THE INFLUENCE OF FINANCIAL RATIOS TOWARD INITIAL PUBLIC OFFERING IN BANKING SECTOR WHICH LISTED IN INDONESIA STOCK

EXCHANGE 2006-2009

Proposed by: Faw zia Am elia 107081103371

Int ernat ional Undergraduat e Program Syarif Hidayat ullah St at e Islamic Universit y Jakart a

i

9. E-mail : [email protected]

II.

EDUCATIONAL BACKGROUND1. TK Manaratul Ulum 1993-1995

2. SDN Kramat Pela 01 1995-1999

3. SDN Sirnabaya III 1999-2001

4. SMPN 1 Karawang 2001-2004

5. SMAN 5 Karawang 2004-2007

6. Undergraduate Universiti Utara Malaysia (BIBM) 2009-2011

7. Strata 1 UIN Syarif Hidayatullah Jakarta (Management) 2007-2011

III.

ORGANIZATIONAL BACKGROUND1. Member of Indonesian Student Committee in UUM

ii

Abstrak

Rasio keuangan dapat digunakan sebagai perubahan pendapatan, pendapatan masa depan, kegagalan perusahaan, evaluasi dan harga penawaran. Objeksi dari penelitian ini adalah ingin identifikasi pengaruh dari rasio keuangan terhadap harga penawaran perdana saham yang terdaftar di Bursa Efek Indonesia.

Sampel di penelitian ini adalah perusahaan yang terdaftar di pasar modal. Sampel adalah perusahaan yang bergerak di perbankan. Sampel diambil berdasarkan tanggal terdaftar mereka tahun 2006-2009. Di skala tahun ini terdapat 10 perusahaan.

Hasil dari penelitian ini menemukan bahwa rasio keuangan berpengaruh lemah terhadap harga perdana saham di perbankan.

iii

Abstract

Financial ratios can be used as earning change prediction, future earning, company failure or bankruptcy, performance evaluation and offering price. The objective of this research wants to identify the influence of financial ratio to offering price of stock that listed in Indonesia Stock Exchange.

Sample in this research are companies those listed their stock in capital market. Sample are companies those run in banking sector. Samples are taken based on their listed date from 2006-2009. In this scale year, listed banking are 10 companies.

The result of this research found that financial ratio influenced weakly the offering price of stocks for all sample in banking sector.

iv

PREFACE

Assalamualaikum, wr.wb

Firstly thanks to Allah SWT because of His blessing the writer can finished this proposal.

Shalawat and Salam also give to the guidance prophet Muhammad SAW also to his best

friends.

In this chance, writer wants to say thanks for supporting and helping from every party to

writer in finishing this proposal. So, thankful would be for:

Writer’s family, Father, Mother, Sister and my big family who always support me, pray

me, and inspired me, also be my big motivation for writer herself, so can make the writer

in high spirit to finish this thesis.

Mr. Indoyama Nasaruddin, SE, MAB, first guidance who already gives me so much

suggestion, opinion, and helps me in doing this thesis.

Mr. Arief Mufraini, Lc, M.Si the head og International Program and as my second

guidance who already kindly helping me in doing the thesis, gives me so many supports

and suggestion.

Prof Dr . Abdul Hamid, MS as a Dean of Economic and Business Faculty.

All Lecturer who already give their knowledge for me and I can’t mention their name by

name, wish Allah replying your all kindness.

All the staffs of Faculty of Economic and Business, thanks for helping, simplicity, and all

v Alditya Aris Rinandy, for so much helping and supporting.

My friends in Islamic State University for the togetherness and friendships.

My internship friends in Bank Muamalat Indonesia Icha, Lucky and Lia who already

support me in finishing this thesis while I’m doing internship there.

My friends in Universiti Utara Malaysia who already given me support and shoulder to

cry on.

My dual degree friends Ariningtyas, Pramayassya, Weldan, Dewi, and Fitra as a struggle

friends in UUM.

With the humbleness, this thesis is still far from the perfection because of the limited

ability and knowledge that the writer has. Thus, writer wish for suggests and critics also

responses from all parties toward the better thesis and can be useful for everyone else who read

it. In the end, writer wishes that this thesis can be useful for reader and parties who need it.

Jakarta, 6 June 2011

vi

CHAPTER 1 INTRODUCTION A. Background ... 1

B. Research Problem ... 3

C. Research Quest ion ... 5

D. Research Object ive ... 5

E. Populat ion and Research Sam ple ... 6

CHAPTER 2 THEORITICAL FRAM EW ORK A. Lit erat ure Review ... 8

CHAPTER III RESEARCH M ETHODOLOGY A. Dat a Collect ion M et hod ... 50

vii

C. Variable Definit ion and M easurem ent of Operat ional ... 51

D. Populat ion and Sam ple ... 52

E. Dat a Collect ion Techniques ... 53

F. Classic Assum pt ion ... 54

G. Hypot hesis Test ... 57

CHAPTER IV ANALYSIS AND FINDING A. General Descript ion of Research Object ... 62

