CHAPTER 6

CONCLUSION

This paper aims to find the answer of the following question: how to

forecast the stock price index in in Indonesian stock exchange? Whether the

forecasted IDX through the learning procedure techniques of ANN model or

not. Is it RWH and EMH theory true?. And comparing the results with

some recent research using ANN model in this market.

Due to the issue of accurately forecasting the direction of movements of the

stock market price levels is highly significant for formulating the best

market trading solutions. It is fundamentally affecting financial trader’s

decisions to buy or sell.

The research finding can be concluded as follows:

a. ANN technique can be applicable to forest stock price index in

Indonesian stock market, The results of learning rate can be reached

99%, while the best result of forecasting rate is 66%, and the worst rate is

51%. This forecasting technique is considered as a new method which

need to be improved in term of designing the model and find out its input

variable that the market related to. So that it will enhance the better

forecasting results.

b. The power of prediction may not really high in this research

methodology

as the author’s expectation. However,

the prediction result

This paper a

aim

ims to find the answer of the foll

llow

o

ing question: how to

foreca

ast

st the stock price ind

ndex

x

i

in

n

in

in

I

Ind

nd

on

on

e

esian stock exch

han

ange? Whether the

fo

forecasted IDX

X

t

t

hr

hrou

ugh the learning proced

d

ur

ure

e

te

te

ch

c

niques of AN

ANN model or

not. Is

Is it

t

RWH

H

a

an

d

EM

H theo

ry

true?.

And

An

d

comp

pa

arin

ing

g th

t

e resu

u

lt

l

s with

so

some

me recen

en

t

re

s

earc

h using AN

N

model in this mark

et

t

.

Due

e to the issue of accurately f

orec

asting t

he

direction of

mo

oveme

m

nt

nts

s of

o

the

e

st

t

o

oc

k market price levels is

h

ighly

si

gnificant for

fo

rmul

at

ating

th

the

e

best

s

m

ma

rket trading

sol

ut

ions.

It

i

s

fu

nd

am

entall

y af

fe

cting fina

nc

cial trade

er’s

s

d

de

cisions to buy or sell

.

The research finding can be

b c

con

onclud

uded

ed as follows:

a.

AN

ANN

N

N

N

N

techni

niqu

que

e

ca

c

n be applicable to

to

f

for

ores

e

t stoc

ck

k

pr

pric

ice in

inde

dex

x

in

Indonesi

i

an

an

s

s

t

tock m

mar

a

ket,

T

The

he

r

results

s

o

of

f

lear

ar

ni

ning

ng rate can be

be

re

eached

99

99%

%,

w

w

h

hile the best result

t of fore

ec

casting rate is 66%,

% a

and

nd

t

the

he worst rate is

51%. This forecasting

g technique

is considered as a new method which

need to be improved in te

erm of de

esigning the model and find out its input

variable that the market rel

e

ate

ed to. So that it will enhance the better

showed above is fairly good. So, it means that stock market price can be

predictable.

c. In terms of comparing ANN performance with recently research. Putra

and Kosala (2011)-using technical variables as input data, the highest

accuracy rate is 80.48% and the worst one is 49.90%, but their

forecasting was focused on individual company, not index prices. For

Veri and Baba (2013) forecasting index price of the next trading day

they’ve used

daily prices as input variables, the empirical results showed

that 95% of training accurate and for prediction value percentage varied

from 95% to 5% of accuracy. Due to both research provided higher

forecasting rate so this research model is not outperform their research

methodology.

d. However, author believes this methodology can be applied along with

other techniques to help a trading decision.

e. This research methodology has been proved very successful in other

stock market research like LMY, TEPX, etc. there are some factors may

affect the results of this research as to be mentioned in the limitation of

this study.

f. A few of input indicators in the research may not enhance the accuracy

rate (unnecessary), because, this stock market can be affected by many

macro-

economic factors such as political events, investors’ expectations,

institutional investors’ choices, firms’ policies, general economic

c. In terms of comparin

ing

g

A

ANN perf

f

or

r

ma

mance with recently research. Putra

and Kosala

a

(

(2011)-using technical variables as

as input data, the highest

accu

cur

racy rate is 80.48

4

%

%

an

n

d

d

th

th

e wo

w

rst one is

4

49.

9

90%, but their

forecasting wa

was

s fo

fo

cused on individual

l

co

co

mp

mpan

any, not index

x

p

prices. For

Ve

Veri

ri

a

a

nd

nd

Bab

b

a

a

(2

(2

013) forecasting index

p

p

ri

rice of

f

th

the

e

n

next tradi

ding day

th

the

ey’ve

e us

ed

daily prices as input variables

,

the

em

mpi

p

rical re

re

su

sult

lts

s

show

owed

that

at

9

5%

of trai

ni

ng accurate and for prediction value

pe

percen

nta

tage

g

varie

ed

f

fr

om 95% to 5% o

f

accuracy. Due to both research

pro

rovide

ded

d

hi

hi

gher

forecastin

g

rate so this r

es

earch model is n

ot

out

pe

rform

th

heir resear

rch

ch

methodology.

d

d.

However,

a

aut

utho

hor

r

be

beli

liev

e

es this meth

hod

odol

olog

ogy

y

ca

c

n

be app

lied

d

a

al

long w

wit

th

h

other techniques to help a t

tra

radi

ing

ng decision.

e.

e

This research methodology has been proved very successf

sful

ul i

i

n

n o

oth

her

st

t

oc

k

k ma

rk

rket

et r

res

esearch

l

lik

ike

e

LM

LMY,

Y, T

TEPX, e

etc

tc.

. th

ther

e

e are

so

me fac

acto

tors

rs may

affect t

the

he results of this

r

r

esearch

a

as to be menti

ion

oned

ed in the

e

li

lim

mitation of

this study.

conditions, interest rates, foreign exchange rates, movement of other

stock market, psychology of investors etc.

The limitations of current study: Forecasting stock price index using

artificial neural network is a new methodology applied in emerging market

(Suchira Chaigusin, 2011) comparing to other methodology i.e. fundamental

analysis, technical analysis etc. accessibility to this methodology have some

limited.

The most important part of research work is to concentration on coding or

programing to create the right forecasting model and find out the best

training parameter combination in the goal of reaching the best forecasting

results. Meanwhile the researcher himself has very less experience in the

field of computer science and information technologies, as this

knowledge/skill is required by the research itself. So, the forecasting model

in this research may not perfectly done as same as IT expert does. However,

author hope that this research will be the first step for other students who

wish to continue improving this research methodology or other ANN model.

For further research, author would like to provide some such suggestion as

following:

a. Improving this methodology through using matlab tool box, which will

enhance more accurate prediction rate.

b. Each method has its own strengths and weaknesses. So, author suggest

to use technical indicators of this study and other combining techniques

The limitations of

of

c

current study: Forecas

asti

t

ng stock price index using

artificial neu

eural network is a new methodology appli

lied

e

in emerging market

(Suc

c

hi

hira Chaig

gusin

n

,

,

2011)

)

co

o

mpar

mp

arin

ng t

to

o

oth

h

er

er methodology

y

i

i

.e. fundamental

analysis,

,

te

t

chnica

cal

l

analysis e

e

tc

tc.

ac

acce

ce

ss

ss

ibility to

t

thi

h

s me

eth

t

odology ha

h

ve some

limi

mite

ted.

d

Th

T

e m

mo

st important

p

art of re

se

arch work is t

o

concen

tr

at

a

ion on

on

c

cod

o

ing or

o

prog

ogra

ming to crea

te th

e right

forecastin

g

model and fi

nd

nd out

t the

he best

t

tr

rai

ning p

ar

ameter com

bi

nation in th

e

goal of reach

f

ing

the be

s

st for

rec

ecas

as

ting

ng

r

re

sults. Meanw

hi

le the r

es

earcher himself

has very less expe

ri

ience in

n

the

f

fi

eld of computer science and informat

io

n

te

chnologi

e

es,

as

t

thi

his

s

knowledge/skill is required

d

by

by the

e

r

res

esearch itself. So, the forecasting mo

mode

del

in this research may not perfectly done as same as IT expert does. H

How

wev

ev

e

er,

au

auth

thor

or

h

hop

op

e

e

th

that

at

thi

t

his

s

re

rese

sear

arch

ch wil

ll

l

be

be t

the

he

f

fir

irst

st

s

ste

tep

p fo

fo

r

r

ot

ot

he

her

r

st

stud

uden

ents

ts

w

ho

wi

wish

sh

t

to

o co

contin

nue

ue improving

ng this resear

rc

ch method

d

ol

olog

ogy or

or

o

oth

ther

er

A

ANN

NN model.

