ACP Average collection period ADR American Depository Receipt

APR Annual percentage rate AR Accounts receivable

b Beta coefficient, a measure of an asset’s market risk bL Levered beta

bU Unlevered beta BEP Basic earning power BVPS Book value per share CAPM Capital Asset Pricing Model

CCC Cash conversion cycle

CF Cash flow; CFtis the cash flow in Period t CFPS Cash flow per share

CR Conversion ratio CV Coefficient of variation

Δ Difference, or change (uppercase delta) Dps Dividend of preferred stock

Dt Dividend in Period t DCF Discounted cash flow

D/E Debt-to-equity ratio DPS Dividends per share DRIP Dividend reinvestment plan

DRP Default risk premium DSO Days sales outstanding EAR Effective annual rate, EFF%

EBIT Earnings before interest and taxes; net operating income EBITDA Earnings before interest, taxes, depreciation, and amortization

EPS Earnings per share EVA Economic Value Added

F (1) Fixed operating costs (2) Flotation cost FCF Free cash flow

FVN Future value for Year N

FVAN Future value of an annuity for N years

g Growth rate in earnings, dividends, and stock prices I Interest rate; also denoted by r

I/YR Interest rate key on some calculators INT Interest payment in dollars

IP Inflation premium IPO Initial public offering IRR Internal rate of return

LP Liquidity premium

M (1) Maturity value of a bond (2) Margin (profit margin) M/B Market-to-book ratio

MIRR Modified Internal Rate of Return MRP Maturity risk premium

MVA Market Value Added n Number of shares outstanding

N Calculator key denoting number of periods

N(di) Represents area under a standard normal distribution function NOPAT Net operating profit after taxes

NOWC Net operating working capital NPV Net present value

P (1) Price of a share of stock in Period t; P0= price of the stock today (2) Sales price per unit of product sold

PMT Payment of an annuity PPP Purchasing power parity

PV Present value

PVAN Present value of an annuity for N years Q Quantity produced or sold

QBE Breakeven quantity

r (1) A percentage discount rate, or cost of capital; also denoted by i (2) Nominal risk-adjusted required rate of return

¯

r “r bar,”historic, or realized, rate of return ^

r “r hat,”an expected rate of return r* Real risk-free rate of return rd Before-tax cost of debt

re Cost of new common stock (outside equity) rf Interest rate in foreign country

rh Interest rate in home country

ri Required return for an individual firm or security rM Return for“the market”or for an“average”stock rNOM Nominal rate of interest; also denoted by iNOM

rps (1) Cost of preferred stock (2) Portfolio’s return rPER Periodic rate of return

rRF Rate of return on a risk-free security rs (1) Required return on common stock

(2) Cost of old common stock (inside equity)

ρ Correlation coefficient (lowercase rho); also denoted by R when using historical data ROA Return on assets

ROE Return on equity RP Risk premium RPM Market risk premium

RR Retention rate S (1) Sales

(2) Estimated standard deviation for sample data (3) Intrinsic value of stock (i.e., all common equity) SML Security Market Line

∑ Summation sign (uppercase sigma)

σ Standard deviation (lowercase sigma) σ2 Variance

t Time period

T Marginal income tax rate

TVN A stock’s horizon, or terminal, value TIE Times interest earned

V Variable cost per unit VB Bond value

VL Total market value of a levered firm Vop Value of operations

Vps Value of preferred stock

VU Total market value of an unlevered firm VC Total variable costs

w Proportion or weight wd Weight of debt

wps Weight of preferred stock

ws Weight of common equity raised internally by retaining earnings wce Weight of common equity raised externally by issuing stock WACC Weighted averaged cost of capital

X Exercise price of option YTC Yield to call

Theory and Practice

THIRTEENTH EDITION

M I C H A E L C . E H R H A R D T

University of Tennessee

E U G E N E F . B R I G H A M

University of Florida

VP/Editorial Director: Jack W. Calhoun Publisher:

Joe Sabatino Executive Editor: Mike Reynolds Developmental Editor:

Michael Guendelsberger Senior Editorial Assistant:

Adele Scholtz Marketing Manager:

Nathan Anderson Marketing Coordinator:

Suellen Ruttkay Content Project Manager:

Jacquelyn K Featherly Technology Production Analyst:

Starratt Alexander

Senior Manufacturing Coordinator: Kevin Kluck

Production House/Compositor: Integra Software Services Pvt. Ltd. Senior Art Director:

Michelle Kunkler Cover and Internal Designer:

Rokusek Design Cover Images:

© Lael Henderson/Stock Illustration Source/Getty Images, Inc.

recording, scanning, digitizing, taping, Web distribution, information networks, or information storage and retrieval systems, except as permitted under Sec-tion 107 or 108 of the 1976 United States Copyright Act, without the prior written permission of the publisher.

For product information and technology assistance, contact us at Cengage Learning Customer & Sales Support, 1-800-354-9706

For permission to use material from this text or product, submit all requests online atwww.cengage.com/permissions

Further permissions questions can be emailed to permissionrequest@cengage.com

ExamView®and ExamView Pro®are registered trademarks of FSCreations, Inc. Windows is a registered trademark of the Microsoft Corporation used herein under license. Macintosh and Power Macintosh are registered trademarks of Apple Computer, Inc. used herein under license.

Library of Congress Control Number: 2010920554 Student Edition ISBN 13: 978-1-4390-7810-5 Student Edition ISBN 10: 1-4390-7810-6

Package Student Edition ISBN 13: 978-1-4390-7809-9 Package Student Edition ISBN 10: 1-4390-7809-2

South-Western Cengage Learning 5191 Natorp Boulevard

Mason, OH 45040 USA

Cengage Learning products are represented in Canada by Nelson Education, Ltd.

For your course and learning solutions, visitwww.cengage.com

Purchase any of our products at your local college store or at our preferred online storewww.CengageBrain.com

Preface xix

PART

1

Fundamental Concepts

of Corporate Finance

1

CHAPTER 1 An Overview of Financial Management and the Financial Environment 3

Web Extensions 1A:An Overview of Derivatives

1B:A Closer Look at the Stock Markets

CHAPTER 2 Financial Statements, Cash Flow, and Taxes 47

Web Extensions 2A:The Federal Income Tax System for Individuals

CHAPTER 3 Analysis of Financial Statements 87

PART

2

Fixed Income

Securities

121

CHAPTER 4 Time Value of Money 123

Web Extensions 4A:The Tabular Approach

4B:Derivation of Annuity Formulas

4C:Continuous Compounding

CHAPTER 5 Bonds, Bond Valuation, and Interest Rates 173

Web Extensions 5A:A Closer Look at Zero Coupon Bonds

5B:A Closer Look at TIPS: Treasury Inflation-Protected Securities

5C:A Closer Look at Bond Risk: Duration

5D:The Pure Expectations Theory and Estimation of Forward Rates

PART

3

Stocks and Options

215

CHAPTER 6 Risk, Return, and the Capital Asset Pricing Model 217

Web Extensions 6A:Continuous Probability Distributions

6B:Estimating Beta with a Financial Calculator

CHAPTER 7 Stocks, Stock Valuation, and Stock Market Equilibrium 267

Web Extensions 7A:Derivation of Valuation Equations

CHAPTER 8 Financial Options and Applications in Corporate Finance 305

PART

4

Projects and Their

Valuation

333

CHAPTER 9 The Cost of Capital 335

Web Extensions 9A:The Required Return Assuming Nonconstant Dividends and Stock Repurchases

CHAPTER 10 The Basics of Capital Budgeting: Evaluating Cash Flows 379 Web Extensions 10A:The Accounting Rate of

Return (ARR)

CHAPTER 11 Cash Flow Estimation and Risk Analysis 423

Web Extensions 11A:Certainty Equivalents and Risk-Adjusted Discount Rates

PART

5

Corporate Valuation

and Governance

471

CHAPTER 12 Financial Planning and Forecasting Financial Statements 473

Web Extensions 12A:Advanced Techniques for Forecasting Financial Statements Accounts

CHAPTER 13 Corporate Valuation, Value-Based Management and Corporate Governance 511

PART

6

Cash Distributions and

Capital Structure

557

CHAPTER 14 Distributions to Shareholders: Dividends and Repurchases 559

CHAPTER 15 Capital Structure Decisions 599

Web Extensions 15A:Degree of Leverage

PART

7

Managing Global

Operations

639

CHAPTER 16 Working Capital Management 641

Web Extensions 16A:Secured Short-Term Financing

CHAPTER 17 Multinational Financial Management 691

PART

8

Tactical Financing

Decisions

731

CHAPTER 18 Lease Financing 733

Web Extensions 18A:Leasing Feedback 18B:Percentage Cost Analysis

18C:Leveraged Leases

CHAPTER 19 Hybrid Financing: Preferred Stock, Warrants, and Convertibles 759

Web Extensions 19A:Calling Convertible Issues

CHAPTER 20 Initial Public Offerings, Investment Banking, and Financial Restructuring 787

