AQcᆪjQTQTOVセ@

Analysis of Accounting Treatment of Islamic Credit Card in the

Islamic Perspective

(Case Study in Bank Danamon Syariah)

SKRIP SI

Submitted by :

Savirul Afifi Student ID: 604082000024

0;10; ゥゥGセ|@ J:irl

INTERNATIONAL CLASS PROGRAM

DEPARTMENT OF ACCOUNTING

FACULTY OF ECONOMICS AND SOCIAL SCIENCES

STATE ISLAMIC UNIVERSITY SYARIF HIDAYATULLAH

JAKARTA

(Case Study in Bank Danamon Syarialn)

SKRIP SI

Submitted to Faculty of Economy and Social Sciences

As Partial Requirement for Acquiring Bachelor Degree of Economy

Academic Advisor I

Submitted by:

Savirul Afifi

Student ID: 604082000024

Under Guidance of

Academir. Advisor II

Prof. Dr. Abdul Hamid, MS Ade Wirman Syafoi, SE., MSc

INTERNATIONAL CLASS prqLgraセNQ@

DEPARTMENT OF ACCOUNTING

FACULTY OF ECONOMICS AND SOCIAL SCIENCES STA TE ISLAMIC UNIVERSITY SY ARIF HIDAY ATULLAH

Today, we administered a comprehensive test examination to Savirul Afifi ID

604082000024. The title of his thesis is: "Analysis of Acconnting Treatment of

Islamic Credit Card in the Islamic Perspective (Case Study iu Bank Danamon

Syariah)". After proper examination of the work student, we have decided that he

has met all of the requirements for the title of Bachelor of Economics on the field of

Accounting, State Islamic University (Universitas Islam Neg'3ri) Syarif Hidayatullah

Jakarta.

Jakarta, August

1st2008

Comprehensive Examination Team

Prof. Dr. Abdul Hamid, MS.

Dean of Faculty of Economics

and Social Sciences

ii

Analysis of Accounting Treatment of Islamic Credit Card in the Islamic Perspective

(Case Study in Bank Danamon Syariah)

SiffiIPSI

Submitted to Faculty of Economy and Social Sciences As Partial Requikment for Acquiring Bachelor Degree of Economy

Academic Advisor I

Submitted by:

Savirul Afifi

Student ID: 604082000024

Under Guidance of

Academic Advisor II

Prof. Dr. Abdul Hamid, MS Ade Wirma.> Syafei, SE., MSc

Professional Examiner

id Cebba Ak MBA

INTERNATIONAL CLASS PROGRAM

DEPARTMENT OF ACCOUNTING

FACULTY OF ECONOMICS AND SOCIAL SCIENCES

STATE ISLAMIC UNIVERSITY SY ARIF IDDAYATULLAH

JAKARTA

CURRICULUM VITAE

I. Personal Biodata

!. Name Savirul Afifi

2. Place/Date of Birth : Jakarta I October 23rd 1985

3. Address JI. Poncol Indah IV No.20A Rt02/02, Cirendeu,

Ciputat, Tangerang, 15419 ..

4. Religion Islam

5. Citizen Indonesia

6. Name of Father Chusnan Yusuf

7. Name of Mother Masyitoh

8. Motto Struggle till the end, back to Allah SWT.

II. Formal Education

I. Muhammadiyah Elementary School 1st Grade, Banda Aceh.

2. As-Syafi'iyah Islamic Boarding School 2nd-5th Grade, Jakarta.

3. Rawalaut Elementary School 2 (SDN 2) 6th Grade, Bandar Lampung.

4. Junior High School 3 (SMPN 3), Jakai1a.

5. Senior High School 37 (SMUN 37), Jakarta.

6. Accounting Background, Faculty of Economics and Social Sciences,

ABSTRACT

The Islamic Credit Card is facility provided by Bank for the communities and the customer as one of the facilities in order to fulfill the basic need and secondary need. However, the community began to consider to use credit card in being caused by the existence of the interest element that was regarded as something that was prohibited by Islamic Law.

Savirul "Analysis of Accounting Treatment of Islamic CreditCard in the Islamic Perspective (Study Case in Bank Danamon Syariah)". One of the indicators that could be made to measure Sharia Compliance is avoidance of Islamic prohibited acts, especially in providing the credit card service.

This research aimed at knowing as well as studying the system and the accounting treatment that was done by Islamic Banking in providing the credit card service. The analysis method used by writer in this research is the Qualitative Descriptive Analysis.

ABSTRAK

Kaitu Kredit Syariah adalah fasilitias yang diberikan oleh Bank untuk masyarakat dan nasabah sebagai salah satu fasilitas untuk memenuhi kebutuhan dasar dan pelengkap. Bagaimanapun, masyarakat telah mulai memikirkan ulang untuk menggunakan kartu kredit yang menggunakan elemen bunga, tetapi dilarang oleh hokum Islam.

Savirul "Analysis of Accounting Treatment of Islamic CreditCard in the Islamic Perspective (Study Case in Bank Danamon Syariah)". salah satu indikator yang dapat dijadikan ukuran kepatuhan terhadap hukum ekonomi syariah adalah terhindarnya perilaku dalam perbankan syariah yang mengarah kepada hal-hal yang dilarang oleh agama, terutama dalam menyediakan jasa kartu kredit.

Penelitian ini bertujuan untuk mengetahui serta mempelajari sistem dan perilaku akuntansi yang diberlakukan oleh perbankan syariah dalam menyediakan jasa kartu !credit. Metode analisis yang digunakan dalam penelitian ini adalah Analisis DeskriptifKualitatif.

FOREWORD

By praising Thank Heavens to Allah that showered divine guidance, the

hidayah and inayah so writer can finish the task of Thesis that be entitled

"Analysis of Accounting Treatment of Islamic CreditCard in the Islamic

Perspective (Study Case in Bank Danamon Syariah)"

Shalawat and greetings it is hoped was showered to Rasulullah SAW as

well as the family, the friends but also anyone who followed the step and his

guidance.

In an effort to this Thesis there are many obstacks and the barrier as well

as the difficulty that the writer faced. To face this difficulty, the writer received

much good help of morale and material that are so valuable, the guidance und

facilities that really were needed. Especially to my parents that never tired gave

the affection and their support took the form of the prayer, morale and material to

the writer towards the compilation of this Thesis.

In connection with this Thesis also, then the writer sent the expression of

thanks to:

!. Mr. Prof. Dr. Abdul Hamid, Ms as the Thesis Advisor I and as the

Dean of Faculty of Economics and Social sciences, State Islamic

University SyarifHidayatullah Jakarta, that sinwrely give time to give

the guidance that were useful for the compilation of this Thesis.

2. Ade Wirman Syafei, SE., MSc as the Thesis Advisor II that also

sincerely give time to give the guidance and that were useful for the

3. Drs. Abdul Hamid Cebba, Ak, MBA as head of Accounting

department of Faculty of Economics and Social sciences, State

Islamic University SyarifHidayatullah Jakarta

4. My lecturer who often performed an educational service the writer

with various science sorts while joining lectures as well as the staff

Faculty of Economics and Social sciences, State Islamic University

SyarifHidayatullah Jakaita.