B. Descript ive St at ist ic ... 64

C. Pre- Analysis (Classic Assum pt ion) ... 80

D. Hypot hesis Test ... 85

E. Int erpret at ion ... 91

CHAPTER V CONCLUSION A. Conclusion ... 93

B. Recom m endat ion ... 93

C. Im plicat ion ... 94

D. Lim it at ion ... 94

REFERENCES ... 95

viii LIST OF TABLES

No. Description

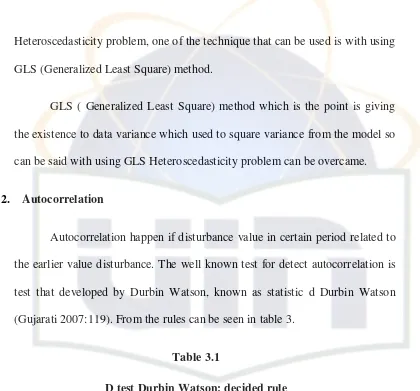

3.1 D Test Durbin W atson : decision rule ... 56

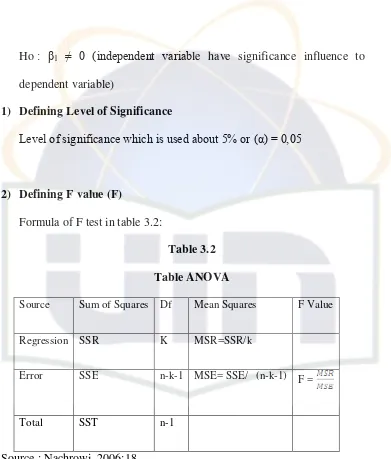

3.2 Table Annova ... 59

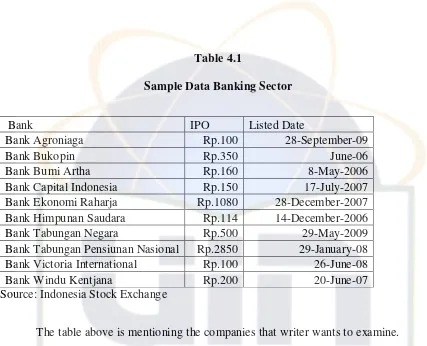

4.1 Sample Data Banking Sector ... 65

4.2 M odel Summary of Durbin W atson ... 82

4.3 M odel Summary of F test ... 84

4.4 M odel Summary of T Test... 85

ix LIST OF FIGURES

No. Description

2.1 Interaction of Company and Financial M arket ... 12

2.2 Theoretical Framew ork ... 46

2.3 IPO M odel ... 47

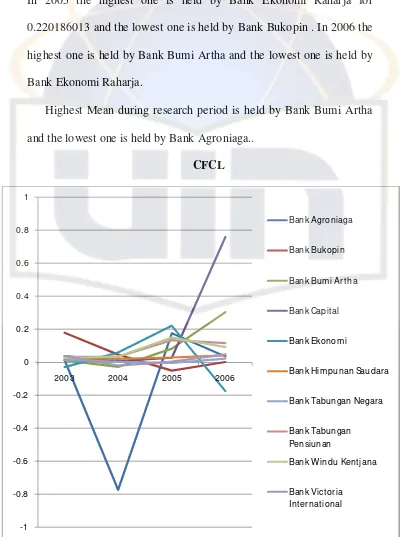

4.1 CFCL Data ... 68

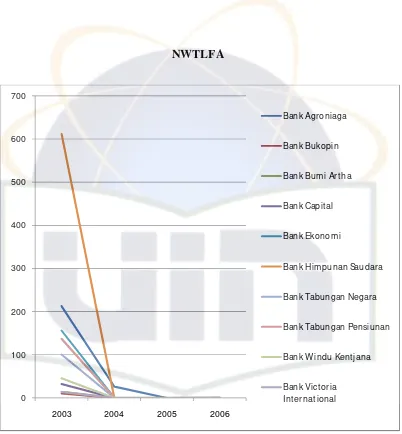

4.2 NW TLFA Data ... 70

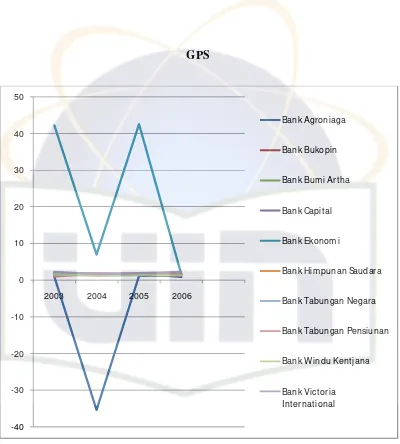

4.3 GPS Data ... 72

4.4 NIS Data ... 74

4.5 OITL Data ... 76

4.6 NW S Data ... 78

4.7 NITL Data ... 79

4.8 NINW Data ... 80

4.9 NW TL Data ... 81

1 CHAPTER I

INTRODUCTION

A. Background

Capital Market is a place to look for liquid money to increase

business activity so can produce much more profit. Fresh money that exists

in capital market is come from society who is called as investor. Investor

doing some kind of analysis technique to determine where the investment

place have higher chance to produce profit and have less risk will faced by

higher demand of investors to invest in the company. In order we can get

fund from stock market, emittent has to fulfill the requirement which is

applied by stock market. The most important requirement for demand the

fund from stock market is emittent has to provide their financial report

which is describing its financial position. What it means by financial report

is it’s balance sheet.

Financial report is financial information notes of a company to an

accounting period of time which can be used to describe affectivity of

company performance. Financial report is part of financial reporting

process. Complete financial report consist of balance sheet, statement in

changes in equity.

Elements that related directly to financial position measurements

2

performance measurement in balance sheet is income statement. Financial

report is usually reflecting to the elements of balance sheet and profit loss

statement.

Profit can be considered to be differentiate between the purchase

price and the cost of bringing to market whatever it is that is accounted as

an enterprise (whether by harvest, extraction, manufacture or purchase) in

terms of the component cost of delivering goods and or service and other

operating or other expenses.

Financial report define as information about financial position in a

period of time which beneficial for take any economic decision, also

management responsibilities for managing economic source which applied

by owner to the company. In the base of financial report, users in this case

investor can predict the situation of your financial company currently and

future. In order to predict the present financial situation and for future can

be used some variables. One of them is financial ratio.

From some of the researches one of them is Marian Vorek (2009),

he said that financial ratio can be used to predict financial position

currently and future. Thus, this research take variables which same as the

earlier research that is financial ratio, but those financial ratios used to

predict the first stock price that offered in initial public offering. Based on

the explanation, writer was attract to research how the influence of

3

banking sector those listed in Jakarta Stock Exchange. Thus, title of this

research is “THE INFLUENCE OF FINANCIAL RATIOS TOWARD

INITIAL PUBLIC OFFERING IN BANKING SECTOR WHICH LISTED IN INDONESIA STOCK EXCHANGE 2006-2009”

B. Research Problem

As the background stated above, we want to know the relationship

between financial ratios to IPO of banking industry.

Mas’ud Machfoedz (1994:114) classifying financial ratio in 9 group of financial ratio which are :

1. Short term liquidity:

It consists of Cash to Current Liabilities, Cash Flow to Current

Liabilities, Quick Asset, Current Asset

2. Long term solvency

It consists of Current Asset to Total Liabilities, Net Worth and Long

Term Debt to Fixed Assets, Net Worth to Fixed Assets.

3. Profitability

It consists of Operating Income to Net Income Before Taxes, Earnings

Before Taxed to Sales, Gross Profit to Sales, Operating Income to

4

4. Productivity

Inventory to working capital, cost of goods sold to inventory, sales to

quick assets, sales to cash, sales to account receivable, cash flow to

total asset, current asset to total asset, quick asset to inventory,

inventory to sales, sales to total asset, working capital to total asset

5. Indebtedness

It consists of Total liabilities to current asset, operating income to total

liabilities, current liabilities to total asset,

6. Investment intensiveness

It consists of Cash flow to total Liabilities, Sales to Fixed Assets,

Working Capital to Asset, Current Assets to Sales, Quick Asset to

Total Asset, Net Worth to Sales, Working Capital to Sales, Inventory to

Total Assets, Cash Flow to Sales.

7. Leverage

It consists of Net Worth to Total Assets, Current Liabilities to

5

8. Return on investment

It consists of Earning before taxes to net worth, net income to fixed

assets, net income to net worth, earning before income taxes to total

assets, Net Income to Total Assets

9. Equity

It consists of Sales to Current Liabilities, Net Income to Total

Liabilities, Current Liabilities to Net Worth, Net Worth to Total

Liabilities.

