Bridging the Gap between Theory, Research, and Practice

TRUST ME! A CASE STUDY OF THE INTERNATIONAL ISLAMIC

UNIVERSITY MALAYSIA’S WAQF FUND

MALIAH SULAIMAN

MOHD AKHYAR ADNAN

PUTRI NOR SUAD MEGAT MOHD NOR

International Islamic University

Abstract

This paper documents the development of the International Islamic University

Malaysia’s Waqf Fund (IIUMWF) from its inception in 1999 to the present.

Specifically, we examined four pertinent areas: the management of the fund, the

fundraising activities (and the types of funds, waqf khas or waqf am), the programs

undertaken and the accounting practices of the IIUMWF. Interestingly, we found

that although the IIUMWF is recognized as a Waqf, it is not registered as such,

primarily because Malaysian Law requires that funds registered as Waqf funds have

to be administered by the State Religious Council. Given the negative results of

prior studies examining the accounting and management practices of religious

organizations in Malaysia as well as overseas, this decision may be understandable.

The theoretical framework is based on the Islamic concept of accountability.

Specifically, there are two pertinent issues addressed in this study. The first is on

disclosure and the second assesses the performance of the waqf. We examined the

accounts of the IIUMWF and benchmarked against the framework developed by

Ihsan and Shahul (2007). On performance, we computed three ratios to assess its

efficiency: Program Expenses to Total Expenses, Investment Income to Average

Investment and Fund Raising Expenses to Total Related Contributions. We

concluded our paper with various suggestions and recommendations for further

improvements in the management and accounting practices of waqfs in general and

the IIUM Waqf Fund in particular.

Bridging the Gap between Theory, Research, and Practice 2

Trust Me! A Case study of the International Islamic University Malaysia’s Waqf

Fund

1 Introduction

The institution of waqf dates back to the time of Prophet Mohamed (pbuh). Waqf is

generally considered a religious and a charitable organization (Islahi, 2003). Sadeq

(2002) is of the same opinion. He argues that the institution of waqf may be regarded

as a charity in perpetuity. Historically, waqf funds were used for the provision of

public goods such as education and health. However, more recently, there have

been suggestions by some authors that the institution of waqf may help alleviate

poverty (Sadeq, 2002). Thus, the increasing emphasis of its socio-economic role is

clearly evident. Peters’ (1986) viewpoint is similar. He argues that the institution of

waqf may be regarded as one of the more important economic institutions of an

Islamic society. In order to ensure that waqf may assist in alleviating poverty, it is

important that the fund is properly organized and managed. More importantly, there

need to be a conscious effort to plan and execute programs that will enable the

institution to achieve its objectives. Accordingly, there is a need for a “proactive

waqf administration with capable and committed personalities in its leadership”

(Sadeq, 2002, p149). Without this precondition, a waqf would neither alleviate

poverty nor help in the socio-economic development of a community. Further, given

that waqf funds are actually funds that belong to the community, to some extent, it is

important for the institution to exhibit credibility and integrity in its activities and

also in its management of the funds. Of more importance, perhaps, is to ensure its

continuity. This can only happen if the organization is financially sound. Herein lies

the significance of accounting. Adnan (2005) argues that waqf may be regarded as

either a social organization or a commercial enterprise. The latter stems from the

fact that investments by waqf authorities as well as the rent charged on waqf

properties should all be driven by the profit motive. Thus, the hybrid nature of waqf

Bridging the Gap between Theory, Research, and Practice 3 A donor or a contributor to a waqf would want to know what the funds have been

used for and if the funds have been disbursed to the appropriate beneficiaries. The

importance of providing assurance to the waqifs that the money they have

contributed have been properly managed and have been used for the relevant

beneficiaries cannot be overemphasized. Given that the general well being of an

organization is generally interpreted in terms of its financial performance, proper

accounting practices is essential. Following this, prior studies on waqf institutions in

Malaysia have largely focused on the accounting disclosure practices of such

institutions (Rokyah, 2004; Hisham, 2005). Ihsan and Shahul (2007)’s study was a

commendable effort to develop a reporting framework for waqfs. Their framework

was adapted from the Statement of Recommended Accounting Practice (SORP,

2005) issued by the Charity Commission (under the auspices of the Accounting

Standards Board). No study, to the authors’ knowledge, has actually examined the

performance of waqf institutions. Accordingly, our study examining the

performance of the International Islamic University’s Waqf Fund (IIUMWF) is a

humble attempt to address this issue. More specifically, there are three primary

objectives of the study. The first is documenting the development of the IIUMWF

since its inception in 1999 to the present. The second focuses on examining the

disclosure practices of the IIUMWF. Finally, we examine the performance of the

Fund by computing various efficiency rations. We then compared these ratios with

that of the waqf administered by the Muslim Religious Council of Singapore. Given

the mounting reports on the mismanagement of funds in religious and charitable

organizations in general and the mounting scholarly interest on waqfs, our study

examining the accounting and management practices of waqfs is timely for several

important reasons. First, prior studies examining the accounting practices of

religious organizations have rarely focused on the institution of waqf. Secondly, the

mounting scholarly interest in the management (or mismanagement) of waqf funds is

an issue that should be addressed through empirical work. Finally, the results of our

