This study examines the dynamic relationship between five-year US-EU-UK CDS financial index spreads for the banking and insurance sectors over the recent period marked by the onset of the global financial crisis. This study also helps to understand the nature of the relationship between the sectors (insurance, banking) and to assess the risk exposure for both banking and insurance sectors from the perspective of Islamic finance.

Background

Justification of the Research

Problem statement

The study also seeks to understand the nature of the relationship between sectors (insurance, banking) and to assess the risk exposure of both sectors banking and insurance. Due to recent significant changes in financial systems and countries' economies in general, the relationship is not expected to be constant over time, but instead to exhibit diversity.

Thesis outline

Chapter five presents the estimation of the dynamic relationship between CDS sectors (insurance and banking) in the three markets UK, US, UER. As well as some recommendations that could help solve some of the problems in the global financial market.

Introduction

Definition

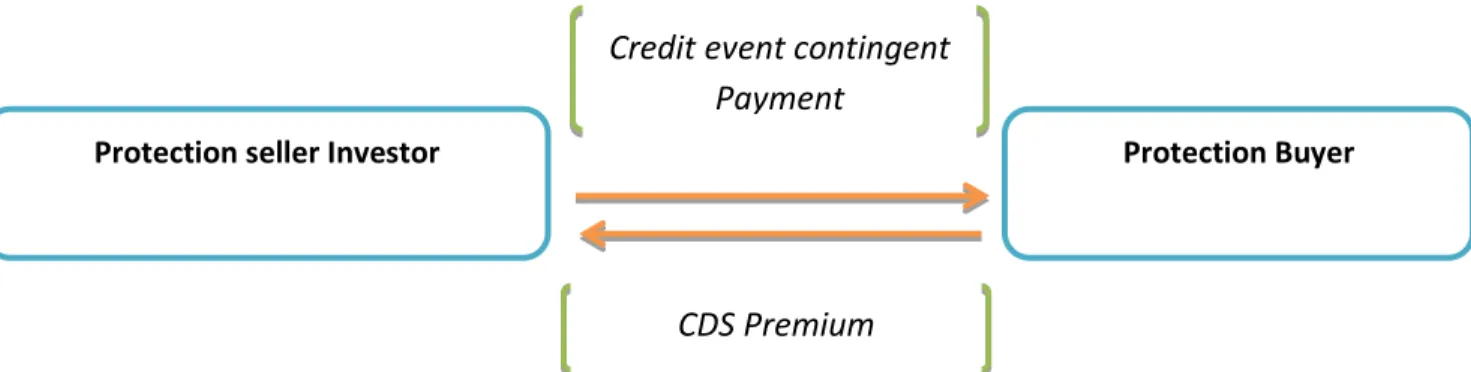

The seller of the insurance receives a periodic premium from the buyer of the insurance in exchange for a contingent payment if a credit event of the reference entity occurs.

Benefits of using CDS theoretically

However, when liquidity comes from leveraged investors, the additional systemic risk from the activity of these entities must be weighed against potential benefits. Finally, one of the theoretical advantages of CDS is that CDS spreads provide a valuable market-based assessment of credit conditions. It has been argued that by using CDS, Stulz, (2010), "enabling trading with specific risk, they help make financial markets more efficient and transparent in price discovery and increase liquidity." Stulz, (2010.).

But Stulz then goes on to mention that "the market for CDS was manipulated." Stulz, (2010) This could mean that the benefits were then outweighed in the practical world.

Caveats to CDS

First, we see a lack of information on where open positions are, as most CDS contracts are privately negotiated contracts and do not need to be disclosed to anyone, thus creating hidden liabilities that are not reflected in the financial statements. A practical disadvantage of CDS is that there is currently no legislation or regulation in the CDS market. This needs to change to prevent manipulation and damage to global economies.

Das (2010) stated that “CDS contracts may in turn encourage moral hazard in institutions encouraging them to take more risk on the assumption that the additional risk will be transferred or hedged”.

FINANCIAL CRISIS AND CDS

Opinions around the effect of CDS

Since a financial innovation on the current debt crisis varies, there are two main opinions regarding this issue that need to be mentioned and considered.

CDS negative influence on current sovereign debt crisis

From this perspective, we can see that credit default swaps have been abused in the real world, leading to a riskier situation, which is actually increasing, as the seller of insurance will try to hedge his risk by pooling and sharing it with other entities, and thus the result the default of the reference entity and the huge amount of money to be paid to CDS buyers, there is a systematic risk that causes a financial crisis. For these reasons, a section of those who support this view call for a ban on at least the speculative part of credit default swaps, as they harm the economy.