For further research, autho

or would lik

ke to provide some such suggestion as

following:

models by integrating ANN with other classification models such as

Support Vector Machines (SVM), Genetics Algorithm (GA) etc. The

weakness of one method can be balanced by the strengths of another by

achieving a systematic effect.

c. To the best knowledge of the author, the prediction performance of this

model can be improved by many ways i.e. adjusting the model

parameters by conducting a more sensitive and comprehensive parameter

setting. Otherwise, reduction of current variables and adding more

different input variables i.e. macro-economic variables such as foreign

exchange rates, interest rates and international stock indexes that related

to IDX, etc.

Benefit of this research: author believes that this research method would

benefits to other students in many ways for their further study about

using artificial neural network as a tool to forecast stock prices:

a.

For student who don’t know about ANN, this research can provide

some information and idea on ANN, how its work and why it’s used

in financial field.

b. It will be the basic idea for students who wants to try a new

methodology of forecasting stock prices, especially, who are

majoring finance or related fields.

c. Student can learn some part of its function used in this research and

its code in the matlab program. So that they can create their own

weakness of one me

e

th

thod

od can be ba

b la

lanc

n

ed by the strengths of another by

achieving

g

a

a s

systematic effect.

c. To t

th

he best knowledge

e

of

f

t

the

h

a

aut

utho

ho

r,

,

t

the prediction pe

performance of this

model can b

b

e

e

im

im

proved by many way

ays

s

i.e. adjusting

g

the model

pa

ara

ra

me

mete

te

rs by

y

co

cond

ucting a m

or

e sensit

ive

e

an

an

d comp

mpre

rehe

he

nsive pa

ara

r

meter

se

set

tting.

g.

Otherwise, reduction of current vari

ab

ble

le

s and

d

ad

addi

ding m

more

diff

ff

erent input variables i.e. macro-economic variab

les

s such

h

a

as

s

foreig

gn

n

ex

ch

ange rates, interest rates and int

er

national stock ind

ex

x

es

e

tha

hat

t re

rela

l

ted

d

to IDX, etc.

Be

ne

fit of

f

t

hi

hi

s

s

re

rese

sear

arch

ch: author belie

ieve

ves

s

th

that

at

t

t

hi

h

s research

m

m

et

eth

hod wo

oul

uld

d

benefits to other students i

in

n

ma

m

ny ways for their further study ab

abou

out

using artificial neural network as a tool to forecast stock prices

es:

:

a.

F

Fo

r

stud

t

uden

ent

t who do

don’

n’t

t

kn

know

ow

ab

a

bout A

ANN

NN,

,

th

thi

is

r

es

ea

rch ca

an

n pr

pro

ovide

some

me

i

information and

nd idea on

n

A

ANN, how its

w

wor

ork and wh

why it’s used

in financial field.

methodology and may have more powerful prediction model than

current research.

d. Author believes that this research methodology cannot be done

without any mistake. However, this research provides student some

basic understanding on how to do it and also benefits to other

researcher more or less in someway.

e. As we are a student at present who want to be a successful investor

in the future, we cannot reliance on the old ways of forecasting stock

prices or using single analyzing technique for making investment

decision. This technique (ANN) is highly supported for further study

and author believes this research can be a reference or being the first

step for other researcher who never used this forecasting technique

before.

d. Author believes th

that this rese

e

ar

arch

c

methodology cannot be done

withou

ut

t

any mistake. However, this researc

rch

h

provides student some

ba

basic understandin

ng

g on

on

h

h

ow

ow

t

t

o do

d

it and also

b

benefits to other

research

h

e

er m

mor

or

e or less in someway.

e.

.

A

As w

w

e are a

a st

ud

en

t at pre

se

nt who

wan

ant

t

to be

e a

a su

su

cc

ccessful in

i

vestor

in t

t

h

he

futur

e,

we cannot reliance on the old w

ay

ys

s

of

f

for

orec

ecas

asti

t

ng s

s

to

t

ck

pr

ic

es or using single analyzing technique for

m

ak

a

ing

g

in

inve

v

stmen

nt

decision. This tec

hn

ique (ANN) is highly supported f

or

r fur

rth

ther

er

s

s

tudy

and

au

thor believes this research

ca

n be

a r

ef

er

ence or

be

eing th

h

e firs

rst

step for other

r

esearcher who never used this forecasti

ng

g techn

hnique

ue

REFERENCES

Alireza Shahkarami, Shahab D. Mohaghegh & Vida Gholami (2014)

Artificial Intelligence (AI) Assisted History Matching. West

Virginia University, SPE-169507-MS

Adebiyi Ayodele A., Ayo Charles K., Adebiyi Marion O. and Otokiti

Sunday O. (2009) Stock Price Prediction using Neural Network

with Hybridized Market Indicators. Journal of Emerging Trends in

Computing and Information Sciences. Retrieved January 2012.

Vol. 3, No. 1

Altay, E., & Hakan Satman, M. (2005) Stock market forecasting: artificial

neural network and linear regression comparison in an emerging

market. Journal of Financial Management and Analysis, 18(2),

18-33

A. Victor Devadoss & T. Antony Alphonnse Ligori (2013) Stock Prediction Using

Artificial Neural Networks. International Journal of Data Mining

Techniques and Applications. December. Vol. 02, 283-291

An-Sing Chen, Mark T. Leung and Hazem Daouk (2003) Application of

neural networks to an emerging financial market: forecasting and

trading the Taiwan Stock Index. Computers & Operations

Research 30, 901

–

923

Appel, Gerald (2005). Technical Analysis Power Tools for Active Investors.

Financial Times Prentice Hall. p. 166. ISBN 0-13-147902-4

Chung-Ming Kuan and Halbert White (1994) Comment on artificial neural

networks: an econometric perspective. Econometric Reviews 13(1):

93-97

David Sutyanto (2013) Investing in Indonesia: a basic Introduction to the

Indonesia Stock Exchange, April 1. at

http://www.indonesia-investments.com

Daniel Svozil, Vladimir Kvasni

č

ka, Ji

ĭί

Posp

ί

chal(199

7) Introduction to

multi-layer feed-forward neural networks. Chemometrics and

Intelligent Laboratory Systems 39, 43-62

Eddy F. Putra & Raymondus Kosala (2013) Application of Artificial Neural

Networks To Predict Intraday Trading Signals. Recent Researches

in E-Activities ISBN: 978-1-61804-048-0

E. E. Peters, Chaos and order in the capital markets: A new view of cycles,

prices, and market volatility, John Wiley & Sons Inc. (1991).

g

(

(

)

y

g

Virginia Unive

ers

rs

it

ity, SPE-169

9

50

507

7-MS

Adebiyi Ayod

del

ele A., Ayo Charles K., Adeb

biy

iyi

i

Marion O. and Otokiti

Su

un

nday O. (200

0

9) Stock Price Prediction us

u

ing Neural Network

with Hybridized

d

Ma

Ma

rk

ket Indicator

o

s. Journal of

f E

Emerging Trends in

Comp

putin

ing

g

and In

In

fo

fo

rmat

rm

atio

ion

n

Sc

Scie

ienc

nc

es. Retrieved

d January 2012.

Vol. 3

3

,

, No

No. 1

Altay,

y,

E

E., &

&

Hakan S

S

at

at

man, M. (2

005)

5)

S

S

to

to

ck

c

market

t

fo

for

recasting: artificial

neural

l

n

netwo

rk and linear regression

c

c

om

o

pariso

son

n

in

in an em

merging

ma

a

rk

rk

et

. Journal of Fin

an

cial Managemen

t

an

an

d An

An

al

alys

ysis

is, 18(2

2

),

),

18-3

33

A. Vic

ic

to

r Devadoss & T. Antony A

lp

honnse L

ig

or

i (2013) Sto

ck

ck Predi

dict

ctio

i

n Usin

ng

g

Artificial N

eu

ral Netw

or

ks. Intern

ational Journal

of

of D

Dat

ta

a M

Mining

g

Techniques and Applications. Dece

mb

er. Vol. 02, 283-2

91

1

A

An

-Sing Chen,

Mark T. Leung and

Haze

m Da

ouk

(2003) A

p

pplica

a

ti

tion o

of

neural net

wo

rks

to an emerging fin

an

cial market: for

e

ecasting a

and

d

trading the Ta

iw

an Stock

Ind

ex. Computers & Operat

ati

ions

Research 30, 90

1–923

A

Ap

pel, G

er

eral

al

d

d

(2

(2005). Tech

chnical Anal

al

ys

ys

i

is Power

T

T

oo

oo

ls

s for Activ

ve Invest

t

or

ors.

