Investment Activities of Social Islami Bank Limited” as a subject requirement of the MBA program. I am pleased to inform that Masum Billah of MBA program with ID has been advised to prepare a report on “Investment Activities of Social Islami Bank Limited” for the purpose of internship. This student went through all the relevant materials and did practical work for three months at Social Islami Bank Limited to gain practical knowledge about the banking sector in Bangladesh.

On the other hand, I am really grateful from the bottom of my heart to Executive Vice President and In charge Social Islami Bank, Charfashion branch. This report was developed through the secondary data of banking activities of Social Islami Bank Bangladesh Limited and primary data of day to day activities during my internship period. Social Islami Bank Bangladesh Ltd is the first and large private sector commercial bank in Bangladesh fully owned by the Bangladeshi Entrepreneurs.

Here, the first chapter discusses the background of the report, the objective and methodology used in the preparation of the report and the limitations faced in the preparation. In Chapter Two: Historical Background, Mission & Vision, Operational Performance, SIBL Department, Organization Chart of SIBL, Products and Services, Corporate Social Responsibility (CSR), Investments, Investment Management, Theoretical Aspect, Concepts of Social Islami Bank Ltd. this chapter.

Chapter: 1 Introduction

- Origin of the Report

- Objectives of the Report

- Methodology

- Primary source of data

- Secondary source of data

- Scope of the Report

- Limitations of the Report

From the dawn of civilization, the banking sector has dominated a country's economic development by mobilizing the savings of the ordinary population and channeling these savings into investment and thus economic development and growth. The importance of this sector is reflected in its contribution to the country's economic growth. I have already completed my internship program at Social Islami Bank Bangladesh Limited (IBBL) and gained practical knowledge about Social Islami Banking.

Based on my practical experience as well as theoretical knowledge, I completed the report regarding “Investment Activities of Social Islami Bank Bangladesh Limited. After all the data is collected, it is coded and processed, the Investment Management analyzes graphically. Besides that, I also collect some primary data by taking expert opinion of the officers and direct observation while doing the internship program at the bank.

Bank annual report, monthly statement of the bank, SIBL bank website, banker training guide were used. SIBL is one of the most new generation banks in Bangladesh, formed to develop a balance and healthy economic, social and industrial sector of Bangladesh.

Chapter: 2

Company Profile of Social Islami Bank Limited

- Historical Background

- Mission & Vision

- Operating Performance

- SIBL Department

- Organogram of SIBL

- Organization Structure for Branch

- Board of Directors

- Products and Services

- Corporate Social Responsibility (CSR)

- Investment

- Investment Management

- Concepts of Social Islami Bank Limited

- Theoretical Aspect

The expanded range of operational parts of the bank was initiated to include three segments - formal, non-formal and intentional - in a far-reaching amendment. The productivity of the bank is extremely affected by the way it has to maintain a significant amount of arrangement for its grouped Speculations each year. The administration of the bank is vested in a 27-member top management staff led by an executive officer.

The bank has a 5-member Shariah Board to ensure consistency of corporate Islamic standards in implementation. Finally, "reducing the level of need" is our vision, which is the main issue as expressed in the Notice of the Keep money relationship with the dedication "Cooperation for a thinking society". The bank's working pay allowance as on December 31, 2017 remained at Tk.

The Bank believes that any kind of social and grand exercise would improve the nature of life of the poor masses of the nation. The governing body of the Bank consists of winning identities in a particular territory of Exchange, Trade and Industry of the country. Under the proactive direction, approach and direction of the Board, the executives direct its business activities.

The directorate provides initiative and direction to the administration to achieve the bank's goals and objectives. For efficient deployment of mobilized resources in profitable, safe and liquid investments, a sound, well-defined, well-planned and appropriate investment policy framework is a prerequisite for achieving the bank's purpose. One of the two essential elements of an investment bank is to expand investments into the financial deficit unit involving different types of borrowers.

Social Islami Bank Limited is a money-related organization whose status, norms and systems explicitly express its responsibility to the rule of Social Islamic Sharia and for limiting reception and encouraging enthusiasm for all its activities. The bank must share in the benefits or misfortunes arising from the business for which the money is borrowed. There are the securities taken by the owner of the property for which the banks provide the facility.

In a windy sense, it indicates any kind of security on which the bank has an individual right of activity on the debtor in relation to the advances. The purchase of a concept pressures the seller on nearby cash at the household focus while the pay after the introduction of the.

