But a significant number of independent financial planners are leaving the industry permanently or joining alternative models. The purpose of this study is to determine the factors that influence independent financial planners and the impact of these factors on the sustainability of independent financial planners.

LIST OF TABLES

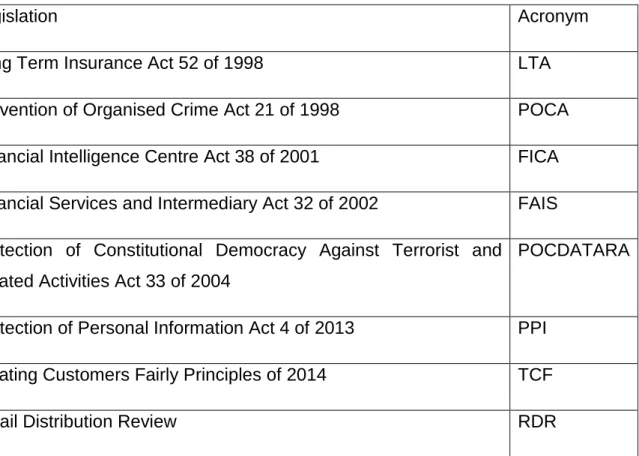

LIST OF ACRONYMS AND ABBREVIATIONS

CHAPTER ONE INTRODUCTION

- Introduction

- Focus of the Study

- Research Questions

- Research Methodology

- Overview of the Study

Recommendations to overcome these factors to retain independent financial planners for marketing, distribution and sales of insurance products. The second chapter details the literature review used to discuss the factors influencing independent financial planners in KZN.

CHAPTER TWO LITERATURE REVIEW

Introduction

Background

According to Hawkins (2003), the absence of independent financial planners could affect wealth creation goals. The demise of independent financial planners could result in inadequate financial planning services being available to the public at unaffordable costs.

Definition of terms .1 Insurance Product

- Financial Planning

- Financial Planner

- Franchise Agents and Tied Financial Planners

- Bank Financial Planners

- Role of Financial Planner

They help customers choose insurance products by presenting them with alternatives (Dan-Constantin, 2008). Bank-employed financial planners are employed to market, distribute and sell risk and investment products from insurance companies and investment houses.

Legislation

- Applicable legislation

- Financial Services and Intermediary Act (FAIS)

- Fit and Proper Requirements

- Treating Customers Fairly Principles (TCF)

- Protection of Personal Information Act (PPI)

- Impact of legislation – an international perspective

- Impact of legislation – a South African perspective

- Commission Regulations

- Commission debate

- Retail Distribution Review (RDR)

- Impact of commission regulations – an international perspective The UK and Australia have implemented RDR or a version thereof recently (Future

- Impact of commission regulations – a South African perspective Changes to financial planner remuneration models will impact on the financial

Legislation, as discussed above, requires independent financial planners to have succession plans (FAIS Act 32 of 2002). The traditional pipeline for new independent financial planners is the tied agents of insurance companies.

Technology

- Internet

- Smartphones and tablets

- Social media platforms

- Use of technology by consumers

- Use of technology by insurance companies

Consumer purchasing preferences are changing as they make use of the Internet and smartphones in the decision making and product purchasing process (Capgemini, 2013). This development is motivated by the need to have continuous access to the Internet (Kaplan, 2012). A quarter of smartphone owners prefer to connect to the Internet from smartphones rather than computers.

Facebook acts as word of mouth due to information exchange between users of the Internet (Park and Cho, 2012). Consumers use these devices to easily get information and updates about insurance products and services (Capgemini, 2013). Consumers are less dependent on the financial services industry for knowledge and now use the Internet to gather information about various.

Alternative channels (competition) to independent financial planners The financial services markets across the world have changed with the emergence

- Direct insurers

- Bank financial planners

Alternative channels (competition) to independent financial planners Financial services markets around the world have changed with the advent. The introduction of a direct link between provider and client in the mid-1980s changed the way insurance was provided, bypassing the existing sales channel of independent financial planners. Direct insurers were able to create and offer a low-cost mix of features and services that was compelling enough to lure clients away from traditional independent financial planners ( Deloitte, 2010 ).

