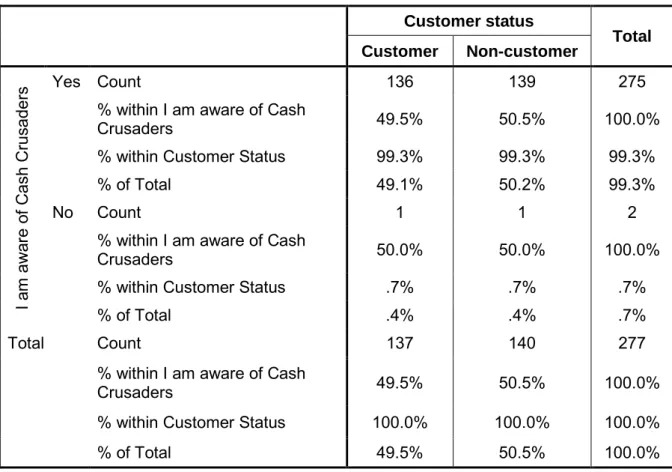

Private label products were introduced by Cash Crusaders to offer a budget alternative of value to customers. The survey also received responses from both customers and non-customers about whether they knew about the private label range.

List of Tables

List of Definitions

List of Acronyms and Abbreviations

CHAPTER ONE

OVERVIEW OF THE STUDY

- INTRODUCTION

- MOTIVATION FOR THE STUDY

- FOCUS OF THE STUDY

- PROBLEM STATEMENT

- OBJECTIVES AND RESEARCH QUESTIONS The objectives of this study were the following

- AIM OF THE STUDY

- LIMITATIONS OF THE STUDY

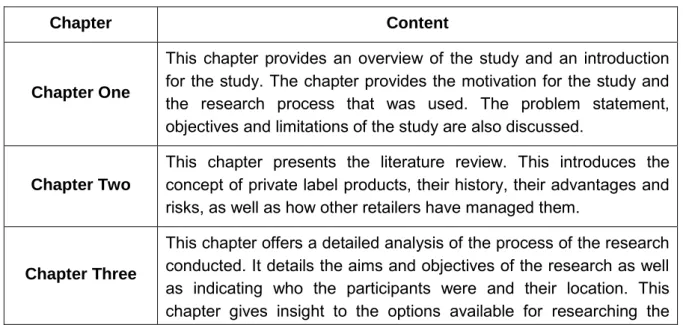

- OUTLINE OF THE STUDY

- SUMMARY

To identify whether customers are aware of the private label brands sold by Cash Crusaders. What is the profile of Cash Crusaders private label customers in the Western Cape.

CHAPTER TWO

LITERATURE REVIEW

INTRODUCTION

BACKGROUND

Shoprite Checkers private label “Ritebrand” has taken a similar stance of simple and no frills (Shoprite, 2013). Spar also has its own brand products, which are self-titled “Spar” brand products (Spar, 2013).

HISTORY

To affirm their stance on the quality of their products, Spar's private label products offer a double money back quality guarantee as a mark of quality (Spar, 2013). Pick n Pay, on the other hand, has three categories in their private label range, which appeal to three different markets.

THE ADVANTAGES OF PRIVATE LABEL PRODUCTS

Well-known names in the private label industry are Tesco and Costco, companies that are at the forefront of introducing private labels into their business model. The author further stated that a combined effort of innovative marketing and creative packaging gave new life to the appeal of private label products (Van-Wyk, 2012b).

THE NEED FOR PRIVATE LABEL PRODUCTS

Smarter consumers, bargain hunters, restrictive economic conditions, among others detailed above, have created an environment that encourages an increase in demand for private label products (Van Wyk, 2012a). Arnold stated that 72% of South African shoppers identify private label products as a suitable shopping alternative.