That can be counted be 49 financial ratios. From 49 ratios can be

used as 9 ratios to predict the future profit changes of a company. From

that 9 ratios, there is a significant in a significance level 5% which consists

from profitability ratio group that are Gross Profit to Sales, Income to

Sales, Income to Sales and Net Income to Net Worth. The research result

also found out that financial ratio can predict future profit for one period of

time.

C. Research Question

In attempting to achieve the objectives above, this study seeks to

address the following research question what does the influences of

financial information to the initial public offering for banking industry in

6 D. Research Objective

This research is aimed to know the influence of financial ratios

partially and simultaneously (x) toward the initial public offering in

banking industry in Indonesia Stock Exchange.

1. Usage of Research

Usages of this research are:

a. Academic

Theoretically it can be used as knowledge development and

expand the references about influence of financial ratios to

initial public offering in Stock Exchange Jakarta.

b. Investor

Whish this research can give any suggestion to investor,

co-investor and companies about factors that can be influence the

initial public offering.

c. Writer

This research is a media to applied knowledge that has been

gotthen from, thus writer would know the difference and

7 d. Stock Exchange

Wish this research can give any advice to stock exchange as a

transaction place about factors which influence initial public

8 CHAPTER II

THEORITICAL FRAMEWORK

A. Literature Review

1. Bank:

According to (duhaime :2011) definition of bank is a corporation

empowered to deal with cash, domestic and foreign, and to receive the

deposits of money and to loan those monies to third-parties.

Bank definition authentically has been arranged in law of banking

1967. Which means that bank is financial institution that the main business

is giving credit and services in financial traffic and money spreading.

Rachmadi Usman (2003:59).

2. Financial

Financial management is concerned with the maintenance and

creation of economic value or wealth. This focuses on decision making

with an eye toward creating wealth. As such, we will deal with financial

decision such as when to introduce a new product, when to invest in new

assets, when to replace existing assets. When to borrow from banks, when

to issue stocks or bonds, when to extend credit to a customer, and how

9

In learning finance, well managed company in financial side can be

used for fulfill goal of the firm such as profit maximization and

maximization for shareholder wealth.

In companies, finance division is kind of important division

because it is measuring whether the company has health financial or not. It

can be measured by providing financial statement such as net income,

balance sheet, and cash flow.

Companies can raise fund through several ways and one of them is

by financial market.

3. Financial Market

Financial Market the place where financial assets are

exchanged. Although the existence of a financial market is not

necessary condition for the creation and exchange of a financial asset,

in most economies financial assets are created and subsequently traded

in some type of organized financial market structure (Fabozzi, J Frank

& Franco Modigliani : 2009)

They also considered that financial market can be classified in

10

a. First is according financial claim. The claims are traded in a

financial market may be either for a fixed dollar amount or a

residual amount.

b. Second way is according to the maturity of the claims. Financial

market for the short term financial assets called money market,

and the one for longer maturity financial assets is called the

capital market. The traditional cut off between short term and

long term is one year. A financial asset with a maturity of more

than one year is part of the capital market. Thus, the debt

market can be divided into debt instruments that are part of the

capital market, and those that are part of the capital market,

depending on the number years to maturity.

c. Third way to classify financial market is by whether the

financial claims are newly issued. The market for newly issued

financial asset is called the primary market. After a certain

period of time, the financial is bought and sold (i.e., exchanged

or traded) among investors. The market where this activities

takes place is referred to as the secondary market.

According to Roberto G. Medina(1988) Capital Market is that

portion of the financial market which deals with longer term loanable

funds, the money market in contrast deals with short term funds. The

11

time. Money market deal with short term fund which is for a year the

maturity date and capital market deal with long term maturity date

which is more than a year.

There, in financial market where the traded place for all

financial claims (securities). Financial claims could be divided into:

a. Financial Asset is claims for future payment by one economic unit

on another (Arthur J. keown : 2009). Financial asset serves

economic functions which is transfer funds from those parties who

have surplus funds to invest to those who needs funds to invest in

intangible assets. (Fabozzi, J Frank & Franco Modigliani : 2009)

b. Real Assets is tangible assets such as houses, equipment, and

inventories. ( Arthur J. keown : 2009).

One of company goal is raising fund and it can be done through

financial market. Let us take a look the flow of capital through the financial

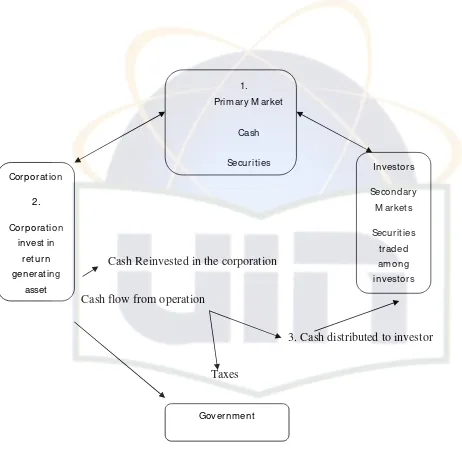

12

Cash Reinvested in the corporation

Cash flow from operation

3. Cash distributed to investor

Taxes

Figure 2.1 : Interaction of corporation and financial market

Figure above is explaining about relationship among government,

individuals, and corporation. Initially corporation raising funds in the

financial markets by selling securities. Corporation receives cash in return

for securities-stocks and debt. Corporation then invests this cash in

return-generating assets new projects for example and the cash flow from this

13

assets is then either reinvested in the corporation; given back to the

investors in the form of dividens or interest payments, or used to

repurchase stock, which cause the stock price to raise; or given to the

government in the form of tax payments. (Arthur J. Keown : 2009)

Table above, we can see the financial market elements just like

primary market and secondary market. A primary market is a market in

which new, as opposed to previously issued, securities are traded. Once

the newly issued stocks in the public’s hands. It then begin the trading

in the secondary market. Arthur J. Keown (2009:11). In primary

market, there is the trading of initial public offering begin.

4. Initial Public Offering (IPO)

Primary market which is the primary trading of claims, initial public offering of company also happen there.

According to Achleitner (2002 ; .242) Initial Public Offering (IPO)

means initial placing of enterprise’s shares on an organized capital

market.

According from Richard P. Kleeburg (2005) said that initial

public offering is the process many business owners go through in the

hope of becoming extremely wealthy. The IPO marks the beginning of

14

change the structure of the business, once the decision is made to sell

stock to the public.

