The improvement is mainly due to improved internal control within the municipality and the effective implementation of the audit action plan developed by the Management Board. The Municipal Property Rates Policy, approved in terms of the Municipal Property Rates Act, 2004 (Act No. 6 of 2004) (MPRA);.

2014/2015 Proposed Tariff

In addition to the statutory exemption of R15,000 allocated to each residential property under the Property Rates Act, the municipality continues to maintain the same threshold limit of R70,000 for all residential properties ie. this was done to reflect that the total rebate of R 70,000 applies to all residential households against the budget requirements as set by the National Treasury.

Service Charges

In particular, the current rate applicable to business and government institutions has been reduced from the current 0.25005 to 0.2382 before the 6% increase. The estimated rebate the city is extending to all residential properties is projected to be in the region of R45,728 million for 2015/16 and R48,486 million and R51,409 million respectively for the MTREF.

In the financial year 2014/15, the foregone revenue for tariffs was budgeted in accordance with the division between foregone revenue of R 24,370 million (including the statutory portion of R 15,000) and operating grants and grants of R 54,577 million (including the portion of R 55,000 of the discount related to the policy).

2014/15 Proposed Tariff from 1

The percentage increase in the water revenue is informed by new developments that have taken place in the City, as well as the efforts that have been implemented to reduce the water losses and the billing of irresponsible water. The City maintains the same walking rate structure that was introduced in the 2012/13 financial year.

Residential

A basic fee of R20.00 per month will be introduced for all residential users who own a property with a market value of R70 000.00 or more.

Step Tariffs 2012/13

Current 2014/15 Percentage Increase %

Proposed Tariff from 1 July 2015

Non-Residential

Step Tariffs

Increase % Proposed Tariff from 1 July 2015

13 c) Refuse Removal

Size of the Stand (Square metres)

Current 2014/15 R

Tariff per month (Maximum of 1

The deviation is mainly due to the increase in the Sale of Plots projection by R 13.133 million, contribution to bulk services based on a conservative estimate of the contribution to bulk contract signed by the City of R 252.5 million and the projected proceeds from the land price of R 292.5 million from the identified land parcels for disposal. The revenue projections for the two outer years of the MTREF period are R 721,482 million and R 609,883 million respectively.

Revenue per Vote

OPERATING EXPENDITURE

Operating Expenditure Framework

Millions

Budget 2017/18 Budget 2016/17 Budget 2015/16 Budget 2014/15

Adj. Budget

Budget EXPENDITURE PER TYPE

OPERATING EXPENDITURE BUDGET – HIGHLIGHTS AND REASONS FOR SIGNIFICANT VARIANCES

Employee Related Costs

18 Salaries and Wages per Category

19 Salaries and Wages per Vote

Leave Provision 1.09%

Other Allowances 0.02%

Night/Shift Allowance 0.32%

Overtime

4.23% Provision Staff Bonus 0.16%

Salaries And Wages 68.68%

Susidy Housing 1.04%

Subsidy Motor Scheme 4.74%

Transport Allowance 0.63%

Cellphone Allowance 0.24%

Definined Benefit Plan 1.59%

Group Insurance 0.66%

Medical Aid 6.62%

Pension/Provident Fund 9.46%

UIF 0.48%

Salary Budget per Categorie 2015/16

20 Remuneration of Councillors and Directors

General Expenditure

Bulk Purchases

CITY MANAGER. 41 677

FRESH PRODUCE MARKET

ENGINEERING SERVICES

Salary Budget per Directorate 2015/16

21 Water

Contracted Services

Transfers and Grants

Finance Charges (Interest on External Borrowings)

Repairs and Maintenance

Repairs and Maintenance Trend

22 Depreciation

Transfer to Bad Debt Reserve

23 Operating Expenditure per Vote

24 C. CAPITAL BUDGET

FINANCING - MANGUANG AND CENTLEC

Budget Year

2015/16 Budget Year

2016/17 Budget Year 2017/18

Grants and Subsidies

External Loans Revenue Public Contributions Grants and Subsidies

An additional loan amount of R 218,140 million. must be procured through a tender procedure for leasing the municipal fleet. The rest of the external debt for 2016/17 and 2017/18 will be financed by the proposed municipal bonds that Metroen is currently working on.

