CRRF Capital Replacement Reserve Fund DBSA Development Bank of South Africa DoRA Division of Revenue Act.

ANNUAL DRAFT BUDGET

Mayor’s Report

UMkhanyakude district will ensure that all employees of the municipality subscribe to Batho Pele principles. The 2018-2019 draft budget will be published and communicated to the community for their input towards the adoption of the final annual budget by 30 May 2018.

Council Resolution

EXECUTIVE SUMMARY

- Introduction

- Strategic priorities for 2018‐2019

- Challenges

- Budget principles and guidelines that directly informed the compilation of the 2018‐2019

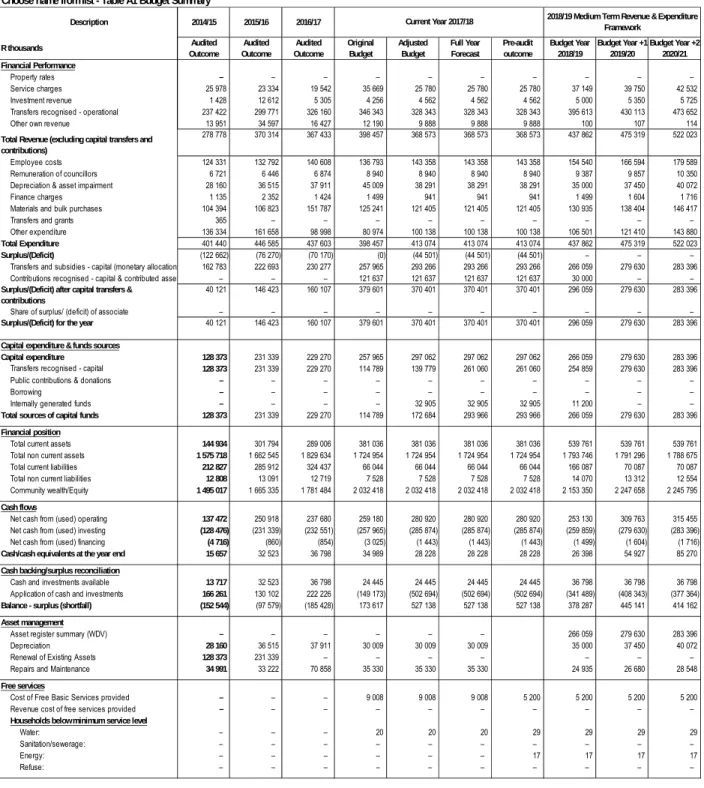

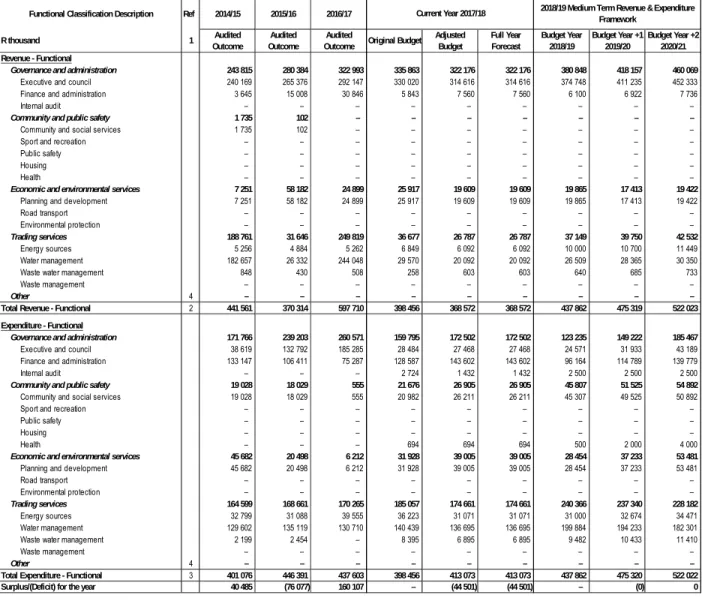

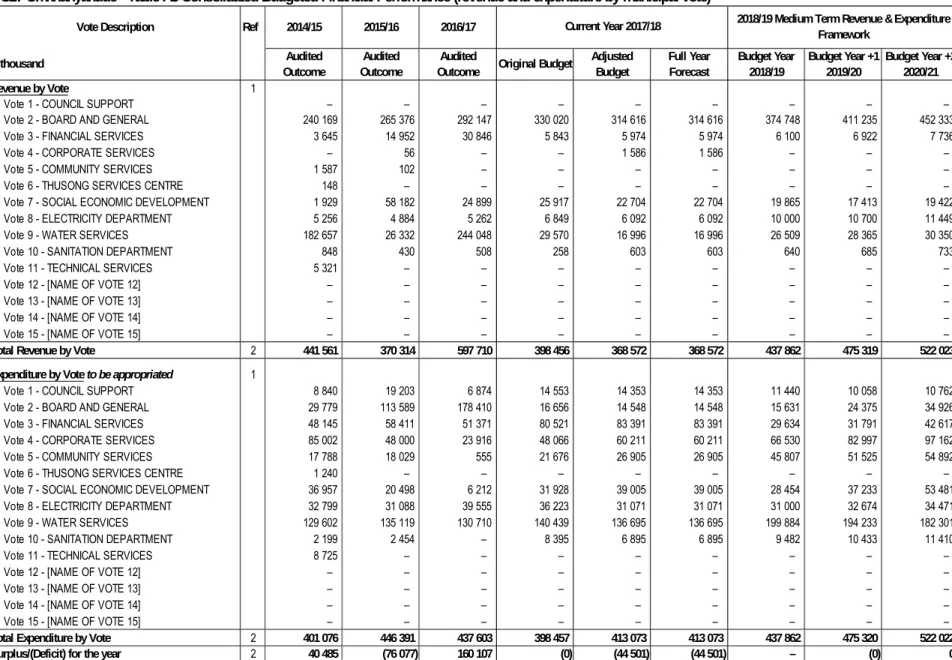

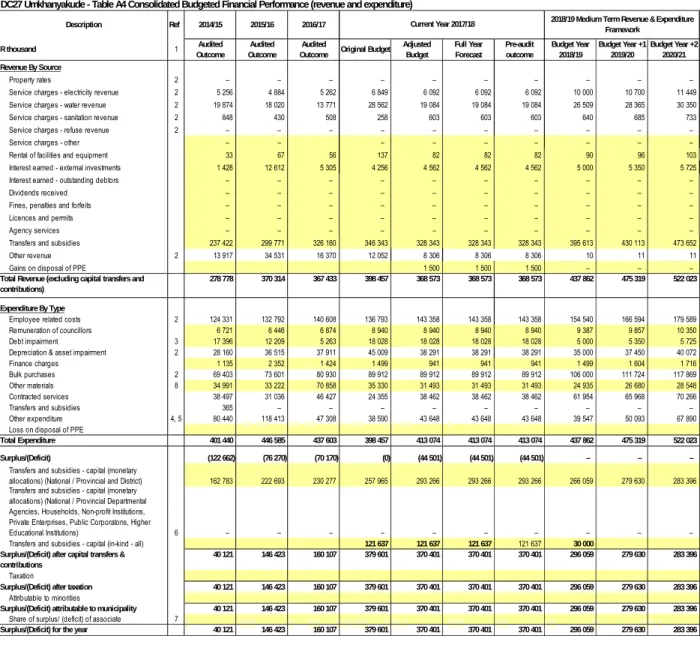

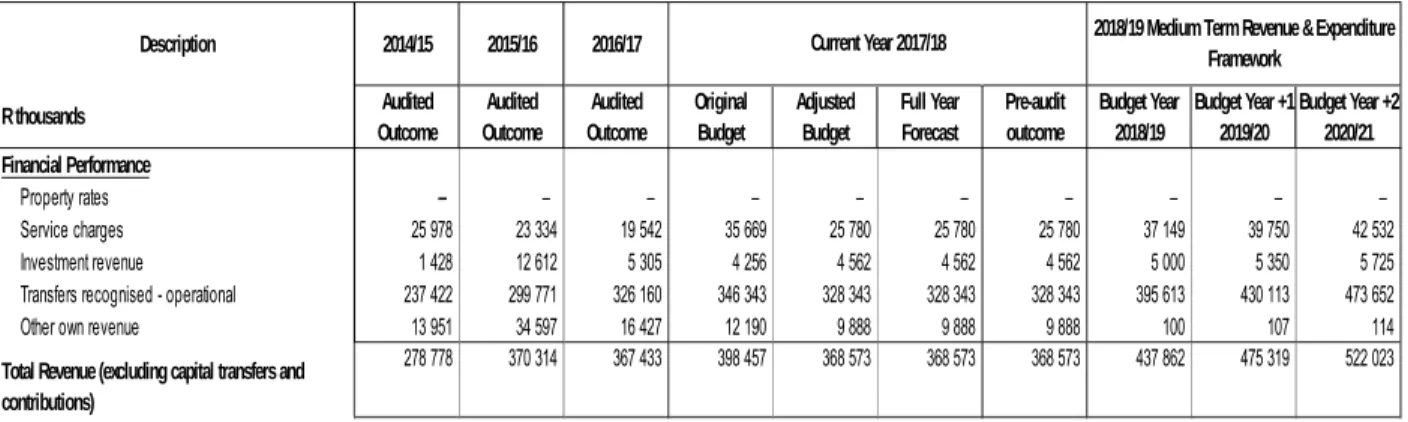

The need to re-prioritise projects and expenses within existing resources given the cash flow reality and the council's declining cash position; The consolidated operating income for both the parent municipality and the municipality entity is R437 million, 5.4 percent compared to the 2017-2018 adjustment budget.