It must be ascertained if an IPO is really the best strategy of the

company. In deciding whether going public is the right thing to do,

managers must weigh the benefits against and drawbacks. The most

appealing benefits and opportunities are these:

Enhanced financial condition

Increase in shareholder value

Diversification of current shareholders portfolios

Additional capital to perpetuate growth

Higher market value for the company

Improved opportunities for future financing

Greater potential for mergers and acquisition

Enhanced corporate image and increased employee

Stock exchange listing

While the drawbacks are:

Loss of company control

Sharing the company’s success

Loss of control over information

15 Extensive periodic reporting and accountability

Initial and continuing expense

Limits on major shareholder

New fiduciary responsibilities

Stocks are first issued to investors through what is known as the

primary or new issues market.

In Initial Public Offering (2005:30) According to (Alon Brav :1999)

Typically, companies are founded by one or few entrepreneurs and initially

held by a small number of investors. At some point the company decides to

raise capital by offering shares to the general public. This is known as an

initial public offering (IPO). The company may decide to raise more capital

through selling shares in the future. These subsequent offerings are called

seasoned equity offerings (SEO). IPOs and SEOs together form the equity

primary market. In most cases companies enlist the help of an investment

bank for conducting these offerings. The bank handles the distribution of

shares to investors. Sometimes they also provide companies with a

guarantee to sell a certain number of shares in exchange for a fee. Investors

purchase stocks for their returns. These returns come in the form of:

capital gains - the appreciation in value over time, and 3 dividends - most

companies pay periodic dividends. Investors will be reluctant to purchase a

16

stocks. This allows them to realize capital gains and to obtain liquidity

independently of the payout policy of the company. Provision of a resale

mechanism is the function of the stock exchange (also known as the

secondary market). Investors are able to buy and sell stocks through the

stock exchange. Investors trade between themselves on these exchanges.

The company is not a party to the transaction and receives no funds as a

result of these transactions. Conversely, investors can liquidate their

investments for consumption purchases without forcing the company to

liquidate investments. This feature of a secondary market is crucial for

economic development: companies can plan their investment policies

independently of the consumption patterns of their investors.

In Initial Public Offering (2005:29) a study of 1,526 IPOs from

1984-1995 performed by Charles J. Kaplan (1997) found that from opening

to close of the first trading day, IPOs produced an average return of 16.4

%. Kaplan also found that for three years after the IPO, for over 80% of the

stocks, the valuation underperformed market expectations. He concludes,

in fact, that on average an investor would have been ended up with only 83

cents compared to a dollar invested in the similar non IPO firms.

There is no formula or universal rule to determine whether a

company is sufficiently large, mature, or profitable to go public, but a

review of recent successful offerings illuminates some useful

17 a. Size

Underwriters have their own rules of thumb, based primarily on

revenue and net earnings, for what constitutes adequate company

size to support a public offering. Today, however, size is often

measured in terms of market capitalization or float.

If a company appears to lack the sales volume or the earnings to

support a successful public offering, there are other avenues to

explore. Management might look for another company in the same

industry that also is too small for an IPO. The result could be an

amalgamated company whose combined assets, earnings, and

management make a public offering feasible.

b. Growth

Underwriters and investors look for a consistent record of high

growth as well as demonstrated potential for continuing that growth

in the future. That means growth of 15 to 25 percent per year for the

next several years. Unless a company has that kind of momentum

going when it goes public, investor will turn to more promising

opportunities and offering may fizzle. An innovative product,

significant market share, or proven potential in a new market that is

part of an emerging industry all contribute to the company’s real

18 c. Profitability

Many companies that have successful IPOs have a track record of

stable revenue and earnings. In exceptional cases where companies

have excellent earnings trends lines, investors may trade off

prospects for exceptional growth and price appreciation for lower

risk and reliable dividend stream.

There are no hard-and-fast rules. Each company must evaluate its

present circumstances and its prospects, bearing in mind that few

elements in overall picture will impress the investor as much as

momentum. Nevertheless, every year, start-up companies in

“glamour” or “hot” industries go public. Many of these companies

have never posted a profit. Some have never even reported

revenues.

Although a positive trend line is optimal, it certainly is not always

necessary. Even mature companies with aberrations in their

earnings trends have successfully executed their IPO strategies,

particularly if the aberration was caused by some unusual, one-time,

or nonrecurring change that is unlikely to affect future operating

result. In the final analysis, the critical success factor is not

short-term earnings but the ability to sustain financial performance over

19 d. Management Capabilities

Underwriters and investors carefully consider size, growth, and

profitability in evaluating a company but weaknesses in any of

these areas will not necessarily preclude a public offering. The issue

on which underwriters and investors are most reluctant to

compromise is management strength. Strong management thus

translates into the most important intangible element in any IPO

investor confidence.

Senior executives must be painfully honest in analyzing whather

they can comfortably adjust to public scrutiny of their actions on

behalf of the company. Are they ready to cope with the inevitable

loss of freedom and privacy? Are they ready to admit outsiders to

the decision-making process? Do they have the leadership

capability to grow as the company grows?

Go Public is a public offering to sell the stock in stock

exchange, company has to fulfill these requirement:

a. Financial report has to be corrected by Public Accountant that has

been listed in Bapepam and get fair opinion without exception for

the last annual year

20

c. Compulsory to listing all stocks that has been fully stored, as long as

not contradict with provision about stock belonging presentation by

foreign investor.

d. Company has been established and operated minimal for 3 years

e. In the late two years, company get operating income and net income.

f. Has total wealth minimum 20 billion rupiah, own capital Rp 7.5

billion and stored capital minimum Rp 2 billion

g. Commissioner and directors of the company has to be in good

reputation

5. Financial Reporting

The prospectus for the company’s IPO generally include

audited financial statements for the previous three years, although that

requirement is reduced in certain circumstances, such as for small

business issuers under Regulation S-B. It also may require selected

financial information for the previous five years. These disclosure

requirements apply only for years the company has been existence.

(Kleburg P. Richard: 2005)

A company will not be allowed go public if its financial

statements have not been audited. Sometimes, two- or three-year audits

can be performed in anticipation of a public offering but these may

cause unforeseen delays and turn up unexpected adjustments to

21

Public companies are subject to certain SEC disclosure

requirements, such as specified data by industry segment. To prepare

for these disclosures, the company should fine-tune its financial

reporting system to provide the necessary data, which should in any

case be reviewed by the auditor. Many internal reporting system

already provide industry segment data in some form, but the method

they use may not correspond to the one prescribed by the SEC or by

Statement No. 14, “Segment Reporting” issued by the Financial

Accounting Standards Board (FASB). By making the necessary

changes in accounting practices early, the company can avoid the

inconvenience of having to implement then when they will distract

from the IPO, or, worse, having to delay the offering

A company also can run into problems if in the two three years

preceding a public offering, it acquires a significant business that saw

not previously audited. Because the financial statements of unaudited

subsidiaries affect the consolidated financial statements, and also

because of the SEC requirement of separate audited financial

statements for significant acquired companies, a company that makes

such an acquisition may not be able to go public until the needed audits

done. Any company that is planning a public offering of securities in

the next two or three years will want to keep SEC audit requirements in

22

Many private companies have annual audits even if they are not

otherwise required. This puts them in a position to go public on the

short notice. An audit improves the credibility and reliability of the

company’s financial statements and will help in dealings with external

lenders and suppliers and improve internal management.

