Statement of Changes in Equity 11. Notes to the Financial Statements 13. i) These financial statements are general purpose financial statements and cover the business of The Hills Shire Council. The Council's financial statements must be audited by external auditors (who generally specialize in local government).

STATEMENT OF CHANGES IN EQUITY

Plus: cash and cash equivalents – beginning of year Cash and cash equivalents – end of year.

Total cash, cash equivalents and investments

STATEMENT OF CASH FLOWS

CONTENTS OF THE NOTES ACCOMPANYING THE FINANCIAL STATEMENTS

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Summary of significant accounting policies

Summary of significant accounting policies (continued)

The preparation of financial statements requires the use of certain critical accounting estimates (in accordance with AASBs). The estimates and assumptions that involve a significant risk of a material adjustment to the carrying amount of assets and liabilities within the next financial year are set out below:. i) Estimated fair value of investment properties (ii) Estimated fair value of infrastructure, real estate,.

Developer contributions may only be used for the purposes for which the contributions were required, but Council may use the contributions in accordance with the priorities set out in the schedules of work. A gain or loss on the sale of an asset is recognized when control of the asset has irrevocably passed to the buyer.

The liability is recognized in relation to revenues that are reciprocal in nature, insofar as the requested service has not been performed on the balance sheet date. Revenue is recognized when the board's right to receive payment is established, which is generally when shareholders approve a dividend.

The Council is of the opinion that it does not control or significantly influence the above mentioned district council/s and consequently these entities are not consolidated or otherwise included in these financial statements.

Summary of Significant Accounting Policies (continued). page 15 Overdrafts are shown under loans in current liabilities on the balance sheet, but are included in cash and cash equivalents for cash flow statement presentation.

Realized and unrealized gains and losses resulting from changes in the fair value of the financial assets classified as 'fair value through profit and loss'. Unrealized gains and losses resulting from changes in the fair value of non-monetary securities classified as.

Investments are placed and managed in accordance with the policy and with particular regard to approved investments prescribed in the executive order on municipal investments. The council changed its policy following revisions to the Ministerial Local Government Investment Order arising from the Cole Inquiry's recommendations.

The Council has an approved Investment Policy in order to invest in accordance with (and in accordance with) section 625 of the Local Government Act and s212 of the LG (General) Regulations 2005. The Council maintains its investment policy in accordance with Act and ensures that he or his representatives exercise the care, diligence and skill that a prudent person would exercise in investing Council funds.

Subsequent recoveries of amounts previously written off are credited against other expenses in the Income Statement.

If such an indication exists, the Council determines the fair value of the asset and revalues the asset to that amount. Any gain or loss arising from the derecognition of an asset (calculated as the difference between the net disposal proceeds and the asset's book value) is included in the Council's profit and loss account in the year the asset is derecognised.

Depreciation of Council's infrastructure and assets is calculated on a balance basis, except for plant and equipment, which is on a straight line basis. Property, plant and equipment is derecognised upon disposal or when no future economic benefits are expected from its use or disposal.

When rehabilitation is performed on a systematic basis over the life of the operation, rather than at the time of closure, a provision is made for the estimated ongoing rehabilitation work outstanding at each balance sheet date and the cost is charged to the income statement. A provision is made for the estimated present value of the costs of environmental remediation obligations outstanding on the balance sheet date.

Closure, restoration and repair costs are a normal consequence of tipping and quarry operations and most closure and restoration costs are incurred at the end of their life.

Non-current assets classified as 'held for sale' are presented separately from the other assets in the balance sheet. The results of discontinued activities are presented separately in the income statement.

A discontinued operation is a component of the Council which has been disposed of or is classified as 'held for sale' and which represents a separate major business line or geographical area of operations, is part of a single co-ordinated plan to such a line of business or area of business, or is a subsidiary acquired solely with a view to resale.

Summary of Significant Accounting Policies (continued). page 24 time value of money and the risks associated with the. The increase in the provision due to the passage of time is recognized as interest expense.

