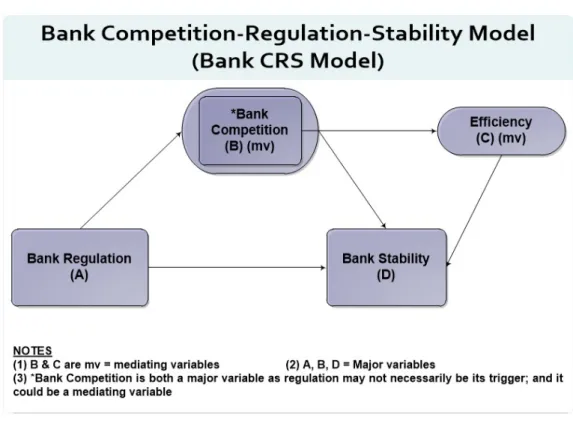

This study examined the relationship between competition, regulation and stability in commercial banks in sub-Saharan Africa. Hence the agitation to draft policies that will increase competition in the banking sectors in the region.

Background of the Study

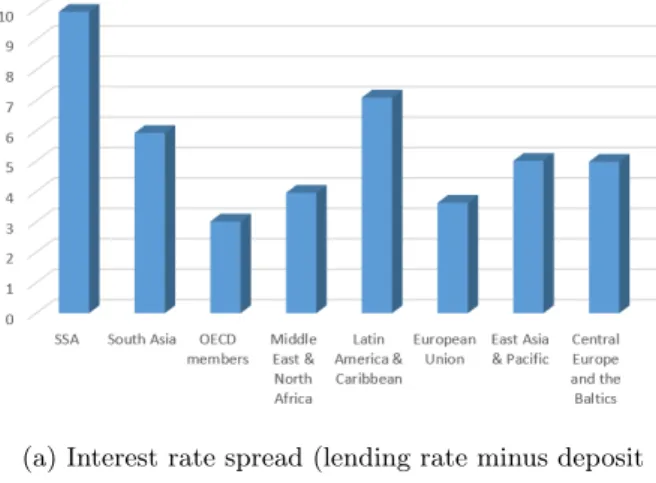

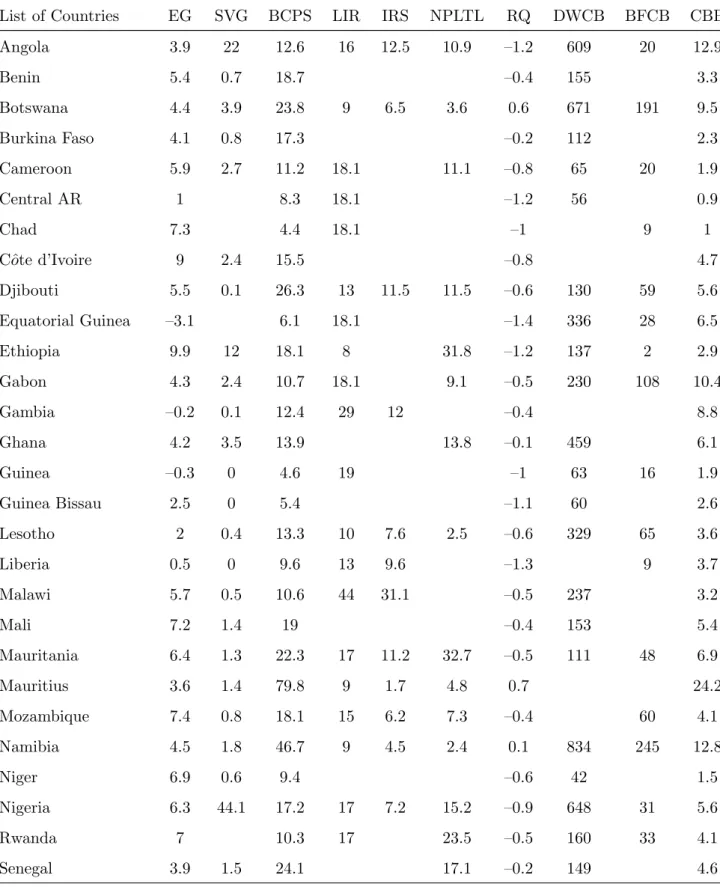

In addition, most banking sectors are relatively small and characterized by low loan-to-deposit ratios. Banking sectors in SSA are well capitalized, with most banks having a capital base exceeding the 10% minimum capital adequacy ratio (CAR).

Statement of the Problem

However, the desirability of a competitive banking system must consider the trade-off between competition and stability, as excessive competition and deregulation are to blame for recent financial crises (Fu et al., 2014). It tests the relationship between competition and stability in SSA banking sectors and analyzes the role of regulation in implementing competition and stability in banks.

