While working on the General Banking section, preparing my report required me to gather various information by working with different departments of the Bank. Masubur Rahman, SAVP and Manager of First Security Islami Bank Ltd (Banani Branch) & Sultan Ahmed and Tanjim Hasan Chowdhury; Officials of the General Banking System. The main objective of this report is to evaluate the general banking activities of FSIBL and analyze the customer satisfaction of the said bank in the general banking sector.

Then recommendations as well as conclusions were inserted in the report to guide the future of FSIBL which were drawn from the analysis of the entire study. The primary findings of the survey of FSIBL is that online banking service of FSIBL is not too much faster as expected by the customers.

CHAPTER ONE: INTRODUCTORY

Introduction

Objectives of the Report

Sources of Data

There I gathered practical and theoretical knowledge on the purpose of creating my Report to complete my internship program. The report is an outcome of the internship program and as part of the internship program, the topic of my Report is assigned by the Honorable Supervisor Mohammad Amzad Hossain; Assistant Professor, School of Business and Economics, International International University. There are several objectives both Primary and Secondary for which I am preparing my Report.

For the purposes of my Report, I have collected 2 categories of data which have played a vital role in the preparation of my Report. So these are the primary sources that I have taken for the purpose of preparing my Report from discussion with the individual responsible employees of FSIBL.

CHAPTER TWO: BACKGROUND OF FIRST SECURITY ISLAMI BANK LTD

Background of FSIBL

Mission

Vision

First Security Islami Bank Ltd (FSIBL) is one of the most prominent Islamic Shari'ah compliant banks in Bangladesh. FSIBL provides Digital Banking services along with offline services, as a part of Digital Banking service, it provides Mobile Banking service, ATM Banking, Internet Banking, SMS Banking, Online Banking & Agent Banking. Shari'ah based banking solutions that cater to the customers who need Islamic banking services.

FSIBL's main motive is to maintain rapid growth of market share which will be ensured by Ethics as well as Accountability in all spheres. FSIBL's main vision is to be a leading financial institution in the country based on Islamic Shari'ah by providing high quality products and excellence in services backed by latest technology and in terms of highly motivated staff to deliver excellence in banking services.

Strategic Objectives

Goal

Departments of FSIBL

In this department, the FSIBL sanctions or approves loans or investments to both individuals and companies. So the bank gets more than or an equal amount of money from the loan amount given to the borrowers. This is an agreement between buyer and seller whereby the seller sells the product with layout to the buyer.

Under the agreement, the two parties share the profit, but in the event of a loss, the capital or fund supplier must bear that loss. MUSHARAKAH: This is a type of Partnership mode where 2 parties have to supply the Capital or Fund for the Partnership business.

CHAPTER THREE: GENERAL BANKING OF FSIBL

General Banking

Functions of General Banking

- Account opening

- Account closing

- Issuing Cheque Book

- Cheque clearing house

- Cash section

- Online Banking & SMS Banking

- ATM Banking

Basically, this Account is suitable for the Businessman because Business People can Deposit the money as well as withdraw the money from this Account at various times within Transaction Hours of the Bank. Within the Transaction Hour of the Bank, the Account Holders can deposit as many times as they wish. The photocopy of the NID card or birth certificate of both the account holder and the nominee.

If the account holder is a Taxpayer, the photocopy of the e-TIN certificate will be attached. If the account holder is an Employee, must submit the photocopy of Job ID card or Visitor card. If the account holder is a Student, he/she must submit the photocopy of Student ID card.

If the account holder does not want to withdraw the future value after maturity, he can keep the fund in the bank. In this type of scheme, the account holder has to deposit a fixed amount of money or installment every month. While the First Security Islami Bank (FSIBL) branch receives checks from other banks to collect money, the FSIBL branch sends them to the FSIBL head office.

In this section Deposit is collected from the various customers of the Bank by means of the Deposit Slip. The note that Bank collects from the account holder is whether it is faded or fake note or not. Under this service, Account Holder sends SMS by writing his/her Account Number to the Bank Number for his/her Balance enquiry.