Telemarketing has been used in the insurance industry for decades, but it is now emerging as a prominent alternative distribution channel (Deloitte, 2010). It is now among one of the most important channels in Europe and is the third most productive distribution channel after independent financial planners and the Internet (Capgemini, 2013). The strength of the bank brand is used to sell insurance products (Grice, Ouarbya, Rodriguez and Temple, 2008).

Consumers’ perceptions and expectations of independent financial planners

Consumer expectations and perceptions of financial planners can be determined by complaints lodged against financial planners with the Financial Advice and Intermediation Ombudsman. The Ombudsman was established in 2003 and is responsible for consumer protection; and maintaining and improving the integrity of the financial services industry (FAIS Ombud, 2013). To retain clients, financial planners face the burden of proving that they have provided value to their clients.

Financial planners sometimes negotiate fees with their clients instead of commissions (Cummins and Doherty, 2006). This mismatch between the perceptions of insurance consumers and financial planners has implications for what clients will pay versus financial planners who believe they are entitled to the initial commission for the financial advice provided.

Summary

Consumers are willing to pay 30% less than the scheduler's average required hourly earnings to cover costs. Financial advice to guide consumers throughout the sales process is the part of the insurance market where the price of the service is seen as inconsistent with what consumers are willing to pay for the service in question. Planners believe that the value of their advice encourages consumers to save; it is an offering that helps with financial planning and empowers consumers to achieve their financial goals.

Consumers are hostile to paying for advice because they believe the advice is free (Deloitte, 2006). Client perceptions of the industry and independent financial planners have resulted in a decline in the number of independent financial planners. The follow-up survey of independent financial planners in KZN will attempt to ascertain whether these factors are affecting the viability of independent financial planners in KwaZulu-Natal.

CHAPTER THREE

RESEARCH METHODOLOGY

- Introduction

- Research Design

- Study Setting (Location of Study)

- Sample Process .1 Population

- Sample size

- Data Collection

- Questionnaire Design

- Questionnaire Administration

- Analysis of Data

- Ethical Considerations

- Summary

The population was based on the computerized database of independent financial brokers maintained by the KZN Regional Office of the Broker Distribution, Old Mutual. This data collection method was most appropriate for the research purpose due to time and cost constraints and the length of the questionnaire. According to Saunders et al (2002), the questionnaire is one of the most commonly used techniques for collecting survey data.

Quantitative questions were used to collect attribute and behavioral data for the sample (Saunders et al, 2003). The language of the questionnaire took into account the respondents' level of understanding. Chapter 3 will provide an analysis of the data obtained from the questionnaire and a subsequent discussion of the results obtained from the questionnaire.

CHAPTER FOUR

ANALYSIS AND DISCUSSION OF RESULTS

Introduction

Pearson correlation matrix was used to determine the direction, strength and significance of a bivariate relationship.

