Vol. 25 No.1 (2017) pp. 109-138 Doi: 10.21580/ws.25.1.1540

FACTORS INFLUENCING

NON-PERFORMING FINANCING (NPF) AT SHARIA BANKING

J A E N A L E F F E N D I1, U S Y T H I A R A N Y2, T I TA N U R S YA M S I A H3

Bogor Agricultural University

Abstract

The risk of inancing is the risk caused by the failure of the custom -ers to fulill their obligations. Non-performing inancing (NPF) is a representation of inancing risk that is channeled and has a direct impact on bank proitability. The value of NPF tends to increase annually with a value that is already close to the maximum limit set by Bank Indonesia of 5 percent. This condition is able to lead to the ineficiency of the banking system and in the long run, will have an impact on the sustainability of the bank. Therefore, the analysis of NPF factors should be conducted as a preventive mea -sure and a risks controller of business activities. This research an -alyzes the factors inluencing NPF at sharia banking (BUS) using a quarterly datafrom irst quarter of 2012 until third quarter 2016. Method used in this research is panel data analysis. The result of analysis shows that the factors inluencing NPF negatively and sig -niicantly are ratio of revenue sharing inancing (RR), Return on Assets (ROA), inlation, Capital Adequacy Ratio (CAR) and Bank -size while Gross Domestic Product (GDP) and Operating Cost to Operating Income (BOPO) have a signiicant positive effect.

Risiko pembiayaan adalah risiko yang disebabkan oleh adanya ke-gagalan nasabah dalam memenuhi kewajibannya. Non-Performing

Financing (NPF) merupakan representasi dari risiko pembiayaan

yang disalurkan dan berdampak langsung pada proitabilitas per -bankan. Nilai NPF yang cenderung meningkat setiap tahunnya dengan nilai yang sudah mendekati batas maksimum yang tel-ah ditetapkan oleh Bank Indonesia yaitu sebesar 5 persen dapat

menyebabkan ineisiensi perbankan dan dalam jangka panjang

akan berdampak pada kelangsungan bank. Maka dari itu, anal-isis faktor-faktor NPF perlu ditinjau sebagai upaya pencegahan dan untuk mengendalikan risiko dari kegiatan usaha. Penelitian ini menganalisis faktor-faktor yang memengaruhi NPF pada Bank Umum Syariah (BUS) dengan menggunakan data kuartal dari kuartal I 2012 hingga kuartal III 2016. Metode yang digunakan dalam penelitian ini adalah analisis data panel. Hasil analisis menunjukkan bahwa faktor-faktor yang memengaruhi NPF secara

negatif dan signiikan adalah RR, ROA, inlasi, CAR dan Banksize sedangkan GDP dan BOPO berpengaruh positif signiikan.

Keywords: panel data analysis; sharia bank; inancing; risk.

Introduction

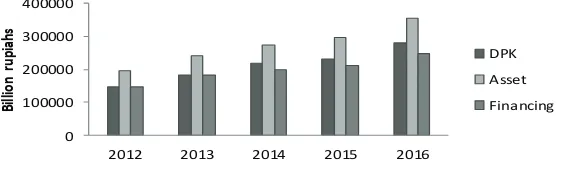

Figure 1

The development of total assets, deposits, inancing of Islamic Banking (BUS) and Sharia Business Unit (UUS)

0

Source: Statistik Perbankan Syariah OJK 2016

Figure 1 shows that sharia banking has increased total as -sets, deposits and inancing annually. The total assets of 195 018 billion rupiahs in 2012 and in 2016 reached 356 504 billion ru -piahs. On the DPK side, the value in 2012 amounted to 147 512 billion rupiahs and reached 279 335 billion rupiahs in 2016. When the bank has large total assets and deposits, it is able to expand its inancing so that the inancing increased, which in 2016 reached 248 007 billion rupiahs. The greater the inanc -ing disbursed, the greater the level of proit shar-ing and proit margins to be accepted by Islamic banks. The eficiency made by having larger inancing may increase the proit of sharia banks. In addition, inancing is the main commercial activity conduct -ed by sharia banks since its principal to develop the real sector. Therefore, inancing to deposit (FDR) ratio in sharia banking is on average 87.65 percent in 2016 (OJK 2017). It implies most of the deposit fund is used for inancing activities. This indicates that the inancing is the main activity and the main indicator to measure the development of sharia banking.

with varying levels of complexity attached to their business ac -tivities. One risk that has a major impact is the risk of inancing. The risk of inancing is the risk caused by the failure of the cus -tomers to fulill their obligations.