Operating Revenue Framework

- Sale of water and impact on tariff increases

- Sale of electricity and impact on tariff increases

- Sanitation and impact on tariff increases

Now the municipality has increased its actual revenue and the conventional revenue budget has been increased by 4 percent of the total revenue. Operating grants and transfers total R395 million in fiscal year 2018-2019 as published for UMkhanyakude District Municipality, excluding the entity's provincial grants (UMhlosinga Development Agency).

Operating Expenditure Framework

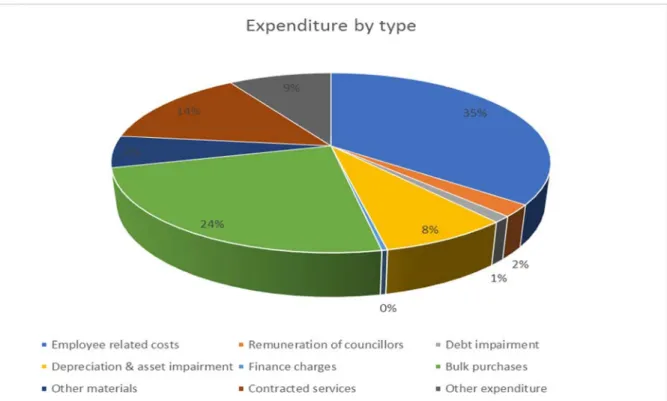

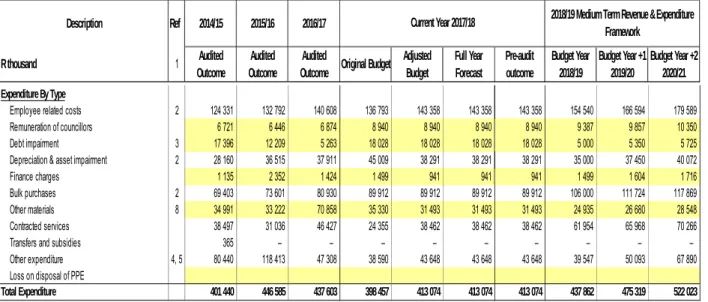

The budgeted allocation for employee-related costs for the 2018-2019 financial year amounts to R154 million, which is 35 percent of the parent municipality's total operating expenses. Budgetary allocations in this direction amount to R35 million for the financial period 2018-2019 and are equal to 8 percent of the total operating expenses.

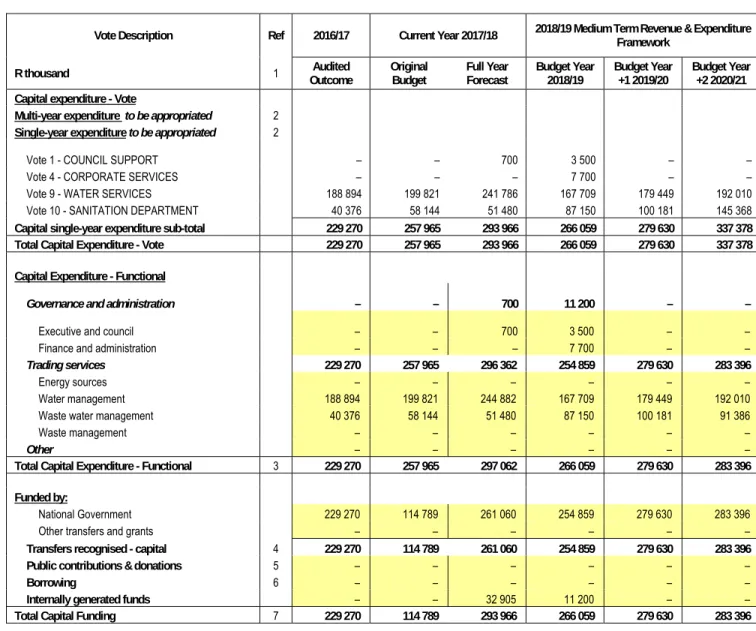

Capital expenditure

Other expenses consist of various line items related to the daily operations of the municipality. Growth is limited to 8 percent for the inclusion of the other expenses of the entity.