Bridging the Gap between Theory, Research, and Practice 4 The remainder of the paper is structured as follows. Section 2 describes the

development of the IIUMWF. The concept of accountability from an Islamic

perspective (on which this study is based) is discussed in section 3 while section 4

elaborates on the disclosure framework for waqfs as well its performance

measurement aspects. Section 5 describes the data collection and discusses the

results of the study. Section 6 provides the conclusion together with the limitations

of the study and suggestions for future research.

2 Development of the IIIUMWF

The IIIUMWF was established in March 1999 with the initial funds of RM 3.5

million provided by the Malaysian government. Part of the initial funds was used to

finance the cost of living of the needy students at the International Islamic University

Malaysia (IIUM) and the balance was invested (to generate income). The noble

vision of IIIUMWF is to create a global ummatic network. Its mission includes

strengthening the Muslim brotherhood, building international networking as well as

providing financial support to needy students of IIUM. It is indeed interesting to

note that the IIUMWF is not registered as a waqf primarily because the university

does not want the funds to be managed by the State Religious Council (SRC). This

is not surprising given the results of prior studies examining the management and

accounting practices of religious organizations have not been positive (e.g. Laughlin,

1988; Booth, 1993; Duncan et al, 1999; Bowrin, 2004; Rokyah, 2004; Hisham,

2005). However, it must be emphasized here that the IIUMWF, even though not

registered as a waqf, it is waqf in every sense of the word.

The 5 year plan

The 5 year strategic plan started with ensuring that the public knows of the existence

of the Fund as well as its vision and mission. This involved establishing contacts

with individuals and corporate bodies locally and internationally. The first year also

saw IIIUMWF executing its “charity starts at home” program. Staff of the

Bridging the Gap between Theory, Research, and Practice 5 deductions. The second year focused on getting the help of corporations (that

provide services to IIUM) to participate in the RM 1 campaign. The Foster Parents

program was also initiated in the second year. Programs in the third year

concentrated on internationalization. This is when the IIIUMWF solicit donations

for its foster parents program from individuals and companies in Africa, the USA,

various Asean countries and the Gulf states. The fourth year plan was to embark on

business and investment activities. In fact, the funds that our former rector, Dato’ Dr

Abul Hamid Abu Sulayman, donated were invested in a unit trust --- the KL Mutual

(Ittikal) Fund. The plan in the fifth year was to invest the waqf funds in real estate.

Funds raised

As alluded to earlier, the initial fund to set up the IIIUMWF came from the

Malaysian government. The voluntary monthly salary deduction from staff of IIUM

provides additional funding for the various projects of the IIIUMWF. Further, the

IIIUMWF’s RM 1 campaign (started since 2000) constitutes another source of funds.

Funds obtained from donors for the Kafalah (foster parents) program is another

source of funds for the IIIUMWF. It is interesting to note that the IIIUMWF also

recruits agents to solicit donations and these agents are paid commissions on the

funds raised.

Programs

There are various activities undertaken by the IIIUMWF. The Kafalah (Foster

Parents) program invites donors to sponsor the cost to maintain a student at IIUM

(estimated to be RM 350 a student per year). The donor may opt to bear the cost of

just one student for the duration of the student’s stay at IIUM or to sponsor different

students for different years. There is also flexibility in the amounts donated starting

from a minimum of RM 70 to a maximum of RM 350 per student. In order to

alleviate the financial burden of some students, the IIIUMWF also assists students to

find work, usually as support staff in campus. This enabled them to earn pocket

Bridging the Gap between Theory, Research, and Practice 6 Management of the IIIUMWF

The Executive Board (henceforth referred to as the Board), headed by our

Honourable Rector, is the highest decision making authority of the IIUMWF. The

Board comprises the Deputy Rector (Academic), the Deputy Rector (Research and

International), the Deputy Rector (Students), the General Manager of the IIUMWF,

the Finance Director, the Director of the Management Centre, a representative from

the Alumni and a senior academic staff. Additionally, there is an Investment

committee headed by a Finance Professor that oversees the investment activities of

the IIIUMWF. The Board as well as the Investment Committee hold meetings three

times a year or whenever there was a need.

Accounting practices

The accounts of the IIIUMWF are handled by a qualified accountant (a Bachelor of

Accounting graduate of the International Islamic University Malaysia). Given this,

stakeholders would be assured of satisfactory accounting practices being adopted by

the Fund. However, because the IIUMWF is relatively young, to date the accounts

have not been disseminated to the public. However, an interview conducted in late

April 2007 with the Finance Manager, Sister Norain, revealed that the 2006 accounts

would be available to the public once it has been audited and after it has been

endorsed by the Board.

