I would also like to thank all the people who helped me prepare for it. Offer to their customers and what services they are providing to their customers and the important objective is the financial growth of the bank. And on the other side the Islamic banking industry also has the supply power and the purchasing power and both are the bank's customers.

And now the sharia banking method is popular among the customers and some of the customers also come for that particular service.

CHAPTER I - INTRODUCTION

- Background of the Report

- Objectives of the Report

- Motivation of the Report

- Scope and Limitations of the Report

Islamic banking has its roots in the early years of Islam and the principles of Islamic law, or Sharia. However, the industry gained momentum in the 1990s and 2000s, thanks to government efforts to promote Islamic banking as a viable alternative to conventional banking. These measures helped create a favorable environment for Islamic banking and encouraged the establishment of new Islamic banks and financial institutions.

Another challenge facing Islamic banking in Bangladesh is the lack of a comprehensive legal and regulatory framework.

CHAPRER II - COMPANY PREVIEW

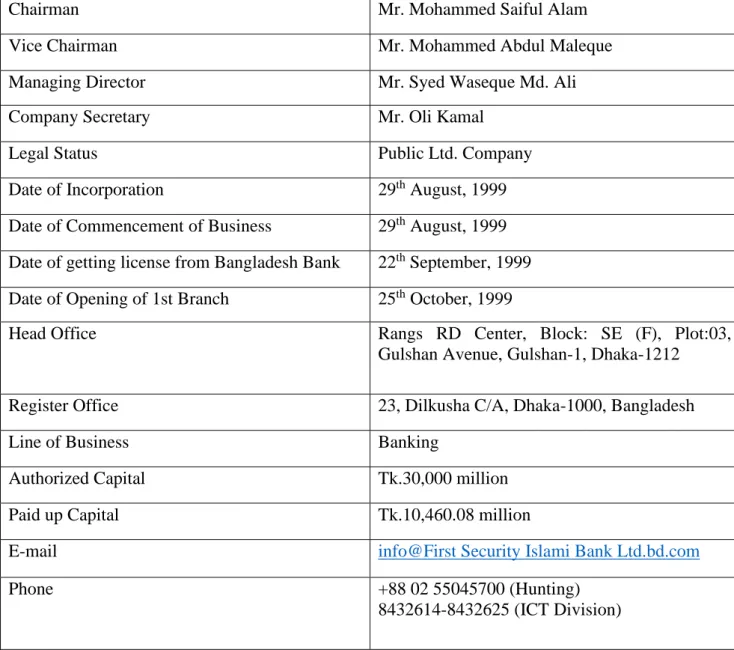

Overview and History

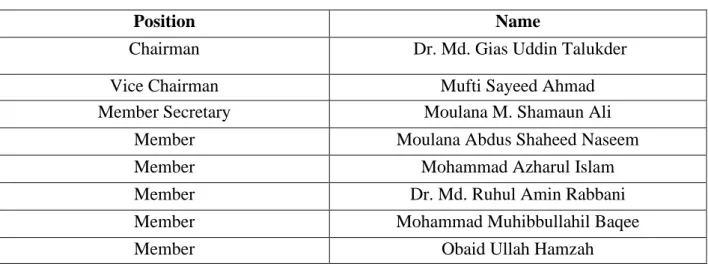

First Security Islami Bank Limited is a commercial bank in Bangladesh based on the principles of Islami Shariah method. One of the key success factors of First Security Islami Bank Ltd. was her adherence to Islamic Sharia principles. The bank was one of the first in the country to introduce mobile banking services, which enables customers to perform transactions with a mobile phone.

The bank has set ambitious goals for the coming years and is investing heavily in its digital infrastructure to ensure it remains at the forefront of innovation in the banking sector.

Trend and Growth

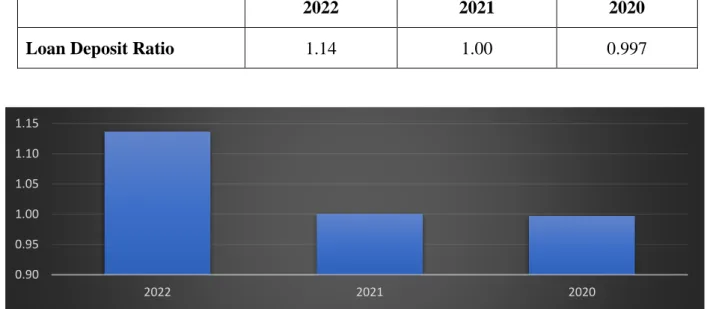

Page | 17 It shows how skilled the bank has been at converting the bank's assets into net profits, while calculating how much a bank earns. Because net income will also be low in 2022, the return on equity will decrease. So the bank has to take deposits at a higher interest rate. Page | 20 The equity ratio shows how much of a company's assets are financed by issuing shares rather than by borrowing money.

