i

DECLARATION

I, Ratna Mega Sari, hereby declare that the thesis entitled:

FACTORS INFLUENCING INDONESIAN COCOA EXPORT TO THE EUROPEAN UNION

Submitted to fulfill a requirement for the award of Master of Science in Agribusiness from Bogor Agricultural University Indonesia and Georg August University of Goettingen Germany in the framework of international joint degree program between both universities is my own work through the guidance of my academic advisors and to the best of my knowledge it has not been submitted for the award of any degree in any other academic institutions. This thesis does not contain any pieces of work of other person, except those are acknowledged and referenced herein.

Bogor, January 2013

iii

ABSTRACT

RATNA MEGA SARI, Factors Influencing Indonesian Cocoa Export to the European Union. Under direction ANDRIYONO KILAT ADHI, SUHARNO, andBERNHARD BRUEMMER

One of plantation commodity which is potentially developed in Indonesia is cocoa. Indonesia is the third largest exporter of cocoa bean after Ivory Coast and Ghana. Even though Indonesia is one of the biggest cocoa producer countries but only 1.07 percent of cocoa bean and 7.79 percent of cocoa butter and oil can enter European Union Market as the biggest cocoa consumer in the world. Based on that problem this paper will analyze what factors which can influence cocoa export of Indonesia to European Union and what policy implication can be conducted regarding to this condition.

Data processing was conducted by using stata which used panel data analysis with gravity model panel data. There are three models which can be estimated in panel data. This study deals with the flows of trade between Indonesia and Countries in European Union. Therefore the Fixed Effects will be a more appropriate model than random specification. The eleven importer countries are selected for the period 1996 - 2011.

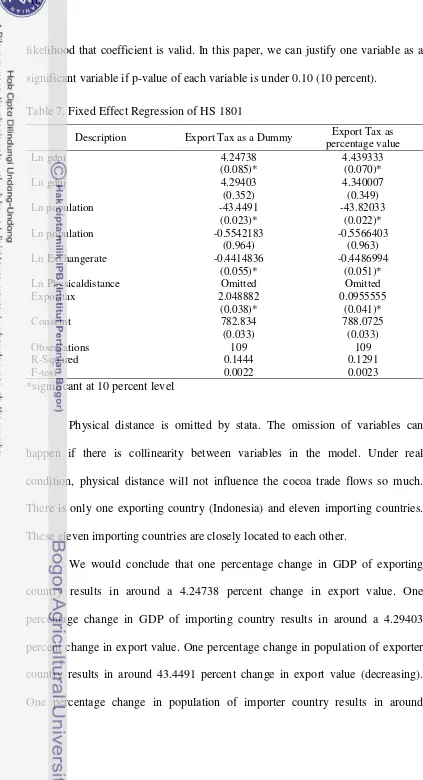

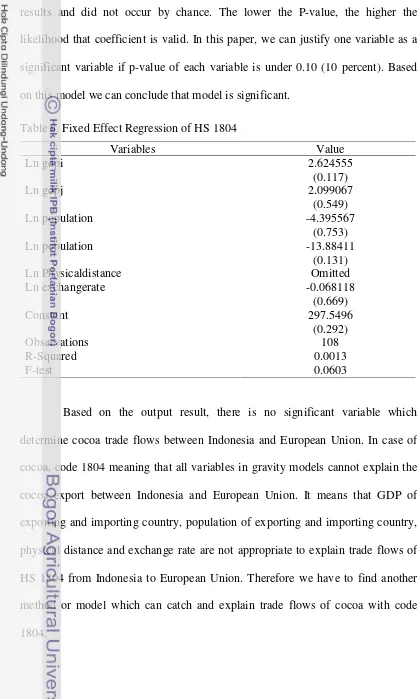

Based on econometric results there are four significant variables that influence trade flows of cocoa code 1801 from Indonesia to European Union. Those are GDP of exporting country, population of exporting country, exchange rate and export tax. There is no significant variable which can explain trade flows of cocoa, code 1804 from Indonesia to European Union. It would be concluded that in this case gravity model is not the best model. The next research should consider the other variable which can explain the trade flows well.

v

ABSTRAK

RATNA MEGA SARI, Faktor-Faktor yang Mempengaruhi Ekspor Kakao Indonesia - Uni Eropa. Dibawah Bimbingan ANDRIYONO KILAT ADHI,

SUHARNO, danBERNHARD BRUEMMER

Kakao adalah salah satu komoditi perkebunan yang potensial dikembangkan di Indonesia. Indonesia merupakan negara eksportir kakao terbesar ke tiga di dunia setelah Pantai Gading dan Ghana. Meskipun Indonesia merupakan salah satu produsen kakao terbesar di dunia namun hanya 1.07 persen biji kakao dan 7.79 persen minyak dan mentega kakao yang dapat memasuki pasar Uni Eropa sebagai konsumen kakao terbesar di dunia. Berdasarkan permasalahan tersebut penelitian ini akan menganalisis faktor-faktor apa saja yang mempengaruhi ekspor kakao Indonesia ke Uni Eropa dan bagaimana implikasi kebijakan yang dapat dilakukan terkait dengan kondisi tersebut.

Pengolahan data dilakukan dengan menggunakan stata. Analisis yang dilakukan adalah analisis panel data dengan menggunakan model gravitasi. Terdapat tiga model yang bisa diestimasi dalam panel data. Penelitian ini menganalisis aliran perdagangan antara Indonesia dan Uni Eropa. Oleh karena itu FE (Fixed Effects) lebih tepat dari pada menggunakan RE (Random Effects). Sebelas negara importir dipilih pada periode tahun 1996 - 2011. Adapun kesebelas negara tersebut adalah Jerman, Perancis, Belanda, Inggris, Belgia, Italia, Spanyol, Austria, Hongaria, Polandia dan Republik Ceko.

