Actual increased spending for the year was 83.92% of the R4.781 billion adjustment budget. National Treasury has been brought on board to assist/provide guidance on the areas of disagreement between the council and the Office of the Auditor General. The allocation of the outer two years of the MTREF period is R 6,156 billion and R 6,531 billion respectively.

The allocation for the two outer years of the MTREF period is R1,454 billion and R1,552 billion respectively. The allocation for the two outer years of the MTREF period is R57,360 million and R60,592 million respectively. The allocation for the two outer years of the MTREF period is respectively 1,625 R million and R1,759 million.

The allocation for the two outer years of the MTREF period is R649,091 million and R668,931 million respectively. Reclassification of management fee expenditure of R100.4 million in the 2013/14 budget to entity personnel costs.

11 Bulk Purchases

Contracted Services

Transfers and Grants

Free Basic Services

Interest on External Borrowings

12 Repairs and Maintenance

Repairs and Maintenance Trend

Depreciation

Transfer to Bad Debt Reserve

Operating Expenditure per Vote

Budget 2013/14 Adj Budget 2013/14 Budget 2014/15 Budget 2015/16 Budget 2016/17

OPERATING REVENUE BUDGET - HIGHLIGHTS AND REASONS FOR SIGNIFICANT VARIANCES Operating Revenue Framework

For the Mangaung Metropolitan Municipality to continue with its quality service delivery there is a need to generate the required income. Setting merchant services' user charges at levels that reflect the cost-bearing nature of these services;. The municipality's Property Tax Act Policy approved in terms of the Municipal Property Tax Act, 2004 (Act No 6 of 2004) (MPRA);.

The allocation for the last two years of the MTREF period is R7.265 billion and R7.687 billion respectively. Revenue generated from tolls and service charges form a significant part of the city's revenue basket. The chart below illustrates the sources of municipal revenue during the MTREF period, as noted above.

STATEMENT OF FINANCIAL PERFORMANCE - MANGAUNG (CONSOLIDATED)

17 Assessment Rates

Revenue ForgoneRatesFuel Levy

Millions

Revenue by Source

It has been determined that general assessment rates will increase by an average of 6% for the 2014/15 financial year and by 6% for the last two years as shown in the table below. The city has committed to reducing the ratio between residential and other categories, and specifically for this budget process, the current tariff applicable to businesses and government institutions has been reduced from the current 0.24836 to 0.23590 before the 6% increase. In addition to the statutory exemption of R15 000 granted to each residential property under the Property Rates Act, the City continues to maintain the same threshold value of R70 000 for all residential properties ie.

The expected rebate extended by the City to all residential properties is expected to be in the range of R56 864 million for 2014/15 and R60 999 million and R65 435 million for the MTREF respectively.

Category Current

2013/2014 Proposed Tariff

Service Charges a) Sewerage Charges

Category Current 2013/14 Proposed Tariff

The first step rate is still the lowest compared to other Metropolitan Municipalities and is intended to benefit the needy households and including the residential properties. Water is considered a scarce commodity and the more water you use, the more the consumer moves to higher tariff groups. Nevertheless, in terms of the comparison made, the water charges for the City are still considered favorable compared to other Metropolitan Municipalities.

Treasury MFMA Circular No. 70 directs municipalities to reimburse the full costs associated with the provision of trading services, i.e. trading services should not be cross-subsidised from income from real estate prices, therefore the determination of the water tariff must take into account the total cost of providing the service, including overheads. In accordance with the policy of the poor, the municipality is currently extending 10kl to all approved poor households.

The first 6kl of water delivered to the needy households is financed from the equitable share in terms of National Treasury and the remaining 4kl represents the lost income.