GRANTS FUNDING

Budget Year 2015/16

Budget Year 2016/17

Budget Year 2017/18

GRANTS & SUBSIDIES

Corporate Services

Social Services

Planning

Economic and Rural Development

Human Settlement and Housing

Water

Waste and Fleet Management

Other Grant Funded Projects

Neighbourhood Development Partnership Grant

Integrated City Development

National Electrification Programme

28 Borrowings/Loan Funded Projects

CAPITAL EXTERNAL LOANS

Budget 2015/16

Budget 2016/17

Planning Projects

Engineering Services Projects

Own Funded Projects

Finance

Fresh Produce Market

31 Water

Centlec

32 Capital Budget per Vote

33 D. SUMMARY OF THE BUDGET

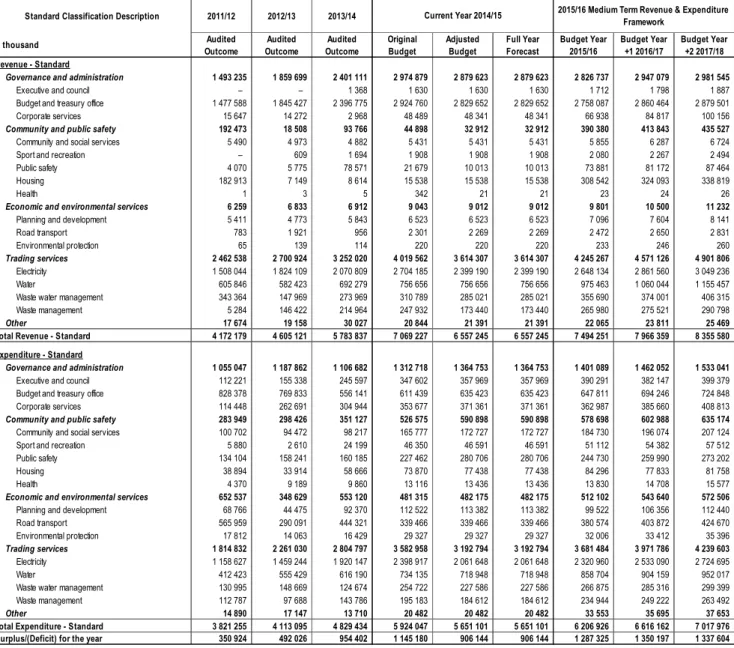

MAN Mangaung - Table A1 Consolidated Budget Summary

35 3. BUDGET RELATED RESOLUTIONS

- The Mangaung Metropolitan Municipality acting in terms of Section 24 of the Municipality Finance Management Act, Act 56 of 2003, present for approval the 2015/16 annual budget with the total revenue

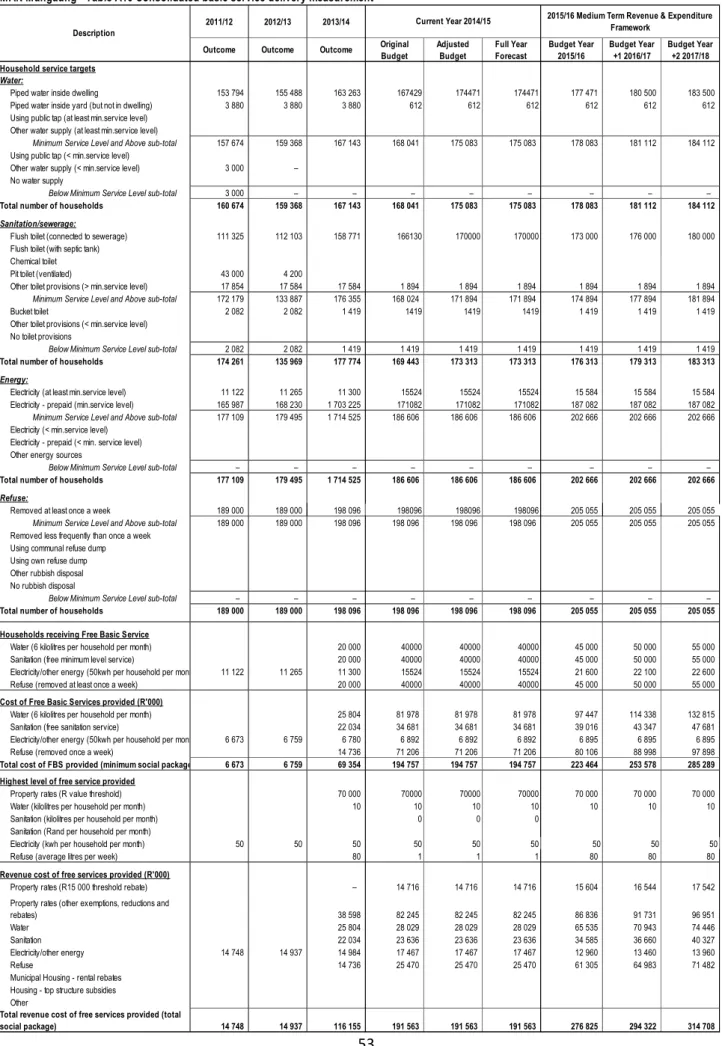

- that the financial position cash flow cash-backed reserve/accumulated surplus asset management and basic service delivery targets be approved as set out in the following tables

- That the consolidated budget that includes the financial impact of Centlec (SOC) Ltd be approved

- That the Council of Mangaung Metropolitan Municipality acting in terms of Section 75A of the Local Government Municipal Systems Act, Act 32 of 2000 as amended approve the following tariffs to be applied

- That the General Tariffs as set out in the Tariffs Booklet be approved for the 2015/16 financial year

- That in terms of Section 24(c) (v) of the Municipal Finance Management Act, Act 56 of 2003 the budget related policies including any amendments and the applicable by-laws as set out in the Annexure B be

- That Centlec (SOC) Ltd budget submissions for the period 2015/16 - 2017/18 be approved as listed below

- The additional R 50 million long term loan included in the Development Bank of Southern Africa’s proposal for Financing of Various Infrastructure Projects (Bid: MMM/BID 1562013/14) be approved

- That the restrictive conditions as set prescribed by the Virement Policy shall be suspended for the duration of the implementation phase of the mSCOA Project until 1 July 2017

Municipal revenue operating expenditure and capital expenditure are then classified in terms of each of these functional areas enabling the National Treasury to compile 'whole of government' reports.