Berdasarkan analisis ekonometrik, terdapat empat variabel signifikan yang mempengaruhi perdagangan kakao kode 1801 dari Indonesia ke Uni Eropa. Variabel-variabel tersebut adalah GDP negara eksportir, populasi negara eksportir, nilai tukar dan pajak ekspor. Pada kode kakao 1804, tidak terdapat variabel yang signifikan yang dapat menjelaskan aliran perdagangan kakao dari Indonesia ke Uni Eropa. Oleh karena itu dapat disimpulkan bahwa pada kasus ini model gravitasi bukan merupakan model yang terbaik. Penelitian selanjutnya sebaiknya mempertimbangkan variabel lain yang dapat menerangkan aliran perdagangan dengan baik.

vii

SUMMARY

RATNA MEGA SARI, Factors Influencing Indonesian Cocoa Export to the European Union. Under direction ANDRIYONO KILAT ADHI, SUHARNO, andBERNHARD BRUEMMER.

Indonesia is the third largest exporter of cocoa bean after Ivory Coast and Ghana. Even though Indonesia is one of the biggest cocoa producer countries but only 1.07 percent of cocoa bean and 7.79 percent of cocoa butter and oil can enter European Union Market as the biggest cocoa consumer in the world. Based on that problem this paper will analyze what factors which can influence cocoa export of Indonesia to European Union and what policy implication can be conducted regarding to this condition.

Data used is panel data from 1998 - 2011 including cocoa export value of Indonesia to eleven countries, GDP of exporter and importer countries, population of exporter and importer countries, exchange rate and physical distance. Data processing was conducted by using stata which used panel data analysis with gravity model panel data. There are three models which can be estimated in panel data. This study deals with the flows of trade between Indonesia and Countries in European Union. Therefore the FE will be a more appropriate model than random specification. The eleven importer countries are selected for the period 1998 -2011. Those countries are Germany, France, Netherlands, United Kingdom, Belgium, Italy, Spain, Austria, Hungary, Poland and Czech Republic

Based on econometric results there are four significant variables that influence trade flows of cocoa code 1801 from Indonesia to European Union. Those are GDP of exporting country, population of exporting country, exchange rate and export tax. There is no significant variable which can explain trade flows of cocoa, code 1804 from Indonesia to European Union. It would be concluded that in this case gravity model is not the best model. The next research should consider the other variable which can explain the trade flows well.

In case of export tax, this variable also significantly influences trade flows of Indonesia cocoa, code 1801 to European Union positively. Exchange rate has the same condition with export tax which is not consistent with general previous studies. In this case cocoa bean exporter should not be worry about applied export tax in the years later and exchange rate. In specific condition (European Union Market), those variables do not influence cocoa demand. Indonesia cocoa exporter can focus on optimizing potential market, searching the new buyer etc. In order to achieve this goal, exporters have to pay attention to requirement of European Union people to cocoa they consume. Requirement could be related to the safety and quality of cocoa entering to their market.

Based on the output result, there is no significant variable which can explain trade flows of cocoa, code 1804 from Indonesia to European Union. It would be concluded that in this case gravity model is not the best model. The next research should consider the other variable which can explain the trade flows well. The model has to include variable.

ix

Copyright© 2012. Bogor Agricultural University All Right Reserved

1. No part or all of this thesis maybe excerpted without inclusion and mentioning the sources.

a. Excerption only for research and education use, writing for scientific papers, reporting, critical writing or reviewing of a problem.

b. Excerption does not inflict a financial loss in the proper interest of Bogor Agricultural University.

xi

FACTORS INFLUENCING INDONESIAN COCOA EXPORT

TO THE EUROPEAN UNION

RATNA MEGA SARI

A thesis

Submitted to the Graduate School in Partial Fulfillment of the Requirement for Master of Science Degree in Agribusiness

GRADUATE SCHOOL

BOGOR AGRICULTURAL UNIVERSITY

BOGOR

xiii

Thesis Tittle : Factors Influencing Indonesian Cocoa Export to the European Union

Name : Ratna Mega Sari

NRP : H451100071

Mayor : Agribusiness

Approved by

Advisory Committee

Agreed by

Examination Date : Submission Date :

Dr. Ir. Andriyono Kilat Adhi Chairman

Dr. Ir. Suharno, M.Adev. Member

Prof. Dr. Bernhard Bruemmer Member

Coordinator of Major Agribusiness

Prof. Dr. Rita Nurmalina, MS.

Dean of Graduate School

xv

ACKNOWLEDGEMENT

This research would have been impossible without the support from many people. I would like to appreciate everything they have given to me. First of all, all praise to God, who the most precious and the most merciful for His blessing from the first until the last step of the research process. I would like to acknowledge the support of the National Education Ministry of Indonesia for funding my study in Germany.

I would acknowledge my supervisors in Indonesia, Dr. Ir. Andriyono Kilat Adhi and Dr. Ir. Suharno, M. Adev from Bogor Agricultural University Indonesia, for their support and their insight to my research and my study. I also thank to Dr. Amzul Rifin S.P. M.A. and as examiners in my final examination for their constructive critics and comments. I am indebted to my supervisor in Germany Prof. Dr Bernhard Bruemmer from Goettingen University, who supports me academically and mentally in thesis writing from the beginning until the last step. I would like also to thank for their insight and his constructive criticism of my thesis.

My Special thank to my husband Efri Junaidi, Mas Rangga, Ratna SS, Krystal Lin, Pak Samsul, Mas Iqbal, Ria, Mas Adnan, Bang Firman, Mba Ira, Ulf Roemer, and Dek Am for discussion and proof reading this thesis. My sincere thank further to all my friends and family in SIA program and in Goettingen Indonesian Student Community, especially for the ‘Roko Jaya Family’ for providing me a friendly and warm environment during my study in Goettingen. Finally I would like to thank my family for their love and their support for me. I dedicate this work to my beloved mothers and fathers who always pray for me and give me their love and taught me the values of life.

Bogor, January 2013

AUTOBIOGRAPHY

Ratna Mega Sari, the author of this thesis, was born in Dumai, on 16th of August 1987. She completed her primary education in 1999 at SDN 002 Pangkalan Sesai Dumai Barat. She did her Junior high school at SLTPN 4 Dumai in 2002 and completed her senior high school at SMAN 2 Dumai in 2005. She spent her bachelor degree in Bogor Agricultural University with major Agribusiness. She got her B.A in 2009 supported by Dumai Government.