3 Accountability

A description on the Islamic concept of accountability precedes any discussion on the

accounting practices of any Islamic religious organization. From the Islamic

perspective, accountability surfaces from the concept of amanah (trust) (Al-Faruqi,

1992). Amanah is related to another important concept in Islam, khilafah

(vicegerency). The Islamic sense of accountability is different from that which is

generally understood in the West. In Islam, accountability is viewed from two

different perspectives: man’s accountability to God, and man’s accountability to other

men (i.e. society). Thus an individual worships God and executes all his duties as a

Bridging the Gap between Theory, Research, and Practice 7 accountability is established through a contract between man and other men. More

importantly, his relationship with other individuals mirrors his relationship with God.

One can also regard the transcendent accountability to God as the “vertical”

accountability and the accountability to other individuals as the “horizontal”

accountability. Examples of the latter include agency contracts between the owners

and managers, contracts between employers and employees or contracts between

superiors and subordinates (Shahul, 2000). Further, under the concept of khilāfah, the ownership of resources is a trust or āmānah. Thus, any financial resources made available to the waqf are made in the form of a trust (āmānah) and what is pertinent with respect to accountability is the relationship that arises between the waqif (the

providers of the waqf funds) and the mutawalli and also between the mutawalli and

the public. It is this accountability relationship that is of importance in our study.

More importantly, the dissemination of accounting information can be regarded as an

important mechanism through which major aspects of accountability may be

discharged.

4 Accounting practices and performance measurement of charities

There are two pertinent aspects that one needs to address when examining the

institution of waqfs. The first is on its disclosure practices while the second focuses

on assessing its performance. While accounting for Islamic banks is regulated and

standardized to some extent (e.g. standards promulgated by AAAOIFI), accounting

for waqf is still in its infancy. This led Ihsan and Shahul (2007) to suggest that,

perhaps, the Statement of Recommended Accounting Practice (SORP, 2005) issued

by the Charity Commission (under the auspices of the Accounting Standards Board)

be adopted and adapted for the accounting of waqf institutions. Their framework

developed on the basis of SORP 2005 is discussed later.

Disclosure

The disclosure practices of a waqf institution are significant for several important

reasons. First, a contributor to the waqf is generally interested to determine the

Bridging the Gap between Theory, Research, and Practice 8 would also be interested to know whether the funds have been properly disbursed to

the beneficiaries. Thirdly, the community has the right to know how the funds have

been used and how such funds are managed. Fourthly, and more importantly, the

mutawalli (trustee) should ensure that the waqf funds have been managed in

accordance with the wishes of the waqif.

Is an annual report important for a charitable organization such as the waqf?

According to the guidance statement on charity accounts (2007), an annual report

represents,

an important milestone in a charity’s life, a chance to take stock of how the year compared to the

trustees’ plans and aspirations, a time to celebrate successes and achievements, and to reflect on

difficulties and challenges. The Annual Report is also an opportunity to highlight the benefit to the

public of the charity’s activities. Its audience is not just trustees and members, funders, donors and

beneficiaries, but also the wider public who have an interest in what charities do and what benefits

they bring to the community (p7).

Further, a good annual report should be informative. It should indicate the charity’s

aims and how it sets out to achieve them. Additionally, the annual report should

provide “a balanced view of the charity’s structure, aims, objectives, activities and

performance” (p7)1. Accordingly, it is imperative that waqf institutions prepare

annual reports for the benefit of its stakeholders. Ihsan and Shaul (2007) argue that

SORP 2005 would provide a good basis on which to develop the framework for the

reporting of waqf.

The Charity Accounts Framework (2007) suggests that all charitable organizations

keep and retained accounting records for at least 6 years, prepare annual accounts

and most importantly, make the accounts available to the public on request. Charity

accounts may be prepared either using the receipts and payments basis or the

accruals basis. The former is only applicable where the charity has a gross income

of not more than 100,000 sterling pounds. A charity with a gross income exceeding

1

Bridging the Gap between Theory, Research, and Practice 9 100,000 sterling pounds have to prepare the balance sheet, a statement of financial

activities (SoFA), a cash flow statement and explanatory notes to the accounts.

However, financial information alone does not discharge the accountability of a

mutawalli, satisfactorily. As SORP 2005 indicates,

accounts have inherent limitations in terms of their ability to reflect the full impact of transactions or

activities undertaken and do not provide information on matters such as structures, governance and

management arrangements adopted by a charity.