Residential

Step Tariffs

2012/13 Current 2013/14 Percentage Increase % Proposed Tariff from 1 July 2014

Non-Residential Step Tariffs

Current 2013/14 Percentage Increase % Proposed Tariff from 1 July 2014

Refuse removal

Size of the Stand (Square metres)

Tariff per month

20 a. Electricity Service Charges

Fuel Levy

Grants and Subsidies

22 Revenue per Vote

Rates Operations

Revenue per Vote

Budget 2016/17 Budget 2015/16 Budget 2014/15 Adj Budget 2013/14 Budget 2013/14

23 Seconded Personnel

Other Revenue

CAPITAL BUDGET

FUNDING BY SOURCE

FINANCING - MANGUANG AND CENTLEC

Budget Year

2014/15 Budget Year

2015/16 Budget Year 2016/17

24 1. USDG Funding

GRANTS & SUBSIDIES

Corporate Services

Social Services

Planning

Human Settlement and Housing

Waste Water Treatment

Landfill Sites

Bulk Water Supply

26 Loan Funded Projects

Proposed New Loans

LOAN FUNDED PROJECTS

Budget

2014/15 Budget

Proposed New Loans Planning Projects

Engineering Services - Projects

Existing Loans

Other Grant Funded Projects

27 OTHER GRANT FUNDED PROJECTS

Budget 2014/15

Budget 2015/16

Budget Year 2016/17

Own Funded Projects

Finance

Human Settlement and Planning

Fresh Produce Market

Engineering Services

Water

Strategic Projects and Service Delivery Regulations

Network Service (Low Voltage)

Infrastructural Support Services (Transmission)

Botshabelo Regional Services

Design and Development

Network Optimisation

Medium Voltage

Capital Budget per Cluster

MANGAUNG AND CENTLEC

BUDGET 2015/2016

BUDGET 2016/2017

TOTALCLUSTER WARD NR's

31 D. SUMMARY OF THE BUDGET

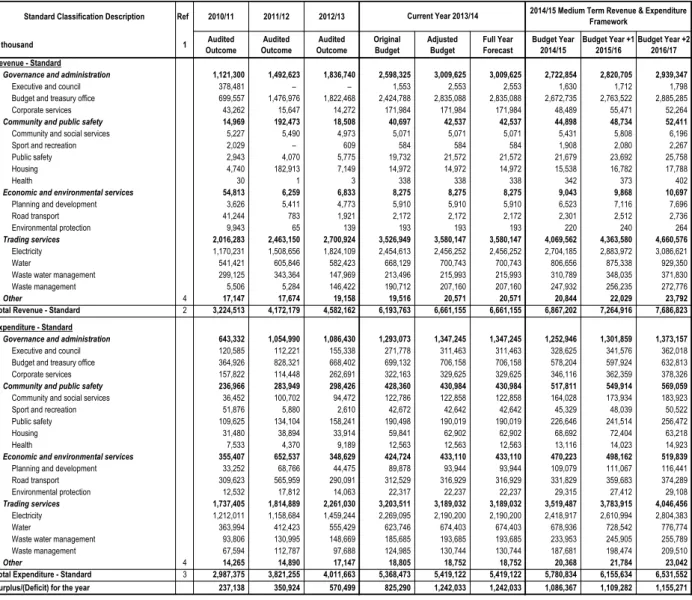

Table A1 is a budget summary and provides a concise overview of the City’s budget from all the major financial perspectives (operating, capital expenditure, financial position, cash flow and

MAN Mangaung - Table A1 Consolidated Budget Summary

33 3. BUDGET RELATED RESOLUTIONS

- That in terms of Section 24 of the Municipal Finance Management Act, 56 of 2003, the draft annual budget of the municipality’s total revenue is R 6,867 billion operating expenditure of R 5,781 billion and capital

- that the financial position, cash flow, cash-backed reserve/accumulated surplus, asset management and basic service delivery targets be tabled as set out in the following tables

- That the consolidated budget that includes the financial impact of Centlec (SOC) Ltd be tabled

- That the Council of Mangaung Metropolitan Municipality acting in terms of Section 75A of the Local Government Municipal Systems Act, Act 32 of 2000 as amended, tabled the following tariffs to be applied

- That the General Tariffs as set out in the Tariffs Booklet be tabled for the 2014/15 financial year,

- That in terms of Section 24(c) (v) of the Municipal Finance Management Act, Act 56 of 2003, the budget related policies, including any amendments and the applicable by-laws as set out in the Annexure B be

- That Centlec (SOC) Ltd draft submission for the period 2014/15 - 2016/17 be tabled, as listed below

The municipality's revenues, operating expenses and capital expenses are then classified in terms of each of these functional areas that enable the preparation of the National Treasury.