.

Financial Times Pr

Pren

en

ti

t

ce H

Hal

all

l. p. 166. ISBN 0-13-147902-4

Chung-Ming Kuan and Halbert Wh

W

ite (1994) Comment on artificial

al

n

neu

ur

ral

networks: an econometric perspective. Econometric Re

Revi

view

w

s

s 13(

3(1):

93

93

-9

97

7

Da

David Su

Suty

tyan

an

t

to (

(20

2013

13)

)

In

Invest

t

in

ing

g

in Ind

i

ndo

ones

esia

ia:

:

a

basi

ba

sic

c

Introd

od

uc

ucti

tion

on to the

In

n

do

donesia Stock Ex

E

change

e, April 1. a

t

t

http

://

/

/www

w

.indonesia-

i

investments.com

Daniel Svozil, Vladimir K

Kvasni

č

ka, Ji

ĭί

Posp

ί

chal(1997) Introduction to

multi-layer feed-f

forward n

neural networks. Chemometrics and

Intelligent Laborato

tory Syste

ems 39, 43-62

E. GiEord, Investor’s Guide to Technical Analysis: Predicting Price Actio

n

in the Markets, Pitman Publishing, London, 1995.

Tae Hyup Roh (2007) Forecasting the volatility of stock price index. Expert

Systems with Applications, 33, 916

–

922

Jhon Veri and Mohd.Sopiyan Baba (2013) Intelligent Decission Support

System For Prediction Of Indonesia Stock Exchanges. IJISI, Vol 1,

No. 1, April. ISSN: 2289-3709

Jing Tao YAO & Chew Lim TAN (2001) Guidelines for Financial

Forecasting with Neural Networks, available at

http://www2.cs.uregina.ca/~jtyao/Papers/guide_iconip01.pdf

J. Chang, Y. Jung, K. Yeon, J. Jun, D. Shin, H. Kim, Technical Indicators

and Analysis Methods, Jinritamgu Publishing, Seoul, 1996.

J.J. Murphy, Technical Analysis of the Futures Markets: A Comprehensive

Guide to Trading Methods and Applications, Prentice-Hall, New

York, 1986.

Kim Kyoung-jae (2003) Financial time series forecasting using support

vector machines. Neurocomputing 55, 307

–

319

Mark T. Leunga, Hazem Daoukb and An-Sing Chen (2000). Forecasting

stock indices: A comparison of classification and level estimation

models. International Journal of Forecasting, 16, 173

–

190.

Liao Zhe & Wang Jun (2010). Forecasting model of global stock index by

stochastic time effective neural network. Expert Systems with

Applications, 37, 834

–

841

Mahmood Moein Aldin et al., (2012) Evaluating the Employment of

Technical Indicators in Predicting Stock Price Index Variations

Using Artificial Neural Networks, International Journal of

Business and Management; Vol. 7, No. 15

Manish Kumar & Dr. M. Thenmozhi (2006) Support Vector Machines Approach to

Predict the S&P CNX NIFTY Index Returns, available at:

http://ssrn.com/abstract=962833

Mark Hudson Beale et al.

Nueral Nextwork Toolbox -

User’s Guide R2013b.

MathWorks

Najeb Masoud (2014) Predicting Direction of Stock Prices Index Movement

Using Artificial Neural Networks: The Case of Libyan Financial

Market. British Journal of Economics, Management & Trade

Systems with App

ppli

lic

ca

tions, 33

i

33

,

, 916–922

Jhon Veri and M

Mohd.Sopiyan Baba (2013)

I

Int

ntel

e

ligent Decission Support

Sy

yst

stem For Prediction Of Indonesia Stock

k

E

Exchanges. IJISI, Vol 1,

N

No. 1, April. ISSN

SN: 2289-3709

Jing

ng Tao YAO

AO

&

& Chew

w

Li

Lim

m

TA

TAN

N (2

(2

00

001)

1) Guidelines

for Financial

Foreca

ast

s

in

ing

g

with Neural Ne

Netw

t

orks, avai

ailable at

ht

http

t

://www2.cs

cs

.u

u

r

re

gi

i

na.c

a/

/

~j

j

ty

ty

ao

ao

/P

/

apers/guid

de_

e_ic

ic

onip01.p

J. C

Cha

ha

ng

ng, Y. J

J

u

un

g, K. Yeon, J. J

un

, D. Shin, H

.

Ki

Ki

m, T

Tec

ec

hn

hnic

i

al Ind

d

ic

icators

an

an

d

d

Analysis Methods

,

Jinritamgu Pub

lishing,

g, Seoul,

, 19

1996

96.

J.

J.J. M

M

u

urph

y, Technical Analysis

of

the Futures Markets: A

A

Co

o

mp

mpre

rehensiv

ve

Guide to Tra

di

ng Methods and Applications, P

re

ent

n

ice-

e-Ha

Hall

ll,

,

New

w

York, 1986.

K

Ki

m Kyoung-jae (2003)

Fina

ncia

l

ti

me series forecasting

us

using su

supp

p

or

ort

vector m

ac

hines. Ne

ur

oc

om

pu

ti

ng 55

, 307

–

319

M

Ma

rk T. Leunga, Ha

ze

m

Daoukb a

nd

An-Sing Chen (2000). Foreca

astin

g

g

stock

indices:

A comparison of

c

lassificat

ion

and le

ve

l

l esti

timati

ion

on

mo

de

els

ls.

In

Int

tern

rnat

atio

i

nal Journal

l

of

of

F

For

r

ec

ec

as

as

ti

t

ng

,

16

,

17

3

–

–19

190.

Liao Zhe & Wang Jun (2010)

0). Fo

F

re

rec

casting model of global stock index by

by

stochastic time effectiv

v

e

e

neural network. Expert Systems wit

t

h

h

Applications, 37, 834–841

Ma

Mahm

hm

oo

ood

d

Mo

Moei

ein

n

Al

Aldi

din

n et

et a

al., (2

(201

012)

2) E

Eva

v

lu

luat

atin

ing

g

th

the

e

Em

Empl

ploy

yme

men

nt of

Te

e

ch

chni

nical In

Indi

dicators

s

i

in

n Pr

Predicti

ti

ng

ng Stock

ck P

P

ri

r

ce Index

x

V

Var

ria

iations

U

Usin

n

g

g Artificial

l

Neural N

Networks,

Inte

In

t

rnat

atio

iona

nal

l Jo

Jou

urnal of

B

Business and Manag

agement;

;

Vol. 7, No. 15

Manish Kumar & Dr. M. The

enmozhi (200

06) Support Vector Machines Approach to

Predict the S&P

P

CNX N

NIFTY Index Returns, available at:

http://ssrn.com/abstr

ract=96283

833

Mark Hudson Beale et al.

Nuer

ral

a

Nex

extwork Toolbox - User’s Guide R2013b.

MathWorks

O.E. Barndorff-Nielsen, J.L. Jensen and W.S. Kendall (1993). Networks and

chaos: statistical and probabilistic aspects. London: Chapman and

Hall; 1993.

Sneha Soni (2011) Applications of ANNs in Stock Market Prediction: A

Survey. International Journal of Computer Science & Engineering

Technology.

Vol. 2, Issue.3, 71-83

Suchira Chaigusin (2011) An Investigation Into the Use of Neural Network

for the Prediction of the Stock Exchange of Thailand. Edith Cowan

University

S.B. Achelis, Technical Analysis from A to Z, Probus Publishing, Chicago,

1995.

Ser-Huang Poon (2005) A Practical Guide to Forecasting Financial Market

Volatility. Jhon Wiley and Sons, ltd, England.

Stock price data (Jan. 2005 - May 2014) of Indonesia Stock Index available

at

https://finance.yahoo.com/q/hp?s=^JKSE&a=00&b=1&c=2005&d

=04&e=28&f=2014&g=d

Zaiyong Tang, C. de Almeida, P. A. Fishwick (1991) Time series

forecasting using neural networks vs. Box-Jenkins methodology.

Simulation 57(5):303-310 from

http://www.researchgate.net/publication/242925036_Time_series_f

orecasting_using_neural_networks_vs._Box_Jenkins_methodology

Tuan Zea Tan, Chai Quek and Geok See Ng (2007). Biological

brain-inspired genetic complementary learning for stock market and bank

failure prediction. Computational Intelligence, 23(2), 236

–

261.

Wythoff BJ. (1993) Back-propagation neural networks: a tutorial.

