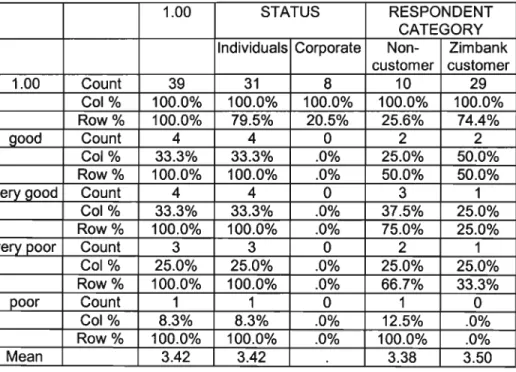

The introduction of new products and the renovation of branches would also strengthen the bank's image. Table3a Rating of company performance in customer service during the pre-renovations era 80 Table3a1 Rating of company.

I LIST OF FIGURES

EXECUTIVE SUMMARY

CHAPTER ONE

- Introduction

- Background of the research

- Motivation for the research

- Value of the project

- Problem statement

- Objectives of the study

- Hypothesis 1

This study will determine ZIMBANK's profits and losses during the period 1995-2003 as a result of new product launches. This research seeks to determine the impact of new products on customer attitudes towards Zimbank, i.e. whether the image of the bank has improved.

1. 7 Research methodology

- Data Collection

- Limitations of the Study

- Structure of the study

- Timetable

- Summary for Chapter 1

This chapter covers the general background of the research, statement of the problem, summary of the methodology used, objectives and ends with the organization of the study. The motivation for research, the value of the project as well as the goals of the study.

CHAPTER TWO

LITERATURE REVIEW 2.0 Introduction

Market segmentation and targeting

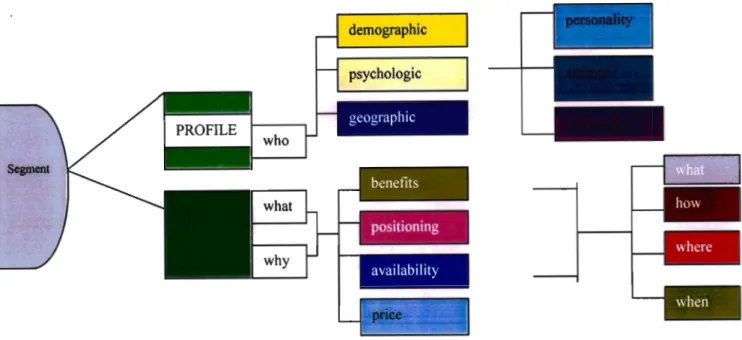

Market segmentation helps in learning and determining with whom the organization wants to have a relationship. Zimbank, as a service provider has a greater ability to personalize service offerings in real time, hence the reason why they have practiced market segmentation and targeting.

Market segment size and growth

- Variables used to segment the market Two main variables are generally used

- Advantages of market segmentation

- Dynamics of market segmentation

Market segmentation isn't about trying to convince some faceless crowd of customers to see things the way you do. Market segmentation describes the division of the market into homogeneous groups that will respond differently to promotions, communications, advertising and other variables of the marketing mix.

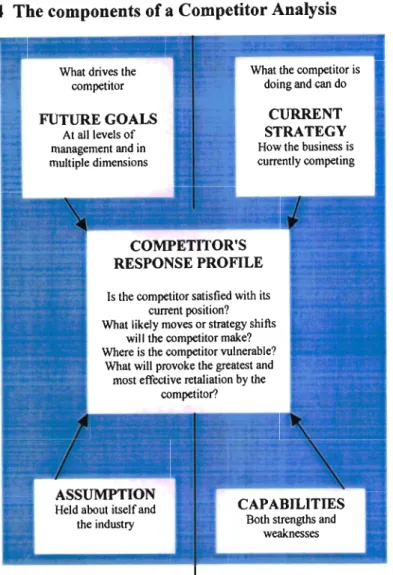

Five forces that determine the long run attractiveness of a market segment

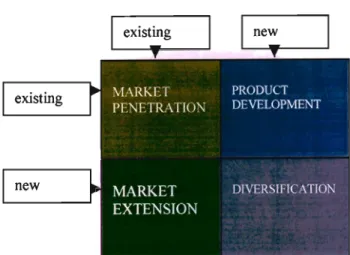

Market penetration can occur with existing products or by developing new products for those unserved markets. Consequently, banks must plan strategies that are appropriate for each stage of the product life cycle.