The ratio is an indicator of how financially stable the company may be in the long term. The cash position ratio measures the company's ability to meet its short-term obligations. The higher the rate, the higher the chances of handling short-term risk and this means the company has cash on hand.

And the high rate means that the bank is taking risk because the bank does not have enough cash on hand. So we can see in 2022 the rate is high which means the bank has less cash so the bank has to take risk to avoid losses.

Product/Service Mix

The account holder will receive a free 100-page checkbook, an ATM card and a life insurance policy of Tk.100,000. Mudarabah Savings Deposit Account: This account can be started with a minimum deposit of Tk.500 and a reserve balance of Tk.500. For the first year, the account user receives a free 10-page checkbook and a free ATM card.

Mudarabah Student Savings Account (School Banking-ONKUR): This account started with a minimum of Tk.100 and no reserve amount is required. For the first year, the account user receives a free 10-page checkbook and a free ATM card. This account can be started with a minimum deposit of Tk.200 and a minimum reserve balance of Tk.100.

This account can be started with a minimum deposit of Tk.5000 and a reserve balance of Tk.5000. For the first year, the account user receives a free 20-page checkbook and a free debit card. Mudarabah Monthly Profit Scheme (MMPS): The deposit amount must be Tk.25,000 or double the amount.

Online Banking at any Branch: First Security Islami Bank Ltd. to provide financial services of any branch to its consumers. First Security Islami Bank Limited is a Shariah-based and technology-based modern commercial bank that offers complete passive banking services such as online banking, financial services agent mobile banking, internet banking, ATM and other banking services.

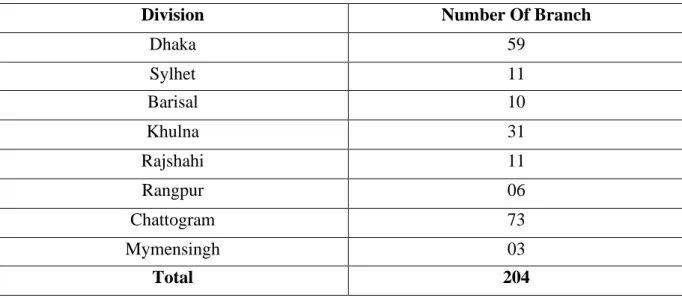

Operational Network of First Security Islami Bank Ltd

Errors and fraud caused by a lack of internal control and compliance can result in operational losses. The Bank aims to maintain, operate and improve its technology platform in order to provide services to its clients without technical problems and to ensure that the clients are satisfied with the service. The Foreign Trade Department is responsible for supporting branches in dealing with global trade; import and export of companies by accepting transactions and their control at various levels, as well as doing business with all clients of foreign banks in agreements with First Security Islami Bank Ltd.

The greater the number of customers and the wider the coverage area, the more valuable the bank's foreign connections will be, adding value to the economy. According to the principles of corporate governance, the Head of the Audit Department must have knowledge in finance, accounting or auditing.

SWOT Analysis

It is a Sharia based bank, which is an advantage for First Security Islami Bank Ltd. Customers are well informed these days; they understand a lot about Islamic banking and are currently showing interest in Islamic banks. No other bank will be able to give such a thorough workplace as First Security Islami Bank Ltd.

Competitors started using Islamic banking and consequently opened a branch to compete with Islamic banks. Due to intense rivalry competitors First Security Islami Bank Ltd. are entering the market with a new line of ATM services. However, the number of ATMs is not as large as that of their competitors like DBBL which has the most number of ATMs.

Customer Mix

Corporate clients are also served by First Security Islami Bank Ltd., which includes multinational companies, government agencies, non-profit organizations and educational institutions. Clients with more complex financial needs, such as cash management services, corporate lending, capital market services and treasury management solutions, are more likely to be served. Individuals who use basic banking services such as savings accounts, checking accounts, debit cards and personal loans are considered retail banking customers.

They can also use the bank's additional services, such as mortgages, car loans and investment products.