Chemometrics and

Intelligent Laboratory Systems. 18(2):115-155.

Yakup Kara, Melek Acar Boyacioglu, Ömer Kaan Baykan (2011) Predicting

direction of stock price index movement using artificial neural

networks and support vector machines: the sample of the Istanbul

Stock Exchange. Expert Systems with Applications 38, 5311-5319

Yanshan Wang & In-Chan Choi (2013) Market Index and Stock Price

Direction Prediction using Machine Learning Techniques: An

empirical study on the KOSPI and HSI. ScienceDirec. 1-13

Yaser S. Abu-Mostafa & Amir F. Atiya (1996). Introduction to financial

forecasting. Applied Intelligence, 6(3), 205

–

213.

Sneha Soni (2011) Appl

plic

icat

ati

ions of

f

AN

ANNs in Stock Market Prediction: A

Survey. In

n

te

ternational Journal of

C

Com

omputer Science & Engineering

Techno

nol

logy. Vol. 2, Issue.3, 71-83

Suchira Ch

Chaigusin (2011)

) An Investigation Into the Use

se of Neural Network

for the Prediction

n

o

of

f th

the St

Stoc

ock

k

Ex

E

ch

ch

ange of Thaila

land

n

. Edith Cowan

Univer

ersi

si

ty

ty

S.B. Ach

hel

elis

i

, Technica

a

l

l An

An

al

l

ysi

is

f

f

ro

m

m

A

A

to

t

Z, Probus

s

P

P

ub

u

lishing, Chicago,

19

19

95.

Se

Ser-

r-Hu

H

ang

g

P

Po

on (

20

05) A Practical Guide to Forecas

ting

ti

n

Fin

in

an

anci

ci

al

al Marke

k

t

Volati

lity

.

Jhon Wiley

a

nd

Sons, ltd, England.

Stoc

ck

k

price data (Jan. 2005 - May 2014)

of

Indonesia Sto

ck

k Ind

d

ex

ex

a

ava

vail

i

able

le

at

ht

tps://finance.yahoo.com/q/hp?s

=^

JKSE&a=00&

b=1

1&c=

=20

2005

05

&d

=04&e=28&f=2014&g=

d

Z

Za

iyong Tang, C. de Al

meid

a,

P

. A. F

is

hw

ic

k (1991) Time seri

es

s

forecasting using neural net

wo

rk

s

vs. Box-Jenkins me

th

hodolog

ogy.

Si

mu

lati

on

57(5

):303-310 from

ht

tp

tp

:/

:/

/w

/www.resea

ea

rc

rchgate.net/

/

pu

pu

blicatio

b

n/

n/

24

24

29

2

25036_

Ti

i

m

me_serie

es_

s_f

f

orecasting_using

_neu

n

eural_

_ne

netw

twor

ks

_vs._Box_Jenkins_methodo

o

lo

logy

gy

Tuan Zea Tan, Chai Quek and

d Geok See Ng (2007). Biological

al

b

bra

ain

in-inspired genetic complementary learning for stock ma

ark

rket

et a

a

nd

nd b

ba

ank

fa

fa

il

ilur

ur

e

e pr

pred

edic

ic

tion

ti

on.

.

Co

Computat

atio

iona

na

l

l

In

Inte

te

ll

llig

igen

en

ce

ce,

,

23(2

3

(2),

),

2

236

36–

–26

261

1.

Wy

Wythoff

f

BJ

BJ. (1

(199

993)

3)

B

B

ack-

k pr

prop

opagat

t

io

io

n

n

ne

neur

u

al

al

n

net

etwo

w

rks:

s:

a

a t

tu

utorial.

Ch

h

em

emometrics and

d

Intelligent Labora

at

tory System

ms. 18(2):115-155.

Yochanan Shachmurove and Dorota Witkowska (2000) Utilizing Artificial

Neural Network Model to Predict Stock Markets. The City College

of the City University of New York and The University of

Pennsylvania.

Variable at

http://www.scribd.com/doc/189092644/file

y

Apendix A: Matlab code

The code below are some of the main part of this research methodology

A. Preprocess code

function varargout = preproses(varargin) % PREPROSES M-file for preproses.fig

% PREPROSES, by itself, creates a new PREPROSES or raises the existing

% singleton*. %

% H = PREPROSES returns the handle to a new PREPROSES or the handle to

% the existing singleton*. %

% PREPROSES('CALLBACK',hObject,eventData,handles,...) calls the local

% function named CALLBACK in PREPROSES.M with the given input arguments.

%

% PREPROSES('Property','Value',...) creates a new PREPROSES or raises the

% existing singleton*. Starting from the left, property value pairs are

% applied to the GUI before preproses_OpeningFcn gets called. An

% unrecognized property name or invalid value makes property application

% stop. All inputs are passed to preproses_OpeningFcn via varargin.

%

% *See GUI Options on GUIDE's Tools menu. Choose "GUI allows only one

% instance to run (singleton)". %

% See also: GUIDE, GUIDATA, GUIHANDLES

% Edit the above text to modify the response to help preproses

% Last Modified by GUIDE v2.5 23-Jul-2014 08:15:08

% Begin initialization code - DO NOT EDIT gui_Singleton = 1;

gui_State = struct('gui_Name', mfilename, ... 'gui_Singleton', gui_Singleton, ... 'gui_OpeningFcn', @preproses_OpeningFcn, ...

'gui_OutputFcn', @preproses_OutputFcn, ...

'gui_LayoutFcn', [] , ... 'gui_Callback', []); if nargin && ischar(varargin{1})

gui_State.gui_Callback = str2func(varargin{1}); end

A. Preprocess code

function varararggout = preproses(varrarargin) % PREPROSESS M-file for preproses.fig

% PPRREPROSES, by itself, creates a newew PREPROSES or raiseses the existingg

% singleton*. %

%

% H == PPRREPRP OSES returns thehe hhanandldlee to a new PPREPROSES or thehe handldle to

% the existstining singleton*. %

%

% PREREPROSES('CALLBACK',hObject,evenntDatta,a,hahandndlel s,....) ca

callls tthe local %

% function named CALLBACK in PREPROSES..M wiithth tthe giveven input arguments.

% %

% PREPROSES('Property','Value',...) createss a nnewew P

PREPROSES or raises the

% existing singleton*. Starting from the leeft, property value pairs are

% applied to the GUI before preproses_OpeninggFcn getsts called. An

% unrecognized property name or invalid value makeses property application

% stop.p AlAlll inputs are ppasassesedd to preproses_OOpepeningFcFcnn via vavarararggin.

%

% *See GUI Optionss onon GUIDE's Tools menu. Choose "GUGUII allows only one

% instance to run (singleton)". %

% %

% SeSee alalsoso:: GUUIDIDEE, GGUIUIDAD TAA,, GUGUIHIHANANDLD ESES

%

% EdEditit thee above texext to modifify the reespsponnsese tto hehelplp pr

prepeprorosses

% Last Modified by GGUIDE v2.55 23-Jul-2014 08:15:08

% Begin initializatiiono code - DO NOT EDIT gui_Singleton = 1;

if nargout

[varargout{1:nargout}] = gui_mainfcn(gui_State, varargin{:});

else

gui_mainfcn(gui_State, varargin{:}); end

% End initialization code - DO NOT EDIT

% --- Executes just before preproses is made visible. function preproses_OpeningFcn(hObject, eventdata, handles, varargin)

% This function has no output args, see OutputFcn. % hObject handle to figure

% eventdata reserved - to be defined in a future version of MATLAB

% handles structure with handles and user data (see GUIDATA)

% varargin command line arguments to preproses (see VARARGIN)

% Choose default command line output for preproses handles.output = hObject;

% Update handles structure guidata(hObject, handles);

% UIWAIT makes preproses wait for user response (see UIRESUME)

% uiwait(handles.figure1);

% --- Outputs from this function are returned to the command line.

function varargout = preproses_OutputFcn(hObject, eventdata, handles)

% varargout cell array for returning output args (see VARARGOUT);

% hObject handle to figure

% eventdata reserved - to be defined in a future version of MATLAB

% handles structure with handles and user data (see GUIDATA)

% Get default command line output from handles structure varargout{1} = handles.output;

