In the context of the National Development Plan, as a Buffalo City Metropolitan Municipality, we see our primary role as developing and maintaining our infrastructure to ensure that our private sector partners see the potential to continue increasing their investment in our city while creating more jobs for our people. In addition, we are planning a major R650 million power infrastructure upgrade for the entire BCMM area to improve the security of supply of the BCMM network for both residential and commercial consumers. One of the biggest challenges we still face as a city is the increasing cost of maintaining our existing infrastructure.

The Fleet Street upgrade totaling around R100 million will improve the condition of the main bypass road used by freight and the public passing through the city. In the longer term in relation to our road infrastructure, we have commissioned a feasibility study to look at diverting traffic onto the N2 via the R72. Through our international twinning, we are keen to facilitate business-to-business partnerships between our Metro and these Cities.

V. NCITHA

COUNCIL RESOLUTIONS

It is recommended that the Council of Buffalo City Metropolitan Municipality, acting in accordance with section 24 of the Municipal Financial Management Act (No. 56 of 2003), approve and pass the following resolutions:-. 6 The Buffalo City Metropolitan Municipality Council approves and adopts, effective July 1, 2013, the rates for other services as set forth in Appendix F. 8 The Buffalo City Metropolitan Municipality Council approves and adopts, effective July 1, 2013, the rates for other services listed in Appendix F. 8 The Buffalo City Metropolitan Municipality Council approves the proposed budget, and approves the associated budget proposal as Appendix F.

9 That no new capital expenditure be undertaken until a commitment for funding has been received by Buffalo City Metropolitan Municipality and such project has been approved by Council. 10 The Council notes that the 2013/14 Draft MTREF budget tabled for adoption is structured in terms of the then Buffalo City Municipality's votes and functions. MFMA Circular 66 and 67, Municipal Budget Circular for the 2013/14 MTREF attached as Annexure for Council's note.

EXECUTIVE SUMMARY

- KEY FOCUS AREAS FOR THE 2013/14 BUDGET PROCESS

- NATIONAL PRIORITY – EMPLOYMENT OPPORTUNITIES a) Service Delivery and Labour Intensive Capital Projects