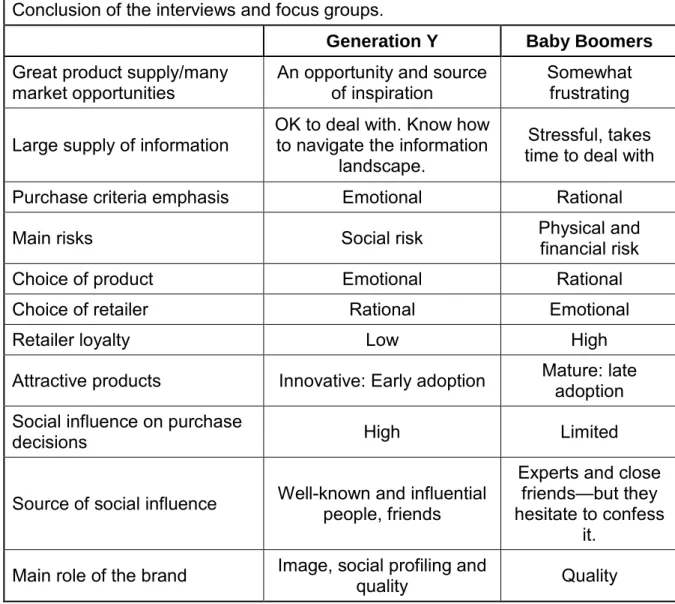

RESISTANCE TO PRIVATE LABEL BRANDS

Product packaging is traditionally of a slightly lower quality to save costs (Halstead & Ward, 1995). The price of the product in the fourth generation does not affect the purchase decision as these products are different.

RISKS IN PRIVATE LABEL PRODUCTS

- Functional risk

- Financial risk

- Social risk

- Physical risk

- Time risk

- Psychological risk

- Risk reduction mechanisms

This can be through physical damage through the use of the product through fires, explosions, poisoning and the like (Beneke et al., 2012). 1996 cited in Beneke et al., 2012) mentioned that risk is a barrier when customers decide to buy private label products.

MAINTAINING COMPETITIVE ADVANTAGE ON PRIVATE LABEL GOODS

2012) states that risk mitigation measures are necessary to change consumer uncertainty when making a purchasing decision. This can be done using a variety of methods, namely samples, routes, money back guarantees, installations, informative packaging, instruction manuals, informed staff, brand awareness through advertising and promotions, store image improvement, purchasing from a major manufacturer, promotion of product quality and quality position and investing in research and development to improve products (Beneke et al., 2012).

PACKAGING

According to Shires (2012), in many cases the packaging of private label products mimics national brands, potentially confusing the customer. Venter et al. (2011) explain that the consumer forms an idea about the product from the information on the packaging and often scrutinizes the packaging in order to reduce possible doubts about the private label product.

STORE IMAGE

Beneke and Fieldings (2006 cited in Beneke, 2009) cited that packaging can help build the private label brand; it has a longer lasting feeling in the mind of the consumer and provides a freshness that can be used to eclipse manufacturer brands. According to Beneke (2009), product packaging is a strong medium of communication and is known to reach all customers within a category.

SHELF SPACE

Private label brands that intend to lead their brands must take a stance that speaks to “A voice that transcends the shelf, and they must have a personality that transcends mere price.” This implies, by extrapolation, that when retailers stock private label products of a particular class, the atmosphere and positioning of their store brand should be one of savings and quality at discounted prices (Henry, 2012).

MARKETING PRIVATE LABEL BRANDS

By sharing the brand story with customers in a way that emotionally connects them to the product, retailers are able to attract customers (Van Wyk, 2012a). This is similar to product merchandising at the store level, as mentioned in the discussion of shelf space (Beneke et al., 2012). This is a better tool for generating private label brand value when considering budget implications and advertising effectiveness.

To facilitate a stronger brand presence for the private labels, retail marketers should consider joint category management of the brands that the retailer sells.

OPPORTUNITIES FOR PRIVATE LABELS

SUCCESSES OF PRIVATE LABELS

STORE LOYALTY

PRIVATE LABEL BRAND EQUITY

The number of consumers becoming part of the private label following has already started to increase. The authors further stated that there are opportunities within categories that allow for building brand equity differentiation. Private label products for which the perceived risk is higher require an increase through brand capitalization.

