DESCRIPTION OF THE INDUSTRY

- PRODUCTION AREAS

- PRODUCTION TRENDS

- LOCAL CONSUMPTION

- EMPLOYMENT

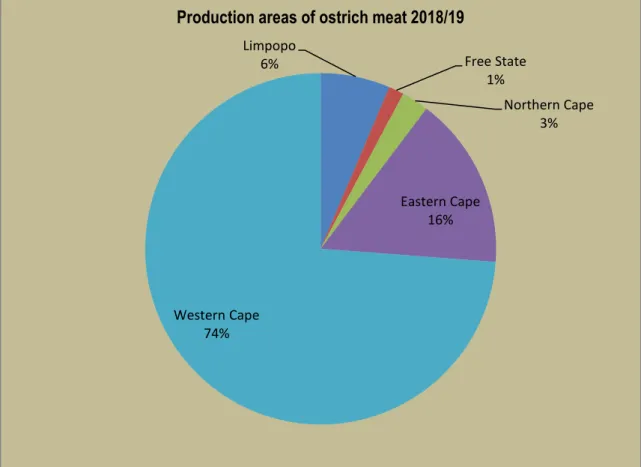

At least 70% of the world's ostriches are found in South Africa, while 90% of the products produced (feathers, meat and leather) are exported. According to Figure 2 above, 74% of ostriches are found in the Western Cape, with the Klein Karoo dominating production. Oudtshoorn in the Klein Karoo of the Western Cape is considered the ostrich capital of the world.

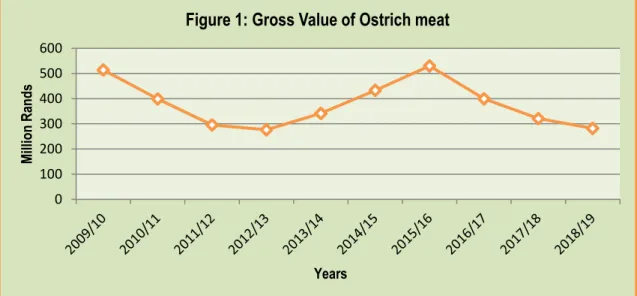

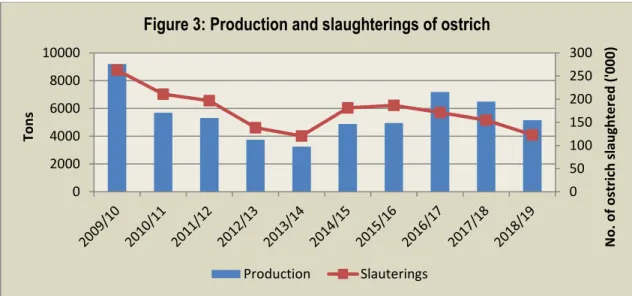

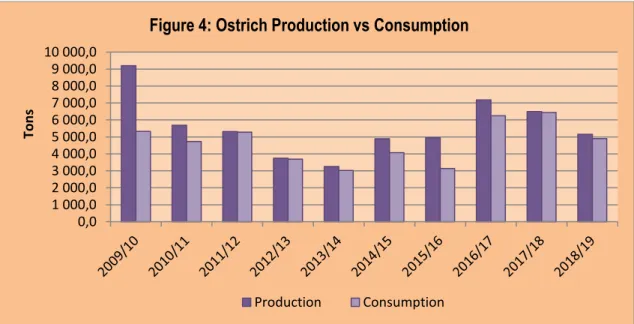

The data show that the maximum (peak) production of ostrich meat was achieved in 2009/10 at approximately 9,201 tons. As the industry rebounded in 2016/17 with increased production, another burst of AI occurred in 2017, causing ostrich production and slaughter to decline until 2018/19. The drastic increase in local consumption in 2011/12 and 2016/17 to 2017/18 was due to the fact that ostrich producers decided to explore the local market due to the ban on ostrich meat in the EU.

The resumption of the export of ostriches to South Africa's main market (European Union) due to the end of a four-year ban will contribute to the increase in employment opportunities. The job opportunities will mainly increase in the Western Cape as the province produces around 75% of ostriches.

