THE INFLUENCE OF SERVICE QUALITY TOWARD CUSTOMER SATISFACTION

(Case Study of Mandiri Syariah Bank)

Thesis

Submitted to Faculty of Economics and Businesses

To meet the Requirements in Achieving Degree of Bachelor of Economics

Submitted By:

Audita Arfanda NIM: 605082000027

INTERNATIONAL CLASS PROGRAM MANAGEMENT DEPARTMENT

FACULTY OF ECONOMICS AND SOCIAL SCIENCES UNIVERSITAS ISLAM NEGERI SYARIF HIDAYATULLAH

THE INFLUENCE OF SERVICE QUALITY TOWARD CUSTOMER SATISFACTION

(Case Study of Mandiri Syariah Bank)

Thesis

Submitted to Faculty of Economics and Businesses

To meet the Requirements in Achieving Degree of Bachelor of Economics

Submitted by:

Audita Arfanda NIM: 605082000027

Under Supervison of

Academic Supervisor I Academic Supervisor II

i

Prof. Dr. Ahmad Rodoni Arief Mufraini, LC, M.si

NIP: 19690203200112.1.003 NIP: 197701222003121001

INTERNATIONAL CLASS PROGRAM MANAGEMENT DEPARTMENT

FACULTY OF ECONOMICS AND SOCIAL SCIENCES UNIVERSITAS ISLAM NEGERI SYARIF HIDAYATULLAH

Today, we administered a comphresive examination to Audita Arfanda, ID

605082000027. The title of his thesis is “The Influence of Service Quality Toward

Customer Satisfaction (Case Study of Mandiri Syariah Bank)”. After proper examination,

we have decided that he has met all of the requirements for the title of Bachelor of

Economics on the field of Management, State Islamic University Syarif Hidayatullah

Jakarta.

Jakarta, June 29th, 2009

Comprehensive Examination Team

Examiner I Examiner II

ii

Prof. Dr. Abdul Hamid, MS Prof. Dr. Ahmad Rodoni NIP: 19570617198503.1.002 NIP: 19690203200112.1.003

Examiner III

THE INFLUENCE OF SERVICE QUALITY TOWARD CUSTOMER SATISFACTION

(Case Study of Mandiri Syariah Bank)

Thesis

Submitted to Faculty of Economics and Businesses

To meet the Requirements in Achieving Degree of Bachelor of Economics

Submitted by:

Audita Arfanda NIM: 605082000027

Under Supervison of

Academic Supervisor I

Prof. Dr. Ahmad Rodoni NIP. 19690203200112.1.003

Academic Supervisor II

M. Arief Mufraini, Lc., M.Si NIP. 197701222003121001

Expert Examiner I

Prof. Dr. Abdul Hamid, MS NIP. 19570617198503.1.002

Expert Examiner II

Cut Erika Ananda Fatimah, SE., MBA

INTERNATIONAL CLASS PROGRAM MANAGEMENT DEPARTMENT

FACULTY OF ECONOMICS AND SOCIAL SCIENCES UNIVERSITAS ISLAM NEGERI SYARIF HIDAYATULLAH

JAKARTA 1431 H / 2010 M

iii

iv

AUTO BIOGRAPHY

1. PERSONAL INFORMATION

Name : Audita Arfanda

Place/Date of Birth : Bekasi, September 13rd , 1987

Religion : Islam

Nationality : Indonesia

Address : Jl. Sejahtera No. 39 RT/RT 03/003

Kel/Kec Jatiwaringin, Pondok Gede, Jawa Barat, 17411

Phone Number : 021 8487438

E-mail : auditwidjojo@gmail.com

2. FORMAL EDUCATION

1993 - 1999 : Assyafiiyah Elementary School,Jatiwaringin, West Java

1999 - 2002 : Putra I Junior High School, Kalimalang, East Jakarta

2002 - 2005 : Dwiwarna Boarding School, Parung, Bogor

2005 - 2010 : Faculty of Economics and Business, Major in Management

State Islamic University Syarif Hidayatullah Jakarta

2007 - 2009 : College of Business, Bachelor of International Business

Management, Dual Degree Programme, Universiti Utara

Malaysia (UUM)

2009 - Present : College of Business, Master of Human Resource Management

v

3. INFORMAL EDUCATION

2006 - 2007 : Brevet A & B Tax Accounting, FISIP, University of Indonesia

2009 : Entrepreneurship Skill, College of Business,

Universiti Utara Malaysia

2010 : Occupational Safety & Health Management System

vi

ABSTRAK

Penelitian ini dilakukan untuk menganalisis pengaruh service quality terhadap customer satisfaction diindustri perbankan syariah. Penggunaan model SERVQUAL terdiri dari enam dimensi : tangibles, responsiveness, assurance, dan empathy dengan menambahkan dimensi compliance untuk mengukur service quality di bank. Responden penelitian sebesar 120 nasabah yang memiliki rekening dibank syariah. Responden penelitian adalah nasabah yang memiliki rekening bank syariah dan memiliki rekening konvensional. Analisis data yang digunakan dalam penelitian ini uji instrument yang terdiri dari uji validitas dan reliabilitas. Untuk pengujian hipotesis menggunakan metode regresi sederhana untuk menganalisis enam dimensi : tangibles, responsiveness, assurance, dan empathy dengan menambahkan dimensi compliance untuk melihat pengaruhnya terhadap service quality di bank. Hasil penelitian secara keseluruhan menunjukkan bahwa secara keseluruhan dimensi dari service quality berpengaruh terhadap customer satisfaction.

vii

ABSTRACT

This study attempts to examine the relationship between service quality perception and customers’ satisfaction in Indonesian Islamic banking This model starts with SERVQUAL measurement scales consisting of six dimensional structures: tangibles, reliability, responsiveness, assurance, and empathy, and plus the compliance dimensions to measure Indonesian Islamic banking service quality.Respondents are from 120 customers who visit the bank counters. They must have an account with one of the full-fledged Islamic banking and dual-banking systems. The results showed that the majority of the Islamic banking customers were satisfied with the overall service quality provided by their banks. The data analysis used instrument test consists of validity and reliability test. For the hypothesis testing used simple regression tests to analyzed six dimensional structures: tangibles, reliability, responsiveness, assurance, and empathy, and plus the compliance dimensions toward service quality. The findings suggest that the standard model of Islamic banking service quality dimensions should consist of the six dimensions and good determinants of satisfaction. The relationship between service quality and customer satisfaction was significant.

viii

PREFACE

Bismillahirrohmanirrohim

By praising Thank Heavens to Allah that showered divine guidance, the hidayah and

inayah so writer can finish the task of Thesis that be entitle “The Influence of Service Quality Toward Customer Satisfaction (Case Study of Mandiri Syariah Bank)”.

Shalawat and greetings it is hoped was showered to Rasulullah SAW as well as the

family, the friends but also anyone who followed the steps and his guidance.

In an effort to this Thesis there are many obstacles and the barriers as well as the

difficulty that the writer faced. To face this difficulty, the writer received much good help of

morale and material that are so valuable, the guidance and facilities that really were needed.