CHAPTER FOUR: PRODUCTS & SERVICES OF FSIBL

Products of FSIBL

Deposit Scheme

Foreign Remittance

MUDARABA Special Savings Account: This is one type of savings account that is opened for special purposes. MUDARABA Labor Savings Account (MEHNOTI): This product (account) is a one-way savings account opened by laborers. MUDARABA Student Savings Account (ONKUR): This product (account) is considered as a savings account and the users of this account are students only.

MUDARABA Salary Savings Account (PRAPTI): This product (account) is considered as savings account where salary holders open this account. MUDARABA Senior Savings Account (PROBIN): This product (account) is for citizens of Bangladesh who are senior citizens. MUDARABA New Generation Savings Account (PROJONMO): This product is for the new generation of Bangladesh.

MUDARABA Agent Savings Account: This is the savings account where agents of the Bank maintain this account. Bangladeshi workers living in different countries of the world can send their money to Bangladesh easily, safely and also quickly. FSIBL also has a contract with MoneyGram, just like the Western Monetary Union, in the case of a money transfer agreement with MoneyGram.

Service of FSIBL

FSIBL provides mobile banking facilities to the customers where the account holders of the bank can transact using this mobile application. For setting up this application, the representative of the bank's receiving department helps people to use this application properly. If the account holders have Savings or current or STD account, in that case, they are eligible to use the FSIBL ATM card.

Under this service, the Customers send SMS through a specific number provided by the Bank for specific queries. Bank is a financial institution which is responsible to not only secure the fund of account holders but also to secure another assets of them. Here the account holders want to check the overall report of their banking transaction in the form of a statement.

This bank statement will be up to how many periods, depends on the account holders. While providing banking services to them, some customers may not be mentally satisfied with the banking service. Here FSIBL has opened Complaint cell for any issue regarding banking services for the betterment of their customers.

This service allows a customer to file a complaint about any issue with the banking service in the complaint cell. In this fund, the people who are liable to pay Zakat can pay their Zakat amount into the Zakat Fund of the FSIBL. With that Zakat fund, FSIBL distributes among the needy people who are eligible for the share of that fund.

CHAPTER FIVE: INTERNSHIP EXPERIENCE AT FSIBL

Overview of my internship experience

Actual job responsibilities

Account opening

Cheque Book requisition

ATM card requisition

Challenges & limitations faced by me

Sultan Ahmed and Tanjim Hasan Chowdhury; Junior officers of FSIBL at the reception. Under their supervision, I worked mainly in the customer service department as well as complying with the rules and regulations of this accounting. I observed their work in filling the account opening form very carefully whether they follow the instructions mentioned in the form or not.

If they could not understand an issue written on the form, I clarified that issue. In the deposit slip they are required to write the initial opening amount of that particular Account. After that, I told them to sign the depositor's signature on the slip and told them to go to the Cash section to deposit that initial amount that was written on the slip.

After knowing I entered the date of claim, account number of the account holders, check number in the check claim book. When opening an account, account holders are usually asked whether they need an ATM card or not. After they need an ATM card, they have to go to an ATM card application.

So, for requisition when any customer comes to the front desk, I asked their account number and then in the ATM card requisition book, I entered that specific customer information related to ATM card. Basically after ATM card is handed over to the customers after 1 or 2 weeks from the Requisition period. So, while handing over the ATM card, they were instructed how to activate their ATM card by going to ATM booth near FSIBL Banani branch (at ABC Tower).

CHAPTER SIX: SWOT ANALYSIS OF FSIBL

Strength

Weakness

Opportunity

Threat

As, FSIBL believes that there is a positive relationship between the customer satisfaction and customer retention ratio. If they maintain the services for the betterment of the customers, provide a perfect service to the respected customers, because of this, customers will be very satisfied with the Banking Service. According to the customers, FSIBL is the top rated Islamic Bank in the Islamic banking segment in Bangladesh. FSIBL has a very strong image as well as a strong identity.