There is insufficient information available to account for the scheme as a defined benefit plan (in accordance with IAS 119) because the scheme assets are pooled across all Councils. The amount of employer contributions to the defined benefit section of the local authority pension scheme and recognized as an expense and disclosed as part of pension expense in note 4 (a) for the year ended 30 June 2016 was.

The last valuation of the scheme was carried out by Richard Boyfield, FIAA on 24 February 2016 and covers the period ending 30/6/2016. The council's share of this shortfall cannot be calculated exactly as the scheme is a mutual scheme where assets and liabilities are pooled for all member councils.

As a result, no impairment liability has been recognized in these financial statements. However, the Board has disclosed a contingent liability in Note 18, which reflects a potential liability that may arise if the scheme requires an immediate payment to remedy the deficiency.

Interpretations issued (not yet effective) Certain new (or amended) accounting standards and

Income from continuing operationsExpenses from continuing operationsTotal assets held (current and non-current) Functions/activities 20162015CurrentCurrentGrants included in income from continuing operations.

Details relating to the Council’s functions/activities as reported in Note 2(a) are as follows

Income from continuing operations

TOTAL RATES AND ANNUAL CHARGES

TOTAL USER CHARGES AND FEES

INCOME FROM CONTINUING OPERATIONS

Income from continuing operations (continued)

TOTAL INTEREST AND INVESTMENT REVENUE

TOTAL OTHER REVENUE

INCOME FROM CONTINUING OPERATIONS (continued)

Financial assistance general part Financial assistance part local roads Retiree rate Subsidies general part Total public benefit.

TOTAL GRANTS AND CONTRIBUTIONS

Expenses from continuing operations

Superannuation - defined contribution plans Superannuation - defined benefit plans Workers' Compensation Insurance Fringe Benefit Tax (FBT).

TOTAL EMPLOYEE COSTS EXPENSED

TOTAL MATERIALS AND CONTRACTS

Auditor remuneration

Operating lease payments are attributable to

EXPENSES FROM CONTINUING OPERATIONS

Expenses from continuing operations (continued)

TOTAL DEPRECIATION AND IMPAIRMENT COSTS EXPENSED

TOTAL OTHER EXPENSES

Gains or losses from the disposal of assets

NET GAIN/(LOSS) ON DISPOSAL OF ASSETS

GAINS OR LOSSES FROM THE DISPOSAL OF ASSETS

TOTAL CASH ASSETS, CASH

EQUIVALENTS AND INVESTMENTS

D Development contributions not yet spent to provide services and provisions under premium plans (see Note 17). F Subsidies that have not yet been spent for the purposes for which the subsidies were obtained.

INVESTMENT - DETAILS

Receivables

TOTAL NET RECEIVABLES

RECEIVABLES

Inventories and other assets

TOTAL INVENTORIES

TOTAL OTHER ASSETS

INVENTORIES & OTHER ASSETS

Inventories and other assets (continued)

INVENTORIES & OTHER ASSETS (continued)

Financial Statements 2016 Hills Shire Council 20135 Notes to the Financial Statements for the year ended 30 June 2016 Note 9a. Fair value measurement for information about the fair value of infrastructure, property, facilities and other equipment.

TOTAL PAYABLES, BORROWINGS AND PROVISIONS

NOTE 9B. EXTERNALLY RESTRICTED

EQUIPMENT - CURRENT YEAR IMPAIRMENTS

Debt, borrowings and provisions (continued). ii) Short-term liabilities that are not expected to be settled within the next 12 months. The following liabilities are not expected, although they are classified as current.