- BUDGET PRINCIPLES AND GUIDELINES

- FINANCIAL MODELLING AND KEY PLANNING DRIVERS

- CHALLENGES

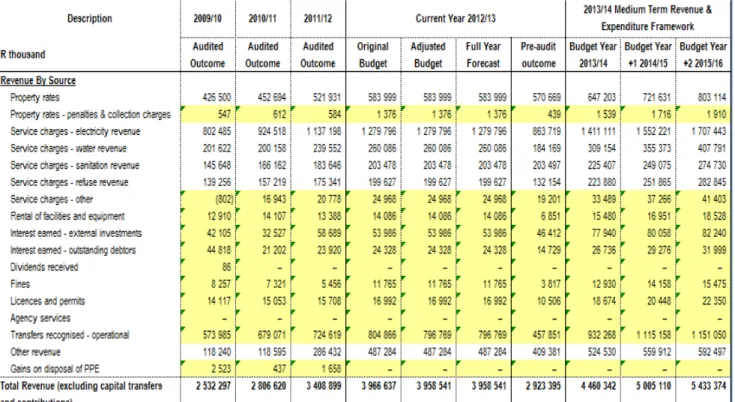

- OPERATING BUDGET .1 REVENUE

- EXPENDITURE

- CAPITAL BUDGET

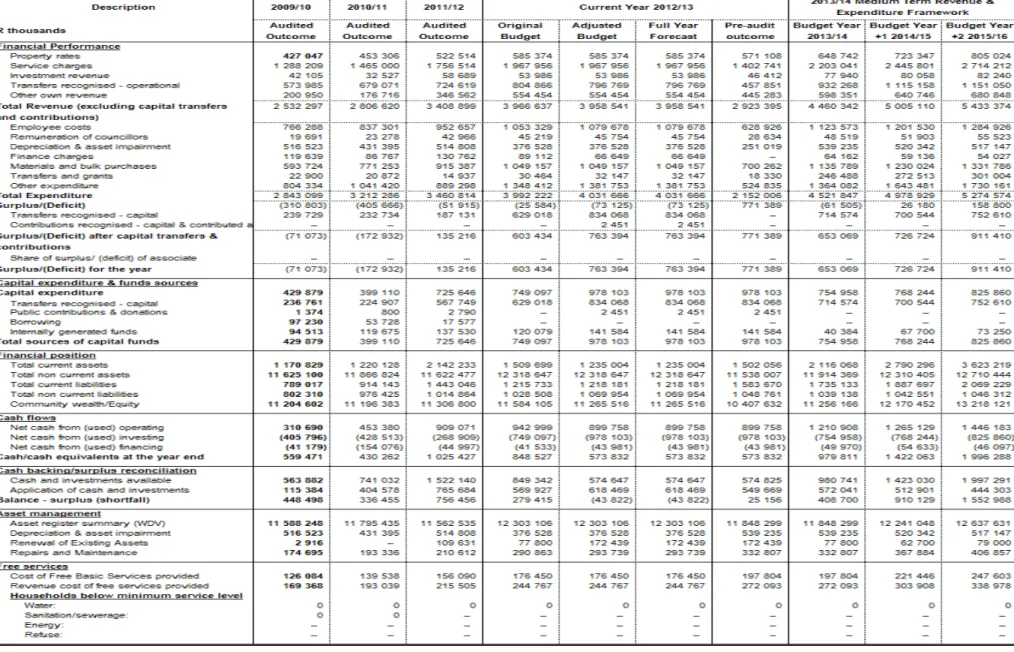

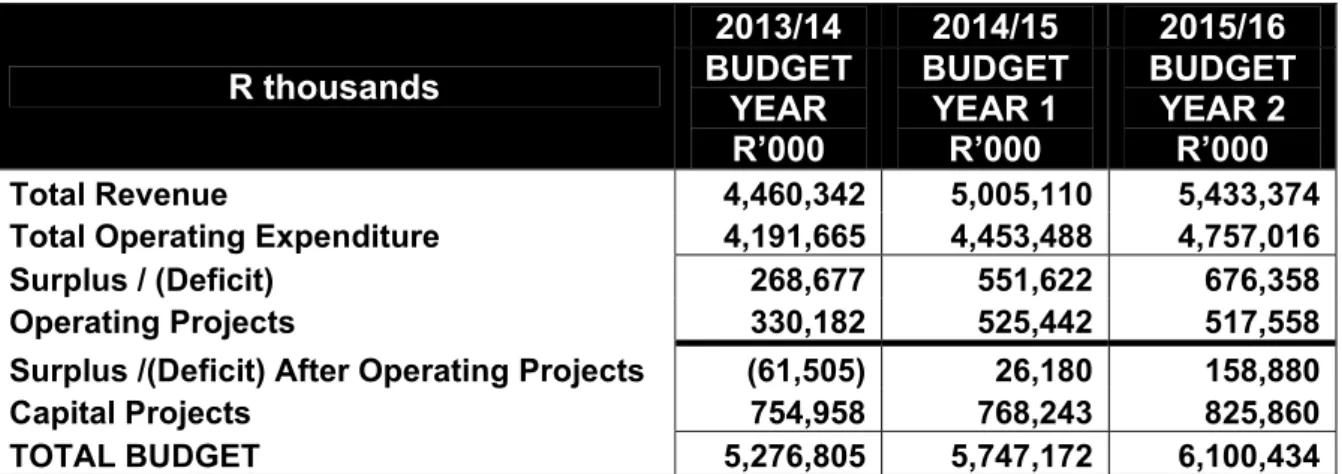

As part of the compilation of the MTREF 2013/14, extensive financial modeling has been performed to ensure long-term affordability and financial sustainability. The need for rate increases versus the community's ability to pay for services;. A decrease in the growth of the fair share distribution from 16.9% in FY 2012/13 to 0.3% in FY 2013/14 as a result of the revision of the share fair share formula.

