Therefore, economic growth can be stimulated through the endogenous money supply hypothesis: that is, loans create deposits and deposits create reserves and creditworthiness determines loans, i.e. From this perspective, the increase in money supply would only lead to inflation, meaning that the is exogenous to central banks. Thus, any fluctuation in the money supply will not have a significant effect on the real economic sector.

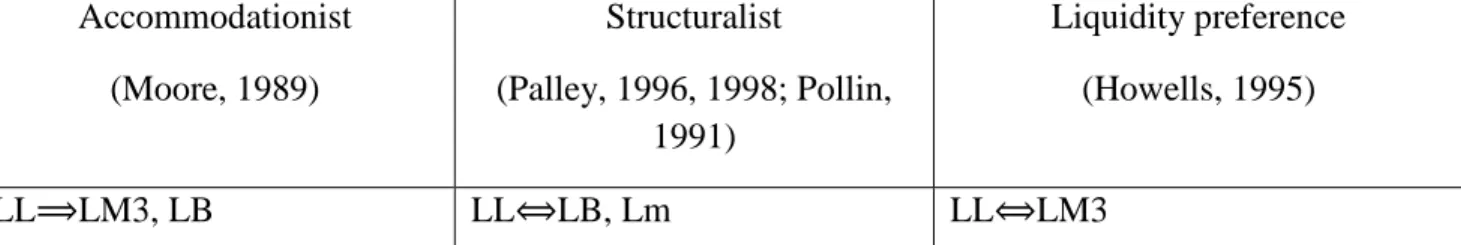

In general, orthodox monetary theory holds that central banks play a key role in controlling the growth of the money supply. On the other hand, the essential point of the endogenous money supply approach is that the demand for bank credit is what determines the money supply. However, the endogenous money supply approach is not uniform and can be divided into three different aspects.

The Liquidity Preference View

However, according to Pollon (1991), liability management may be an insufficient tool to generate sufficient reserves to meet reserve demand. Overall, they conclude that the causality between total commercial bank lending (LL), monetary base (LB), and money multiplier (Lm) is in fact bidirectional. Howells (1995), a proponent of the liquidity preference approach, denies the belief that no independent demand money function exists because each economic unit has different liquidity preferences, i.e.

To summarize, the liquidity preference view concludes that there is bidirectional causality from total commercial bank loans (LL) to money supply (LM3). Notes: Definition of variables: LL stands for log level of total commercial bank loans; LB indicates log level of monetary base; LM3 stands for log level of the money supply M3; Lm represents log level of the money multiplier.

Empirical Literature Review

As far as research shows, the endogenous money hypothesis has not yet been tested in Saudi Arabia. The literature review here will therefore rely on more general descriptions and examples of the use of the endogenous money approach. In the previous literature, the money supply is endogenous in that central banks cannot control the money supply, while interest rates are exogenous in that the central banks have control over interest rates and banks can influence them (Moore, 1979).

While the conventional money approach shows that the money supply is exogenous because central banks control the money supply (Choi and Oh, 2000). In the literature, the post-Keynesian theory of endogenous money supply can be divided into two approaches: "heisontalist" and. Additionally, Vera (2001) provided empirical evidence that money supply is endogenous by testing Granger causality within the monetary base, bank lending and various money multipliers using a Spanish time series from 1986-1998.

Vera found that Granger causality runs from bank lending to the base and money supply. In addition, economists Shanmugam and Li tested the endogenous money supply hypothesis on the case of Malaysia from 1985 to 2000. They tested which endogenous money perspective (accommodative view, structuralist view, or liquidity preference view) holds true in the case of Malaysia.

Certainly, the results are consistent with the post-Keynesian hypothesis, which means that the money supply in Malaysia was endogenous from 1985 to 2000 (Shanmugam & Li 2003). Other studies also provide empirical evidence of endogenous money supply (Arestis & Mariscal, 1995; Pollin, 1991 and Howells, 2006).

