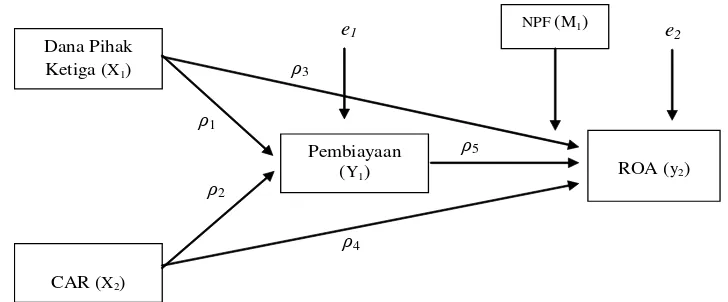

Factors Affecting the Financing of Profitability Using Non Performing Financing as Moderating Variable in Sharia Business Unit of Bank Sumut (Bank of North Sumatera) in North Sumatera

Teks penuh

Gambar

Dokumen terkait

murabahah, pembiayaan mudharabah , pembiayaan musyarakah dan Non Performing Financing (NPF) berpengaruh signifikan terhadap Return On Asset (ROA) Bank Umum Syariah

The result of analysis shows that the factors inluencing NPF negatively and sig - niicantly are ratio of revenue sharing inancing (RR), Return on Assets (ROA), inlation,

Then the Non-Performing Financing NPF and Cost to Income Ratio BOPO variables as other risk management ratios have a significant negative effect on the performance ROA of Islamic

Result of Liquidity Risk Regression to Financing of Indonesian Sharia Banking with Bank Size as Moderating Variable Based on the research problems formulated to de- termine the

The purpose of this study was to determine the relationship between profit sharing financing Mudharabah and Musyarakah, leasing Ijarah and non performing financing NPF on ROA in Islamic

The Influence of BOPO, Capital Adequacy and Musyarakah Financing on Profitability of Islamic Commercial Banks According to research conducted by Aulia & Anwar 2021, who conducted a

This research seeks to analyze the impact of both internal and external factors on the risk involved in non-performing financing where the variables taken into account are the

Penelitian ini bertujuan untuk menguji pengaruh variabel Non Performing Financing (NPF), Capital Adequacy Ratio (CAR), Financing to Deposit Ratio (FDR) dan ROA terhadap profitabilitas PT. Bank Victoria Syariah yang diukur dengan Return on Assets