Aim of the Study

Research Questions

Research Hypotheses

The competitive stability view expects that effective competitive banking will bring stability. Due to the underdeveloped and less sophisticated nature of banking systems in the SSA region, the study does not predict an efficient banking system and as such supports the view of competitive fragility.

Scope/Delimitation of the Study

Most of the work on these models has been done in developed economies where banks are highly developed and sophisticated. Third hypothesis: The main reason for reforms or regulations in the banking sector is to promote competition and ensure the stability of the banking system.

Research Contributions

Description of Study Concepts

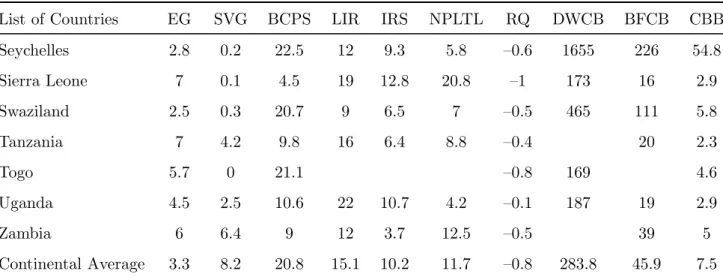

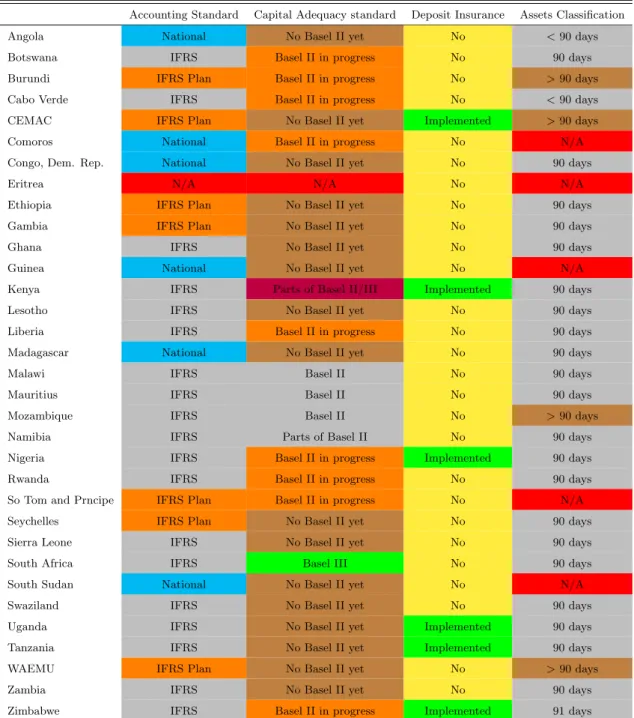

So Tom and Principe plan IFRS Basel II in progress No data. Seychelles IFRS Plan No Basel II yet No 90 days. South Sudan National Not Basel II yet Not N/A. Swaziland IFRS No Basel II yet No 90 days.

Underpinning Theoretical Review

The failure to measure behavior in the PKS has been identified as the main weakness of the structural model. On the contrary, competition-stability theory emphasizes the possible positive effects that competition has on the stability of the banking system.

Structure of the Thesis

Introduction

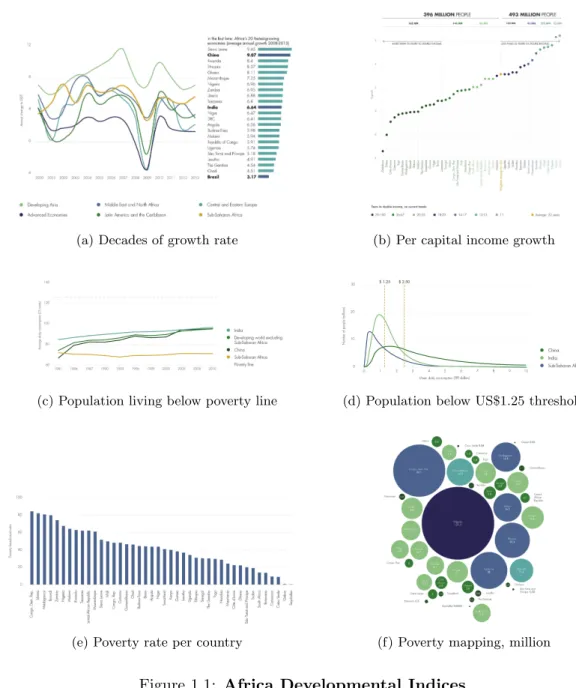

As a result, the region lags behind its global peers in terms of financial depth and access. This growth was mainly supported by rising commodity prices, as most countries in the region are endowed with natural resources (IMF report).