Accordingly, the Trustees’ Annual Report is an important document in the annual

report of a charitable organization. Similarly, in the case of waqf, the Mutawallis’

Report is necessary in order to explain the areas that the accounts do not explain. In

particular, the report provides a fair review of the waqf’s structure, its aims,

objectives, activities and performance. It is this report that will indicate to a user the

progress made by the institution and whether it has met its various objectives.

Additionally, the Mutawalli’s report will also include the governance and

management structure of the waqf. Table I presents the reports and information that

Bridging the Gap between Theory, Research, and Practice 10

Table I

Annual Report: Waqf

i Balance Sheet

ii Statement of Financial Activities (SoFA)

iii Cash flow statemet

iv Notes to the accounts

v Mutawallis' Report

vi Other matters

names of mutawallis and their qualifications

names of advisers and their qualifications

the organization structure

how the mutawallis have been appointed

the decision making process

the objectives of the waqf

the activities undertaken

The achievements in relation to its objectives

any other matters that may help user to assess the progress and performance of the

waqf

i. The balance sheet

The funds of the waqf should distinguish between a general waqf (waqf am) and a

specific waqf (waqf khas). Additionally, following SORP 2005, assets should be

classified as functional and non-functional assets. Functional assets are used for

charitable purposes such as a mosque that is being used primarily for communal

prayers. Non-functional assets refer to investments out of the waqf funds (Ihsan and

Shahul, 2007). Table II presents a summary of the assets and categories of funds to

Bridging the Gap between Theory, Research, and Practice 11

Table II

Balance Sheet

Assets Funds

Functional Assets Waqf Am Non-Functional Assets Waqf Khas

Endowment

ii. SoFA

The Statement of Financial Activities (SoFA) presents the net inflow or outflow of

resources of the waqf institution. In the SoFA it is useful to analyze all incoming

resources according to the particular activity that generates the particular income.

For example, funds raised through agents should be separated from income obtained

through voluntary “direct” donations from the public. Four categories of income are

pertinent to a waqf: donations, income from investments, funds raised by the waqf

institution and “others”. The third refers to specific activities undertaken by the

organization to raise funds including engaging agents. The last is a category to

ensure that all income other than the first three is “captured” in the accounts. It is

important for the waqf institution to separate this income primarily because the

community would want to know how the funds of the waqf were obtained.

Additionally, distinguishing the four categories of income would also enable the

organization to compute various efficiency ratios when assessing the performance of

the waqf. This will be further elaborated in the later part of the paper. Income

should also be further categorized into Restricted, Unrestricted and Endowment

income. We term this the secondary income categories (see Table III).

Ihsan and Shahul (2007), following SORP 2005, suggest that there are three types of

expenditure incurred or resources expended by the waqf institution: costs of

generating funds, costs of charitable activities and governance costs. Similarly,

Sorensen and Kyle (2007) propose that expenses be categorized into fundraising

expenses, program services costs and management and general expenses. Costs of

generating funds include the commission given to agents in raising funds. Costs of

Bridging the Gap between Theory, Research, and Practice 12 operational costs in managing the waqf. Distinguishing expenses into these three

categories enhance the accountability of the mutawalli. However, we are proposing

that the expenses be grouped into four main categories: program expenses,

management or governance costs, fund raising costs and “others”. We also suggest

that waqfs attempt to relate expenses of raising specific funds to the particular

income generated. This will, to some extent, help the user of accounts to determine

the efficiency of the waqf institution (discussed later). Table III provides a useful

summary of the categories of income and expenses for a waqf institution.

Table III

Statement of Financial Activities (SoFA)

Income Expenses

Primary income categories Secondary Income categories

Voluntary donations Restricted Program expenses Funds raised through specific activities Unrestricted Management expenses Investment income Endowment Costs of fund raising

Others Others

iii. Cash flow statement

The cash flow statement records the flow of cash and cash equivalents into and out of

the organization during a particular accounting period. Additionally, the statement

allows users to understand how the organization’s operations are running, where its

money is coming from, and how it is being spent. SORP 2005 requires charities to

prepare cash flow statements in accordance with FRS 1.

iv. Explanatory notes

Similar to commercial organizations, the notes to the account generally indicate the

basis on which the accounts have been prepared. As for charities in the UK, the

accounts are normally prepared in accordance with SORP 2005 and using historical

costs. The trustees should also the accounting policies adopted in dealing with

Bridging the Gap between Theory, Research, and Practice 13 v. The Mutawallis’ Report

The Mutawallis’ report provides information that the financial accounts do not

explain. A good Mutawallis’ report should explain what the organization is trying to

do and how it plans to embark on its activities. As such the report will enable the

stakeholders to assess the whether the waqf has achieved its objectives. A good

report will also include the organizations’ governance and management structure and

enable the reader to understand how the accounting numbers link to the

organisational structure and activities of the waqf institution. It is also recommended

that matters such as the names of the mutawallis and advisers as well as their

respective qualifications, the organization strucrure, how the mutawallis have been

appointed, the decision making process, the objectives of the waqf, the activities

undertaken and any other matters that the mutawallis deem necessary so that

stakeholders will be well informed about the waqf should be included in the

mutawallis’ annual report.

