I. Introduction

This final project, "Sistem Informasi Akuntansi Pajak Penghasilan (PPh) Pasal 21 Pada Pegawai PT Bank SUMUT Cabang Medan Iskandar Muda," by Rahmi Utami Siregar, investigates the income tax (PPh) Article 21 accounting information system for employees at PT Bank Sumut's Medan Iskandar Muda branch. The study's significance lies in its exploration of a practical application of accounting information systems within a specific organizational context, offering valuable insights into the complexities of tax administration and its integration with accounting practices. The research provides a case study which can be used for educational purposes, demonstrating real-world challenges and solutions in tax compliance.

1.1 Background of the Problem

The introduction establishes the importance of accurate accounting information for effective management decision-making, highlighting the crucial role of information systems in facilitating this process. It emphasizes the significance of income tax (PPh) Pasal 21, a substantial source of government revenue, and its impact on a company's financial health. The discussion of relevant Indonesian laws and regulations, such as Undang-undang Nomor 7 tahun 1983 and Keputusan Direktorat Jendral Pajak No. KEP-545/PJ/2000, further contextualizes the study and underscores the legal framework governing PPh Pasal 21 calculations and reporting. The need for an accurate system for this specific tax is clearly stated.

1.2 Research Questions

The research questions clearly define the scope of the investigation, focusing on three key aspects of the PPh Pasal 21 system at PT Bank Sumut: the mechanics of calculation, withholding, and reporting; the mechanism for tax remittance; and the documentation used in the PPh Pasal 21 administrative system. These questions directly address the practical challenges of tax compliance within the chosen setting, providing a structured framework for data collection and analysis, suitable for replication in similar case studies for teaching purposes.

1.3 Objectives and Benefits of the Research

The stated objectives directly correspond to the research questions, providing a clear roadmap for the research process. The research aims to understand the calculation, remittance, and reporting processes of PPh Pasal 21, and to identify the documents employed in this system. The benefits outlined emphasize both the contribution to the author's knowledge and the potential for broader application within the academic community and the target organization. This section highlights the pedagogical value, showing how the research contributes to understanding the practical applications of accounting theory.

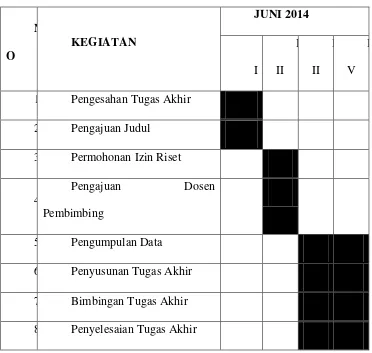

1.4 Research Plan

This section details the timeline and content plan for the thesis, showing the systematic approach taken to conduct the research. The inclusion of a detailed schedule (Table 1.1) demonstrates a structured research process, valuable as a model for students conducting their own research. The planned content, covering an introduction, company profile, PPh Pasal 21 system analysis, and conclusions, showcases a thorough approach to the research topic. The structured approach is academically sound and suitable as a pedagogical tool.

II. PT Bank Sumut Cabang Medan Iskandar Muda

This chapter provides a comprehensive overview of PT Bank Sumut's Medan Iskandar Muda branch, setting the stage for the subsequent analysis of its PPh Pasal 21 system. The information presented—including the company's history, organizational structure, job descriptions, business network, recent performance, and future plans—offers valuable contextual information for understanding the operational environment within which the tax system operates. This contextual information is crucial for understanding the practical implications and challenges of implementing accounting systems.

2.1 Company History and Profile

The historical overview of PT Bank Sumut, from its establishment in 1961 to its current status as a significant regional bank, provides essential background for comprehending the organization's evolution and current position. The discussion of its functions, vision, mission, and corporate culture establishes the context for understanding the organizational values and goals that shape its accounting and tax practices. The inclusion of the logo and its symbolism offers insight into the bank's self-image and branding strategy.

2.2 Organizational Structure and Job Descriptions

The detailed analysis of the organizational structure and associated job descriptions provides critical context for comprehending the roles and responsibilities of individuals involved in the PPh Pasal 21 processes. This section clarifies the workflow and lines of accountability, crucial for understanding how the tax system is integrated into the bank's daily operations. This organizational chart (Appendix 1) allows for a visualization of the structure, aiding comprehension for students.