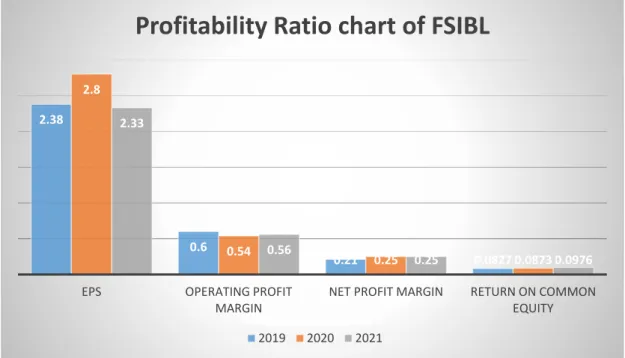

With these good weapons, FSIBL has positioned itself better in the minds of the customers. FSIBL's banking hours are from 10:00 AM to 3:30 PM, but for special customers they also provide services outside banking hours. Both the chart and graph show that FSIBL's strength lies in its profitability.

So based on the overall scenario it can be concluded that FSIBL has a strength to achieve banking growth in future and with this ability and this is the second strength of FSIBL. FSIBL's entry position is even lower than other Islamic as well as conventional banks. Due to this low salary structure in FSIBL, it will be very difficult to retain the existing employees in the bank and if it continues, potential fresh job candidates from FSIBL will not be attracted and influenced in future.

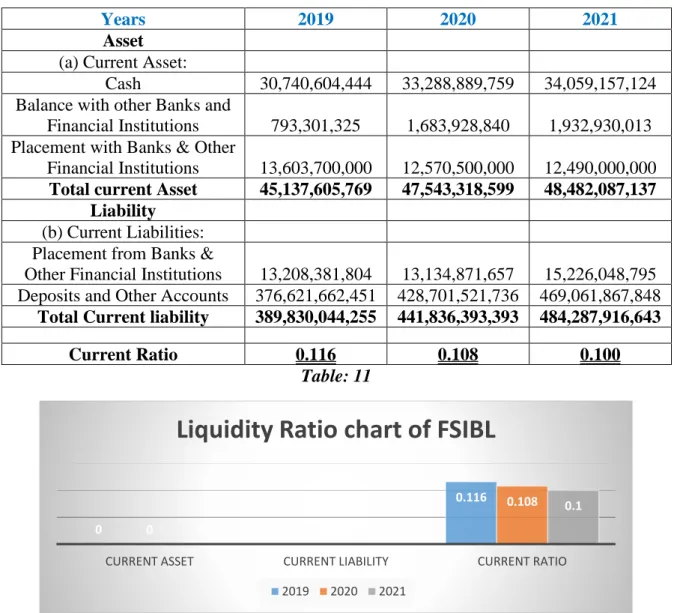

Thus, there is a high probability that the bank will face a liquidity crisis due to the inefficient backup of current assets for repayment of short-term liabilities. But the fact is that there is no software backup system in Banani Branch. So even though there is load loss, there is a possibility that the software may not backup all the files and data stored in the software.