These are often linked through pricing and communication of the product to initiate the experience (Cuneo et al., 2012).

CONCLUSION

As customers have expressed their reluctance to switch brands in certain categories, brand equity varies accordingly in certain categories. Conversely, lines that have no room for differentiation would challenge the growth of private label brands.

CHAPTER THREE

RESEARCH METHODOLOGY

- INTRODUCTION

- RESEARCH DESIGN

- Quantitative

- Mixed methods

- Adopted methodology

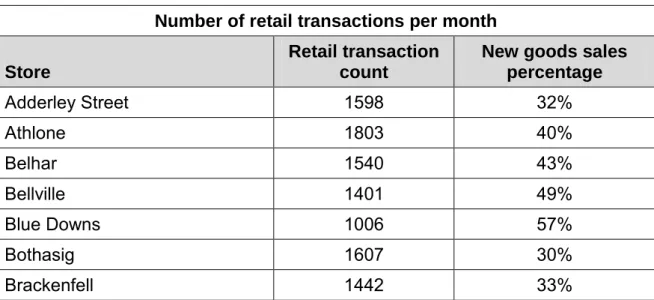

- PARTICIPANTS AND LOCATION OF THE STUDY

- APPROACH

- POPULATION AND SAMPLE

- DATA COLLECTION STRATEGIES

- Description and purpose

- Construction of the instrument

- Reliability and validation

- Pretesting

- Administration of the questionnaire

- ANALYSIS OF THE DATA

- SUMMARY

How often do they exhibit certain behaviors?” This type of survey requires a random sample of the population (Sukamolson, 2007). The questionnaire is designed to better understand the type of customer who has shopped at Cash Crusaders within the 12 months prior to the date of the questionnaire. The questionnaire was designed to identify customer views of the private label range available at Cash Crusaders in terms of quality and risks associated with purchasing private label products.

Section B ascertained whether respondents were aware of the private label range and classified customers and non-customers, who are those who have purchased a private label product within the last 12 months.