CDS positive influence on current sovereign debt crisis

The second argument is that CDS are a measure of the creditworthiness of the reference entity, especially if the reference entity is under financial stress, in the sense that this entity is given a credit rating, which allows the market information to be shared in a more unbiased way . between borrowers and lenders, in that sense it would bring less transaction costs. Jenkinson, (2008) stated that "Many investors have of course also delegated their auditing responsibility to credit rating agencies.

This argument supports the idea of efficient market which is a positive thing when applied to the sovereign debt crisis, as the CDS acted as a warning signal to the countries facing a possibility of default and more pressure on their governments are trying to find a solution to prevent this from happening.

Conclusion

In practice, the financial world moves on the basis of the pure benefit of the individuals involved in the process and not the entire economy. Credit default swaps should be managed and regulated by governments in a way that would make them serve the purpose for which they were made - hedging risk - rather than being a speculative tool. In this regard, the US government and the governments of the Eurozone countries are constantly working to find the best legislative way to help restore balance in the financial world.

This chapter summarizes the existing studies on the relationship between sectoral CDS banking and insurance sectors and some other studies that are somehow related to the topic.

Study on sovereign CDS

Studies on banking, insurance and financial services

They demonstrated that the own and cross effects between all measures of CDS and other risk, especially CDS financial spreads are significant and contagious throughout the study period. Banks, corporate default risk premiums and insurance came in second behind the financial services CDS index. This study is about how to price CDS by taking 14 different entities dealing with the same CDS.

In their methodology, they estimate the regression model as well as the t-statistic based on the heteroscedastically consistent estimate of the covariance matrix.

Methodology

- Copula

- Sklar Theorem

- Time-Varying Copulas

Let X=(X1, .., Xn) be a random vector of n logarithmic returns of risk factors affecting the value of the portfolio, with marginal cumulative distribution functions (C.D.F.) F1, .., Fn. Sklar's theorem (1959) is very important, as it enables the analysis of the dependence structure of multivariate distributions without studying the marginal distributions. According to Sklar's theorem, copulas provide greater flexibility by allowing any edges to be fitted to different random variables, and these distributions may vary from one variable to another.

Moreover, copulas offer greater flexibility in that they allow for a much wider variety of possible dependence structures.

Marginal distributions

Negative returns mean a greater proportion of debt over a reduced company's market value, leading to greater volatility.