Objectives of the research study

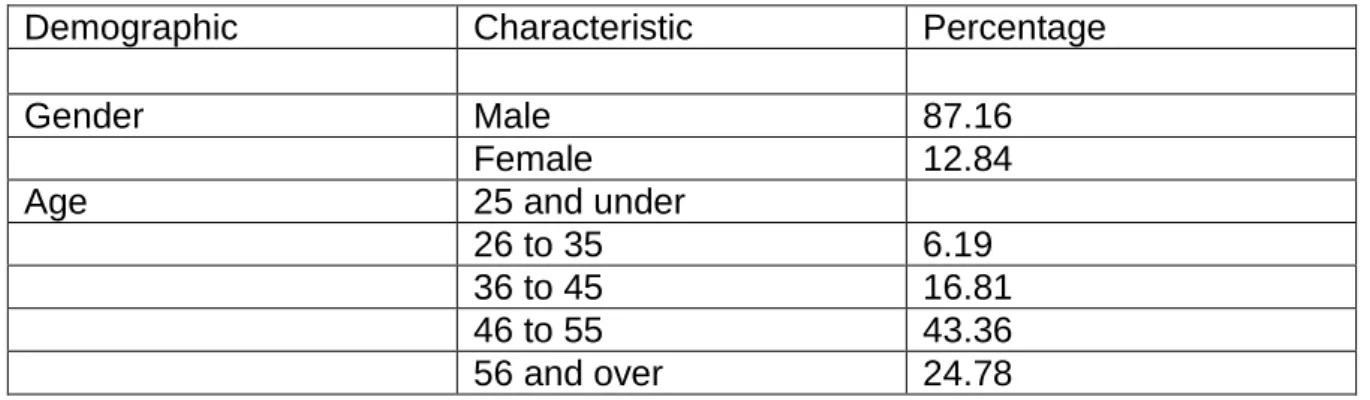

Demographic Distribution

This supports Bird's (2011) view that independent financial planning as a career was on the decline. This is worrying as it suggests that the sector is aging and fewer people are entering the sector or becoming independent financial planners. More than half of the respondents have been working as a financial planner for more than twenty years.

The results show that a third of respondents had a diploma as their highest educational qualification. This may be due to the fact that this study was limited to independent financial planners in KZN, while the previous study included all types of financial planners working in the financial services sector across the country. According to the Institute of Practice Management (2012) research, independent financial planners' profit margins are declining due to regulatory requirements.

Objective One: To determine the factors affecting independent financial planners

- Financial Planning Practise

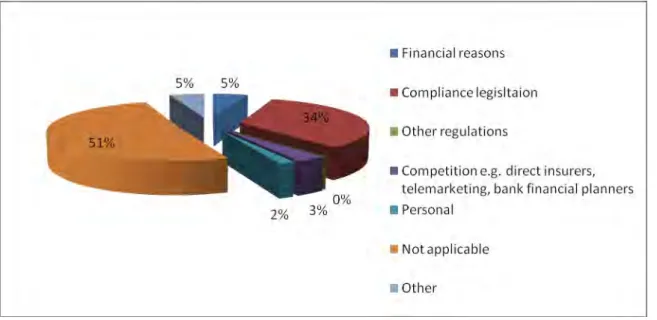

- Exiting the industry

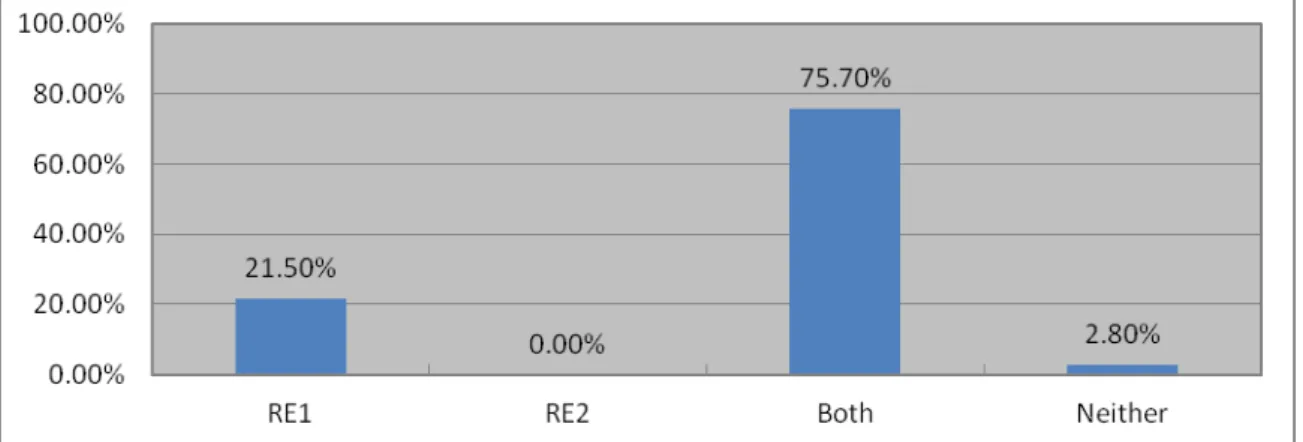

- Legislation

- Compliance legislation

- Succession planning

- Commission regulations

- Alternative channels (competition) to independent financial planners In terms of Table 4.5, over 56% of all respondents agree or strongly agree that

- Clients perceptions and expectations of independent financial planners

More than a third of all respondents experienced a decrease in income in the last five years, as shown in Figure 4.12. Although more than 95% of the respondents have concluded contracts with more than three insurance companies, more than three quarters of all respondents failed to achieve the financial goals of the insurance companies (Figure 4.17). Although three quarters of all respondents did not reach the financial goals of all insurance companies, more than 55% of them would still like to conclude a contract with more than three companies, as confirmed by Figure 4.18.