CHAPTER FOUR

STATEMENT OF FINDINGS, EXPLANATIONS AND DISCUSSION OF PRIMARY DATA

INTRODUCTION

THE SAMPLE

THE RESEARCH INSTRUMENT

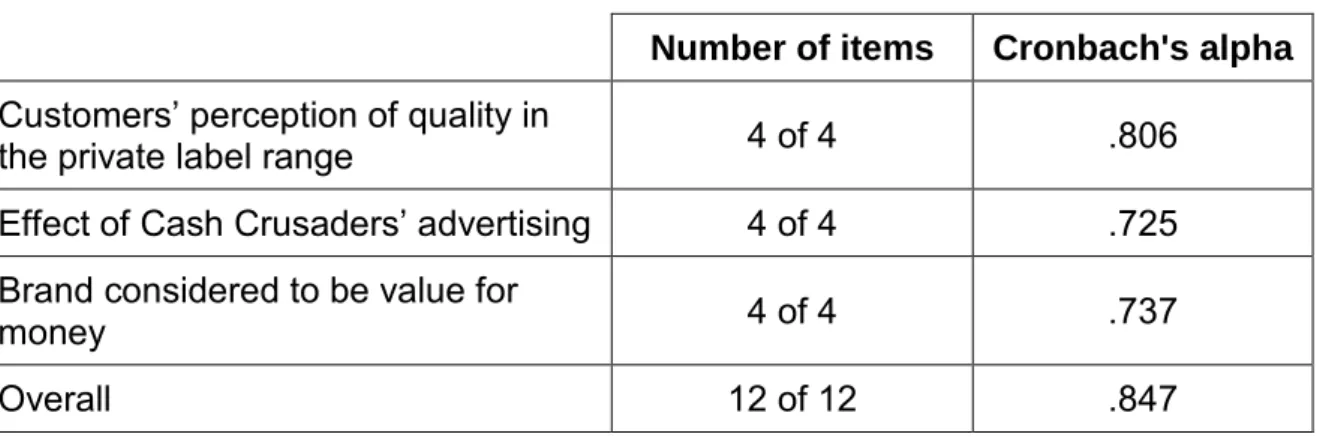

RELIABILITY STATISTICS

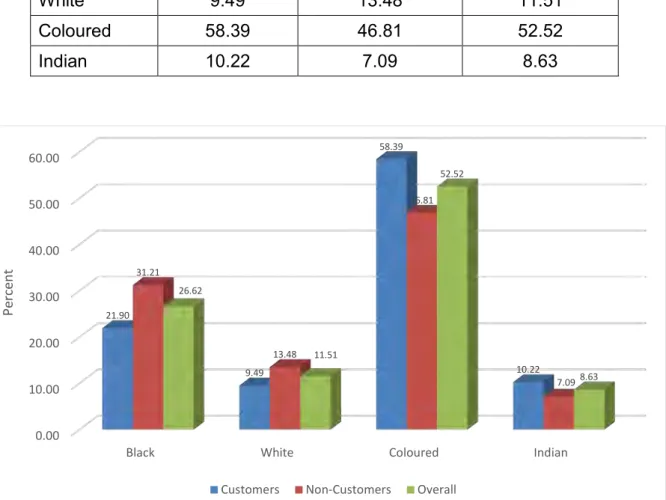

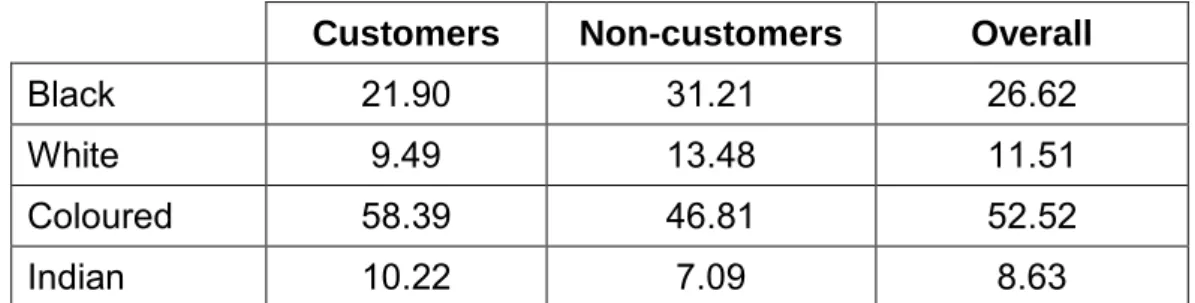

SECTION A - DEMOGRAPHIC DATA

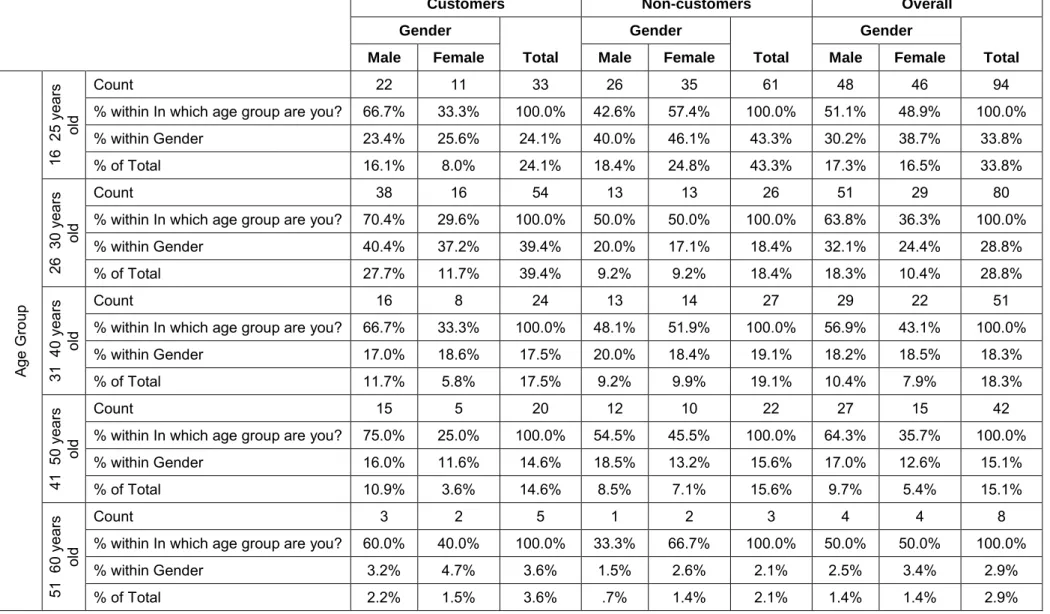

This category of men between the ages of 16 and 25 made up 17.3% of the total sample. This category of men between the ages of 26 and 30 made up 18.3% of the total sample. This category of men aged 41 to 50 made up 9.7% of the total sample.

This category of men between the ages of 51 and 60 constitutes 1.4% of the total sample.