Annual Budget tables

Supporting Documentation

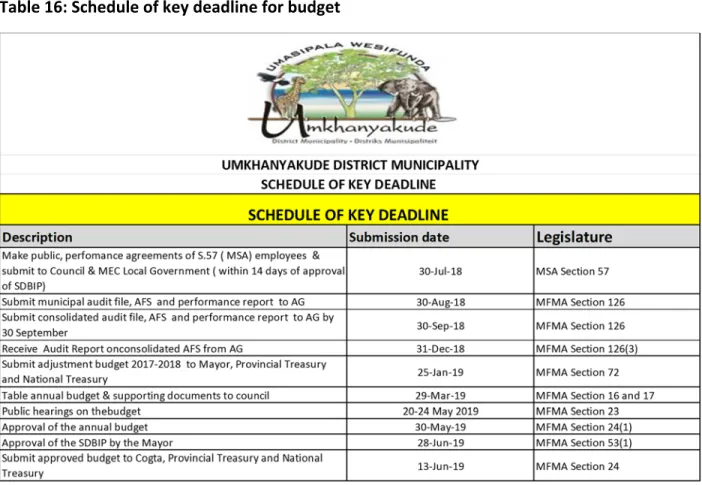

Overview of the annual budget process

- Budget Process overview

- Key IDP Processes and Deliverables

- Financial Modeling and Key Planning Drivers

- Community Consultation

To set the stage to manage the planning process and legal requirements in the planning of the implementation of the integrated planning system;. Outlining appropriate mechanisms, processes and procedures for how the public, stakeholders, government agencies can participate in the preparation of the IDP and the formulation of the budget structures that will be used to ensure this participation. Specify necessary organizational arrangements to ensure successful implementation of the integrated development planning process.

Program specifying how the process is monitored to manage the progress of the IDP and budget processes. Extensive financial modeling was performed during the compilation of the MTREF 2018-2019 to ensure long-term affordability and financial sustainability. The need for rate increases versus the community's ability to pay for services;.

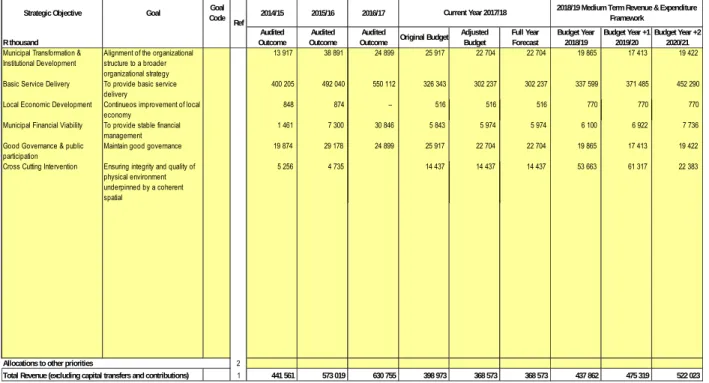

Overview of alignment of annual budget with Integrated Development Plan

- Strategic objectives

All documents in the appropriate format (electronic and hard copy) have been forwarded to National Treasury and other national and provincial departments in accordance with section 23 of the MFMA to enable them to contribute. In addition, integrated development planning provides a strategic environment for the management and direction of overall planning, development and decision-making in the municipality. For the municipality, issues of national and provincial importance should be reflected in the municipality's IDP.

The goal of this review cycle was to develop and coordinate a coherent plan to improve the quality of life for all the people living in the area, which also reflects issues of national and provincial importance. Only a member or a committee of a municipal council can make proposals to change the municipality's integrated development plan in the council. Consult all five local municipalities in the district municipality's area about the proposed change; and.