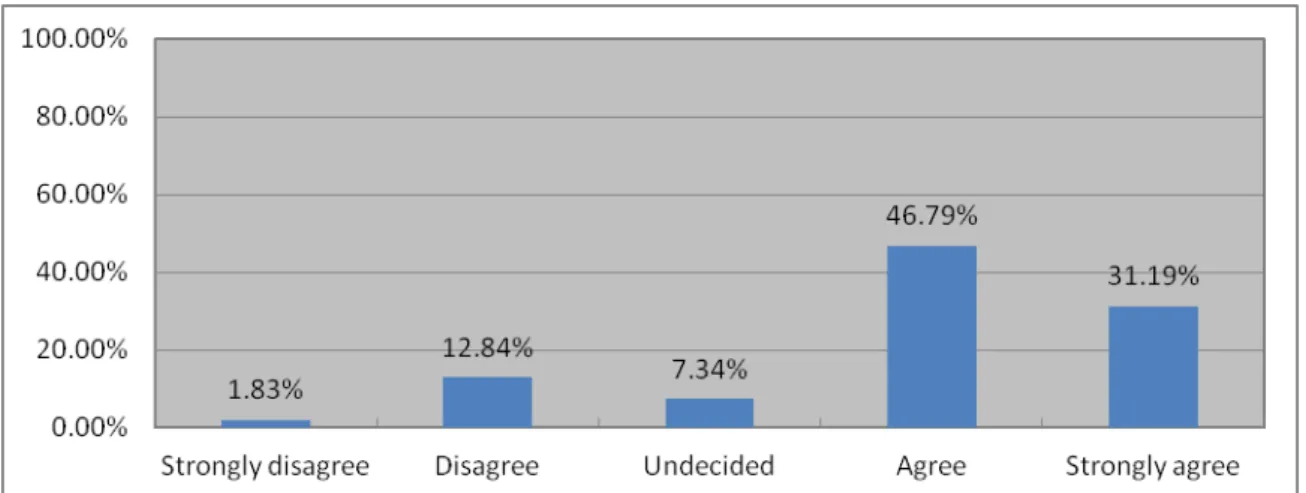

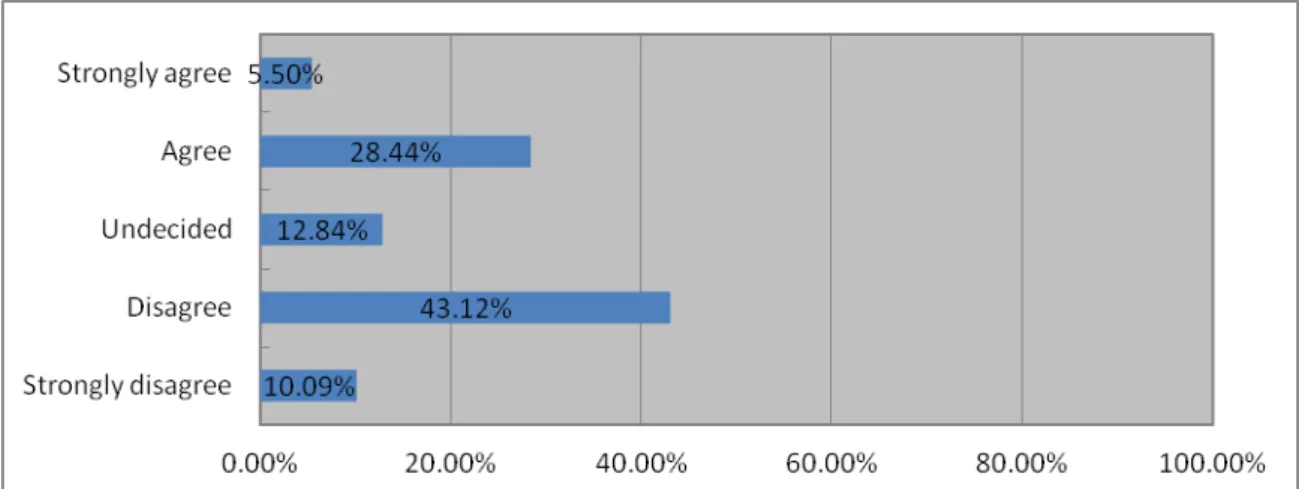

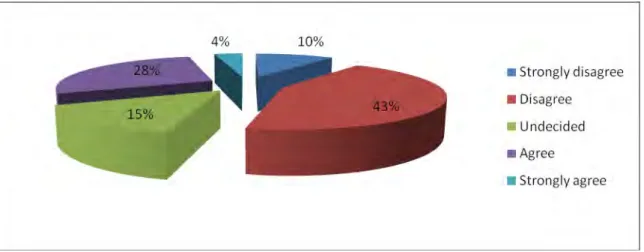

About 86% of respondents fully or partially agree that clients are more financially literate (Figure 4.23). However, in terms of Figure 4.24, 62% of all respondents strongly disagree or disagree with the statement that customer purchasing preferences are changing (i.e. a shift from independent financial planners to online purchasing). According to Figure 