5. My parents, Chusnan Yusuf and Masyitoh Chusnan, who gave the

support and became the source of the motivation, were most main and

valuable.

6. My three older brothers, Haikal Djauhari, Paiz Rafdhi, and

Muhammad Alva Ashri who helped beth from the aspect of morale

and material in the thesis process.

7. My close friend, Tanty Hmjati Amie, that never tired continued to

support and help the writer in the thesis finishing. Hope you can

continue your education soon.

8. My friend, Sofyan Kaharu. Sholatia Dalinmnthe, Aysa Nawazir (you

all are the best pay I've ever had). Abdul, Fajar,, as well as other

alay-alay that was still scattered in FEIS.

9. All the sides that helped in the thesis finishing.

On all help that was given, once more the writer give thank. Hope that this

thesis could be useful for many sides.

Jakarta, April 2009

LIST OF CONTENT

PAGE OF THESIS APPROVAL... ..

iPAGE OF COMPREHENSIVE TEST...

nCURRICULUM VITAE...

111ABSTRACT...

IVFOREWORD ...

vLIST OF CONTENT ··· ...

VILIST OF TABLES...

vnLIST OF FIGURES . . . ...

vmCHAPTER I INTRODUCTION

A.Background ofStudy... 1

B. Problem Formulation... 2

C. Purpose and Benefit... . . . .. 3

CHAPTER II THEORETICAL FRAMEWORK

A.Highlight oflslamic Banking... 5

1.

The Characteristics oflslamic Banking... . . . 5

2. Islamic Banking in Indonesia... . . ... . 9

B. Basic Concept oflslamic Banking Credit Card...

10

2. Substance, Aim, and Function of Credit... 12

3. Definition and Terminology in Banking Cards...

17

4. Basic Concept ofislamic Banking Cards...

24

5. Accounting "'reatment for Banking Cards... 27

a. Accounting ofijarah (Leasing)... . . 29

b. Accounting of Qardh (loan)... 34

c. Accounting ofKafalah (Guarantee)... 39

6. Fatwa of National Sharia Board . . . .. . . 40

CHAPTER III RESEARCH METHODOLOGY A.

Scope of Research. . . .. 41

B. Sampling Method...

42

C. Data Collection Method... 42

I.

Library Research ... ... 42

2. Field Research... 42

D. Data Analyze Method... 43

E. Variable Operational... 44

CHAPTER IV RESULTS OF RESEARCH AND DISCUSSIONS

A. Highlight of Research Object... . . . .. 46

I.

History ofCompany...

46

2. Business Expansion...

50

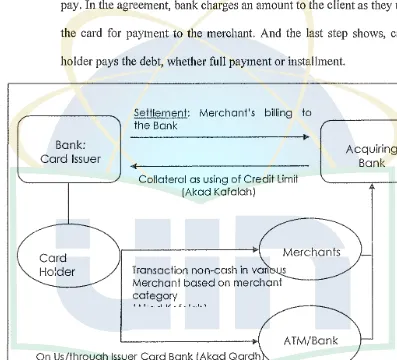

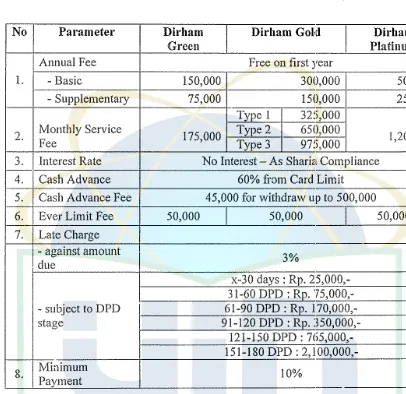

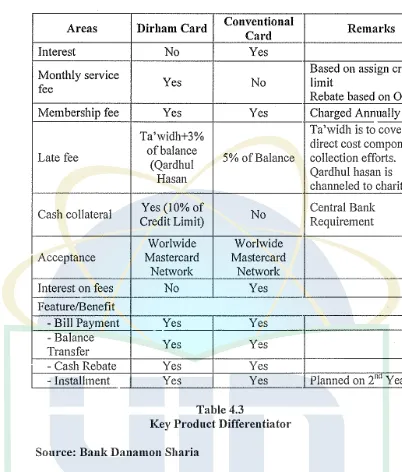

B. System ofDirham Cards Bank Danamon Syariah... ... 52

1.

General Perspective... 52

2. Application... . . . 54

3. Component... 59

4. Data Processing... 62

5. Accounting Treatment... 65

a. ljarah... ...

65

b. Qardh... 65

c. Kafalah... ... ... ... ... ... .. ... ... .. . ... ... ... ... .. .. ... ...

66

d. Fee, Charges and Penalty... 67

6. Billing Statement . . . .. . . 67

CHAPTER V SUMMARY AND IMPLICATIONS A.

Summary. . . 7 0

B. Implications ... 72

REFERENCES APPENDIX

LIST OF TABLES

Table 4.1 Limit Assigmnent . . . 57

Table 4.2 Fee and Charges . .. .. . . .. .. .. .. . . .. . . .. . . . .. . . .. . . .. .. . . .. . .. .. . .. . 58

Table 4.3 Key Product Differentiator .. . . .. . . .. . . .. . . .. . .. .. .. . . .. . . .. .. . .. .. . . .. . . 60

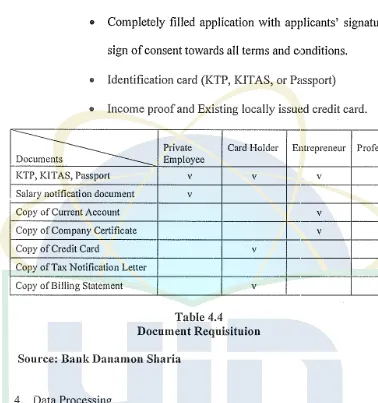

Table 4.4 Document Requisition . . . .. . ... . .. .. . . .. .. . . ... 61

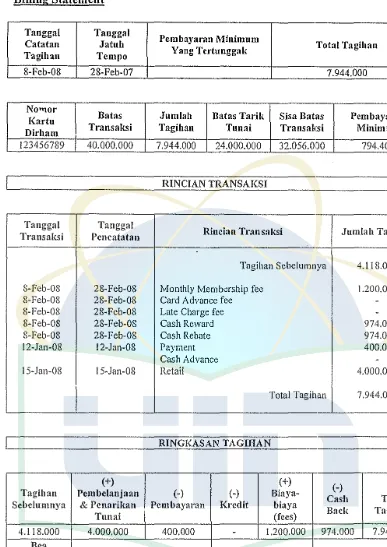

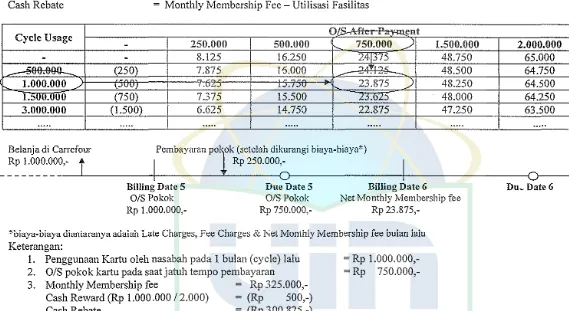

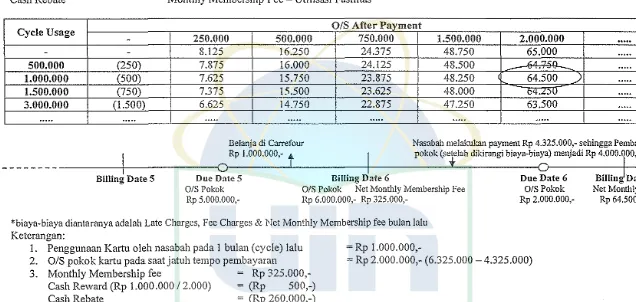

Table 4.5 Billing Statement . . . .. 69

[image:13.595.82.488.147.557.2]LIST OF FIGURES

[image:14.595.90.474.166.553.2]Figure 4.1 Akad in Transaction .. . . .. . . .. . . 55