Web Extensions 20A:Rights Offerings

PART

9

Special Topics

825

CHAPTER 21 Mergers, LBOs, Divestitures, and Holding Companies 827

Web Extensions 21A:Projecting Consistent Debt and Interest Expenses

CHAPTER 22 Bankruptcy, Reorganization, and Liquidation 869

Web Extensions 22A:Multiple Discriminant Analysis

CHAPTER 23 Derivatives and Risk Management 899

Web Extensions 23A:Risk Management with Insurance

PART

10

Advanced Issues

929

CHAPTER 24 Portfolio Theory, Asset Pricing Models, and Behavioral

Finance 931

CHAPTER 25 Real Options 971

Web Extensions 25A:The Abandonment Real Option

25B:Risk-Neutral Valuation

Appendixes

Appendix A Solutions to Self-Test Problems 1029

Appendix B Answers to End-of-Chapter Problems 1063

Appendix C Selected Equations and Data 1071

Appendix D Values of the Areas under the Standard Normal Distribution Function 1085

Glossary 1087 Name Index 1113 Subject Index 1119

Web Chapters

CHAPTER 27 Providing and Obtaining Credit

CHAPTER 28 Advanced Issues in Cash Management and Inventory Control

CHAPTER 29 Pension Plan Management

Preface . . . xix

PART 1

Fundamental Concepts of Corporate Finance 1

C H A P T E R 1

An Overview of Financial Management and the Financial Environment 3

The Five-Minute MBA 4

Box: Say Hello to the Global Economic Crisis! 5 The Corporate Life Cycle 5

Box: Columbus Was Wrong—the WorldIsFlat! And Hot, and Crowded! 6

The Primary Objective of the Corporation: Value Maximization 9

Box: Ethics for Individuals and Businesses 10

Box: Corporate Scandals and Maximizing Stock Price 13

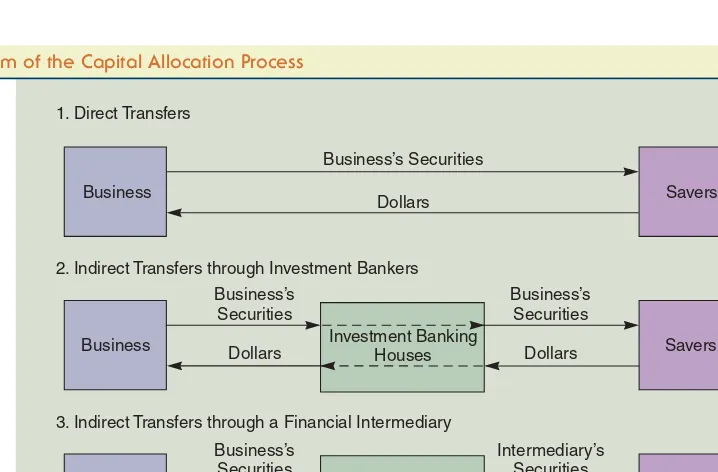

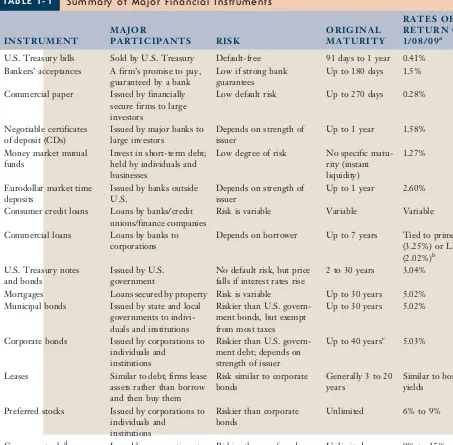

An Overview of the Capital Allocation Process 13 Financial Securities 15

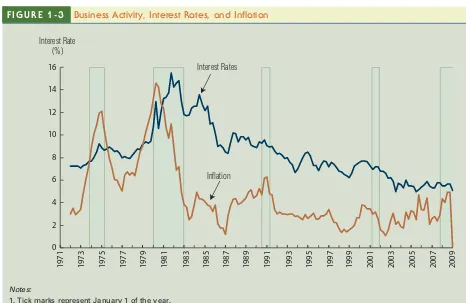

The Cost of Money 19 Financial Institutions 23 Financial Markets 27

Trading Procedures in Financial Markets 29 Types of Stock Market Transactions 30

Box: Rational Exuberance? 31 The Secondary Stock Markets 31

Box: Measuring the Market 33

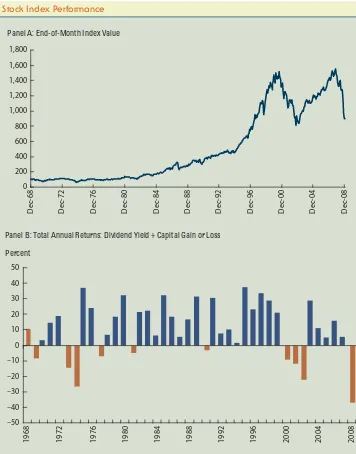

Stock Market Returns 34 The Global Economic Crisis 36 The Big Picture 42

e-Resources 43 Summary 44 Web Extensions

1A: An Overview of Derivatives 1B: A Closer Look at the Stock Markets C H A P T E R 2

Financial Statements, Cash Flow, and Taxes 47

Box: Intrinsic Value, Free Cash Flow, and Financial Statements 48 Financial Statements and Reports 48

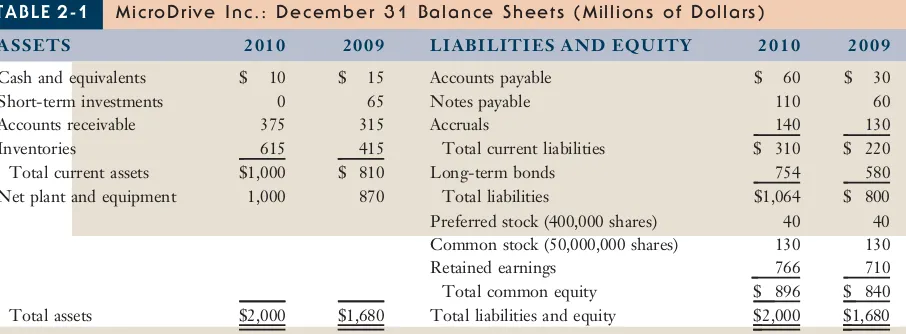

The Balance Sheet 49

Box: Let’s Play Hide-and-Seek! 51

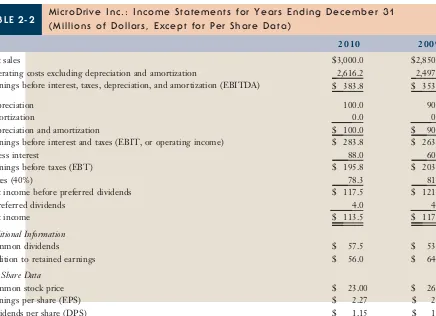

The Income Statement 52

Statement of Stockholders’Equity 53 Net Cash Flow 54

Statement of Cash Flows 55

Box: Financial Analysis on the WEB 56

Modifying Accounting Data for Managerial Decisions 59

Box: Financial Bamboozling: How to Spot It 63 MVA and EVA 67

Box: Sarbanes-Oxley and Financial Fraud 70

The Federal Income Tax System 71 Summary 76

Web Extensions

2A: The Federal Income Tax System for Individuals C H A P T E R 3

Analysis of Financial Statements 87

Box: Intrinsic Value and Analysis of Financial Statements 88 Financial Analysis 88

Liquidity Ratios 89

Asset Management Ratios 92

Box: The Price is Right! (Or Wrong!) 93

Debt Management Ratios 95 Profitability Ratios 98

Box: The World Might be Flat, but Global Accounting is Bumpy! The Case of IFRS versus FASB 99

Market Value Ratios 100

Trend Analysis, Common Size Analysis, and Percentage Change Analysis 102 Tying the Ratios Together: The Du Pont Equation 106

Comparative Ratios and Benchmarking 107 Uses and Limitations of Ratio Analysis 108

Box: Ratio Analysis on the Web 109 Looking beyond the Numbers 110 Summary 110

PART 2

Fixed Income Securities 121

C H A P T E R 4

Time Value of Money 123

Box: Corporate Valuation and the Time Value of Money 124

Time Lines 125 Future Values 125

Box: Hints on Using Financial Calculators 129

Box: The Power of Compound Interest 132

Finding the Interest Rate, I 136 Finding the Number of Years, N 137 Annuities 138

Future Value of an Ordinary Annuity 138 Future Value of an Annuity Due 141

Present Value of Ordinary Annuities and Annuities Due 141

Box: Variable Annuities: Good or Bad? 144

Finding Annuity Payments, Periods, and Interest Rates 144 Perpetuities 146

Box: Using the Internet for Personal Financial Planning 147 Uneven, or Irregular, Cash Flows 148