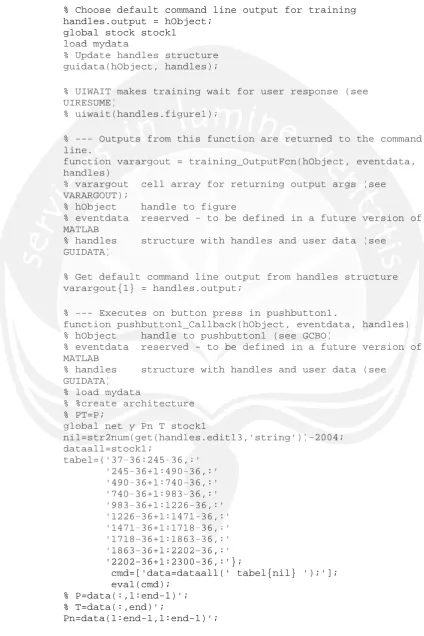

% --- Executes on button press in pushbutton1.

function pushbutton1_Callback(hObject, eventdata, handles) % hObject handle to pushbutton1 (see GCBO)

% eventdata reserved - to be defined in a future version of MATLAB

% handles structure with handles and user data (see GUIDATA)

else

gui_mainfcn((guguii_State, vararargig n{:}); end

% End inittiaialization code - DO NOT EDIITT

% ---- Executes justt bebefoforere pprereprprososese is made vvisi ible. f

function pprereprprooses_OOpepeniningn Fcn(Fcn hOhObjb ecect,t, eventdataa,, handles, varargin)

% Thisis function haass nono outtpuputt arargs, see Ouutptputu Fcn. % hOhObjbjece t hhandle to figure

%

% evevenentdattaa reserved - to be defined ini a ffututurure versioi n of

of MATLAAB %

% handdles structure with handles and userer datataa (s(see G

GUIDDAATA)

% vvarargin command line arguments to preprosses ((sesee e VAARARGIN)

% Choose default command line output for preprosees handles.output = hObject;

% Update handles structure guidata(hObject, handles);

% UIWAIT makakeses pprereprp oses wait foforr ususerer response (seseee UIRESUSUMEME))

% uiwait(handles.figurure1e );;

% --- Outputs from this function are returned to the command line.

functition vararargogoutut == preprosp seses_OOututpuputFcn(h(hObObject,, ev

evenentdtdatataa, hhanandldles))

% varargrgououtt ccelelll array y foforr retuturnrnini g ououtptput args (s(seeee VA

VARARARGRGOOUT)T);; %

% hOhObjbjeect handle toto figurure

% eventdata reservedd - to bbe defined in a future version of MATLAB

% handles structuure with hhandles and user data (see GUIDATA)

% Get default command line output from handles structure varargout{1} = handles.o. uttput;

global stock1 stock

format short g, format compact

stock=xlsread('table.xls','sheet1','mydata1'); t=handles.uitable1;

set(t,'Data',stock);

set(t,'Columnname',{'AD' 'CCI' 'LW%R' 'MACD' 'Mom' 'Roc' 'RSI' 'SMA' 'Stoch.K%' 'MA%k-D%' 'MA%D-%D' 'WMA'}); t=handles.uitable2;

stock1=[];

for i=1:size(stock,2)-1

stock1=[stock1 normalisasi(stock(:,i),-1,1)]; end

stock1=[stock1 stock(:,end)]; set(t,'Data',stock1);

set(t,'Columnname',{'AD' 'CCI' 'LW%R' 'MACD' 'Mom' 'Roc'

'RSI' 'SMA' 'Stoch.K%' 'MA%k-D%' 'MA%D-%D' 'WMA'}); save mydata stock stock1

% --- Executes on button press in pushbutton2.

function pushbutton2_Callback(hObject, eventdata, handles) % hObject handle to pushbutton2 (see GCBO)

% eventdata reserved - to be defined in a future version of MATLAB

% handles structure with handles and user data (see GUIDATA)

close(preproses)

% --- Executes on button press in pushbutton3.

function pushbutton3_Callback(hObject, eventdata, handles) % hObject handle to pushbutton3 (see GCBO)

% eventdata reserved - to be defined in a future version of MATLAB

% handles structure with handles and user data (see GUIDATA)

B. Training code

function varargout = training(varargin) % TRAINING M-file for training.fig

% TRAINING, by itself, creates a new TRAINING or raises the

% existing singleton*. %

% H = TRAINING returns the handle to a new TRAINING or the

handle to the existing singleton*. %

% TRAINING('CALLBACK',hObject,eventData,handles,...) calls the

% local function named CALLBACK in TRAINING.M with the given

input arguments. %

set(t, Data ,stock);

set(t,'Columnname' {,{'AD' 'CCI'I' 'LW%R' 'MACD' 'Mom' 'Roc' 'RSI' 'SMA' 'SStotoch.K%' 'MA%k-D%' 'M'MA%D-%D' 'WMA'});

t=handles.uiuitable2; stock1=[[]];

for i==11:size(stock,2, )-1

stock1=[stock1 nnorormamalilisasasisi(s(stock(:,i),-1,1)1 ]; ennd

stock1=[sttocockk1 stockk(:,end)]; set(t,t,'Data'a',stock1);

set(t(t,t 'C' olumnnamme'e',{'AD' 'CCI' ''LWL %R' 'MACCD'D' 'Mom' ''RoR c' 'RRSIS '' ''SMA' ''Stoch.K%' 'MA%k-D%' 'MA%A%D-%D'' 'W'WMAMA'}); sa

saveve mydatata stock stock1 %

% ---- ExExecutes on button press in pushbuttton2. fu

f nctition pushbutton2_Callback(hObject, eventntdataa, hahandles)s) % hOhObject handle to pushbutton2 (see GCBO))

% eeventdata reserved - to be defined in a futturu e veversrsion of

of MATLAB %

% handles structure with handles and user datta a (sseeee GUIDATA)

close(preproses)

% --- Executes on button press in pushbutton3.

function pushbutton3_Callback(hObject, eventdata, handndles)) % hObject hhanandldle e to pushbutttoton3n3 ((sesee e GCBO)

% evenentdtdatataa rresesererved d - to bbe dedefifinenedd inin aa ffuture version n of MATLAB

% handles structure wwitith handles and user data (see GUIDATA)

B.

B. Tr

T

aini

i

ng

ng c

cod

od

e

functionn vvarargout = ttraining(g(varargin) % TRAINING M-file for trainining.fig

% TRAINING, by iitself, crcreates a new TRAINING or raises the

% existing singlleton*. %

% H = TRAINING reeturns the handle to a new TRAINING or the

handle to the exisi titing singleton*. %

% TRAINING('Property','Value',...) creates a new TRAINING or

% raises the existing singleton*. Starting from the left,

% property value pairs are applied to the GUI before training_OpeningFcn gets called. An

% unrecognized property name or invalid value makes property application

% stop. All inputs are passed to training_OpeningFcn via varargin.

%

% *See GUI Options on GUIDE's Tools menu. Choose "GUI allows only one

% instance to run (singleton)". %

% See also: GUIDE, GUIDATA, GUIHANDLES

% Edit the above text to modify the response to help training

% Last Modified by GUIDE v2.5 12-Aug-2014 06:57:57

% Begin initialization code - DO NOT EDIT gui_Singleton = 1;

gui_State = struct('gui_Name', mfilename, ... 'gui_Singleton', gui_Singleton, ... 'gui_OpeningFcn', @training_OpeningFcn, ...

'gui_OutputFcn', @training_OutputFcn, ...

'gui_LayoutFcn', [] , ... 'gui_Callback', []); if nargin && ischar(varargin{1})

gui_State.gui_Callback = str2func(varargin{1}); end

if nargout

[varargout{1:nargout}] = gui_mainfcn(gui_State, varargin{:});

else

gui_mainfcn(gui_State, varargin{:}); end

% End initialization code - DO NOT EDIT

% --- Executes just before training is made visible. function training_OpeningFcn(hObject, eventdata, handles, varargin)

% This function has no output args, see OutputFcn. % hObject handle to figure

% eventdata reserved - to be defined in a future version of MATLAB

% handles structure with handles and user data (see GUIDATA)

% varargin command line arguments to training (see VARARGIN)

% property value pap irs are applied to the GUI before training_OpeningFccnn gets calleed.d. An

% unrecoggninized property name oror invalid value makes property appppllication

% stotop. All inputs are passed to traraining_OpeningFcn via vaarrargin.

%

% *Seee GUGUII Optiiononss onn GGUIIDEE'ss TTools menu. Choose "GUI a

allows only y ononee

% instaancnce to run (singleton)". %

% SeSeee alalso: GUGUIDE, GUIDATA, GUIHANDLLESES

%

% EdEdit tthe above text to modify the responsese to hehelplp tr

trainining

% LLast Modified by GUIDE v2.5 12-Aug-2014 06:57:5: 7

%

% Begin initialization code - DO NOT EDIT gui_Singleton = 1;

gui_State = struct('gui_Name', mfilename, ... 'gui_Singleton', gui_Singleton,, ... 'gui_OpeningFcn', @training_OpenningFcnn, ...