Another benefit is that an independent auditor who is

knowledge-able about the business may come up with creative

solutions to the business needs of the company. These ideas, whether

communicated in personal meeting or in management letters, can lead

to cost-effective ways to improve internal controls. Effective and

timely internal financial reporting and a good system of internal

controls may be crucial for public companies but they are also highly

important for a private company.

In addition to their professional and advisory services, the

auditors will help determine whether the accounting practices used are

appropriate for a public company. Sometimes, SEC interpretations of

GAAP may necessitate a change in accounting practices and

disclosures by a company about to go public. Alternatively, companies

may desire to conform their accounting policies to those more

commonly used by other public companies in their industry and thereby

to enchance the value of the IPO. By making the necessary changes

23

public. Such changes may also have tax implications that need to be

taken into account.

Once the company is publicly held, the SEC sets limits in the

sale of “restricted” stock, generally shares issued in private placements

and shares held by controlling shareholders. Existing shareholders may

sell any portion of their holdings without technical restriction as part of

the IPO the only “restriction” then is a practical concern that the

offering not be perceived as a bailout of existing shareholders.

However, if one of the goals of the public offering is to make shares of

controlling shareholders salable in aftermarket advance planning can

reduce the impact of these SEC restriction (Hensler, Rutherford and

Springer, 1997) put in initial public offering by Richard P. Kleeburg

(2005: 35)

Initial public offering pricing fixed based on agreement between

emittent company with underwriter. Important role of underwriter is

fixed the public offering price. For considering stock price fairness,

underwriter have to pay attention how big the basic of company power,

how much the demand of stocks that will be offered and how big the

power and weaknesses of market today. Underwriter have to set the fair

price for issuers and also attracted for investor (Dalton, 1993) put in

24

There are two things that need to get issuers attention in doing

public offering for the stocks, which is when the offering will be did

and in what price the stocks will be offered. Both factors determine the

succeed of issuers get the fund in capital market which signed with

selling all offered stocks (Shahaluddin Haikal, 1996)

Settlement of company stock price is a point that determine in

get the fund from stock public offering in initial market which is known

as (Initial Public Offering). In this step, company hasn’t have guidance

about beneficial capital market price for issuer or investor. Stock value

have to refer to the real company value and monetary value which

wished will be got from IPO based company capitalization. To

determine stock value, emission guarantor do earlier scoring which

usually compared with similar company emission which listed in stock

exchange. Rating will be done with deeper analysis of financing

projection of issuer candidate.

Stock price settlement in prospectus in huge amount that have

to paid by investor in stock offering time with using offering buying

form through appointed bank. Settled stock price in offering period is

the real amount that has to be paid by investor. If there is a differentiate

of stock price with the highest limit settled in offering, so there will be

25

Determination of initial price is a the most difficult matter for

issuer and issuer guarantor. If the price is too high, so the stocks wont

be fully sold out, otherwise if the price is too low, the share holder face

the possibility of loss.

Determination of initial stock price hasn’t done through supply

and demand mechanism which proceed through auction opening in

stock exchange, but done together between emission guarantor and

issuer trough negotiation process. Initial stock price valuation

theoretically can be measured with using these analyses:

a. Income approach

Stock intrinsic approach determined based on payback period from

stock infestation which determined using fairness ratio from capital

market and earnings per share which known with Price to Earnings

Ratio (PER), with this formulation:

PER: stock price: earning per share

In this appraisal model first issuer determine the wanted PER and

next multiply with EPS projection at that year.

b. Net Tangible Assets Approach (NTA)

In this approach, the value of stock determined by net asset

company divided of issuing shares. Net that recognized by listed

company in financial report or company balance sheet. NTA can be

26

total of liability divided the issuing stocks. Explanation of

intangible asset is capital asset that has no physical appearance and

the value dependant to the right in their holder.

For doing analytic and choosing stock there are two

approaching which are, Fundamental Approaching and Technical

Approaching.

a. Analytic Approaching

Technical analytic is a study about action market supported

by certain graphic. This analytic is made by seeing market

price, market fluctuation, also estimation with using pattern that

made by graphic and or mathematic calculating about past price

movement can be predict for the future price (Ahmad Rodoni,

2008:62).

b. Fundamental Approaching

This approaching is analytic which done toward that

company which related with prospectus and ability to get

profit which including three analytic steps, which are (1)

macro economy (2) industry and (3) company (Ahmad

Rodoni, 2008:70).

Fundamental analytic trying to estimate future stock

27

1) Estimating value of fundamental factors which

influencing future stock price.

2) Applied those variable relationship so get the

estimation stock price.

This model often called as share price forecasting model,

and often used in Securitas analytic (Suad Husnan, 2008:307).

Initial stock price settlement not merely measured by

calculation of fundamental data of a company and also considering

ability of capital market when general offering. Nonetheless initial

stock price settlement has to be encouraged with calculation of

issuer financial fundamental data.

Fundamental Factor :

a. Company Characteristic

According (Ahmad Rodoni, 2008:70) said that this analytic

aimed to see company situation for company aspect like company

financial condition, marketing condition, production and marketing.

1) Return on Assets (ROA). This ratio is used to measure

asset efficiencies that used by company to produce

profit. This ratio is calculated with dividing available net

28

2) Asset Turn Over (ATO). This ratio is used to show the

efficiency level of und using which restrained in asset.

This ratio is calculated with comparing between net

sales with company total asset.

3) Price to Earning Ratio (PER). This ratio is used to show

how big the investor gets per rupiah from reported

profit. This ratio is calculated with comparing between

stock price to earnings per share.

4) Market to book ratio (MBR). This ratio give indication

about how investor appreciate stocks of a company. This

ratio comparing between earning per share to book value

per share.

5) Price to Sales Ratio (PSR). This ratio is used to showing

how big investors want to pay per rupiah from reported

selling. This ratio comparing between market value of

total shares to selling.

b. Industry

This analytic is more specific and aim to see the relation of

industry to company, like the development of competitor.

Industry standard and market growth (Ahmad Rodoni, 2008:70)

Besides, there are some ratios which is publicized in

29

additional information in financial report: price to Earning Ratio

(PER), Price to Book Value (PBV), Dividend Payout, Dividend

yield, Current Ratio, Debt to Equity Ratio, Leverage Ratio, Gross

Profit Margin, operating Profit Margin, Net Profit Margin,

Inventory Turnover, Total Assets Turnover, Return on Investment

and Return on Equity.

According Sunariyah (1997; 85-100) for analyze stock price and infestation in stock can be used 2 approaching, which are

traditional approaching and modern port folio management.