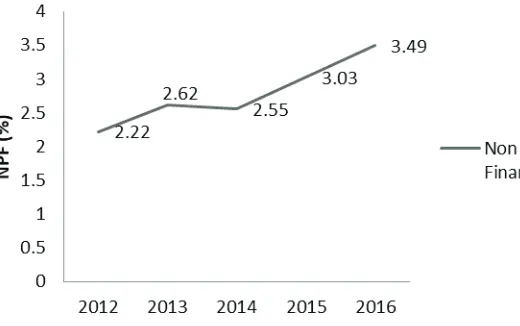

Non-performing inancing (NPF) is a representation of i -nancing risk and has a direct impact on bank proitability. This is supported by the results of the research by (Rahman and Roch -manika 2012), which shows that the ratio of NPF negatively affects Return on Assets (ROA). Based on sharia banking system data from the Financial Services Authority (OJK), Islamic bank -ing NPF is increas-ing in every year (Figure 2).

Figure 2

Development of NPF of Sharia Banking (BUS) and Sharia Business Unit (UUS)

Source: Statistik Perbankan Syariah OJK 2016

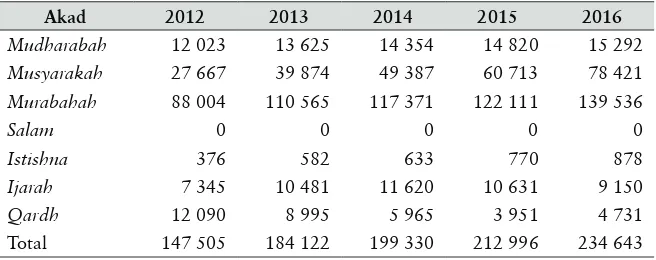

ciple of buying and selling (Murabaha) and the principle of proit sharing (musyarakah and mudaraba). This is shown in Table 1.

Table 1

Composition of inancing of Sharia Banking (BUS) and Sharia Business Unit (UUS) based on the contract (billions rupiahs)

Akad 2012 2013 2014 2015 2016

Mudharabah 12 023 13 625 14 354 14 820 15 292

Musyarakah 27 667 39 874 49 387 60 713 78 421

Murabahah 88 004 110 565 117 371 122 111 139 536

Salam 0 0 0 0 0

Istishna 376 582 633 770 878

Ijarah 7 345 10 481 11 620 10 631 9 150

Qardh 12 090 8 995 5 965 3 951 4 731

Total 147 505 184 122 199 330 212 996 234 643 Source: Statistik Perbankan Syariah OJK 2016

Based on Table 1, total inancing increases annually from 147.505 billion rupiahs in 2012 to 234.643 billion rupiahs in 2016. Table 1 shows that from 2012 to 2016 inancing with murabahah schemes dominates the inancing channeled by the sharia banks and followed by mudharabah and musyarakah. Murabahah inancing is considered lower risk compared to the inancing of proit sharing systems such as mudharabah and musyarakah contracts. This causes murabahah contracts be -come dominant in sharia banking.

Wijoyo (2016) states that the macroeconomic factors such as inlation and GDP and the speciic condition of the bank affect the NPF. Saniati (2015) shows that inlation has a posi -tive effect on NPF. Setyowati shows that GDP signiicantly and negatively effects non-performing loans (see Ihsan 2011). On the internal side of Islamic banking, it can be analyzed with the achievement by looking at the inancial ratios. Financial ratios affecting NPF level are capital adequacy ratio (CAR) and opera -tional cost to operating income (Auliani 2016). Besides, Addina (2016) shows that Return on Assets (ROA) and bank size nega -tively affect NPF. Therefore, previous studies imply some of the internal sharia banking e.g. CAR BOPO, bank size as well as ROA and external factors may signiicantly affect the NPF. The external factor denotes to the macroeconomic variables such as GDP and inlation.

The value of NPF which tends to increase annually with a value i.e. already close to the maximum limit set by Bank In -donesia of 5 percent is able to lead to the ineficiency of the banking system and in the long run, will have an impact on the sustainability of the bank. Therefore, the analysis of NPF factors should be reviewed as a preventive measure and risks controller of business activities. Some previous studies analyzes factor af -fecting NPF in sharia banks by using general data set provided by OJK. However, this study attempts to analyze factor affecting NPF by using individual data provided by nine sharia banks in Indonesia. Based on the description, then the problem statement that can be raised in this study are: Firstly, how the develop -ments of NPF in sharia Bank? Second, what factors affect the NPF in sharia Bank?