4.25, about a third of respondents believe that customers see them only as information providers.

Objective 2: To investigate the impact of these factors on the sustainability of independent financial planners

- Legislation

- Compliance legislation

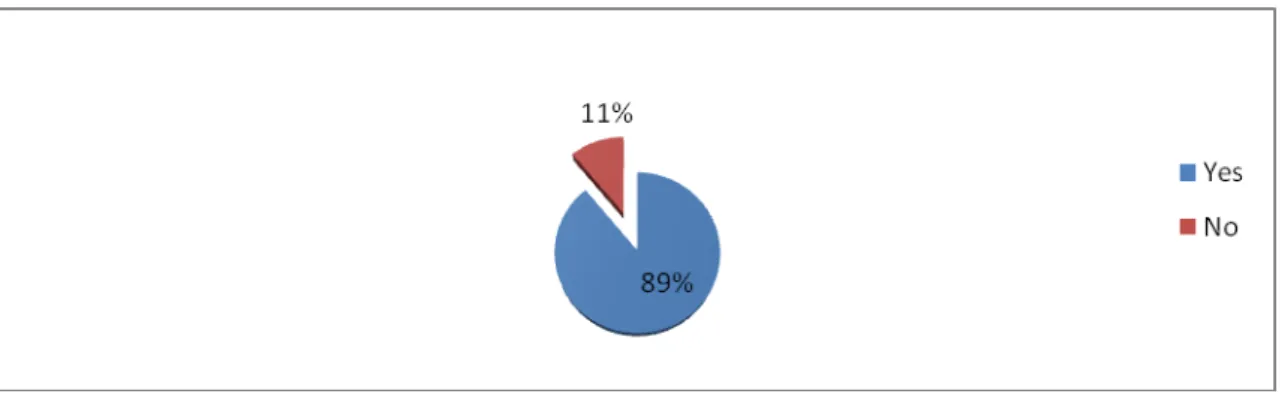

- Becoming a tied agent

- Technology

- Alternative channels (competition) to independent financial planners In terms of Table 4.6, about 40% either agree or strongly agree that direct