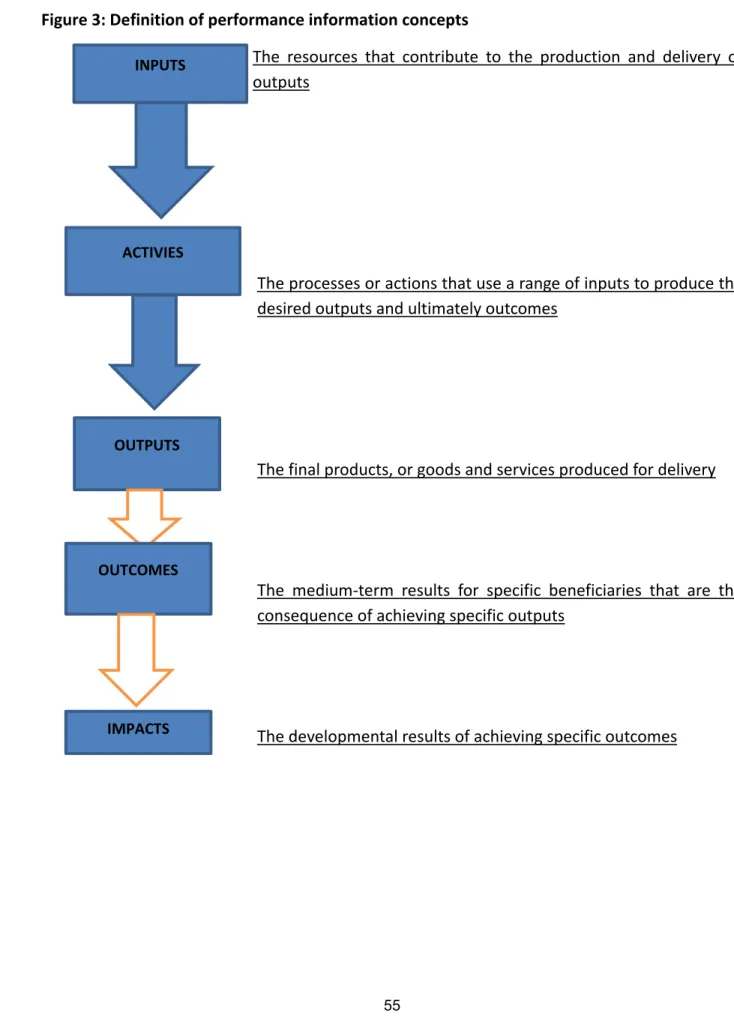

Measurable performance objectives and indicators

- Performance indicators and benchmarks

- Free Basic Services: basic social services package for indigent households

The performance of the municipality is directly related to the extent to which it has succeeded in realizing its goals and objectives, meeting legislative requirements and meeting the expectations of stakeholders. The following table provides the main measurable performance objectives that the municipality undertakes to achieve this financial year. The municipality succeeded in ensuring that creditors are settled within the legislative 30 days of invoice.

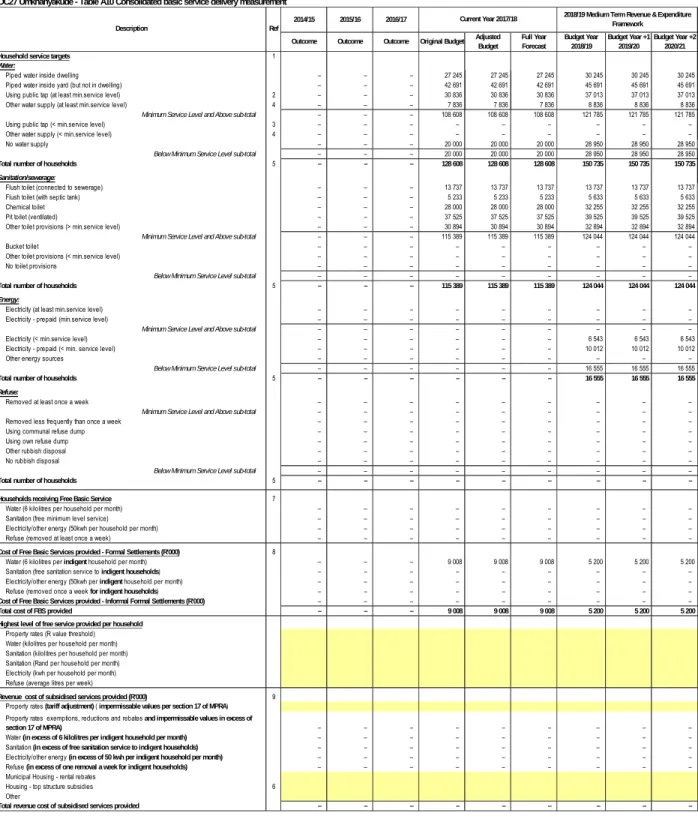

Although the liquidity ratio is a concern, the municipality managed to ensure compliance with this legal obligation by using daily cash flow management. Note that the number of households in informal areas receiving free services and the costs of these services (eg water supply via stands, water tanks, etc.) are not taken into account in the table above. In accordance with the Water Act of 1997, the municipality is the water service for the entire municipality and acts as a water service provider.

Overview of budget related‐policies

- Supply Chain Management Policy

- Expenditure management policy

- Risk management framework and risk management policy

- Indigent policy

UMkhanyakude Municipality decided in accordance with section 111 of the Municipal Financial Management Act, No. 56 of 2003, to have and implement a supply chain management policy giving effect to section 217 of the constitution; and Part 1 of Chapter 11 and other applicable provisions of the Act is fair, equitable, transparent, competitive and cost-effective; complies with the rules; and any minimum norms and standards that may be prescribed under section 168 of the Act are in accordance with other applicable legislation, e.g. Broad Based Black Economic Empowerment (BBBEE) does not undermine the goal of uniformity in Supply Chain Management Systems between government agencies in all areas; and is in accordance with national economic policy regarding the promotion of investment and trade with the public sector, assign responsibility for the implementation of the policy to the municipality's accountant. Pursuant to Section 65 of the MFMA, the accounting officer in each municipality is obliged to take all reasonable steps to ensure that the expenses, including the payments and the financial documents for this, are controlled and managed correctly.