NOTE 10B. DESCRIPTION OF MOVEMENTS IN PROVISIONS

- Statement of cash flows – additional information

- STATEMENT OF CASH FLOWS - ADDITIONAL INFORMATION

- Statement of cash flows – additional information (continued)

- Commitments for expenditure

- STATEMENT OF CASH FLOWS - ADDITIONAL INFORMATION (continued)

- COMMITMENTS FOR EXPENDITURE

Creditors, loans and provisions (continued). ii) Operating liabilities that are not expected to be settled within the next twelve months. The following liabilities, although classified as current, are not expected. to be settled within the next 12 months. The bank overdraft facility can be drawn at any time and can be terminated by the bank without notice.

Local government industry indicators – consolidated

Operating performance ratio

Own source operating revenue ratio Total continuing operating revenue (1)

Unrestricted current ratio

Debt service cover ratio

Cash expense cover ratio Current year’s cash and cash equivalents

NOTE 13A(I). STATEMENT OF PERFORMANCE MEASUREMENT - INDICATORS (consolidated)

- Investment properties

- INVESTMENT PROPERTIES

- Financial risk management

- FINANCIAL RISK MANAGEMENT

- Financial risk management (continued)

- FINANCIAL RISK MANAGEMENT (continued)

- Material budget variations

- MATERIAL BUDGET VARIATIONS

- Material budget variations (continued)

- MATERIAL BUDGET VARIATIONS (continued)

- Contingencies and other assets/liabilities not recognised

- CONTINGENCIES AND OTHER ASSETS/

A comparison of the carrying and fair values of the Council's financial assets and financial liabilities recognized in the financial statements, by category, is presented below. Interest rate risk – the risk that changes in interest rates could affect returns and revenues.

LIABILITIES NOT RECOGNISED

- Contingencies and other assets/liabilities not recognised (continued)

- Other liabilities (continued) (i) Infringement notices/fines

- Interests in other entities

- INTERESTS IN OTHER ENTITIES

- Retained earnings, revaluation reserves, changes in accounting policies, changes in accounting estimates and errors

- RETAINED EARNINGS, REVALUATION RESERVES, CHANGES IN ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES &

Retained earnings, revaluation reserves, changes in accounting policies, changes in accounting estimates and error policies, changes in accounting estimates and errors. RETAINED EARNINGS, REVALUATION RESERVES, CHANGES IN ACCOUNTING GUIDELINES, CHANGES IN ACCOUNTING ESTIMATES AND ACCOUNTING GUIDELINES, CHANGES IN ACCOUNTING ESTIMATES &.

ERRORS

Retained earnings, revaluation reserves, changes in accounting policies, changes in accounting estimates and errors (continued)

Due to an error in the reports run on June 30, 15, accumulated depreciation reflected balances as of June 30, 16. Retained earnings, revaluation reserves, changes in accounting policies, changes in estimates, and errors (continued).

Held for sale’ non-current assets and disposal groups

TOTAL NON-CURRENT ASSETS CLASSIFIED AS ‘HELD FOR SALE’

HELD FOR SALE’ NON-CURRENT ASSETS

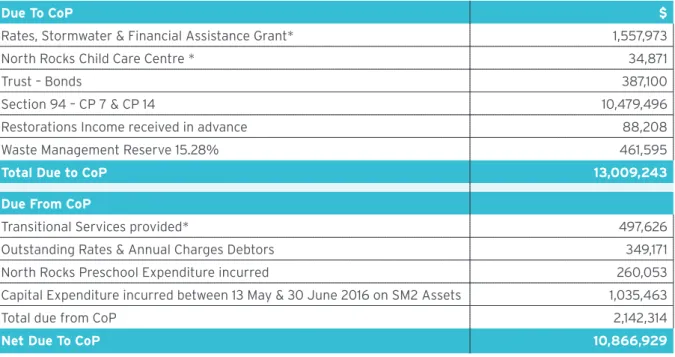

Boundary Adjustments

NET PROFIT/(LOSS) FROM BOUNDARY ADJUSTMENT

- BOUNDARY ADJUSTMENTS

- Fair value measurement

- Unadjusted quoted prices in active markets for identical assets or liabilities that the entity can access at the measurement date