Future Value of an Uneven Cash Flow Stream 151 Solving for I with Irregular Cash Flows 152 Semiannual and Other Compounding Periods 153

Box: Truth in Lending: What Loans Really Cost 156

Fractional Time Periods 157 Amortized Loans 158 Growing Annuities 159

Box: An Accident Waiting to Happen: Option Reset Adjustable Rate Mortgages 160

Summary 162 Web Extensions

4A: The Tabular Approach 4B: Derivation of Annuity Formulas 4C: Continuous Compounding C H A P T E R 5

Bonds, Bond Valuation, and Interest Rates 173

Box: Intrinsic Value and the Cost of Debt 174 Who Issues Bonds? 174

Key Characteristics of Bonds 175

Box: Betting With or Against the U.S. Government: The Case of Treasury Bond Credit Default Swaps 176 Bond Valuation 180

Changes in Bond Values over Time 184

Box: Drinking Your Coupons 187

Bonds with Semiannual Coupons 187 Bond Yields 188

The Pre-Tax Cost of Debt: Determinants of Market Interest Rates 191 The Real Risk-Free Rate of Interest, r* 192

The Inflation Premium (IP) 193

The Nominal, or Quoted, Risk-Free Rate of Interest, rRF 195

The Default Risk Premium (DRP) 195

Box: Might the U.S. Treasury Bond Be Downgraded? 199

Box: Are Investors Rational? 201 The Liquidity Premium (LP) 201 The Maturity Risk Premium (MRP) 201 The Term Structure of Interest Rates 204 Financing with Junk Bonds 205

Bankruptcy and Reorganization 206 Summary 207

Web Extensions

5A: A Closer Look at Zero Coupon Bonds

5B: A Closer Look at TIPS: Treasury Inflation-Protected Securities 5C: A Closer Look at Bond Risk: Duration

5D: The Pure Expectations Theory and Estimation of Forward Rates

PART 3

Stocks and Options 215

C H A P T E R 6

Risk, Return, and the Capital Asset Pricing Model 217

Box: Intrinsic Value, Risk, and Return 219 Returns on Investments 219

Stand-Alone Risk 220

Box: What Does Risk Really Mean? 227

Box: The Trade-off between Risk and Return 229 Risk in a Portfolio Context 231

Box: How Risky Is a Large Portfolio of Stocks? 236

Box: The Benefits of Diversifying Overseas 239

Calculating Beta Coefficients 243

The Relationship between Risk and Return 246

Box: Another Kind of Risk: The Bernie Madoff Story 252

Some Concerns about Beta and the CAPM 253

Some Concluding Thoughts: Implications for Corporate Managers and Investors 253 Summary 255

Web Extensions

6A: Continuous Probability Distributions 6B: Estimating Beta with a Financial Calculator C H A P T E R 7

Stocks, Stock Valuation, and Stock Market Equilibrium 267

Box: Corporate Valuation and Stock Prices 268

Legal Rights and Privileges of Common Stockholders 268 Types of Common Stock 269

Valuing Common Stocks 273

Valuing a Constant Growth Stock 276

Expected Rate of Return on a Constant Growth Stock 279 Valuing Nonconstant Growth Stocks 281

Stock Valuation by the Free Cash Flow Approach 285 Market Multiple Analysis 285

Preferred Stock 286

Stock Market Equilibrium 287 The Efficient Markets Hypothesis 290

Box: Rational Behavior versus Animal Spirits, Herding, and Anchoring Bias 293

Summary 294 Web Extensions

7A: Derivation of Valuation Equations C H A P T E R 8

Financial Options and Applications in Corporate Finance 305

Box: The Intrinsic Value of Stock Options 306 Overview of Financial Options 306

Box: Financial Reporting for Employee Stock Options 309

The Single-Period Binomial Option Pricing Approach 310 The Single-Period Binomial Option Pricing Formula 314 The Multi-Period Binomial Option Pricing Model 316 The Black-Scholes Option Pricing Model (OPM) 319

Box: Taxes and Stock Options 324 The Valuation of Put Options 325

Applications of Option Pricing in Corporate Finance 326 Summary 328

PART 4

Projects and Their Valuation 333

C H A P T E R 9

The Cost of Capital 335

Box: Corporate Valuation and the Cost of Capital 336 The Weighted Average Cost of Capital 337 Basic Definitions 338

Cost of Debt, rd(1−T) 340

Cost of Preferred Stock, rps 342

Box: GE and Warren Buffett: The Cost of Preferred Stock 343

Cost of Common Stock, rs 344

The CAPM Approach 345

Dividend-Yield-Plus-Growth-Rate, or Discounted Cash Flow (DCF), Approach 353 Over-Own-Bond-Yield-Plus-Judgmental-Risk-Premium Approach 355

Adjusting the Cost of Equity for Flotation Costs 357

Composite, or Weighted Average, Cost of Capital, WACC 358

Box: Global Variations in the Cost of Capital 361

Factors That Affect the WACC 361 Adjusting the Cost of Capital for Risk 363 Privately Owned Firms and Small Businesses 366 Four Mistakes to Avoid 367

Summary 368 Web Extensions

9A: The Required Return Assuming Nonconstant Dividends and Stock Repurchases C H A P T E R 1 0

The Basics of Capital Budgeting: Evaluating Cash Flows 379

Box: Corporate Valuation and Capital Budgeting 381 An Overview of Capital Budgeting 381

Net Present Value (NPV) 383 Internal Rate of Return (IRR) 387

Box: Why NPV Is Better Than IRR 389

Multiple Internal Rates of Return 390 Reinvestment Rate Assumptions 392

Modified Internal Rate of Return (MIRR) 393 NPV Profiles 396

Profitability Index (PI) 400 Payback Period 401

Conclusions on Capital Budgeting Methods 403 Decision Criteria Used in Practice 405

Other Issues in Capital Budgeting 405 Summary 411

Web Extensions

10A: The Accounting Rate of Return (ARR) C H A P T E R 1 1

Cash Flow Estimation and Risk Analysis 423

Box: Corporate Valuation, Cash Flows, and Risk Analysis 424 Conceptual Issues 424

Analysis of an Expansion Project 429 Risk Analysis in Capital Budgeting 435 Measuring Stand-Alone Risk 436 Sensitivity Analysis 436

Scenario Analysis 439 Monte Carlo Simulation 442

Box: Are Bank Stress Tests Stressful Enough? 445

Project Risk Conclusions 446

Replacement Analysis 448 Real Options 449

Phased Decisions and Decision Trees 451 Summary 454

Appendix 11A Tax Depreciation 468 Web Extensions

11A: Certainty Equivalents and Risk-Adjusted Discount Rates

PART 5

Corporate Valuation and Governance 471

C H A P T E R 1 2

Financial Planning and Forecasting Financial Statements 473

Box: Corporate Valuation and Financial Planning 474 Overview of Financial Planning 474

Sales Forecast 476

Additional Funds Needed (AFN) Method 478 Forecasted Financial Statements Method 482 Forecasting When the Ratios Change 496 Summary 499

Web Extensions

12A: Advanced Techniques for Forecasting Financial Statements Accounts C H A P T E R 1 3

Corporate Valuation, Value-Based Management and Corporate Governance 511

Box: Corporate Valuation: Putting the Pieces Together 512 Overview of Corporate Valuation 513

The Corporate Valuation Model 514 Value-Based Management 521

Managerial Behavior and Shareholder Wealth 530 Corporate Governance 531

Box: Let’s Go to Miami! IBM’s 2009 Annual Meeting 533

Box: Would the U.S. Government Be an Effective Board Director? 536

Box: Shareholder Reactions to the Crisis 538

Box: The Sarbanes-Oxley Act of 2002 and Corporate Governance 540

Box: International Corporate Governance 542

Employee Stock Ownership Plans (ESOPs) 543 Summary 546

PART 6

Cash Distributions and Capital Structure 557

C H A P T E R 1 4

Distributions to Shareholders: Dividends and Repurchases 559

Box: Uses of Free Cash Flow: Distributions to Shareholders 560

Procedures for Cash Distributions 562 Cash Distributions and Firm Value 564 Clientele Effect 567

Information Content, or Signaling, Hypothesis 568 Implications for Dividend Stability 569

Box: Will Dividends Ever Be the Same? 570

Setting the Target Distribution Level: The Residual Distribution Model 570 The Residual Distribution Model in Practice 572

A Tale of Two Cash Distributions: Dividends versus Stock Repurchases 573 The Pros and Cons of Dividends and Repurchases 582

Box: Dividend Yields around the World 584 Other Factors Influencing Distributions 584 Summarizing the Distribution Policy Decision 585 Stock Splits and Stock Dividends 587