Banking Sector by Country

The banking sector is dominated by five largest banks that hold more than 79% of total banking sector assets. The way this plays out will affect the banking system in the near term. The banking sector is open to foreign competitors as seven out of nine commercial banks are foreign-owned.

The banking sector is also concentrated with three largest banks accounting for 54% of total banking assets.

Summary

Introduction

The strength of these reforms has been the opening of the financial system to competition to create a strong banking system that is capable of exploiting the region's potential for economic growth (Senbet & Otchore, 2006). The essence of this chapter is to research the competition of the commercial banks of the KLSH1 and to take into account the drivers of competition at the bank level. 1 Commercial banks account for more than 70% of the region's banking sector Allen, Otchore and Senbet (2011).

This regional analysis of competition at the banking level is particularly necessary due to the increasing aspirations for regional integration.

Review of Literature

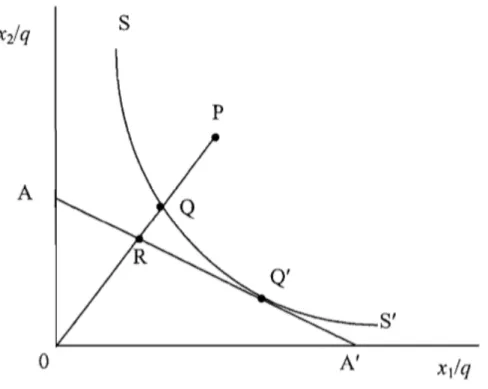

They see competition as a complex process of rivalry between firms and relate the essence of competition to the behavior of firms in the market. The threat of potential competition guarantees an efficient banking system, regardless of the existing players in the market (Dietsch, 1993). This corresponds to the number of banks in the industry which react to variables such as competition and.

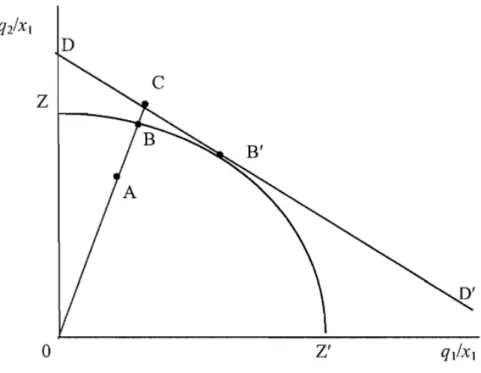

SCP assumes that competition affects performance, therefore the degree of bank concentration in the market affects the competitive position of banks.

Methodology

This study adopts the Lerner index because it is one of the two most superior competitive measures among its contemporaries, following the outcome of the correlation of all indicators by Liu et al. Furthermore, it has been argued that the index ignores the risk that a large portion of the costs of banks and that the associated effect would mean an inflated index (Tan, 2013). The model for estimating the determinants of the competitive position of the commercial SSA banks is based on the general method of moments of Arellano and Bond (1991) and Arellano and Bover (1995), modeled in subsection 4.3.1 in Chapter 4.

Our most important variable for competition in the SSA region's commercial banks is bank size.