Performance measurement

The concept of performance in charitable organizations is rather complex (Wise,

2001). According to Wise (2001), the “3Es” of performance, economy, efficiency

and effectiveness, would be a useful way to assess not-for-profit organizations. In

order to do this, it is necessary to determine the objectives of the organization, the

resources used (inputs) and the outputs achieved. The relationship between the

objectives and inputs used is a measure of economy. The relationship between

inputs and outputs is a measure of the efficiency of the organization while the

association between outputs achieved and the organization’s objectives is a measure

of its effectiveness. Since the objectives of the organization may not generally be

quantifiable, it leaves us with determining the efficiency of the institution of waqf

although it must be emphasized that waqf management must embody the values of

efficiency and effectiveness.

Keating and Frumkin (2001) suggest that the efficiency of a not-for-profit

Bridging the Gap between Theory, Research, and Practice 14 Expenses. The authors, however, did not provide a benchmark with which the ratios

should be compared. It was Sorensen and Kyle (2007) that indicated that the ratio

should be at least 65%2. The primary reason for this is that charities are not

supposed to hoard funds. A low percentage is an indication that either the waqf

institution is not disbursing enough funds to the rightful beneficiaries or that

operational expenses are too high. This is a signal for further investigation. Another

ratio to assess efficiency is (Rental Revenue- Rental Expenses)/Rental Revenue.

Given that a large proportion of waqf properties are leased, this is a useful ratio to

compute, particularly waqfs that manage a large number of properties. A low

percentage could mean that there have been excessive repairs or rents charged do not

accord with market rents. Either of the reasons would indicate further investigation.

Yet another ratio that is pertinent in assessing waqfs is Investment Income/Average

Investment. The mutawalli should ensure that adequate and proper returns are

obtained for its investments. Besides getting contributions from the public, waqf

institutions do generally embark on fund raising activities and such activities are not

without costs. Accordingly, a useful ratio to compute is the Total Fund Raising

Expenses to Total Related Contributions. This ratio should not be more than 35%

(Sorensen and Kyle, 2007)3. Table II presents the summary of the ratios that can be

used to measure the efficiency of a waqf.

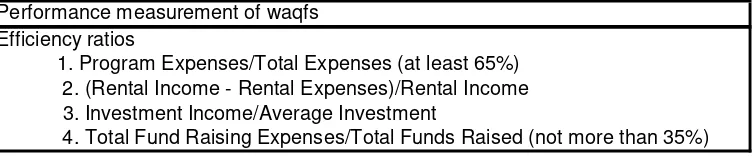

Table IV

Performance measurement of waqfs Efficiency ratios

1. Program Expenses/Total Expenses (at least 65%) 2. (Rental Income - Rental Expenses)/Rental Income 3. Investment Income/Average Investment

4. Total Fund Raising Expenses/Total Funds Raised (not more than 35%)

Given the importance of assessing the performance of waqfs, we suggest that these

four ratios be disclosed in the annual report of waqfs (where applicable). This

would, to some extent, enable the stakeholders to determine if waqf funds have

actually been properly managed.

2

Quoting the Better Business Bureau’s Wise Giving Alliance Standard 8.

3

Bridging the Gap between Theory, Research, and Practice 15

5 Data collection and analysis

Generally, the choice of method depends on the objective of the study, the current

state of knowledge regarding a particular phenomenon, the environment in which the

study is to be conducted and the conditions under which the research project is to be

carried out (Yin, 1989). Yin (2002) defines a case study as an empirical research

investigating a contemporary phenomenon within its real-life context. While

experimental research and surveys involve the development of hypotheses and

subsequent testing of these hypotheses, case research often proceeds in the reverse

direction; data collection precedes and forms the basis for the generation of the

hypotheses (Brownell and Trotman, 1988). The case study represents an in-depth,

longitudinal examination of a phenomenon. Consequently, the researcher gains a

better understanding of the “how”, the “what” and the “why” of a particular issue

under study. Additionally, using the case study to examine the management and

accounting practices of a particular waqf will provide a better insight on managerial

and organizational issues. According to Yin (1989), the case study approach enables

the researcher to describe, understand and explain the phenomenon of interest.

However, one criticism often leveled at the case study approach is that the results are

not generalized. To this, Yin (1994) argues that in case study research, the

generalization of results is typically made to the theory and not to the population.

Following this strand of argument and given the aim of this study is to document a

particular waqf the case study method of data collection is used.