- Consumers perceptions and expectations of independent financial planners

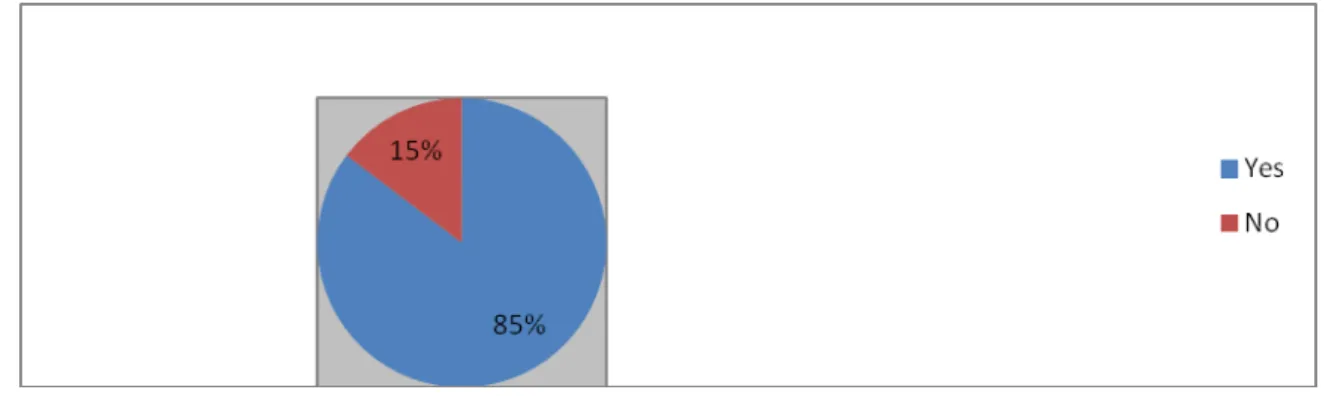

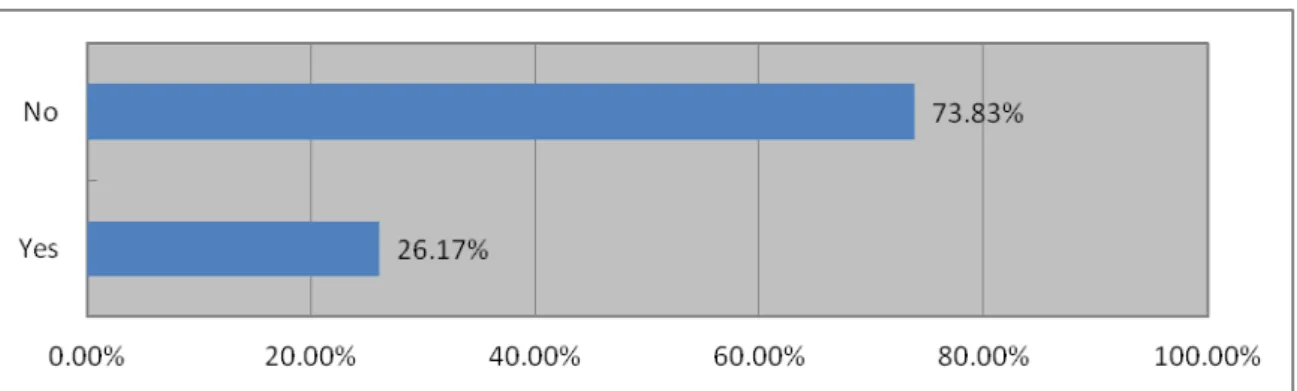

Almost 18% of all respondents considered marketing and selling only one insurance company's products (Figure 4.33). In terms of Figure 4.34, about 16% of all respondents thought about becoming an agent of an insurance company, bank or affiliate network. More than one quarter (26.85%) of the respondents did not automate their manual processes in their practices (Figure 4.38).

