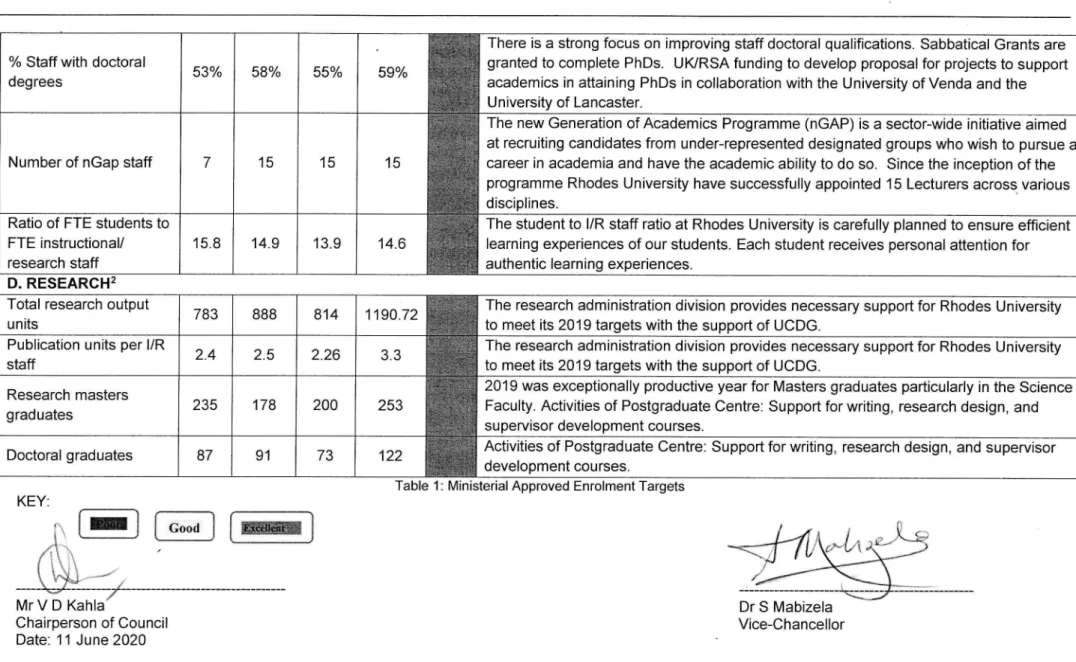

The Chancellor is the titular head of Rhodes University and is empowered in the name of the University to confer all degrees. These indicators include the university's ministerially approved enrollment targets for 2019 in the current enrollment cycle (2013 to 2019).

Statutory Governance Information

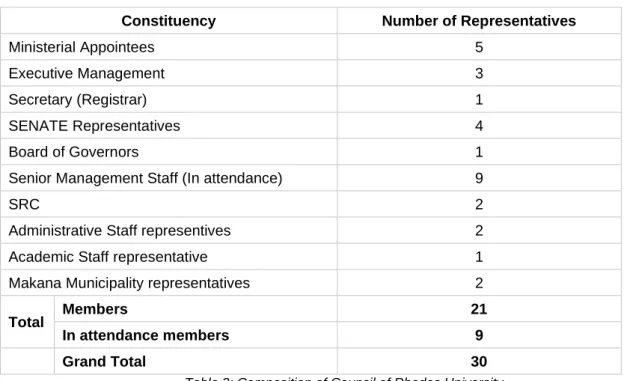

Composition of Council

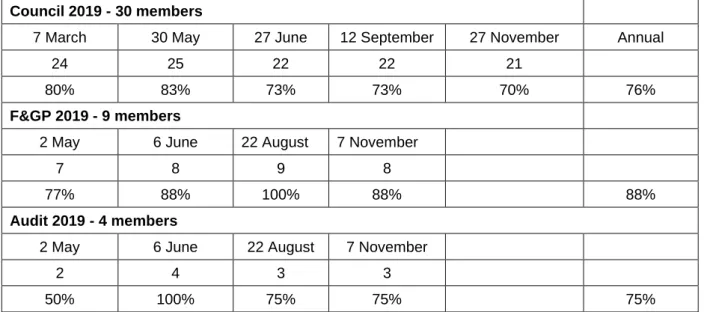

Summary of Attendance at Meetings of Council and Committees of Council

Major Statements/decisions of council

The Council APPROVED the appointment of PwC as external auditor for a two-year period. m) Advisory Panel for Afrikaans and Dutch Studies. Council APPROVED a proposal that a second graduation ceremony be held and that only Master's and PhD students be considered for the second graduation ceremony.