The IIUMWF

The total funds, since its inception in 1999 to December 2005, stand at about RM 11

million. To date two former rectors of IIUM have donated substantial sums to the

IIUMWF. Dato Dr Abdul Hamid Abu Sulayman, our second Rector, donated his

monthly salary while Tan Sri Kamal Hassan donated a piece of land. With such

exemplary behaviour from top management, it is not surprising that salary

deductions and the RM1 campaign have received favourable support from the staff

Bridging the Gap between Theory, Research, and Practice 16 Disclosure

We examined the accounts of the IIUMWF from 2003 to 2005. As indicated earlier,

to date, the accounts of the IIUMWF were not available to the public. However, we

were told that the 2006 accounts will be made available to the stakeholders after it is

audited and endorsed by the Board of the IIUMWF in the middle of this year.

Incidentally, the accounts of the IIUMWF are subject to both internal and external

audits.

Examining the accounts revealed some interesting points. The IIUMWF’s accounts

that are available to the public are the ones that have been consolidated with the

university’s accounts. However, the IIUMWF does prepare its accounts for internal

use, yearly. There are three financial reports prepared by the IIUMWF annually: the

balance sheet, the “trading and profit and loss account” and the cash flow statement.

Explanatory notes to the accounts were not evident. Similarly, there was no

Mutawallis’ report prepared. Given that the accounts are not in the public domain,

the non-existence of both the explanatory notes and the Mutawallis’ report is

understandable.

The balance sheet

The IIUMWF’s balance sheet does not distinguish the various incomes into

Endowment Funds, Restricted Funds and Unrestricted Funds (as proposed by Ihsan

and Shahul, 2007 and SORP 2005). However, the investments made out of the

funds from the Dato’ Abdul Hamid Abu Sulayman’s Funds was clearly indicated as

such in the 2003 balance sheet. Further, the separation between functional and

non-functional assets was also not evident. This may, perhaps, be due to the IIUMWF

not having any functional assets at the moment.

SoFA

It is interesting to note that the IIUMWF has indicated that it has prepared a “trading

and profit and loss account”, thus, regarding the Fund as a commercial entity.

Following SORP 2005’s proposal and Ihsan and Shahul’s (2007) suggestion, a

Statement of Financial Activities (SoFA) would have, perhaps, been more

Bridging the Gap between Theory, Research, and Practice 17 Income

The income of the IIUMWF is generally grouped into various categories as presented

in Table V (Panel A). However, the income does not distinguish between restricted

income, unrestricted income and endowment funds. Further, given that the

IIUMWF engages agents to raise some of its funds, one would expect the “donations

and collections” category to be separated into the funds raised by agents and

voluntary “direct” donations. Separating the funds in this manner would enable

stakeholders to determine the ratio of fund raising expenses to total funds raised,

easily. This will be further clarified in a later part of the paper.

In 2004, the total income increased by 90% (from 2003) while the 2005 income

posted a 25% decrease (as compared to 2004). Examining each category, in turn,

reveal that the income from business activities, the Kafalah (foster parents) program

and the RM 1 campaign show an increasing and healthy trend throughout the 3 years.

The big jump in the “others” category in 2004 is actually due to the gain in sale of

investments in that year. Interestingly, in 2005, there is also another source of

income “Amil income” that is reflected in the accounts. This represents the income

that the IIUMWF gets from being the “Amil” for zakat collection and provides a very

important source of income for the IIUMWF.

Expenses

As far as the resources expended, there was no effort to categorize the various

expenses into program activities, fund generating expenses, management or

governance and “others”. The last is, of course, the “catch all” category. Generally,

it is this category that should have explanatory notes listing all the expenses that have

been included. Because all the expenses were merely put as a list of expenses in the

“trading and profit and loss account” we anticipate that it would be difficult for us or

any stakeholder to compute the various efficiency ratios. We then proceeded with

grouping the various expenses into three main categories: fund raising expenses,

program expenses and “others” (see Table V, Panel B) to enable us to compute the

efficiency ratios later. However, we were later informed that the IIUMWF will

Bridging the Gap between Theory, Research, and Practice 18 emoluments, administrative expenses, fund raising costs, human resource

development costs, program expenses (assistance to students), contingency expenses

and a catch all category of “others”.

Explanatory notes

Explanatory notes, particularly on the core activities of the IIUMF, were

non-existent. For example, the number of students that were given assistance each year

was not included. As a stakeholder, this is one of the information that is of interest.

Further, the basis on which the accounts were prepared was not indicated. For

example, are the accounts prepared on the basis of historical costs or current values?

The Mutawallis’ report

The IIUMWF does not include any Mutawallis’ report with its accounts. This is

primarily because the accounts are currently not available to the public. It would be

interesting to see if the Mutawallis’ report is included in the 2006 and subsequent

years’ accounts.