CHAPTER SEVEN: CUSTOMER SATISFACTION ANALYSIS OF FSIBL

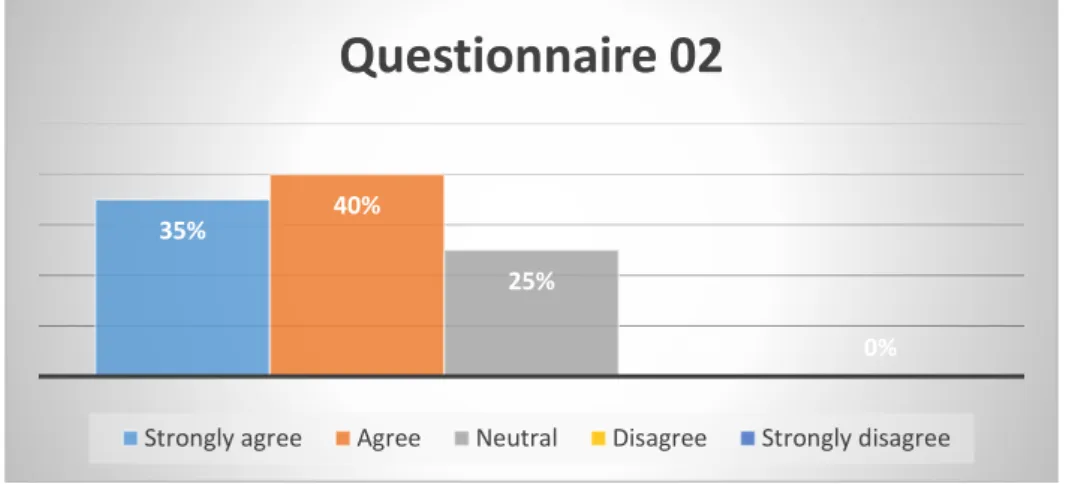

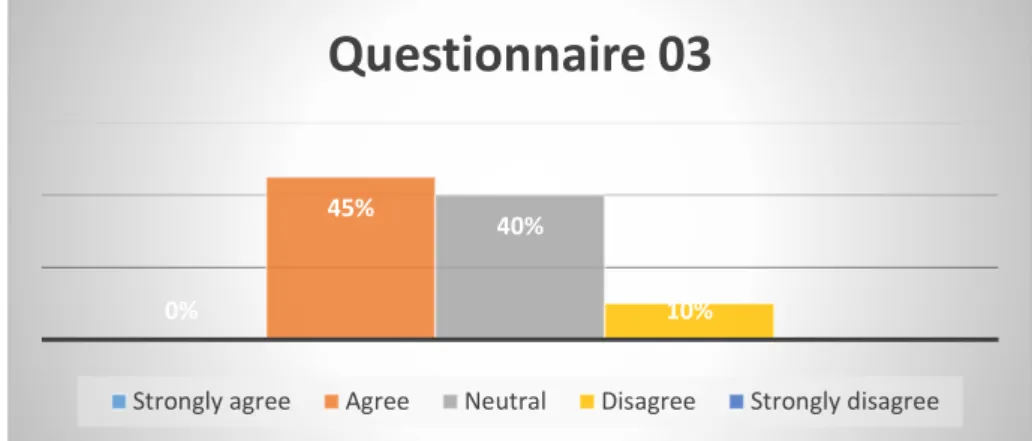

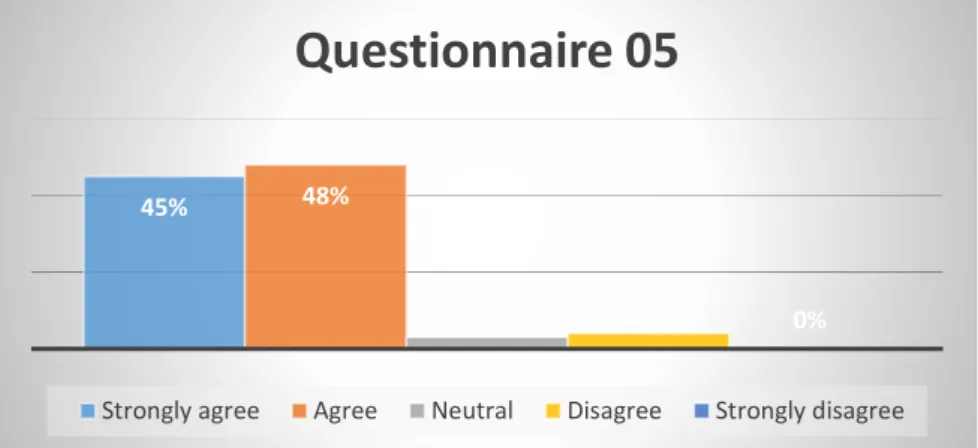

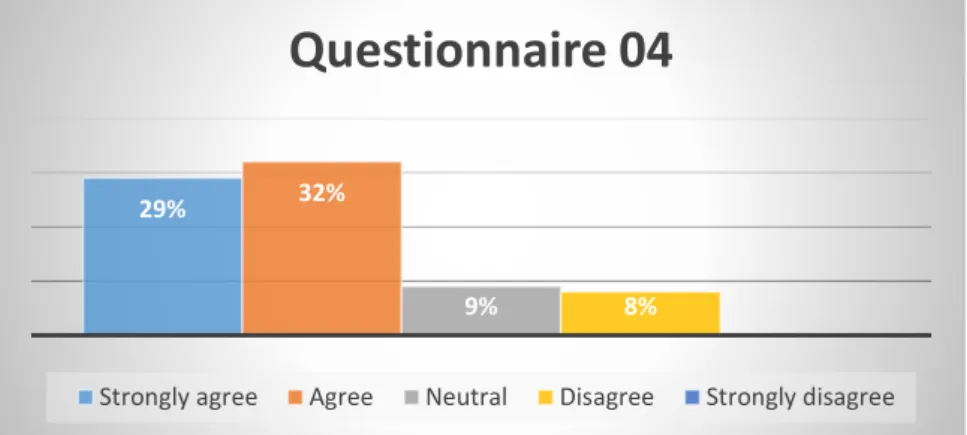

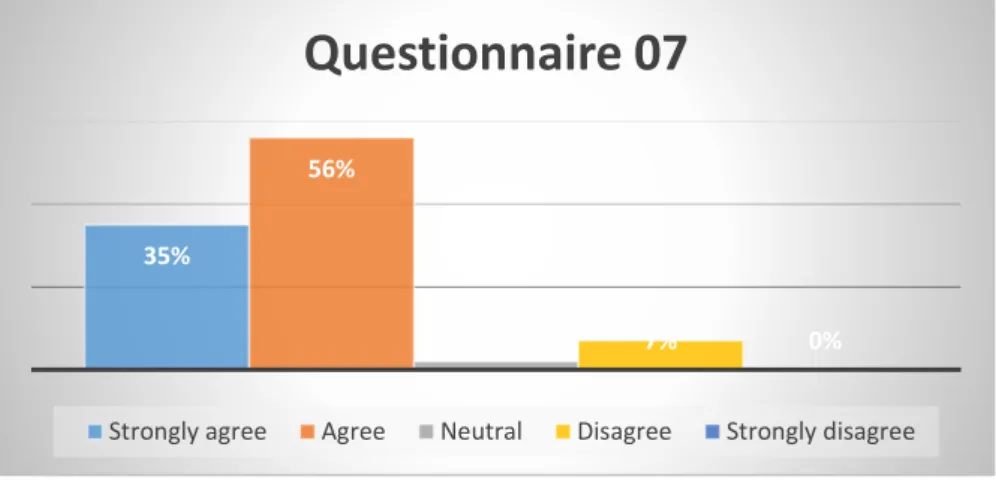

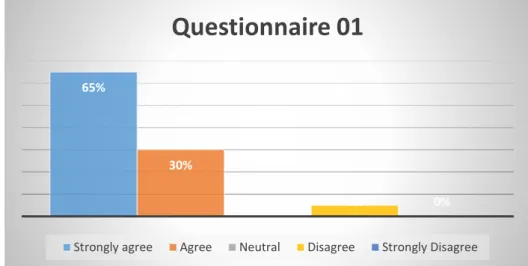

I personally conducted a small survey on 15 customers of FSIBL based on their satisfaction about FSIBL.

CHAPTER EIGHT: RECOMMENDATIONS & CONCLUSIONS

Recommendations

Conclusions

List of References

APPENDIX