SECTION B – AWARENESS OF THE PRIVATE LABEL PRODUCT RANGE

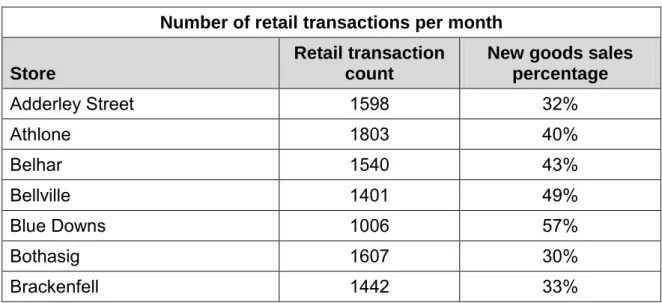

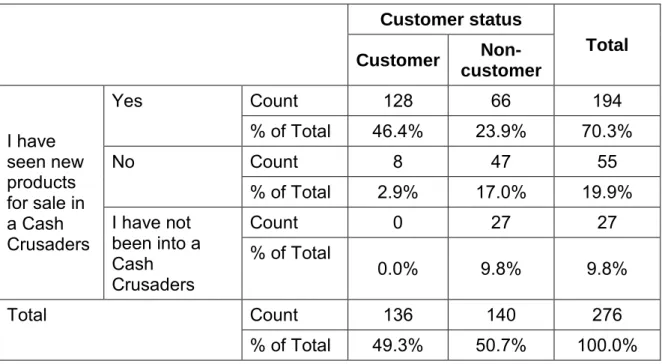

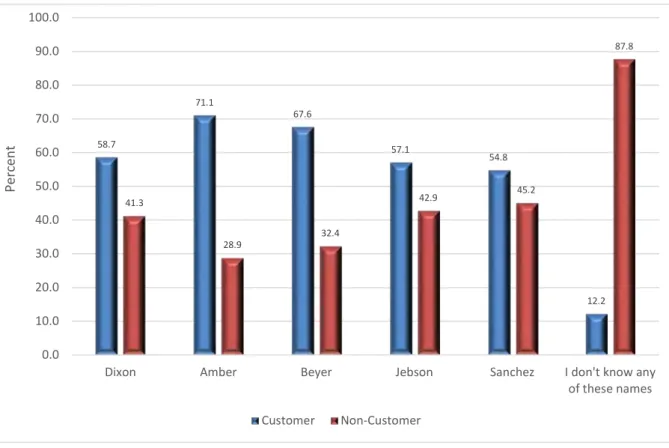

Of the respondents who recognized Jebson, 57.1% were customers and 42.9% were non-customers, and of the respondents who recognized Sanchez, 54.8% were customers and 45.2% were non-customers. The majority of respondents are aware that new products are available from Cash Crusaders. In total, 70.04% of respondents indicated that they had seen new products for sale, 20.2% had not seen any new products for sale and 9.75% indicated that they had not been to Cash Crusaders.