MARKET STRUCTURE

DOMESTIC MARKET

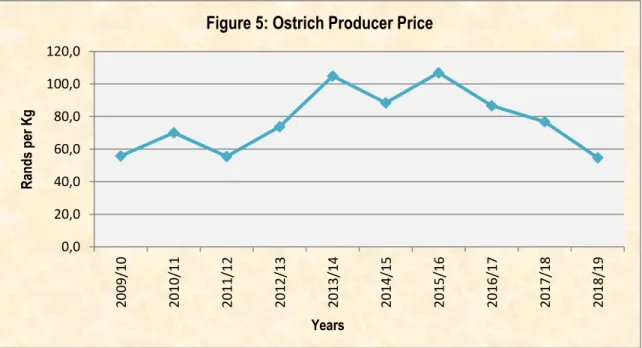

Local consumption comes in all sorts of forms, with wors (sausage) and biltong (dried and seasoned meat) being among the favourites. The trend shows that prices then fell until 2018/19, reaching the lowest (R54.70) price in the past decade.

IMPORT- EXPORT ANALYSIS OF OSTRICH

- EXPORTS OF OSTRICH MEAT

- IMPORTS OF OSTRICH MEAT

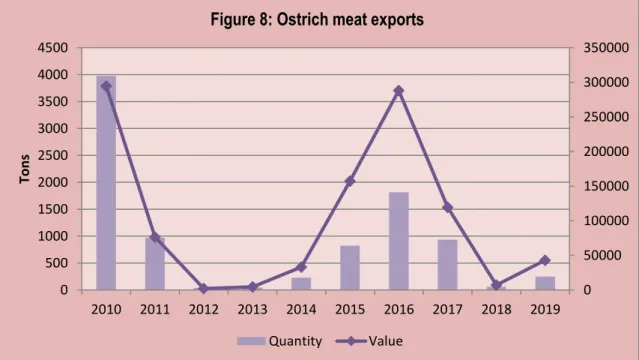

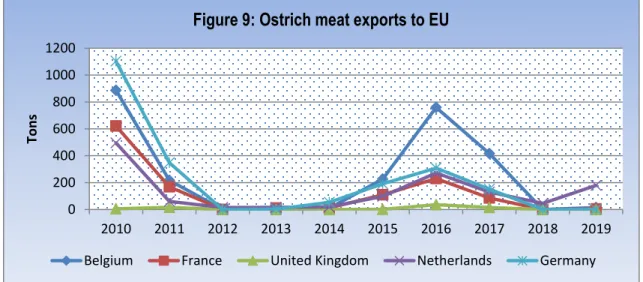

Figure 8 shows that the quantity and value of ostrich meat exports has fluctuated over the past ten years. Ostrich meat exports to the EU fell dramatically from 2011 to 2015 as a result of the outbreak. The values of ostrich meat exports from different provinces of South Africa are shown in Figure 12.

Figure 12 above clearly shows that the largest export of ostrich meat comes from the Western Cape province. Low exports from 2011 to 2014 were due to the suspension of ostrich meat exports from South Africa due to the H5N2 bird flu outbreak. The following figures (Figures 13-21) show the export value of ostrich meat from various district municipalities in the nine provinces of South Africa.

From the Western Cape Province, Eden District Municipality was the main exporter of ostrich meat with a total value of R1.11 billion during the period under review. The Cape Winelands District municipality was the smallest exporter of ostrich meat during the period under review. The figure shows that the value of ostrich meat exports from Eden District Municipality peaked at R409 million in 2010.

From Free State Province, the exports of ostrich meat were recorded in Mangaung, Lejweleputswa and Thabo Mofutsanyane District Municipalities. In the period under review, Thabo Mofutsanyane District Municipality was the highest exporter of ostrich meat worth R13.9 million in total. From the province of KwaZulu-Natal, eThekwini Metropolitan Municipality has achieved 100% export share of ostrich meat value in the last decade except 2011 and 2013.

The municipality of Dr. Ruth Segomotsi Mompati achieved the highest export value of ostrich meat in 2012 at 971 331 Rand. The municipalities of Sedibeng, Ekurhuleni and West Rand counties recorded the lowest exports of ostrich meat during the period under review. Ehlanzeni District Municipality achieved the highest export value of ostrich meat at R88 031 in 2016, while Gert Sibande achieved the highest value of R22 759 in the same year.