Managing differentiation

- Personnel differentiation

What the customer expects is called the primary service package, and secondary service features can be added to this. At Zimbank, various such secondary service functions like TV in the banking halls, packing slips for executive customers, different check books for executive customers as well as personalized diaries and pens for these executive customers. Many organizations are using the web to offer secondary service features that were never possible before.

All banking halls have been renovated to give a welcoming appearance and look more spacious. Televisions have been installed in all banking halls to prevent boredom and at the same time promote products. The banking halls now consist of two areas, one serving regular customers and the other with seating areas, coffee mugs, coffee makers, cookies, cakes, a steward and refrigerators with drinks for Executive customers.

In order for banks to be able to offer these services to the best of their abilities, it is necessary to constantly learn to stay ahead of the times and customers.

Customer Relationship Management

Now that technology has changed at a faster pace, customer training has remained essential. Customer advisory refers to the data, information systems and advisory services that the seller offers to buyers. Better trained personnel exhibit six characteristics which include, competencies, required skills and knowledge; politeness, with refers to kindness, respect and considerateness; credibility, is to be trustworthy;.

CRM as competitive tool

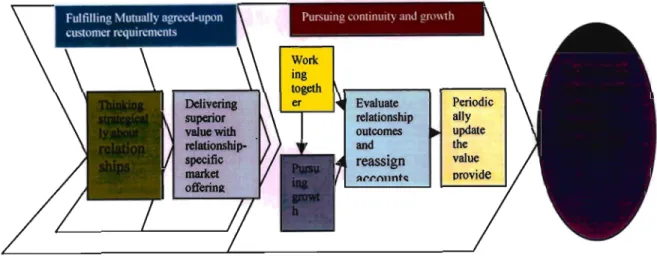

Keith Thompson, Lynette Ryals & Simon Knox from Cranfield University argue that CRM requires a reorganization of the entire bank around its customers. They state that the purpose of CRM is to integrate marketing, sales and service functions throughout. In fact, a pragmatic view of CRM is that a financial institution should be able to sell all its products to its customers during their lifetime, also called life cycle marketing.

However, in their paper (Strategic Framework for CRM 2001), Patrick Sue and Paul Morin argue that it is customers, not products and services, that create shareholder value. What traditional thinking previously failed to take into account is that shareholder value is determined almost entirely by the types of customers a company attracts. And since customers are not equally profitable, shareholder value is determined almost entirely by the types of customers an institution attracts.

Customer attributes that are important to the enterprise are current profit, future profit - lifetime value, product holdings, customer share - share of portfolio, customer loyalty, likelihood of repeat purchase.