'gui_OutputFcn', @training_OutpputFtFcn, ...

'gugui_i LayoyoututFcFcn'n', [[]] , ... 'gui_i_Caallllback', []); if nargin && ischar(varargrgin{1})

gui_State.gui_Callback = str2func(varargin{1}); en

end

if nargoutt

[v[varararargoutut{1{1:narargoutt}]}] = guiui_maiainfnfcn(g(guiui_StateS te,, varargin{:{:}});

ellse

gui_mainfcn(gui_SState, vararargin{:}); end

% End initialization code - DOO NOT EDIT

% --- Executes just beefore ttraining is made visible.

function training_Openini gFcncn(hObject, eventdata, handles, varargin)

% This function has no oututput args, see OutputFcn.

% Choose default command line output for training handles.output = hObject;

global stock stock1 load mydata

% Update handles structure guidata(hObject, handles);

% UIWAIT makes training wait for user response (see UIRESUME)

% uiwait(handles.figure1);

% --- Outputs from this function are returned to the command line.

function varargout = training_OutputFcn(hObject, eventdata, handles)

% varargout cell array for returning output args (see VARARGOUT);

% hObject handle to figure

% eventdata reserved - to be defined in a future version of MATLAB

% handles structure with handles and user data (see GUIDATA)

% Get default command line output from handles structure varargout{1} = handles.output;

% --- Executes on button press in pushbutton1.

function pushbutton1_Callback(hObject, eventdata, handles) % hObject handle to pushbutton1 (see GCBO)

% eventdata reserved - to be defined in a future version of MATLAB

% handles structure with handles and user data (see GUIDATA)

% load mydata

% %create architecture % PT=P;

global net y Pn T stock1

nil=str2num(get(handles.edit13,'string'))-2004; dataall=stock1;

tabel={'37-36:245-36,:' '245-36+1:490-36,:' '490-36+1:740-36,:' '740-36+1:983-36,:' '983-36+1:1226-36,:' '1226-36+1:1471-36,:' '1471-36+1:1718-36,:' '1718-36+1:1863-36,:' '1863-36+1:2202-36,:' '2202-36+1:2300-36,:'};

cmd=['data=dataall(' tabel{nil} ');']; eval(cmd);

% P=data(:,1:end-1)'; % T=data(:,end)';

Pn=data(1:end-1,1:end-1)'; load mydata

% Update handles sstrtructure guidata(hObjecctt, handles);

% UIWAITT makes trainning wait for user resppono se (see UIRESUUMME)

% uiuiwait(handles.figgurure1e1);;

% --- Outpututs frfrom this function arre rreturned to theh command line.

funcnctitionon vararrggout = training_OutpututFcF n(hObjbjecect,t, eventtdata, ha

handndleles) %

% vavararggoout cell array for returning outptput argrgss (s(see VA

VARRARGGOOUT); %

% hObbject handle to figure

% evventdata reserved - to be defined in a futtuure veversrsion ofof MAATTLAB

% handles structure with handles and user dataa (seee G

GUIDATA)

% Get default command line output from handles struucture varargout{1} = handles.output;

% --- Executes on button press in pushbutton1.

function pushbututtot n1_Callback(hObjbjecect,, eventdata, hahandndles) % hObjjecectt handle toto pushbututton1 (see GCGCBOBO)

% eventdata reserveedd -- to bbee ddefined in a future versionn ofof MATLAB

% handles structure witi h handles and user data (seee GUIDATA)

%

% loloadad mmydydatataa %

% %c%crereatate arrchchittecectuturere % PT=P;

gl

globobalal nnetet yy PPn T ststock11

nil=str22nunum(get(handleles.edit1313,'string')))-202 04; dataall=stock1;

T=data(2:end,end)'; save data Pn T data

nh=str2num(get(handles.edit4,'string')); net = newff(minmax(Pn),[nh 1],{ 'tansig' 'purelin'},'traingdx');

%inisialize before train

net.LW{2,1} = net.LW{2,1}*0.01; net.b{2} = net.b{2}*0.01;

net.performFcn = 'sse'; %e

EPOCH=str2num(get(handles.edit7,'string'));

net.trainParam.epochs =EPOCH ;%10000; %parameter epoch net.trainParam.goal = str2num(get(handles.edit9,'string')); LR=str2num(get(handles.edit5,'string'));

net.trainParam.lr=LR;

net.trainParam.show = 1000;

MC=str2num(get(handles.edit6,'string')); net.trainParam.mc = MC; %momentum koefisien net.trainParam.time=20*60;

net.trainParam.min_grad=1e-50; % do train

[net,tr,Y,E,Pf,Af] = train(net,Pn,T); y=sim(net,Pn);

yt=[];

for i=1:length(y) yt(i)=fth(y(i)); end

hasil=[(1:length(T))' T' y' yt']; t=handles.uitable1;

set(t,'Data',hasil);

set(t,'Columnname',{'Day' 'Actual' 'Predicted' 'Up/Down'}); set(t,'Columnwidth',{30 50 50 75});

MAE=sum(abs(T'-yt'))/length(T'); set(handles.edit1,'string',MAE); RMSE=sqrt(mse(T'-yt')); %versi one set(handles.edit2,'string',RMSE); MAPE=sum(abs(T'-yt'))/length(T'); set(handles.edit8,'string',MAPE); SSE=sse(T-yt);

SST=sse(T-mean(T)); R2=1-(SSE/SST);

set(handles.edit3,'string',R2); tot=0;

for i=1:length(y) if T(i)==yt(i) tot=tot+1; end

end

PR=tot/length(yt);

set(handles.edit10,'string',PR); Pstat=ranksum(T,yt);

set(handles.edit15,'string',Pstat);

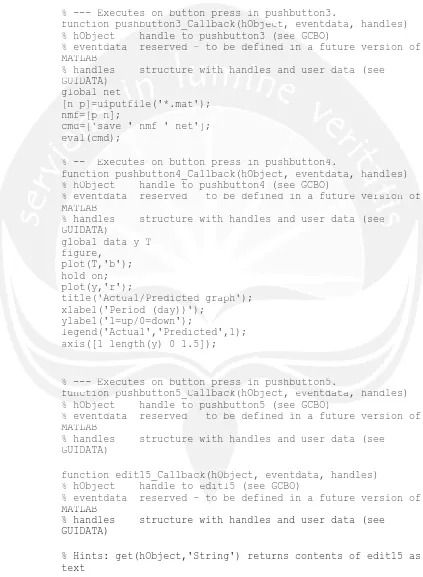

% --- Executes on button press in pushbutton2.

function pushbutton2_Callback(hObject, eventdata, handles) % hObject handle to pushbutton2 (see GCBO)

purelin }, traingdx ); %inisialize beforee ttrain

net.LW{2,1} = nenet.LW{2,1}*0.01; net.b{2} = nneet.b{2}*0.01;

net.perforormFcn = 'sse'; %e

EPOCH=ststr2num(get(hahandles.edit7,'string'));

net..ttrainParam.epochhs =E=EPOOCHCH ;;%11000 00; %parameteter epoch neett.trainPara amam.g.goal == ststr22nuum((geet((hahandles.edit9,9 'string')); L

LR=str2num(g(getet(hhandlles.edit5,''ststriringng')'));) net.trraia nParramam.lr=LR;

net.trtraiainParam.shohow = 1000;

MC=s=strtr2n2num(ggetet(handles.edit6,'string')'));) ne

net.t.trtrainPParam.mc = MC; %momentum koefissiei n ne

net.t.traiinParam.time=20*60; ne

net.trrainParam.min_grad=1e-50; % doo train

[netet,tr,Y,E,Pf,Af] = train(net,Pn,T); y==sim(net,Pn);

yt yt=[]; f

for i=1:length(y) yt(i)=fth(y(i)); end

hasil=[(1:length(T))' T' y' yt']; t=handles.uitable1;

set(t,'Data',hasil);

set(t,'Columnnama e'e ,{'Day' 'Actual' 'Predicted' 'Up/D/Doown'}); set(t,'CCololumnwidth',{3{30 50 500 75});

MAE=sum(abs(T'-yt')))/)/lelengn thh(T(T')'); set(handles.edit1,'strinng'g ,MAE); RMSE=sqrt(mse(T'-yt')); %%versi one set(handles.edit2,'string',RMSE); MA

MAPEPE=s=sumum(a(absbs(T(T'-ytyt')))/length(T'));; se

set(t(hahandndleles.ededitt8,8,'s'strtrining',M,MAPAPE)E);; SSE=sse(TT--ytyt));

SS

SST=T sssse(e(TT-meeaan(T)); R2=1-(SSESE//SST);

set(handles.edit3,'strring',RR2)2 ; tot=0;

for i=1:length(y) if T(i)==yt(i) tot=tot+1; end

end

PR=tot/length(yt);

% eventdata reserved - to be defined in a future version of MATLAB

% handles structure with handles and user data (see GUIDATA)

close(training)

function edit1_Callback(hObject, eventdata, handles) % hObject handle to edit1 (see GCBO)

% eventdata reserved - to be defined in a future version of MATLAB

% handles structure with handles and user data (see GUIDATA)

% Hints: get(hObject,'String') returns contents of edit1 as text

% str2double(get(hObject,'String')) returns contents of edit1 as a double

% --- Executes during object creation, after setting all properties.

function edit1_CreateFcn(hObject, eventdata, handles) % hObject handle to edit1 (see GCBO)

% eventdata reserved - to be defined in a future version of MATLAB

% handles empty - handles not created until after all CreateFcns called

% Hint: edit controls usually have a white background on Windows.