Statement on IT Governance

A risk assessment process, which also involves university leadership, informs the Institutional Risk Register, which contains the Top Risks for the university. The CIOVID-19 pandemic has had a major impact on all aspects of the university's business and operations.

AND CONTROLS

VICE.CHANCELLOR'S REPORT ON MANAGEMENT AND ADMINISTRATION (continued)ADMINISTRATION (continued)

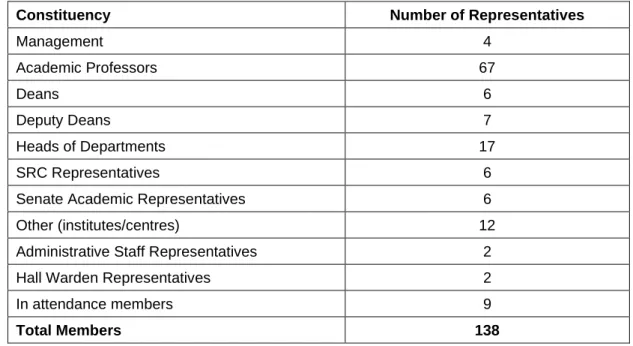

- Composition of Senate & Attendance of Meetings in 2019

- Major decisions of Senate in 2019

The Senate RECOMMENDS APPROVAL of the proposed amendment relating to the alignment of the Rhodes University Program and the combination of qualifications. The Council-approved three-year financial capacity plan remains in place as the message from DHET is clear – funding increases in recent years have come at the expense of other national budgets and similar rates of increase are not sustainable in the future. The continued existence of an open defined benefit pension fund poses a significant risk to the financial sustainability of the university.

The Council is responsible for preparing and giving a true and fair view of Rhodes University's consolidated financial statements.

INDEPENDENT AUDITOR’S REPORT

TO THE MINISTER OF HIGHER EDUCATION AND TRAINING AND THE COUNCIL OF RHODES UNIVERSITY

REPORT ON THE AUDIT OF THE CONSOLIDATED FINANCIAL STATEMENTS

In preparing the consolidated financial statements, the council has responsibility for assessing the university's ability to continue as a going concern, disclose, where relevant, matters relating to going concern and apply the going concern basis, unless the relevant management structure either intends to liquidate. the University or to cease operations, or has no realistic alternative but to do so. Auditor's responsibilities for the audit of the consolidated financial statements Our objective is to obtain a high degree of assurance as to whether the consolidated financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor's report containing our conclusion. Misstatements may arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to affect the financial decisions that users make on the basis of these consolidated financial statements.

A further description of our responsibilities for the audit of the consolidated financial statements is included in the appendix to this auditor's report.

REPORT ON THE AUDIT OF THE ANNUAL PERFORMANCE REPORT

We performed procedures to determine whether the reported performance information was presented correctly and whether performance was in accordance with the approved performance planning documents. We performed further work to determine whether the indicators and related objectives were measurable and relevant, and assessed the reliability of the reported performance information to determine whether it was valid, accurate and complete. We have not made any material findings about the usefulness and reliability of the reported performance information for the above objectives.

Information on the achievement of the planned goals for the year can be found in the annual report on operations on pages 6 to 8.

REPORT ON THE AUDIT OF COMPLIANCE WITH LEGISLATION

Report to the project's stakeholders whether, in our opinion, the annual project statements give a true and fair view of the project's financial results in accordance with the original objective. Report to the project's stakeholders whether, in our assessment, the annual project statements give a true and fair view of the project's financial results in accordance with the project's terms of reference. Conclude on the appropriateness of the Board's use of the going concern basis of accounting in the preparation of the annual accounts.

Obtain sufficient appropriate audit evidence regarding the financial information of the entities or business activities within the University to express an opinion on the consolidated financial statements.

Restated

2017 Restated

EQUITY AND LIABILITIES

Restated 2018

1 Jan 2019

The statement of profit or loss shows the

Total

Assets

Recognised fair value measurements

Classification

The fair value of trade payables and other debts approximates the accounting values, as the majority of trade payables and other debts are non-interest-bearing and are usually settled within agreed terms with creditors.

31 Dec 2019

01 Jan 2019

The university derives revenue from the transfer of goods and services over time and at a point in time in the following revenue streams:.