Table V

Panel A

Income 2003 2004 2005

Donation and collections RM 1,513,830 2,998,538 2,116,296

Business Activities 33,627 34,230 55,351

Kafalah 41,547 53,176 62,312

RM 1 campaign 16,085 20,568 29,897

Others 8,551 62,353 17,658

Dividends 347,751 548,918 494,838

Amil income 21,526

Total 1,961,392 2,797,8793,717,783

Panel B

Expenses 2003 2004 2005

Fund raising expenses RM 50000 50000 0

Program Expenses (Students' assistance) 782805 1601988 919676

Others 1514652 642582 1651756

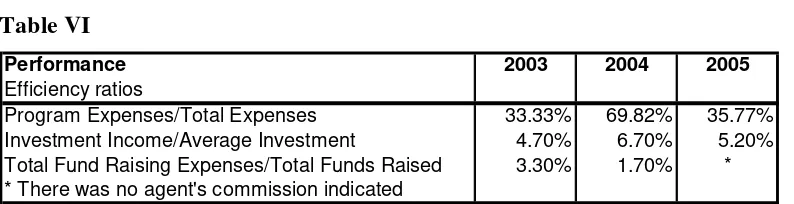

Bridging the Gap between Theory, Research, and Practice 19 Performance

The core program of the IIUMWF is to assist needy students of the IIUM. As

presented in Table VI, three ratios to assess the efficiency of the IIUMWF were

computed. The recommended percentage of at least 65% for Program

Expenses/Total Expenses, as suggested by Sorensen and Kyle (2007), was only

evident in 2004. Both 2003 and 2005 percentages are well below 65%. The low

percentage could mean that there were not many students requiring assistance in

2003 and 2005. Alternatively, it could also mean that the expenses of the IIUMWF

are much too high. The latter, is undoubtedly, a cause for concern. The program

expenses primarily refer to the amounts disbursed to needy students of the IIUM.

Although the return on investments ranging from 4.7% to 6.7% appears low, this

may be due to the conservative policy of the Investment Committee in focusing on

investments with lower risks. Given that the IIUMWF has no waqf property and that

it has not invested in any real property, the ratio of Net rental income to Total Rent is

not applicable. However, we were told that the IIUMWF is seriously considering

investing in real estate in the very near future. It would seem that the IIUM has not

really met its plan of having real estate in the fifth year of its inception.

The IIUMWF also engages agents to raise funds. In 2003 and 2004, the agents’

commission amounted to RM 50000. As indicated elsewhere in the paper, the

IIUMWF did not attempt to separate the funds that were raised through agents and

“direct” voluntary donations. As such, in computing the ratio of Fund Raising

expenses to Total Funds raised, we used the total funds under “donations and

collections”. Thus, the 3.3% in 2003 and 6.7% may not be a good indication of this

efficiency ratio. It would have been more informative if we could calculate this ratio

using just the funds raised by the agents. Additionally, it would be more useful if

ratios for each particular income fund raised be compared with the expenses incurred

in generating that fund. This would enable stakeholders to assess how efficient the

IIUMWF is in raising a specific income. For example, the expenditure spent on

advertising and soliciting the Kafalah income should be matched with that particular

Bridging the Gap between Theory, Research, and Practice 20

Table VI

Performance 2003 2004 2005

Efficiency ratios

Program Expenses/Total Expenses 33.33% 69.82% 35.77% Investment Income/Average Investment 4.70% 6.70% 5.20% Total Fund Raising Expenses/Total Funds Raised 3.30% 1.70% * * There was no agent's commission indicated

While there are various other ratios that can be computed to assess the efficiency of

the waqf fund, we have chosen to focus only on the above three ratios. We were

also told that the IIUMWF in fact calculate two ratios annually. The first is Total

Management Expenses to Total Donations and Collections and the second is

Program expenses (amounts disbursed to needy students) to Total Donations and

Collections.

6 Conclusion

Our empirical work examining the accounting and management practices of

IIUMWF revealed that its structure, governance and management practices appear

sound. Its performance from 2003 to 2005 is satisfactory with a return on

investments ranging from 4.7% to 6.7%. Its income is promising particularly

income from the RM 1 campaign and the foster parents’ program (kafalah).

However, its disclosure practices need further improvement. This is understandable

since there is currently no guidelines or standards for accounting for waqfs. The

framework suggested by Ihsan and Shahul (2007) and extended in this study, is a

good start to having a consistent basis of reporting by waqf agencies in Malaysia as

well as in other countries. More importantly, the accounts of the IIUMWF should

be made readily available to the public. The public has every right to know how

waqf funds are managed and disbursed. It is for this purpose that an annual report is

pertinent for waqf institutions. In an unregulated environment, the management of

waqfs will be wholly dependent on the mutawallis. Thus, the mutawallis’ report is

one document that needs to be prepared by waqf institutions. Given that the Islamic

concept of accountability emphasizes the proper discharge of accountability, a

detailed Mutawallis’ report is a must. This is clearly absent in the case of the

Bridging the Gap between Theory, Research, and Practice 21 The existence of an Executive Board and having a committee to oversee the

investments made by the IIUMWF is some indication that governance is not an issue

at the IIUMWF. However, this fact is not reported to the public. Even the website

does not include such information. Further, an established organization such as the