The tariff increases are necessary to address essential operating requirements, maintenance of existing infrastructure, provision of new infrastructure and to ensure the financial sustainability of the. The tariff increases are necessary to address essential operational requirements, maintenance of existing infrastructure, provision of new infrastructure and to ensure the financial sustainability of the service. This reflects a growth of 69% compared to the 2012/13 financial year due to an increase in the Human Settlements allocation for housing top structure.

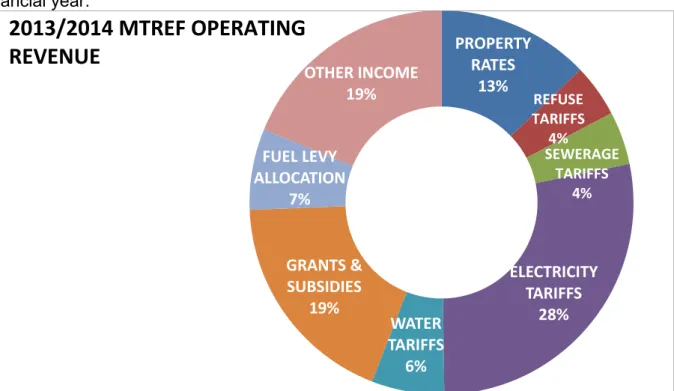

OPERATING REVENUE FRAMEWORK

2013/2014 MTREF OPERATING REVENUE

Property Rates and Service Charges and Impact of Tariff Increases

- Property Rates

Property rates are a major source of revenue for the city and help cover the cost of providing general services. Therefore, the determination of the effective property rate fee is an integral part of the BCMM budgeting process. 51, among other things, concerns the implementation of the Law on Municipal Property Norms, with the regulations issued by the Department of Cooperative Governance.

The implementation of these regulations was accomplished in the previous budget process and the Property Tax Policy of the Municipality was amended accordingly. The first R15 000 of the market value of a property used for residential purposes is excluded from the taxable value (Section 17(h) of the MPRA). For pensioners, physically and mentally disabled persons, a maximum/total rebate of 40% will be granted to owners of taxable property if the total gross income of the applicant and/or his/her spouse, if any, does not exceed R5,000 per month.