Methodology: Econometric Methods and Data

Augmented Dickey-Fuller Unit Root Tests

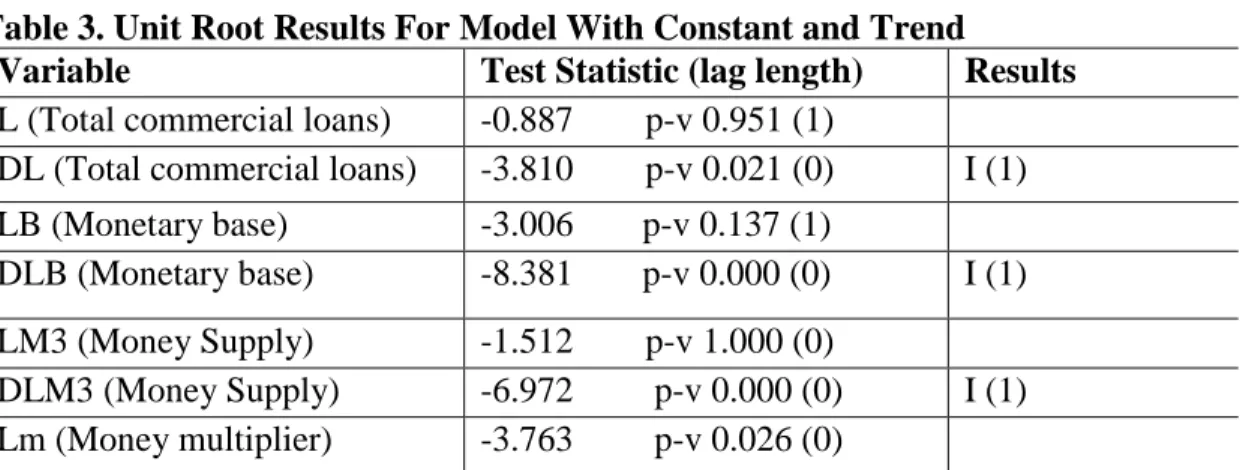

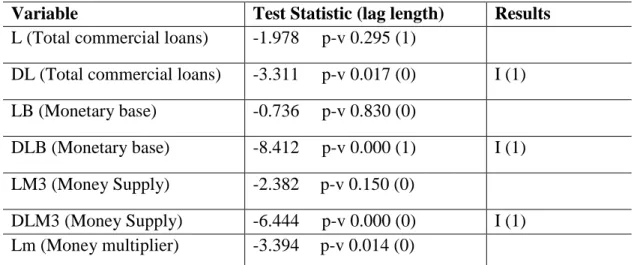

In this subsection, a unit root test will be performed to make sure that the variables have unit roots. A variable is said to have a unit root if it does not fluctuate around zero mean and constant variance. To find this, the variables will be tested at their levels and first differences, trended and trendless.

For all four time series variables, the tests will be based on two models; one is with constant and the other with constant and trend. If t > ADF critical value, fails to reject the null hypothesis and a unit root exists. Thus, it is clear that the null hypothesis (the variable has a unit root) cannot be rejected at 5 percent.

The Augmented Dickey-Fuller root of unity test with constant and trend is used for this. If t > ADF critical value does not reject the null hypothesis, and a root of unity exists. The results in Table 3 show that since the null hypothesis cannot be rejected at 5 percent of statistical significance for all variables, the latter are non-stationary at their level, meaning that the regression cannot be performed for all variables at their level because the results will be false.

However, the null hypothesis was rejected at 5 percent after taking the first differences for all variables and they became stationary after taking the first difference. In short, it can be clearly seen that both ADF tests - with constant and trend and with constant and no trend - result in similar results.

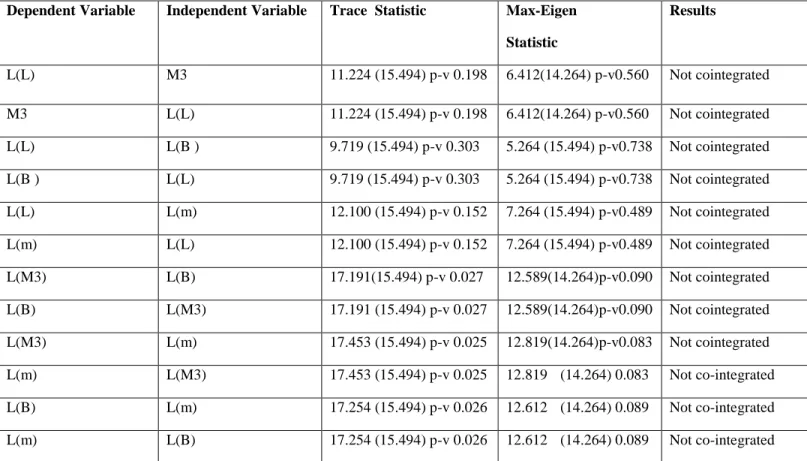

The Johansen Multivariate Co-integration Tests (Pairwise Maximal Eigenvalue Test and Pairwise Trace Tests)

- Standard Granger Causality Test

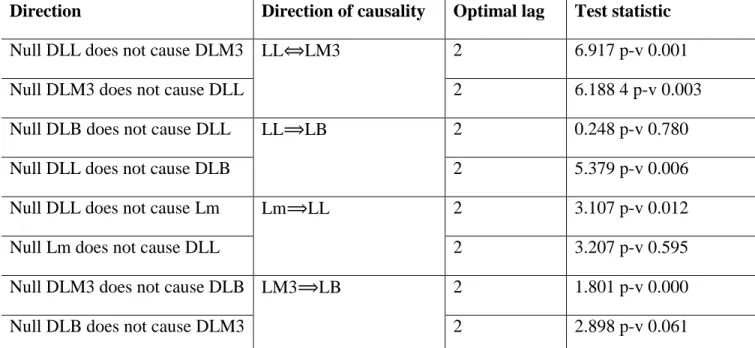

Consequently, the standard Granger causality will be used to detect the direction of causality in the case of Saudi money supply. Furthermore, the results will provide a clear picture of the post-Keynesian approaches to endogenous money supply, which better match the case of Saudi Arabia. The paper shows that there is a two-way Granger causality running from total commercial bank loans to the money supply and vice versa.