Figure 4.2 Akad in Transaction II . . . .. . . .. . . .. . . 56

Figure 4.3 Application Flow . . . .. . . .. . . .. . . .. . . .. . . .. . . .. . ... 64

A. Background of Study

Chapter I

Introduction

Between the important things in modern period on economic area

since 50 years ago is financial transaction cards system, which the first time

emerge in America, then in Europe, and then spread up in Islamic state and

non-Islamic state.

In economic practice and trading, this system has high benefit and

effectiveness. Economic institution has practice the experience so long and

has known society characteristic so that can collect people in every level,

special for the high level and middle to take apart in this system. Advertising

is focused for the positive thing of this card such as safety aspect, prestige,

satisfy of needed, financial ambition. Advertising covers negative aspect to the

society, either religion or economic, such as debt and interest that

unconsciously by the people. If the negative aspect describe specifically of

course society uninterested with the system, such as cost of cash credit and

cost of money change, interest of fall into areas so that the account which

should be paid by borrower greater. All of them are a debt which burden card

holder so that they can't standing under for the future, specifically for the

limited income people.

All of this happen because unopened agreement between card

account between them. While that agreement is used for base by banker to get

the higher benefit. The banker gets higher benefit than interested income

which is got by application and the other product.

This banking cards system grows and spread up in western suitable

with the framework and economic capitalist philosophy. This system is hefty

and specific so that all can be going on. All the system is used for getting the

benefit from the card holder (Abu Sulaiman, 2006: 12)

Besides it, Islamic society has its special economic foundation,

different with the other transaction. The economist offer and explain banking

card system with the economic language and terminology that much people

knew. Every science has a specific terminology, may be this terminology

unknown by a few people. Although some people know, but the knowledge is

!lOt as deepest as the expert one.

B. Problem Formulation

Based on the background that has the writer suggested above, and

then the writer formulated the problem as follows:

I) How will the bank obtain the profit if they are giving the service of the Islamic

banking credit card?

2) What system and Accounting Treatment that was used in the applicatiou of the

3) What are the agreements that are stated on the Dirham Card?

4) Can Muslims use the credit cards that are available in the market?

C. Purpose and Benefit

I. Purpose

The purposes of this research are:

a. To know from where the bank will obtain the profit if they are giving

the Islamic credit card service

b. To !mow the system that was used in the application of the Islamic

credit card

c. To know the allocation or funding for the Islamic credit card, by

analyzing the system and its scheme.

d. To know the available contracts and agreement in Dirham Card.

2. Benefit

Whereas the benefit that it was hoped with the implementation of this

research was as follows

a. For the Danamon Sharia Bank, it's expected to be able to be made

input in increasing the role and the achievement from system that was

used in Dirham Card to increase the Customer's satisfaction the

b. For the Faculty, it's hoped could add literature the book in the Faculty

Of Economics especially the Accounting Backg;round so it is able to

increase the concept and knowledge for the writer especially, and for

the reader generally. As well as could be made the reference for the

other writer who carried out the research about the Islamic Credit Card

and Islamic Banking

c. For the Writer, as one of the requirement to follow the final

examination in order to receives the Bachelor Degree of the Faculty of

Chapter II

Theoretical framework

A. Highlight oflslamic Banking

1. The Characteristics of Islamic Banking.

The Islamic Principle in the assets management stressed on the

balance between the interests of the individual and the community. The

wealth must be used for productive matters especially the economic

activity in getting the profit. Therefore, intermediary institute was needed

to intermediary the fund owner with the fund manager. One of the forms

of this intermediary institute was the Bank, which are their activities were

based on the Islamic principle. The Islamic Bank is the Bank that was

based on the paiinership, justice, the transparency, and universal as well as

carried out the activity of Banking efforts was based on the principle of

Islamic principle (Muhammad Syafi'i Antonio, 2002:48) The Islamic

Banki"g activity was the implementation and the principle of Islamic

economics characteristically, these are:

a. The banning of usury or riba in various forms.

b. There is no time value of money concept.

c. The concept of money as the implement exchanged, not as

commodity goods.

d. It is not allowed to carry out two prices for one goods.

Islamic Bank operated on the basis of the profit-sharing concept.

Islamic Bank did not use interest as the implement to get revenue and

burden the interest on the use of the fund and the loan because interest is

usury or riba that is prohibited. Difference from non··Islamic Bank that did

not distinguish firmly between the monetary sector and the real sector, so

as in its business activity could carry out real sector transactions, like the

trade and rent leased.

Islamic Bank could run its business activity to receive the

repayment for the other Banking service that was not against with the

Islamic principle.

A transaction in accordance with the Islamic principle if filling

these conditions, those are:

a. The transaction did not contain the element of fraudulent

b. Not riba or usury

c. Did not pay the side personally or other side

d. There is no deception (Gharar)

e. No contain materials that are prohibited

f. No contain the element of gambling (Muhammad Syafi'i

Antonio, 2002: 46)

In relation to the above matter, was gotten by several Islam

propositions that banned the system riba. Nevertheless, Allah filed

First srage:

In Alquran surah Al-Ruum [30]: 39 were named:

39. and that which You give In gift (to others), In order that it may increase (your wealth by expecting to get a better one In return) from other people's property, has no increase with Allah, but that

which You give In Zakat seeking Allah's Countenance Then those, they shall have manifold increase.

Second Stage

In Alquran surah An-Nisaa [6]: 160-161 were named:

セ@

iA

jjj

iy!T

セセヲ。@

@

i4

セt@ セ@

d-

セP@

NセS@

セi@

エ[iセ@

セ@

0oA

gセ|ェ@

Bセゥ@

u-"t:JT

JS:f, ·

1<f3

\ ' _ . . , . . ,, ..-,,. セiM

I 60. for the wrong-doing of the Jews, we made unla11ful to them certain good foods which has been lmvfiil to them, and for their hindering many from Allah's Way;

Third Stage

In Alquran surah Al-Imran (3]: 130 were named:

130. 0 You who believe! eat not Riha (uswy) doubled and

multiplied, but fear Allah that You may be successfiil.