Sharia banks which became the object of this research are PT Bank Muamalat Indonesia, PT Bank Syariah Mandiri (BSM), PT Bank Negara Indonesia Syariah (BNI Syariah), PT Bank Central Asia Syariah (BCA Syariah), PT Bank Rakyat Indonesia Syariah (BRI Syariah), PT Panin Syariah, PT Bank Mega Syariah, PT Bank Jabar Banten Syariah and PT Bukopin Syariah. The data used in this study are: Return on Assets (ROA), the ratio of rev -enue sharing inancing to total income inancing (RR), Capital Adequacy Ratio (CAR),Operational Cost to Operating Income (BOPO), Net Operational Margin (NOM) Banksize, inlation, and Gross Domestic Product (GDP). Data obtained from vari -ous sources include data derived from the inancial statements of personal sharia banks, inancial services authority, central bu -reau of statistics and Bank Indonesia.

The methods of analysis used in this research are descriptive and quantitative analysis method. Descriptive analysis is used to see the developments of NPF level in sharia banking. Descrip -tive analysis method presents images/graphs in the form of data plots to show the conditions of movement and correlation of each variable. The quantitative analysis used in this research is static panel data analysis method. Data panel analysis method is used to obtain the factor affecting NPF by using panel data. Panel data is the combination of cross-section and time-series data used in this research. Quantitative analysis is conducted by using Microsoft Excel and Eviews 8.

Sharia Financing

“Whoever gives a virtuous loan to Allah will receive dou -ble from Him in addition to an honora-ble reward”

In general, there are three types of inancing applied by sharia banking, including:

1. Buying and selling principles

a) Bai’ al-Murābahah, is the distributions of the fund in the form of buying and selling. The bank will buy the goods the service user needs and then sell them back to the service user at an inlated price according to the proit margin set by the bank, and the service user can repay the goods. The amount of lat installment in accordance with the contract at the beginning and the amount of installment of the basic price plus the agreed margin. b) Bai’ al-Salām, The Bank will buy the required goods in

the future, while the payment made in advance. Items purchased must be measured and weighed clearly and speciically, and the determination of the purchase price based on the full pleasure between the parties.

c) Bai’ al-Istishnā’, is a special al-Salām form in which the price of goods can be paid on contract, paid in install -ments, or paid in the future. The bank binds each the buyer and seller separately, unlike al-Salām where all parties are tied together from the start. Accordingly, the bank as the party carrying the goods is responsible to the customer for the misconduct of the work and the guar -antee arising from the transaction.

2. Rent Principles

b) Al-Ijārah al-Muntahia bi al-Tamlīk along with ijārah is a contract of transfer of rights to goods and services through the payment of the rents, but at the end of the lease, there is a transfer of ownership of the leased goods. 3. Proit Sharing Principles

a) Mudhārabah Financing. Mudhārabah comes from the word dhāraba, which means hitting or walking. Accord -ing to Karim (2010), mudhārabah is a form of contract between two parties where one party as the owner of the capital and entrust the amount of the capital to be man -aged by the second party, i.e. business actors in order to gain proit. Mudhārabah transactions do not require the presences of shāhibul māl representatives in project management. Mudhārib should act cautiously and be re -sponsible for any losses incurred due to the negligence. The proits earned are divided according to the agreed portion, whereas in the case of losses will be borne en -tirely by the owner of the fund, and the manager of the lost funds in mind and energy.

b) Musyārakah Financing. According to Tarsidin (2010), musyārakah is a contract of cooperation between two or more parties for a particular business in which each party contributes funds with the agreement that the ben -eits and risks will be borne together according to the agreement. Proit or loss should be clearly identiied and shared according to the agreement.

for problems to be occurred due to several reasons. Sharia banks should be able to analyze the causes of the problems so they can make an effort to reinvent the qualities of the inancing.

Financing Quality

According to Bank Indonesia regulations Number 8/21/ PBI/2006 (Bank Indonesia 2006) concerning quality assessment of commercial banks conducting business activities based on sharia principles, there are two types of inancing based on i -nancing quality.

First, “performing inancing”; It is is categorized into two qualities: current quality and quality that must be given a special attention. Second, “non-performing inancing”; it is a inancing that is categorized into three qualities: sub-standard quality, doubtful quality, and bad debt inancing.

According to Bank Indonesia regulation number 8/21/ PBI/2006 concerning quality assessment of commercial banks conducting business activities based on sharia principles article 9 paragraph 2, the quality of productive assets in the form of inancing is divided into 5 groups, i.e. current (L), under special attention (DPK), substandard (KL), doubtful (D), bad debt (M).