Effective risk management is imperative for the institution to meet its mandate, public service delivery expectations and performance expectations within the institution. The provision of basic services to the community is in a sustainable manner within the Council's financial means and to provide procedures and guidelines for subsidizing service charges and rates to its poor households by using part or all of the Fair Share for this purpose. The Council also recognizes that many of the residents simply cannot afford to pay the required service charges and rates and the Council will endeavor to ensure affordability throughout.

Overview of budget assumptions

The basic assumption is that rate and rating increases will increase at a rate of CPI over the long run. The recovery rate is currently very low as the community of UMkhanyakude has high levels of unemployment and deprivation. The debtor's revenues are assumed to increase at a rate influenced by the debtor's collection rate from the consumer, rate/tariff prices, real growth rate of the municipality, growth rate of household formation and poor household change rate.

The increase on salaries for 2018/2019 is based on the Bargaining Council's salary agreement which is CPI plus 1 per cent. The focus will be to strengthen the link between policy priorities and expenditure in order to ensure the achievement of the national, provincial and local objectives. It is estimated that a spending rate of at least 100 per cent on operating expenses and 100 per cent on the capital program for the 2018-2019 MTREF, the performance of which is factored into the cash flow budget, is achieved.

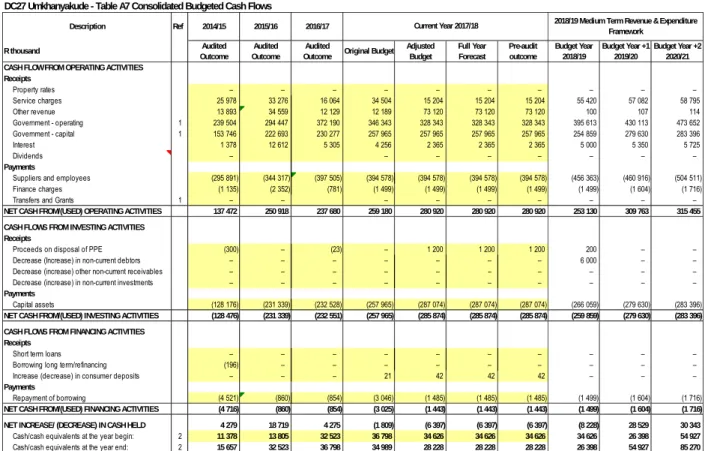

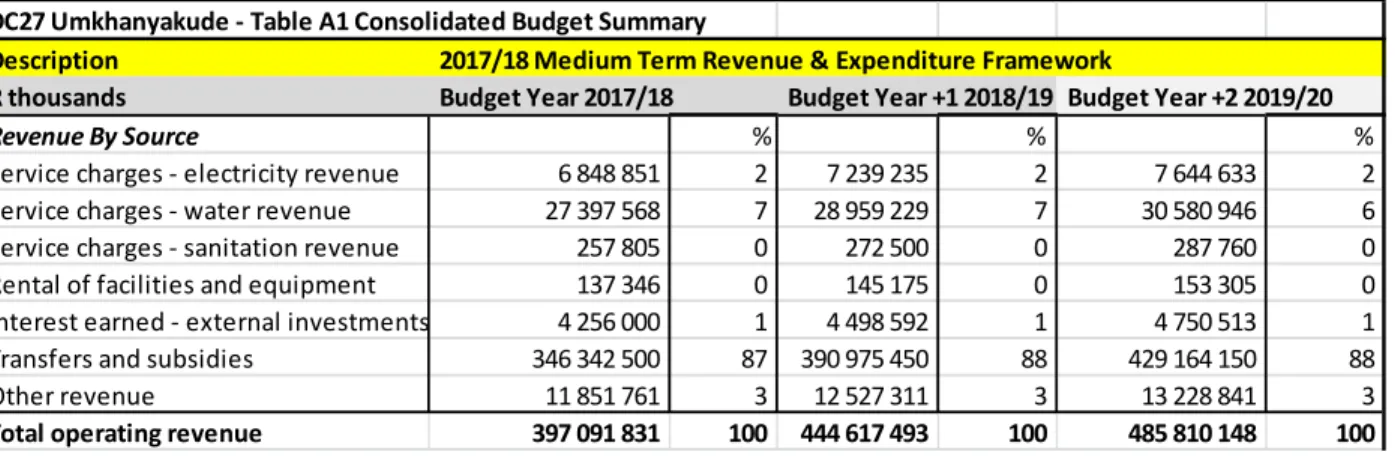

Overview of budget funding

The following chart is a breakdown of the operating income by main category for the 2018-2019 financial year. What is the forecasted cash and investments available at the end of the budget year. A deficit (applications > cash and investments) is indicative of non-compliance with section 18 of the MFMA requirement that the municipality's budget must be 'funded'.

Any underperformance in relation to debt collection could put upward pressure on the municipality's ability to meet its creditor obligations. The municipality's expected liquidity was discussed as part of the budgeted cash flow statement. This trend must be closely monitored and managed with the implementation of the budget.