Especially to my parents that never tired gave the affection and their support took the form of

the prayer, morale and material to the writer towards the compilation of this Thesis.

In making this thesis, the writer was not alone but I was supported and taught by many

parties. In this opportunity, the writer would like to say my huge thankful to:

1. Prof. Ahmad Rodoni as the Thesis Supervisor 1 and as the Assistant Dean of

Academic Faculty of Economics and Business, State Islamic University Syarif

Hidayatullah Jakarta, that sincerely gave time to give the guidance that were useful

for the compilation of this Thesis.

2. Arief Mufraini, LC, M.SI as the Thesis Supervisor 2 and as the Technical

Coordinator of International Faculty of Economic and Business, State Islamic

University Syarif Hidayatullah Jakarta that sincerely gave time to give the

ix

3. Prof. Abdul Hamid MS as a Dean of Faculty of Economic and Business, State

Islamic University, Jakarta.

4. My lecturer who often performed an educational service the writer with various

science sorts while joining lectures as well as the staff Faculty of Economic and

Business, State of Islamic University Syarif Hidayatullah Jakarta.

5. My lovely parents, Dr. Adi S. Widjojo, MM, MBA and Mrs Untari Susilowati who

gave the support and become the source of the motivation, was most main

valuable. I realize that I could be nothing without their prayer to Allah SWT,

especially to my mother for her time every midnight, doing prayer to his children

and my family in general.

6. My brother and sister, Advan Adrianda and Armita Athennia who helped both

from the aspect of morale and material in this thesis process.

7. My cousins, Mas Eri Wirandana and Mas Jay zay. Thanks for the times and energy

to accompany and assist the writer to finish this thesis.

At the end, the writer Expects for any critics as well as suggestions that could improve

the content of this thesis. Hopefully this thesis could be worthwhile for all of us. Amien.

Thank you.

Wassalamualaikum Warrahmatullahi Wabarrokatuh.

Jakarta, October 2010

x

TABLE OF CONTENTS

Page of Thesis Approval ... i

Page of Comprehension Test ... ii

Page of Thesis Comprehension Test ... iii

Auto Biography ... iv

Abstrak ... vi

Abstract ... vii

Preface ... viii

Table of Contents ... x

List of Table ... xii

List of Figure ... xiv

List of Appendix ... xv

Chapter I INTRODUCTION A. Background ... 1

B. Problem Formulation ... 5

C. Research Objective and Purpose ... 6

Chapter II LITERATURE REVIEW A. Islamic Banking ... 7

B. Service Quality Concept ... 15

C. Service Quality Attributes of Retail Banking ... 17

D. Customer Satisfaction ... 21

E. The Effect of Satisfied and Dissatisfied Customer ... 23

F. Measuring Customer Satisfaction ... 25

G. Customer Satisfaction Measurement Advantages ... 27

H. Consideration Framework ... 29

xi

Chapter III RESEARCH METHOD

A. Research Scope ... 33

B. Sampling Method ... 34

C. Population Research ... 34

D. Data Collection Method ... 35

E. Analysis Method ... 35

E.1 Validity Analysis ... 36

E.2 Reliability ... 37

F. Operationalization Variable ... 37

Chapter IV ANALYSIS A. Responden Characteristics ... 41

B. Instrument Test ... 46

C. Descriptive Statistics ... 52

D. Hypothesis Testing ... 66

Chapter V CONCLUCION AND IMPLICATION A. Conclusion ... 69

B. Implication ... 69

C. Limitation ... 70

D. Recommendation ... 71

REFERENCES ... 72

xii

LIST OF TABLES

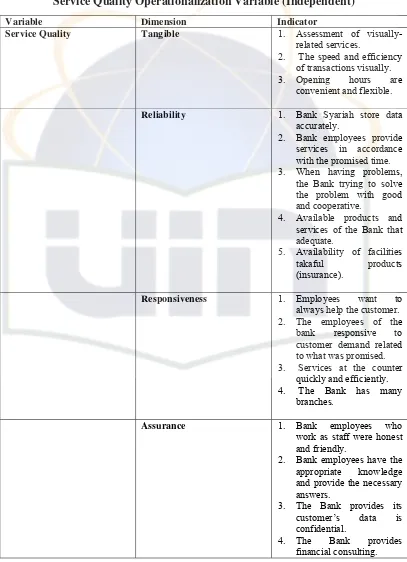

Table 3.1 Service Quality Operationalization Variable ... ... 39

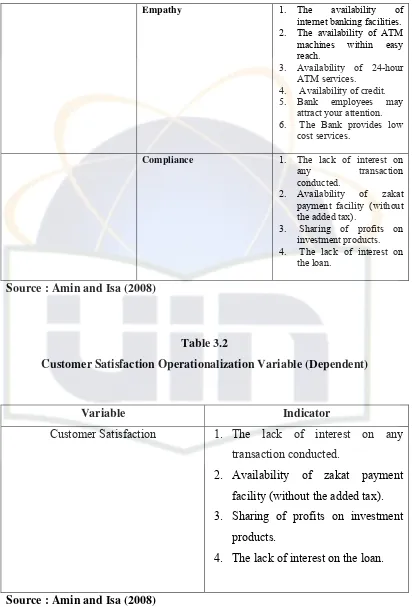

Table 3.2 Customer Satisfaction Operationalization Variable ... ... 40

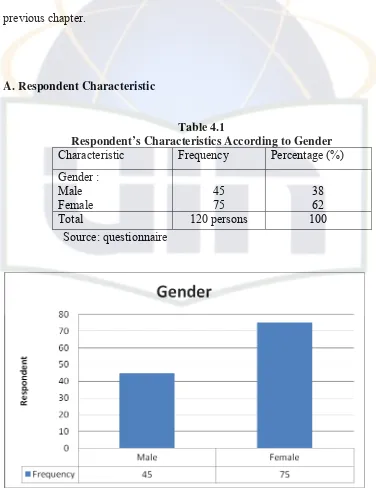

Table 4.1 Respondent’s Characteristics According to Gender ... 41

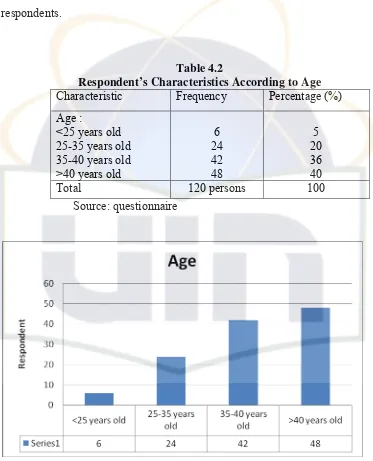

Table 4.2 Respondent’s Characteristics According to Age ... 42

Table 4.3 Respondent’s Characteristics According to Education ... 43

Table 4.4 Respondent’s Characteristics According to Occupation ... 44

Table 4.5 Respondent’s Characteristics According to Income ... 45

Table 4.6 Validity Test of Tangible ... 47

Table 4.7 Validity Test of Reliability ... 47

Table 4.8 Validity Test of Responsiveness ... 48

Table 4.9 Validity Test of Assurance ... 48

Table 4.10 Validity Test of Empathy ... 49

Table 4.11 Validity Test of Compliance ... 50

Table 4.12 Validity Test of Customer Satisfaction ... 50

Table 4.13 Reliability Test ... 52

Table 4.14 Descriptive Statistic of Tangible, Reliability, Responsiveness, Assurance, Empathy, Compliance, and Customer Satisfaction ... 53