Fourth Stage

In Alquran surah Al-Baqarah [2]: 278-279 were named:

278. 0 You who believe! be afraid of Altdh and give up what

remains (due to you) ji-om Ribd (uswy) (fi·om now onward),

if

Youarc (really) believers.

279. and

if

You do not do it, Then take a notice of war ji·om Allahand his Messenger but

if

You repent, You shall have Your capitalThese four steps, shows people's paradigm of mind set for avoiding.

Riba.

In collecting fund, Bank Sharia used the principle of wadiah,

mudharabah and another principle which related to Sharia, even though in

flow Bank Sharia uses the principle, such as:

a. Musyarakah principle and/or mudharabah for investment or

cost (financing)

b. Murabahah principle, salam and/or istishna for trading

c. Ijarah principle and/or Ijarah muntahiyah bittamlik for rent

(leasing)

d. Other principle that match with Sharia principles.

2. Islamic Banking in Indonesia.

In Indonesia the pioneer of Islamic Banking was the Bank of

Muamalat Indonesia. Stood in 1991, this Bank was initiated by the

Council of Ulama Indonesia (MUI) and the government as well as the

support from the Association of the Indonesian Muslim Intellectual

(ICM!) and several Muslim businessmen. This Bank could be affected by

the monetary crisis at the end of the 90's so as its equity only remained a

third of the capital of early. IDB afterwards gave the injection of the fund

to this Bank and in the period 1999-2002 could rise and produce the profit.

in regulations that is No. UU I 0 in I 998 about the Change in No. UU 7 in

1992 about Banking (Karim, 2001:23)

Until 2007 was gotten by 3 institutions of the Islamic Bank in

Indonesia that are the Bank of Muamalat Indonesia, Bank Sharia Mandiri

and the Mega Sharia Bank. In the meantime the public's Bank that had the

unit of Sharia eff01ts was 19 Banks including being the big Bank like the

Bank of Negara Indonesia (Persero ), the Bank of Rakyat Indonesia

(Persero ), and the Danamon Bank.

B. Basic Concept oflslamic Banldng Credit Card

I. Definition of Credit

Credit is the provision of resources, such as granting a loan, by one

party to another party where that second party does not reimburse the first

party immediately, thereby generating a debt, and instead arranges either

to repay or return those resources (or material[s] of equal value) at a later

date. The first pa1iy is called a creditor, also known as a lender, while the

second party is called a debtor, also known as a borrower.

Other definitions about the terminology of credit as follows:

a) Credit may be defined as the right to receive payment or the obligation

to make payment on demand or at some future time on account of an

immediate transfer of goods (Raymond P. Kent, 196 I)

b) The word of "credit" has many meaning, but in economics it usually

return for a promise to pay for it at some future time, combining the

element ofa promise and of time (Charles L. Prather, 1961)

c) ... credit may be appropriately described as the transmittal of economic

value now, on faith, in return for an expected equivalent economic

value in the future (National Association of Credit Management, 1965)

d) Credit in general is the ability to obtain goods, service, or money now

in exchange for promise of payment in the future (Christine Ammer

and Dean S. Ammerm, 1979)

e) Credit in economics and finance, refers to the faith that creditor

(lender) places in a debtor (borrower) by extending him loan

(Encyclopedia Americana, 1980)

f) Credit and its opposite, debt, are transactions in which command over

resources is obtained in the present in exchange for a promise to pay in

the future, normally with a payment of interest as compensation to the

lender (Encyclopedia of Economics, 1982)

Therefore, in practice credit is:

• The transfer value of economics is now based on trustiness in the

hope of getting same value of economics in the next time.

• An action on the basis of the agreement where in this agreement

was gotten by the service and the recompense (the achievement

and contra- achievement) that both of them was separated by the

• Rightful authority, with this right a person could utilize credit for

the certain aim, in the certain time and based on ce1tain

considerations (Abu Sulaiman, 2006: 3)

2. Substance, Aim, and Function of Credit

a. Substance of Credit

Credit is given on the basis of trustiness so as giving of credit was giving

of the trust. This means that the achievement given is really believed in

could be returned by the credit recipient in accordance with time and

conditions that were agreed together. Based on the matter above, elements

in this credit were as follows:

I) There are two parties, that are creditor and customer

2) There is a trustness between creditor and costumer

3) There is an agreement, as an agreement Bankir with another party

that promise to pays from costumer to the creditor. That promise

could be language or written (credit akad) or as a instrument (credit

instrument)

4) There are a transfer of goods, services or money from creditor to

customer

5) There is time element. Time element is an essential time element.

Credit will be available because of time eleme:nt, from the issuer or

6) There is degree of risk both of creditor and costumer. The risk in

creditor is risk of default. The risk in costumer is creditor falseness,

such as give a credit in order to take the costumer's business or

field warant.

7) There's an interest as a compensation to the creditor. As a creditor,

the interest consist of any componen such as cost of capital,

overhead cost, premium risk, etc. If costumer credit rating is high,

premium risk can be decreased by safety discount.

b. Aim of Credit

Aim discussions of credit included the wide scope. Basically

there are two connected functions mutually from credit, which is as

follows:

• Profitability, receive credit compensation by taking profit that was

gained from the interest that must be paid by the customer. In

Conventiorn;l Bank.

• Safety, that is the security from the achievement or facilities that

were given really must be guaranteed so as the aim profitability

could be reached without the significant obstacle.

Besides it, there are two main parties that is intervense in every

creditor so that in every credit giver will cover the two main parties aim

a) Bank (Creditor)

(1) Giving credit is a main bisnis and almost the bigest in every

Bank.

(2) Receiving Interest from creditor to the most of Bank is the

higher income

(3) Credit is one of instrument/Bank product as give service to the

customer.

b) Costumer (Businessman)

(1) Credit is one of potential things to spread out the business

(2) Credit is a an alternative of payment.

c. Function of Credit

Credit had the role that was very imp011ant in the economy. In

brief outline, the function of credit in the economy, the trade, and

finance raise as follows.

1) Credit could increase utility (the usefulness) from capital/money.

The customer save their money in the Bank in giro form,

deposite or even saving. In spesific presentation, the advantage of

their money will be increased by Bank. The enterpreneur enjoy

increasing production, trading, or rehabilitation effort or even

general increasing productivities effort.

2) Credit increased utility (the usefulness some goods).

Producer with gra11ting of Bank credit can product

finished good so that the utility of that things increase, such as

increasing palm utility to kopra, and becomes palm oil/ fried oil,

increasing rice-plant utility to rice, thread to textile, etc. Producer

with granting of credit can move the things from somewhere which

is under-utilization to the full places.

3) Credit increased the circulation and the money traffic.

Credit that was distributed through the current accounts, the

businessman created the increase in the circulation of money giral

and this kind of money such as, giro bilyet, the money order, et

cetera through credit. The circulation of money kaiial and giral will

be more developing because credit created a passion tried so as the

use of money will improve, both qualitatively and quantitatively.

Hal ini selaras dengan pengertian Bank selalrn money creator. The

money creation apait from by means of substitution, which is

conversion of money kartal that was kept in giro by money giral,

there was the method exchange of claim that is the Bank gave

credit in the form of giral. By that, by means of the transformation,

4) Credit triggered the enthusiasm to run business in the community.