She was active in some organizations during her study period in Bachelor degree such as DKM Al-hurriyah, HIPMA IPB, FORCES IPB and IKPMR. She participated in some paper competition and being a winner in some events. In 2009, She got scholarship to be a participant of IELSP (Indonesian English Languange Study Program) in Ohio University, United States of America.

xvii

1.4. Significance of the Research ... 7

II. LITERATURE REVIEW ... 9

2.1. International Trade of Indonesia Cococa ... 9

2.2. Gravity Models of Trade... 11

2.3. Gross Domestic (GDP), Population, Physical Distance, Exchange Rates, and Export Tax ... 15

2.3.1. Gross Domestic Product ... 15

3.1. Theory of International Trade on Indonesian Cocoa ... 19

3.2. International Demand and Supply of Cocoa... 23

3.3. Export Import Theory... 25

4.4.1. Model Formulation of HS 1801 (Cocoa Beans, Whole Or Broken, Raw or Roasted... 35

4.4.2. Model Formulation of HS 1804 (Cocoa Butter, Fat and Oil ... 36

V. DESCRIPTION OF INDONESIAN COCOA... 39

5.1. Development of Indonesian Cocoa... 39

5.3. Cocoa Development Policy in Indonesia ... 40

VI. RESULT AND DISCUSSION... 45

6.1. HS 1801 (Cocoa Beans, Whole or Broken, Raw or Roasted).. 45

6.2. HS 1804 (Cocoa Butter, fat, and Oil)... 51

VII. CONCLUSION, POLICY AND RESEARCH OUTLOOK... 53

REFERENCES ... 55

xix

LIST OF TABLES

Number Page

1. Export and Import of Cocoa and Cocoa’s

Processing In Indonesia ... 4

2. The Progression of Cocoa Consumption in 2001/2002 -2006/2007 ... 5

3. Absolute Advantages ... 19

4. Comparative Advantages ... 20

5. Sources of Data ... 29

6. Budget Recapitulation of Cocoa Program for Three Years 2009 - 2011 ... 41

7. Fixed Effect Regression of HS 1801 ... 46

LIST OF FIGURES

Number Page

1. Gross Domestic Product on The Basis of Constant Price

in 2000 According to Sector in 2004 - 2008 ... 1

2. Export Value of Indonesian Plantation Commodity

in 2004 -2008... 2

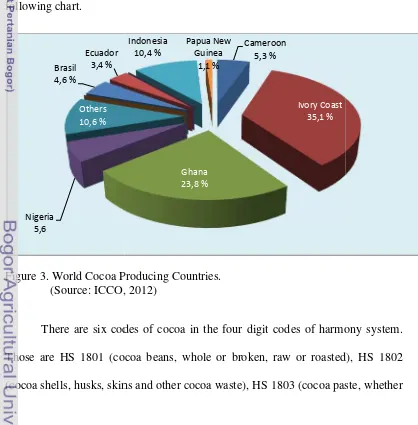

3. World Cocoa Producing Countries... 3

4. The Progression of Export Volumes of Cocoa Bean

According to the Destination Country in 2004 - 2008 ... 6

xxi

LIST OF APPENDICES

Number Page

1. HS 1801 ( Export tax as dummy variable)... 61

2. HS 1801 (Export tax as percentage value)... 62

LIST OF ABBREVIATION

FE Fixed Effects

GDP Gross Domestic Product

0,00 2.000,00 4.000,00 6.000,00 8.000,00 10.000,00

2004 2005 2006 2007 2008

E

xp

o

rt

Va

lu

e

(

M

il

li

o

n

Year

percent). Hence, smallhol

llholder plantation contributes 90 percent of

t al, 2008).

processed to be many kind of food and

ocoa is not only for food or beverage industries but

y other beauty products. It can be turned to be w

k of cocoa.

beans in the world are produced by three count

frica and also Indonesia. In 2002, Indonesia was

oa bean after Ivory Coast. But this condition

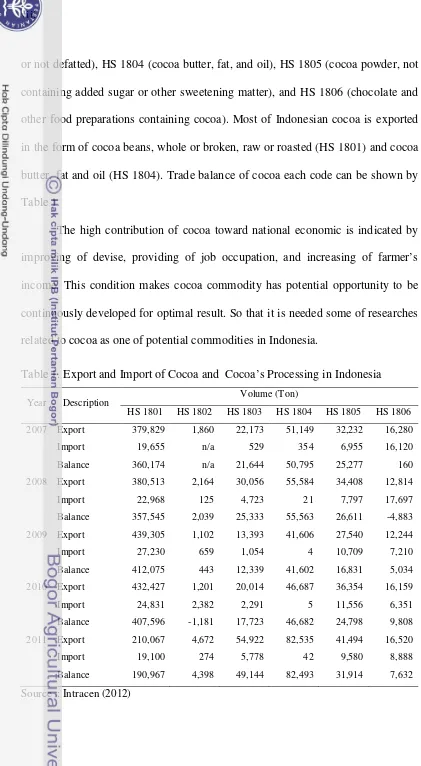

or not defatted), HS 1804 (cocoa butter, fat, and oil), HS 1805 (cocoa powder, not

containing added sugar or other sweetening matter), and HS 1806 (chocolate and

other food preparations containing cocoa). Most of Indonesian cocoa is exported

in the form of cocoa beans, whole or broken, raw or roasted (HS 1801) and cocoa

butter, fat and oil (HS 1804). Trade balance of cocoa each code can be shown by

Table 1.

The high contribution of cocoa toward national economic is indicated by

improving of devise, providing of job occupation, and increasing of farmer’s

income. This condition makes cocoa commodity has potential opportunity to be

continuously developed for optimal result. So that it is needed some of researches

related to cocoa as one of potential commodities in Indonesia.