Tabel 4.15 Descriptive Statistic Tangible ... 55

Tabel 4.16 Descriptive Statistic Reliability ... 57

Tabel 4.17 Descriptive Statistic Responsiveness ... 59

Tabel 4.18 Descriptive Statistic Assurance ... 60

Tabel 4.19 Descriptive Statistic Empathy ... 62

xiii

xiv

LIST OF FIGURE

xv

LIST OF APPENDIX

Number Explanation Page

1 Questionnaire……….. 75

2 Validity Test ……… 83

3 Reliability Test ……… 87

4 Descriptive Statistic Test ……… 88

CHAPTER I INTRODUCTION

A. Background

Islamic banking is a popular topic in Muslim countries. Islamic

banking has been established in more than 100 countries, with an

estimated $300 billion in assets that are increasing by 15 percent a year,

according to the Asian Banker (2005) a financial-services consultancy. In

Malaysia, where 60 percent of the population is Muslim, both Islamic

banks and conventional banks operate side by side (Karim and Affif,

2005).

In the last five years, the Islamic banks development in Indonesia

is phenomenal. The number of banks increased from only five banks ( two

Islamic Commercial Banks and three Islamic Banking Unit) in 2000 to 18

banks ( three Islamic Commercial Banks and 15 Islamic Banking Unit) by

the end of 2004. Assets grow by an average of 70% per year in the last five

years, namely from Rp 1,790 trillion to Rp 14,035 trillion by the end of

2004. Fund collected by the Islamic banks in Indonesia has reached Rp

10,559 trillion, while financing channelled by the Islamic banks reached

Rp 10,978 trillion, creating a finance to deposit ratio of 104,00 %. Another

important development of Islamic banks in Indonesia is the number of

branch and sub-branch offices. In 2000, the number of branch offices was

only 28, while in 2004 it has grown to 148.1 this does not include the

number of ATM (Automatic Teller Machines) that can be accessed by

Islamic bank customers ( Karim and Affif, 2005).

In 2005, the numbers of Islamic banks still increase significantly.

Following this growth is the increase of number of branch offices,

sub-branch offices, ATM, assets, and of course customers. Unfortunately,

studies’ regarding customers’ behavior of the Islamic banking customers

in Indonesia is still rare. Questions regarding: what is the public perception

of Islamic banks, why customers choose an Islamic bank for its financial

need, why customers choose a certain bank, why customers prefer a

certain Islamic bank, and what is customer’s knowledge on Islamic bank

products are so important but currently not fully understood yet. This lack

of consumer knowledge then creates the dilemma of Islamic banking in

Indonesia.

Service quality has become a main interest in the industrial world

especially in the service industries. The key to success in winning the

global competition now and in the future is to have high quality service.

High quality of service is believed to influence over customer value and

customer satisfaction. (Heskett et.al., 2007). Therefore, the importance of

service quality, value, and customer satisfaction seems justified to the

survival of service companies, including the banking companies. Many

empirical studies in various sectors of service industry such as banking,

hotel, insurance; long distance calls companies, workshops, car rental, and

other financial companies have been conducted to find out the factors that

determine service quality.

Service quality has always been the main study for retail banking

(Sureshchandar et.al., 2002) in today's very competitive environment in

which a lot of banks are available for customers to choose from. However,

we need to study further the factors that enable banks to attract and

maintain their customers. Banks seeking strong competitiveness in the

future need to develop new ideas to foster good relationships with their

retain customers.

The significant growth of banks has caused the appearance what is

called "buyer's market" in which the supply exceeds the demand. In this

condition, the customers are in strong bargaining position and therefore the

banks have to be more effective in providing services because customers

now have many choices in determining the bank they want. The customers'

need for excellent service keeps changing. The level of service quality

varies from time to time.

There is no guarantee that what is excellent service today is also

applicable for tomorrow. There is also the rapid change of the

retail-banking sector in the last 15 years with the increased application of the

technology in the service delivery. To win the battle of global competition

in the service industries and be able to survive, banks will need to use new

strategies in providing service that will satisfy their customers. This is the

reason why service marketing and bank marketing in particular keeps

developing and it is gaining the prominence in the marketing literature.

The interest in service marketing research on service quality and

customer satisfaction has grown recently. Hundred of studies have been

conducted by applying related theories and methods in the service

industry, especially in retail banking industry. Angur et al. (1999) tested

SERVQUAL and SERVPERF frameworks in the retail banking industry.

Avkiran (1994) has also proposed an instrument for measuring the quality

of banks' branches. Similarly, Bahia and Nantel (2000), Sureschandar and

colleagues (2002) developed a reliable and valid scale for measuring the

quality of retail banking services.

However, there are continuing demands for refining the theories

that are suitable to retail banking setting. One way to refine a theory is to

consider variables within the existing model that are potentially powerful

in predicting the dependent variable. For this reason, after Caruana (2002)

examined his model that links service quality to service loyalty via

customer satisfaction, he suggested the need to consider the role of

customer value and company image/reputation within the model.

Likewise, Cronin and his colleagues (2000) who assessed the

effects of quality, value and customer satisfaction on behavioral intentions

across multiple services industries (excluding banking industry) suggested

the need to include additional decision-making variables such as the

tangible quality of service products, the quality of service environment

(i.e. the servicescape), and customers' expectations. They also suggested

the need to conduct replication in another area.

This study attempts to examine the relationship between service

quality perception and customer’s satisfaction in Indonesian Islamic

banking by adapting and modifying SERVQUAL and CARTER scales

(Othman and Owen, 2002). This research is important in line with the

obvious cross-cultural and religious differences between these two key

customer segments. In the Indonesian context, there is a strategic

dimension that needs to be understood. The dichotomy between

conventional and Islamic Bank has traditionally been an invisible frontier

between ethnic groups in light of the role of religion in Indonesia. The

widespread use of Islamic banking by non-Muslim customers may indicate

that this invisible barrier can be crossed. That would bode well for the

Indonesian Government’s effort to promote national unity.

B. Problem Formulation

Business competition is much stretched force all bank or service company

to have business strategy in running business. Related in these things, so

the problem will be researches are:

Is there significant influence between service quality toward

customer satisfaction?

C. Research Objective and Purposes 1. Objective

The objective of this research is :

To analyze the influence of service quality toward customer

satisfaction

2. Usefulness of Research

a. For the researcher, to increase knowledge, especially

knowledge about the activity consumer in service quality

attribute and customer satisfaction. Also as the form of the

implementation on the theory and knowledge those were

received in the studying process.

b. For the student and the academic, as the addition of the

scientific reading material to become one of the sources of

knowledge towards the subject consumer behavior,

especially concerning the application consumer preference.

c. For Banking Industry

To be consider on improving the service quality of islamic

bank to develop and maintain customer satisfaction.