Copula-CoVaR method

- Multivariate CoVaR

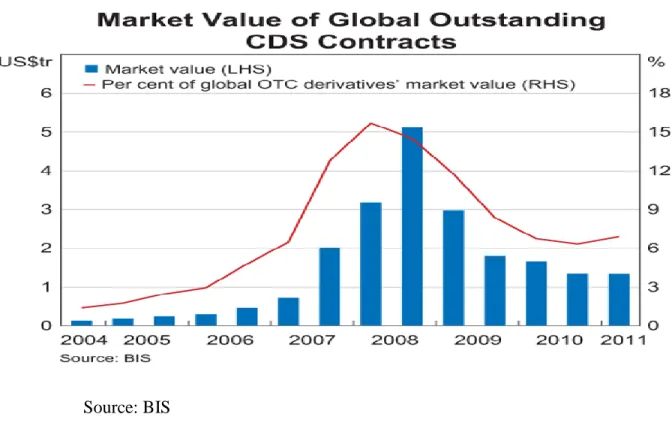

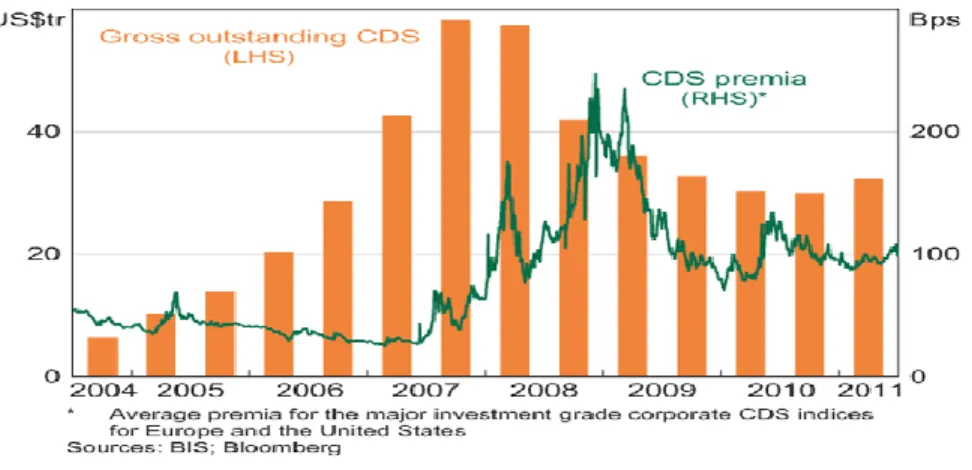

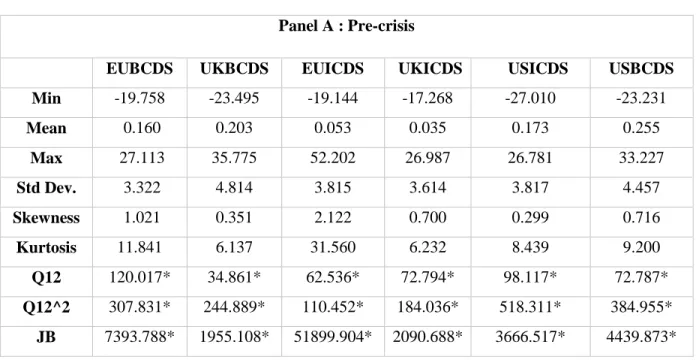

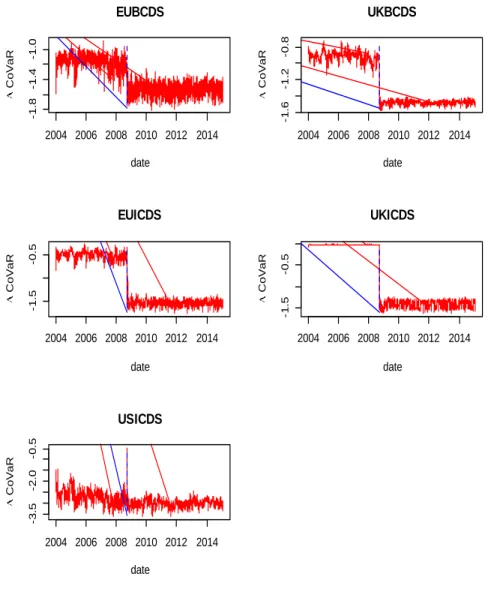

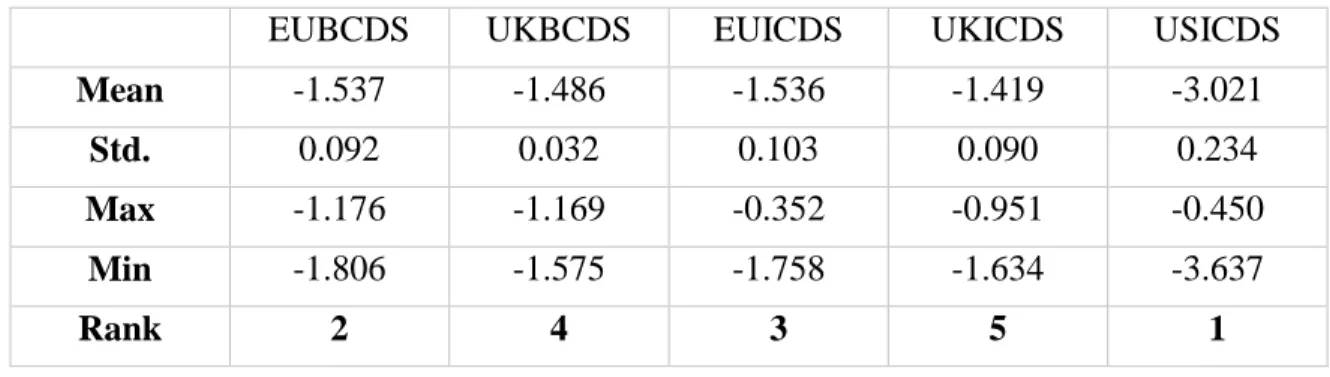

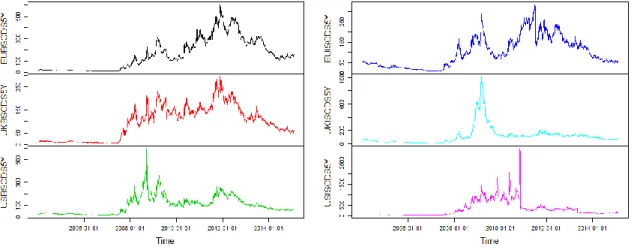

In the period before the crisis, both indicators for banking and insurance had the same stable trend. This chapter presents the estimation of the dynamic relationship between CDS sectors (insurance and banking) in the three markets UK, US, UER. Basic characteristics of the data in the period before and after the crisis are summarized in Table 1.

This table shows descriptive statistics for the return series in the period before and after the crisis. These coefficients remain higher after the onset of the financial crisis, except for the United States. The collapse that happened in the insurance sector of the US market led to the collapse of the rest of the financial market eventually.

