Directory UMM :Data Elmu:jurnal:J-a:Journal Of Economic Dynamics And Control:Vol24.Issue5-7.Jul2000:

Teks penuh

Gambar

Dokumen terkait

This larger view nests conventional rational expectations general equilibrium theory in the sense that if the costs of acquiring & full knowledge of the true model expectations

This model tries to combine both a well de " ned economic structure in the market trading mechanisms, along with inductive learning using a classi " er- based system..

Using the BDS and the NEGM tests, and 15-s, 1-min and 5-min returns (from September 1 to November 30, 1991), they reject the hypothesis of independence in favor of a nonlinear

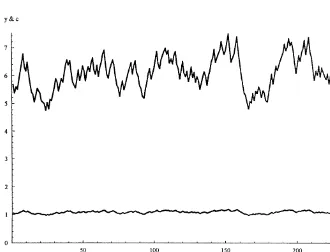

Marimon and Sunder (1993) examine a related experimental OLG economy in which the money supply is allowed to grow over time, and " nd that observed price paths tend to converge

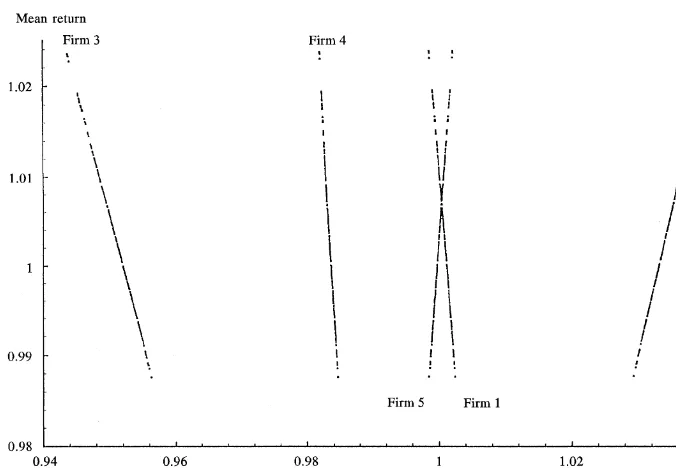

Bifurcation diagrams plotting long-run behavior versus intensity of choice b for (a) constant beliefs about conditional variances of returns, (b) time varying beliefs about

In this paper we show how the global dynamics of an economic model can be analyzed by the study of some global bifurcations that change the shape of the chaotic attractors and

In a pure exchange overlapping generations model we obtain that to have a cycle and a chaotic dynamics under bounded rationality learning we need a coe $ cient of risk aversion for

for every initial resource stock a critical level of debt, below which debt may be steered to zero but above which debt tends to in " nity, no matter how the rate of extraction