Human was the creature that always carried out the

economic activity, which is always tried to satisfy their wants. The

efforts activity in accordance with his dynamics always will

increase, but the increase in efforts not always was matched by the

increase in the capacity. Therefore, human always tried with all the

powers to meet lacks that was connected with other human that had

the capacity. Because of that also, the businessman will always be

connected with the Bank to secure help funding or financing in

order to increase in his efforts. Credit that was accepted by the

businessman from the Bank that afterwards to enlarge the volume

of effmts and his productivity. Inspected from the law and demand,

towards all the sorts and their style efforts, the request will

continue to improve when the community began carried out

demand. Emerge afterwards the cumulative effect by increasingly

the request size so as in sequence afterwards caused the passion

that spread in society. Therefore, this matter increased the

productivity. Automatically afterwards emerged also the

impression that for each increase effo1t in the productivity, the

community might not worry the lack could be, because of their

3. Definition and Terminology in Banking Cards

a. The loan contract of the analysis of fiqih and iits practice on credit

card

The contract or akad with the card that was issued by the Bank

with various kind sorts and functions are the new matter in fiqih Islam.

Generally this contract is not including in the category of the akad

muamalah in fiqih Islam with the number of .accomplishers of the

contract, relations, the bond, and the card kind that are used.

Briefly, agreements that are stated in using card akad are as

follows:

I. Contract between the creditor and the card holder

2. Contract between the creditor and the marketer

3. Contract between merchant and the card holder

4. Contracts were separated between two accomplishers; the

creditor joined in as well as in each contract

In each form of the contract that used the card, it has special

discussions in .fiqih depended the position of the contract and its

situation, because in a fiqih law the contract that was counted did not become the obstacle. The kind of the contract for anyone in accordance

with the aim and its role was separated with the other aims. For

example the creditor had relations independent with the holder of the

as the guarantor of the right of the goods and services trader against

the holder of the card that carried out the transaction. Thirdly, as the

holder of power of attorney on acceptance of the loan in doing

payment without the existence of the dispute, considering each

contract syar'I had responsibility and the influence

In Fiqh, card holder and creditor have a relation. Different with

relation between card holder and merchant. Card holder has many

costs in transaction (Abu Sulaiman, 2006:84).

Between merchant and card holder have a syar'I position and

polis. Even though relation with the creditor different with merchant.

Between one to another parties has a complicated relation, and every

parties in relation with another pa1iies has a syar'i interlocked without

other parties intervenes.

With this study, God willing to give a conclusion which is

hope. This study about credit card include: position a few akad in fiqh

and relation between one to another parties in iadependent agreement

without any intervention from another parties (Abu Sulaiman,

2006:41).

Explaining about credit card rules has been discussed about

division of credit card which is used in transaction. There are two kind

of credit card: (I) credit card, (2) non credit can!. Study about it has

!. Credit card

2. Charge credit

3. Retailer credit

Three of cards above are included in a loan akad, where the

akad in every card uses can be done between creditor and card holder

based on creditor first than card holder as a costumer, suitable with the

conditions which have been agreed by two parties.

Relation between creditor and card holder in every kind of card

is a relation between creditor and card holder.

b. Requirements in Banking Card Agreement

The contract agreement used the card included several

conditions and has many discussions concerning the importance of the

condition to iqrad in fiqih Islam.

Firstly, legal condition Iqrad. Issuer Bank ask fow

pre-requirement in the agreement, these are:

• Its legality in line with the basic concepts, and the aim of

Islamic law on the agreement of credit card application.

• It's not against maqasis al syar'i.

l. The commitment to responsibility and punctuality in loan

payment.

a. The pre-requirement for the side issuer the Bank must make

a commitment towards financial responsibility, whereas for

card holder must has commitment to loan payment in

accordance with the agreement.

b. Card issuer to get price and transaction services to the card

holder.

c. Loan is occurred in agreement period.

d. Card holder has a competent of card owner.

e. Issuer or Bank has a responsibility in every represented

activity.

2. The issuer gave credit to the card.

Some Bank required the existence of the account opening, as the

guarantee for the Bank from the person/the customer who put

forward the card service of various kinds, and as the strengthening

of bank's rights. Moreover also as the occurrence guarantee of

payment for the transaction that was carried out card holder. In

fiqih Islam, the condition could be found in the problem of rahn

(security); where the debt guarantee with something that could be

taken, all of things or some to them that cannot settle payment took

something that has been known and enabled to be able to get the

half price loan of from the goods or costing with the goods that

was pawned (Abu Sulaiman, 2006: 3).

Pawn will be legal if the pawned things are able to be sold;

because pawn has an aim gives trustiness to get loan, even tough

with cash or credit payment.

3. The condition of subscription payment in card system.

The bank burdens an amount of money to the customer

in order to be a member of Bank and get the card. This

subscription came to card holder and merchant as the condition

for the subject to get the card and became the network member

of these banks as the fund for the administrative activity of the

office.

Generally, cost for gold card is higher than silver card and

debit card cost is higher than credit card. This kind of fee h2.s

not any relation with loan. It just as a salaIT services.

Certain requirement in Credit Card application, generally as

follows:

a. The interest in each transaction that used credit card

between I % and 2.5 % from the price of goods.

c. When the loan without the maximal limit, then must pay

10% of each numbering pulling 5.000 riyal, afterwards was

multiplied in accordance with the loan.

d. The Cost of payment of foreign currency of the changing

cost.

e. The Cost of payment on the process of card using in

transaction, counted since transaction time.

There is also the other condition that must be followed

card holder without being based on the agreement and the

review. These additional conditions included or not included in

the agreement of using credit card became the source of the

profit for issuer the Bank.

Additional condition on the loan from the side issuer is

forbidden, when being inspected from the Islamic law. This

wns based on two reasons: first, the additional interest on the

postponement of loan payment including usury (riba) nasiah.

This usury was forbidden to be based on Moslems's agreement.

Without any difference, this usury was al.so acknowledged as

usury Al-jahiliyah, was forbidden because of the existence of

the increase of the number of loans to be caused by the

In Alquran surah AI-Imran [3]: 130-131 were named:

セ@

.... J " , J . J , , ... セLLLLjセLNNL@

セ@

PセGw@

(>.51J

.WI lyt;lj

`uNセ@

"O ye who believe! Devour not usury, doubled and multiplied; but fear God; that may (really) prosper. Fear the fire, which is prepared for those who reject faith"

And in Al Quran surah Al Ruum [30]: 39 were named:

4. Basic Concept oflslamic Banking Cards

Based on Sharia National Council about Sharia credit card, based

concept which is used for Sharia credit card are:

a. The Provision of Akad

Akad which is used in Sharia card are:

I) Kafalah; in this case issuer card is a warrant (kafil) for card holder

to the merchant in every obliged payment (dayn) which is shown

by transaction between card holder and merchant, and/or cash

withdrawal beside Bank or card issuer Bank A TM. Based on

kafalah, card issuer can get fee (1ljrah kafalah)

2) Qardh; in this case issuer card is a loan giver (muqridh) to the

card holder (muqtaridh) by cash withdrawal from Bank or card

issuer Bank

3) Ijarah; On the Ijarah scheme, the card issuer acts as the provider

of payment and service system for the card holder. For the

provision of this service, the card holder is charged a membership

fee.

b. Limitation Provisions (Dhawabitft wa Hudud) Sharia Card

I) Do not cause usury

2) It is used for the transaction that was not m accordance with

3) Do not push the excessive issuing (israf), by maintaining the

maximum ceiling of financing

4) The Card Holder must have the financial capacity to settle in time

5) Do not give facilities that were not compatibk with Islamic law.

c. Provisions of Fee

There are few provisions of fee that must be folfilled by the customer

in order to propose the application. They are:

!) Membership fee 7 issuer card has a right in accept membership

fee (rusum al- 'udhwiyah) include prolong the member period from

card holder as a payment (ujrah) of card uses Facilities permit.