Table 1. Export and Import of Cocoa and Cocoa’s Processing in Indonesia

Year Description Volume (Ton)

HS 1801 HS 1802 HS 1803 HS 1804 HS 1805 HS 1806

2007 Export 379,829 1,860 22,173 51,149 32,232 16,280

Import 19,655 n/a 529 354 6,955 16,120

Balance 360,174 n/a 21,644 50,795 25,277 160

2008 Export 380,513 2,164 30,056 55,584 34,408 12,814

Import 22,968 125 4,723 21 7,797 17,697

Balance 357,545 2,039 25,333 55,563 26,611 -4,883

2009 Export 439,305 1,102 13,393 41,606 27,540 12,244

Import 27,230 659 1,054 4 10,709 7,210

Balance 412,075 443 12,339 41,602 16,831 5,034

2010 Export 432,427 1,201 20,014 46,687 36,354 16,159

Import 24,831 2,382 2,291 5 11,556 6,351

Balance 407,596 -1,181 17,723 46,682 24,798 9,808

2011 Export 210,067 4,672 54,922 82,535 41,494 16,520

Import 19,100 274 5,778 42 9,580 8,888

Balance 190,967 4,398 49,144 82,493 31,914 7,632

5

1.2 Problem Statements

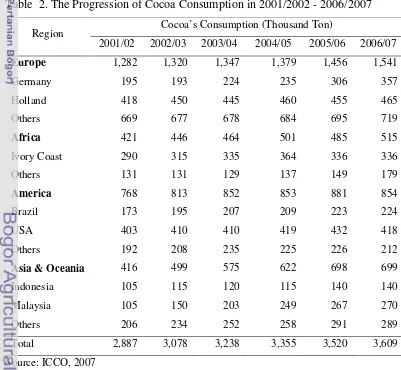

World’s cocoa consumption tends to increase over year and even world’s

cocoa consumption is more than production. Europe is the biggest cocoa

consumer in the world. European Union has the highest number of consumption

per capita in the world. FAO (2003) explained that world cocoa market is

concentrated in EU around 40 percent of world production are consumed. This

condition is caused some countries in Europe such as Germany and Holland have

big downstream industries so that cocoa bean is needed for that purpose. The

other big cocoa consumer country is America especially United States of

America.

Table 2. The Progression of Cocoa Consumption in 2001/2002 - 2006/2007

Region Cocoa’s Consumption (Thousand Ton)

2001/02 2002/03 2003/04 2004/05 2005/06 2006/07

Europe 1,282 1,320 1,347 1,379 1,456 1,541

Germany

Africa 421 446 464 501 485 515

Ivory Coast

America 768 813 852 853 881 854

Brazil

Asia & Oceania 416 499 575 622 698 699

Indonesia

Total 2,887 3,078 3,238 3,355 3,520 3,609

0 50000 100000 150000 200000

2004 2005 2006 2007 2008

7

Cocoa which is imported by European Union is processed to be some products.

Although European Union is the biggest cocoa consumer in the world, Indonesia

cannot export cocoa to this region in big volume. Competitors of Indonesian

cocoa in European Union are Ivory Coast which is supplied 41.54 percent of

Cocoa and followed by Ghana, Nigeria, Cameroon, Brazil, Ecuador and

Switzerland.

Based on that description, the problem that will be analyzed in this

research are what factors that can influence cocoa export of Indonesia to European

Union and what policy implication can be conducted regarding to this condition.

1.3 Objective

According to the background and problem statement which has been

explained, so the purposes of this research is to identify factors that influence

Indonesia cocoa export to European Union and briefly determine policy

implication regarding factors influencing Indonesia Cocoa Export to European

Union.

1.4 Significance of the Research

The Study is expected to:

1. Provide information in the formulation of international trade policy of cocoa.

2. Increase knowledge in applying science which has been obtained in analytical

problem solving skills.

II.

LITERATURE REVIEW

2.1 International Trade of Indonesia Cocoa

Trade relations among countries occur because of differences in potential

resources, cost of production and tastes, differences in demand and supply, as well

as desire to expand market and to raise foreign exchange. In international trade

there are many factors affecting exports. It can be analyzed from demand and

supply that occurred in those commodities both domestically and internationally.

Theoretically, export volume of a particular commodity from one country to

another is difference between higher domestic supply and domestic demand which

is referred to excess supply. At that time, domestic excess supply will be used by

other country that is having excess demand. In addition, Solvatore (1997) showed

that exports are also affected by commodity price and other factors that may also

affect either directly or indirectly. There are some main export products including

plantation commodity in Indonesia.

Plantation products are widely traded commodity. Cocoa is one of the

plantation commodities which have an important contribution to the national

economy. This was demonstrated by research of Hadi and Mardianto (2004)

which showed that cocoa products are one group commodities in 1999 - 2001

(when Indonesia had decreasing of export competitiveness) has a positive

composition effect so need to get greater attention to be exported.

Lolowang (1999) conducted an analysis of supply and demand for

Indonesian cocoa in domestic and international markets that are formulated in the

form of simultaneous equations. Model is suspected by Three Stage Least Squares

domestic and international markets in the form of simultaneous equations. Result

of this study indicates that behavior of plant areas in west and east Indonesia in

the short time are not responsive to the domestic cocoa price, domestic coffee

price, labor rates and bank interest rates. Productivity of cocoa in western and

eastern of Indonesia in the short time is not responsive to the domestic price of

cocoa, fertilizer price and plant areas.

Exports of cocoa beans are the difference between productions or

consumption reduced by domestic demand coupled with the stock of the previous

year. According to research Nurasa and Muslim (2008) Indonesian cocoa exports

have a tendency to increase from year to year. But still be exported cocoa beans

that have not undergone processing.

According to research of Widianingsih (2009), Indonesian cocoa export to

Malaysia, Singapore and China is determined by some factors. Those are export

price, population of Malaysia, Singapore and China, exchange rate and gross

domestic product per capita. Her research found that export price has not

significant and negative correlation to export demand of Indonesia cocoa.

Population has positive significant influence because increasing population will

increase cocoa consumption. Exchange rate and GDP per capita also has positive

influence to export demand.

Sitorus (2009) also conducted the cocoa trade analysis of Indonesia,

Malaysia, Singapore, Hongkong and Thailand to China. She concluded that cocoa

export is significantly influenced by exporter GDP, exporter population, exchange

11

Although exports have increased from year to year, Indonesia experienced

obstacles in marketing their cocoa to the EU. Indonesia must compete with the

cocoa from Africa who enters the EU without tariffs. This rate gives a negative

effect for cocoa exports.