- New Products, Quality Management and Customer Care

- Customer Service

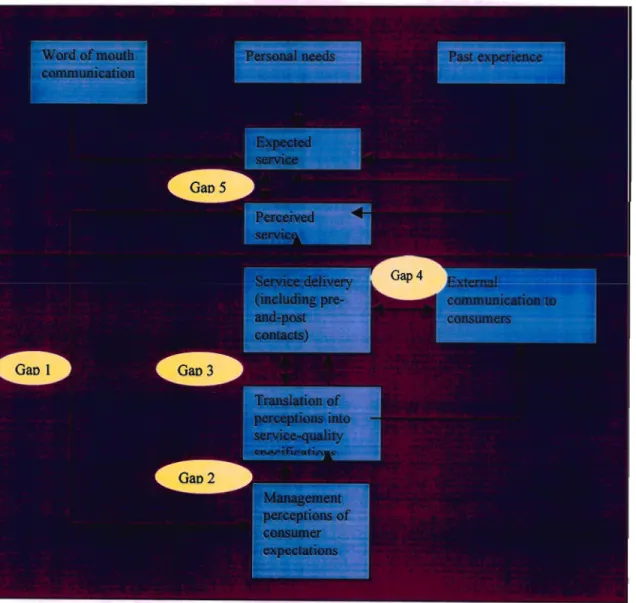

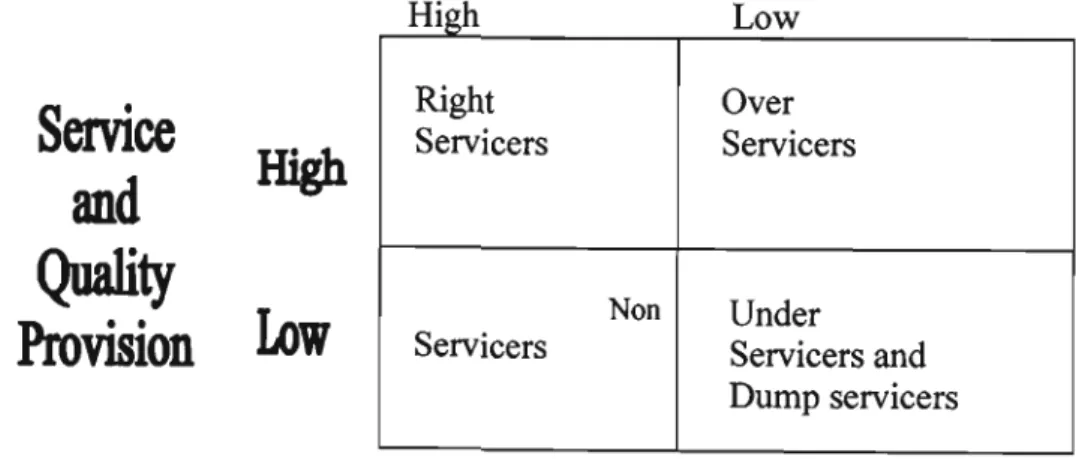

Gerson (1992) described customer service as all the activities that the business and employees perform or carry out to satisfy customers. Lovelock (1991:p.263) defined customer service as 'a task other than proactive selling, involving interactions with customers in person, by telecommunications or by mail. Customer service should be considered a strategic issue because it has a direct link to profitability through customer retention.

He suggested that customer service begins well before the product is delivered and ends well after the delivery. Customer service can be used as a way to differentiate an organization's product or service from competitors, especially if the products are generic. Gerson (1992) has devised a seven-step approach to a successful customer service system that can be very useful.

Which essentially shows the need for management commitment for the effective implementation of a customer service system.

TRANSFORM THE VOICES OF CUSTOMERS INTO PRODUCT DESIGN

DIFFERENTIATE CUSTOMER IN

2. 8 Summary for Chapter 2

BIBLIOGRAPHY References

- RESEARCH METHODOLOGY

- Introduction

- Objectives of the study

- Target Population

- Sampling

- Research Instruments Used

The questionnaire is designed with the purpose of finding out information stated in the research objectives. Although the target respondents in this study were individuals with access to telephones, the cost of conducting a 30-minute questionnaire would have been prohibitive. Shortening the questionnaire to suit telephone interviews would have led to the loss of vital information.

Therefore, the method was set aside based on the preferred length of the questionnaire. Semi-structured, structured and open-ended questions were used in the questionnaire to ensure that individual responses were obtained in an easily interpretable manner in support or opposition to the stated research questions. A significant portion of the questionnaire was multiple-choice and respondents were limited to choosing from a set of alternatives.

The questionnaire was pre-tested before the actual survey and some corrections/additions were made to improve understanding and terminology consensus.

The Research Question

To overcome these problems in actual fieldwork, the researcher developed a comprehensive self-presentation to make it easier for respondents to answer even sensitive questions. Some questions that seemed difficult to understand were reworded or framed to make them more understandable and responsive. It was also important to measure the level of knowledge among the respondents to ensure that the questions did not cover areas of which they had no knowledge.