Almost half of the total number of respondents (49.3%) had made a purchase within the past 12 months.

SECTION C – PERCEPTIONS OF QUALITY .1 Section analysis

- Pricing

- Technically good

- Reliability

- Aftersales service

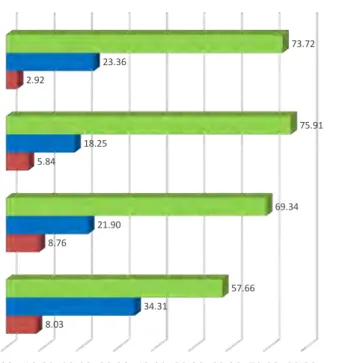

These refer to the price, how good the product is and the reliability of the product. However, the mean decreases due to the impact of the lower level of agreement on after-sales service (57.66%). Thus, the research points out that private label prices are good, but that there is more room to attract customers.

After-sales service was listed as one of the risks of buying a private label product. It is a service that must be of a high standard, and which gives customers the opportunity to easily shop with the store.

SECTION D – VALUE FOR MONEY

- Promoting private label products

- Value for money

- Easy to find in stores

- Benefits of private labels

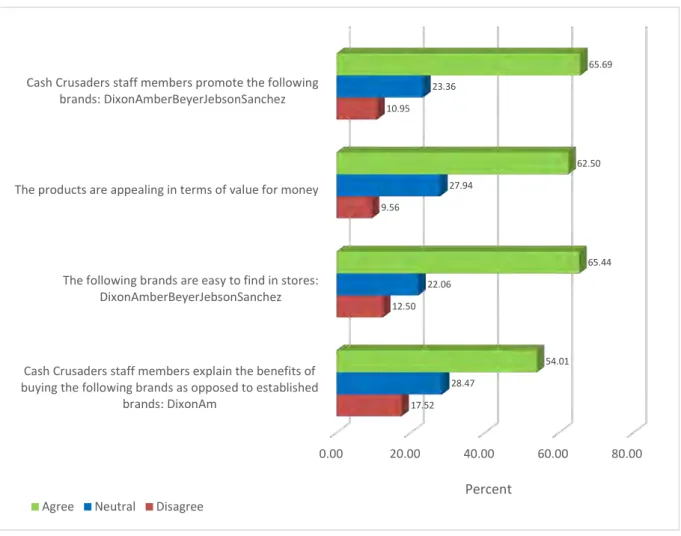

The survey showed that 27.21% fully agreed that Cash Crusaders provides good after-sales support for their brands. The value proposition of the private label products sold by Cash Crusaders offers reasonable quality products at discounted prices. Cash Crusaders employees explain the benefits of buying the following brands, as opposed to established brands.

The research showed that 27.95% strongly agreed with the statement that Cash Crusaders staff explain the benefits of purchasing private label products, 26.06% partially agreed, 28.47% were neutral, 11.76% partially disagreed and 5.76% strongly disagreed.