In contrast, the additional null hypothesis postulating that total commercial bank lending does not cause the monetary base can be rejected; thus, there is a Granger causality extending from total commercial bank lending to the monetary base. Finally, it is clear that there is a Granger causality running from the money multiplier to the total commercial bank loans because the null hypothesis, which is that the total commercial bank loans do not cause the money multiplier, cannot be rejected. On the other hand, the other null hypothesis, which is that the money multiplier does not cause the total commercial bank loans, can be rejected.

To summarize, there is a mix of results that reveal that the Saudi economy has endogenous money supply according to the Accommodation and Liquidity preference views. This theory states that if a country has a floating exchange rate, the money supply in that country will be. Furthermore, the classic version of Modern Monetary Theory claims that if a country has a fixed exchange rate, then the money supply will be exogenous and the interest rate will be endogenous.

Empirically, Saudi Arabia contradicts the claim of this theory with a fixed exchange rate, but with an endogenous money supply and an exogenous interest rate during the quarter 2000 to the fourth quarter 2018. In short, these results are clearly consistent with the post-Keynesian hypothesis , which rejects the orthodox view of the exogenous money supply and concludes that the money supply is endogenous.

Interpretations of Results

Saudi Money Supply Mechanism

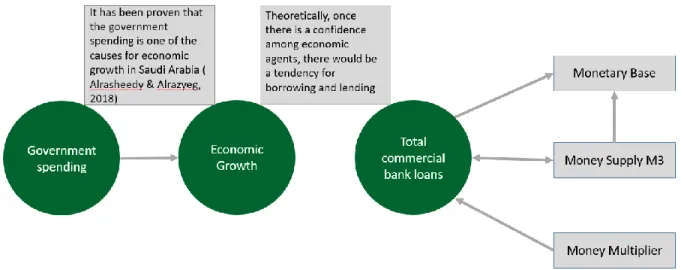

The endogenous money supply hypothesis assumes that loans create deposits, and deposits create reserves, and creditworthiness determines the loans, i.e. from a theoretical perspective, the main driver of the money supply is public spending by stimulating safety among economic agents (borrowers and lenders). So if there is significant public consumption, there would be a positive future expectation among the agents, in return agents would seek more loans, regardless of the purpose of loans, i.e.

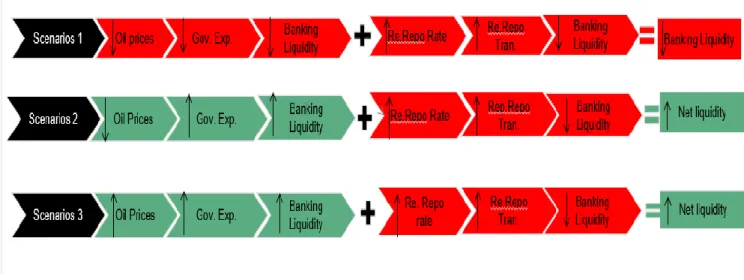

In context, if the purposes of the loan were investment, then there would be job creation. In short, the endogenous money view is valid in the case of the Saudi economy due to certain factors, including government spending and current Saudi monetary policy. The theory assumes the ability of a country (which in the case of Saudi Arabia is a commodity-based economy with a fixed exchange rate regime) to accumulate more foreign exchange reserves during periods of high oil prices and to regulate public spending during periods of low oil prices. by drawing from reserves.

This figure contains three scenarios, the first of which shows that lower oil prices cause a decrease in government spending, leading to a contraction in bank liquidity. On the contrary, the second scenario shows the impact of government spending on the Saudi banking system even in case of lower oil prices. The second scenario also clarifies that if there will be an increase in government spending, there would be an increase in bank liquidity, even in the case of lower oil prices.

However, in this scenario the reverse repo increases, which will cause an increase in reverse repo transactions, the net liquidity in the system will increase due to government spending. High oil prices will increase government spending and the liquidity in the banking system will increase despite the increase in reverse repo rate, causing an increase in the reverse repo transactions that reduce the liquidity in the banking system that would offset the government spending.

Conclusion

Further, the classical version of MMT asserts that if a nation has a fixed exchange rate, then the money supply would be exogenous and the interest rate would be endogenous. Empirically, Saudi Arabia defies this theory with a fixed exchange rate but with an endogenous money supply and an exogenous interest rate over the period (2000Q1 to 2018Q4) In short, these results are clearly consistent with the post-Keynesian hypothesis, which rejects the orthodox view of exogenous money supply and concludes that the money supply is endogenous. Endogenous money supply hypothesis assumes that loans create deposits and deposits create reserves and creditworthiness determines the loans, i.e.

Moreover, this paper starts from the fact that government spending is the main cause of economic growth, which, in turn, increases certainty among economic agents (borrowers and lenders). Essentially, government spending increases confidence among economic agents and, therefore, banks would lend as long as they have credit-worthy customers, eventually credit can be the second driver of economic growth. For future research, one could take this approach and apply it to the breakdown of economic sectors, to further investigate the impact of endogenous money on specific economic sectors and activities.

Furthermore, the role of the fiscal under endogenous money hypotheses can be further illustrated. Tax-driven money: additional evidence from the history of economic thought, economic history, and economic policy1. Complexity.