Expenditure on grants and reconciliations of unspent funds

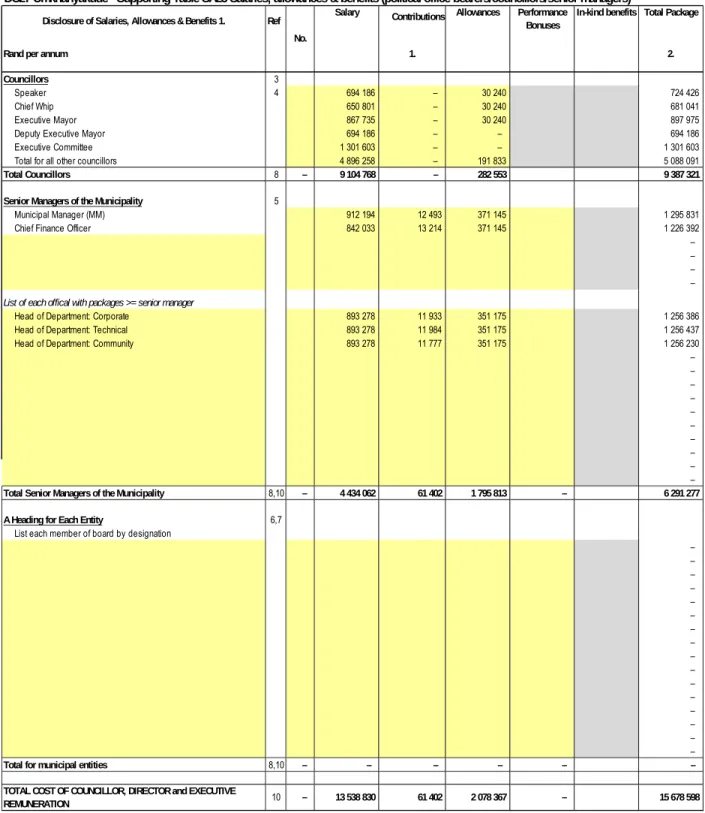

DC27 Umkhanyakude - Supporting Table SA23 Salaries, Allowances and Benefits (Political Officers/Councillors/Senior Managers). There are currently no vacant positions in the upper management structure of the Water Services Department. The departmental strategy ensures that the economic value and useful life of the water network and infrastructure is maintained.