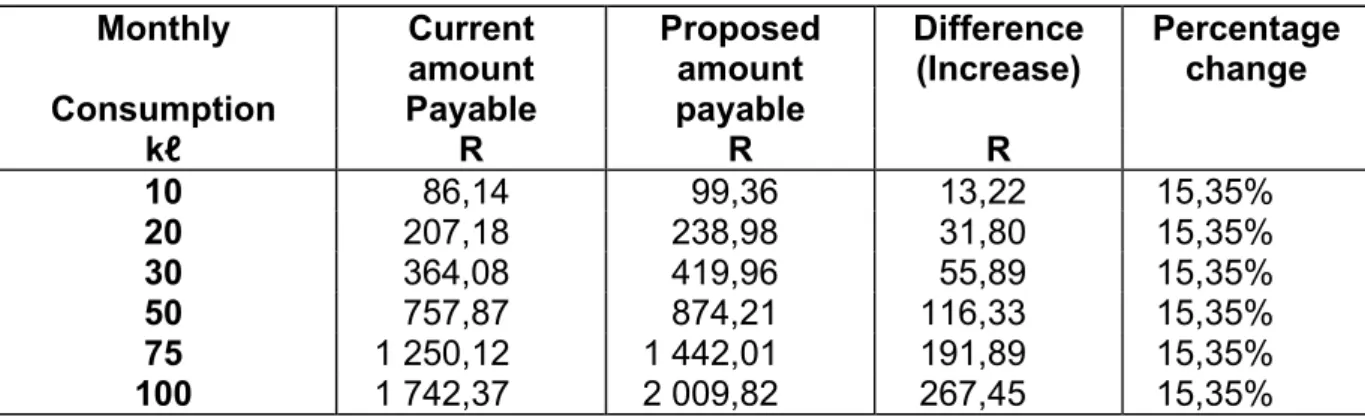

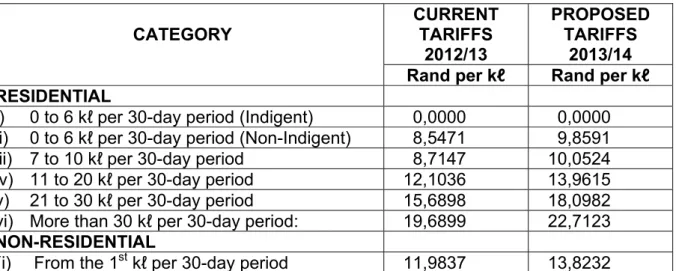

Sale of Water and Impact of Tariff Increases

In addition, all poor residents will again be provided free 6 kℓ of water per 30-day period. The tariff structure is designed to charge higher levels of consumption at a higher rate, gradually increasing to a rate of R22.7123 per kiloliter for consumption in excess of 30kℓ per 30-day period.