2.2 Gravity Models of Trade

The gravity model is one of the great success stories of economics. The

success of the model is its great explanatory power. The equations fit well

statistically and give quite similar answers across many different datasets-inferred

bilateral trade cost are big, varying with distance and border crossings. Gravity

model became very popular because of its quite simple usage combined with a

substantial power of explaining the flows in general. The gravity equation has

been exploited as an instrument to model not only international trade flows but

also tourism or migration. Subsequently it has been recognized that gravity

equation can be derived from different models including Ricardian,

Hecksher-Ohlin, and the monopolistic competition model. Gravity has long been one of the

most successful empirical models in economics. In corporating deeper theoretical

foundations of gravity in to recent practice has led to a richer and more acurate

estimation and interpretation of the spatial relations described by gravity.

Despite this success, the inferred trade costs have had little impact on the

broader concerns of economics until very recently. There are two difficulties.

First, national buyer and seller responses to bilateral trade cost depend on their

incidence instead of the full cost. Second, the high dimensionality of bilateral

and for use in the wide class of trade models that focus on resource and

expenditure allocation as sectoral aggregates (Anderson, 2003).

The classical conception of gravity model originally reported by Tinbergen

(1963) was inspired by the Newton’s law of universal gravitation. This law states

that every point mass attracts every other point mass with a gravity force Fg that is

directly proportional to the product of their masses M1 and M2 and inversely

proportional to the square of the distance between them:

= 1 2

Before Tinbergen, Ravenstein (1885) and Zipf (1946) used gravity

concepts to model migration flows. Independently from Tinbergen, Poeyhoenen

(1963), inspired by Leo Tornqvist, published a paper using a similar approach.

Tinbergen’s student and team-member of the Netherlands Economic Institute,

Hans Linneman published a follow up study (Linneman 1966) which extended the

analysis and discussed the theoritical basis of the gravity equation using the

Walrasian model as a benchmark. By the 1970s the gravity equation was already a

must. The famous international trade book by Edward Leamer and Robert Stern

included almost an entire chapter on it (Leamer and Stern 1970, pp.157-170),

based on the contribution of Savage and Deutsch (1960). Leamer and Stern’s book

introduced trade economist to the term resistance, that entered their glosary as a

synonim for distance and other trade impediments. To make a long story short,

from the first conceptualisation of Tinbergen (1962) the gravity equation has been

used time and again to empirically analyse trade between countries. It has been

13

life” in the field of research (Deardorff, 1998). The gravity equation’s ability to

correctly approximate bilateral trade flows makes it one of the most stable

empirical relationship in economics (Leamer and Levinson 1995)

Gravity model for international trade considers the bilateral trade as the

“gravity force” between two countries and suggests the same relationship between

this force, masses of the countries proxied by GDP and the distance between

them.

The basic gravity model is developed by Tinbergen in the 1960s

explaining bilateral trade between two countries depending positively on their

economic sizes and negatively distances between them. Tinbergen (1963)

explained that an economic model describing international trade flows can be

formulated in varying degrees of detail. The model consists of only one equation

in which the value of total exports from one country to another is explained by a

small number of variables. The explanatory variables that play a preponderant role

are:

a. The Gross National Product (GNP) of the exporting country;

b. The Gross National Product of the importing country; and

c. The distance between the two countries.

In several calculations other explanatory variables were introduced;

however, their contribution to an explanation of the value of exports was very

limited as compared to that the three main variables. Other important

characteristics of the present analysis are that:

a. No separate demand and supply functions for exports are introduced-meaning

b. Only a statistic analysis is made – no attention is paid to the development of

exports over time.

For estimating purposes, the traditional gravity model of international

trade could be written in the form:

Xji= β0 GDPjβ1GDPiβ2Dijβ3εij

Where Xji stands for the bilateral trade between countries i and j; Dij is a

distance between these two countries; εij stands for the error term and β0, β1, β2

and β3are parameters to be estimated.

We assume that the error term εij is statistically independent on the other

regressors; moreover, we further assume that E (εij GDPi, GDPj, Dij) = 1. This

assumption leads to:

E (Xji GDPi, GDPj, Dij) = β0 GDPjβ1GDPiβ2Dijβ3

However, the gravity model is identified in multiplicative form, which

does not permit for employing standard estimation techniques. The traditional

way in the literature how to deal with estimation of multiplicative form of the

model is to estimate the logarithmic transformed model:

15

2.3 Gross Domestic Product (GDP), Population, Physical Distance, Exchange Rate, and Export Tax

2.3.1 Gross Domestic Product

Gross domestic product is used to measure the country’s total output. It is

one of the primary indicators used to gauge the health of a country’s economy.

Economic production and growth, what GDP represents, has a large impact on

nearly everyone within that economy. According to the gravity model, a large

economy spends more on imports and exports. GDP influence country’s ability

towards trade flows. The higher GDP of one country means more trade for a

country. Bergstrand (1989) reports a positive GDP per capita coefficient. He

interprets a negative GDP per capita coefficient in a way that the product group

which is subject to the estimation is not capital intensive but labor intensive.

However, in the long run higher population has a tendency to decrease

income per capita, making every individual poorer, and therefore it may cause

production and exports to decrease. In addition to that, lower income per capita

tends to decrease the demand for imports as well.

2.3.2 Population

Big population can possibly increase trade flows between countries. It is

possible to extend the basic gravity model by including the populations of

exporting and importing countries to see what the effect of population on bilateral

trade flows between two countries is. It is possible to modify the basic gravity

model by including populations of exporting and importing counties to know the

effect of population on bilateral trade flows between two countries. Matyas (1997)

conclude that population has a tendency to increase trade and the level of

(1999) finds a negative population coefficient which means a negative

relationship between population and trade flows, suggesting that imports and

exports are capital intensive in production.

Moreover, according to Bertrand (1989) the impact of population on trade

may also differ depending on the length of the estimation period (short term vs.

long term). Population may have a positive impact on trade flows in the short run,

since it may increase the amount of labor force, the level of specialization and

more products to export as a result.