Table 2

Summary of inancing quality criteria

No Financing Quality Criteria

1 Current

a. Installments and loan principal are paid on time

b. Have an active mutation account

c. Included as inancing with cash collateral

2 Under special attention

a. Installments and loan principal are still in arrears, but not exceeding 90 days

No Financing Quality Criteria

c. Sometimes an overdraft occurs or a nega -tive balance on a demand deposit account that cannot be paid in full

d. Rarely violate contracts that have been agreed

e. Supported by new loans

3 Substandard

a. Unpaid installments and loan principal exceeds 90 days

b. An overdraft often takes place

c. Breaking the contract agreement more than 90 days

d. The existence of an indicator of inancial problems faced by the debtor/borrower e. Weak loan documentation

4 Doubtful

a. Unpaid installments and loan principal exceeds 180 days

b. Overdrafts are permanent

c. Weak documentation of inancing, both for inancing agreements and binding of warranties

d. The existence of wan prestasi exceed 180 days

5 Bad Debt

a. Unpaid installments and loan principal exceeds 270 days

b. The operational loss experienced was closed using new loans

c. Warranties cannot be redeemed at the fair value, in terms of law or under market conditions

Source: Peraturan Bank Indonesia Nomor 8/12/PBI/2006

Non-Performing Financing

indicators used to measure the level of health of a banking insti -tution (measure the soundness of a banking insti-tution). The lev -els of problem inancing are relected in the NPL or NPF ratio, which is the formulations of:

NPF is very inluential against the control of the cost and also affect the inancing policy that will be done by the bank itself. NPFs can have an unfavorable impact if the NPF values are large. The amount of NPL or NPF ratio allowed by Bank Indonesia is a maximum of 5 percent. If it exceeds 5 percent, it will affect the rating of the health of the bank. Therefore, sharia banks need inancing management capabilities.

Factors Affecting the NPF

Factors that are expected to inluence NPF are Return on Assets (ROA), Ratio of revenue sharing inancing (RR), Bank size, Capital Adequacy Ratio (CAR), Operating Cost to Operat -ing Income (BOPO), Net Operational Margin (NOM) Inlation, and Gross Domestic Product (GDP). The following describes the relationship between the independent variables used in this study with the dependent variable:

1. Non-performing inancing relations with Return on Asset (ROA)

obtained by the banks, it will be easier to overcome the risks, so the risk of non-performing inancing will decrease.

2. Non-performing inancing relations with RR

Types of inancing proit loss sharing (PLS) consists of mudharabah and musyarakah inancing where the inancing of PLS has a high risk, this is because in this contract the proit earned by shahibul mal (bank) is relatively uncertain

even the bank must be ready to bear the loss. The absences of a guarantee provision in the PLS inancing cause the bank to face the risk of moral hazard and adverse selection due to the asymmetric information. Setting a ratio that will give high returns for risky types of PLS means that it has prevent -ed the occurrences of moral hazard risks, in this case, an in -creasing NPF ratio, for irresponsible debtors. The higher the return ratio, the better the bank policies in anticipating the possibilities of moral hazard (Nasution and Wiliasih 2007). 3. Non-performing inancing relations with Capital Adequacy

Ratio(CAR)

The CAR describes an indicator of the bank’s ability to cover its decline in assets as a result of the bank loss caused by risky assets. The higher the CAR value indicates that the bank’s capital increases, thus reducing the NPF. This indi -cates that the increased level of capital adequacy, banks will manage the risks of problem inancing more easily, which can decrease the value of NPF.

4. Non-performing inancing relations with BOPO

5. Non-performing inancing relations with Net Operational Margin (NOM)

NOM is a ratio to determine the bank ability to manage its productive assets to produce higher net income. When setting high margins, banks need to consider legal lending limits and appropriate inancing analysis according to the level of the inancing risk. The higher the pricing of sharia banks in determining the inancing margin and the lower the pricing of savings, the higher the risk of the non-performing inancing. This is caused by the pricing of the inancing that is too high, which can affect the inability of the customers to pay off the installments. In addition, low proit-sharing rates can cause third party funds to decrease.

6. Non-performing inancing relations with bank size

In the banking sector, the size is more likely seen from the total assets because the main products are inancing and investment. According to Firmansyah (2015), banks that have a large size or more assets have the possibilities to gen -erate greater proits.

7. Non-performing inancing relations with Inlation

One of the effects of inlation is on the real income of the community. There are groups of people who are able to in -crease the real income but most people experience a decline in the real income. The worsening of the real income of this society will affect the problematic inancing, because it will be dificult for the community to pay the obligations to the bank.