Question response Format

Wording of Questions

All questions focus on the issue under study and they are specifically formulated to answer the same aspects of strategic management. The wording of such questions was carefully studied to ensure that no leading questions were included. Leading questions can result in answers that are preferred by the researcher according to the respondents.

The section approach was used to arrange the questions, that is, questions dealing with the same issue were listed together. To highlight the groups, some questions were divided into subsets, for example (a) and (b). This allows respondents to focus on a single issue at a time, thereby reducing questionnaire administration time.

Questionnaire Structure

- Data Gathering

- Data Analysis

- Conclusion

- Summary for chapter 3

- RESULTS AND DISCUSSION

- Introduction

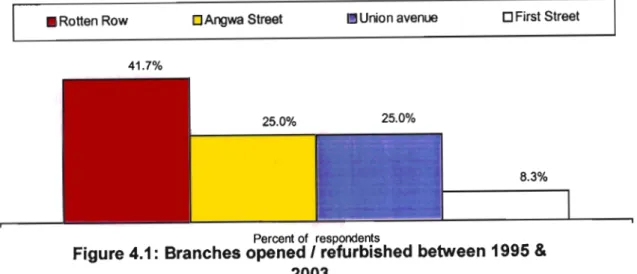

- New products & branch refurbishments (Appendix 11, Tables 1-2)

- The pre versus the post refurbishment/new products era (Appendix 11, Tables 3a-3hl)

- Evaluating new products / branch refurbishments (Appendix 11, Tables 4a-4d)

- Impact of new products/refurbishments on key indicators (Appendix 11, Tables 5a-)

- Summary for chapter 4

Insurance was also said to be some of the new products introduced during the period (10%). Respondents were asked to state whether, in their opinion, new products and branch renovations are effective in attracting new customers and retaining existing ones. Figure 4.3: About new products I-department renovations are effective in attracting new customers and retaining existing ones.

It is also said that the introduction of new products and the renovation of branches improves the image of the bank (10%). Half of the respondents were convinced that the renovation of branches and new products are very effective in increasing profitability and market share. Overall, almost three-quarters of respondents therefore had confidence in the ability of new products to increase profitability and market share.

Respondents were asked to indicate the impact of new products and branch innovations in terms of how ZIMBANK does business with them by focusing on the key words.

CHAPTERS

CONCLUSION AND RECOMMENDATIONS

- Introduction

- Conclusion

- Hypothesis 1 confirmed

- Recommendations

- Suggestions for Further Research

- Summary for chapter 5

But there were also those who did not believe in new products and branch renovations. According to them, most of the new products are useless and it would be better if new branches were opened in rural areas. Overall, most respondents were confident in the ability of new products to increase profitability and market share.

The research has proven that the new products introduced and branch renovations in Zimbank have had a positive impact on the institution's performance. Almost three-quarters of respondents claimed that new products and renewals are effective because customer choice has increased and that simply by introducing new products, the company shows an image of great customer focus. ZIMBANK should continue with the strategy of introducing new products and renewing branches, if this is found to result in greater profitability and market share.

When new products are introduced, the bank should implement a promotional program to inform current and potential customers about the products.

APPENDICES

QUESTIONNAIRE

GRADUATE SCHOOL OF BUSINESS UNIVERSITY OF NATAL

Questionnaire

APPOINTMENT LETTER

I am writing this letter to book an appointment to come and see you at your premises on Monday 21st July 2003. The matters I would like to discuss are regarding the changes that have taken place in Zimbank which you have put new since 1995 and how these have influenced the bank's success. Changes can be new products that are developed, interior decorations, changes in segments/classes that are served or any other.

Please call the undersigned if you have any objections to the time or date.

TABLES

Q3a: Do you think that new products and branch renovations are effective in attracting new customers and retaining existing ones. Q3b: Reasons to say that new products and branch remodeling are effective in attracting new customers and retaining existing ones. Q3b: Reasons to say that new products and branch remodeling are not effective in attracting new customers and retaining existing ones.

Q4a: Are new products and branch renovations effective in improving Zimbank's profitability and market share.