Box: Talk about a Split Personality! 588

Dividend Reinvestment Plans 590 Summary 591

C H A P T E R 1 5

Capital Structure Decisions 599

Box: Corporate Valuation and Capital Structure 600 A Preview of Capital Structure Issues 600 Business Risk and Financial Risk 603 Capital Structure Theory 609

Box: Yogi Berra on the MM Proposition 611

Capital Structure Evidence and Implications 618

Box: Taking a Look at Global Capital Structures 620 Estimating the Optimal Capital Structure 621 Anatomy of a Recapitalization 625

Box: Deleveraging 630

Summary 630 Web Extensions

15A: Degree of Leverage

PART 7

Managing Global Operations 639

C H A P T E R 1 6

Working Capital Management 641

Box: Corporate Valuation and Working Capital Management 642

Current Asset Holdings 643

Current Assets Financing Policies 644 The Cash Conversion Cycle 648

Box: Some Firms Operate with Negative Working Capital! 653

Cash Management and the Target Cash Balance 657

Box: TheCFOCash Management Scorecard 658

Cash Management Techniques 659 Inventory Management 661

Box: Supply Chain Management 662 Receivables Management 663

Box: Supply Chain Finance 665

Accruals and Accounts Payable (Trade Credit) 667 Short-Term Marketable Securities 670

Short-Term Financing 672 Short-Term Bank Loans 672 Commercial Paper 676

Use of Security in Short-Term Financing 677 Summary 678

Web Extensions

16A: Secured Short-Term Financing C H A P T E R 1 7

Multinational Financial Management 691

Box: Corporate Valuation in a Global Context 692 Multinational, or Global, Corporations 692

Multinational versus Domestic Financial Management 693 Exchange Rates 694

Exchange Rates and International Trade 698

The International Monetary System and Exchange Rate Policies 699 Trading in Foreign Exchange 703

Interest Rate Parity 704 Purchasing Power Parity 706

Box: Hungry for a Big Mac? Go To Malaysia! 708

Inflation, Interest Rates, and Exchange Rates 709 International Money and Capital Markets 710

Box: Greasing the Wheels of International Business 711

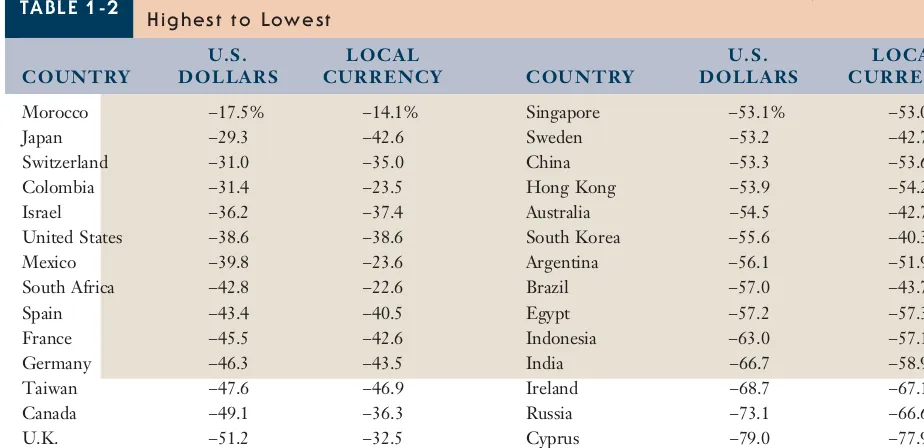

Box: Stock Market Indices around the World 713

Multinational Capital Budgeting 714

Box: Consumer Finance in China 715 International Capital Structures 718

Multinational Working Capital Management 720 Summary 723

PART 8

Tactical Financing Decisions 731

C H A P T E R 1 8 Lease Financing 733

Tax Effects 736

Financial Statement Effects 738

Box: Off–Balance Sheet Financing: Is It Going to Disappear? 740

Evaluation by the Lessee 740 Evaluation by the Lessor 745 Other Issues in Lease Analysis 747

Box: What You Don’t Know Can Hurt You! 748 Box: Lease Securitization 750

Other Reasons for Leasing 751 Summary 753

Web Extensions 18A: Leasing Feedback 18B: Percentage Cost Analysis 18C: Leveraged Leases C H A P T E R 1 9

Hybrid Financing: Preferred Stock, Warrants, and Convertibles 759

Preferred Stock 761

Box: The Romance Had No Chemistry, But It Had a Lot of Preferred Stock! 762 Warrants 765

Convertible Securities 770

A Final Comparison of Warrants and Convertibles 777

Reporting Earnings When Warrants or Convertibles Are Outstanding 778 Summary 779

Web Extensions

19A: Calling Convertible Issues C H A P T E R 2 0

Initial Public Offerings, Investment Banking, and Financial Restructuring 787

The Financial Life Cycle of a Start-up Company 788 The Decision to Go Public 789

The Process of Going Public: An Initial Public Offering 791 Equity Carve-outs: A Special Type of IPO 799

Other Ways to Raise Funds in the Capital Markets 800

Box: Bowie Bonds Ch-Ch-Change Asset Securitization 803

Investment Banking Activities and Their Role in the Global Economic Crisis 803

Box: Investment Banks and the Global Economic Crisis 805 The Decision to Go Private 806

Managing the Maturity Structure of Debt 808 Refunding Operations 810

Box: TVA Ratchets Down Its Interest Expenses 813

Managing the Risk Structure of Debt with Project Financing 815 Summary 817

PART 9

Special Topics 825

C H A P T E R 2 1

Mergers, LBOs, Divestitures, and Holding Companies 827

Rationale for Mergers 828 Types of Mergers 830 Level of Merger Activity 831

Hostile versus Friendly Takeovers 832 Merger Regulation 833

Overview of Merger Analysis 834

The Adjusted Present Value (APV) Approach 835 The Free Cash Flow to Equity (FCFE) Approach 838

Illustration of the Three Valuation Approaches for a Constant Capital Structure 840 Setting the Bid Price 845

Analysis When There Is a Permanent Change in Capital Structure 847 Taxes and the Structure of the Takeover Bid 849

Box: Tempest in a Teapot? 850

Financial Reporting for Mergers 852 Analysis for a“True Consolidation” 855 The Role of Investment Bankers 855 Who Wins: The Empirical Evidence 857

Box: Merger Mistakes 858

Corporate Alliances 858 Leveraged Buyouts 859 Divestitures 859 Holding Companies 860 Summary 862

Web Extensions

21A: Projecting Consistent Debt and Interest Expenses C H A P T E R 2 2

Bankruptcy, Reorganization, and Liquidation 869

Financial Distress and Its Consequences 870 Issues Facing a Firm in Financial Distress 871

Settlements without Going through Formal Bankruptcy 872 Federal Bankruptcy Law 874

Reorganization in Bankruptcy 875 Liquidation in Bankruptcy 885

Box: A Nation of Defaulters? 888

Other Motivations for Bankruptcy 889 Some Criticisms of Bankruptcy Laws 889 Summary 890

Web Extensions

C H A P T E R 2 3

Derivatives and Risk Management 899

Box: Corporate Valuation and Risk Management 900

Reasons to Manage Risk 901 Background on Derivatives 903 Derivatives in the News 904 Other Types of Derivatives 907 Corporate Risk Management 913

Box: Enterprise Risk Management and Value at Risk 916 Using Derivatives to Reduce Risks 917

Box: Risk Management in the Cyber Economy 920

Summary 924 Web Extensions

23A: Risk Management with Insurance

PART 10

Advanced Issues 929

C H A P T E R 2 4

Portfolio Theory, Asset Pricing Models, and Behavioral Finance 931

Box: Corporate Valuation and Risk 932

Efficient Portfolios 932

Choosing the Optimal Portfolio 936

The Basic Assumptions of the Capital Asset Pricing Model 939 The Capital Market Line and the Security Market Line 940 Calculating Beta Coefficients 944

Box: Skill or Luck? 945

Empirical Tests of the CAPM 952 Arbitrage Pricing Theory 954

The Fama-French Three-Factor Model 957

An Alternative Theory of Risk and Return: Behavioral Finance 961 Summary 963

C H A P T E R 2 5 Real Options 971

Valuing Real Options 972

The Investment Timing Option: An Illustration 973 The Growth Option: An Illustration 982

Concluding Thoughts on Real Options 986 Summary 989

Web Extensions

C H A P T E R 2 6

Analysis of Capital Structure Theory 995

Box: Corporate Valuation and Capital Structure Decisions 996

Capital Structure Theory: Arbitrage Proofs of the Modigliani-Miller Models 996 Introducing Personal Taxes: The Miller Model 1006

Criticisms of the MM and Miller Models 1010

An Extension of the MM Model: Nonzero Growth and a Risky Tax Shield 1011 Risky Debt and Equity as an Option 1015

Capital Structure Theory: Our View 1019 Summary 1021

Appendix ASolutions to Self-Test Problems . . . 1029

Appendix BAnswers to End-of-Chapter Problems . . . 1063

Appendix CSelected Equations and Data . . . 1071

Appendix DValues of the Areas under the Standard Normal Distribution Function . . . 1085

Glossary . . . 1087

Name Index . . . 1113

Subject Index . . . 1119

WEB CHAPTERS

C H A P T E R 2 7

Providing and Obtaining Credit

C H A P T E R 2 8

Advanced Issues in Cash Management and Inventory Control

C H A P T E R 2 9

Pension Plan Management

C H A P T E R 3 0

When we wrote the first edition ofFinancial Management: Theory and Practice, we had four goals: (1) to create a text that would help students make better financial decisions; (2) to provide a book that could be used in the introductory MBA course, but one that was complete enough for use as a reference text in follow-on case courses and after graduation; (3) to motivate students by demonstrating that finance is both interesting and relevant; and (4) to make the book clear enough so that students could go through the material without wasting either their time or their professor’s time trying to figure

out what we were saying.