2) Merchant fee 7 card issuer able to accept foe which is taken by

object transaction price or services as payment (ujrah) of mediator

(samsarah), marketing (taswiq) and debt collec:tor (tahsil al-dayn)

3) Cash Withdrawal fee 7 The card issuer might receive fee for the

cash withdrawal (rusum sahb Al-nuqud) as fee on the service and

the use of facilities that the size was not connected with the number

of pulling

4) Fee Kafalah 7 card issuer is able to receive fee from card holder

of given of kafalah.

5) Every kind of fee above must be fixed by card application akad

d. The Provisions of Ta'widlt and Penalty.

I) Ta'widh

Issuer is able to give ta 'widh, which is compensation against fees

that were spent by the issuer resulting from the delay of the holder

of the card in paying his obligation that was due.

2) Late Charge.

Issuer is able to give late charge payment, which is recognized as

social fund, or also for Corporate Social Responsibility/Charity.

e. Closing Provisions

I) If one of party did not fulfill his obligation or ifthe dispute among

related sides happening, will be solved by Arbitrase Syari'ah Board

or by Jurisdiction of Religion if there is no any agreement by

deliberation.

2) Fatwa by National Sharia Board about Sharia Card had been valid

since the date was determined with the provisions if in afterwards

the day evidently was gotten by the error, will be changed and

5. Accounting Treatment for Islamic Banking Cards

Financial accounting especially linked with the provisions of

information to help the stakeholder in decision making. They who did

business with Islamic banks had the interest to obey and search Allah's

ridha in the financial matters and their other affair.

In Alquran surah Al-Baqarah [2]: 168 were named

168. 0 mankind! eat of that which is lawful and good on the earth, and follnw not the footsteps of Shaitdn (.<fatan). Veri(v, He is to You an open

enemy.

Targets of financial accounting for other banks most were

appointed in the non-Islamic country. Therefore, it's acceptable that there

are differences between aims determined for other banks and for banks that

will be appointed for Islamic banks. This difference especially came from

the difference in targets of them who need accounting information. But, this

did not mean us refused all the results of modern accounting method in the

non-Islamic countries.

This because of between Moslem and non-Moslem users having

non-r· ..

l__

u_1_N_S,_f1'.\HUJ.JIA!/!'-Moslem together want to increase their wealth and to get results that could

be accepted from their investment. This is legal and was acknowledged in

Islamic Principles that in accordance with Firman Alah:

In Alquran surah Al-Mulk [67]: 15 were named

15. He it is, who has made the earth subservient to You (i.e. easy for You to walk, to live and to do agriculture on it, etc.), so walk In the Path thereof and eat of his provision, and to Him will be the Resurrection.

The aim of the Sharia Bank's Accounting

I. Determined the right and obligation of related parties, including the

right and the obligation came from the transaction that has not been

finished yet and/or other economic activity, in accordance with the of

Islamic principle that based on the concept of honesty, justice, and the

obedience towards the values of the Islamic business.

2. Provided useful financial information for the stakeholder in decision

making.

3. Increased the compliance towards of Islamic principle in .all

transactions and other economic activity.

Based on National Sharia council of Indonesian statement about

Sharia credit card, finance-accounting standard statement (PSAK) and

based on Fatwa National Sharia Board - Moslem Council of Indonesia

(DSN-MUI). Accounting treatment to Sharia credit card, as follow.

a. Accounting ofljarah (Leasing)

Ijarah was the transaction rent-leased on an asset. In the

transaction Ijarah, it was stressed or the object of the guarantee

transaction is the using of benefit of an asset. Therefore, one of the

pre-requirement is the rental price. Conventionally this system was

known by the name of leasing. In this principle the customer might

have this thing after the rented period was finished ifthe rented cost is

already included the main installment of the price of goods.

Bads of Syar'i:

In Alquran surah Al-Baqarah [2]: 233 were named

233 .... And

if

You decide on a foster suckling-mother for Yourchildren, there is no sin on you, provided You pay (the mother) what You agreed (to give her) on reasonable basis. and fear Allah and know that Allah is All-Seer of what You do.

l. Characteristics

As being explained before that Ijarah was the rented

leasee to get the repayment for the object of rent that was hired out,

whereas Ijarah muntahiyah biitamlik was the rented contract leased

between the owner of the object of rent and the leasee to get the

repayment for the object of rent at the time of certain in accordance

with the rented contract

Related with the move of object proprietary rights of rent to

the leasee in Ijarah muntahiyah biitamlik could be carried out by

means of as follows.

a. Giving

b. Marketing before and of akad as big as prices which suitable

with rest instalment rent.

c. Marketing in the and of rent peroid with appointed payment

which is agree in the begin of akad

d. Rank marketing as big as appointed price which agree in akad

2. Acknowledgment, measurentment and presenting Ijarah and ljarah

Muntahiyah Bitlamlik

PSAK No. 59 (2002) classified the acknowkdgement and ljarah

measurentment and Ijarah muntahiyah bittamlik to 4 classes, that

are:

• Bank as the owner of lease object

• Selling and re-Leasing

• Lease dan re-Leasing

b. Bank as the owner of rent object

Based on PSAK No. 59 (2002) when getting rent

object, rent object is recognized as big as income cost. The

journal as follows:

Assets of Ijarah

Cash

Rp. Xxx

I

Rp. xxxIn the end of year, when Bank Sharia will arrange a

finance report so the active Ijarah must be decreased with the

rules that are:

a. The policy of the depreciation to the owner of rent object

for the similar asset if being the Ijarah transaction, and

b. Rent periode if in ljarah muutahiyah bittamlik transaction

And the journal, as follows:

Cost of depreciation

Accumulated depreciation

Income ofljarah

Rp.Xxx

I

Rp. xxxThere must be pay off bit by bit the object of rent in

Income of fjarah and Ijarah muntayiyah bittamlik is

recognized proporsionally in rent period except Ijarah

muntahiyah bittamlik income by rank selling so the income in

every period will decease progressively in akad period because,

The paying off paii by paii the object of rent in each certain

period. The journal is shown as follows:

Cash

Income from Ijarah

Rp. Xxx

I

Rp. xxxCost related to ljarah

About cost with related to akad Ijarah, PSAK No. 59

(2002) regulates, as follow.