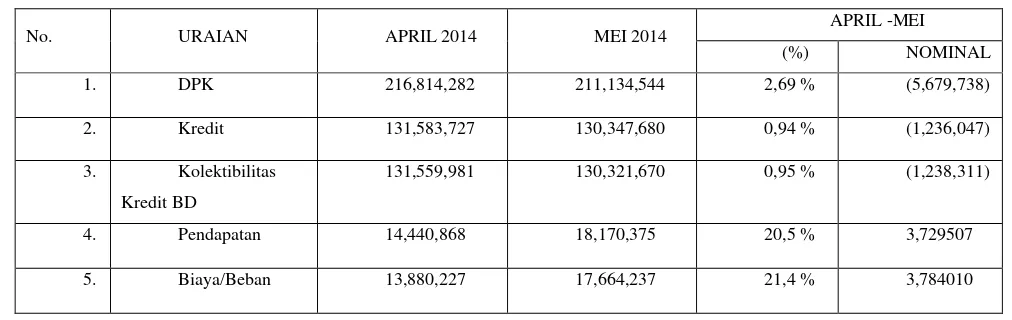

2.3 Business Network and Performance

The description of the bank's business network, including its partnerships and relationships with various organizations, highlights the complexity of its operations and the potential implications for its tax obligations. The financial performance data (Table 2.1) provides a quantitative measure of the bank's success, further enhancing our understanding of the scale of the operations and tax implications of those operations. This showcases the practical application of financial data analysis for students.

2.4 Business Plans

The future plans of the bank illustrate the dynamic nature of the business environment and its influence on the PPh Pasal 21 system. Understanding the bank's strategic direction is essential to anticipating future changes and adjustments in tax compliance practices. This analysis demonstrates the interplay between business strategy and accounting compliance in a real-world setting, highly valuable for teaching purposes.

III. PPh Pasal 21 Accounting Information System

This core section delves into the intricacies of the PPh Pasal 21 accounting information system within PT Bank Sumut. It provides a detailed examination of the theoretical underpinnings of accounting information systems, the concept of taxation, and the practical application of these concepts to the specific context of the bank's tax compliance processes. This section bridges theory and practice, a valuable pedagogical tool.

3.1 Definition of Accounting Information Systems

This subsection lays the theoretical groundwork, defining key concepts such as 'system,' 'information,' and 'accounting information system.' It describes the components and functions of an accounting information system, highlighting the importance of data processing and information delivery for effective decision-making. Different viewpoints are presented providing a robust understanding of the concept. This provides the theoretical framework for the later practical analysis.

3.2 Definition of Tax, Tax Functions, and Principles of Tax Collection

This section elaborates on the definition of tax within the Indonesian legal context, exploring its budgetary and regulatory functions. It examines the principles of tax collection, particularly the principles of equality, certainty, convenience, and economy. The discussion of Indonesian tax laws provides a crucial legal framework, necessary for comprehending the bank's tax compliance obligations, allowing students to apply legal and theoretical frameworks to real-world problems.

3.3 Mechanism for Calculating, Withholding, and Reporting Income Tax

This section offers a detailed explanation of the practical steps involved in calculating, withholding, and reporting PPh Pasal 21, providing a step-by-step guide to the process. It includes examples to illustrate the calculations and demonstrates the practical application of accounting principles and tax regulations within the PT Bank Sumut's context. This detailed explanation is of high pedagogical value, clearly demonstrating the process.

3.4 Remittance Mechanism

This subsection clarifies the procedures followed by the bank for remitting PPh Pasal 21 to the government. It explains the practical steps involved in transferring the withheld taxes and ensures the compliance with legal requirements. This section provides practical instructions for compliance which would be extremely useful to students.

3.5 Documents Used in the Administrative System

The identification and explanation of the documents used in the PPh Pasal 21 system provide valuable insights into the practical workings of tax administration. This section highlights the importance of accurate record-keeping and documentation for maintaining compliance. The use of Table 3.1 is a practical example for students.

IV. Conclusion and Suggestions

This chapter summarizes the findings of the research and offers recommendations for improvement. The conclusions reiterate the key aspects of the PPh Pasal 21 system at PT Bank Sumut, highlighting the importance of accurate and efficient tax administration within the context of the organization. The recommendations provide practical suggestions for enhancing the bank’s tax compliance process. This section demonstrates the practical application of research findings, valuable for teaching students how to synthesize information.

4.1 Conclusion

The conclusion summarizes the key findings of the study, reiterating the understanding of the PPh Pasal 21 system at PT Bank Sumut. It emphasizes the importance of an efficient system in maintaining tax compliance, and the challenges faced by the bank in managing this process. This section provides a summary of the research findings, helpful for students learning to draw conclusions from their work.

4.2 Suggestions

The suggestions section provides practical recommendations for improving the bank’s PPh Pasal 21 system, based on the findings of the study. This includes suggestions for enhancing efficiency, accuracy, and compliance. This section provides actionable recommendations, teaching students how to apply their research findings to improve a situation.