The collapse of the sub-prime mortgage market, the financial crisis, and the global economic crisis make it more important than ever for students and managers to understand the role that finance plays in a global economy, in their own companies, and in their own lives. So in addition to the four goals listed above, this edition has a fifth goal, to prepare students for a changed world.

I

NTRINSIC

V

ALUATION AS A

U

NIFYING

T

HEME

Our emphasis throughout the book is on the actions that a manager can and should take to increase the intrinsic value of the firm. Structuring the book around intrinsic valuation enhances continuity and helps students see how various topics are related to one another. As its title indicates, this book combines theory and practical applications. An understanding of finance theory is absolutely essential for anyone developing and/or implementing effective financial strategies. But theory alone isn’t sufficient, so we

provide numerous examples in the book and the accompanyingExcelspreadsheets to illustrate how theory is applied in practice. Indeed, we believe that the ability to ana-lyze financial problems usingExcelis absolutely essential for a student’s successful job

search and subsequent career. Therefore, many exhibits in the book come directly from the accompanying Excel spreadsheets. Many of the spreadsheets also provide brief“tutorials”by way of detailed comments onExcelfeatures that we have found to

be especially useful, such as Goal Seek, Tables, and many financial functions.

The book begins with fundamental concepts, including background on the eco-nomic and financial environment, financial statements (with an emphasis on cash flows), the time value of money, bond valuation, risk analysis, and stock valuation. With this background, we go on to discuss how specific techniques and decision rules can be used to help maximize the value of the firm. This organization provides four important advantages:

1. Managers should try to maximize the intrinsic value of a firm, which is determined by cash flows as revealed in financial statements. Our early coverage of financial statements thus helps students see how particular financial decisions affect the vari-ous parts of the firm and the resulting cash flow. Also, financial statement analysis provides an excellent vehicle for illustrating the usefulness of spreadsheets.

2. Covering time value of money early helps students see how and why expected future cash flows determine the value of the firm. Also, it takes time for stu-dents to digest TVM concepts and to learn how to do the required calcula-tions, so it is good to cover TVM concepts early and often.

resource

Be sure to visit the

Financial Management: Theory and Practice (13thEdition)Web site at www.cengage.com/ brigham.This site provides access for instructors and students.

3. Most students—even those who do not plan to major in finance—are interested

in investments. The ability to learn is a function of individual interest and moti-vation, soFinancial Management’searly coverage of securities and security markets is pedagogically sound.

4. Once basic concepts have been established, it is easier for students to understand both how and why corporations make specific decisions in the areas of capital budgeting, raising capital, working capital management, mergers, and the like.

I

NTENDED

M

ARKET AND

U

SE

Financial Managementis designed primarily for use in the introductory MBA finance course and as a reference text in follow-on case courses and after graduation. There is enough material for two terms, especially if the book is supplemented with cases and/or selected readings. The book can also be used as an undergraduate introductory text with exceptionally good students, or where the introductory course is taught over two terms.

I

MPROVEMENTS IN THE

13

THE

DITION

As in every revision, we updated and clarified materials throughout the text, reviewing the entire book for completeness, ease of exposition, and currency. We made hundreds of small changes to keep the text up-to-date, with particular emphasis on updating the real world examples and including the latest changes in the financial environment and financial theory. In addition, we made a number of larger changes. Some affect all chap-ters, some involve reorganizing sections among chapchap-ters, and some modify material covered within specific chapters.

C

HANGES THAT

A

FFECT

A

LL

C

HAPTERS

Reorganization to better accommodate one-semester and two-semester sequences. Finance is taught as a one-semester course at many schools, so we moved the essential material into the first 17 chapters. The remaining chapters cover addi-tional topics and provide more advanced treatment of the essential material in the first 17 chapters. This makes it easy for a professor teaching a one-semester course to cover the essential materials and then pick and choose from the remaining topics if time per-mits. If finance is taught in a two-semester sequence, the first semester can focus on the essential materials in the first 17 chapters and the second semester can focus on advanced materials in the remaining chapters, perhaps supplemented with cases.

The global economic crisis. In virtually every chapter we use real world examples to show how the chapter’s topics are related to some aspect of the global economic

crisis. In addition, many chapters have new“Global Economic Crisis”boxes that

fo-cus on particularly important issues related to the crisis.

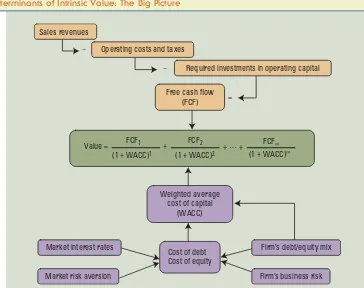

The big picture. Students often fail to see the forest for the trees, and this is espe-cially true in finance because students must learn new vocabularies and analytical tools. To help students understand the big picture and integrate the different parts into an overall framework, we have added a graphic at the beginning of each chap-ter (and in the PowerPoint shows) that clearly illustrates where the chapter’s topics

Value = FCF1 + +…+ FCF∞ (1 + WACC)1

FCF2

(1 + WACC)2 (1 + WACC)∞ Free cash flow

(FCF)

Market interest rates

Firm’s business risk Market risk aversion

Firm’s debt/equity mix Cost of debt

Cost of equity Weighted average

cost of capital (WACC)

Required investments in operating capital Net operating

profit after taxes −

=

Determinants of Intrinsic Value: The Weighted Average Cost of Capital

Additional integration of the textbook and the accompanyingExcel Tool Kit

spreadsheet models for each chapter. Many figures in the textbook are actually screen shots from the chapter’s Excel Tool Kitmodel. This makes the analysis more

transparent to the students and better enables them to follow the analysis in theExcel model.

Signficant Reorganization of Some Chapters

Financial markets and performance measures. Chapter 1 still addresses the financial environment, but now is followed by two chapters focused on measuring the firm’s performance in the financial environment by understanding financial

state-ments, calculating free cash flow, and analyzing ratios.

Time value of money and bond valuation. Chapter 4 covers the time value of money and Chapter 5 applies these concepts to bond pricing. Thus, students learn a tool and then immediately use the tool.

Dividends and stock repurchases before capital structure decisions. We now cover dividends and stock repurchases in Chapter 14 so that students will already un-derstand stock repurchases when we discuss recapitalizations in Chapter 15.

Notable Changes within Selected Chapters

We made too many small improvements within each chapter to mention them all, but some of the more notable ones are discussed below.

the World Is Flat! And Hot, and Crowded,”and a new box on the global economic

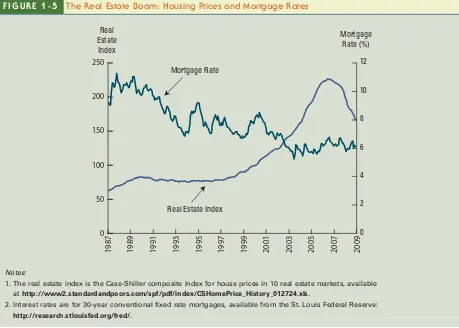

crisis, “Say Hello to the Global Economic Crisis!” We completely rewrote the

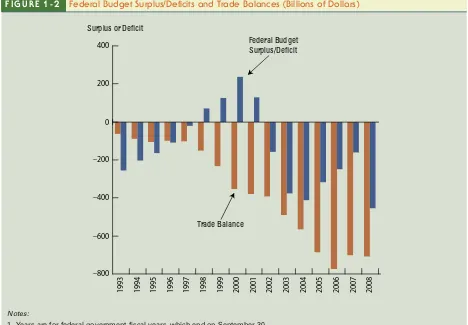

sec-tion on financial securities, including a discussion of securitizasec-tion, and added a new section on the global crisis. New figures showing the national debt, trade balances, federal budget deficits and the Case-Shiller real estate index help us better illustrate different aspects of the global crisis.