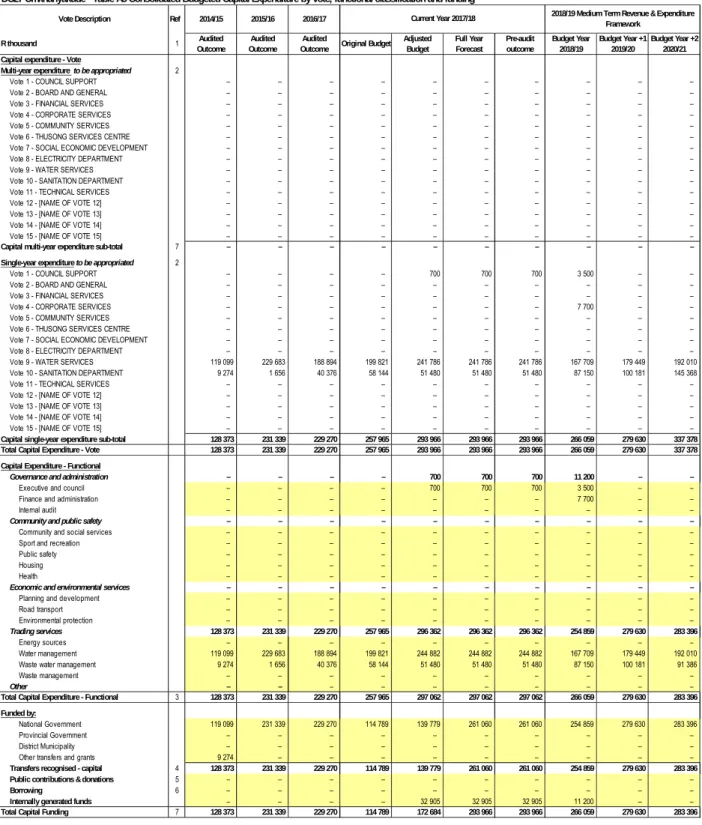

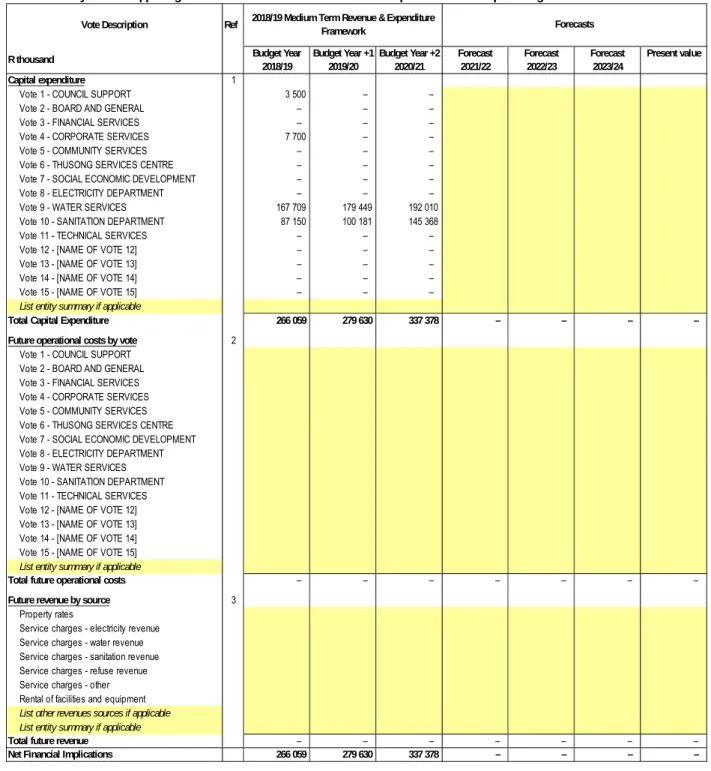

The following three tables present details of the municipality's capital expenditure program, first for new assets, then for asset renewal, and finally for asset repair and maintenance. The following three tables present details of the municipality's capital expenditure program, first for new assets, then for repairs and maintenance. DC27 Umkhanyakude - Supporting table SA34b Consolidated capital expenditure for renewal of existing assets by asset category.

The municipality is participating in the Municipal Financial Management Internship program and has hired five interns who are being trained in different divisions of the Financial Services Department. The detailed SDBIP document is at a draft stage and will be finalized after the approval of the MTREF 2018/17 in May 2018.

Councillor and employee benefits 2.9 .. Monthly

Annual budgets and SDBIPs – internal departments

The department is primarily responsible for the distribution of drinking water within the municipal boundary, including the treatment of raw water, maintenance of the grid and the implementation of the departmental capital program. As part of the performance targets for the financial year, the expansion of the Water Demand Management functional unit will entail an adjustment of the department organization chart and the associated filling of vacancies. Transfers & Grants - Capital (Monetary Allocations) (National/Provincial Departmental Agencies, Households, Non-Profit Institutions, Private Enterprises, Public Corporations, Institutions of Higher Education) & Transfers & Grants.

Contracts having future budgetary implications

Capital expenditure details

Power plants HV substations HV switching station HV transmission conductors MV substations MV switching stations MV networks LV networks Capital spare parts. Railway lines Railway constructions Railway furniture Drainage Collection Rainwater transport Damping MV substations LV networks Capital reserves. HV Substations HV Switching Station HV Transmission Conductors MV Substations MV Switching Stations MV Networks LV Networks Capital Spares.

Track Structures Track Furniture Drainage Collection Stormwater Transport Damping MV Substations LV Networks Capital Parts. Service Charges - electricity revenue Service Charges - water revenue Service Charges - sanitation revenue Service Charges - garbage revenue Service Charges - other Rental of facilities and equipment List other sources of income if applicable List entity summary if applicable. Service charges - electricity revenue Service charges - water revenue Service charges - sanitation revenue Service charges - garbage revenue Service charges - other Rent of facilities and equipment List other sources of income if applicable List entity summary if applicable.

Legislation compliance status

Other supporting documents

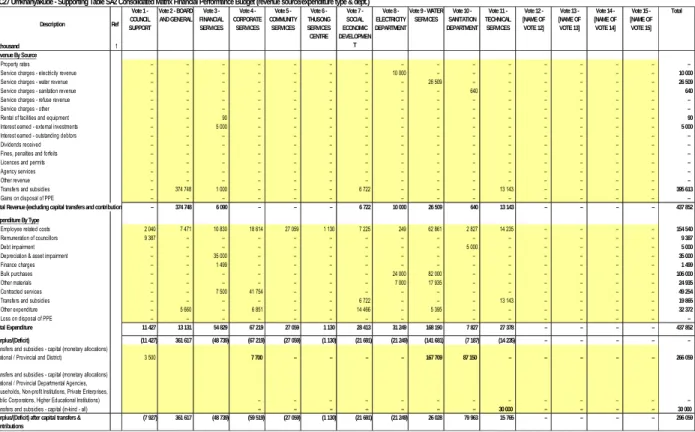

DC27 Umkhanyakude – Supporting Table SA2 Consolidated Financial Performance Budget Matrix (Source of Revenue/Type of Expenditure and Department).