Quantitative Finance authors titles recent submissions

Teks penuh

Gambar

Dokumen terkait

On the existence of optimal portfolios for the utility maxi- mization problem in discrete time financial market models. In From stochastic calculus to mathematical finance ,

Next, by utilizing a fast computational method for how the rare event occurs and the proposed importance sampling method, we provide an efficient simulation algorithm to esti- mate

The standard Gaussian prior (setting 1) in red solid strokes, the row-wise Lasso prior (setting 2) in blue long-dashed strokes, the column-wise Lasso prior (setting 3) in

(There is also a paper by Cox and Hoeggerl [9] which asks about the possible shapes of the price of an American put, considered as a function of strike, given the prices of

With only minimal ingredients, this model is able to capture the aggregate e ff ect of idiosyncratic shocks to aver- aged economic output growth measures.. It thereby establishes

We study in this paper a class of constrained linear-quadratic (LQ) optimal control problem formu- lations for the scalar-state stochastic system with multiplicative noise, which

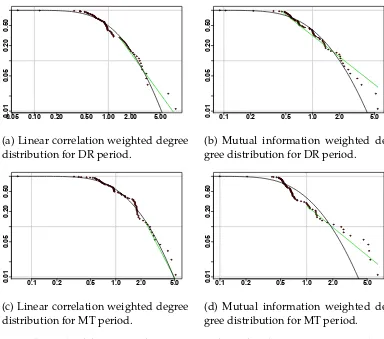

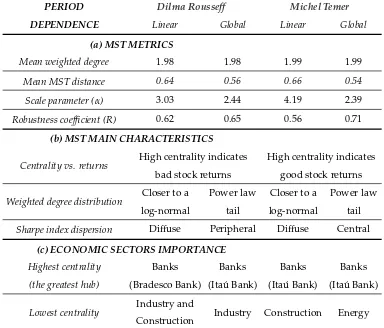

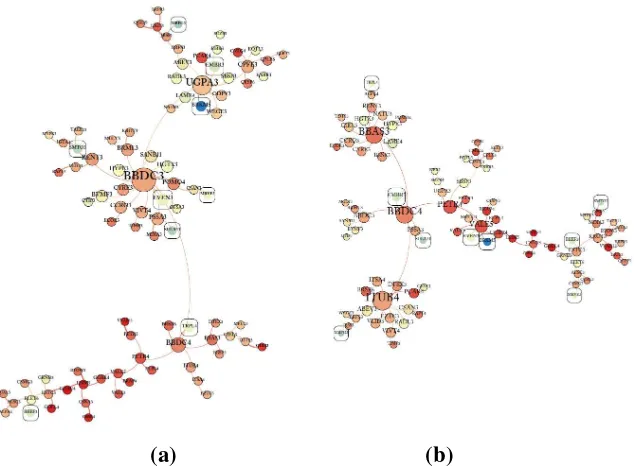

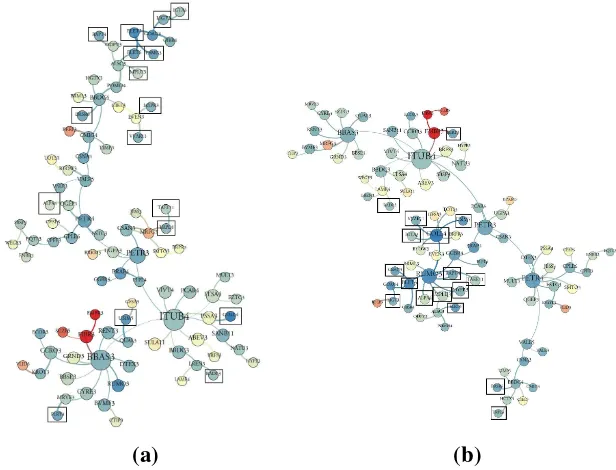

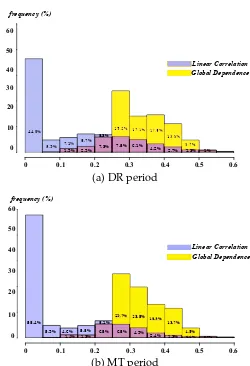

∗ Corresponding author, [email protected].. using the analytical approaches developed in the cross-disciplinary research fields in- volving econophysics and

We also investigate the saver’s decision of whether to manage her/his portfolio personally ( DIY investor ) or hire, against the pay- ment of a management fee, a professional