Sale of Electricity and Impact of Tariff Increases

Sanitation and Impact of Tariff Increases

Waste Removal and Impact of Tariff Increases

Overall impact of tariff increases on households

OPERATING EXPENDITURE FRAMEWORK

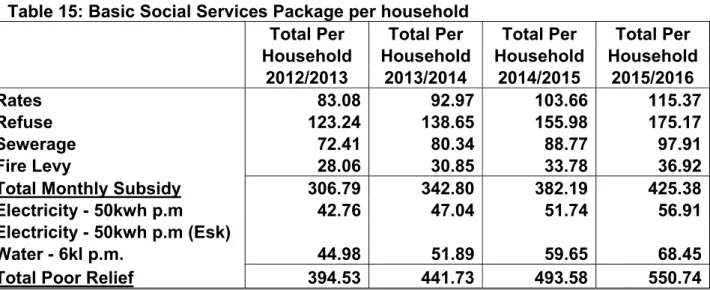

- Free Basic Services: Basic Social Services Package

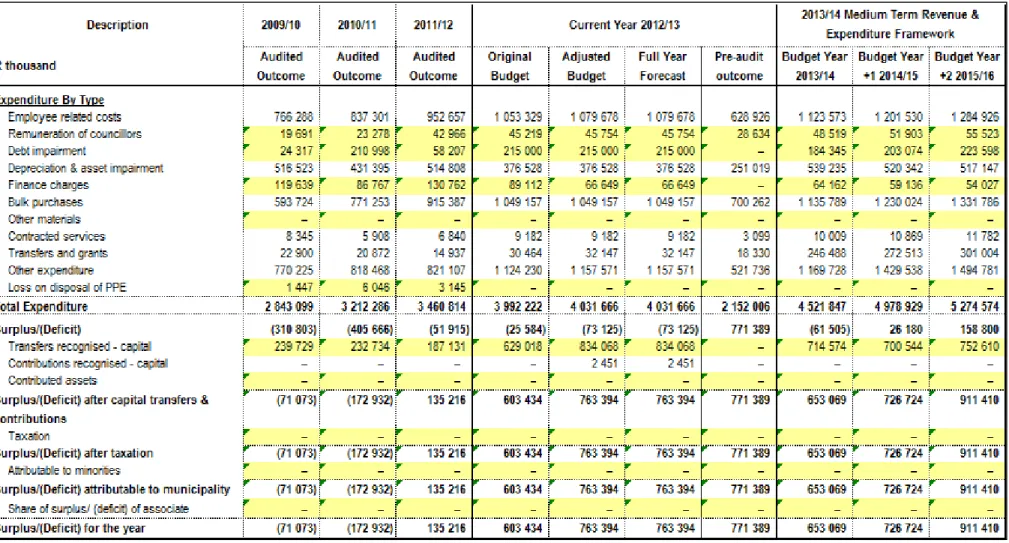

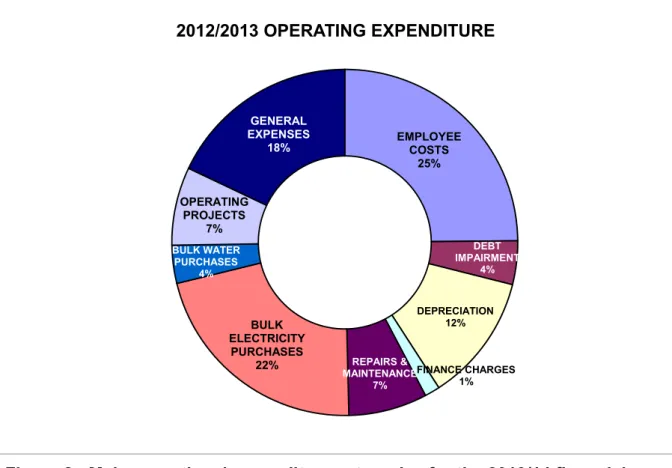

The budgeted allocation for employee-related costs for the 2013/14 financial year amounts to R1.12 billion, which is equivalent to 25% of total operating expenditure. The provision for depreciation and amortization of assets is widely regarded as an indicator for measuring the rate of consumption of assets. The budget allocations in this direction amount to Rr 539 million for the financial year 2013/14 and are equal to 12% of the total operating expenses.

Other expenses consist of various items related to the daily operations of the municipality. The city is aiming for a 10 percent repair and maintenance share of the total operating budget due to the city's aging infrastructure and historical deferred maintenance. To receive these free services, households must register under the city's indigent policy.

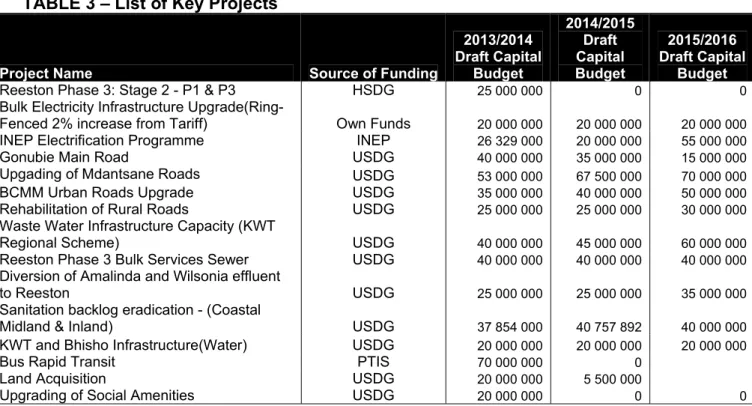

CAPITAL EXPENDITURE FRAMEWORK

This can be attributed to an increase in the USDG allocation over the 2013/14 MTREF to R1.8 billion for infrastructure and housing development. It is important to note that asset renewal represents the upgrade or replacement of existing City-owned assets, while new assets will result in an increase in the asset base of this City.

ANNUAL BUDGET TABLES

- I In term

OVERVI

SUPPO

ANNUA

RTING

AL BUDG

DOCUM

GET PRO

MENTAT

OCESS

TION

IDP and Service Delivery and Budget Implementation Plan

The review of the 2012/13 IDP began in September 2012 after the IDP Process Plan and the Budget Time Schedule for the 2013/14 Draft MTREF were presented to Council in August 2012. The Metro's IDP is the most important strategic planning tool, directly guiding and informing its planning, budgeting, management and development actions. This framework is rolled out into objectives, key performance indicators and targets for implementation that directly inform the service delivery and budget implementation plan.

The IDP was engaged in a business and financial planning process leading to the 2013/14 MTREF, based on the approved 2012/13 MTREF, half-year performance review and adjustment budget. The business planning process was then refined in light of current economic conditions and the resulting revenue projections. In compiling the 2013/14 MTREF, each function/directorate had to review the business planning process, including setting priorities and targets after reviewing the mid-year performance against the 2012/13 Service Delivery and Budget Implementation Plan.

The business plan responds to Metro's prioritized needs, revised strategic objectives and informs detailed operational budget allocations and three-year capital programme. The draft Service Delivery and Budget Implementation Plan (SDBIP) with draft performance agreements will be submitted to the Executive Mayor following the approval of the draft IDP and budget; and the final SDBIP will be presented to Council for approval with the performance agreements on 28 May 2013 with the final IDP and budget.