8. Non-performing inancing relations with Gross Domestic Product

decrease in sales and corporate earnings, it will affect the ability of the company to return the loan. This will lead to an increase in non-current inancing (Rahmawulan 2008). Meanwhile, GDP growth can increase the ability of custom -ers in fulilling their obligations so that NPF decreases.

Research Methods

Data Panel

The estimation method for panel data can use three ap -proaches: Pooled Least Squared, Fixed Random Effect, and Random Effect Model. To ind the exact model can use Chow test and Hausman test.

Research Model

Looking at the results of earlier empirical studies and con -sidering the assumptions that the panel data model refers to, the variables that are expected to affect non-performing inancing at sharia commercial banks are internal banking variables includ -ing inanc-ing policies and external variables. Here are the main models in this study:

…………...(I)

Notes:

NPFit : Non Performing Financing (percent) RRit : Ratio return (percent)

NOMit : Net Operational Margin (percent) ROAit : Return on Assets (percent) LNBANKSIZEit : Ln total asset (percent)

CARit : Capital Adequacy Ratio (percent) BOPOit : Level of eficiency (percent) LNGDPit : Gross Domestic Product (percent) INFit : Inlation (percent)

i : Cross section t : time series

Operational Deinition of Variables

The variables used in this research model are classiied into two, internal and external banking. The operational deinitions of the variables used are as follows:

a. Gross Non-Performing Financing (NPF) is a ratio of the earning asset qualities that measure the ability of the bank management in managing the non-performing inancing (substandard, doubtful and loss) provided by the bank. b. RR is a comparative picture of the income generated by

the proit loss sharing inancing with the total return on i -nancing. NOM is the ratio used to determine how much the bank’s ability to manage all its productive assets to generate higher proits.

c. Return on Assets (ROA) measures the ability of the bank management in gaining proit (proit before tax) generated from the average total assets of the bank. Proit before tax is net income from pre-tax operating activities.

d. Bank size is a proxy of the total assets of each bank.

e. Capital Adequacy Ratio (CAR) measures the capital ade -quacy of a bank to support assets that contain or generate inancing risks.

f. Operational Costs of Operating Income (BOPO) measures the management’s ability to control operational costs against operating income.

g. Inlation represents a general price increase and occurs con -tinuously. In this study, the inlation rate used is the average rate of inlation per 3 months.

Model Evaluation Based on Econometrics Criteria

Tests of classical assumption violations consist of multico -linearity test, normality, heteroscedasticity and autocorrelation. The model is said to be good if it is free from the violation of the classical assumption.

Table 3

Estimation results against violation of classical assumptions

Probability

Model 1 1.695347 157.7606 207.8044 0.067716

Source: Output eviews 8

Based on the output in Table 3 to the classical assumption test, the following results are obtained:

a. Normality test

From the Skewness/Kurtosis, the result shows that the prob -ability of the JarqueBera is more than the true alpha level of 0.05, so that there is enough evidence to reject H0. Thus, the residuals in the research are spreads normally.

b. Multicollinearity Test

c. Heteroscedasticity Test

Heteroskedasticity can be known by comparing Sum Square Resid on Weight Statistic with Sum Squared Resid Unweighted Statistic. If Sum Square Resid on Weight Statistic is smaller than Sum Squared Resid Unweighted Statistic, there is heteroscedas -ticity. The model in the study using GLS Cross-Section so that direct heteroskedasticity problems can be corrected so that the model is free from heteroscedasticity problem.

d. Test Autocorrelation

The autocorrelation test can be done by looking at Durbin Watson (DW). Models that are free from autocorrelation should be in an autocorrelation-free area that has a DW-stat value between DU <DW <4-DU. The result of regression in this research shows that Durbin Watson Statistic (DW-stat) value in each model is not in autocorrelation free area so that there is autocorrelation in the model. This autocorrela -tion problem is overcome by GLS weighting.

The Analisys of Non-Performing FinancingDevelopment of

Sharia Banking

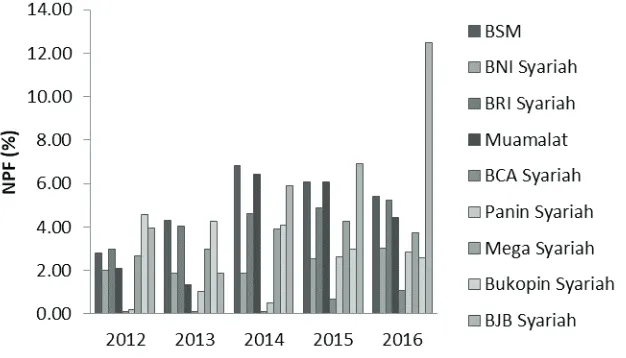

Figure 3

Development of non-performing inancing at Sharia Banks

In Figure 3 it can be seen that NPF in sharia banks have an average NPF rate of 0 until 7 percent. By 2015 and 2016, the highest NPF rate is owned by BJB Syariah Bank. This is caused by the decline in oil prices and followed by a decline in commod -ity prices that becomes complementary such as coal and oil sub -stitution goods such as natural rubber so that oil companies and supporting industries are experiencing inancial dificulties, even some companies have experienced bankruptcy demands due to the inability of the company to fulill its inancial obligations to the creditor.

high pressures that ultimately affect cost eficiency as relected by the rising BOPO ratio also affect proits (Bank BJB Syariah 2017).