If akad cost becomes rent object owner cost, the cost

will be allocated consistently with Ijarah income allocation or

ijaarah muntahiyah bittamlik in akad period

Reparation of rent objeck, PSAK No. 59 (2002)

regulates as follow.

a. Bank regulates reparation estimation cost of rent object

unstable proportionally in the advantage periode for every

b. Realisation reparation of rent object cost is decreased from

estimation reparation cost which is recognized in the

running period.

If the leasee does routine reparation of rent object with

the owner's agreement so the cost will be cost by the owner

and recognized as cost in that period.

In Ijarah muntahiyah bittamlik by rank selling,

reparation rent object will be carried by the owner and Leasee

balance with the owner's of things in rent object.

b. Bank as Leasee

PSAK 59 (2002) arranged the cost and the ljarah

burden where the Bank as the leasee's side, that is the cost of

ljarah and ljarah muntahiyah bittamlik was acknowledged for

the contract period when being due.

Akad cost

If the cost will be a burden for Leasee so that fund

will be allocated consistenly with Cost allocation of ljarah or

Ijarah muntahiyah bittamlik in akad period

c. Lease and re-lease

In the matter of the Islamic law Bank leased an asset

Islamic law hire out to costumer then PSAK NO. 59 (2002)

arranged about treated accountancy as follows: "If the Bank

hire out to costumer the asset that was leased by the Bank

before from the third party then the treatment of the Bank's

accountancy as the owner of the object and the leasee

applied". The burden of the maintenance will be presented in

profit and lost report.

b. Accounting of Qardh (loan)

I) Qardh

Qardh is a flexible loan without interest, usually for buying

fungible things (a calculate things a!1d can be substituted suitable

with weight, size and account).

Basis of Syar'i

In Alquran surah Al-Hadiid [57]: 11 were named

The object from the Qardh loan usually is money or the

other implement exchanged (Saleh, 1992), the pure loan

transaction without the Interest when the borrower got cash from

the owner of the fund (in this case the Bank) and only obligatory

returned capital when ceitain in the next period. The borrower on

the initiative personally could pay back bigger as the expression of

thanks.

Certain Muslim scholars allowed the loan giver to charge

the cost of the loan of the pro-:urement service. This service cost

not was the profit, but was the actual cost that was spent by the

loan giver, like the cost, the official's pay, and office equipment of

building rent (Al-Omar and Abdel-Haq, 1996). The Islam la\v

permitted the loan giver to ask for to the borrower to pay operating

costs apart from the loan of the subject, but so that this cost does

not become Interest the commission or this cost might not be made

proportional towards the number of loans (Ashker, 1987).

This contract was especially used by IDB when giving the

soft loan to the government. This service cost generally not more

than 2.5 percent, revolved between 1-2 perce:nt. In implicating on

Islamic Banking, Qardh is normally used to provide the fund to the

first-rate customer and to contribute the sector of small

businesses/micro or helped the social sector. In the last matter, its

be used as the savings contract and also could be used as the

funding contract.

· There are a few Qardh or Qardhul Hasan foundations that

must be completed in a few transactions.

I) First and second party of Contract: muqtaridh (borrower), the

party which is need fund, and muqridh (loan giver), the party

which have fund;

2) Akad object, is Qardh (fund)

· 3) The aim is 'iwad or counter value as a loan without interest

(loan Rp. X,- paid Rp. X,-)

4) Sighah, that is ijab and Qabul

Even qardh or qardhul Hasan's conditions that must be

completed in every transaction, that is:

!) The willingness of two parties; and

2) Fund will be used for something useful and permitted.

Usually qardh loan is given to the costumer by the Banker

as a money-lender facility when they have overdraft. This facility

is shape of another cost set to make the costumer's transaction

easier.

PSAK No. 59 (2002) regulates an acknowledgement and

qardh loan measurement as follow.

• Qardh loan is recognized as big as fund which is loan for that

time. Surplus acceptance from paid loan of qardh is recognized

as an income in that time.

• Banker do as qardh loan, payment surplus to the qardh giver is

recognized as load (burden). Banker will give a loan, so the

Banker will make a quotation as follow.

(a) When giving the Qardh loan

I

AIR"'"'"

Cash

(b) When receiving the paying off added by the payment surplus

Date Cash Rp.Xx

--A/RQardh -- Rp.Xx

Income Qardh

--

Rp.XxIn the matter of the Bank as the borrower/Qardh then the Bank will make the journal record as follows

Date Cash Rp.Xx

1:,

x,

A!P Qardh

--(b) When the paying off of the Qardh debt added by the payment surplus

Date

A!P

Qardh Rp.Xx--Surplus Qardh Rp.Xx

--Cash

--

Rp. xxc. Accounting ofKafalah (Guarantee)

Kafalah is the guarantee, the cost, or the security that was

given by the guarantor (kafil) to the third party to carry out the

second party's obligation or the party who is guaranteed (makful).

Kafalah can be also meant to shift someone's responsibility

who was guaranteed in a gripping manner in the person's other

responsibility as guarantor. On his service the: guarantor could ask

for the certain repayment from the person who was guaranteed

(Ascarya, 2007: I 05).

Basis of Syar'i

In Alquran surah Al-Yusuf[l2]: 72 were named

72. they said: "We have missed the (golden) bowl of the king and/or Him who produces it is (the reward of) a camel load; I will be bound by it."

There are 3 akad that must be fulfilled in the transaction:

I) Subject of akad. Kafil or guarantor. And makful, the

party who is guaranteed.

2) Object of Akad (makful alaih), is the object guarantee,

and

3) Shighah, or !jab and Qahul.

And the condition that must have been fulfilled:

I) Object of akad must be available, clear and guarantable.

2) Must not be against Sharia Principle.

Accounting treatment for Kafalah

1) For the Guarantor.

When accepting the repayment of cash

I

DateI

CashIncome from Kafalah

I

When paying the cost

Date Cost for Kafalah

Cash

2) For the Guaranteed

When paying the cost

Date Cost for Kafalah

Cash

xxx

xxx

I

6. Fatwa of National Sharia Board about Islamic Banking Credit Card.

xxx

xxx

xxx

National Sharia Board has issued Fatwa about Jslamic Banking Crectit

Card. This Fatwa is contained in "FATWA DEWAN SYARI'AH

NASIONAL NO: 54/DSN-MUI/X/2006 About SHARIA CARD". And

Bank of Indonesia's Note No. 9/183/DPbS/2007 about Agreement of

Danamon Syariah Card.

Chapter III

Research Methodology

According to Sekaran (2006:7), the research is investigation that is carried

out, systematic, based on the data, critical, objective, and scientific towards a

specific problem, which was carried out with the aim of finding the answer or the

related solution. Basically, the research gave information that was needed to

achieve the truth, receive the answer, and take the decision that was informed in

order to be able to solve the problem successfully. Information that was received

could come from the deep analysis, or from the data that was available.

Therefore the research method basically is the method of the data

collection in decision making t0wards a research that was analyzed. So, then the

writer determined the research method as follows:

A. Scope of Research

In compiling this thesis, the researcher carried out the research in the Bank

Danamon Sharia Office, which is addressed in the Building of Graha Surya

Internusa the floor 3. Rasuna Said Street kav. X-0, Kuningan. Southern Jakarta.