MAN Mangaung - Table A2 Consolidated Budgeted Financial Performance (revenue and expenditure by standard classification)

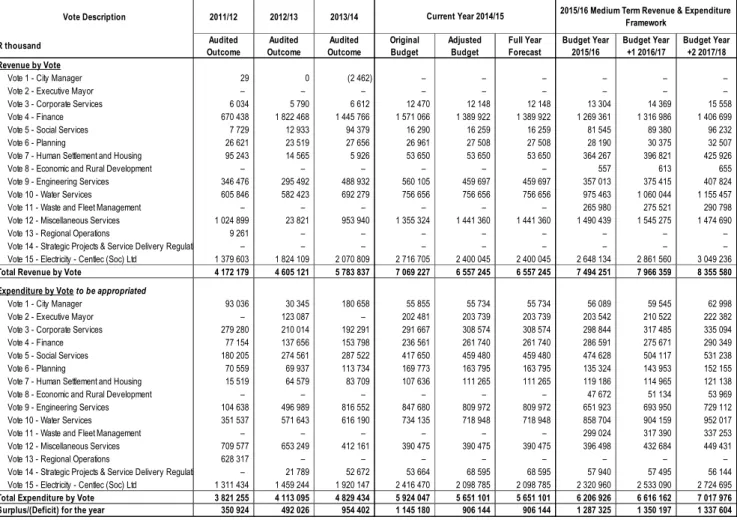

This table facilitates the view of the budgeted operating performance in relation to the organizational structure of the municipality.

MAN Mangaung - Table A3 Consolidated Budgeted Financial Performance (revenue and expenditure by municipal vote)

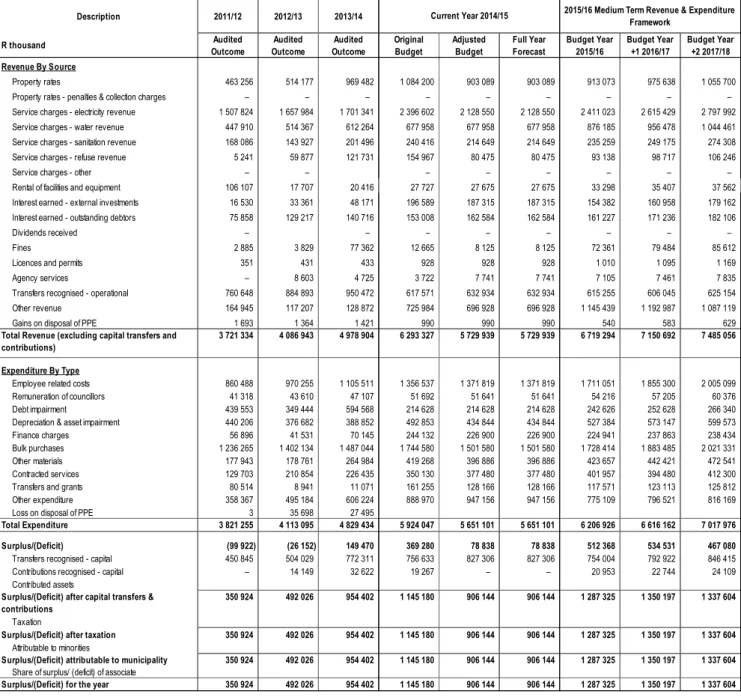

This table provides an overview of the planned operational performance according to the funding sources and for which activities the funds should be used:

MAN Mangaung - Table A4 Consolidated Budgeted Financial Performance (revenue and expenditure)

MAN Mangaung - Supporting Table SA2 Consolidated Matrix Financial Performance Budget (revenue source/expenditure type & dept.)

Corporate

Electricity -

Economic and

Engineering

Waste and

Miscellaneous

Strategic

MAN Mangaung - Table A5 Consolidated Budgeted Capital Expenditure by vote, standard classification and funding

- Social Services – 5 614 6 085 56 807 64 695 64 695 40 465 62 841 42 614

- Planning – – 41 032 175 692 81 336 81 336 55 939 32 866 11 700 6.1 - Administration and Finance

- Human Settlement and Housing – 4 718 – – 365 365 4 000 23 000 53 000

- Economic and Rural Development – – – – – – 13 157 20 789 20 500

- Engineering Services 78 301 64 559 258 400 300 071 365 592 365 592 496 053 920 057 1 009 414

- Water Services 69 060 92 227 169 575 274 720 366 309 366 309 139 063 420 529 454 250 10.1 - Water 69 060 92 227 169 575 274 720 366 309 366 309 139 063 420 529 454 250

- Strategic Projects & Service Delivery Regulation – – – 5 400 5 400 5 400 20 000 25 000 40 000

- Social Services 14 239 8 041 32 101 22 452 21 102 21 102 27 136 20 907 40 249

- Planning 36 728 43 344 29 755 76 424 49 964 49 964 110 700 51 000 35 000 6.1 - Administration and Finance

- Human Settlement and Housing 330 16 433 6 167 19 264 10 264 10 264 56 200 33 935 16 800

14.3 - City Services, Monitoring and Evaluation 14.4 - Bloemfontein Regional Center 14.5 - Botshabelo Regional Center 14.6 - Thaba Nchu Regional Center.