% See ISPC and COMPUTER.

if ispc && isequal(get(hObject,'BackgroundColor'), get(0,'defaultUicontrolBackgroundColor'))

set(hObject,'BackgroundColor','white'); end

function edit2_Callback(hObject, eventdata, handles) % hObject handle to edit2 (see GCBO)

% eventdata reserved - to be defined in a future version of MATLAB

% handles structure with handles and user data (see GUIDATA)

% Hints: get(hObject,'String') returns contents of edit2 as text

% str2double(get(hObject,'String')) returns contents of edit2 as a double

% --- Executes during object creation, after setting all properties.

function edit2_CreateFcn(hObject, eventdata, handles) % hObject handle to edit2 (see GCBO)

% eventdata reserved - to be defined in a future version of MATLAB

% handles empty - handles not created until after all CreateFcns called

close(training)

function edit11_Callback(hObject, eveC ventn data, handles) % hObject handle to edit1 (see GCBOO))

% eventddaata reserved - to be defined in aa future version of MATLABB

% haanndles structuuree wwitthh hahanddleles and user ddata a (see GUUIIDATA)

% Hintts:s: gett(hObjectt,', StStriringng')) returnss contetentnts of eedid t1 as textt

% strtr22double(get(hObject,'Strinng'g')) retetururnsn conttents of

of eeddit1 as a double

%

% ---- Executes during object creation, after ssettiinng aall propoperties.

fuunnction edit1_CreateFcn(hObject, eventdata, hanndleses) % hObject handle to edit1 (see GCBO)

%

% eventdata reserved - to be defined in a future versrsioion of MATLAB

% handles empty - handles not created until afteer all CreateFcns called

% Hint: edit controls usually have a white backgrouund onon Windows.

% SeSeee ISPC andnd COMPUTER.R.

if ispc && isequal(gl(getet(h( Objejectct,'B'BackgroundCdColor'), get(0,'defaultUicontrolBlBacckgkgroundColor'))

set(hObject,'BackgrounundColor','white'); end

fu

funcnctitionon eedidit2t2_C_Calallblbacack(k(hObjbjecect,t, eevev nttdadatata,, hahandndleles)s) % hObjectt handle too eedidit2t2 (see GCBOBO))

%

% evevenentdtdatata reserveved - toto be dedefined ind i aa ffututururee veverssiion of MATLAB

% handles structuree with hah ndles and user data (see GUIDATA)

% Hints: get(hObject,,'String')) returns contents of edit2 as text

% str2double(geet(hObjject,'String')) returns contents of edit2 as a double

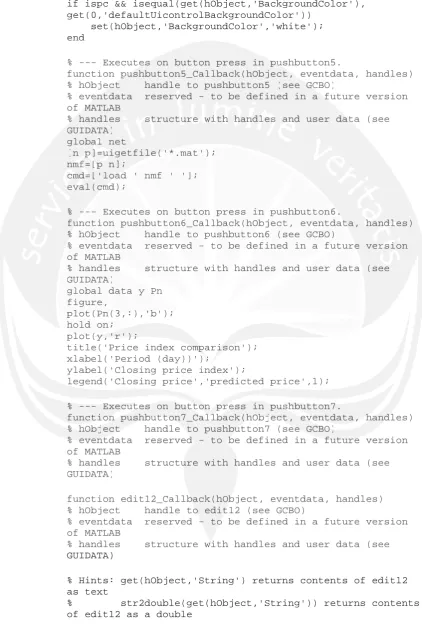

% Hint: edit controls usually have a white background on Windows.

% See ISPC and COMPUTER.

if ispc && isequal(get(hObject,'BackgroundColor'), get(0,'defaultUicontrolBackgroundColor'))

set(hObject,'BackgroundColor','white'); end

function edit3_Callback(hObject, eventdata, handles) % hObject handle to edit3 (see GCBO)

% eventdata reserved - to be defined in a future version of MATLAB

% handles structure with handles and user data (see GUIDATA)

% Hints: get(hObject,'String') returns contents of edit3 as text

% str2double(get(hObject,'String')) returns contents of edit3 as a double

% --- Executes during object creation, after setting all properties.

function edit3_CreateFcn(hObject, eventdata, handles) % hObject handle to edit3 (see GCBO)

% eventdata reserved - to be defined in a future version of MATLAB

% handles empty - handles not created until after all CreateFcns called

% Hint: edit controls usually have a white background on Windows.

% See ISPC and COMPUTER.

if ispc && isequal(get(hObject,'BackgroundColor'), get(0,'defaultUicontrolBackgroundColor'))

set(hObject,'BackgroundColor','white'); end

function edit4_Callback(hObject, eventdata, handles) % hObject handle to edit4 (see GCBO)

% eventdata reserved - to be defined in a future version of MATLAB

% handles structure with handles and user data (see GUIDATA)

% Hints: get(hObject,'String') returns contents of edit4 as text

% str2double(get(hObject,'String')) returns contents of edit4 as a double

% --- Executes during object creation, after setting all properties.

function edit4_CreateFcn(hObject, eventdata, handles) % hObject handle to edit4 (see GCBO)

if ispc && isequal(get(h(hObObjeject, BackgroundColor ), get(0,'defaultUicocontntrolBackgrounundCd olor'))

set(hObjecctt,'BackgroundColor','w'whih te'); end

functiion edit3_Callbback(hObject, eventdata, hah ndles) % hOhObbject handle too eediit3t3 ((seee GCG BO)

% eventdataa rreseserveedd - too bbee dedefiineed d ini a futurree version of M

MATLAB

% handdleles structuurere wwitithh hahandles anndd userer data (sseee GUIDIDATATA)A)

%

% HiHints:: get(hObject,'String') returns conontentss ofof eedit33 as te

text %

% str2double(get(hObject,'String')) reteturnss conontentss of eedit3 as a double

%

% --- Executes during object creation, after setttingg allll p

properties.

function edit3_CreateFcn(hObject, eventdata, handlles) % hObject handle to edit3 (see GCBO)

% eventdata reserved - to be defined in a future vversion off MATLAB

% handles empty - handles not created until afteer allll CreateFcns called

% Hint: edit contrololss ususuallllyy hhave a white background on Windows.

% See ISPC and COMPUP TER.

if ispc && isequal(get(hObject,'BackgroundColor'), geet(t(0,0,'ddefefauaultltUiUicocontn rolBackgrounundCdCololoror'))))

seset(t(hOhObjbjece t,t,'BBacackgrokgroundCdCololoror',,'whihitete')');; end

fu

f nctionon edit4_Callbacck(hObjeect, eventdatata, handleles)s) % hObject handle too edit44 (see GCBO)

% eventdata reservedd - to be defined in a future version of MATLAB

% handles structurre with hahandles and user data (see GUIDATA)

% Hints: get(hObject,'StStrinng') returns contents of edit4 as text

% eventdata reserved - to be defined in a future version of MATLAB

% handles empty - handles not created until after all CreateFcns called

% Hint: edit controls usually have a white background on Windows.