CHAPTER III - INDUSTRY PREVIEW

- Specification of the industry

- Size, Trend & Maturity of the industry

- External Economic Factors

- Barriers to entry

- Supplier Power

- Buyer Power

- Threat of Substitutes & Industry rivalry

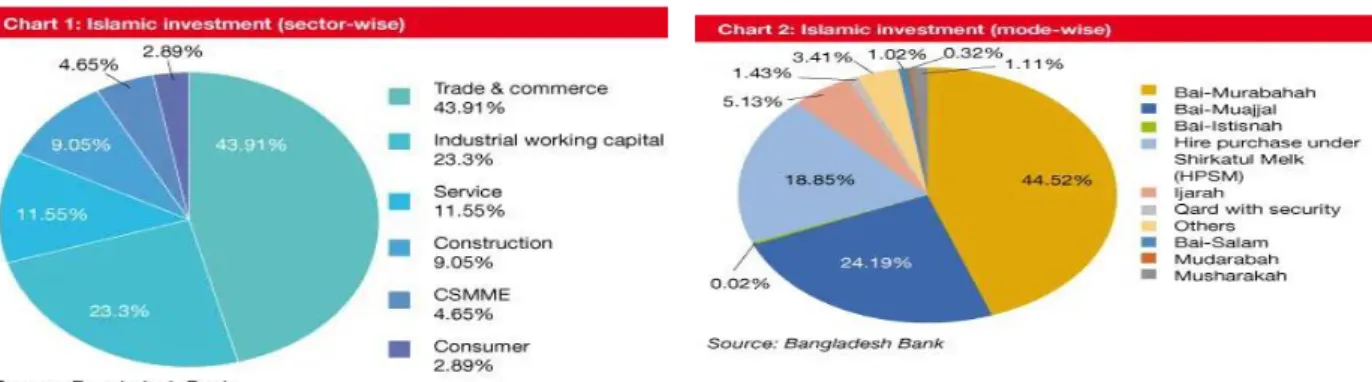

According to wise analysis it is the highest investment and it made by Murabahah mode 44.52%. Page | 41 The Islamic banking industry holds one-fourth share of the entire banking industry in terms of deposits, investments and remittances in Bangladesh. Political factor: The share of the Islami bank is very difficult to come with the political right.

And the aspects of Islami Bank these days it is not good enough from the political side. It provides the customers and the banking industry a good privacy and it also makes a regulatory process for the industry. The Islami banking sector has embraced FinTech, but there are no general regulations or rules in place to protect Islami FinTech and digital assets under the Central Bank of Indonesia or the Financial Services Authority (Azizah, 2023).

For starters, it's about a series of ongoing issues that need to be dealt with. The response of Muslim scholars to these difficulties will determine the future of Islamic banking. Furthermore, the lack of an effective legal framework, standards and procedures, competent employees and effective government support increase the risks of the Islamic banking industry.

There is a lack of standardization in Islamic banking due to the prevalence of many views on Islamic principles (Edib Smolo & Elmin Habibovic, 2012). And it will be a substitute for industry, and that is the threat to Islamic banking.

CHAPTER IV - INTERNSHIP EXPERIENCE

- Position, Duties & Responsibilities

- Training

- Evaluation

- Skills Applied

- New Skills Developed

Taking necessary papers from customers such as making photocopy of National Identity Card, Passport, TIN Certificate etc. In the bank, the bank manager appoints an officer as my supervisor during working hours. He teaches me how to check the voucher and how to get the information from the papers like NID copy or TIN certificate etc.

Here at the university I learn to work with tight schedules and I have applied the skill there in my work. At the bank I check the voucher and the checks and most of the time I just did the work so now I think I can spot the mistakes easily. And another threshold that I develop that now I know how to work in the corporate country and that is a big development for me.

CHAPTER V - CONCLUSIONS

Page | 49 First Security Islami Bank has emerged as a leading Islamic bank in the financial sector that has successfully integrated Islamic principles with modern banking practices. Overall, First Security Islami Bank has established itself as a reputable and dynamic financial institution that utilizes Islamic banking principles to deliver innovative solutions to its customers. With its strong financial performance, commitment to social responsibility and technological advances, the bank is well positioned for continued growth and success in the future.

Retrieved October 5, 2023, from https://First Security Islami Bank Ltd.bd.com/al-wadiah-current-deposit-account/. Retrieved May 22, 2023, from https://First Security Islami Bank Ltd.bd.com/First Security Islami Bank Ltd._cloud/. An assessment of the adoption level of Fintech among Islami banks in the MENA region.

Retrieved October 5, 2023, from https://First Security Islami Bank Ltd.bd.com/morjada-al-wadiah-current-plus-account/. Retrieved September 5, 2023, from https://First Security Islami Bank Ltd.bd.com/mudaraba-deposit-double-scheme-2/. Retrieved December 5, 2023, from https://First Security Islami Bank Ltd.bd.com/mudaraba-haj-saving-account/.

Retrieved September 5, 2023 from https://First Security Islami Bank Ltd.bd.com/mudaraba-monthly-profit-scheme-2/. Retrieved September 5, 2023 from https://First Security Islami Bank Ltd.bd.com/onkur-account-mudaraba-students-savings-a-c-school-banking/.