49 Table A6 - Budgeted Financial Position

MAN Mangaung - Table A6 Consolidated Budgeted Financial Position

MAN Mangaung - Supporting Table SA3 Supportinging detail to 'Budgeted Financial Position'

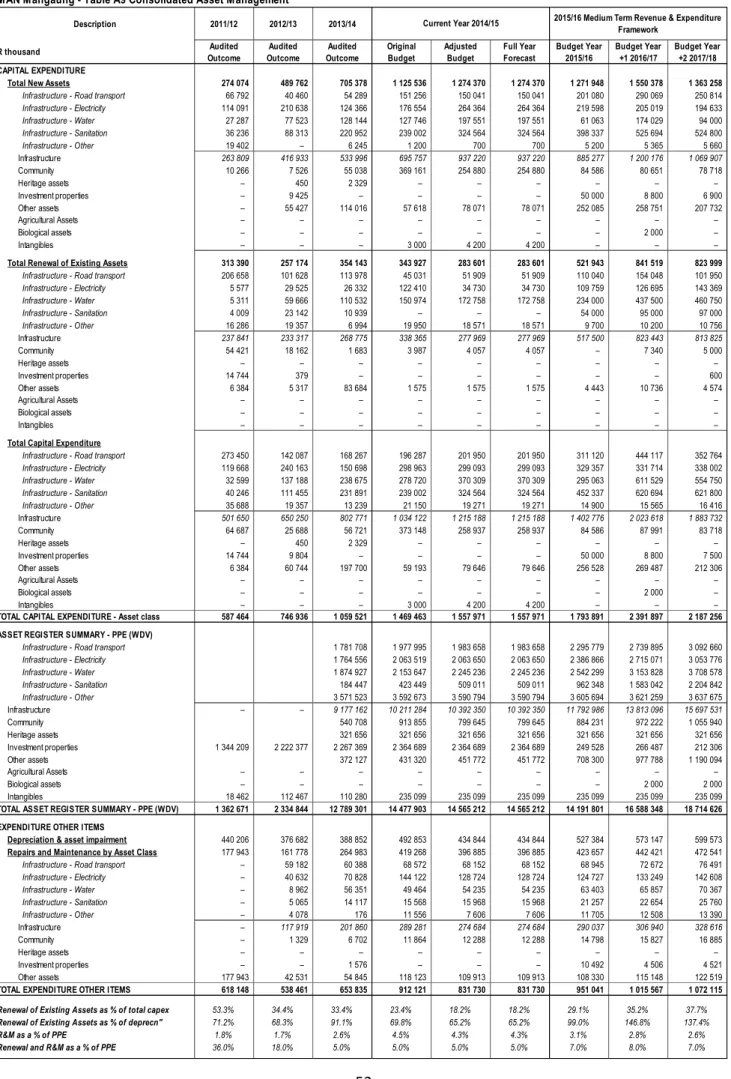

Total capital expenditure includes expenditure on nationally significant priorities