Chapter: Three

Investment Activities of Social Islami Bank Limited

- Different Investment Modes

- Mudaraba (The Hiring of Capital)

- Musharaka (Partnership Profit Sharing)

- Bai-Mudaraba (Contract Sale)

- Hire Purchase Under Shirkatul Meelk

- Investment Policies of SIBL

- Investment Approval

Stakeholders have the privilege of taking an interest in the performance of the task and can also defer this privilege to an explicit accomplice. In the primary case, the bank has an interest in the value and receives an offer of benefit every year on an ace rata basis, and no reference is made to the time of the end of the agreement. This framework also provides future installments of cash that go well beyond the bank's offer in the form of a repayment of the asset the bank holds.

Under this method, the bank buys the goods as per the demand of the customer and then puts the products to him/them. In this way, the benefits do not remain the property of the bank towards the end of the lease term, as is the case in the assignment lease. In conclusion, the bank transfers and exchanges the responsibility for the offer/part/segment to the customer in return for installments of costs settled for that part, either gradually part by part or in single amounts within the contract's time frame or after the expiry of the contract claim.

In the bank, Bai-Muajjal is treated as an agreement between the bank and the customer whereby the bank offers certain explicit products to the customer, purchased on request and specifically from the customer at an agreed value, payable within a certain single amount in the future . or per portion. Bai-Salam can be characterized as an agreement between a buyer and a seller whereby the dealer transfers in advance the specific items/items that can be passed on to the buyer under the Social Islamic Sharia, at an agreed value, payable upon execution of the said contract and the goods. /items are transported according to determination, size, quality, quantity at a future time at a specific place. The transfer of the sold product is allowed, but the payment of the costs is quick.

Bai-Salam is a mode of investment permitted by the Social Islamic Sharia, whereby commodities/products can be sold without the said commodities/products existing or being physically/constructively owned by the seller. It is permitted to obtain a mortgage and/or personal guarantee from a third party as security before signing the agreement or at the time of signing the agreement. The task regarding setting up the speculation proposal lies with the RM of the branch and also with the Corporate Banking department (for task/syndicated financing or large companies) at the head office.

The IRM approval team will take the necessary steps to obtain approval of the proposal from the competent authority. The IRM Approval Team, after proper analysis of the proposal, will prepare the relevant note/memo for the approval of the Managing Director directly or on the recommendation of the Management Committee. After approval from the competent authority, the IRM approval team will inform the site of the authority's decision.

Branch will then take necessary action as per the communication/sanction letter from the Head Office. If the proposal is beyond the discretionary power of Managing Director, the proposal will be placed before the Executive Committee of the Board or before the Board by the Managing Director, EC/BOD will advise the decision regarding the proposal to IRMD.

Evaluation of Investment Performance of Islami Bank Limited (2013-2017)

Investment Monitoring / Recovery Cell

The monitoring and recovery unit at the Branch will be responsible for monitoring and recovering the overdue accounts of the Branch.