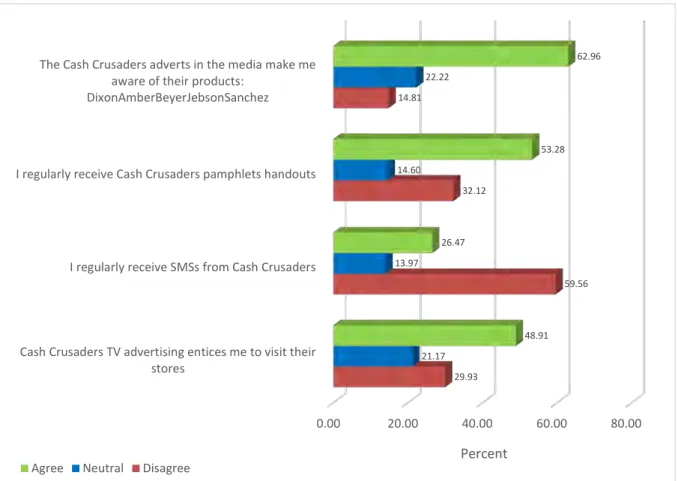

SECTION E - MARKETING

- Awareness of private label range through media

- Receiving flyers regularly

- Receiving SMSs

- Cash Crusaders’ television advertising

Explaining the benefits of purchasing a product from Cash Crusaders through the warranties offered, reduced prices compared to national brands and exclusivity to Cash Crusaders, gives customers an insight into the benefits of the products sold. I regularly receive SMS from Cash Crusaders. I regularly receive Cash Crusaders pamphlet handouts The Cash Crusaders ads in the media make me. The responses indicated that 30.15% customers strongly agreed with the statement: "I regularly receive Cash Crusaders' pamphlets/handouts", 23.13% partially agreed, 14.6% were neutral, 16.18% partially disagreed and 15.94% strongly disagreed.

The responses showed that 26.75% of respondents strongly agreed with the statement: "Cash Crusaders' TV commercials entice me to visit their stores", 22.16% partially agreed, 21.17% were neutral, 12, 5% partially disagreed and 17.43% strongly disagreed. .

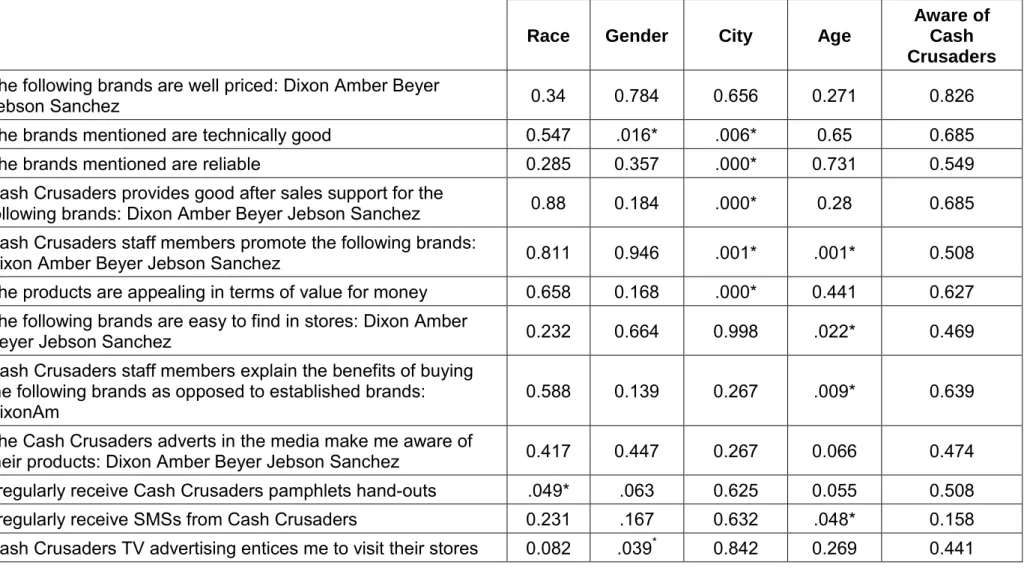

ADDITIONAL STATISTICS

- Hypothesis testing (inferential stats)

- P-value between “Gender” and “The brands mentioned are technically good”

- P-value between “Race” and “I regularly receive the flyers/hand-outs from Cash Crusaders”

- P-value between “Gender” and “The television adverts entice me to visit Cash Crusaders stores”

The p-value between “Race” and “I regularly receive flyers/handouts from Cash Crusaders” is 0.049 (which is less than the significance value of 0.05). The data below shows that black and dark-skinned racial groups regularly receive input. The p-value between “Gender” and “Television ads invite me to visit Cash Crusaders stores” is 0.039 (which is less than the significance value of 0.05).

This means that a respondent's gender does play a role when it comes to being tempted by television advertising to visit Cash Crusaders stores.