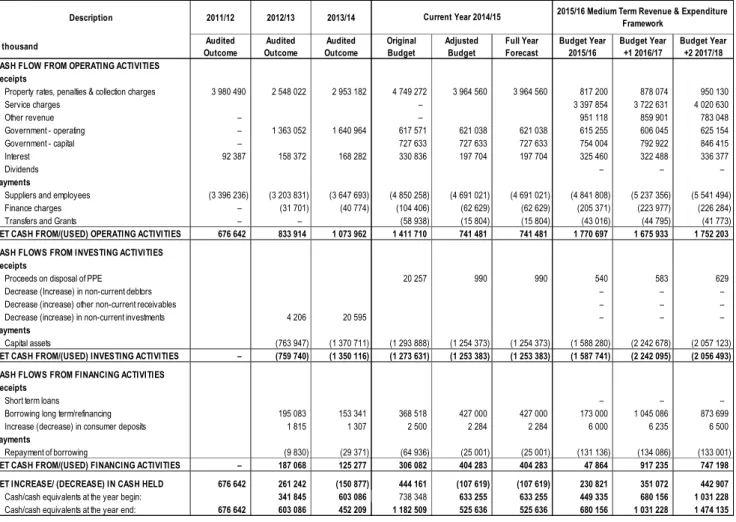

51 Table A7 - Budgeted Cash Flow Statement

MAN Mangaung - Table A7 Consolidated Budgeted Cash Flows

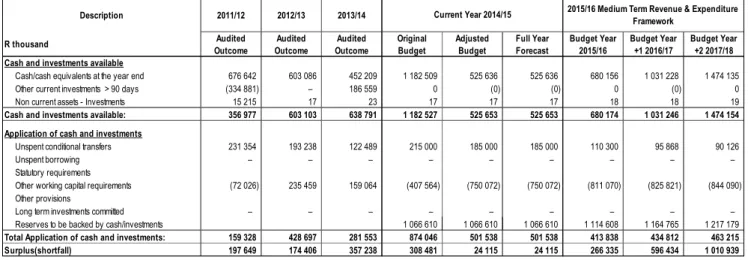

MAN Mangaung - Table A8 Consolidated Cash backed reserves/accumulated surplus reconciliation

54 SUPPLEMENTARY SCHEDULES TO TABLES A2 TO A10

MAN Mangaung - Supporting Table SA1 Supportinging detail to 'Budgeted Financial Performance'

The table below provides the reader of Table A6 with more information on the composition of the main categories of the items disclosed on the Budgeted Financial Position of the municipality for ease of comparison.

59 SERVICES TARIFFS

Assessment Rates

Comma six one three one cent (0, 6131 cent), multiply by comma two five cent (0.25), per rand on the rateable value of farm property (exempt from VAT);

Comma six one three one cent (0,6131 cent ), per rand on the rateable value of residential property (exempt from VAT);

Two comma five two five cent (2, 5250 cent) per rand on the rateable value of state owned facilities (exempt from VAT);

Interest shall be paid to Council on rates which have been paid within thirty (30) days from the date on which such rates became due, at a rate of 1% higher than the prime rate for the period during

Rebates on assessment rates

The first R 70,000 (Seventy thousand rand only) of the rateable value of residential properties are exempted;

That in respect of qualifying senior citizens and disabled persons, the first R 250,000 (Two hundred and fifty thousand rand only) of the rateable value of their residential properties be exempted from

That the rebate on the R 250,000 of the rateable value for residential properties of qualifying senior citizens and disabled persons will only be applicable on properties with a value that do not exceed

That for the 2015/16 financial year the criteria applicable for child headed families regarding the total monthly income from all sources must not exceed an amount equal to three state pensions as

Sewerage Charges

Rebates on sewerage charges

Levy on churches, church halls and other places of similar nature, qualifying charitable institutions and welfare organizations

Martie du Plessis School, Dr Böhmer School, Lettie Fouche School and schools of similar nature

Refuse Removal Charges

Tariff (3)(a): Erf used for Residential Purposes

Size of the Stand (square metres) Current 2014/15

Proposed Tariff increase from 1 July

Tariff per month (maximum of one

Tariff (3)(b): Flats and Townhouses per unit

Tariff (3)(c): Duet Houses and Private Towns

Tariff (3)(d): State Owned Facilities, Businesses, Commercial and Industrial (Non Residential) Tariff per month (Maximum of one removal per week) - R 183.22 per month

Tariff (3)(e): State Owned Facilities , Businesses, Commercial and Industrial ( Non Residential)

Rebates on refuse removal charges

61 4. Water Tariffs

Residential Properties

2012/13 Current 2014/15 Percentage Increase % Proposed Tariff from 1 July 2015

Non-Residential Step Tariffs

Part A: Erf within Municipal Area

Tariff A1

Water Consumed

Tariff A2: Unmetered Erf Used for Residential Purpose only Fixed amount: R 30.17 per month

Tariff A3: Unimproved Erf

Tariff A4: Directorates of Council

Tariff A5: Any other point where water is supplied not mentioned in Tariffs A1, A2, A3 and A4 per Water Meters

Tariff B1: Erf used for Residential Purposes only

Tariff B2: Any other point where water is supplied not mentioned in Tariff B1, per water meter (excluding Special Arrangements)

Housing Rental Tariffs

General Tariffs

Electricity Tariffs It is recommended

Prepayment Inclining Block for

Summer Winter % Inc Summer Winter % Inc Summer Winter Summer Winter

Rotary Flat Business Tariff (EL0005)

Summer Winter % Inc Summer Summer Winter Summer Winter Summer Winter

SUPPORTING DOCUMENTATION 1. OVERVIEW OF ANNUAL BUDGET PROCESS

The National Treasury Budget Regulations give further effect to this by prescribing that the mayor must establish a Budget Steering Committee to help carry out the mayor's responsibility set out in section 53 of the Municipal Financial Management Act. The compilation of the annual budget of the municipality began with the submission of the budget parameters to the Budget Committee, composed of executive political representatives. To examine the budget inputs of the directorates through budget hearings after the presentation of the draft budget and.

After reviewing the budget parameters, the Executive Management Team submitted the operational and capital budgets which were discussed as part of the formulation of the 2015/16 MTREF draft budget which was presented on April 24, 2015. After the presentation of the draft 2015/16 MTREF Budget and proposed fees, stakeholders and citizens will be invited to provide input and comments until May 2015. Progress and assessment of service delivery status, summary of community and stakeholder views on IDPs , the MTREF budget and the budget link with IDP and support from other stakeholders will be presented at the IDP and Budget Conference in May 2015.