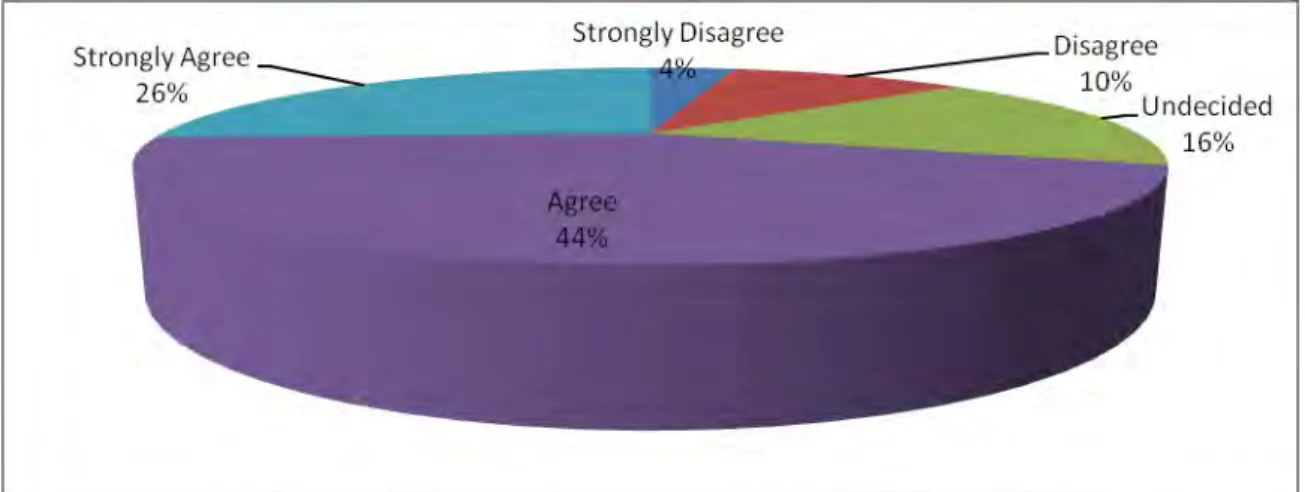

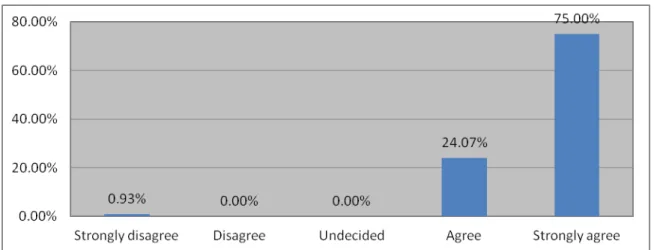

In terms of Figure 4.39, approximately 64% of the respondents do not use social media and other forms of technology in relation to the marketing and sales function of their practices. More than two-thirds of respondents either agree (53%) or strongly agree (14%) that the financial literacy of clients has placed additional demands on their practice (Figure 4.40). According to Figure 4.41, more than 75% of respondents either agree or strongly agree that customers believe that their fee or commission charged is justified in relation to their added value.

Summary

CHAPTER FIVE

CONCLUSIONS AND RECOMMENDATIONS

- Introduction

- Conclusion

- Demographics and Financial Practise

- Objective one: To determine the factors affecting independent financial planners in KwaZulu-Natal (KZN)

- Objective Two: To investigate the impact of the factors on the sustainability of independent financial planners in KZN

- Objective Three: To make recommendations to overcome these factors to retain independent financial planners for the marketing,

- Limitations

- Recommendations for Further Research

- Summary

To determine the factors influencing independent financial planners in KwaZulu-Natal (KZN) financial planners in KwaZulu-Natal (KZN). The results of the survey indicate that there are various factors that influence the independent financial planners. Current and future legislation is considered to affect the continuation of independent financial planners in the industry.

The regulations are seen to have a negative impact on the income of independent financial planners. This illustrates that the expectations of these clients are affecting the sustainability of the practices of independent financial planners. The study has identified various factors that influence the viability of independent financial planners.

Accessed online at: http://www.ighty20.co.za/insightout/consumer-trust-in- the-life-insurance-industry on 15 March 2014]. Geneva Papers on Risk and Insurance – International Association for the Study of Insurance Economics, Issues and Practice, Vol. You are invited to participate in a research project entitled "Factors Influencing the Sustainability of Independent Financial Planners in KwaZulu-Natal".

The objectives of the study are to: (1) determine the factors influencing independent financial planners in Kwazulu-Natal (KZN), (2) investigate the impact of these factors on the sustainability of independent financial planners in KZN, and (3) make recommendations to overcome these factors for retention of independent financial planners to market, distribute and sell insurance products in KZN. Compliance legislation has resulted in financial planners providing an improved quality of service to clients. Clients see independent financial planners only as information providers (ie providing information about product features and benefits).