Data

Descriptive statistics

The return ranges are obtained by using the logarithmic differences of the CDS spread values expressed as a percentage. The standard deviation, which measures the risk in the banking and insurance sectors in the three countries, shows that there is a difference between before and after the crisis. The biggest changes in the post crisis are in the US insurance sector as highlighted in the above table.

The standard deviation of CDS spreads for the US and Europe is particularly high in the post-crisis period.

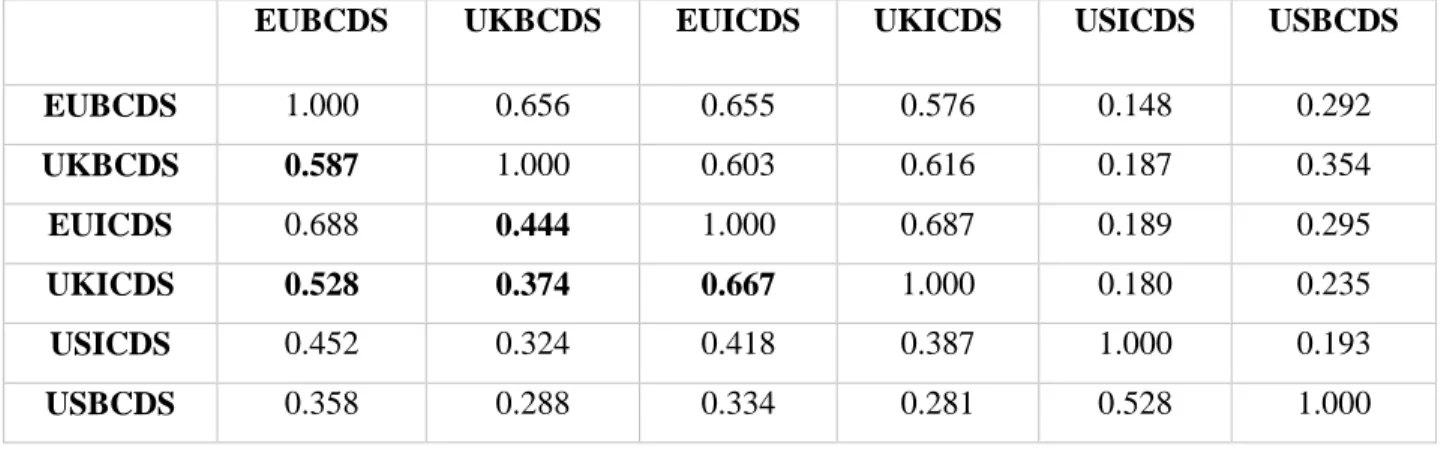

Unconditional correlation

Pearson's correlation coefficients between the CDS spread indices for the two sub-periods are listed in Table 2. The CDS indices of the banking and insurance sectors within the same country show a higher positive correlation.