South African Non-NSFAS

South African NSFAS funded

International Students

Total R’000

Movement during the year

State Appropriations - grants and subsidies are

Cash generated from operations

Adjustments for non-cash items

The following disclosures relate to compensation paid to executive management for the year ended December 31, 2019. The amounts shown below are based on total university labor costs and include flexible compensation packages.

L’Ange Executive Director

The University operates a defined benefit pension fund as well as two defined contribution provident funds. The responsibility for the management and administration of the defined benefit pension fund rests with the trustees. When managing the Fund, the trustees take into account the latest statutory valuation carried out in terms of the Pension Funds Act and recommendations made by the actuaries.

The plan is governed by local regulations and practices of the Financial Services Board as well as the Pension Fund Act of South Africa.

The assets of this fund are held independently of the University's assets in a separate trustee-administered fund. The plan is a final average salary pension plan that offers benefits to members in the form of a guaranteed level of pension, payable for life. The level of benefits provided depends on the member's length of service and their salary in the previous year.

The net actuarial gain on the fair value of the program's assets arose as a result of higher actual returns on assets than calculated interest income on assets.

Assumption Change

Defined benefit

The RUC Pension Fund's valuations reflected in these annual accounts have been arrived at in accordance with IAS19.

Inflation: The risk that future CPI inflation to which salary increases and pension increases are linked is higher than expected and uncontrolled

Longevity: The risk that pensioners live longer than expected and thus their pension benefit is payable for long than expected

Open-ended, long-term liability: The risk that the liability may be volatile in future and uncertain

Future changes in legislation: The risk that changes to legislation with respect to the post- employment liability may increase the liability for the University

Future changes in the tax environment: The risk that changes in the tax legislation governing employee benefits may increase the liability for the University

Administration: Administration of this liability poses a burden to the University

The University provides post-retirement health benefits to certain qualified employees in the form of continuing medical assistance contributions. Eligibility for this benefit is based on the employee having been employed by the university prior to 1991, remaining employed until retirement age, and completing the minimum length of service. This unhedged defined benefit obligation is valued annually by independent actuaries using the projected credit unit method.

The principal actuarial assumptions used were as follows

Inflation: The risk that future CPI inflation to which salary increases and pension increases are linked is higher than expected and uncontrolled

Longevity: The risk that pensioners live longer than expected and thus their pension benefit is payable for long than expected

Retirement benefit obligations (continued) Post-employment medical benefits (continued)

Future changes in legislation: The risk that changes to legislation with respect to the post- employment liability may increase the liability for Rhodes University

Future changes in the tax environment: The risk that changes in the tax legislation governing employee benefits may increase the liability for Rhodes University

Perceived inequality by non-eligible employees: The risk of dissatisfaction of employees who are not eligible for a post-employment healthcare subsidy

Administration: Administration of this liability poses a burden to Rhodes University

Enforcement of eligibility criteria and rules: The risk that eligibility criteria and rules are not strictly or consistently enforced

The financial assets and liabilities of the University are classified as follows

Financial assets at amortised cost

Financial assets at fair value through other

Financial assets at fair value through profit and

Financial risk factors

December 2019, if the FTSW/JSE CPI index increases/decreases by 10% with all other variables held constant and all the University’s equity instruments moved according to the

Fair value estimations

Risk categories

Amounts outstanding at

Loss rate applied

Expected credit loss

Other receivables

Ageing buckets

R’000 Loss rate applied

Loans

NSFAS student loans

Other student loans and employee loans

NSFAS Student Loans

Other Loans

Within

Later than

- Events after reporting period

- Multi-modal remote Learning and Teaching has been implemented

- A reprioritisation of financial resources including capital projects is being reviewed

- The gradual return of students to campus within the ambit of directives provided by the DHET

- An extension of the academic year if necessary into the 2021 calendar year

- IFRS 16 Leases

The financial consequences of the pandemic will affect the university negatively both in the short and medium term. The effects of the COVID-19 pandemic as well as the impact of volatility in global and local markets on the University's financial position are being closely monitored and assessed. The impact on the financial statements of the transition to IFRS 16 resulted in the university recognizing additional right-of-use assets and liabilities of R 12.7 million.

In accordance with IFRS 16, the university recognizes right-of-use assets and lease liabilities for most leases, including operating leases.