Chapter 2: Financial Statements, Cash Flow, and Taxes. A new opening vi-gnette shows the cash that several different companies generated and the different ways that they used the cash flow. We added a new box on the global economic crisis that explains the problems associates with off-balance-sheet assets, “Let’s Play

Hide-and-Seek!”We added a new figure illustrating the uses of free cash flow. We now have

two end-of-chapter spreadsheet problems, one focusing on the articulation between the income statement and statement of cash flows, and one focusing on free cash flow.

Chapter 3: Analysis of Financial Statements. We added a new box on marking to market, “The Price is Right! (Or Wrong!),” and a new box on international

ac-counting standards, “The World Might be Flat, but Global Accounting is Bumpy!

The Case of IFRS versus FASB.”We have included discussion of the price/EBITDA

ratio, gross profit margin, and operating profit margin; we also explain how to use the statement of cash flows in financial analysis.

Chapter 4: Time Value of Money. We added three new boxes: (1) “Hints on

Using Financial Calculators,” (2) “Variable Annuities: Good or Bad?”, and (3) “An

Accident Waiting to Happen: Option Reset Adjustable Rate Mortgages.”

Chapter 5: Bonds, Bond Valuation, and Interest Rates. We added four new boxes related to the global economic crisis: (1) “Betting With or Against the U.S.

Government: The Case of Treasury Bond Credit Default Swaps,” (2) “Insuring

with Credit Default Swaps: Let the Buyer Beware!” (3) “Might the U.S. Treasury

Bond Be Downgraded?”and (4)“Are Investors Rational?”We also added a new table

summarizing corporate bond default rates and annual changes in ratings.

Chapter 6: Risk, Return, and the Capital Asset Pricing Model. The new open-ing vignette discusses the recent stock market and compares the market’s returns to GE’s

returns. We added a new box on the risk that remains even for long-term investors,

“What Does Risk Really Mean?”We added two additional boxes on risk,“How Risky

Is a Large Portfolio of Stocks?”and“Another Kind of Risk: The Bernie Madoff Story.”

Chapter 7: Stocks, Stock Valuation, and Stock Market Equilibrium. A new opening vignette discusses buy- and sell-side analysts. We added a new box on be-havioral issues, “Rational Behavior vs. Animal Spirits, Herding, and Anchoring

Bias.”We added a new section,“The Market Stock Price vs. Intrinsic Value.”

Chapter 8: Financial Options and Applications in Corporate Finance. We completely rewrote the description of the binomial option pricing model. In addition to the hedge portfolio, we also discuss replicating portfolios. We now provide the binomial formula and we show the complete solution to the 2-period model. To pro-vide greater continuity, the company used to illustrate the binomial example is now the same company used to illustrate the Black-Scholes model. Our discussion of put options now includes the Black-Scholes put formula.

values, and target values. We added a new box,“GE and Warren Buffett: The Cost

of Preferred Stock.” We completely rewrote our discussion of the market risk

pre-mium, which now includes the impact of stock repurchases on estimating the market risk premium. We also present data from surveys identifying the market risk premia used by CFOs and professors.

Chapter 10: The Basics of Capital Budgeting: Evaluating Cash Flows. We added a new box,“Why NPV is Better than IRR.”

Chapter 11: Cash Flow Estimation and Risk Analysis. We now show how to use tornado diagrams in sensitivity analysis. We rewrote our discussion of Monte Carlo simulation and show how to conduct a simulation analysis without using add-ins but add-instead using onlyExcel’s built-in features (Data Tables and random number

generators). We have included an example of replacement analysis and an example of a decision tree showing abandonment. We added a new box,“Are Bank Stress Tests

Stressful Enough?”

Chapter 12: Financial Planning and Forecasting Financial Statements. It is difficult to do financial planning without using spreadsheet software, so we completely rewrote the chapter and explicitly integrated the text and the Excel Tool Kit model. We illustrate the ways that financial policies (i.e., dividend payout and capital structure choices) affect financial projections, including ways to ensure that balance sheets balance. The Excel Tool Kit model now shows a very simple way to incorporate financing feedback effects.

Chapter 13: Corporate Valuation, Value-Based Management, and Corporate Governance. The new opening vignette discusses the role of corporate governance in the global economic crisis. We also added three new boxes. The first describes corpo-rate governance issues at IBM, “Let’s Go to Miami! IBM’s 2009 Annual Meeting.”

The second discusses leadership at bailout recipients, “Would the U.S. Government

be an Effective Board Director?”The third discusses the 2009 proxy season, “

Share-holder Reactions to the Crisis.”

Chapter 14: Distributions to Shareholders: Dividends and Repurchases. We consolidated the coverage of stock repurchases that had been spread over two chapters and located it here, which now precedes our discussion of capital structure in Chapter 15. We also use the FCF valuation model to illustrate the different impacts of stock repurchases versus dividend payments. We added two new boxes. The first discusses recent dividend cuts,“Will Dividends Ever Be the Same?”and the second discusses Sun Microsystem’s

stock splits and recent reverse split,“Talk About a Split Personality!”

Chapter 15: Capital Structure Decisions. The new opening vignette discusses re-cent bankruptcies and Black & Decker efforts to reduce liquidity risk by refinancing short-term debt with long-term debt. Because the stock repurchases are now covered in the preceding chapter, we were able to improve our discussion of recapitalizations within the context of the FCF valuation model. We added a new box,“Deleveraging”

that discusses the changes in leverage many companies and individuals are making in light of the global economic crisis.

We added the box “Some Firms Operate with Negative Working Capital!” and a

new section on the cost of cost of bank loans.

Chapter 17: Multinational Financial Management. We added a new opening vignette on the global economic crisis and its impact on world economies, foreign direct investment, and cross-border M&As. We added two new boxes, the first on regulating international bribery and taxation,“Greasing the Wheels of International

Business.”The second new box discusses the wave of foreign companies partnering

with Chinese banks to provide consumer finance services, “Consumer Finance in

China.”

Chapter 18: Lease Financing. The new opening vignette discusses Virgin Atlan-tic’s order of 10 Airbus jets to be leased from AerCap. A new box addresses the

FASB/IASB movement to capitalize all leases, “Off-Balance Sheet Financing: Is it

Going to Disappear?”

Chapter 19: Hybrid Financing: Preferred Stock, Warrants, and Convertibles.

The new opening vignette discusses the Treasury Department’s use of preferred stock

and warrants to support troubled companies. A new box discusses the use of payment-in-kind preferred stock in the merger of Dow Chemical Company and Rohm & Haas,

“The Romance Had No Chemistry, But It Had a Lot of Preferred Stock!”

Chapter 20: Initial Public Offerings, Investment Banking, and Financial Restructuring. The new opening vignette discusses three companies that recently raised capital via an initial public offering, a seasoned stock offering, and a debt offer-ing. We added a new section on investment banking activities. We added a new box on“Investment Banks and the Global Economic Crisis.”

Chapter 21: Mergers, LBOs, Divestitures, and Holding Companies. We added a section explaining how the stock-swap ratio is determined for mergers where the payment is in the form of the acquiring company’s stock.

Chapter 22: Bankruptcy, Reorganization, and Liquidation. The new opening vignette discusses the bankruptcies of Lehman Brothers, Washington Mutual, Chrys-ler, and General Motors. We added a new box on personal and small business bank-ruptcies,“A Nation of Defaulters?”.

Chapter 23: Derivatives and Risk Management. The new opening vignette discusses risk management at Koch Industries, Navistar, and Pepsi. We added a new box on“Value at Risk and Enterprise Risk Management.” Throughout the chapter

we discuss the failure of risk management during the global economic crisis.

Chapter 24: Portfolio Theory, Asset Pricing Models, and Behavioral Finance. We added a box on the WSJ contest between dart-throwers and investors,

“Skill or Luck?”. We expanded our discussion of the Fama-French 3-factor model and

included a table showing returns of portfolios formed by sorting on size and the book-to-market ratio.

Chapter 25: Real Options. The new opening vignette discusses Honda’s flexible

manufacturing plants.

Aplia Finance

book-specific problem sets have instant grades and detailed feedback, ensuring students have the opportunity to learn from and improve with every question.

Chapter assignments use the same language and tone of the course textbook, giv-ing students a seamless experience in and out of the classroom. Problems are auto-matically graded and offer detailed explanations, helping students learn from every question.

Aplia Finance offers:

• Problem Sets:Chapter-specific problem sets ensure that students are completing

finance assignments on a regular basis.

• Preparing for Finance Tutorials:Hands-on tutorials solve math, statistics,

eco-nomics, and accounting roadblocks before they become a problem in the course, and financial calculator tutorials help students learn to use the tools needed in a finance course.

• News Analyses:Students connect course theories to real-world events by reading

relevant news articles and answering graded questions about the article.

• Course Management System

• Digital Textbook

For more information, visithttp://www.aplia.com/finance.

