Okazaki & Mendez 2013), and the most important factor in the completion of online and mobile transactions (Kim et al. 2010). It allows customers to manage transactions cost-effectively, resulting in quick and basic financial transactions (Chishti 2016; Zavolokina et al. 2016).

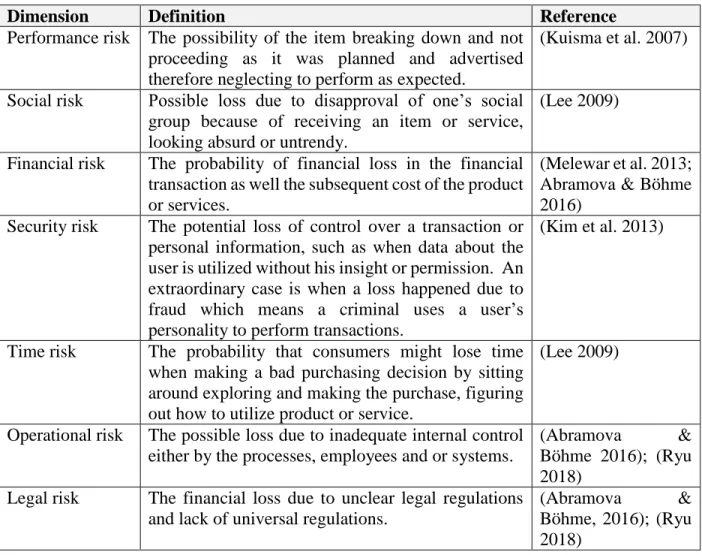

PERCEIVED RISK THEORETICAL BACKGROUND

Featherman and Pavlou (2003) defined perceived risk as the potential loss of obtaining the desired outcome. In the context of online service, a security risk is defined as the possibility of a privacy attack that is a critical concern among consumers (Lwin et al. 2007).

HYPOTHESES DEVELOPMENT AND RESEARCH FRAMEWORK

HYPOTHESES DEVELOPMENT

POSITIVE VALANCE

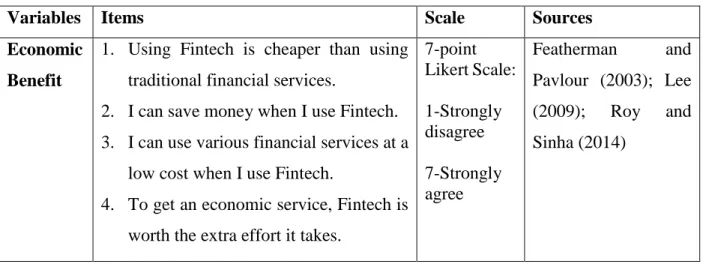

ECONOMIC BENEFIT - CONFIRMATION OF EXPECTATION

Therefore, it is worthwhile to study economic benefits based on the actual behavioral use of Fintech applications by the customer. This study aims to determine the effect of economic benefit to confirm customers' experience of Fintech.

CONVENIENCE - CONFIRMATION OF EXPECTATION

SEAMLESS TRANSACTION PROCESSING - CONFIRMATION OF

This seamless transaction processing on Fintech insists that banks tend to develop their products and services in a competitive and innovative way vis-à-vis non-financial institutions (Fintech companies or IT companies) as they start to introduce Fintech products and services (Ryu 2018). Leong and Sung (2018) see seamless transaction processing as one of the key service characteristics of Fintech on payment aspects.

PERCEIVED SERVICE QUALITY - CONFIRMATION OF

The studies of Keisidou et al. 2015) and Mbama & Ezepue (2018) in the context of digital banking suggest that service quality leads to increased customer satisfaction and bank profitability (Ladhari et al., 2011). They found that service quality improves the probability of increased customer satisfaction and consequently leads to loyal customer-customer and provider-customer relationships.

SECURITY RISK - CONFIRMATION OF EXPECTATION

This study considers Cunningham's (1967) framework of perceived risks to elaborate the individual risk factors arising from the user's experience of Fintech. Therefore, it is believed that negative customer confirmation of Fintech expectations will reduce their perception of security risks.

LEGAL RISK - CONFIRMATION OF EXPECTATION

Therefore, it is suggested that legal risk has a significant impact on the confirmation of expectations towards Fintech.

OPERATIONAL RISK - CONFIRMATION OF EXPECTATION

Thus, it is assumed that the banking sector considers many operational issues, leading to the ability to cancel transactions and financial disorders of transactions. Thus, if there is a high consideration of operational risk by service providers towards Fintech operations, it will result in a positive user experience, satisfaction, loyalty and intention to reuse the system.

FINANCIAL RISK - CONFIRMATION OF EXPECTATION

Which is similar identification by Melewar et al. 2013) for describing the financial risk that leads to monetary loss of almost all transactions, including Fintech-related transactions. On the other hand, customers trust the strong ability of the service provider to protect the transaction from violations (Oghuma et al. 2016).

CONFIRMATION - SATISFACTION

In general, consumer privacy concerns have four dimensions, including collection, errors, unauthorized security use, and improper access (smith et al., 1996; Ozturk et al. 2017). However, it needs maintenance costs of the system with periodic checks and updates as well as upgrades so that the system is in line with the policy and guidelines based on authorities and regulators (Oghuma et al. 2016).

MODERATING EFFECT - FAMILIARITY

Nevertheless, not all the customers have the experience or knowledge; therefore; the customer's level of familiarity may differ and subsequently affect engagement in using Fintech. Therefore; it is suggested that customer level of familiarity will moderate the relationship between confirmation and customer satisfaction.