The time schedule IDP and Budget as well as the participation for the budget cycle 2015/16 within the meaning of Article 21 paragraph 1 sub b of the Municipal Financial Management Act is shown below.

DELIVERABLES AND PROCESS MANAGEMENT

The MFMA requires the mayor of a municipality to provide general political direction to the budget process and to set priorities that should guide the preparation of a budget.

MMM KEY ACTIVITIES TO TAKE PLACE IN TERMS OF THE IDP, BUDGET AND PMS FOR THE 2015-16 IDP PROCESS

IDP PHASES AND PERFORMANCE

REPORTING

PREPARATION PHASE

Briefing session with Section 80: IDP and Finance, MAYCO 13 Aug 2014 13 Aug 2014 DONE Initiate tariffs setting review process & benchmarking

29 Aug 2014 May 2015 In progress Executive Mayor facilitates the establishment of the Budget

31 Aug 2014

DONE Advertisement of IDP and Budget Process Plan

05 Sep 2014

DONE MAYCO to provide budget priorities and key projects for the

22 Oct 2014

02 Dec 2014

DONE One day self-assessment dialogue with EMT, MAYCO and

Councillors and reviewing current implementation progress. 30 Oct 2014 30 Oct 2014 DONE EMT submits inputs on operational budget 03 Nov 2014 26 Mar 2015

EMT to submit budget inputs on capital projects 21 Nov 2014 10 Dec 2014 23 Mar 2015

Initiate group-based public participation process in accordance with MTREF to solicit input and comments from the MMM public on IDPs thereby developing regional/cluster plans.

25 Nov – 19 Dec 2014

03-04 Dec

EMT Reviews and approved tentative capital budget 08 Dec 2014 16 Mar 2015 23 Mar 2015 Budget Steering Committee (BSC) meeting to review

STRATEGIES PHASE

21 Jan 2015 29 Jan 2015 DONE EMT/CM reviews the first draft of the MTREF BEPP report 24 Jan 2015

Centlec submit draft budget and business plans. 28 Jan 2015 28 Jan 2015 20 Mar 2015 Submission of Mid- Year Budget and Performance

Assessment Report for 2014/2015 financial year 30 Jan 2015 29 Jan 2015 DONE Refining municipal Strategies, Objectives, KPA’s, KPI’s and

Centlec submit the revised draft budget and business plan 21 Feb 2015 30 Mar 2015 Done

PROJECT PHASE

Institutional plan refined to deliver on the municipal strategy 27 Feb 2015 17 April

2015 In progress One and multi-year scorecard revised and presented to

2015 In progress

INTEGRATION PHASE

12 Mar 2015 28 Nov 2015 DONE Financial plan, capital investment, spatial development

13 Mar 2015 17 April

MTREF Budget and related resolutions – MMM and Centlec. 26 Mar 2015 28 April

07 Apr 2015 10 April

07 Apr – 16 Apr 2015

21 -22 May

30 Apr 2015 28 Apr 2015 Done Council meeting to deliberate and consider views of local

APPROVAL PHASE (cont)

PUBLIC PARTICIPATION

Aug Sep Oct Nov Dec Jan Feb Mar Apr May Community Participation

Bloemfontein

Nicro Hall 31,32,33,35 and (38 M

39, 40, (41 Part of township) ,42 43 and 49

OVERVIEW OF ALIGNMENT OF ANNUAL BUDGET WITH INTEGRATED DEVELOPMENT PLAN The Mangaung Metropolitan Municipality’s IDP outlined the key area for development in the short to