Leases classified as operating leases under lAS 17

January 2019 transition lease liabilities were measured at the present value of the remaining lease payments, discounted at the University’s incremental borrowing rate at

- IFRS 16 Leases (continued)

- Government grants – IAS 20

- Basis of Preparation

In transitioning to IFRS 16, the University used a practical measure to assess which transactions are leases. In accordance with IAS 20, state grants are recognized in profit or loss systematically in the periods in which the university recognizes expenses for the related costs that the grants are intended to replace, which in the case of grant-related grants requires the grant to be recognized as deferred income or deducted from book value of the asset. Before that, the university decided to set off the received donation with the book value of the asset.

It also requires management to exercise judgment in the process of applying the University's accounting policies.

New Standards not yet adopted

Insurance Contracts

The main accounting policies used in the preparation of these annual accounts are set out below. These policies have been applied consistently for all years presented, except for the changes in accounting policies as described in Note 1. The consolidated financial statements of Rhodes University (the University) have been prepared in accordance with International Financial Reporting Standards (IFRS). and in the manner prescribed by the Minister of Education in accordance with section 41 of Højere.

The preparation of financial statements in accordance with IFRS requires the use of certain critical accounting estimates.

Definition of Material – Amendments to IAS 1 and IAS 8

The areas involving a higher degree of judgment or complexity, or areas where assumptions and estimates are significant to the consolidated financial statements, are valuation of employee benefits, impairment of receivables and calculation of lease liabilities.

Amendment to IFRS 3 Business combinations

Other

Consolidation

Income recognition

State appropriations: subsidies and grants

Tuition and other fee income

Private grants and income from contracts

Finance income

Sale of goods and services

Other non-recurrent income

- Research costs

- Reserve funds

- Foreign currencies

- Offsetting financial instruments

- Property, plant and equipment (a) Owned assets

- Property, plant and equipment (continued) (b) Leased assets

- Leases

Donated fixed assets are recorded at fair value on the date of donation. Tangible fixed assets purchased with state grants are treated as stated in explanation 2.3.1. Depreciation of tangible fixed assets is calculated using the straight-line depreciation method to allocate their purchase or revalued value to their residual value over the estimated useful life.

An impairment loss is recognized at the amount by which the accounting value of the asset exceeds this.

Policy applicable before 1 January 2019

Leases (continued)

Leases in which a substantial portion of the risks and rewards of ownership are retained by the lessor are classified as operating leases. Payments made for operating leases (net of incentives received by the lessor) are charged to the income statement on a straight-line basis over the lease term.

Policy applicable from 1 January 2019

January 2019, leases are recognised as a right-of-use asset and a corresponding liability at the date at which the leased asset is available for use by the University

- Inventories

- Financial instruments - IFRS 9

Financial instruments, consisting of financial assets and financial liabilities, carried at the reporting date by the University include bank and cash, trade receivables, trade payables, borrowings and bank overdrafts. All other financial assets and liabilities are recognized in the balance sheet when the University becomes a party to the contractual provisions of the instrument. A financial asset (unless it is a trade receivable without a significant financing component) or financial liability is initially measured at fair value plus, for a non-FVTPL item, transaction costs directly attributable to its acquisition or issuance.

Financial assets and liabilities are offset, and the net amount is shown in the balance sheet when there is a legally enforceable right to set off recognized amounts and there is an intention to net settlement or simultaneous realization of assets and settlement of liabilities.

Loans receivable at amortised cost Classification

Trade receivables and payables to suppliers exclude prepayments and certain legal obligations and obligations related to employees for the purposes of financial instruments.

Recognition and measurement

Trade and other receivables are recognized when the University becomes a party to the contractual terms of the receivables.

Impairment

Trade and other payables Classification

Recognition and measurement (continued)

Cash and cash equivalents

Investments and other financial assets Classification

Recognition and derecognition

Measurement

Debt instruments

Equity instruments

Provisions

Provisions are recognized when the University has a present legal or constructive obligation as a result of past events, when it is probable that an outflow of resources involved. Provisions are measured at the present value of the expenditure expected to be required to settle the liability using a pre-tax discount rate.

Employee benefits

The University provides post-retirement health benefits to retirees who were employed by the institution prior to 1991. The expected cost of these benefits is accrued over the period of employment using an accounting methodology similar to that used for defined benefit pension plans. Severance benefits are paid when the institution terminates employment before the normal retirement date or whenever the employee accepts voluntary redundancy in exchange for these benefits.

Earnings due more than 12 months after the end of the reporting period are discounted to present value.

Taxes