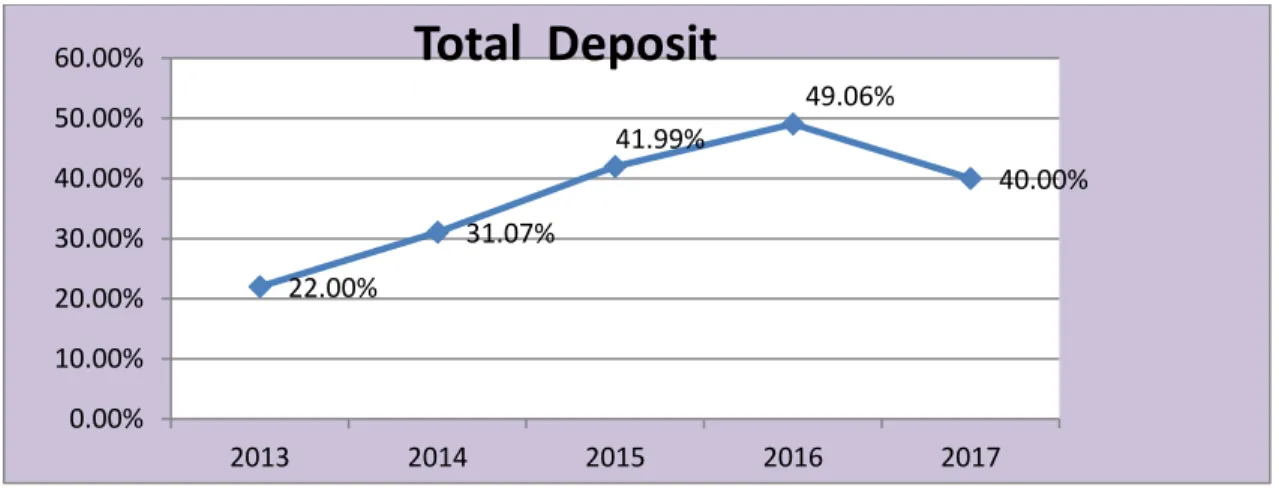

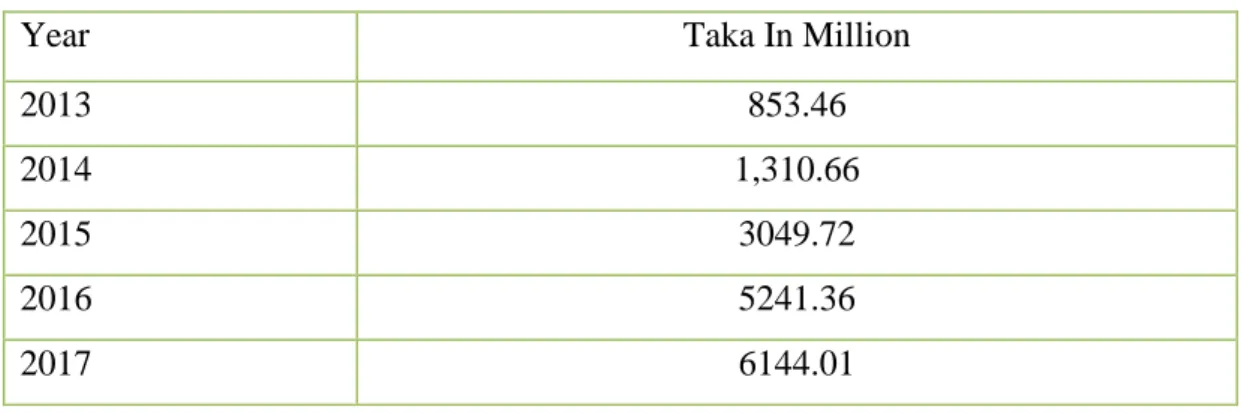

Total deposits

Total Deposit

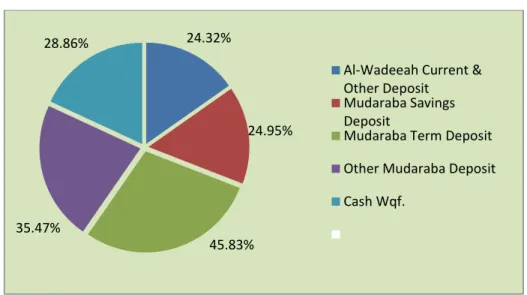

Deposit Mix of SIBL

The deposit mix is the most important because every commercial bank depends on the deposit, so the bank decides where to invest.

Total Deposit

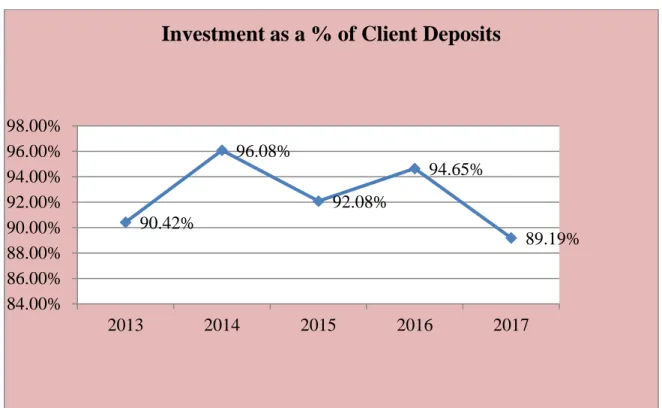

The graph above shows that investment as a % of customer deposits fluctuates over the years.

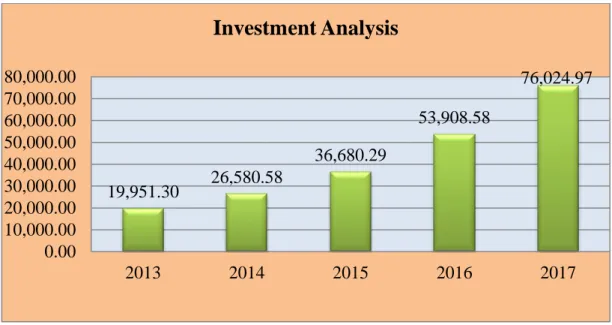

Investments (General)

Investment Analysis

- Investment (Shares & Securities)