MAN Mangaung - Table A2 Consolidated Budgeted Financial Performance (revenue and expenditure by standard classification)

This table facilitates the view of the budgeted operational performance in relation to the organizational structure of the municipality.

MAN Mangaung - Table A3 Consolidated Budgeted Financial Performance (revenue and expenditure by municipal vote)

MAN Mangaung - Table A4 Consolidated Budgeted Financial Performance (revenue and expenditure)

MAN Mangaung - Table A5 Consolidated Budgeted Capital Expenditure by vote

MAN Mangaung - Table A5 Consolidated Budgeted Capital Expenditure by standard classification and funding

MAN Mangaung - Table A5 Consolidated Budgeted Capital Expenditure by vote, standard classification and funding

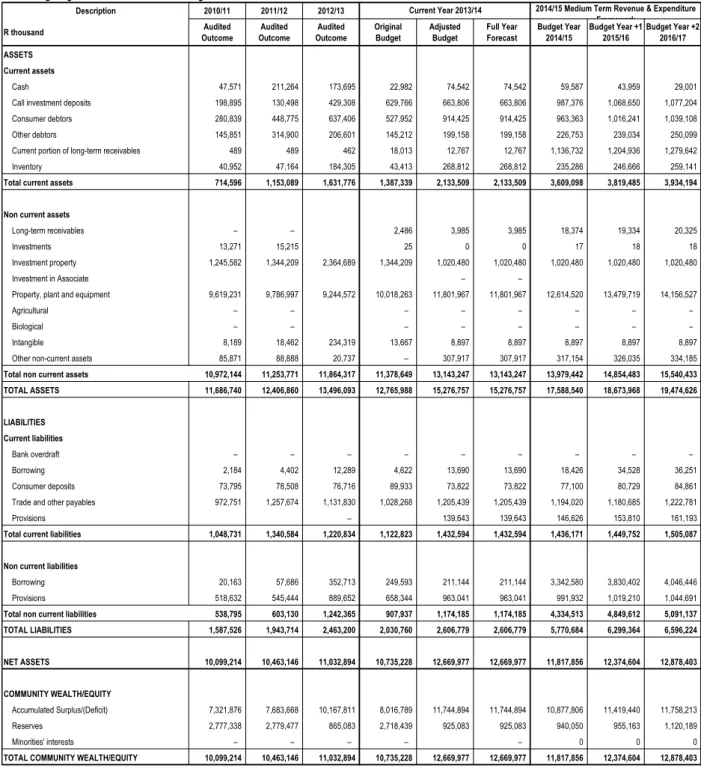

45 Table A6 - Budgeted Financial Position

MAN Mangaung - Table A6 Consolidated Budgeted Financial Position

46 Table A7 - Budgeted Cash Flow Statement

MAN Mangaung - Table A7 Consolidated Budgeted Cash Flows

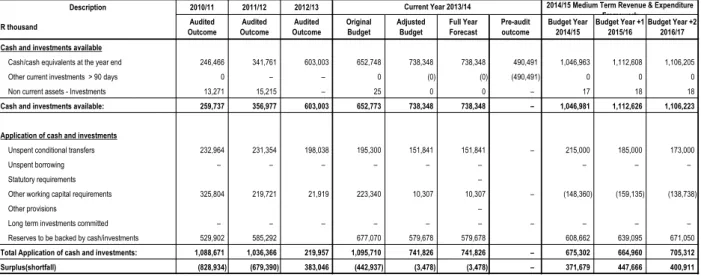

The reconciliation of monetarily supported reserves/accumulated surpluses is aligned with the requirements of circular MFMA 42 - Financing of the municipal budget. The table essentially estimates budget funding levels by first forecasting cash and investments at the end of the year and then reconciling available funds with existing liabilities/commitments. A deficit would mean that deposits exceed available cash and investments and would indicate non-compliance with the MFMA's requirements that the municipal budget must be funded.