- Inputs other than quoted prices included within level 1 that are observable for the asset or liability, either directly or indirectly

- Inputs for the asset or liability that are not based on observable market data (unobservable inputs)

- FAIR VALUE MEASUREMENT

- Fair value measurement (continued)

- Level 2

- Total

- FAIR VALUE MEASUREMENT (continued)

- COUNCIL INFORMATION & CONTACT DETAILS

Fair value measurement hierarchy Level 1 Level 2. NOTES TO THE FINANCIAL STATEMENTS for the year ended 30 June 2016. Financial Statements 2016 The Hi lls Shire Counc il Notes to the Financial Statements for the year ended 30 June 2016 Note 23 .

THE HILLS SHIRE COUNCIL

SPECIAL PURPOSE FINANCIAL STATEMENTS

SPECIAL GENERAL PURPOSE FINANCIAL STATEMENTS

BACKGROUND

THE HILLS SHIRE COUNCIL SPECIAL PURPOSE

FINANCIAL STATEMENTS 2015-2016

CONTENTS

Surplus (deficit) from current operations before capital amounts Subsidies and contributions for capital purposes. SURPLUS (DEFICIT) AFTER TAX Plus initial retained earnings Plus/minus: prior period adjustments Plus/minus: other adjustments.

INCOME STATEMENT OF COUNCIL’S OTHER BUSINESS ACTIVITIES for the year ended 30 June 2016

NET ASSETS

TOTAL EQUITY

Significant accounting policies

The Prices and Costs for Council Business, A Guide to Competitive Neutrality, issued by the Office of Local Government in July 1997, was also adopted. In accordance with Prices and Costs for Council Business - A Guide to Competitive Neutrality, the Council has stated that the following should be considered business activities:. where the gross operating turnover is more than $2 million) a.

The framework for its application is set out in the June 1996 Government Policy Statement, Application of National Competition Policy to Local Governments. The amounts in the financial statements are in Australian currency and rounded to the nearest thousand.

NOTES TO THE SPECIAL PURPOSE FINANCIAL STATEMENTS

SIGNIFICANT ACCOUNTING POLICIES

The Pricing and Costing Guidelines describe the process for determining and allocating costs to activities and provide standards for disclosure. These disclosures are reflected in the Council's pricing and/or financial reporting systems and include tax equivalents, Council grants, return on investment (rate of return) and dividends paid.

Significant accounting policies (continued)

SIGNIFICANT ACCOUNTING POLICIES (continued)

At a minimum, business activities should generate a return equivalent to the Commonwealth 10-year bond yield, which is 2.17% p.a. 30/6/16. The actual return achieved by each business activity is disclosed at the bottom of each respective profit and loss statement.

Operating profit before capital income + interest expenses Written down value of I,PP&E per 30th of June.

SPECIAL SCHEDULES

THE HILLS SHIRE COUNCIL SPECIAL SCHEDULES

SPECIAL SCHEDULE 1 - NET COST OF SERVICES

Parks and gardens (lakes) Other sports and recreation Total recreation and culture Fuel and energy. Sealed Rural Roads (SRR) – local Sealed Rural Roads (SRR) – regional Unsealed Rural Roads (URR) – local Unsealed Rural Roads (URR) – regional Bridges on UR – local.

Infrastructure asset performance indicators * consolidated

Infrastructure renewals ratio Asset renewals (1)

Infrastructure backlog ratio

Asset maintenance ratio Actual asset maintenance

SPECIAL SCHEDULE 7 - REPORT ON INFRASTRUCTURE ASSETS

Councils can claim the value of the income lost due to valuation objections in any year. OLG will extract these amounts from the Council's special Schedule 8 in the financial data return (FDR) to administer this process.

SPECIAL SCHEDULE 8 - PERMISSABLE INCOME CALCULATION

THE HILLS SHIRE COUNCIL FINANCIAL STATEMENTS