Analisis Pengaruh Rasio CAMEL terhadap Harga Saham Pada Perusahaan Perbankan Yang Terdaftar di Bursa Efek Indonesia

Teks penuh

Gambar

Dokumen terkait

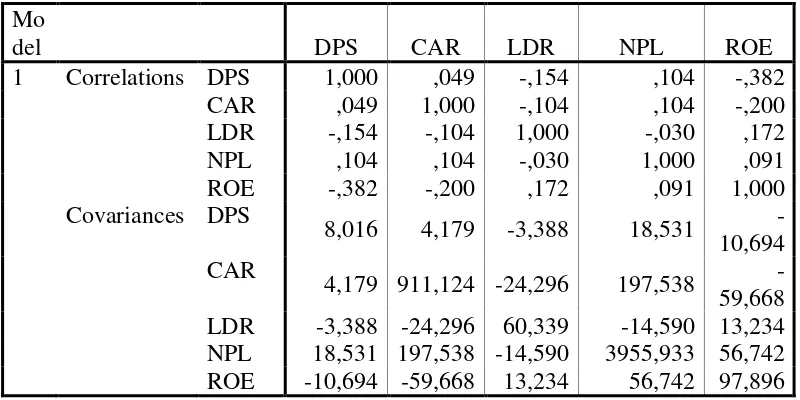

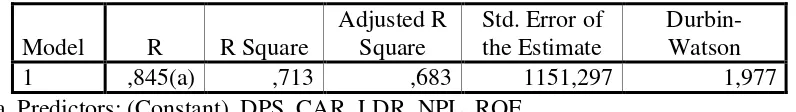

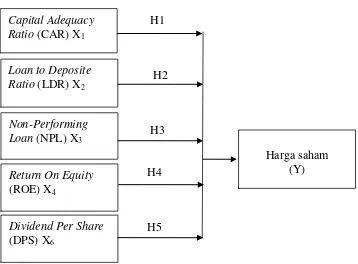

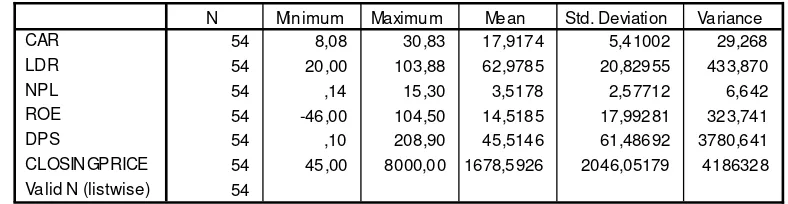

Penelitian ini bertujuan untuk mengetahui pengaruh Capital Adequacy Ratio (CAR), Non Performing Loan (NPL), Likuiditas Dan Efisiensi Operasional Terhadap Profitabilitas

The results of this study show that simultaneously the variable Capital Adequacy Ratio (CAR), Non Performing Loan (NPL), Net Profit Margin (NPM), Return on Asset (ROA), Loan

Secara simultan baik variabel capital adequacy ratio (CAR),net interest margin (NIM),non-performing loan (NPL), dan price earning ratio (PER) berpengaruh signifikan terhadap

Analisis Pengaruh Kinerja Keuangan yang di proxy melalui Capital Adequacy Ratio (CAR), Net Interest Margin (NIM), Non Performing Loan (NPL), dan Price Earning Ratio (PER)

Hasil penelitian ini menunjukkan bahwa Capital Adequacy Ratio (CAR), Non Performing Loan (NPL) , Net Profit Margin (NPM) , Biaya Operasional terhadap Pendapatan

Pengaruh Capital Adequacy Ratio (CAR), Non Performing Loan (NPL), Dan Loan to Deposit Ratio (LDR) Terhadap Profitabilitas (Return on Assets) (Studi Pada Bank Umum Yang terdaftar

Untuk menguji hubungan antaraNon Performing Loan (NPL), Loan to Deposit Ratio (LDR), Good Corporate Governance (GCG) dan Capital Adequacy Ratio (CAR) terhadap

The F test result indicate that the variable Non Performing Loan (NPL), Loan to Deposit Ratio (LDR), Good Corporate Governance (GCG), and Capital Adequacy Ratio (CAR)