In 2014, Bank Syariah Mandiri owns the highest NPF rate by the end of the year with an NPF value of 6.84 percent. This is due to the expansions of inancing in the SME sector undertaken by BSM, which is 67% of the total inancing. At this year, there is also a slowdown in national economic growth that has a ma -jor impact on the business development of BSM debtors. In ad -dition to the internal side of the bank, due to the rapid growth of BSM without fully accompanied by the speeds of infrastructure, during the last three years BSM experienced a decrease in per -formance, especially NPF Gross increased from 2.82% (2012), 4.32% (2013) and 6, 84% (2014) (BSM 2017).

In addition, Bank Muamalat’s NPF has a luctuating de -velopment every year since 2014. In 2014 the value of NPF in Muamalat reached 6.43 percent. Similar to other sharia banks, the cause is the depressed global commodity prices that are the mainstay of Indonesian exports, especially coal. In addition, the cause of the high level of NPF Muamalat in that year was the bankruptcy of Batavia Air. Bank Muamalat funded the airline for Rp 120 billion with outstanding inancing when Batavia went bankrupt was Rp 186 billion. Muamalat’s NPF has experi -enced an improvements trend since the second quarter of 2015, but until 2016 NPF is still high in the corporate sector, especially in the mining sector. Financial markets are still in dire straits as commodity prices are still depressed, which causes the growth rate of the banks, in general, is very low (Bank Muamalat Indo -nesia 2017).

Analysis of Factors Inluencing NPF of Sharia Banking

internal and external variables on the level of Non-Performing Financing (NPF) in the irst quarter 2012 until the third quarter 2016. The results of this study showed that RR, ROA, inlation, GDP, CAR, BOPO, and banksize Signiicantly to NPF of sharia banking. This research shows the value of R2 in model estima

-tion with high enough number that is 0.978106, it means 97.8 percent diversity of NPF variable can be explained by indepen -dent variables in the model and the rest is explained by other variables outside the model. The summary of estimation results can be seen in Table 4.

Table 4

Estimation result of internal and external factors of banking to NPF

Variable Coeficient Probability

INFLATION -0.125498* 0.0002

LNGDP 7.885820* 0.0000

CAR -0.023134* 0.0002

BOPO 0.037532* 0.0001

LNBANKSIZE -0.404362** 0.0303

RR -0.584148* 0.0000

ROA -0.343879* 0.0019

NOM 0.026986 0.3135

Source: Output eviews 8

Notes: ** and * signiicant at level of 5 percent and 1 percent respectively

of research Firmansyah (2015) stating that inlation has a sig -niicant negative effect on NPF. According to (Oktaviani and Novianti 2014) high inlation rates will lead to higher nominal interest rates, which will ultimately lower real money balances. If society holds a relatively low real money balance, then the public will withdraw the money stored in the bank. According to (Huda et al. 2008) the impact of inlation causes people are reluctant to save because the value of the currency is declining. This will lead to a decrease in third party funds or bank assets so that the distribution of funds will decrease. The decrease in inancing disbursed will also reduce the value of NPF.

GDP variable has a signiicant positive effect on NPF with coeficient of 7.885820. This relationship indicates that when GDP increases 1 percent, the NPF level will rise by 7.885820 percent with the assumption that other variables are considered constant. The results of this study are not in accordance with the initial hypothesis but in line with the results of research Fir -mansari and Suprayogi (2015) which indicates that GDP vari -ables have a signiicant positive effect on NPF. If the economic conditions are good, with increasing GDP it will affect people’s income. Increased public income will affect the bank’s DPK be -cause people tend to be able to invest. As the DPK increases, the bank is able to expand its inancing so that the inancing risks faced by banks will be greater.

a inancial performance that describes the ratio of capital ade -quacy to risk-bearing assets, so the higher the CAR value, the NPF value will decrease.