B. Sampling Method

Sample that will be collected in this study is Datas from the Bank

Danamon Sharia. The reason of using that data is based on the purpose of

this thesis, which had an observation of Islamic Bankig Card in Bank

Danamon Sharia, and based on accounting standard in Indonesia (PSAK

no 59) as the Sharia compliance. After the effective of PSAK in year 2003, Sharia Bank in Indonesia has its own accounting standard in disclose their

operation.

C. Data Collection Method

In compiling this mini thesis, to collect the datas that are needed, Carried

out by the research method as follows:

1. Library Research

To gt>t the expansion of the concept as well as the theory base related with

the title of the thesis. This library research was aimed at the data collection

that had the connection with the problem given by the writer to be able to

have the theoretical foundation and as the analysis implement of the

problem from the writing of this thesis.

2. Field Research

To receive the data that was relevant in the writing of the thesis, then the

writer held the direct research to the Danamon Sharia Bank. For this

a. Observation

Direct observation/Observation was technical the data collection by

gathering the data directly towards a problem that was researched. In

the observation method, the researcher carried out observation directly

against the object that is needed, both from near and from far to get

results of taking the form of the accurate data.

b. Interview

The interview is the process of receiving information and the data

collection for the aim of the research by means of the interview orally

while gazing at the face between the interviewer and the respondent

who is considered most knew about the situation that was evaluated

D. Data Analyze Method

The analysis method uses descriptive analysis qualitative, the analysis based

on the statement about the objective situation picture of the problem that is

analyzed and concerning the measurement of the quality. So, the descriptive

analysis is carried out by presenting the data, analyzing and interpreting

E. Variable Operational

Variable Operational is a concept that had the variation point applied in a

research and meant to ensure so that variable that wanted to be researched

clearly could be seen. As for variable that is meant as follows.

I. Recognition

Recognition is a process that occurs in thinking when some event,

process, pattern, or object recurs.

2. Measuring

A procedure for assigning a number to an object or an event.

3. Counting

Counting is the mathematical action of repeatedly adding (or

subtracting) one, usually to find out how many objects there are or to

set 。ウゥ、セ@ a desired number of objects or for well-ordered objects, to find the ordinal number of a particular object, or to find the object with a

particular ordinal number.

4. Recording

Recording is a process of capturing data or translating information to a

format stored on a storage medium often referred to as a record.

one fonn or another. Amongst the earliest are cave painting, runic

alphabets and ideograms.

5. Reporting

Reporting is a fundamental part of the larger movement towards

Chapter IV

Results of the Research and discussions

A. Highlight of Research Object

1. History of Company

PT Bank Danamon Indonesia Tbk was established in 1956 under

the name of PT Bank Kopra Indonesia, in I 976, the Bank's name was

changed to the present name, Bank Danamon Indonesia. The Bank became

the first Indonesian private foreign exchange bank in 1976 and a publicly

listed bank in 1989.

In I 977, as a result of the Asian financial crisis, Bank Danamon

ran into liquidity insolvency and was placed under the supervision of the

Indonesian Bank Restructuring Agency (!BRA) as a BTO (taken over)

bank. In 1999, the government of Indonesia, thought !BRA, recapitalized

the Bank with Rp 32 trillion of government bonds. Within the same year,

another BTO bank was merger into Bank Danamon as part of the

restructuring program of !BRA.

In 2000, Bank Danamon took under its wings eight other BTO

banks. As the surviving entity, Bank Danamon emerged from the merger

During the next three years, Bank Danamon underwent extensive

restructuring involving management, people, organization, systems, core

values and corporate identity. The effo1is succeeded in laying down new

foundations and infrastructure for the Bank to pursue growth based on

transparency, responsibility, integrity and professionalism (TRIP).

In 2003, Bank Danamon was acquired by the Asia Finance

Indonesia consortium which took a majority controlling stake in the Bank.

With new management at the helm, and 180-day remapping of its business

model and strategy, Bank Danamon continues to undergo a

transformational change designed to mold it into a leading national bank

and a key regional player.

The establishment of Danamon Sharia Bank represents Bank

Danamon vision to become The Bank of Choice and also a strategic step

in welcoming the dynamic growth and development of Moslem banking

and as an effort to support government action to increase the ecouomic

growth in Indonesia.

The main segment and fund raising come from middle-upper class,

and the defrayal channeling focuses 80% for UKMK sector and 20% for

consumer.

The grand launch of Danamon Sharia Bank marked with the

Secretary of State Minister of Cooperation and Small and Medium

Industry (UKM), Chairul Fadjar Sofyan deputizing State Minister of

Cooperation and UKM. Nowadays, Danamon Sharia Bank has seven

branch offices spread over Indonesia. Act as Supervisor Council of

Danamon Sharia Bank is member of Council of National Moslem Law

-Council of Indonesian Moslem Scholar (MUI) including Prof. Dr. Din

Syamsuddin, MA (Chief), Ir. Adi Warman Karim, lvlBA (Member) and

Drs. Hasanuddin, Mag (Member).

In running its activity, Danamon Sharia Bank applies systems of

share holder (profit sharing), trading and deposit, so the bank will not be

affected by interest rate fluctuation. These investments are also managed

by high-perform human resources who fulfill the following characteristic:

siddiq (honest), tabligh (reliable), fathonat1 (clever),. amanah (trustable)

and itqan (professional).

The Danamon Sharia Bank existence is expected to fulfill people's

need of banking product and service based on Moslem principles of

business and halal (lawful) instead of embracing riba system (profitting the

money), ghoror (manipulative) and maisyir (speculative). Thereby, people

can enjoy banking service that match with Moslem law, which spirit1ially

will create peace of mind because their fund will be ploughed back to

With technological support and network of Bank Danamon,

including almost 500 branches and about 750 ATM of Bank Danamon in

all provinces, Danamon Sharia Bank is ready to s·erve customers with

varions products of defrayal and financing which are capable to folfill

customers' needs such as:

I. Saving Account With Profit Sharing Scheme (Tabungan

Mudharabah)

2. Trussed Investment (Mudharabah Muqayyadah)

3. Moslem bank gold mortgage (gold and diamond with

defrayal value up to Rp. 250 million)

4. Consumption defrayal (car, motorcycle, house,

horne-renovation and professional goods)

5. Leasing (Ijarah)

6. Share holder defrayal (Mudharabah and Musyarakah)

Danamon Sharia Bank customers can enjoy the ability to transact

at Moslem Bank Branch Office, endorsement transaction at all Bank

Danamon branches, and transaction at 700 ATM of Bank Danamon. They

can also conduct onHne transaction at 25 conventional Bank Danamon

branches in Indonesia. The online transaction includes:

I. Transferring the book from conventional account to Moslem

bank account and vice versa

3. Online transfer to Moslem bank account

4. Cash withdrawal from Moslem Bank account

Meanwhile, until September 2003 Danamon Sharia Bank had

collected third party fund Rp. 127 milliard and channeled defrayal about

Rp I 13 milliard. From total defrayal, about 40% or about Rp 44 milliard

had been channeled in the form of small and medium industry (UKM)

defrayal, both in the form of capital goods and inve