Community Consultation

31 Kaisers Beach, Sunny South, Shelford, Winterstrand, Kidd's Beach, Lillyvale, Igoda, Fort Grey, Bongweni, Ntenteni, Bhompini, Ncera Village 1, Ncera Village 2, Ncera Village 3, Airport Phase 1, Ncera Village 1, Ncera Village, Zishakhyex, Dompina, 9, 9. ndila, Open Shaw, Kiwane, Twecwana , Kalkeni, Xesi, Dyam dyam, Phozi, Gqala, New Rest, Mpongo, Sandile, Tsaba, Xamini, Ncera Village 4, Ncera Village 5, Ncera Village 6, Ncera13yen Village, Ncera1 Village, Ward, 3, Arkalton, Ncera1 Village Highway Gardens, Dice, Hutchinson, Part of Biko Village.

APRIL 15, 2013 19 Buffalo Flats, Parkside, Pefferville 2nd Creek Parkside Hall - 5pm 44 Sweetwaters, Tshatshu, Breidbach, Breidbach Community Hall. 36 Del Dimbaze, Madakeni, Zabalaza, Nakani, Zgornja Mngqesha, Mzintshane, Pierie Mission, Gambushe, Pierie Trust, New Rest.

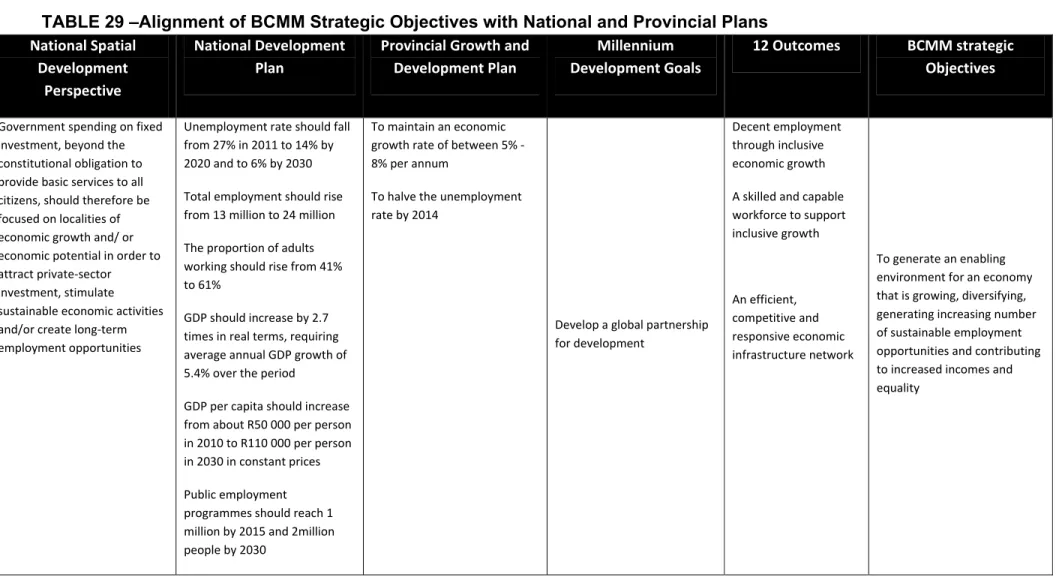

OVERVIEW OF ALIGNMENT OF ANNUAL BUDGET WITH IDP

To generate an enabling environment for an economy that is growing, diversifying, generating increasing number of sustainable

To produce sustainable infrastructure that support social and economic development;

To be a well-structured and capacitated institution that renders effective and efficient services to all by 2016

To enhance and protect all environmental assets and natural resources within Buffalo City Metropolitan Municipality by 2016

- MEASURABLE PERFORMANCE OBJECTIVES AND INDICATORS Table 34 - Table SA8 – Performance indicators and benchmarks

- Borrowing Management

- Safety of Capital

- Liquidity

- Revenue Management

- Creditors Management

- Other Indicators

- Free Basic Services: Basic Social Services Package for Indigent Households The social package assists residents that have difficulty paying for services and are