MAN Mangaung - Table A8 Consolidated Cash backed reserves/accumulated surplus reconciliation

48 Table A9 - Asset Management

MAN Mangaung - Table A9 Consolidated Asset Management

51 SUPPLEMENTARY SCHEDULES TO TABLES A2 TO A10

MAN Mangaung - Supporting Table SA1 Supportinging detail to 'Budgeted Financial Performance'

MAN Mangaung - Supporting Table SA2 Consolidated Matrix Financial Performance Budget (revenue source/expenditure type & dept.)

Description

R thousand Revenue By Source

Settlement and Housing

Fresh Produce

Market Vote 9 -

Services Vote 10 - Water

Services Vote 11 -

Services Vote 12 -

Strategic

Service Delivery

Electricity -

LtdVote 5 - Social

Services Vote 6 -

Manager Vote 2 -

Mayor Vote 3 -

Services Vote 4 -

MAN Mangaung - Supporting Table SA2 Consolidated Matrix Financial Performance Budget (revenue source/expenditure type & dept.) Description

- NAME OF

- Engineering

- Miscellaneo

- Regional

- Corporate

- Social

- Planning

- Human

The table below provides the reader of Table A6 with more information on the composition of the main categories of the items disclosed on the Budgeted Financial Position of the municipality, for ease of comparison.

MAN Mangaung - Supporting Table SA3 Supportinging detail to 'Budgeted Financial Position'

Audited Outcome

Original Budget

Adjusted Budget

Full Year Forecast

Budget Year 2014/15

Budget Year +1 2015/16

Budget Year +2 2016/17

ASSETS

Call investment deposits

Consumer debtors

Debt impairment provision

Property, plant and equipment (PPE)

Current Year 2013/14 2014/15 Medium Term Revenue & Expenditure Framework

Total capital expenditure includes expenditure on nationally significant priorities

56 SERVICES TARIFFS

Assessment Rates

Rebates on assessment rates

Sewerage Charges

Rebates on sewerage charges

Refuse Removal Charges

That the following costs and prices without VAT in connection with the provision of garbage collection services are submitted for confirmation.

Tariff (3)(a): Erf used for Residential Purposes Size of the Stand (square metres) Tariff per month (maximum of

Tariff (3)(b): Flats and Townhouses per unit

Rebates on refuse removal charges

Residential Properties (non-bulk)

58 Business / Commercial (Bulk)

Part A: Erf within Municipal Area Tariff A1

Tariff A2: Unmetered Erf Used for Residential Purpose only Fixed amount: R 27.43 per month

Tariff A3: Unimproved Erf

Tariff A5: Any other point where water is supplied not mentioned in Tariffs A1, A2, A3 and A4 per Water Meters

59 Part B: Erf outside Municipal Area

Tariff B1: Erf used for Residential Purposes only

Water Consumed

Tariff B2: Any other point where water is supplied not mentioned in Tariff B1, per water meter (excluding Special Arrangements)

- Housing Rental Tariffs

- General Tariffs

- Electricity Tariffs It is recommended

- SUPPORTING DOCUMENTATION

- OVERVIEW OF ANNUAL BUDGET PROCESS

The MFMA requires the mayor of a municipality to provide general political guidance on the budget process and on priorities that should guide the preparation of a budget. The new Finance Act gives this further effect by prescribing that the mayor of a municipality must set up a budget steering group to assist with the discharge of the mayor's responsibilities under Section 53 of the Act on Municipal Financial Management. The preparation of the municipality's annual budget begins with the presentation of the budget parameters to the Budget Committee, which is composed of executive political representatives.

To examine the budget inputs of the directorates through budget hearings after the presentation of the draft budget and. After reviewing the budget parameters, the Executive Management Team has submitted the operating and capital budgets which have been discussed as part of the formulation of the MTREF 2014/15 draft budget for presentation in March 2014. and the proposed fee, advertisements will be made to the parties interested parties and public comments until April 4, 5, 8, 9 and 22, 2014.