Traditional approaching consist of 2 approaching which are

technical and fundamental approaching (this approaching is same as

one that explained by Suad Husnan). Modern portfolio approaching

pushed in exchange psychology aspect with hypothesis assumption

about exchange which is market efficient hypothesis. Efficient

market means that stock prices reflecting whole information in

exchange. This approaching needs accurate analysis, therefore

needs framework. Framework is an analysis step that has to be done

systematically which consists of 3 analysis steps which are:

a. Economic analysis

Economic analysis aiming to know the kind also business

30

company profit. If economic growth of a country is low,

generally achieved profit of a company also low. In economic

analysis many variables has macro characteristic like: national

income, monetary policy and fiscal, interest rate and etc.

b. Industry Analysis

In Industry analysis we have to know the strengths and

weaknesses of relevant economy. Adequate knowledge about

industry dynamic from relevant company will help analyst or

investor in doing industry analysis. The referred of company

analysis is group of homogenous company.

c. Company analysis (issuer)

The proposed company analysis to knowing the company

performance. Investor needs relevant information about company as

a basic invest decision. That information include external and

internal information of a company, which are information about

financial period in a certain period. Besides, solvency can be

analyzed, profitability and liquidity of a company. Other important

information is expected information about financial projection or

forecasting. Reminds that information necessity based on

consideration that stock price determined by past company

31 6. Financial Ratios

According to Chunhui Liu and Grace O’Farrell (2009;5) Ratio analysis is an integral part of the analysis of financial statements, which

is a critical step before makin g any foreign investment (Reuvid & Li,

2000), because it quantifies a company’s performance in many aspects

such as the company’s ability to make a profit (profitability), ability to

pay off debts due within a year (liquidity), ability to pay off debts due

after a year (solvency or stability), and the ability to manage financial

resources (activity or efficiency).

According to Mas’ud Machfoedz (1994;12) there are nine financial

ratios those can be used to predict future profit significantly.

Those nine ratios are:

a. Cash flow to current liabilities

Is a measurement of a company’s ability to cover current

liabilities. A value of one would indicate the company can cover its

current liabilities with cash flow and as a “rule of thumb” a value of

one over desired. If the operation cash flow to current liabilities

ratio keeps increasing, it may indicate the cash inflows are

increasing and needs to be invested. The operation of cash flow to

32

analysis spreadsheets highlighted in the left column which provide

formulas, calculation, charts and explanation of each ratio.

The formula is:

CCFL = × 100 %

b. Net Worth and Total Liabilities to fixed assets (NWTLFA)

In business, net worth (sometimes called net assets) is the

total assets minus total outside liabilities of an individual or a

company. For a company this is called shareholders preference and

maybe referred to as book value. Net worth is stated as at a

particular year in time. In the case of an individual, the term estate

is used in relation to decease individuals in probate. For businesses,

the term is used in the context of fraudulent law and on the

dissolution of the company. In personal finance, net worth (or

wealth) refers to an individual’s net economic position; similarly, it

uses the value of all assets (long term assets) minus the value of all

liabilities

NWTLFA = × 100 %

c. Gross Profit to Sales (GPS)

In accounting, gross profit or sales profit is the difference

33

service , before deducting overhead, payroll, taxation and interest

payment. This ratio shows the portion of profit which get from the

selling effort. Bigger the ratio, so the profit would be higher from

the sold effort.

GPS = × 100 %

d. Net Income to Sales (NIS)

This ratio shows the portion of net profit which get from

company’s sells. Higher the ratio is, bigger the net profit which got

from the sales.

NIS = × 100 %

e. Operating Income to Total Liabilities (OITL)

This ratio shows profit portion of a company to the total

liability. Higher the ratio is, the profit that comes from main

business company to the liability also higher.

OITL = × 100

f. Net Worth to Sales (NWS)

This ratio shows profit portion of their self capital for the sales

that happen in a company. Higher the ratio is, higher the net worth

to company sales.

34 g. Net Income to Total Liabilities (NITL)

This ratio shows the net profit portion to the total liabilities.

Higher the ratio is, higher the net profit that get from company total

liabilities.

NITL = × 100%

h. Net Income to Net Worth (NINW)

The ratio shows the net income portion to the net worth. Higher

the ratio is, the expectation of owner to get profit also higher.

NINW = × 100 %

i. Net Worth to Total Liabilities (NWTL)

This ratio shows the portion of company owner importance to

total liabilities of third parties. Higher the ratio is, the portion of net

worth could be higher.

NWTL = × 100%

Financial ratios have some usefulness in predicting the company situation.

Which are:

a. Comparison Performance

Financial ratio can be used as in two different but equally

useful ways. You can use them to examine the current

35

time, from the prior quarter to years ago. Frequently, this can

help you to identify problems that need fixing. Even better, it

can direct your attention to potential problems that can be

avoided. In addition, you can use these ratios to compare the

performance of your company against that of your competitors

or other members of your industries (ziosbank 1999:5).

b. Risk and Return Investment

As financial ratios are used extensively in the corporate

financial reports, it is now a common understanding that if

corporate financial reporting is to be adequately supportive of

investment decision making, then clearly it must provide

information useful to the information of risk and return

investment (farelly, et al.,1985) taken from Richard P. Kleeburg

(2005:25).

In Richard P. Kleeburg (2005:12) there is a statement

from (Ritter (1991), and Loughran and Ritter (1995)said that

firms conducting initial and seasoned equity offerings have

historically experienced relatively low long-run equity returns.

Additionally, these returns covary with firm characteristics such

as size and book-to-market (Brav and Gompers (1997) and

36

phenomena have been offered. The first is predicated on

rational investor behavior and argues that the low average

returns are commensurate with the issuing firms’ risk

characteristics, as captured, for example, by size and

book-to-market. The second argues that firms are able to time their

equity offerings and raise capital by selling overvalued equity.

Thus, the poor long-term performance of the equity issues

reflects the gradual correction of asset prices to their true

fundamental value and any correlation with firm characteristics

is more indicative of security mispricing, as opposed to

additional dimensions of systematic risk.

Firms conducting initial and seasoned equity offerings

have historically experienced relatively low long-run equity

returns. To date, there is lack of consensus as to whether low

average returns are due to mispricing or that these returns

rationally reflect the risk characteristics of the issuing firms. By

examining how institutional lenders perceive the risk of issuing

and non-issuing firms we are able to shed new light on this

issue. We have examined how institutional lenders perceive the

risk of equity-issuing firms relative to non-issuing firms by

focusing on the pricing and contract structure of loans to these

37

otherwise similar non-issuing firms face comparable yields on

their loans, even after adjusting for default risk and accounting

for potential endogeneity between the various components of

the loan contract. (Alon Brav : 2006)

c. Earning Change

In Mujeeb-u-Rehman-Bhayo (2011:2) there is a statement

from Jordan et al. (2009) and Ou and Penmen (1989) found that

a larger proportion of the variation in E/P ratios among

companies is explained by traditional financial statement ratios.