2.3.3 Distance

The concept of bilateral distance is the main determining characteristic of

the gravity model and thus measurement issues related to distance are key to the

validity of any empirical application, but also to the interpretation of the result of

the econometric findings. Economics is no physics. In the natural sciences

distance is well defined and its measurement can be exact and unambiguous.

Economic distance however is a multifaceted concept, and measurement and

interpretation accordingly are subject to continuous debate. Originally distance

entered the model because it could be used as an approximation of transportation

cost and transport time. Also distance was used as a measure for the “mental”

distance of exporters and importers that increases with distance. New and

challenging measures of intangible distances related to different legal and

economic institutions, different cultures and different technologies have recently

been added to the gravity model (Martinez-Zarzoso and Marquez-Ramos 2005;

Dekker et al.2006). Furthermore, larger distances between countries are expected

17

2.3.4 Exchange Rates

Another variable supposed to affect the level of international trade is the

exchange rates. Including exchange rates is also a common practice in the gravity

literature, as the depreciation of a currency makes the exports of a given economy

more competitive in the rest of the world as they get cheaper (Anderson and Van

Wincoop, 2003). We expect a positive sign for exchange rates because

depreciation of home country relative to the foreign country currency will lead to

more export and less export for the home country.

Zarzoso and Lehman (2003) apply the gravity trade model to asses

Mercosur-European Union trade and trade potential following the agreement

reached recently between both trade blocs. The model is tested for sample 20

countries, the four formal members of Mercosur, Chile, and fifteen members of

the European Union. The research finds that exchange rate is one of the important

variables of bilateral trade flows.

Exchange rates, in some cases, have no influence to explain some

country’s trade. Rahman (2006) who analyzes the Bangladesh’s trade with its

major trading partners using the panel data estimation finds that exchange rate has

no effect on the Bangladesh’s import. This also happen in export behavior of

Ethiopia which is investigated by Taye (2009). He finds that real exchange rate is

statistically insignificant to determine Ethiopia’s export performance.

2.3.5 Export Tax

The compound effect of export taxes on trade is ambiguous, depending on

market structure and market power of the applying country. Export tax can

of downstream industries. Overall the impact of export tax on trade is expected to

be negative (Solleder, 2012) that export taxes negatively affect export values and

quantities of tax imposing nations. Burger (2007) conducted research on cocoa

export tax by a case study on Cocoa commodity contained in the Ivory Coast. His

research concluded that the Ivory Coast who has contributed 40 percent of world

cocoa demand almost did not get the benefit of the export tax changes.

Moreover with the above mentioned variables, international or bilateral

trade is affected by many other factors such as common language, common

border, and colonial ties, being in the same trade union or free trade area, sharing

a common culture and religion and so on.

Mehanna (2003) analyzes the effects of politics, as represented by political

freedom and corruption, and cultures as represented by religion and language

affiliation, on Intra-Middle East trade for the period 1996-1999 for sample of 33

countries. It employs an extended version of the gravity model by controlling for

oil exporting countries. The results showed that religion and culture has a

statistically significant effect on the Middle-East trade. However, corruption is

shown to have a highly statistically negative effect on both exports and imports in

the Middle East. In addition she finds that the level of political freedom in these

countries does not statistically affect Middle-East trade.

Gassebneret.al (2006) even includes disaster variable to gravity model in

their paper which examine the impact of major disasters on international trade

flows using a gravity model. Their research consists of more than 170 countries

IV. THEORITICAL FRAMEWORK

3.1 Theory of International Trade on Indonesian Cocoa.

No country in the world that can live without interaction with other

countries. As rich as any natural resources, a country would require other states in

ensuring the survival of its people. International trade is a form of interaction

between countries is one important issue in world economic activity. It is then not

only related to economic issues, but then also extends to political and social

issues.

International trade in principle arises as a result of the interaction between

demand and supply is competitive. This is not apart from the concept of absolute

advantage and comparative advantage. Adam Smith stated that the concept of

inter-state trade is affected by absolute advantage. If a country produces a

commodity with a more cost efficient than other commodities and also compared

with other countries so the concept of specialization of production would be more

beneficial for the country. This means that a country does not need to produce all

the required items.

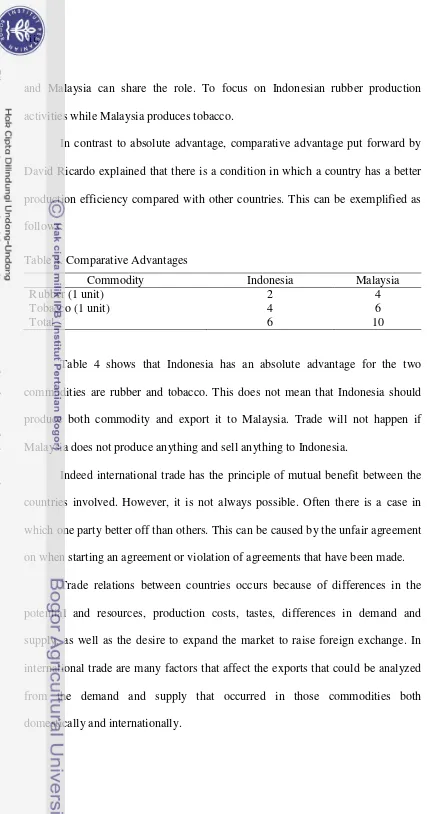

Tabel 3. Absolute Advantages

Commodity Indonesia Malaysia

Rubber (1 unit) 2 4

Tobacco (1 unit) 4 2

Total 6 6

With the advantage absolute different in each country, each country does

not need to produce all the goods. Malaysia and Indonesia can share the role. For

one unit of rubber Indonesia requires less labor than Malaysia. Meanwhile, for a

and Malaysia can share the role. To focus on Indonesian rubber production

activities while Malaysia produces tobacco.