% See ISPC and COMPUTER.

if ispc && isequal(get(hObject,'BackgroundColor'), get(0,'defaultUicontrolBackgroundColor'))

set(hObject,'BackgroundColor','white'); end

function edit5_Callback(hObject, eventdata, handles) % hObject handle to edit5 (see GCBO)

% eventdata reserved - to be defined in a future version of MATLAB

% handles structure with handles and user data (see GUIDATA)

% Hints: get(hObject,'String') returns contents of edit5 as text

% str2double(get(hObject,'String')) returns contents of edit5 as a double

% --- Executes during object creation, after setting all properties.

function edit5_CreateFcn(hObject, eventdata, handles) % hObject handle to edit5 (see GCBO)

% eventdata reserved - to be defined in a future version of MATLAB

% handles empty - handles not created until after all CreateFcns called

% Hint: edit controls usually have a white background on Windows.

% See ISPC and COMPUTER.

if ispc && isequal(get(hObject,'BackgroundColor'), get(0,'defaultUicontrolBackgroundColor'))

set(hObject,'BackgroundColor','white'); end

function edit6_Callback(hObject, eventdata, handles) % hObject handle to edit6 (see GCBO)

% eventdata reserved - to be defined in a future version of MATLAB

% handles structure with handles and user data (see GUIDATA)

% Hints: get(hObject,'String') returns contents of edit6 as text

% str2double(get(hObject,'String')) returns contents of edit6 as a double

% Hint: edit contrtrolols usually hahavev a white background on Windows.

% Seee ISPC and COMPUTER.

if ispc &&& isequal(get(hObject,'BackgroundndColor'), get(0,,''defaultUicontntrolBackgroundColor'))

set(hObject,'BacckggroounndCdCololorr',,'white'); enndd

functiionon ediit5_Callbbacack(k(hOhObjbjecect,, eventtddata,, hahandles)) % hOhObjbjecect hananddle to edit5 (see GCGCBO)

% evevenntdataa reserved - to be defined ini a fututururee versioi n of MA

MATLTLAAB %

% hhandleles structure with handles and userer dattaa (s(seee GU

GUIDATATA)

% HHints: get(hObject,'String') returns contents of eediit5t5 as teext

%

% str2double(get(hObject,'String')) returnss conontetents of edit5 as a double

% --- Executes during object creation, after settinng all properties.

function edit5_CreateFcn(hObject, eventdata, handlees) % hObject handle to edit5 (see GCBO)

% eventdatataa reserveed d - to bee dedefined inin aa future vversion ofof MATLAB

% handles empty - haanndleles not created until after alll CreateFcns called

%

% HiHintnt:: ededitit cconontrtrolo s usually hahaveve aa wwhihitete bbacackgkgrounndd onon Wi

Windndowowss.

% SeSeee IISPC and CCOMOMPUPUTETERR. if

if iispspcc &&& iissequal(g(get(hhObObjectt,'Back' kgrgrouo ndndCoCololor'r ),), ge

g t(0,'ddefefaultUicontrorolBackgrroundColor'))) set(hObject,'BackggroundCColo or','white'); end

function edit6_Callbaack(hObjecct, eventdata, handles) % hObject handle toto edit6 (see GCBO)

% eventdata reserved - to bbe defined in a future version of MATLAB

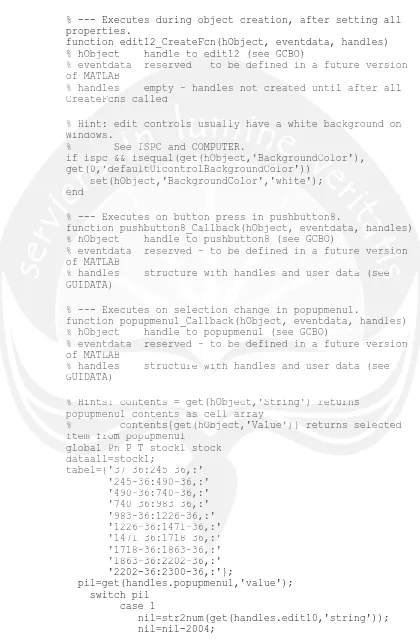

% --- Executes during object creation, after setting all properties.

function edit6_CreateFcn(hObject, eventdata, handles) % hObject handle to edit6 (see GCBO)

% eventdata reserved - to be defined in a future version of MATLAB

% handles empty - handles not created until after all CreateFcns called

% Hint: edit controls usually have a white background on Windows.

% See ISPC and COMPUTER.

if ispc && isequal(get(hObject,'BackgroundColor'), get(0,'defaultUicontrolBackgroundColor'))

set(hObject,'BackgroundColor','white'); end

function edit7_Callback(hObject, eventdata, handles) % hObject handle to edit7 (see GCBO)

% eventdata reserved - to be defined in a future version of MATLAB

% handles structure with handles and user data (see GUIDATA)

% Hints: get(hObject,'String') returns contents of edit7 as text

% str2double(get(hObject,'String')) returns contents of edit7 as a double

% --- Executes during object creation, after setting all properties.

function edit7_CreateFcn(hObject, eventdata, handles) % hObject handle to edit7 (see GCBO)

% eventdata reserved - to be defined in a future version of MATLAB

% handles empty - handles not created until after all CreateFcns called

% Hint: edit controls usually have a white background on Windows.

% See ISPC and COMPUTER.

if ispc && isequal(get(hObject,'BackgroundColor'), get(0,'defaultUicontrolBackgroundColor'))

set(hObject,'BackgroundColor','white'); end

function edit8_Callback(hObject, eventdata, handles) % hObject handle to edit8 (see GCBO)

% eventdata reserved - to be defined in a future version of MATLAB

% handles structure with handles and user data (see GUIDATA)

% Hints: get(hObject,'String') returns contents of edit8 as text

% eventdata reserved to be defined in a future version of

MATLAB

% handles empmpty - handles not crreae ted until after all CreateFcns ccalled

% Hintt: edit controlols usually have a white bbaca kground on Winddows.

% Seee ISISPCPC andd CCOMOMPUUTEER.R. i

if ispc && iiseseququal(get(hObject,''BaBackckgrgrooundColor'), get(0,,'d' efauultl UicontroolBlBacackgkgroundColorr'))

seset(t(hObject,t,'B'BackgroundColor'','white');; endd

fu

funnctionon edit7_Callback(hObject, eventdata, handdleles)s) %

% hObjbject handle to edit7 (see GCBO)

% evventdata reserved - to be defined in a futturu e veversrsion ofof MATTLAB

% handles structure with handles and user dataa (seee G

GUIDATA)

% Hints: get(hObject,'String') returns contents of edit7 ass text

% str2double(get(hObject,'String')) returns contennts of edit7 as a double

% --- Exececututes duriningg object ccreation, aaftfter settinng all properties.i

function edit7_CreateFcncn(hhObObject, eventdata, handles) % hObject handle to edidit7 (see GCBO)

% eventdata reserved - to be defined in a future versrsioionn oof MA

MATLTLAB %

% hahandndleless eempmptyty -- hahandleess nonott creaeatetedd ununtitill afafteterr alalll CreateFcnss ccalalled

% Hint: ededit controlss usuallyy have a whiitete backgrounundd on Windows.

% See ISPC and COMPUTER.R.

if ispc && isequal(geet(hObjectt,'BackgroundColor'), get(0,'defaultUicontrrolBackgrooundColor'))

set(hObject,'BackgkgroundCoolor','white'); end

function edit8_Callback((hOObbject, eventdata, handles) % hObject handle to edidit8 (see GCBO)

% str2double(get(hObject,'String')) returns contents of edit8 as a double

% --- Executes during object creation, after setting all properties.

function edit8_CreateFcn(hObject, eventdata, handles) % hObject handle to edit8 (see GCBO)

% eventdata reserved - to be defined in a future version of MATLAB

% handles empty - handles not created until after all CreateFcns called

% Hint: edit controls usually have a white background on Windows.

% See ISPC and COMPUTER.

if ispc && isequal(get(hObject,'BackgroundColor'), get(0,'defaultUicontrolBackgroundColor'))

set(hObject,'BackgroundColor','white'); end

function edit9_Callback(hObject, eventdata, handles) % hObject handle to edit9 (see GCBO)

% eventdata reserved - to be defined in a future version of MATLAB

% handles structure with handles and user data (see GUIDATA)

% Hints: get(hObject,'String') returns contents of edit9 as text

% str2double(get(hObject,'String')) returns contents of edit9 as a double

% --- Executes during object creation, after setting all properties.

function edit9_CreateFcn(hObject, eventdata, handles) % hObject handle to edit9 (see GCBO)

% eventdata reserved - to be defined in a future version of MATLAB

% handles empty - handles not created until after all CreateFcns called

% Hint: edit controls usually have a white background on Windows.

% See ISPC and COMPUTER.

if isp