CHAPTER 2

Literature Review

This chapter presents the theoretical foundation, based on the literature

pertinent to the current research, by first reviewing the Islamic Banking concepts,

service quality concepts, followed by a critique of SERVQUAL, service quality

attributes, and service quality attributes of retail banking industry. Next, a review

of literature related to perceived value, and customer satisfaction is presented.

This is followed by a review of research conducted on customer satisfaction -

service quality relationship. Finally, the chapter will conclude with a presentation

of the contributions of this research to the service marketing literature, and the

presentation about the loyalty and the effect of service quality attributes on

customer satisfaction.

A. Islamic Banking

Islamic banking operates under Islamic commercial law, or

fiqh-al-muamalat, which deals with contracts and the legal ramifications of contracts.

Contracts may be categorized as valid, invalid, or void. The contract is the basis of

Islamic business and is the measure of a transaction’s validity. A contract also

means an engagement or agreement between two persons in a legally accepted,

meaningful, and binding manner.

Aqad is the Arabic term for contract and means a tie or a knot that binds

two parties together. The word aqad is also used in the sense of confirming an

oath. In legal terminology, aqad refers to a contract between two parties on a

particular matter, which is to be concluded upon the offer and the acceptance of

the parties concerned (Billah 2006).

The various forms of commercial contracts in Islam can be identified in

the Quran and in the jurisprudence of ancient and modern Islamic scholars. In

Islamic banking, contracts play an important role in ensuring transparency and

structuring transactions so that conformity with Islamic law is maintained. In

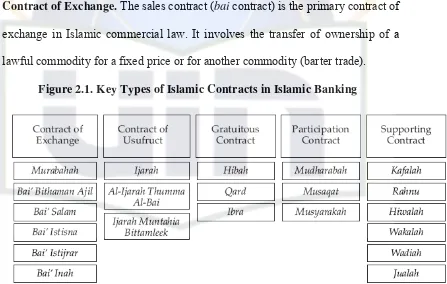

Islamic law, rules are prescribed for specific contracts as illustrated in Figure 2.1. Contract of Exchange. The sales contract (bai contract) is the primary contract of exchange in Islamic commercial law. It involves the transfer of ownership of a

lawful commodity for a fixed price or for another commodity (barter trade).

Figure 2.1. Key Types of Islamic Contracts in Islamic Banking

Source : Adawiah (2007)

Sales contracts are used extensively in Islamic banking and include the following:

• Murabahah contract (cost-plus-markup contract) involves the sale of

lawful goods at a price that includes an agreed-upon profit margin for the

bank (seller). It is mandatory for the bank to declare to the customer the

cost and profit. Payment can be, depending on the agreement between the

parties, spot or deferred.

• Bai’ bithaman ajil contract (deferred-payment sale) is a sale of goods on a

deferred-payment basis. The bank purchases an asset and sells it to the

customer at cost plus a profit margin agreed to by both parties. The bank is

not required to disclose the price and profit margin. Payments can be

monthly, quarterly, or semiannually.

• Bai’ salam contract (forward contract) refers to an agreement whereby

payment is made in advance for delivery of specified goods in the future.

The underlying asset does not exist at the time of the sale. This type of

contract is used in agricultural financing. Funds are advanced to farmers

who deliver their harvested crops to the bank to sell in the market.

• Bai’ istisna contract (supplier contract) is an agreement in which the price

of an asset is paid in advance but the asset is manufactured or otherwise

produced and delivered at a later date. This type of contract is typically

used in the manufacturing and construction sectors.

• Bai’ istijrar contract (also a type of supplier contract) refers to an

agreement between a purchaser and a supplier whereby the supplier agrees

to deliver a specified product on a periodic schedule at an agreed-upon

price rather than an agreed-upon mode of payment by the purchaser.

• Bai’ inah contract (sale and buyback contract) involves the sale and

buyback of an asset. The seller sells the asset on a cash basis, but the

purchaser buys back the asset at a price higher than the cash price on a

deferred basis. This type of contract is primarily used in Malaysia for cash

financing; it is also used for Islamic credit cards.

Contract of Usufruct. Usufruct contracts govern the legal right to use and profit or benefit from property that belongs to another person. The key usufruct

contracts in practice in Islamic banking are the following:

• Ijarah (leasing) refers to an arrangement in which a bank (the lessor)

leases equipment, a building, or other facilities to a client (the lessee) at an

agreedupon rental fee and for a specified duration. Ownership of the

equipment remains in the hands of the lessor.

• Al-ijarah thumma al-bai (leasing and subsequent purchase) is a type of

ijarah contract in combination with a bai (purchase) contract. Under the

terms of the ijarah (leasing) contract, the lessee leases the goods from the

owner, or lessor, at an agreed-upon rental fee for a specified period of

time. Upon expiry of the leasing period, the lessee enters into the bai

contract to purchase the goods from the lessor at an agreed-upon price.

This concept is similar to a hire/purchase contract or closed-end leasing as

practiced by conventional banks.

• Ijarah muntahia bittamleek (buyback leasing) involves an ijarah (leasing)

contract that includes a guarantee by the lessor to transfer the ownership in

the leased property to the lessee, either at the end of the term of the ijarah

period or by stages during the term of the contract.

Gratuitous Contracts. A gratuitous contract is entered into for a benevolent purpose, such as for making a charitable donation. The following are the

gratuitous contracts currently used by Islamic banks:

• Hibah refers to a gift awarded by a bank without any commensurate

exchange. For example, a bank gives hibah to a savings account holder as

a token of appreciation for keeping money in the account.

• Qard involves an interest-free loan that is extended as good will or on a

benevolent basis. The borrower is required to repay only the principal

amount of the loan. The borrower may choose to pay an extra amount,

however, as a token of appreciation for the lender. No extra payment over

the principal amount can be charged by the bank; any such extra charge is

considered riba (charged interest), which is prohibited under Islamic law.

These loans are intended for individual clients in financial distress.

• Ibra occurs when a bank withdraws its right to collect payment from a

borrower. The computation of ibra, a rebate, is based on the terms and

conditions set forth in the governing contract.

Participation Contracts. Shari’a, in order to promote risk-andreward sharing consistent with the principles of Islam, encourages wealth creation from

partnership arrangements that are governed by the following types of participation

contracts:

• Mudharabah (trust financing) is a partnership between a bank and a

customer in which the bank provides the capital for a project and the

customer or entrepreneur uses his or her expertise to manage the

investment. Profits arising from the investment are shared between the

bank and the entrepreneur on the basis of an agreed-upon profit-sharing

ratio. If the project results in a loss, it is borne solely by the bank.

• Musyarakah (partnership financing) refers to an investment partnership in

which all partners share in a project’s profits on the basis of a specified

ratio but losses are shared in proportion to the amount of capital invested.