Thomson ONE

—

Business School Edition

Thomson ONE—Business School Edition is an online database that draws from

the world acclaimed Thomson Financial data sources, including the SEC Disclosure, Datastream, First Call, and Worldscope databases. Now you can give your students the opportunity to practice with a business school version of the same Internet-based database that brokers and analysts around the world use every day. Thomson ONE—

BSE provides (1) one-click download of financial statements toExcel, (2) data from domestic and international companies, (3) 10 years of financial data; and (4) one-click Peer Set analyses.

Many chapters have suggested problems based on data available at Thomson ONE—BSE. Here is a description of the data provided by Thomson ONE—BSE:

I/B/E/S Consensus Estimates. Includes consensus estimates—averages, means,

and medians; analyst-by-analyst earnings coverage; analysts’ forecasts based on 15

industry standard measures; current and historic coverage for the selected 500 com-panies. Current coverage is five years forward plus historic data from 1976 for U.S. companies and from 1987 for international companies, with current data updated daily and historic data updated monthly.

Worldscope. Includes company profiles, financials, accounting results, and market per-share data for the selected 500 companies going back to 1980, all updated daily.

Disclosure SEC Database. Includes company profiles, annual and quarterly com-pany financials, pricing information, and earnings estimates for selected U.S. and Ca-nadian companies, annually from 1987, quarterly for the last 10 years, and monthly for prices, all updated weekly.

DataStream Pricing. Daily international pricing, including share price informa-tion (open, high, low, close, P/E) plus index and exchange rate data, for the last 10 years.

WWW

ILX Systems Delayed Quotes. Includes 20-minute delayed quotes of equities and indices from U.S. and global tickers covering 130 exchanges in 25 developed countries.

Comtex Real-Time News. Includes current news releases.

SEC Edgar Filings and Global Image Source Filings. Includes regulatory and nonregulatory filings for both corporate and individual entities. Edgar filings are real-time and go back 10 years; image filings are updated daily and go back 7 years.

M

AKE

I

T

Y

OURS

Your course is unique; create a casebook that reflects it. Let us help you put together a quality casebook simply, quickly, and affordably.

We want to help you focus on the most important thing–teaching. That’s why we

have made this as simple as possible for you. We have aligned best-selling cases from our Klein/Brigham and Brigham/Buzzard series at the chapter level to Brigham/Ehr-hardt. We encourage you to visit http://www.cengage.com/custom/makeityours/ BrighamEhrhardtand select the cases to include in a custom case book. The cases are listed under each chapter title. To review cases, simply click on “view abstract”

next to each case title. If you would like to review the full case, contact your Cengage Learning representative or fill out the form and we will contact you.

For more information about custom publishing options, visitwww.cengage.com/ custom/.

T

HE

I

NSTRUCTIONAL

P

ACKAGE

: A

N

I

NTEGRATED

L

EARNING

S

YSTEM

Financial Managementincludes a broad range of ancillary materials designed to enhance students’ learning and to make it easier for instructors to prepare for and conduct

classes. All resources available to students are of course also available to instructors, and instructors also have access to the course management tools.

Learning Tools Available for Students and Instructors

The Cengage Global Economic Watch (GEW) Resource Center. This is your source for turning today’s challenges into tomorrow’s solutions. This online portal,

available for free when bundled with the text, houses the most current and up-to-date content concerning the economic crisis. Organized by discipline, the GEC Resource Center offers the solutions instructors and students need in an easy-to-use format. Included are an overview and timeline of the historical events leading up to the crisis; links to the latest news and resources; discussion and testing content; an instructor feedback forum; and a Global Issues Database.

Study Guide. This supplement outlines the key sections of each chapter, and it provides students with a set of questions and problems similar to those in the text and in the Test Bank, along with worked-out solutions. Instructors seldom use the

Study Guide themselves, but students often find it useful, so we recommend that

instructors ask their bookstores to have copies available. Our bookstores generally have to reorder it, which attests to its popularity with students.

Excel Tool Kits. Proficiency with spreadsheets is an absolute necessity for all MBA students. With this in mind, we createdExcelspreadsheets, called“Tool Kits,”for each

chapter to show how the calculations used in the chapter were actually done. The Tool Kitmodels include explanations and screen shots that show students how to use many of the features and functions of Excel, enabling the Tool Kits to serve as self-taught tutorials.

An e-Library: Web Extensions and Web Chapters. Many chapters have Adobe PDF“appendices”that provide more detailed coverage of topics that were addressed

in the chapter. In addition, these four specialized topics are covered in PDF web chapters: Banking Relationships, Working Capital Management Extensions, Pension Plan Management, and Financial Management in Not-for-Profit Businesses.

End-of-Chapter Spreadsheet Problems. Each chapter has a“Build a Model”

prob-lem, where students start with a spreadsheet that contains financial data plus general instructions relating to solving a specific problem. The model is partially completed, with headings but no formulas, so the student must literally build a model. This struc-ture guides the student through the problem, minimizes unnecessary typing and data entry, and also makes it easy to grade the work, since all students’answers are in the

same locations on the spreadsheet. The partial spreadsheets for the “Build a Model”

problems are available to students on the book’s Web site, while the completed models

are in files on the Instructor’s portion of the Web site.

Thomson ONE—BSE Problem Sets. The book’s Web site has a set of problems

that require accessing the Thomson ONE—Business School Edition Web data.

Using real world data, students are better able to develop the skills they will need in the real world.

Interactive Study Center. The textbook’s Web site contains links to all Web sites

that are cited in each chapter.

Course Management Tools Available only to Instructors

Instructors have access to all of the materials listed above, plus additional course manage-ment tools. These are available atFinancial Management’sInstructor companion Web site and on the Instructor’s Resource CD. These materials include:

Solutions Manual. This comprehensive manual contains worked-out solutions to all end-of-chapter materials. It is available in both print and electronic forms at the Instructor’s Web site.

PowerPoint Slides. There is a Mini Case at the end of each chapter. These cases cover all the essential issues presented in the chapter, and they provide the structure for our class lectures. For each Mini Case, we developed a set of PowerPoint slides that present graphs, tables, lists, and calculations for use in lectures. Although based on the Mini Cases, the slides are completely self-contained in the sense that they can be used for lectures regardless of whether students are required to read the mini cases. Also, instructors can easily customize the slides, and they can be converted quickly into anyPowerPointDesign Template.1Copies of these files are on the Instruc-tor’s Web site.

1To convert intoPowerPoint, select Format, Apply Design Template, and then pick any template. Always

Mini Case Spreadsheets. In addition to thePowerPointslides, we also provideExcel spreadsheets that do the calculations required in the Mini Cases. These spreadsheets are similar to the Tool Kits except (a) the numbers correspond to the Mini Cases rather than the chapter examples, and (b) we added some features that make it possi-ble to do what-if analysis on a real-time basis in class. We usually begin our lectures with the PowerPoint presentation, but after we have explained a basic concept we

“toggle”to the mini caseExcel file and show how the analysis can be done inExcel.2

For example, when teaching bond pricing, we begin with the PowerPoint show and cover the basic concepts and calculations. Then we toggle to Excel and use a sensitivity-based graph to show how bond prices change as interest rates and time to maturity vary. More and more students are bringing their laptops to class, and they can follow along, doing the what-if analysis for themselves.

Solutions to End-of-Chapter Spreadsheet Problems. The partial spreadsheets for the“Build a Model”problems are available to students, while the completed

mod-els are in files on the Instructor’s Web site.

Solutions to Thomson ONE—BSE Problem Sets. The Thomson ONE—BSE

problems set require students to use real world data. Although the solutions change daily as the data change, we provide instructors with“representative”answers.

Test Bank. TheTest Bankcontains more than 1,200 class-tested questions and pro-blems. Information regarding the topic and degree of difficulty, along with the com-plete solution for all numerical problems, is provided with each question. The Test Bank is available in three forms: (1) in a printed book; (2) in Microsoft Word files; and (3) in a computerized test bank software package, Exam View, which has many features that make test preparation, scoring, and grade recording easy, including the ability to generate different versions of the same problem. Exam View is easily able to export pools into Blackboard and WebCT.

Textchoice, the Cengage Learning Online Case Library. More than 100 cases written by Eugene F. Brigham, Linda Klein, and Chris Buzzard are now available via the Internet, and new cases are added every year. These cases are in a database that allows instructors to select cases and create their own customized casebooks. Most of the cases have accompanying spreadsheet models that, while not essential for working the case, do reduce number crunching and thus leave more time for students to con-sider conceptual issues. The models also illustrate how computers can be used to make better financial decisions. Cases that we have found particularly useful for the different chapters are listed in the end-of-chapter references. The cases, case solu-tions, and spreadsheet models can be previewed and ordered by instructors at

http://www.textchoice2.com.

Cengage/South-Western will provide complimentary supplements or supplement packages to those adopters qualified under Cengage’s adoption policy. Please contact

your sales representative to learn how you may qualify. If, as an adopter or potential user, you receive supplements you do not need, please return them to your sales representative.