IIUMWF should have an updated website. This is important if the IIUMWF wants

to achieve its vision of “creating a global ummatic network”. On the issue of

efficiency of the IIUMWF, we have found thea related matter, Additionally, the

performance of the IIUMWF in

On the issue of disclosure, it must be emphasized here that there is a dire need for a

standard on waqf accounting to be developed. The existence of a standard will

reduce, to some extent, the diversity of accounting practices across waqfs. This, in

turn, will make it easier for a user to assess the performance of each waqf.

Additionally, this will also make it easier for comparisons to be made between waqfs.

To this end, the efforts of the AAOIFI in coming up with a standard on waqf

accounting in the very near future is, indeed, commendable.

While it has often been suggested that not-for-profit organizations be assessed on its

economy, effectiveness and efficiency, we have only focused on the last. Thus, this

is clearly a limitation of our study. Future studies should make an attempt to

measure the economy and effectiveness of the waqf agency. Further, the framework

developed by Ihsan and Shahul (2007) is based on how best a waqf can discharge its

accountability. Thus, the framework developed is based on the normative---that is

on what users ought to desire. However, what users actually find relevant may not

accord with what they ought to desire. As such, another interesting study is to

examine users’ need for accounting information of waqf institutions. Finally, the

increased scholarly interest on waqfs is certainly a good indication that waqfs will

figure prominently in Islamic societies in future. Accordingly, a study gauging the

ummah’s awareness on the role of waqfs would be a research that is worth

Bridging the Gap between Theory, Research, and Practice 22

References

Adnan, M. 2005. Akuntansi Syariah; Arah, Prospek dan Tantangannya, (Yogyakarta:

UII Press).

Booth, P. 1993. Accounting in churches: research framework and agenda.

Accounting, Auditing & Accountability Journal. Vol. 6. (4): 37-67.

Bowrin, A.R. 2004. Internal control in Trinidad and Tobago religious organizations.

Accounting, Auditing & Accountability Journal, Vol. 17 (1): 121-152

Brownell, P. and Trotman, K. 1988. “Research Methods in Behavioral Accounting"

in K.R. Ferris "Behavioral Accounting Research: A Critical Analysis", Century VII

Publishing Company.

Connolly, C. and Hyndman, N. 2001. A comparative study on the impact of revised

SORP 2 on British and Irish charities. Financial Accountability and Management,

17(1), pp 73-97.

Duncan, J. B., Flesher, D. L. and Stocks, M. H. 1999. Internal control systems in US

churches: An examination of the effects of church size and denomination on systems

of internal control. Accounting, Auditing & Accountability Journal. Vol. 12 (2):

142-163.

Hisyam, M. 2005. Waqf Accounting in Malaysian State Islamic Religious

Institutions: The Case of Federal Teritory SIRC, Masters Dissertation, International

Islamic University Malaysia.

Ihsan, H. 2007. An Exploratory Study of Waqf Accounting and Management in

Indonesian Waqf Institutions, The Cases of Dompet Duafa and Uiversitas Islam

Bridging the Gap between Theory, Research, and Practice 23 Ihsan, H. and Shahul, H. 2007. Waqf Accounting and Possible Use of SORP 2005 to

Develop Waqf Accounting Standards, Paper presented at the Waqf Conference,

Singapore.

Laughlin, R. 1988. Accounting in its social context: an analysis of the accounting

systems of the Church of England. Accounting, Auditing & Accountability Journal.

Vol. 1. (2): 19-41.

Peters, F.E. 1986. Jerusalem and Mecca: The Typology of the Holy City in the Near

East. New York University Press.

Rokyah, S. 2004. Determinants of Financial Reporting Practices on Waqf by

Malaysian Sate Islamic Religious Council in Malaysia. Masters Dissertation,

International Islamic University Malaysia.

Sadeq, A.M. 2002. Waqf, perpetual charity and poverty alleviation. International

Journal of Social Economics, 29(1/2), pp135-151.

Shahul, H. 2000. The need for Islamic accounting: perception of its objectives and

characteristics by Malaysian accountants and academics. Ph. D Thesis. University of

Dundee.

Sorensen, S.M. and D.L.Kyle 2007. Valuable Volunteers, Strategic Finance,

February, pp39-45

Statement of Recommended Practice. 2005. The Charity Commission, Accounting

Standards Board

Yin, R. 1989. Case study research: Design and methods (Rev. ed.). Beverly Hills,

CA: Sage Publishing.

Yin, R. K. 2002. Case Study Research, Design and Methods, 3rd ed. Newbury Park,