All parties to the contract are entitled to participate in the management of

the investment, but they are not required to do so. A musyarakah

mutanaqisah (diminishing partnership) is an agreement in which the

customer (the partner of the bank) eventually becomes the complete and

sole owner of the investment for which the bank has provided the funds.

The profits generated by the investment are distributed to the bank on the

basis of its share of the profits and also a predetermined portion of the

customer’s profits. The payment of this portion of the customer’s share of

profits results in reducing the bank’s ownership in the investment.

• Musaqat, a form of musyarakah, refers to an arrangement between a

farmer, or garden owner, and a worker who agrees to water the garden and

perform other chores in support of a bountiful harvest. The harvest is

shared among all parties according to their respective contributions.

Supporting Contracts. The supporting contracts used in Islamic banking include the following:

• Kafalah contract (guaranteed contract) refers to a contract in which the

contracting party or any third party guarantees the performance of the

contract terms by the contracting party.

• Rahnu (collateralized financing) is an arrangement whereby a valuable

asset is placed as collateral for payment of an obligation. If the debtor fails

to make the payments specified in the contract, the creditor can dispose of

the asset to settle the debt. Any surplus after the settlement of the sale is

returned to the owner of the asset.

• Hiwalah (remittance) involves a transfer of funds/debt from the

depositor’s/ debtor’s account to the receiver’s/creditor’s account; a

commission may be charged for the service. This contract is used for

settling international accounts by book transfers. It obviates, to a large

extent, the necessity of a physical transfer of cash. Examples are a bill of

exchange and a promissory note.

• Wakalah (nominating another person to act) deals with a situation in which

a representative is appointed to undertake transactions on another person’s

behalf, usually for a fee.

• Wadiah contract (safekeeping contract) refers to a deposit of goods or

funds with a person who is not the owner for safekeeping purposes. This

type of contract is used for savings and current accounts in Islamic banks.

Because wadiah is a trust, the depository institution (bank) becomes the

guarantor of the funds, thus guaranteeing repayment of the entire amount

of the deposit, or any part of it outstanding in the account of depositors,

when demanded. The depositors are not entitled to any share of the profits

earned on the funds deposited with the bank, but the bank may provide

hibah (a monetary gift) to the depositors as a token of appreciation for

keeping the money with the bank.

• Jualah contract (a unilateral contract for a task) is an agreement in which a

reward, such as a wage or a stipend, is promised for the accomplishment of

a specified task or service. In Islamic banking, this type of contract applies

to bank charges and commissions for services rendered by the bank.

Shari’a provides the foundation for modern Shari’a-compliant economic

and financial transactions. Thus, Shari’a supplies the philosophy and principles

underpinning Islamic banking products and services. Islamic banking, based on

Islamic law, is an integral part of the attempt to develop the Islamic ideal in social

and economic terms. The Islamic legal system possesses a certain flexibility that

provides for adaptation to new socioeconomic situations in that Islamic law deals

differently with permanent aspects of legal issues and changeable aspects of legal

issues. Islamic law allows room for reasoning and reinterpretation in areas of law

that are changeable and progressive in character. For example, riba (interest) is a

fixed prohibition whereas the ruling of permissibility for gharar (uncertainty)

takes into account a cost–benefit analysis. Hence, permissibility changes with

changing technology, the legal framework, customary practice, and so forth

(Shanmugam and Zahari, 2009).

B. Service Quality Concept

Quality is one of the dimensions that determine the satisfaction rating.

According to Kotler (2008:174) the quality is the totality of features and

characteristics of products or services that have the ability to satisfy the desires

expressed directly or indirectly. This means shows that the features determining

the quality of products or services which satisfy customer needs. Quality can be

detected by comparing consumer perception of service consisting of real services

that they receive the services they really hope for, where consumer perceptions of

consumers’ conclusions derived mainly from his experiences using the products

or services concerned.

Definition of quality services centered on efforts to meet the needs and

desires of customers and delivery accuracy to offset customers' expectations.

Understanding quality of service according to Wyckof in Lovelock, quoted by

Tjiptono (2006; 59) is the expected level of excellence and control over the level

of excellence to meet the customer. In other words there are two main factors that

affect the quality of services, namely Expected service and perceived service

(Parasuraman, et al., Cited by Tjiptono, 2006; 60).

If the services received or perceived as expected, then the perceived

service quality (perceived service) good and satisfactory. If the services received

exceed customer expectations, then the perceived service quality as an ideal

quality. Conversely, if the services received is lower than expected, then the

perceived poor quality of services. Thus good or bad quality of service depends on

the ability of service providers in meeting customer expectations consistently.

In subsequent developments, in Fitzsimmons et al Parasuraman, Zeithaml

and Bitner cited by Tjiptono (2006: 70) found that there are ten dimensions can be

summarized into just five main dimensions. The five principal dimensions

include: 1) direct evidence (tangibles), including physical facilities, equipment,

personnel, and means of communication. 2) Reliability (reliability), the ability to

provide the promised services quickly, accurately, and satisfying. 3)

Responsiveness (responsiveness), namely the desire of staff to assist customers

and provide service with a response. 4) Assurance (assurance), including the

knowledge, ability, courtesy, and trustworthiness are owned by the staff; free from

danger, risk, or doubt. 5) Empathy (empathy), including ease of doing

relationships, good communication, personal attention, and understand the needs

of its customers.

Formation of philosophy based on Islamic banking has not been described

above, so it is important to add dimension to the dimensions of service quality

compliance. Use of service quality dimensions (SERVQUAL) on Islamic banking

(Othman and Owen, 2002). With the aim to obtain an additional view of how

services will be improved, try to develop an alternative model, called by

CARTER. This discussion has been formed on the dimensions of service quality

compliance factor. The results obtained from this analysis that has been shown by

the CARTER model which is a dimensional variable consisting of six dimensions.

The results showed that customers of Islamic banking compliance using the

dimensions, because it is very important to follow the principle of Islamic banking

in Islamic law.

Previous research conducted by the Erol and El-Bdour (1989) in Amin and

Isa (2008) has explained that the religious factor has no role in selecting the

Islamic Bank in Jordan. In Malaysia, 40 percent of Muslims are encouraged to use

Islamic banking with the aim of a compliance factor (Haron et. Al, 1994 in Amin

and Isa, 2008). It was explained that the factor of compliance with the principles

of Islam shown an important role in Malaysia in determining the decision to select

the bank. Meanwhile, the orientation of an advantage over Singapore motivate

people to use the product and service of Islam and Muslims in Singapore further

assess the existence of Islamic banks compared to non-Muslim citizens in

Singapore (Gerrard and Cunningham, 1997 in Amin and Isa, 2008). Karatape et

al, 2005 in Amin and Isa (2008) revealed that the level of service quality measures

the development in one country that produces quality services in other cultures.

C. Service Quality Attributes of Retail Banking

In order to develop marketing strategy, service marketers, especially bank

marketers need to understand the service attributes that used by consumers in

selecting bank. For example, consumers would use bank reputation, bank

reliability, bank assurance, and physical facilities of the bank in selecting bank

services. If marketers can understand which attributes are used to evaluate a

service, they will be better able to manage and influence the customer's

evaluations and perception of the offering (Crane and Clarke, 2000).