Published financial statements are a principal source of

firm-specific information concerning the result of a firm‟s

wealth creating activities (i.e., sales, production, investment and

financing activities). These financial statements present

extensive and low-cost information that assists external

monitoring by outside stakeholders such as shareholders and

banks, and provide a foundation for various contractual

arrangements such as private lending agreements and

employment contracts.

d. Future Earning

The stock price and the earnings per share determine the

value of the ratio. P/E increases when investors are willing to

38

P/E also grows when both the stock price and the earnings per

share increase, however, the increase of stock price must be

sharper than the increase in the earnings per share. Another

scenario of increasing P/E take place, when stock price remain

stable despite there is a decrease in the earnings per share. The

price earnings ratio does not change when there is a balance

between the growth of the stock price and the earnings per

share. (Marian Vorek :2009)

e. Company Failure or Bankruptcy

Bankrupt firms has indicated their worse financial

position for a considerable time before they actually went

bankrupt It is widely believed that profitability and liquidity

ratios can predict bankruptcy to a certain extent I also proved

that the Japanese bankrupt firms had indicated their worse

financial position for a considerable time before they actually

went bankrupt (Cindy Yoshiko Shirata: 1998)

"Failure" is defined as the inability of a firm to pay its

financial obligations as they mature. Operationally, a firm is

said to have failed when any of the following events have

occurred: bankruptcy, bond default, an overdrawn bank

39

A "financial ratio" is a quotient of two numbers, where both

numbers consist of financial statement items. A third term,

predictive ability, also requires explanation but cannot be

defined briefly. The emphasis upon financial ratios does not

imply that ratios are the only predictors of failure. The primary

concern is not with predictors of failure per se but rather with

financial ratios as predictors of important events-one of which is

failure of the firm. Further, the primary concern is not with the

ratios as a form of presenting financial-statement data but rather

with the underlying predictive ability of the financial statements

themselves. The ultimate motivation is to provide an empirical

verification of the usefulness (i.e., the predictive ability) of

accounting data (i.e., financial statements) (William H. Beaver :

1966)

The next task was to identify those firms in Moody's that

had failed during the time period being studied (1954 to 1964,

inclusive). In the front of Moody's there appears a list of

firms-firms on whom Moody's has formerly reported but no longer

does so. There are many reasons why a firm; may be

dropped-name change, merger, liquidation, lack of public interest, and,

most importantly, failure. The list of several thousand names

40

Supplementing this basic list was a list of bankrupt firms

provided by Dun and Brad- street. The final list of failed firms

contained 79 firms on which financial- statement data could be

obtained for the first year before failure (William H. Beaver :

1966)

f. Offering Price

Once we control for IPO fundamentals (such as, income,

sales, book equity, growth opportunities, insider retention, and

investment banker prestige) and allow for different valuation of

these fundamentals across different time-periods,average

valuations of IPOs in the recent boom and crash periods were

not statistically different from those of the late 1980s. A naïve

interpretation of this result would be that valuations of the IPOs

in the late nineties were not excessive compared to the late

eighties. We would caution against such an interpretation, since

we find that fundamentals, especially income and sales, were

valued quite differently in the late nineties.

7. Previous Research

Liquidities ratioattempts to measure a company’s ability to pay off

its short term liabilities the better as it is a clear signal that a company can

pay its debt that are coming due in the near future and fund still in its

41

should rise a red flag for investor as it may be a sign that a company will

have difficulty meeting in running its operations, as well as meeting its

obligations.(investopedia 2010;2)

Lubika Lesakova (2007;3) management wants to increase its ROE,

and we have presented three important levers of financial performance:

profit margin, asset turn over, and financial leverage. We concluded that

whether company is a big one or small one, careful management of these

levers is a challenging managerial task, involving an understanding of the

nature of the company’s business and the interdependencies among the

levers.

Lubika Lesakova (2007;3) thought ratio analysis can provide useful

information concerning a company’s operations and financial condition, it

has some limitations. Potential problem are listed below:

a. Many large firms operate a number of different activities in quite

different industries, and in such cases it is difficult to develop a

meaningful set of industry averages for comparative purposes. This

tend to make ratio analysis more useful for small, narrowly-focused

firms than for large, multidivisional firms.

b. Most firms want to be better than average (although half will be above

42

necessarily good. As a target for high level performance, it is preferable

to look at the industry leaders ratio.

c. Inflation can badly distort firms balance sheet –recorded values are

often substantially

An initial public offering (IPO), referred to simply as an “offering” or

flotation”, is when a company (called the issuer) issues common stock or

shares to the public for the first time. They are often issued by smaller,

younger companies seeking capital to expand, but can also be done by large

privately owned companies looking to become publicly traded

(Wikipedia:2010).

Current profitability and cash flow realizations provide information

about the firm’s ability to generate funds internally. Given the poor historical

earning performance of value firms, any firm currently generating positive

cash flow or profits is demonstrating capacity to generate funds through

operating activities. Relationship between earning and cash flow levels is also

considered, earnings driven by positive accrual adjustment is a bad signal

about future profitability and returns. (Sloan:1996)

Sanjai Bhagat and Srinivangans Rangan (2001:8) there are statement

from Kim and Ritter (1999), hereafter KR, investigate the relation between

43

sample of 190 IPOs completed in the years 1992-1993. KR document that

firm-level and industry-level PE ratios are positively related, but that the

adjusted R2 of their regression is only five percent. Their model’s explanatory

power improves when they consider forecast earnings for the next year instead

of pre-IPO historical earnings. They conclude that industry comparables based

on historical accounting information are of limited value for understanding

IPO pricing.

In Sanjai Bhagat and Srinivangans Rangan (2001:9) there are statement

from Beatty, Riffe, and Thompson (2000), hereafter BRT, question KR’s

conclusion regarding the low relevance of historical accounting information in

the pricing of IPOs. Because KR use only industry multiples in their

regression, their model captures only time and industry variation in pricing

relations and thus does not speak to the value relevance of firm-specific

accounting information. Using a sample of 2,577 IPOs with positive pre-IPO

income and positive book value of equity from the years 1987-1998, they

document that the explanatory power of earnings, book value, and revenues for

offer value is about fourteen percent. Also, they find that when all the variables

in their model are deflated by book value of equity or sales or when all

variables are log-transformed, the model’s explanatory power ranges from

sixty percent to ninety percent.