The progress and evaluation of the status of the service, a summary of community and stakeholder views on the IDP, the MTREF budget and the linkage of the budget to the IDP and support from other stakeholders will be presented to the IDP - and budget conference on 09 May 2014. The time schedule IDP and Budget, as well as the participation for the budget cycle 2013/14 within the meaning of Article 21, paragraph 1, under b, of the Municipal Financial Management Act, is presented below.

DELIVERABLES AND PROCESS MANAGEMENT

Dates Actual Dates Progress

PREPARATORY PHASE

STRATEGIC PHASE

PROJECT PHASE

MAYCO

INTEGRATION PHASE

64 PUBLIC PARTICIPATION

OVERVIEW OF ALIGNMENT OF ANNUAL BUDGET WITH INTEGRATED DEVELOPMENT PLAN The Mangaung Metropolitan Municipality’s IDP outlined the key area for development in the short to

Community Participation Barolong Hall – Thaba

65 IDP Strategic Objective (Revenue)

66 IDP Strategic Objective (Operating Expenditure)

67 IDP Strategic Objective (Capital Expenditure)

MAN Mangaung - Supporting Table SA6 Reconciliation of IDP strategic objectives and budget (capital expenditure)

MEASURABLE PERFORMANCE OBJECTIVES AND INDICATORS A. Measurable Performance Objectives

MAN Mangaung Table SA7 - Measureable Performance Objectives

Description Unit of measurement

Audited

Outcome Audited

Budget Adjusted

2014/15 Budget Year + 1

2 2016/17 Vote 1 - City Manager

Organisational Planning &

Performance

Internal Audit

Facilities Management

Social Services Social Development

Libraries

HIV and AIDS

Disaster Management Attendance of Joint Operations

SDBIP

100 % Contingency

Human Settlements Number of housing opportunities

Sub-function 1 - Provision of

300 households

500 households

800 households

900 households

Sub-function 2 - Accelerating Accreditation to Implement

Informal Settlements

Sub-function 4 - Accelerate

And so on for the rest of the

153 797 households

21 209 informal

26 799 informal

85 community

20 community

10 community

MAN Mangaung - Entities measureable performance objectives

Outcome Audited Outcome

100 % Implementation

- Key Financial Rations/Indicators

77 4. OVERVIEW OF BUDGET RELATED POLICIES

Amended Policies (Annexure B)

Property Rates Policy

78 2. Tariff Policy

- Water Estimate Policy

- Supply Chain Management Policy (Amended)

- Indigent Policy

- Credit Control (Writing Off of Irrecoverable Debt)

79. submitted to the bid specifications committee for review and approval prior to further submission by the bid specifications committee to the Municipal Manager for final approval prior to advertising. A standard checklist should be prepared by the SCM Sub-Department to define the process.

80 5. OVERVIEW OF BUDGET ASSUMPTIONS

Key Parameters

- General inflation general outlook and its impact on the municipal activities

- National and Provincial influences, including taking cognisance of the MFMA circulars No 50 and No 72

- Interest rates for borrowing and investment of funds - refer to Table SA9 (page 69) 5.1.4 Growth in the tax base of the municipality

- Other Assumptions

The budget has included a percentage growth rate of 1.25% on the municipality's existing billing database. The other assumptions that provided the basis for the budget are calculated in the following supporting tables SA9, SA 11 to SA14.

Supporting Table SA11 - Property Rates Summary

Discounted the values of properties currently in dispute and pending the outcome of the Valuation Appeal Board by 20%. The appeal process that is currently under way is schedule to be concluded late

The proposed 6% tariff increase for the MTREF period

MAN Mangaung - Supporting Table SA11 Property rates summary

83 Supporting Table SA12 - Property Rates by Category

84 Supporting Table SA13 - Service Tariffs by Category

86 Supporting Table SA14 - Household Bills

87 6. OVERVIEW OF BUDGET FUNDING

Particulars of Monetary Investment

MAN Mangaung Supporting Table SA10 Funding measurement

2010/11 2011/12 2012/13 Audited

Outcome Audited

Pre-audit outcome

Budget Year +1 2015/16

Budget Year +2 2016/17

2014/15 Medium Term Revenue & Expenditure Framework

MFMA section Ref

Current Year 2013/14

MAN Mangaung - Supporting Table SA15 Investment particulars by type

Parent municipality Securities - National Government

Entities

89 Existing and Proposed New Borrowings

MAN Mangaung - Supporting Table SA17 Borrowing

90 7. BUDGETED GRANTS AND TRANSFERS

MAN Mangaung - Supporting Table SA18 Transfers and grant receipts

MAN Mangaung - Supporting Table SA19 Expenditure on transfers and grant programme