2Note: To toggle between two open programs, such asExcelandPowerPoint, hold the Alt key down and

A

CKNOWLEDGMENTS

This book reflects the efforts of a great many people over a number of years. First, we would like to thank the following reviewers of the Twelfth Edition for their suggestions:

ANNE ANDERSON Lehigh University

OMAR M. BENKATO Ball State University

RAHUL BISHNOI Hofstra University

JONATHAN CLARKE Georgia Institute of Technology

SHARON H. GARRISON University of Arizona

HASSAN MOUSSAWI Wayne State University

A. JON SAXON

Loyola Marymount University

JOSEPH VU

DePaul University-Lincoln

In addition, we appreciate the many helpful comments and suggestions that we incorporated into this edition made by Richard M. Burns, Greg Faulk, John Harper, Robert Irons, Joe Walker, Barry Wilbratte, and Serge Wind.

Keith Johnson, Steve Johnson, Ramon Johnson, Ray Jones, Manuel Jose, Gus Kalogeras, Mike Keenan, Bill Kennedy, Joe Kiernan, Robert Kieschnick, Rick Kish, Linda Klein, Don Knight, Dorothy Koehl, Theodor Kohers, Jaroslaw Komarynsky, Duncan Kretovich, Harold Krogh, Charles Kroncke, Lynn Phillips Kugele, Joan Lamm, P. Lange, Howard Lanser, Martin Laurence, Ed Lawrence, Richard LeCompte, Wayne Lee, Jim LePage, Ilene Levin, Jules Levine, John Lewis, James T. Lindley, Chuck Linke, Bill Lloyd, Susan Long, Judy Maese, Bob Magee, Ileen Malitz, Phil Malone, Terry Maness, Chris Manning, Terry Martell, D. J. Masson, John Mathys, John McAlhany, Andy McCollough, Tom McCue, Bill McDaniel, Robin McLaughlin, Jamshid Mehran, Ilhan Meric, Larry Merville, Rick Meyer, Stuart E. Michelson, Jim Millar, Ed Miller, John Mitchell, Carol Moerdyk, Bob Moore, Barry Morris, Gene Morris, Fred Morrissey, Chris Muscarella, Stu Myers, David Nachman, Tim Nantell, Don Nast, Bill Nelson, Bob Nelson, Bob Niendorf, Tom O’Brien, Dennis O’Connor, John O’Donnell, Jim Olsen, Robert Olsen, Frank

O’Meara, David Overbye, R. Daniel Pace, Coleen Pantalone, Jim Pappas, Stephen

Parrish, Pam Peterson, Glenn Petry, Jim Pettijohn, Rich Pettit, Dick Pettway, Hugo Phillips, John Pinkerton, Gerald Pogue, Ralph A. Pope, R. Potter, Franklin Potts, R. Powell, Chris Prestopino, Jerry Prock, Howard Puckett, Herbert Quigley, George Racette, Bob Radcliffe, Allen Rappaport, Bill Rentz, Ken Riener, Charles Rini, John Ritchie, Jay Ritter, Pietra Rivoli, Fiona Robertson, Antonio Rodriguez, E. M. Roussakis, Dexter Rowell, Mike Ryngaert, Jim Sachlis, Abdul Sadik, Thomas Scampini, Kevin Scanlon, Frederick Schadler, James Schallheim, Mary Jane Scheuer, Carl Schweser, John Settle, Alan Severn, Sol Shalit, Elizabeth Shields, Frederic Shipley, Dilip Shome, Ron Shrieves, Neil Sicherman, J. B. Silvers, Clay Singleton, Joe Sinkey, Stacy Sirmans, Jaye Smith, Steve Smith, Don Sorenson, David Speairs, Ken Stanly, John Stansfield, Ed Stendardi, Alan Stephens, Don Stevens, Jerry Stevens, G. Bennett Stewart, Mark Stohs, Glen Strasburg, Robert Strong, Philip Swensen, Ernie Swift, Paul Swink, Eugene Swinnerton, Robert Taggart, Gary Tallman, Dennis Tanner, Craig Tapley, Russ Taussig, Richard Teweles, Ted Teweles, Jonathan Tiemann, Sheridan Titman, Andrew Thompson, George Trivoli, George Tsetsekos, Alan L. Tucker, Mel Tysseland, David Upton, Howard Van Auken, Pretorious Van den Dool, Pieter Vanderburg, Paul Vanderheiden, David Vang, Jim Verbrugge, Patrick Vincent, Steve Vinson, Susan Visscher, John Wachowicz, Mark D. Walker, Mike Walker, Sam Weaver, Kuo Chiang Wei, Bill Welch, Gary R. Wells, Fred Weston, Norm Williams, Tony Wingler, Ed Wolfe, Larry Wolken, Don Woods, Thomas Wright, Michael Yonan, Zhong-guo Zhou, David Ziebart, Dennis Zocco, and Kent Zumwalt.

Special thanks are due to Dana Clark, Susan Whitman, Amelia Bell, Stephanie Hodge, and Kirsten Benson, who provided invaluable editorial support; to Joel Hous-ton and Phillip Daves, whose work with us on other books is reflected in this text; and to Lou Gapenski, our past coauthor, for his many contributions.

Our colleagues and our students at the Universities of Florida and Tennessee gave us many useful suggestions, and the Cengage/South-Western staff—especially

Mike Guendelsberger, Scott Fidler, Jacquelyn Featherly, Nate Anderson, and Mike Reynolds—helped greatly with all phases of text development, production, and

E

RRORS IN THE

T

EXT

At this point, authors generally say something like this:“We appreciate all the help

we received from the people listed above, but any remaining errors are, of course, our own responsibility.”And in many books, there are plenty of remaining errors.

Having experienced difficulties with errors ourselves, both as students and as instructors, we resolved to avoid this problem inFinancial Management. As a result of our error detection procedures, we are convinced that the book is relatively free of mistakes.

Partly because of our confidence that few such errors remain, but primarily because we want to detect any errors in the textbook that may have slipped by so we can correct them in subsequent printings, we decided to offer a reward of $10 per error to the first person who reports a textbook error to us. For purposes of this reward, errors in the textbook are defined as misspelled words, nonround-ing numerical errors, incorrect statements, and any other error that inhibits com-prehension. Typesetting problems such as irregular spacing and differences in opinion regarding grammatical or punctuation conventions do not qualify for this reward. Also, given the ever-changing nature of the Internet, changes in Web addresses do not qualify as errors, although we would appreciate reports of changed Web addresses. Finally, any qualifying error that has follow-through effects is counted as two errors only. Please report any errors to Michael C. Ehrhardt at the e-mail address given below.

C

ONCLUSION

Finance is, in a real sense, the cornerstone of the free enterprise system. Good finan-cial management is therefore vitally important to the economic health of business firms, hence to the nation and the world. Because of its importance, corporate finance should be thoroughly understood. However, this is easier said than done—the field is

relatively complex, and it is undergoing constant change in response to shifts in eco-nomic conditions. All of this makes corporate finance stimulating and exciting, but also challenging and sometimes perplexing. We sincerely hope thatFinancial Manage-ment: Theory and Practicewill help readers understand and solve the financial problems faced by businesses today.

Michael C. Ehrhardt Eugene F. Brigham

University of Tennessee University of Florida

Ehrhardt@utk.edu Gene.Brigham@cba.ufl.edu

Fundamental Concepts

of Corporate Finance

Chapter 1

An Overview of Financial Management and the Financial Environment

Chapter 2

Financial Statements, Cash Flow, and Taxes

Chapter 3

Analysis of Financial Statements

An Overview of Financial

Management and the

Financial Environment

In a global beauty contest for companies, the winner is…Apple.

Or at least Apple is the most admired company in the world, according to Fortune magazine’s annual survey. The others in the global top ten are Berkshire Hathaway, Toyota, Google, Johnson & Johnson, Procter & Gamble, FedEx, Southwest Airlines, General Electric, and Microsoft. What do these companies have that separates them from the rest of the pack?

According to a survey of executives, directors, and security analysts, these companies have very high average scores across nine attributes: (1) innovativeness, (2) quality of management, (3) long-term investment value, (4) social responsibility, (5) employee talent, (6) quality of products and services, (7) financial soundness, (8) use of corporate assets, and (9) effectiveness in doing business globally. After culling weaker companies, the final rankings are then determined by over 3,700 experts from a wide variety of industries.

What do these companies have in common? First, they have an incredible focus on using technology to understand their customers, reduce costs, reduce inventory, and speed up product delivery. Second, they continually innovate and invest in ways to differentiate their products. Some

are known for game-changing products, such as Apple’s touch screen iPhone

or Toyota’s hybrid Prius. Others continually introduce small improvements,

such as Southwest Airline’s streamlined boarding procedures.

In addition to their acumen with technology and customers, they are also on the leading edge when it comes to training employees and providing a