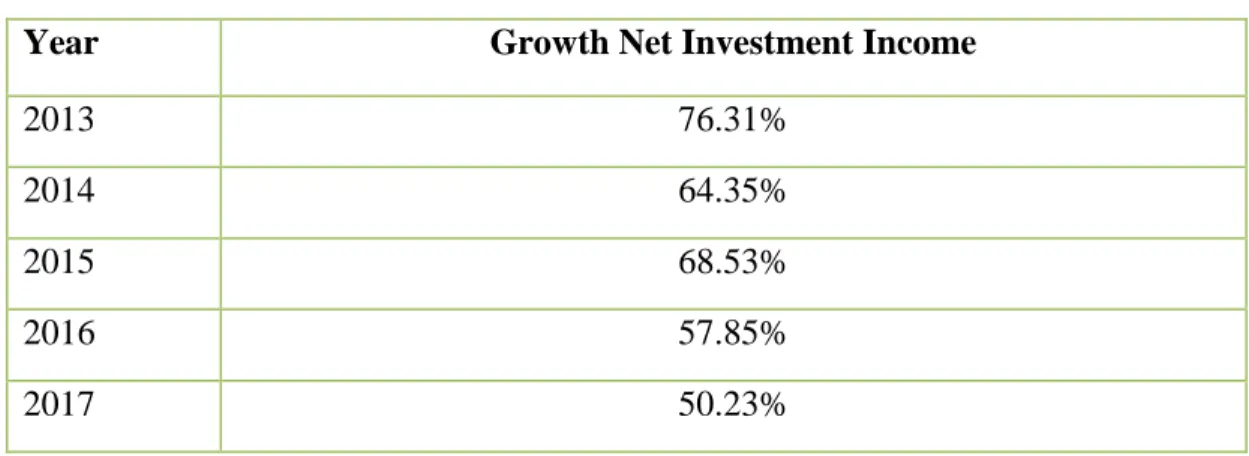

- Net Investment Income

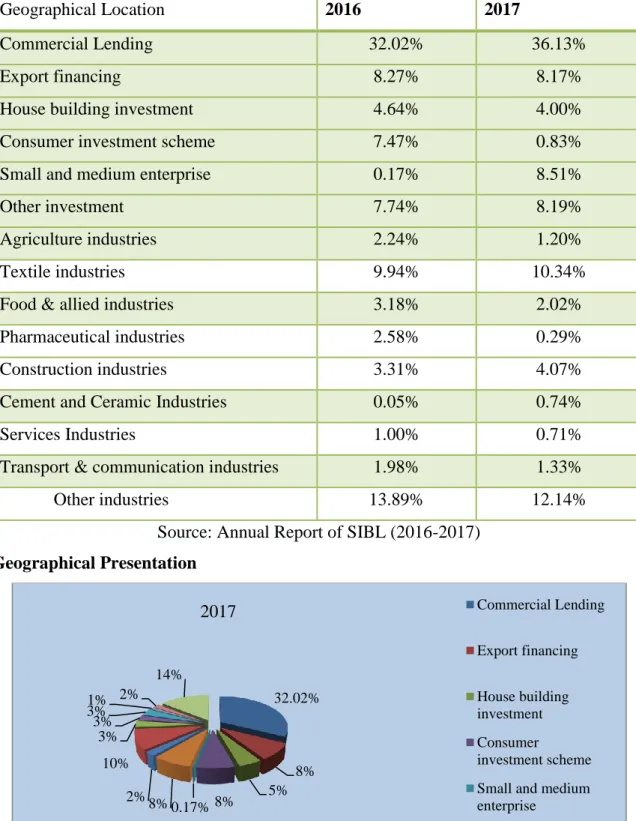

- Industry Wise Classification of Investment

- Portion of Bad/ Loss as of Total Classified Investment

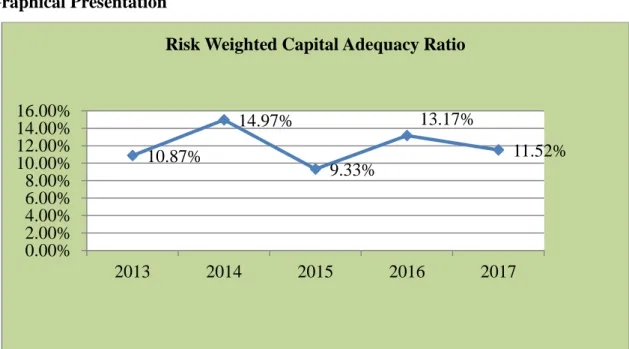

- Risk Weighted Capital Adequacy Ratio

- Recovery Rate

This means that bank increases their investment significantly and in the future the bank should maintain this upward trend. From the above graph it can be seen that the bank provides the highest amount on investment in commercial lending both in the years 2016 and 2017. & 2017, the portion is 1.20% & 2.24%.

The bank should concentrate on reducing the bad/loss investment to increase the performance in the following year. Capital adequacy determines the bank's capacity in terms of meeting and managing their risks such as credit risk, operational risk, etc. In this sense, SIBL's capital adequacy ratio is more than the standard line over the years.

The graph above shows that the rate of return on investments fluctuated during the year. SIBL is more aware of their recovery, but it has picked up a bit in the last year.

Findings, Recommendations & Conclusion

Findings

The bank should concentrate on reducing the bad/loss investment to increase the performance in the following years.

Recommendations

Conclusion

Bibliography