Outcome

Operating expenditure of Transfers and Grants

Framework

MAN Mangaung - Supporting Table SA20 Reconciliation of transfers, grant receipts and unspent funds

National Government

Provincial Government

District Municipality

Other grant providers

ALLOCATIONS OF GRANTS MADE BY THE MUNICIPALITY

COUNCILLORS AND BOARD MEMBER ALLOWANCES AND EMPLOYEE BENEFITS

MAN Mangaung - Supporting Table SA23 Salaries, allowances & benefits (political office bearers/councillors/senior managers)

96 SUMMARY OF PERSONNEL NUMBERS

MAN Mangaung - Supporting Table SA24 Summary of personnel numbers Summary of Personnel Numbers

MONTHLY TARGETS FOR REVENUE, EXPENDITURE AND CASH FLOW

The Supporting Tables SA25, SA26, SA27, SA28, SA29 and SA30 that follow provide management and users of the budget with a monthly breakdown of the budget as contained in Tables A2 to A7. These tables should be used as a measure of budget performance on a monthly basis. They should be used on the monthly Section 71 report to track management's actual implementation of the budget.

MAN Mangaung - Supporting Table SA28 Consolidated budgeted monthly capital expenditure (municipal vote) Description

MAN Mangaung - Supporting Table SA29 Consolidated budgeted monthly capital expenditure (standard classification) Description

102 f. Consolidated budgeted monthly cash flow

MAN Mangaung - Supporting Table SA30 Consolidated budgeted monthly cash flow MONTHLY CASH FLOWS

ANNUAL BUDGETS AND SERVICE DELIVERY AGREEMENTS – ENTITY (a) The entity

The municipality established the municipal unit CENTLEC (SOC). ii) The municipality has entered into a service provision agreement (SDA) and a business sale agreement (SBA), and the SDA expressly states that the said agreement "shall come into force on the effective date and, subject to clause 42, shall be valid for an indefinite period, unless will be replaced by national legislation" SDA Clause 8;. iii). Electricity services for communities, electricity reticulation and electricity infrastructure maintenance;. iv) The duration of the Service Delivery Agreement (SDA) is still in effect. The municipal entity is wholly owned by the city;. ii) The city has established a board of directors that will oversee the activities of the municipal entity on behalf of the municipality.

A political and administrative representative of the city sits on Centlec's board to protect the shareholder's interests. iii). The municipal entity's primary mandate is to provide electricity services to local communities, reticulate electricity and maintain the electricity infrastructure. iv). The financing of the municipal unit comes from the sale of electricity and subsidies received from the Ministry of Energy for electrification.

MAN Mangaung - Supporting Table SA31 Aggregated entity budget

CONTRACTS HAVING FUTURE BUDGETARY IMPLICATIONS

MAN Mangaung - Supporting Table SA32 List of external mechanisms

Monetary value of agreement

Service provided

Expiry date of service delivery agreement or

105 13. CAPITAL EXPENDITURE DETAILS

MAN Mangaung - Supporting Table SA34a Consolidated capital expenditure on new assets by asset class

MAN Mangaung - Supporting Table SA34b Consolidated capital expenditure on existing assets by asset class

MAN Mangaung - Supporting Table SA34c Consolidated repairs and maintenance by asset class

MAN Mangaung - Supporting Table SA35 Consolidated future financial implications of the capital budget Vote Description