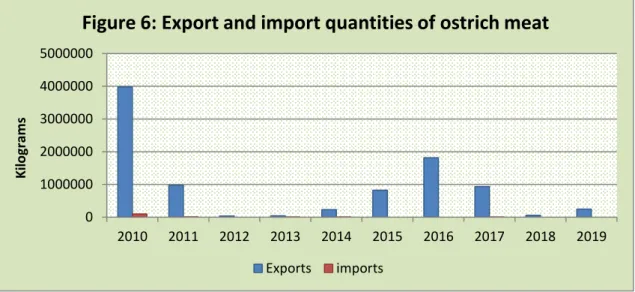

Municipalities from the province of Limpopo, Vhembe, Capricorn and Waterberg recorded intermittent exports of ostrich meat during the analysis period. During the reporting period, imports of ostrich meat were very low except in 2010.

OSTRICH PRODUCTS VALUE CHAIN

ORGANISATIONAL ISSUES

THREATS AND CONCERNS

CHALLENGES FACING EMERGING FARMERS

MEAT QUALITY STANDARDS

In order to export ostrich meat to the EU, slaughterhouses and boning and packing plants must be approved by the EU. The state, as a recognized competent authority, must ensure the inspection of meat in slaughterhouses approved for the export of meat to the EU and certify the meat before export. Quarantine camps must be without ticks, without vegetation and must have 3 meters of cleared surface around the camp.

An abattoir is also closed for export to the EU if an outbreak of Newcastle disease occurs within 10 kilometers of the abattoir. No sand, hay or other organic material is allowed on vehicles used to transport birds to the abattoir and the vehicles must be disinfected before leaving the abattoir site. The avian influenza (AI) status of the farm of origin must be indicated when birds are offered for slaughter.

The occurrence of AI in South Africa in 2011 has caused the closure of the EU to imports of ostrich meat from South Africa. All ostriches must have an identification tag that enables the meat to be traced back to the farm of origin. Slaughter offal must come from a registered farm and must have been on a registered farm for at least 3 months prior to slaughter.

The farm must be registered for at least 6 months before the birds can be submitted for slaughter.

BLACK ECONOMIC EMPOWERMENT PROJECTS

- W ESTERN C APE

- Klein Karoo Agri Business Centre (Klein Karoo Region)

- SCOT: Southern Cape Ostrich Tanning

- Mosstrich BEE Trust (Mossel bay)

- E ASTERN C APE

- Integrated Meat Processors of the Eastern Cape (IMPEC)

- Middleton - Ostrich Development Project

- N ORTHERN C APE

- ALL OSTRICH PRODUCTION AREAS: COUNTRY-WIDE

- OSTRI-BEE QUICK FACTS

SCOT provides training in the production of ostrich leather products to unemployed women in the Mossel Bay area and sells the products through SCOT's marketing channels. The company implemented a project in which it awarded 6,000 preferred shares to 250 employees, which represents 6.5% of the share capital. Employees share in the company's profits, and a total of 1,815 million ran was paid to employees in the form of dividends.

The next step is to extend this program to agricultural workers working on some of the ostrich producers' farms. Integrated Meat Processors of the Eastern Cape (IMPEC) is fully BEE compliant and facilitates the economic empowerment of previously disadvantaged individuals through this integrated project involving beneficiaries throughout the value chain and providing appropriate business training to ensure sustainability. It has trained more than 100 small-scale rural black farmers to raise 7,000 ostriches annually for slaughter in Grahamstown.

This project creates an opportunity to uplift various previously disadvantaged role players and farm workers. The Kuruman Project is a black-owned company with 30 members involved in the production of ostriches. Members of this group make extensive use of the SAOBC Ostrich Production Training Booklet.

After the ostriches reach maturity (slaughter age), the producers buy the birds from their workers. There are also ostrich producers who have set up cooperatives for the benefit of their workers, who are now also shareholders.