According to ECT, confirmation has an effect on customer satisfaction that is further related to continuance intention. Oliver (1980) linked the level of customer satisfaction with the degree of loyalty to the company as a determinant of customer experience, while customer satisfaction is defined as the difference between customer expectations of perceived services and experience.

CONCEPTUAL FRAMEWORK

The research framework of this study is based on ECT and positive and negative factors related to Fintech to develop a theoretical framework to explain the purpose of the study. In the proposed model, there are potential relationships between positive and negative factors (economic benefit, convenience, seamless transaction processing, security risk, legal risk, operational risk, financial risk) with confirmation.

ADVANTAGES OF THE PRESENT RESEARCH FRAMEWORK

Indeed, this study adds to the body of knowledge about the impact of positive and negative customer endorsement and satisfaction on behavioral outcomes; more specifically, the proposed model is complete and detailed about customer satisfaction, loyalty and continuance intentions and their effects on financial performance in the banking sector. Finally, the framework identifies the main elements that lead to customer loyalty and ongoing intent and the overall effect on financial performance in the banking sector.

CONCLUSION

In addition, it provides the banking service provider with the driving reasons for customers to move to the satisfaction stage by taking into account that the customer is familiar with using the service.

INTRODUCTION

THE RESEARCH PARADIGM AND METHODOLOGY

- POSITIVISM

This research is thus established in accordance with the positivist approach rather than interpretive principles. Accordingly, this study employs the positivist paradigm as it is the most appropriate to address the research objectives and hypotheses.

RESEARCH DESIGN

For researchers to address the research objectives, it is sometimes essential to use three types of research. In the primary stages of the study, the researcher applied exploratory research to gather information about the research problem, identify the gap and formulate hypotheses.

RESEARCH POPULATION

Moreover, the survey method is generally faster, cheaper and can be distributed to a large sample of the population (Churchill 1995; Sekaran 2000; Zikmund 2003). Therefore, SEM allows the researcher to analyze which observed variables are good indicators of the latent variables.

SAMPLING FRAME

In the proposed research, the sample must be representative and accurate to limit bias; so there must be a significant correlation between the sampling frame and the research population. Furthermore, the sampling process must be drawn based on the established sampling frame and effectively select research participants.

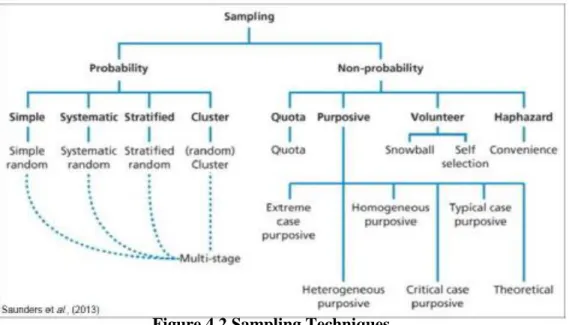

SAMPLING TECHNIQUES

On the other hand, non-probability sampling requires that the selection of the subject in the research is not approximate. Random sampling is crucial in probability sampling; where research participants are randomly selected.

SAMPLE SIZE

Kothari (2004) also recommended that the sample size of research should be large and representative of the population to allow for the generalization of results. Comrey and Lee (1992) and Tabachnick & Fidell (2001) proposed a scale of sample size adequacy: 300 participants is an adequate sample size, while 500 subjects is much better.

DATA COLLECTION PROCESS

In this proposed study, 52 items are proposed making the minimum adequate sample size as 260 and 520 responses are considered ideal. However, the larger sample size was recommended because of the possibility of modeling misspecification, covariance or non-normality of the data, and reduced parameter estimator bias (Hair et al. 2003).

QUESTIONNAIRE DESIGN

The questions are in the form that relates to the client's actual behavior and intentions. All questions are measured on a seven-point Likert scale, except for bank financial performance and customer profile.

OPERATIONALIZATION OF VARIABLES

Respondents are asked to rate operational risk based on their experience performing financial services in Fintech. When I use Fintech provided by the bank, I don't worry about losses due to application changes or weaknesses.

PILOT TEST

- THE DEMOGRAPHICS OF THE SAMPLE

- RELIABILITY AND VALIDITY OF THE INSTRUMENTS

ETHICAL CONSIDERATIONS

STATISTICAL PROCEDURE AND DATA ANALYSIS

CONCLUSION

PRELIMINARY DATA ANALYSIS

EXPLORATORY FACTOR ANALYSIS

TEST FOR COMMON METHOD BIAS

CORRELATION

CONFIRMATORY FACTOR ANALYSIS

- CONSTRUCT VALIDITY

- HYPOTHESES TESTING

- SUMMARY

- INTRODUCTION

- HYPOTHESIS TESTING

- FINTECH POSITIVE DIMENSIONS AND CONFIRMATION OF EXPECTATION

- FINTECH NEGATIVE DIMENSIONS AND CONFIRMATION

- CONFIRMATION AND CUSTOMER SATISFACTION

- MODERATOR- FAMILIARITY

- CUSTOMER SATISFACTION, REPURCHASE INTENTION AND CUSTOMER

- REPURCHASE INTENTION, CUSTOMER LOYALTY AND FINANCIAL

- JUSTIFICATION OF THE OVERALL RESEARCH FRAMEWORK

SUMMARY

- INTRODUCTION

- ACHIEVING THE RESEARCH QUESTIONS AND OBJECTIVES

- RESEARCH CONTRIBUTIONS

- THEORETICAL IMPLICATIONS

- PRACTICAL AND MANAGERIAL IMPLICATIONS

- LIMITATIONS OF THE RESEARCH

- SUGGESTIONS FOR FUTURE RESEARCH

- CLOSING REMARKS