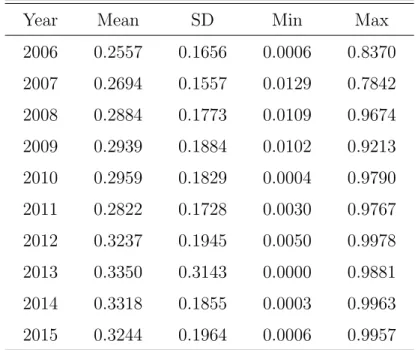

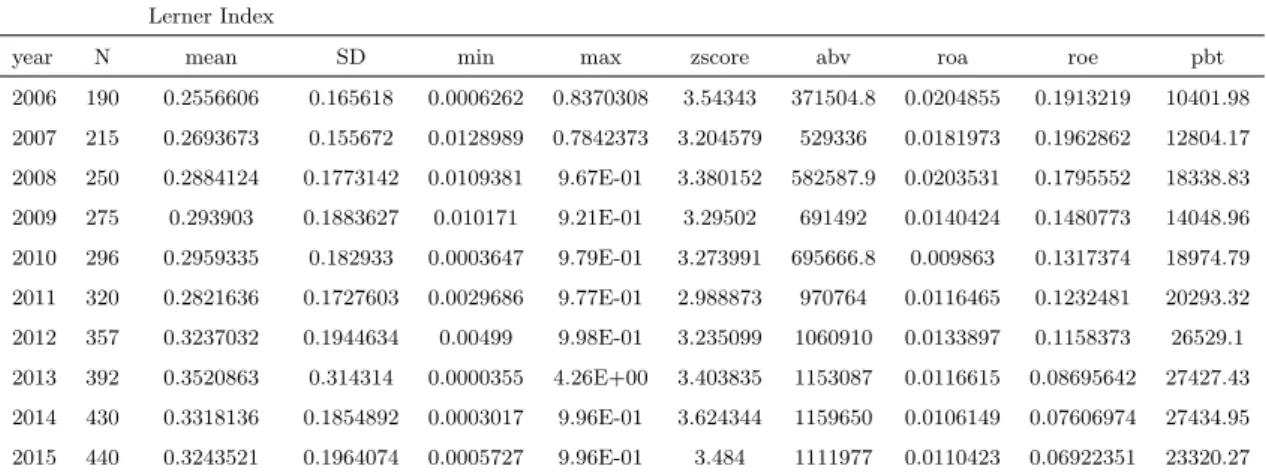

Empirical Results

This is followed by the regression results of the determinant of competition in the commercial banking sectors of the SSA region in Table 3.4. The results show that the economic impact of bank size on competitive conditions is significant. Finally, GDPG and INF prove to be positive and of great importance in determining competition in the banking sector of the SSA region.

For example, a monopolistically competitive commercial banking sector in Tanzania shows an improvement in the competitiveness of the country's banking sectors.

Summary

Introduction

Financial systems in the KLSH region are dominated by the banking system, which is also immature. Given that competition in the banking system has the potential to stimulate other sectors of the economy, to increase access to finance that can stimulate economic growth in the region, there was a debate about increasing competition in this sector. This is the gap that this study aims to fill in addition to investigating the implication of increased competition for stability in the region.

2014) provided evidence that the recent financial crisis is a problem of excessive competition in the banking system.

Literature Review

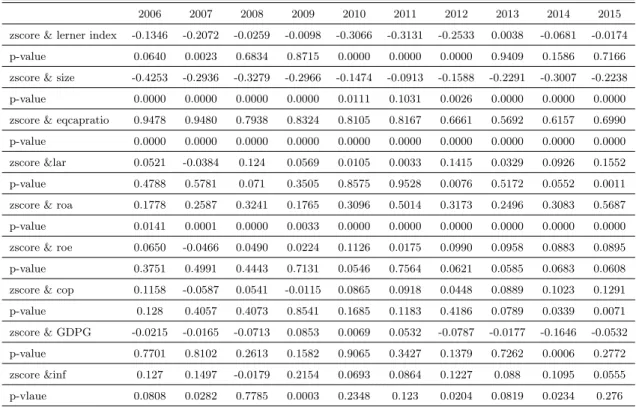

They found a non-linear relationship between competition and stability using Zscore, NPL and equity ratio as a measure of stability and Lerner index as a measure of competition. They found that competition encourages a high level of capital, implying a positive relationship between competition and stability. They found that the nature of the financial institution determines the type. the relationship that exists between competition and stability.

Theories have suggested a potential trade-off between competition and stability in the competition-stability relationship.

Methodology

The implementation of the regression of the relationship between competition and stability in the commercial banks in the SSA region is done using the Generalized Method of Moments (GMM) regression. Here we assume that the relationship between competition and stability of the commercial banks in the SSA region takes the following general form of a linear dynamic panel model; In the view of Griliches and Mairesse (1995), the first differentiating transformation can remove the individual effects.

We use the Z Score of Roy (1952) as a measure of the stability of the SSA region's commercial banks.

Empirical Results

But in the case of the relationship between competition and the equity ratio, the relationships during the study periods are strong, positive and significant, indicating that a very sound capital base is consistent with the stability of the banking system. In other words, the more competitive the banking system is, the worse the stability of the banking system. This confirms the fact that the perception of corruption has a signaling effect on the stability of the banking system in the region as the data suggest a more improved perception during the periods under review.

Liquidity is found to pose a major threat to the stability of the banking sector in the region.

Summary

This again may have contributed to the stability experienced in the banking sectors in the region. In terms of validity, our result meets the various requirements of regression models as shown in Table 4.4. This is a departure from the results of Moyo et al. 2014) that found otherwise in the SSA region and other studies done elsewhere in the world.

Based on these findings, we recommend that policymakers exercise caution in designing policies aimed at increasing competition in the region.