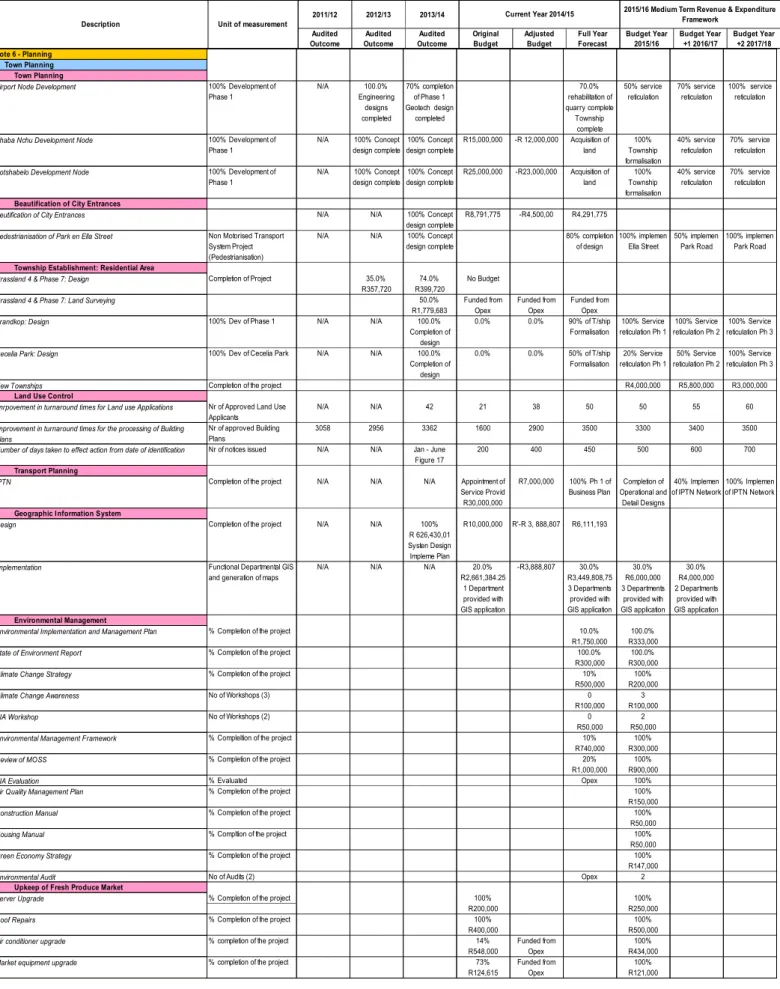

In general, the Mayor's Committee played an important role in shaping these priorities and it was necessary to link them with the priorities and plans of the National, Provincial, District and Sector Directorates. The 2015/16 MTREF draft budget continues to address the stated priorities of the mayors which are informed by the 14 government outcomes, particularly outcome 8 and outcome 9 which focus on integrated human settlement and local governance respectively. The following tables serve to illustrate the alignment of the budget with the strategic objectives of the IDP:

IDP Strategic Objective (Revenue)

Eradication of bucket system, VIP toilets in Mangaung, Botshabelo and Thaba Nchu, roads, aging infrastructure, focus on basics.

70 IDP Strategic Objective (Operating Expenditure)

MAN Mangaung - Supporting Table SA5 Reconciliation of IDP strategic objectives and budget (operating expenditure)

71 IDP Strategic Objective (Capital Expenditure)

MAN Mangaung - Supporting Table SA6 Reconciliation of IDP strategic objectives and budget (capital expenditure)

MEASURABLE PERFORMANCE OBJECTIVES AND INDICATORS

Measurable Performance Objectives - Supporting Table SA7

Budget prepared and submitted in accordance with MFMA Number of budgets submitted to N/A N/A N/A N/A N/A 3 Draft, revised 3 Draft, revised 3 Draft, revised. Number of crime hotspots removed Number of hotspots removed 16 Targeted 16 Targeted 16 Targeted 16 Targeted Visible Running Visible Running Visible. Reducing traffic accidents in high-risk areas Number of law enforcement officers.

Implementation of the traffic-traffic system and speed and no. offenses The system is the system is the system is. Disaster Risk Management Public Education (New) Number of Disaster Risk Management N/A N/A N/A N/A N/A N/A 6 Champaigns 6 Champaigns 6 Champaigns. Construction Construction Construction Construction Thaba Nchu Development Landfill development Transfer station in Transfer station in Transfer station in Transfer station in Completed.

Improvement and/or implementation of internal control measures or system % reduction of the number of theft transfers to 100%.

MAN Mangaung - Entities measureable performance objectives

Key Financial Rations/Indicators

82 4. OVERVIEW OF BUDGET RELATED POLICIES

Amended Policies (Annexure B)

Property Rates Policy

83 3. Indigent Policy

Supply Chain Management Policy (Amended) Page 31: Paragraph 18.3

Paragraph 17.6.11

Composition of the Bid Evaluation Committee

Paragraph 17.7.1.3

Paragraph 21 Cession Agreement

74: Paragraph 24 Local Beneficiation

84 5. OVERVIEW OF BUDGET ASSUMPTIONS

Key Parameters

Actual Data/Parameters Used in compiling the final budget

Parameters

General inflation general outlook and its impact on the municipal activities

National and Provincial influences including taking cognisance of the MFMA circulars No 50 and No 72

Interest rates for borrowing and investment of funds - refer to Table SA9 (page 69) 5.1.4 Growth in the tax base of the municipality

Other Assumptions

Supporting Table SA9 - Social, Economic and Demographic Statistics and Assumptions

Supporting Table SA11 - Property Rates Summary

Discounted the values of properties currently in dispute and pending the outcome of the Valuation Appeal Board by 20%. The appeal process that is currently under way is schedule to

The proposed 6% tariff increase for the MTREF period

86 Supporting Table SA12 - Property Rates by Category

MAN Mangaung - Supporting Table SA11 Property rates summary

87 Supporting Table SA13 - Service Tariffs by Category

MAN Mangaung - Supporting Table SA13b Service Tariffs by category - explanatory

90 Supporting Table SA14 - Household Bills

91 6. OVERVIEW OF BUDGET FUNDING

- Cash/Cash Equivalent at year end

- Cash + investments at the year-end less application

- Monthly average payments covered by cash or cash equivalents

- Surplus/deficit excluding depreciation offsets

- Cash receipts of Ratepayer & Other revenue

- Debt Impairment expense % of billable revenue

- Borrowing receipts % of capital expenditure

- Particulars of Monetary Investment

- Existing and Proposed New Borrowings

Non-compliance: The ratio decreases annually across the MTREF, from an average performance level of 3.1% to 2.6%. Based on the above funding measurement, the budget is funded and can be sustained over the MTREF period. The Metro has fully utilized its existing loan facility with the DBSA and the majority of the assets financed are expected to be commissioned at the start of the 2015/16 financial year.