Perceived quality of service tends to play an important role in high

involvement industries like banking services. Banks have traditionally placed a

high value on customer relationships with both commercial and retail customers.

In the last ten years, the nature of customer relationships in retail banking in

Indonesia has been changing, especially since the advent of automatic teller

machines. A survey that conducted by ISMS (2005) shows that 90% of retail

banking customers in Jakarta use both bank branches and ATMs in their

relationship with banks. Therefore, service quality may well be measured in terms

of both personal support and technical support.

The measurement of perceived service quality may remain a challenge.

Previous research suggested that the dimensionality of service quality might

depend on the type of services under study (Cronin and Taylor, 1992; Babakus

and Boller, 1992). Based on this background, studies have investigated various

attributes, which determine consumers' perception of service quality of retail

banking industry (Sureschandar et al., 2002).

A study of service quality in bank setting by Avkiran (1994) in Amin and

Isa (2008) was conducted to develop an instrument for measuring customer

service quality as perceived by bank branch customers. He designed and

examined six-dimension model for service quality in banking industry

(responsiveness, empathy, staff conduct, access, communication, and reliability)

with 27items.

The six dimensions conceptualized at the start with 27 items were

empirically reduced to 17 items across four discriminating factors. The

dimensions which emerged were staff conduct, credibility, communication, and

access to teller services. The exploratory study conducted by Stafford (1996)

reported the distinct elements (attributes) of bank service quality as perceived by

customers. Seven attributes were found in assessing bank service quality.

The first attribute, named "bank atmosphere"; included cleanliness, as

well as an overall positive and courteous attitude by employees (kindness,

friendliness, and pleasantness). The second attribute, 'relationship", indicates the

importance of a personal relationship with the bank employees, where customers

are recognized easily by long-term employee.

The third attribute, "rates and charges", indicates that low costs and high

interest rates can affect an individual's perception of bank service quality.

The fourth attributes, "available and convenient services", indicates a full

array of services that available, easily accessible and convenient. The fifth

attribute, "ATMs", indicates available, convenient, and working automatic teller

machines. The sixth attribute, "reliability/honesty", indicates the importance of a

solid bank rating and honest, reliable employee. The seventh attribute, "teller",

indicates adequate and accessible teller.

Bahia and Nantel (2000) conducted a study to develop a reliable and valid

scale for the measurement of the perceived service quality of retail banking in

Canada. They argued that the universality of the five dimensions of SERVQUAL

across different types of services had been questioned in a number of subsequent

studies (Amin and Isa, 2008). They also argued that these five dimensions are not

fully generic. As found by Carman (1990) in Amin and Isa (2008), it is often

necessary to incorporate additional items to dimensions because they are

particularly important for some service categories. Another critique addressed to

SERVQUAL since it has focused on the first marketing mix element (i.e. product)

to improve quality.

Further they developed a measurement of perceived service quality with

reference to Parasuraman et al in Amin and Isa (2008) original ten dimensions and

some additional items which are important to retail banking service, then they

purified and tested the measurement scale. Based on this procedure, they proposed

a scale that was called as bank service quality (BSQ).

The BSQ comprises 31 items, which span six dimensions: effectiveness

and assurance, access, price, tangibles, service portfolio, and reliability.

Sureschandar, Rajendran, and Anantharaman (2002) aspired to develop an

empirical model of service quality with a specific focus on the banking sector.

The objectives of their study are: (1) to identify the critical factors of service

quality from the customers' perspective; (2) to develop an instrument to measure

customer-perceived service quality based on the identified factors with a specific

focus on the banking sector; (3) to empirically test the proposed instrument for

unidimensionality, reliability and validity using a confirmatory factor analysis

approach. They proposed the 5 critical factors of service quality from the

customers' perspective i.e. human element of service delivery, core service or

service product, systematization of service delivery, tangibles of service

(servicescapes), and corporate social image. These factors resulted from

modifying the original SERVQUAL instrument, by adding and/or reducing other

relevant factors. The result of empirically tests for unidimensionality, reliability,

and validity show that all the five factors of customer perceived service quality

have strong evidence for unidimensionality, reliability, convergent discriminant,

and criterion-related validities.

D. Customer Satisfaction

The basic purpose of a business is able to create customer satisfaction,

because if the customer satisfaction can be created then this will bring some

benefits to customers and also business people. Among the relationship between

consumers and companies become harmonious, providing a good basis for

re-purchase, forming a recommendation by word of mouth and ultimately consumers

will become loyal to the company. General understanding of consumer

satisfaction or dissatisfaction is the result of the differences between consumer

expectations with performance that is perceived by the consumer.

Customer satisfaction is an output, resulting from the comparison of the

consumer after making a purchase from an expectation of performance with actual

performance and the emergence of cost (Churchill and Surprenant, 1982 in Aydin,

Özer and Orasil, 2005). The theory of customer satisfaction used in two different

ways of transaction and general (Yi, 1991 in Aydin, Özer and Orasil, 2005). The

concept of special transactions associated with customer satisfaction as a form of

judgments made after a specific purchase goal. Customer satisfaction refers to the

assessment of overall consumer to a brand, based on attendance and experience

(Johnson and Fornell, 1991 in Aydin, Özer and Orasil, 2005). In fact, all forms of

satisfaction is seen as a function of the entire satisfaction of certain transactions

(Jones and Suh, 2000 in Aydin, Özer and Orasil, 2005).

Customer satisfaction as a whole represent all forms of evaluation which is

based on the total purchases and consumer experiences with products or services

within a given time. Is where the satisfaction of the special transaction will

provide a diagnostic information about a particular product or service delivery, a

whole satisfaction is more a measurement of a base of experience with companies

in the past, present and future performance (Anderson, 1994 in Aydin, Özer and

Orasil, 2005). This is because the consumers’ conducts repurchase evaluations

and decisions based on the purchase and consumption of existing experience, not

only on a particular transaction or episode (Johnson, et al, 2001, p. 219 in Aydin,

Özer and Orasil, 2005).

Customer satisfaction is very dependent on the views and expectations of

the consumer or the consumer itself. Needs and desires are perceived by

consumers when purchasing a product or service, past experience when using the

product or service, as well as the experiences of colleagues, friends, or relatives

who have used these products or services, and also advertising, can said to be the

factors that can provide a very important influence on the views and expectations

of consumers when buying a product or service. Of the several explanations that

exist about the customer satisfaction that has been researched and defined by

experts marketing, it can be concluded that customer satisfaction is a response to

consumer behavior that can be viewed in full purchasing evaluation form to a

product or service that he felt (product performance) compared with consumers.

From the above definition can be concluded that customer satisfaction is a feeling

of pleasure or disappointment resulting from comparing one product display in

relation to expectations.