Introduction

In this study, the role of competition in the financial stability of the SSA region is examined by estimating a panel analysis of 37 SSA countries. Although our foci differ, these inconsistencies have been found in most studies worldwide (Liu, Molyneux, & Wilson, 2013a; Marques-Ibanez et al., 2014; Schaeck & Cih´ak argued that such inconsistent results are the relationship between competition and stability makes interpretation and policy action very difficult.This issue becomes important as the SSA region seeks a competitive banking sector to fuel the region's economic growth (Watkins, 2014).

However, our instrument of competition provides evidence to support the competition-stability view as found by Moyo et al. 2014) given that the result of the SFA reveals a marginal efficiency in competitive efficiency ratio.

Literature Review

Thus, the three contrasting theories of the efficiency structure hypothesis conclude a negative relationship between competition and efficiency. In other words, an increase (decrease) in inputs leads to the same proportional increase (decrease) in output. Previous application of the theories linking competition and efficiency in banking has encountered competing interpretations of the relationship between concentration and profitability.

Casu and Girardone (2006) analyzed the relationship between competition and efficiency in the European banking market for the periods 1997-2003 and concluded in favor of the quiet life hypothesis.

Methodology

Bank efficiency is measured by the distance between the margin and the specific bank's profit before tax. From this, we can measure bank inefficiency as the distance between the margin and the bank's specific income before tax. The essence of the unconstrained model is to measure the unconditional inefficiency of banks.

Based on the two inefficiency estimates, the benefit due to the impact of competition can then be measured by subtracting the inefficiency of the unconstrained model from the constrained model, i.e.;

Empirical Results

Our argument is that an efficient competition should increase the stability of the banking system. Therefore, we found consistency with Schaeck and Cih´ak (2014) of a possible transmission from competition to efficiency and then to stability in the banking system of the KLSH region. The results of the over-identification test and the serial correlation tests are presented as appendices to the GMM results in Table 5.4.

Similarly, Table 5.4 shows the acceptance of the null hypothesis at order two, which is the system estimator step used for the GMM estimation.

Summary

Efforts must also be made to come up with complementary monetary and fiscal policies to maintain and enhance current gains.

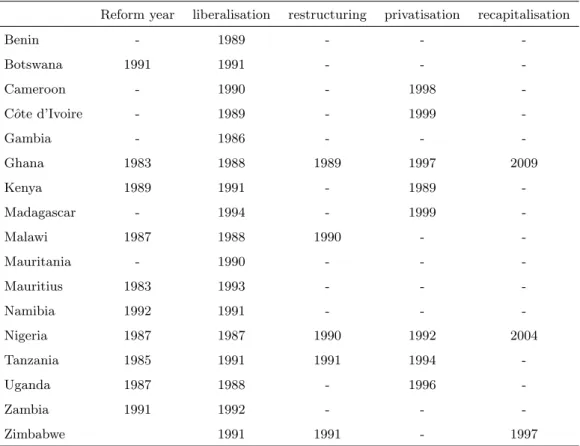

Introduction

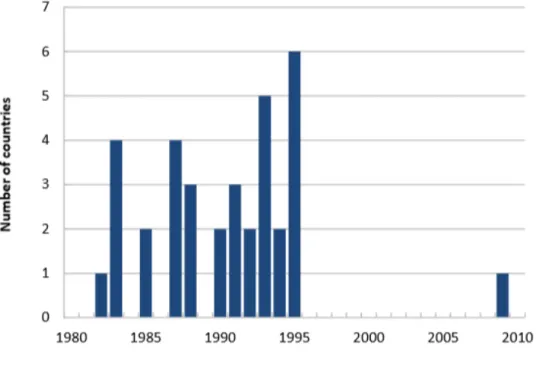

Meanwhile, in an earlier study of some banking sectors in the SSA region, Mlachila, Dykes, et al. 2013) provide evidence to show that reforms in the SSA region reduced the number of systemic crises seen in the region from 1980 to 2010. This was corroborated by Moyo et al. 2014) who found that financial liberalization in the territories had a positive impact on the stability of the system. As seen in the previous chapters of this study, a considerable amount of work has been done on the competition and stability relationship, including the possible trade-off between them, but the dilemma still exists on how to manage this important aspect of the financial system.

We found evidence to support the relationships between these three phenomena in the commercial banks of the SSA region.

Literature Review

In the following subsection, some of the empirical evidence on the role of regulation and how some factors other than competition affect the stability of the banking system are highlighted. Other studies concluded that competition is not itself the cause of instability in the banking sector, but rather the opposite. the uniqueness of the system itself. Ghanaian banking sectors have also recently been recapitalized starting in 2009 in the wake of the 2007-09 financial crises.

It should be noted that reforms in the banking sector are an ongoing phenomenon and only a few have been cited to highlight some of the efforts in this regard.

Methodology