BOPO variable has a signiicant positive effect on NPF with coeficient 0.037532. This relationship shows that when BOPO increases 1 percent, the NPF level will rise by 0.037532 percent assuming other. The variables are considered constant. The re -sults of this study are in accordance with the initial hypothesis and in line with the results of research Ferawati (2016) which in -dicates that the variable BOPO have a signiicant positive effect on NPF. When BOPO value increases, this means that the bank has dificulties in controlling its operational costs and of course this will disrupt the operation of the sharia bank itself and will affect the NPF.

Bank size variables have a negative and signiicant inlu -ence on the level of NPF in sharia banks. Bank size coeficient is -0.404362. This means that an increase in assets of 1 will decrease the NPF by 0.404362 with other factors assumed to be constant. The results of this study are in accordance with the initial hypothesis and in line with the results of (Pratina 2015) which shows that total assets have a signiicant negative effect on NPF. Banks that have large total assets tend to be easy to expand inancing which will also lead to increased revenue. In addition to inancing expansions, banks will also more easily obtain third-party funds. This will help banks manage their business and inancing risks.

Kinasih (2013) study indicating that the RR variable has a sig -niicant negative effect on the NPF because this variable relects the bank’s prudent level in conducting risky inancing. It indi -cates the commitment and seriousness of the bank in preventing the occurrence of a moral hazard and adverse selection.

ROA variable has a negative and signiicant inluence on NPF with a coeficient of -0.343879. This relationship shows that when ROA increases 1 percent, the NPF level will decrease by 0.343879 percent assuming other variables are considered constant. The results of this study are in accordance with the initial hypothesis and in line with the research results (Setiawan and Putri 2013) which indicates that the ROA variable has a signiicant negative effect on NPF. The greater the ROA shows the company’s performance the better, because of the greater the return. With the increase in proits obtained by banks, the bank will be easier in overcoming the risks faced, so the risk of non-performing inancing will decrease.

The NOM variable has a positive but insigniicant effect on the NPF. These results are in line with the results of the (Kinasih 2013) study which shows the NOM variable of XYZ bank, in the long run, has no signiicant effect. This is because at the time of high NOM will increase the proitability of banks so that banks will be able to manage the risk well that makes the NPF value does not increase.

Conclusion

a negative and signiicant effect on NPF, BOPO variable gives positive and signiicant inluence to NPF.

Second, macroeconomic variables of the bank that affect non-performing inancing are inlation and GDP. While inlation has a negative and signiicant effect on NPF, GDP variable gives positive and signiicant inluence to NPF.

The recommendations that writer can provide are as fol -lows: irst, sharia banks should maintain the inancial perfor -mance and set appropriate inancial policies by monitoring the Bank size, BOPO, CAR, ROA, and RR ratios. This is because the internal condition of the bank becomes the thing that affects the ability of banks in managing the NPF. The higher NPF may lead to the ineficiency of the banking system and in the long run will have an impact on the sustainability of the banks. Therefore, it is crucial to maintain the factors affecting NPF from internal banks so they are able to prevent higher NPF value in the future. In addition, regulators have to control the macroeconomic vari -able, particularly inlation rate.

Second, further research can be done more profound on i -nancing, which has a high NPF value based on the type of the inancing or the type of the contracts. Besides, many previous studies conducted about NPF, but few of them discuss about factor affecting NPF from the customer side. Therefore, factor analysis that affects NPF from the customer side may conduct for further research since banks need to understand the reason customers are not able to repay their installment.

Bibliography

Auliani, Mia Maraya. 2016. “Analisis Pengaruh Faktor Internal Dan Faktor Eksternal Terhadap Tingkat Pembiayaan Ber

-masalah Pada Bank Umum Syariah Di Indonesia Periode Tahun 2010-2014.” Universitas Diponegoro.

Bank BJB Syariah. 2017. “Laporan Keuangan Triwulan.” Bank BJB Syariah. http://bjbsyariah.co.id.

Bank Indonesia. 2006. “Peraturan Bank Indonesia No. 8/21/ PBI/2006 Penilaian Kualitas Aktiva Bank Umum Yang Melaksanakan Kegiatan Usaha Berdasarkan Prinsip Sya

-riah.” Bank Indonesia. http://www.bi.go.id/id/peraturan/

perbankan/Pages/pbi_82106.aspx.

———. 2013. “Peraturan Bank Indonesia Nomor 15 /2/ PBI/2013 Tanggal 20 Mei 2013 Tentang Penetapan Sta

-tus Dan Tindak Lanjut Pengawasan Bank Umum Konven

-sional - Bank Sentral Republik Indonesia.” Bank Indone-sia. http://www.bi.go.id/id/peraturan/perbankan/Pages/

PBI_15_2_PBI_2013.aspx.