Present value Capital expenditure

MAN Mangaung - Supporting Table SA36 Consolidated detailed capital budget

FOAM BRANCH COMPLETE WITH

1 COMPLETE RESCUE PROTOCOL

SELF CONTAINED BREATHING

115 PLANNING

REDEVELOPMENT OF HOFFMAN

IMPLEMENTING USER REQUIREMENT

UPGRADING OF STREET

ROAD 6 (PHASE2): UPGRADING OF

BATHO: MSIMANS ST: UPGRADING OF

BATHO: PANYNE ST: UPGRADING OF

BATHO: THEMA ST: UPGRADING OF

BATHO: MAGANO ST: UPGRADING OF

BATHO: COOK AVE: UPGRADING OF

BATHO: KB 1 (MAN RD 1204)

BATHO: MATLI ST: UPGRADING OF

BATHO: KOTSI RD: UPGRADING OF

BATHO: GONYANI ST: UPGRADING OF

BATHO: MOOKI ST: UPGRADING OF

BATHO: THEMA 1 ST: UPGRADING OF

BATHO: MAKHOLISO ST: UPGRADING

BATHO: MOLOKANE ST: UPGRADING

BATHO: THEMA ST 2: UPGRADING OF

BATHO: THEMA ST 3: UPGRADING OF

BATHO: ROAD 42: UPGRADING OF

BATHO: ROAD 39: UPGRADING OF

BATHO: ROAD K13: UPGRADING OF

BATHO: ROAD 68: UPGRADING OF

BATHO: THA RD 2029: UPGRADING OF

BATHO: THA RD 2044: UPGRADING OF

BATHO: THA RD 2031: UPGRADING OF

ABDURAMAN: UPGRADING OF STREET

BOGACH ST: UPGRADING OF STREET

MAN RD 164: UPGRADING OF STREET

MAN RD 165: UPGRADING OF STREET

MAN RD 166: UPGRADING OF STREET

MAN RD 168: UPGRADING OF STREET

MAN RD 225: UPGRADING OF STREET

MOCHOCHOKO ST: UPGRADING OF

MOHLOM ST: UPGRADING OF STREET

MOMPATI ST: UPGRADING OF STREET

NTHATISI ST: UPGRADING OF STREET

UPGRADING OF

UPGRADING OF

UPGRADING OF

REGISTRATION) 801432 Yes INFRASTRUCTURE TRANSMISSION AND RETICULATION N. EXPANSION AND UPGRADING OF THE 11KV BOVENHOKE NETWORK IN THE. SUBSTATION 801432 Yes INFRASTRUCTURE TRANSMISSION AND RETICULATION 5,000 27 N. BOTSHABELO: 132KV LINE FROM DC AROUND WESTERN SIDE TO SOUTH.

REPLACEMENT OF LOW VOLTAGE

REPLACEMENT OF BRITTLE

UPGRADE AND REFURBISHMENT OF

REPLACEMENT OF DECREPIT

REPLACEMENT OF 110V BATTERIES FOR EAST YARD,

WESTDENE,MANGAUNG B, MARK,

REPLACEMENT OF 11KV

REMEDIAL WORK 132KV SOUTHERN

TEMPE DC: 11KV PRIMARY CABLES FROM DC TO VAN BLERK PRIMARY

132KV NORTHERN RING FROM

- PROJECTS DELAYED FROM PREVIOUS FINANCIAL YEAR

- LEGISLATION COMPLIANCE STATUS

- In Year Reporting

- Internship Programme

- Budget and Treasury Office

- Audit Committee

- Risk Management

- Service Delivery and Implementation Plan

- Annual Report

- Property Rates Act

The municipality participates in the Municipal Financial Management Internship program and has employed twelve (12) interns who are undergoing training in various sections of the Financial Services Departments. The detailed SDBIP document is at a draft stage and will be finalized after approval of the 2014/15 MTREF in May 2014. Annual report for the 2012/13 financial year is compiled in terms of the MFMA and National Treasury requirements and is tabled in Council laid on March 5, 2014.

MAN Mangaung - Contact Information A. GENERAL INFORMATION

Street address

General Contacts

Speaker

Municipal Manager

Chief Financial Officer

Official responsible for submitting financial information

Secretary/PA to the Municipal Manager

Secretary/PA to the Chief Financial Officer

Secretary/PA to the Speaker

MANAGEMENT LEADERSHIPB. CONTACT INFORMATION

POLITICAL LEADERSHIP