The Standard Bank loan of R300 million will be used by the end of the 2014/15 financial year.

MAN Mangaung - Supporting Table SA15 Investment particulars by type

Metroen has chosen to pursue financial leasing options to finance its vehicle fleet, mainly service vehicles. Long-term loans (annuity/reducing balance) Long-term loans (non-annuity) Locally registered share Installment Credit Financial Leasing PPP obligations.

94 7. BUDGETED GRANTS AND TRANSFERS

95 (b) Expenditure on Transfers and Grants

ALLOCATIONS OF GRANTS MADE BY THE MUNICIPALITY

COUNCILLORS AND BOARD MEMBER ALLOWANCES AND EMPLOYEE BENEFITS

MAN Mangaung - Supporting Table SA23 Salaries, allowances & benefits (political office bearers/councillors/senior managers)

101 SUMMARY OF PERSONNEL NUMBERS

MAN Mangaung - Supporting Table SA24 Summary of personnel numbers

MONTHLY TARGETS FOR REVENUE EXPENDITURE AND CASH FLOW

Supporting tables SA25 SA26 SA27 SA28 SA29 and SA30 to follow provide management and budget users with a monthly breakdown of the budget as contained in Tables A2 to A7. These tables will be used as a measure of budget performance on a monthly basis. They will be used in the monthly Section 71 Report to track the actual implementation of the budget by management.

MAN Mangaung - Supporting Table SA30 Consolidated budgeted monthly cash flow

ANNUAL BUDGETS AND SERVICE DELIVERY AGREEMENTS – ENTITY

The municipal entity is fully owned by the city. ii) The city has established a Board of Directors which will oversee the activities of the municipal unit on behalf of the municipality. A political and administrative representative of the city serves on the Board of Directors of Centlec to protect the interests of the Shareholder. iii). The primary mandate of the municipal entity is to provide electricity services to communities with electricity grid and maintain electricity infrastructure. iv).

The financing of the municipal entity comes from the sale of electricity and grants received from the Ministry of Energy for electrification. SDA mainly ensures the provision of electricity services in accordance with the requirements of the national electricity regulator as set out in the distribution and generation licences. On an annual basis, the services provided by the municipal unit are defined in the entity's business plan, which is approved by the board of directors and then by the municipality.

The municipality and the municipal unit have begun the process of reviewing the SDA and SOB;.

MAN Mangaung - Supporting Table SA31 Aggregated entity budget

CONTRACTS HAVING FUTURE BUDGETARY IMPLICATIONS

CAPITAL EXPENDITURE DETAILS

MAN Mangaung - Supporting Table SA32 List of external mechanisms

ABSA

Most projects under the Infrastructure class and subclass are for development and construction until projects are safely completed for projects that are completed in phases.

MAN Mangaung - Supporting Table SA35 Consolidated future financial implications of the capital budget

- LEGISLATION COMPLIANCE STATUS

- In Year Reporting

- Internship Programme

- Budget and Treasury Office

- Audit Committee

- Risk Management

- Service Delivery and Implementation Plan

- Annual Report

- Property Rates Act

BEERSTRIJEN MASELSPORT WEG: MOVING STREET AND HEERWATER Yes INFRASTRUCTURE OF ROADS, PAVEMENTS, BRIDGES AND HEERWATER N. REALIZATION OF CURVE DAN PIENAAR DRV: RAISING STREET AND HEEERWATER Yes INFRASTRUCTURE ROADS, PAVEMENTS, BRIDGES AND HEEERWATER N. RESTORATION OF WATER SUPPLY LY SYSTEMS : REAL LOSS REDUCTION PROGRAM (WATER Yes INFRASTRUCTURE WATER TANK & RETICULATION AFTER ALL- N.

ERECTION OF STEEL STRUCTURE AND ROOF FACING SOUTH SECTION BOOTSHABELO WORKSHOP Yes OTHER ASSETS OTHER LAND AND BUILDINGS N. The municipality participates in the Municipal Financial Management Internship Program and has employed twelve (12) interns who are undergoing training in various sections of the Financial Services Departments . The detailed SDBIP document is at a draft stage and will be finalized following approval by the 2015/16 MTREF in June 2015.

The annual report for the financial year 2013/14 has been prepared in accordance with MFMA and National Treasury requirements and was presented to Council on 24 April 2015.

MAN Mangaung - Contact Information

GENERAL INFORMATION

MANAGEMENT LEADERSHIPB. CONTACT INFORMATION

POLITICAL LEADERSHIP