In Sanjai Bhagat and Srinivangans Rangan (2003:10) there is a

44

years 1997-1999 whose pre-income book value of equity is positive and

income before non-recurring items is negative. Using a logarithmic

specification, he finds that IPO valuation (based on offer price and first-day

closing price) is positively and linearly related to the pre-income book value of

equity, but negatively and concavely related to income before non-recurring

items. Consistent with the argument that large R&D and marketing costs are

intangible assets and not period expenses, he documents that offer values are

increasing and concave in R&D and marketing costs. Further, IPO values are

unrelated to sales and cost of goods sold expenses.

In Sanjai Bhagat and Srinivangans Rangan (2003:8) there are statement

from Bartov, Mohanram, and Seethamraju (2002), hereafter BMS, focus on the

valuation of 98 internet IPOs and 98 offer-date and size-matched non-internet

IPOs that were completed during 1996-1999. Their conclusions are based on

per share regressions. For internet IPOs, they find that cash flows, sales, and

sales growth are significantly related to offer prices (at the filing date and at

the offer date). In contrast, earnings, book value of equity, and R&D per share

do not bear a significant relation to offer prices. 7 When they consider first-day

closing prices, they find that, with the exception of sales growth and R&D per

share, investors do not value the financial statement variables reported by

internet firms.

In Wan Nordin Wan Husen journal (2006:4) there is study from

45

countries, higher cash flow rights attached to the largest controlling

shareholders are associated with a higher market valuation, measured by the

market-to-book ratio of assets. In contrast, higher control rights are associated

with a lower valuation. Furthermore, a large wedge between cash flow rights

and control rights leads to value losses.7 In sum, the results suggest that (1)

there is a positive incentive effect associated with high cash flow rights in the

hands of the controlling shareholders and (2) the risk of expropriation is

particularly severe when the discrepancy between cash flow rights and control

rights is high. When the sample is segmented based on the types of ultimate

owner (family-controlled, statecontrolled, widely held financial institution or

widely held corporation), the results on expropriation are found to be strongest

for family owned companies, moderate for state–controlled companies and

46

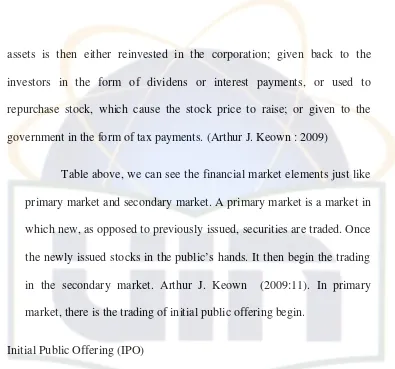

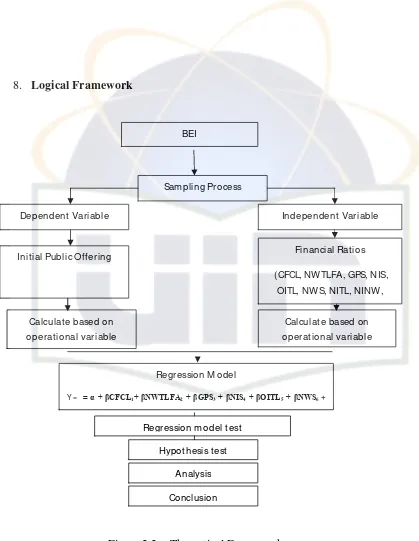

8. Logical Framework

Figure 2.2 : Theoretical Framework

Sam pling Process

Dependent Variable Independent Variable

Init ial Public Offering Financial Rat ios (CFCL, NWTLFA, GPS, NIS,

OITL, NWS, NITL, NINW, NWTL)

Calculat e based on operat ional variable

Calculat e based on operat ional variable

Regression M odel

Y = = α + βCFCL1+ βNWTLFA2+ βGPS3+ βNIS4+ βOITL5+ βNWS6 +

Regression m odel t est Hypot hesis t est

Analysis Conclusion

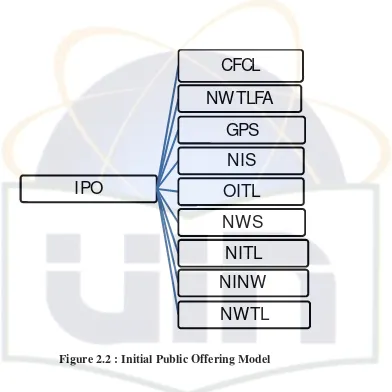

47 Figure 2.2 : Initial Public Offering Model

IPO

CFCL

NWTLFA

GPS

NIS

OITL

NWS

NITL

NINW

48 9. Hypothesis

Hypothesis have been developed for this study based on dependent and

independent variables are given below:

H1: Cash Flow to Current Liabilities has an influence toward Initial

Public Offering

H0 : Cash Flow to Current Liabilities doesn’t have an influence

toward Initial Public Offering

H2: Net Worth and Total Liabilities to fixed Asset has an influence

toward Initial Public Offering

H0 : Net Worth and Total Liabilities to fixed Asset doesn’t have an

influence toward Initial Public Offering

H3: Gross Profit to Sales has an influence toward Initial Public

Offering

H0 : Gross Profit to Sales doesn’t hav an influence toward Initial

Public Offering

H4: Net Income to Sales has an influence toward Initial Public

Offering

H0 : Net Income to Sales doesn’t have an influence toward Initial

49

H5: Operating Income to Total Liabilities has an influence toward

Initial Public Offering

H0 : Operating Income to Total Liabilities doesn’t have an influence

toward Initial Public Offering

H6: Net Worth to Sales has an influence toward Initial Public

Offering

H0 : Net Worth to Sales doesn’t have an influence toward Initial

Public Offering

H7: Net Income to total Liabilities has an influence toward Initial

Public Offering

H0 : Net Income to total Liabilities doesn’t have an influence

toward Initial Public Offering

H8: Net Income to Net Worth has an influence toward Initial Public

Offering

H0 : Net Income to Net Worth doesn’t have an influence toward

Initial Public Offering

H9: Net Worth to Total Liabilities has an influence toward Initial

Public Offering

H0 : Net Worth to Total Liabilities doesn’t have an influence toward

50 CHAPTER III

METHODOLOGY

A. Data Collection Method

A type of data used is secondary data. Data is used in this study

were obtained from financial report those gotten from Indonesia Stock

Exchange.

B. Research Scope

This research is quantitative data used are secondary data. The

sample used was data from the initial public offering (Y), and financial

ratios (X) with sub variables are Cash Flow to Current Liabilities (X1) ,

Net Worth and Total Liabilities to Fixed Assets (X2), Gross Profit to Sales

(X3), Net Income to Sales (X4), Operating Income to Total Liabilities

(X5), Net Worth to Sales (X6), Net Income to Total Liabilities (X7), Net

Income to Net Worth (X8) and Net Worth to Total Liabilities (X9).

In this research will be used ratio that was used by previous

research (Mas’ud Machfoedz) which 9 ratios where the ratios have

significant influence to predict company future profit. Those ratios are

Total Go Public company that listed in Stock exchange Jakarta are 422