In contrast to absolute advantage, comparative advantage put forward by

David Ricardo explained that there is a condition in which a country has a better

production efficiency compared with other countries. This can be exemplified as

follows:

Table 4. Comparative Advantages

Commodity Indonesia Malaysia

Rubber (1 unit) 2 4

Tobacco (1 unit) 4 6

Total 6 10

Table 4 shows that Indonesia has an absolute advantage for the two

commodities are rubber and tobacco. This does not mean that Indonesia should

produce both commodity and export it to Malaysia. Trade will not happen if

Malaysia does not produce anything and sell anything to Indonesia.

Indeed international trade has the principle of mutual benefit between the

countries involved. However, it is not always possible. Often there is a case in

which one party better off than others. This can be caused by the unfair agreement

on when starting an agreement or violation of agreements that have been made.

Trade relations between countries occurs because of differences in the

potential and resources, production costs, tastes, differences in demand and

supply, as well as the desire to expand the market to raise foreign exchange. In

international trade are many factors that affect the exports that could be analyzed

from the demand and supply that occurred in those commodities both

21

Theoretically, the volume of exports of a particular commodity from one

country to another is the difference between domestic supply is referred to as

excess supply. At the time of the excess supply of domestic used by other

countries that are experiencing excess demand. In addition, exports are also

affected by commodity price and other factors that may also affect either directly

or indirectly (Salvatore, 1997).

Offering country exports of cocoa beans is the difference between

productions or consumptions is reduced by domestic demand coupled with the

stock of the previous year. According to research Nurasa and Muslim (2008)

Indonesian cocoa exports have a tendency to increase from year to year. But still

be exported cocoa beans that have not undergone processing.

Although exports have increased from year to year, Indonesia experienced

obstacles in marketing their cocoa to the EU. Indonesia must compete with the

cocoa from Africa who enters the EU without tariffs. This rate gives a negative

effect for cocoa exports. Burger (2007) conducted research on cocoa export tax by

a case study on Cocoa commodity contained in the Ivory Coast. His research

concluded that the Ivory Coast who has contributed 40% of world cocoa demand

almost did not get the benefit of the export tax changes. In the long run this will

have negative consequences for farmers. Welfare of farmers will be affected by

high taxes.

Research on cocoa has also been performed by Armanda (2009) and

Lolowang (1999). The results Armanda (2009) showed that the response of cocoa

of CPO a year earlier, the area under the previous cocoa, cocoa prices the previous

year and the rainfall the previous year.

Generally, the analysis of international trade is done by using

simultaneous equations model. According to Nachrowi (2006), simultaneous

equations consist of endogenous and exogenous variables. Endogenous variables

are variables whose values are determined in the model. Although not identical,

the endogenous variables is similar to the dependent variable in the regression

equation, where its value can be determined if the value of independent variables

has been determined in advance. While the exogenous variables are variables

which are determined from outside of the model. Endogenous variables in an

equation affect the endogenous variables in other equations.

In a simultaneous equations model there are two types of structural models

and model reduction. Structural model is also called behavioral models, has a

form based on the underlying theory to fit the behavior or structure of existing

markets. While model reduction is a simple structural model.

Studies using simultaneous equation analysis have been done by

Lolowang (1999) Sanjaya (2009), Setiawan (2005) and Sihotang (1996). In his

research, Lolowang (1999) and Sihotang (1996) using the estimation methods

Three Stage Least Squares (3SLS) while Sanjaya (2009) analyzed the response

deals with the estimation method of Ordinary Least Square (OLS).

Cocoa bean is one of the export commodities that are able to contribute in

the efforts to increase foreign exchange Indonesia. As specified in the objectives

of this study emphasize the study of the factors that influence development of

23

cocoa, domestic consumption of cocoa beans, cocoa beans Indonesia export

supply to the EU and the impact of economic policies and external to the grain

market balance Indonesian cocoa. As a commodity traded on world markets,

cocoa Indonesia is more oriented to export. With these considerations the model

formulated must be related to the order of the market in cocoa beans producer and

consumer countries.

Indonesia exports of cocoa beans were analyzed based on the country's

main export destination of Indonesia to find out whether there are differences in

the behavior of Indonesian cocoa exports offerings based on the segmentation or

differentiation of export destinations. Analysis of the domestic price of cocoa

beans is expected to inform the extent to which the prospect of the domestic price

of cocoa beans is affected by the change from the side of consumers and

producers, as well as domestic policy.

3.2 International Demand and Supply of Cocoa

Trade relations among countries occur because of differences in potential

resources, cost of production and tastes, differences in demand and supply, as well

as desire to expand market and to raise foreign exchange. In international trade

there are many factors that affect exports that can be analyzed from demand and

supply that occurred in those commodities both domestically and internationally.

Cocoa export is difference between production and consumption which is

reduced by domestic demand and coupled with stock of the previous year.

Therefore cocoa exports are as follows:

Where:

QXt= Total exports of cocoa in the year t

QPt= Total production of cocoa in the year t

QCt= Total consumption of cocoa in the year t

St-1= Stock of previous year

Assumptions used in this equation are import of cocoa-exporting countries

is relatively small when compared with production, so it can be ignored. Then,

considering the amount of cocoa production when compared with demand stock

demand in producer countries suspected rather than functioning as a buffer to

adjust market conditions, but the rest of the production at the end of the year that

are not sold and entered into this year offerings, because these factors are

relatively constant value then the variables can be excluded from the model. Then

the formula becomes as follows:

QXt= QPt- QCt

QPt= Area (At) x Productivity (Yt)

Commodity price is positively related to production. It means that higher

price commodity will increase production. It is similar to area. Higher land area

will increase production. For wages and interest rates, the hypothesis is negatively

related. It means that increasing of wage and interest rate will reduce production.

Cocoa production produced in part will be consumed and the rest is used for

export. Amount of cocoa beans that are required or consumes at a certain period is

25

income (Y), related-price commodity (HL), Number of population (Pop).

Mathematically, function of cocoa consumption is as follows:

QCt=f(PDt, Yt, HLt, Popt)

3.3 Export Import Theory

Exports are a product that a country produces more than it can consume in

order to ship to other countries for a profit. An Import is product that a country

gets from another country because it has a lower price than if they were to

produce it themselves.

Exports consist of transaction in good and services from residents to non

residents. Meanwhile imports consist of transaction in good and services from non

residents to residents. An export of a good occurs when there is a change of

ownership from a resident to a non resident. Export of commercial quantities of

goods normally requires involvement of the customs in both the country of export

and the country of import.