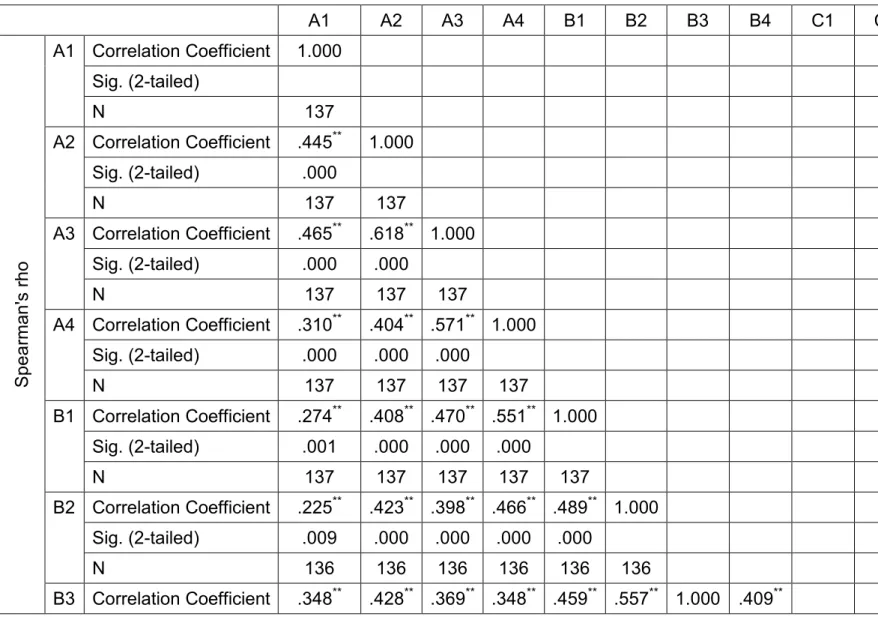

CORRELATIONS (INFERENTIAL STATS)

Cash Crusaders staff members explain the advantages of purchasing the following brands versus established brands: Dixon Amber Beyer Jebson Sanchez. C1 Cash Crusaders advertisements in the media alert me to their products C2 I regularly receive Cash Crusaders brochures. The correlation value between “A1” and “C2” is 0.359, which indicates that the relationship between good price private label products and receipt of Cash Crusaders flyers/handouts is proportionally related.

Respondents agree that the better the after-sales support for certain brands, the more attractive the products would be in terms of value for money.

SUMMARY

CHAPTER FIVE

CONCLUSIONS AND RECOMMENDATIONS

- INTRODUCTION

- OBJECTIVE ONE

- Findings

- Literature

- Recommendations

- OBJECTIVE TWO

- Findings

- Literature

- Recommendations

- OBJECTIVE THREE

- Findings

- Literature

- Recommendations

- OBJECTIVE FOUR

- Findings

- Literature

- Recommendations

- OBJECTIVE FIVE

- Findings

- Literature

- Recommendations

- LIMITATIONS OF THE STUDY

- SUGGESTIONS FOR FURTHER RESEARCH

- CONCLUSION

To identify whether respondents are aware of the private label brands sold by Cash Crusaders. To better position Cash Crusaders through an integrated marketing campaign will help provide value for money. One of the study's limitations is that it was limited to Cash Crusaders'.

The purpose of this study was to understand consumer perceptions of private label products at Cash Crusaders.

The influence of perceived risk on purchase intention – The case of South Africa's premium supermarket private label brands. Towards a better understanding of private label brand image – How consumers respond to extrinsic cues and in-store brand awareness. ed.), Proceedings of the 8th International Conference on Business and. Consumer orientations toward private labels and national brands across product categories: Exploring young adults' personal values through Means-End-Chain analysis.

The effect of store image and service quality on brand image and purchase intention of private label brands.

INTRODUCTORY AND CONSENT LETTER

QUESTIONNAIRE

16 Cash Crusaders staff members explain the benefits of buying the following brands over popular brands Strongly agree.

ETHICAL CLEARANCE

TURNITIN ORIGINALITY REPORT