———. 2017. “Kamus Bank Sentral Republik Indonesia.” Bank

Indonesia. http://www.bi.go.id/id/Kamus.aspx.

Bank Muamalat Indonesia. 2017. “Laporan Keuangan Triwu

-lan.” Bank Muamalat Indonesia. http://bankmuamalat.

co.id.

BSM. 2017. “Laporan Keuangan Triwulan.” Bank Syariah Mandiri. http://syariahmandiri.co.id.

Ferawati, Dwi. 2016. “Faktor-Faktor Yang Mempengaruhi Non Performing Financing Pada Bank Umum Syariah Di Indo

-nesia Pada 2012-2015.” UIN Sunan Kalijaga .

Variabel Makroekonomi Dan Variabel Spesiik Bank Ter

-hadap Non Performing Financing Pada Bank Umum Sya

-riah Dan Unit Usaha Sya-riah Di Indonesia Periode 2013-2014.” Jurnal Ekonomi Syariah Teori Dan Terapan 2 (6).

doi:10.20473/VOL2ISS20156PP%P.

Firmansyah, Irman. 2015. “Determinant of Non Perform

-ing Loan: The Case of Islamic Bank in Indonesia.” Bule-tin Ekonomi Moneter Dan Perbankan 17 (2): 241.

doi:10.21098/bemp.v17i2.51.

Huda, Nurul, Handi Risza Idris, Mustafa Edwin Nasution, and Ranti Wiliasih. 2008. Ekonomi Makro Islam: Pendekatan

Teoretis. Jakarta: Kencana Prenadamedia Group.

Ihsan, M. 2011. “Pengaruh Gross Domestic Product, Inlasi, Dan Kebijakan Jenis Pembiayaan Terhadap Rasio Non Performing Financing Bank Umum Syariah Di Indonesia Periode 2005 Sampai 2010.” Universitas Diponegoro. Karim, Adiwarman. 2010. Bank Islam: Analisis Fiqih Dan

Keuangan. Jakarta: Rajagraindo Persada.

Kinasih, SW. 2013. “Analisis Faktor Determinan Tingkat Risiko Pembiayaan Bank Syariah Pada 2005-2012.” Universitas Indonesia.

Nasution, Mustafa Edwin, and Ranti Wiliasih. 2007. “Prof

-it Sharing Dan Moral Hazard Dalam Penyaluran Dana Pihak Ketiga Bank Umum Syariah Di Indonesia.” Jurnal Ekonomi Dan Pembangunan Indonesia 7 (2): 231–55.

doi:10.21002/JEPI.V7I2.175.

OJK. 2017. “Statistik Perbankan Syariah - Desember 2016.”

Pages/Statistik-Perbankan-Syariah---Desember-2016.aspx. Oktaviani, Rina, and Tanti Novianti. 2014. Teori

Makroe-konomi 1. Bogor: IPB Press.

Pratina, DG. 2015. “Faktor-Faktor Yang Memengaruhi Tingkat Non Performing Financing Pada Bank Pembiayaan Rakyat Syariah Di Indonesia.” Institut Pertanian Bogor.

Rahman, AF, and R Rochmanika. 2012. “Pengaruh Pembiayaan Jual Beli, Pembiayaan Bagi Hasil, Dan Rasio Non Perform

-ing Financ-ing Terhadap Proitabilitas Bank Umum Syariah Di Indonesia.” Universitas Brawijaya.

Rahmawulan, Y. 2008. “Perbandingan Faktor Penyebab Tim

-bulnya NPL Dan NPF Pada Perbankan Konvensional Dan Syariah Di Indonesia.” Universitas Indonesia.

Saniati, R. 2015. “Analisis Eksternal Dan Internal Dalam Me

-nentukan Non Performing Financing Bank Umum Syari

-ah.” UIN Sunan Kalijaga.

Setiawan, Chandra, and Monita Eggy Putri. 2013. “Non Per

-forming Financing and Bank Eficiency of Islamic Banks in Indonesia.” Journal of Islamic Finance and Business Re-search 2 (1).

Silmi, Addina. 2016. “Pengaruh Variabel Makroekonomi Dan Kinerja Perbankan Terhadap Non Performing Financing Bank Umum Syariah Di Indonesia Periode 2012-2015.” Institut Pertanian Bogor.

Sukmana, Raditya. 2015. “Determinants of Non Performing Financing in Indonesian Islamic Banks.” Working Papers.

The Islamic Research and Teaching Institute (IRTI).

-Wangsawidjaja, A. 2017. Pembiayaan Bank Syariah. Jakarta:

Gramedia Pustaka Utama.