- Providing Clean Water and Managing Waste Water

- OVERVIEW OF BUDGET-RELATED POLICIES

- Tariff Policy

- Credit Control Policy

- Indigent Policy

- Investment and Cash Management Policy

- Long-Term Borrowings Policy

- Supply Chain Management Policy

- Asset Management Policy

- Capital Infrastructure Investment Policy

- Funding and Reserves Policy

- Virement Policy

- OVERVIEW OF BUDGET ASSUMPTIONS

- General inflation outlook and its impact on the municipal activities

- Credit rating outlook Table 38 - Credit rating outlook

- Interest rates for borrowing and investment of funds

- Collection rate for revenue services

- Growth in the tax base of the municipality

- Salary and Wage increases

- Impact of National, Provincial and Local policies

- Ensuring maintenance of existing assets General Expenses and Repairs & Maintenance

- OVERVIEW OF BUDGET FUNDING

- Proposed Tariff Increases over the Medium-term

- Detailed Investment

- Medium-term outlook: capital revenue

- Details of Borrowings

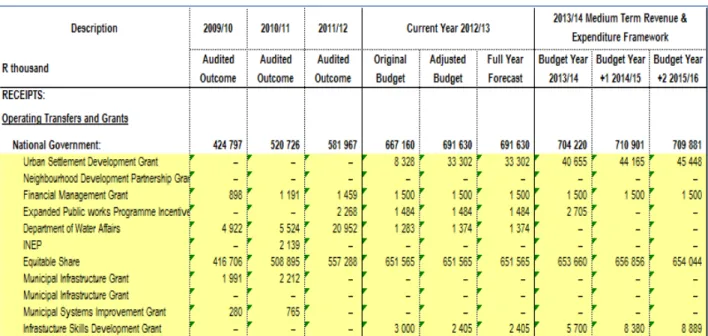

- Capital Transfers and Grant Receipts

- Cash Flow Management

- Cash Backed Reserves/Accumulated Surplus Reconciliation

- Funding compliance measurement

- EXPENDITURE ON GRANTS AND RECONCILIATIONS OF UNSPENT FUNDS

- COUNCILLOR AND EMPLOYEE BENEFITS

- MONTHLY TARGETS FOR REVENUE, EXPENDITURE AND CASH FLOW Table 51 - SA25 - Budgeted monthly revenue and expenditure

- CONTRACTS HAVING FUTURE BUDGETARY IMPLICATIONS

- CAPITAL EXPENDITURE DETAILS

- LEGISLATION COMPLIANCE STATUS

- In year reporting

- Internship programme

- Budget and Treasury Office

- Audit Committee

- Service Delivery and Implementation Plan

- Annual Report

- Policies

- OTHER SUPPORTING DOCUMENTS

- CITY MANAGER’S QUALITY CERTIFICATE

Cost of capital to operating expenses is a measure of the cost of borrowing in relation to operating expenses. The liquidity ratio measures the ability of the municipality to use cash and cash equivalents to immediately eliminate or settle its current liabilities. In terms of the Municipality's compassion policy, registered households are entitled to 6kℓ water, 50 kwh electricity.

The aim of the draft Resource Policy is to manage budget transfers efficiently and effectively to ensure optimal service. BCMM will work to improve this allocation in the 2014/15 MTREF to ensure the continued health of municipal infrastructure. What are the projected funds and investments available at the end of the fiscal year.

As far as the borrowing and investment policy of the municipality is concerned, the borrowings are withdrawn only after the expenses for the specific project have been completed. Any underperformance with respect to collections could put increasing pressure on the city's ability to meet its obligations to creditors. Long-term investments consist mainly of sinking funds for the repayment of a future loan.

The municipality increased cash reserves, which is part of the strategic financial sustainability of MOL. As part of the planning strategy, this should be managed aggressively as part of the medium-term planning objectives. The MTREF was informed by ensuring that the financial plan met the minimum requirements of the MFMA.

The city's forecasted cash position was considered as part of the budgeted cash flow statement. The table above shows that the growth percentage is a total of 5.7, 5.1 and 5.0 percent for the individual business years of MTREF 2013/14. This trend will need to be carefully monitored and managed through budget execution.

Details of the City's strategy in relation to asset management and repairs and maintenance are contained in Table 59 SA34C. In terms of the City's Supply Chain Management Policy, no contracts are awarded outside the medium term revenue and expenditure framework (three years) unless MFMA Section 33 has been complied with.