E. The Effect of Satisfied and Dissatisfied Customer

Many company often neglected the customer satisfaction, their orientation

is only to sell as many products and services as they can, in order to get higher

profit. In fact, good customer satisfaction has an effect on the profitability of

nearly every business.

Gitomer (1998) in Meng & Elliot (2009, p.59) stated the cost of gaining a

new customer is ten times greater than the costs of keeping a satisfied customer.

Irawan (2002, p.9) believes that satisfied customers are a good mouth to

mouth recommendation and promotion, while unsatisfied customers will spread

their bad experiences to others.

To illustrate the situation, when customer receive good service and

satisfied with the company, each will typically tell nine to ten people, but if they

are not satisfied, they will also tell their bad experiences to fifteen to twenty

people. For that reason, we can not afford to let our customers dissatisfied and tell

to other. However, once customers have been delighted, their expectations are

raised. They will be dissatisfied if the service levels return to the previous level

and it will definitely take more effort to delight them in the future.

Customer expectations are influenced by several factors (Zeithaml, Bitner, &

Gremler (2009):

1. Informal recommendations.

Word of mouth communications, customers tend to have a higher

expectation of a specific that has been recommended to them by family or

friends.

2. Formal recommendations

Recommendations of agents found in certain publications

3. Personal need.

Each customer has different needs for each service. Therefore, this need

also influences customers to judge the quality of the service, and whether

or not it has satisfied their needs.

4. Past experience.

Customers with different past experiences with that specific service type

seem to have different expectations of the service.

5. Price.

The price to be paid for a service determines, in the customer’s mind, the

level of quality to be demanded.

6. All elements of promotional mix.

These elements convey a message to the customer that has an influence on

expectation.

7. Good corporate image.

It is very important asset because it positively shapes the expectations of

the customers.

8. External communication.

The influence of messages sent out by service providers plays an important

role on customer expectations. Customers will expect the service to be in

keeping with the messages.

F. Measuring Customer Satisfaction

After discussing about customer satisfaction, the next question arise is, how to

measure the customer satisfaction? Kotler (2008, p.41) discuss several ways to

measure customers’ satisfaction:

1. Complaint and Suggestion System

The organization makes it easy for its customers to deliver suggestions and

complaints. The media is suggestion boxes, comment cards or toll free

telephone.

2. Customer Satisfaction Survey

Responsive companies obtain a direct measure of customer satisfaction by

conducting periodic surveys. They send questionnaires or make telephone

calls to random sample of their recent customers or make telephone calls

to a random sample of their customer to find out their feel about various

aspects of the company’s performance. Customer Satisfaction Survey is

divided into 4 categories:

a. Directly Reported Satisfaction

The respondents are being asked directly with questions in order to

know if they are very satisfied, satisfied, enough, dissatisfied, or very

dissatisfied. This survey is used to collect the customer opinion and

needs which can give the result called the customer satisfaction index.

This customer satisfaction index is the standard that the company

needs to maintain.

b. Derived Dissatisfaction

The questions that being asked included in two aspects, how high is the

customer expectation in the certain attribute, and how high is

performance that customer’s feel of this attribute.

c. Problem Analysis

Respondents are being asked to describe two things; the problems

which related with the company offers and the suggestion for

improvement.

d. Importance-Performance Analysis

The respondent is asked to rate the services according to the customer

importance and company performance in each attributes.

3. Ghost shopping

This method is to hire person to pose as potential buyers to report their

finding on strong and weak points they experienced in buying the

company’s and competitors’ products

4. Lost Customer Analysis

Companies contact customers who have stopped buying or who have

switched to another suppliers to learn why this happened. Much of this interest

has centered on the controversy generated by their service quality gaps model

Parasuraman (1985) in Kottler (2008), and particularly the SERVQUAL

instrument developed to measure service quality (Parasuraman et al., 1988) in

Chowdhary & Prakash (2007).

G. Customer Satisfaction Measurement Advantages

There are several advantages of measuring customer satisfaction (Blankenship, et

al. 2008, p.308).

• Customer satisfaction results can help to present the current standing of

customer satisfaction.

This utilization often goes beyond reporting statistical data such as mean,

range, and standards deviation. These descriptive data can assist in

identifying specific strengths and weakness in satisfaction dimensions, the

specific items under each, as well as information about overall scores.

However, different types of data analysis can be used to identify not only

aggregate but also individual information. From here emerge the distinct

patterns or gaps between different individuals, groups, or among particular

items.

• Customer satisfaction results can help to identify important customer

requirements. Identification of the specific customer requirements for

achieving satisfaction is useful at a very fundamental level. An organization

is able to clearly focus efforts in those areas that are most important to the

customer. Distinguishing those requirements most valued by customers

allows for pinpointing efforts for service modifications as well as further data

collection. Comparisons of specific items to the satisfaction dimension or

overall score can assist in determination of those items that are more closely

linked with satisfaction.

• Customer satisfaction results can help to monitor customer satisfaction results

over time.

Quite simply, the same information gathered at different points in time can

assist in identification of trends and patterns that develop as an organization

evolves and changes. Furthermore, this can be helpful in demonstrating the

levels of effectiveness of interventions, services and so forth at particular

points in history. What may work during a certain point in time may not at

another? This temporal collections and comparison of information allows for

an organization to adapt and modify services and products to meet the

changing requirements of its customers.

• Customer satisfaction results can help to provide comparisons to other

organizations.

Comparisons either within an organization by department or sub-group as

well as with outside agencies can provide a wealth of information. This

includes not only structural and organizational strengths and weaknesses, but

also effectiveness of service components and service delivery. This can assist

in coordination of planned changes specific to each area, as opposed to

general, “blanket” approaches. Also, this can give a perspective of how one

organization is performing in relation to others, namely one’s competition.

This gives the customer the information necessary to make informed choices

and selections.

• Customer satisfaction results can help to determine the effectiveness of

business practices.

Data gathered from customer satisfaction studies can provide valuable and

accurate information that can assist in evaluation of service components and

delivery. Services can be altered to become more effective, and business

practices can be altered to meet the standards of excellence within a certain

business. In essence this is the comparison of a particular item against a

standard predetermined by the customer. Those scores above the standard are

positive, while those below are in need of improvement. This enables more

thoughtful and considered prioritization of any possible plans of action. The

message is clear: customer satisfaction is essential for the success and

continued success of any business. Not only does positive customer

satisfaction help business, but also a lack of satisfaction takes an even bigger

toll on the bottom line. For a company to remain solvent, information

regarding customer satisfaction must be adequately collected and analyzed.

H. Consideration Framework

SERVQUAL dimensions are variable in the study revealed the level of

customer satisfaction and reliability dimension having the highest impact at all

levels of customer satisfaction assessment (Arasly et al, 2005 in Amin and Isa,

2008). The discussion is based on the disclosure there is a strong influence

between SERVQUAL and customer satisfaction (Othman and Owen, 2001 in

Amin and Isa, 2008). Service quality or service quality which consists of tangible,

reliability, responsiveness, assurance, empathy, and compliance has a close

relationship with customer satisfaction. Quality provides an incentive to

customers to establish strong ties with the company. In the long-term

commitments as this allows the company to thoroughly understand customers'

expectations and their needs. Thus, companies can increase customer satisfaction

where the company maximizes its customers an enjoyable experience and

minimizing or eliminating the customer experience less enjoyable. In turn,

customer satisfactions to create customer loyalty to companies that provide

satisfactory quality.