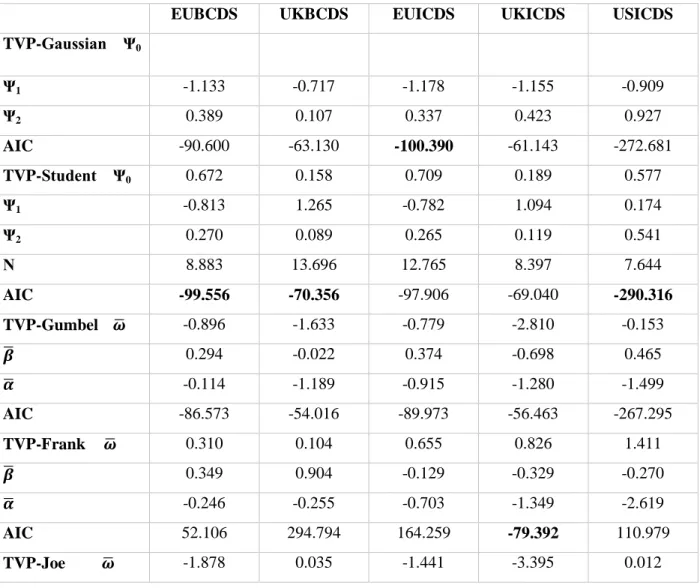

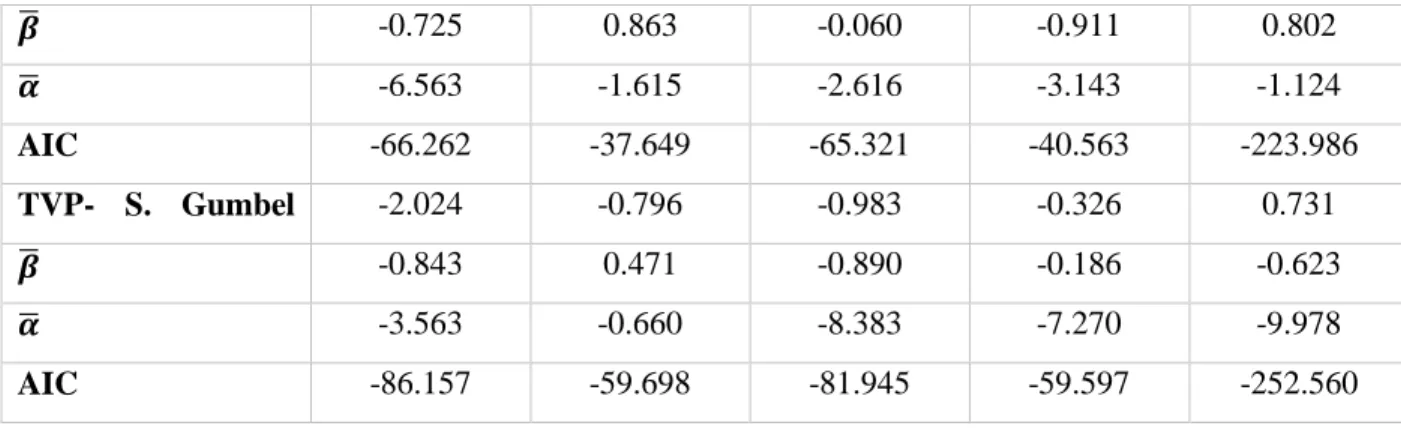

Estimation of Copula parameters

For the link between US banking and insurance, the nature of the impact before and after the financial crisis remained unstable due to the strong relationship between two sectors. Due to the strong relationship that binds the global financial markets to each other, the decline in the US market led to the decline in the rest of the global financial markets respectively. We investigated the dynamics of US–EU–UK five-year financial CDS sector index spreads for the banking and insurance sectors in the recent period marked by the onset of the global financial crisis.

We had to understand the nature of the relationship between sectors (insurance, banking) and assess the risk exposure for both sectors, banks and incidents. Because of the strong relationship that binds global financial markets together, the fall of the US market led to the fall of the rest of the global financial markets respectively. Both sectors (insurance, banking) affect the economic health of countries and the speed at which new information is processed.

Interactions between sectorial financial CDS markets

Conclusion

The recent financial and debt crises changed the perception of the common links within the financial sectors. Since the collapse of Lehman Brothers in September 2008, the shocks have increased and involved many countries such as the US, UK and Europe. After the analysis we can say that the connection between the CDS sector markets for US, UK and Europe is now clear and all these markets are connected together.

We can also say that both industries (insurance, banking) are related to each other with a direct relationship where the banking industry tends to lead the insurance industry.

Recommendation through Islamic finance point of view

While financial innovation and engineering can be beneficial, Islamic finance provides consistent guidance for these innovations. Moreover, Islamic finance promotes transparency, good governance and integrity, which makes products simple and understandable. However, many Islamic financial products today are said to be complicated, signaling a worrying tendency to mimic conventional finance.

Investors/speculators bought securities Involvement in debt trading is prohibited Credit Default Swaps (CDS) to.