MARKET INTELLIGENCE

EXPORT TARIFFS OF OSTRICH MEAT

IMPORT TARIFFS

PERFORMANCE OF SOUTH AFRICAN OSTRICH INDUSTRY IN 2019

E XPORTS

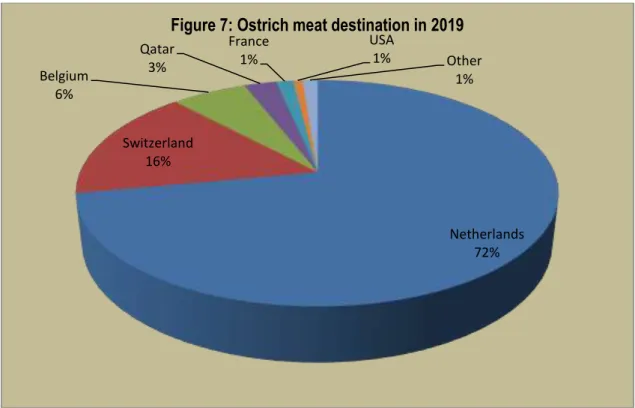

In 2019, South Africa's exports accounted for 0.7% of world exports of ostrich meat (fresh, chilled or frozen) and its ranking in world exports was 22. The main export destinations for ostrich meat originating from South Africa in 2019 were the Netherlands, Switzerland and Belgium. The Netherlands was the leading market for ostrich meat, accounting for 52.9% of the South African export market, followed by Switzerland with 17.3% and Belgium (10.7%) respectively.

On average, South African ostrich meat exports fell by 41% in value and 38% in quantity between 2015 and 2019. In the same period, the Netherlands experienced a decline of 23% in value and 19% in quantity per year. South Africa's exports of ostrich meat to the world increased in value by 139% in the period 2018 to 2019 and the Netherlands increased in value by 317% and Switzerland increased by 195% in the same period.

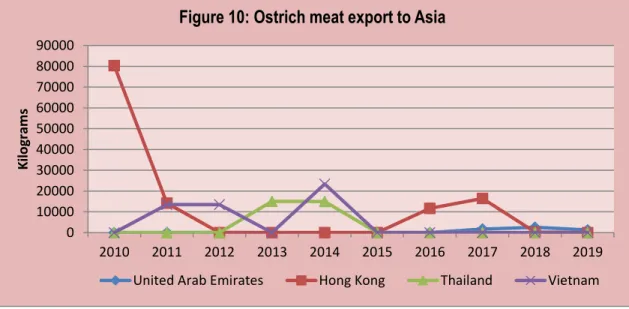

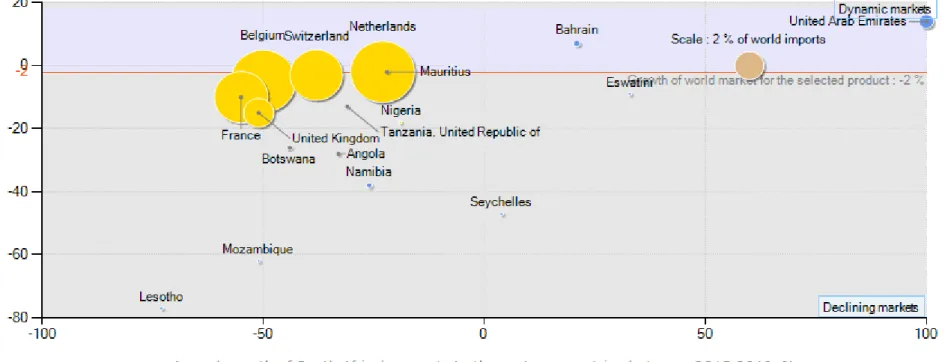

During the same period, South Africa's ostrich meat exports to Namibia, Bahrain, the United Arab Emirates (UAE) were growing at a faster rate than their imports from the rest of the world. South Africa's fastest growing ostrich meat export market is the United Arab Emirates and its annual export growth is 100%. The most attractive markets although small Somalia because its annual growth of imports has increased by 55%.

South Africa currently exports less than what is imported from the world, therefore penetration into this market could be beneficial.

ACKNOWLEDGEMENTS/REFERENCES