Likewise in the banking sector, which must be undertaken by a bank, is to

provide a quality service. This service forms one of which is chargeable to

employees who meet directly with customers is more intense because transactions

conducted over the many and varied. If the elements of services provided for

employees of Bank Syariah make our customers comfortable and in accordance

with what was expected by the client before, then the customer is satisfied with

the services provided. Likewise, if customers feel the service performance of

Bank employees more than what was expected previously, the customer was very

satisfied, therefore the quality of services provided by the Bank Syariah influence

on customer satisfaction levels. With good service quality expected a strong

relationship existed between the Bank Syariah with its customers. Thus the bank

can increase the satisfaction of its customers who in turn can create customer

satisfaction (customer satisfaction) to the bank that has been providing quality

service.

Figure 2

Theoretical Framework

Customer Satisfaction Service Quality

Tangible Reliability Responsiveness

Assurance Empathy Compliance

I. Hypothesis

Previous research has identified various factors that determine the level of

customer satisfaction. Bank of Greece in Turkey using the quality of services to

achieve the level of customer satisfaction. Dimension of SERVQUAL is a

variable in the study revealed the level of customer satisfaction and reliability

dimension having the highest impact at all levels of customer satisfaction

assessment (Arasly et al, 2005). The discussion is based on the disclosure there is

a strong influence between SERVQUAL and customer satisfaction (Othman and

Owen, 2001).

Results from previous research conducted by Amin and Isa (2008) using a

sample of students at Bahrain, indicating that younger customers revealed several

factors, such as a bank's reputation, bank employees are friendly, the location of

affordable, possess 24-hour ATM, and the availability of a vast parking lot in

choosing a bank (Almossawi, 2001). Bank's ability to deliver the benefits of an

influence of toward bank customer satisfaction level has an innovative method of

customer satisfaction levels, such as internet banking only, and the system via

Internet, telephone and call center. Based on the disclosure Leveque and

McDougall (1996), satisfaction and competitive rivalry of the bank are two

important factors that are usually used to influence all levels of satisfaction from a

customer.

Robust formation of the importance of service quality perception and

influence between service quality and customer satisfaction led researchers and

academics describe the level of customer satisfaction as factors related to the level

of previous studies of service quality and others that reveal the level of service

quality as a factor in shaping the level of previous research, customer satisfaction

(Amin and Isa, 2008).

The conceptual model is demonstrated and tested as Figure 2. This model

starts with SERVQUAL measurement scale, consisting of six dimensional

structures: tangibles, reliability, responsiveness, assurance, and empathy, and

compliance dimensions to measure Indonesian Islamic banking service quality.

Furthermore, a conceptual model of the relationship between service quality and

customer satisfaction (Figure 2) is developed based on the literature and

hypotheses are explored. The hypotheses research is:

H1: There is significant influence between service quality toward customer

satisfaction

CHAPTER III RESEARCH METHOD

The research design that will be use in this research is causal research, which

explains about the causal relationship between research variables, the purposes to

make a decision of relationship methods cause and effect from independent

variables to dependent variables. On problem that discussed on chapter 1 about is

there any influence of service quality customer satisfaction in Islamic Bank?

Because of that research method is needed to answer those problem formulation

based on the hypothesis that already discussed on chapter 2.

A. Research Scope

This research attempts to examine the effect of service

dimensions/attributes on perceive service quality, and customer

satisfaction based on the research questions which presented as follows:

1. Using a retail-banking services setting in Jakarta, what are the specific service

2. quality attributes that influence service quality.

3. Using a retail-banking services setting in Jakarta, what are the specific predictors (service quality attributes, customer value, or

customer satisfaction) will influence customer satisfaction.

B. Sampling Method

The focus of this research is on the relationship between service quality

attributes and customer satisfaction as dependent variables. As mentioned before,

this research sample used non probability sampling. Not all the content or element

of population have the same opportunity to become sample.

The purposive judgmental sampling was used where the collection of

specialized informed respondent about Islamic bank (Sekaran, 2003).

Respondents are the customers who visit the bank counters and have an account

with one of the full-fledged Islamic banking.

C. Population Research

Data were gathered from personal interviews using questionnaire as a

measurement tool, and it was conducted in Jakarta by 5 trained interviewers

during two-month period in May until June 2010. The first part of the

questionnaire focuses on customer perceptions of service quality attributes, which

are the independent variables of this research. The second and third focus on

customer satisfaction, which are dependent independent variables of this research.

The third part of the questionnaire collects demographic data, such as gender,

marital status, age, education, and occupation, and other information such as the

length to be a customer of this bank, and how frequently do they have relationship

with the bank. In determinining sample size, Sekaran (2003) proposes that sample

size larger than 30 and less than 500 are appropriate for most research. The

questionnaires distributed are 150 questionnaires in which the questionnaires are

returned and can be used total of 120 questionnaires.

D. Data Collection Methods

This research method did on May 2010 use collection and observation

data, data is collected from Mandiri Syariah, Jakarta, there are:

1. Primary Data : Data is getting from the survey result with giving

questioner to the respondent that suitable with the population characteristic

of customer Mandiri Syariah. The sample of respondent was drawn from

Pondok Kelapa Branch, Saharjo Branch, Rawamangun Branch, Meruya

Branch and M.H Thamrin Branch of BSM.

2. Secondary Data : the general data is getting from the last research and

literature about relationship influence services quality towards customer

satisfaction

E. Analysis Method

This research method using the analysis method is the descriptive method.

The purpose is to get some figure of descriptive or systematic outline, actual,

accurate about the fact, also the phenomenon relationship that will be researched

and explore.

The analysis method that will be use in this research to measure the

customer satisfaction with the service quality is single regressions. The

independent variable (X) in this research is the service quality of Islamic Bank.

The variables that are used to measure the service quality is 6 dimensions of

service quality: Reliability, Responsiveness, Assurance, Empathy, Tangible and

Compliance. The dependent variable (Y) is customers’ satisfaction with Mandiri

Syariah throughout the experiences that they had. If the service quality provided is

the same or exceed the customers’ expectation, the customers will be satisfied,

and vice versa.

All indicators of the variables used in this research are illustrated in the following

equation:

Y = βo + β1 X1 + ε

Where:

Y : Customers’ satisfaction level

βo : Y intercept

β1 : slope of Y with variables X1 (Service Quality)

ε : random error in Y

E.1. Validity Analysis

Validity is the degree to which a measure accurately represents what it is

opposed to (Hair, 2006). According to Nunnaly (1994), there are three type of

validity that can be assessed: content validity, predictive validity, and construct

validity. Content validity is the assessment of the correspondence between the

individual items and the concept (Hair, 2006). The current study addressed

content validity through the review of literature as presented in Chapter II, and