International trade can give devise contribution. This condition will

increase economic development of country. Amir (1995) stated that general

characteristic of a commodity which is potential to be exported are:

1. Having production surplus.

2. Having certain advantages such as: scarce, good quality compared to the

same products from the other countries.

3. Export oriented.

(Export activities contribute big benefit to country. Benefit of export for

government are increasing country’s devise, enlarging benefit of national

resources etc).

3.4 Operational Framework

Cocoa is one of the most important commodity in Indonesia. Export value

of cocoa bean has third rank after oil palm and rubber. Indonesia is also the big

three of cocoa producing countries in the world. But apparently Indonesia cannot

export cocoa to the European Union in a big volume although FAO (2003)

explained that world cocoa market is concentrated in EU around 40 percent of

world production are consumed. By using gravity model, this research will

determine what factors which can influence indonesian cocoa trade flows to

European Union. There are two codes of cocoa which will be analyzed in this

paper. Those are HS 1801 and HS 1804. Determination of these codes based on

the two highest cocoa export of Indonesia. Based on this condition operational

IV. RESEARCH METHOD

4.1 Scope of Study

This research was conducted in Indonesia focusing on factors that

influence Indonesian cocoa export to the European Union.

4.2 Types of Data and Sources

The type of data used in this research is secondary data time series (time

series) and cross section as much as 14 years, start from 1998 until 2011. The data

obtained from several agencies such as: Statistics of Indonesia, Agricultural

Ministry, ICCO, Global Trade Atlas Navigator and other institutions. Data used

are export volume of cocoa, the distance between countries, Gross Domestic

Product and population.

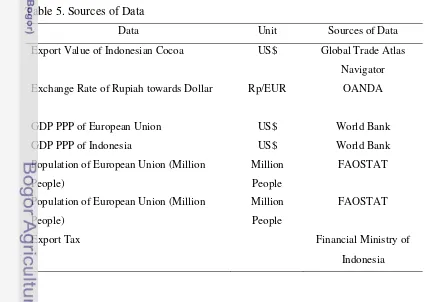

Table 5. Sources of Data

Data Unit Sources of Data

Export Value of Indonesian Cocoa US$ Global Trade Atlas Navigator Exchange Rate of Rupiah towards Dollar Rp/EUR OANDA

GDP PPP of European Union US$ World Bank

GDP PPP of Indonesia US$ World Bank

4.3 Data Analysis Methods

Data processing was conducted by using stata which use panel data

Analysis with gravity model panel data. We often find problem regarding to data

availability. Sometimes time series data provided are short and sometimes cross

section data provided are limited. In Econometrics this problem can be solved by

using pooled data in order to get efficient estimation.

A panel data set, while having both a cross sectional and a time series

dimension, differs in some important respects from independently pooled cross

section. To collect panel data, sometimes called longitudinal data, we follow (or

attempt to follow) the same individuals, families, firms, cities, states, or across

time. For example a panel data set on individual wages, hours, education and

other factors is collected by randomly selecting people from a population at a

given point in time. Then, these same people are interviewed at several

subsequent points in time. This gives us data on wages, hours, education, and so

on, for the same group of people in different years.

Panel data sets are fairly easy to collect for school districts, cities,

counties, states, and countries, and policy analysis is greatly enhanced by using

panel data sets. Hsiao (2003) lists several benefits from using panel data.

1. Controlling for individual heterogeneity.

2. Panel data give more informative data, more variability, less collinearity

among the variables, more degrees of freedom and more efficiency.

31

4. Panel data are also well suited to study the duration of economic states like

unemployment and poverty, and if these panels are long enough, they can

shed light on the speed of adjustments to economic policy changes.

5. Panel data are better able to identify and measure effects that are simply not

detectable in pure cross section or pure time-series data.

6. Panel data models allow us to construct and test more complicated

behavioral models than purely cross-section or time series data.

7. Micro panel data gathered on individuals, firms and household may be more

accurately measured than similar variables measured at the macro level.

Biases resulting from aggregation over firms or individuals may be reduced

or eliminated.

8. Macro panel data on the other hand have a longer times and unlike the

problem of nonstandard distribution typical of unit roots tests in time series

analysis.

There are three model which can be estimated in panel data. These are

Pooled Least Square, Fixed Effects and Random Effects.

4.3.1 Pooled Least Square

Pooled least square use panel data by using cross section, time series and

pooling. Every observation (each period) has regression. We can know N

(Quantity of unit cross section) and T (period of time). From all of the

observations (N.T), we can write function

Yit= α + Xitβj + εit

where:

Yit = endogenous variable

Xit = exogenous variable

α = intercept

β = slope

i = individual i

t = period year t

ε = error

N = Quantity of unit cross section

T = Quantity of time period

The simplest approach to estimate this function is ignoring cross section

and time series dimension from panel data and estimating by ordinary least square

which is determined by pool data.

In this method, model assume that variable’s intercept is the same, then

this model also assume that coefficient slope from two variables is identical for all

unit cross section. This is strict assumption. Although PLS method (pooled least

square) is relatively easy, but model possibly distort the real relationship between

Y and X in unit of cross section.

Pooled Least Square models are consistent if the dependent variables are

not correlated to the error. Pooled models also produce an unbiased estimator if

the unit effects (αi ) are uncorrelated with the independent variable (x). But,

commonly αi is correlated to the x, therefore pooled and pa tend to produce a bias

estimator of β (Clark and Linzer, 2012). Fixed effects and random effects model

33

model will produce unbiased estimates of β, but those estimates need a high

variability on the sample.

4.3.2 Fixed Effect Model

Fixed effect model is model which considers eliminated variables can

change intercept of cross section and time series. Dummy variables can be added

to the model to make intercept changes possible. Afterward model is estimated by

using Ordinary Least Square (OLS)

Yit=αiDi+ β Xit+ εit

Where:

Yit = endogenous variable

Xit = exogenous variable

α = intercept

D = dummy variable

β = slope

i = individual i

t = period year t

ε = error

4.3.3 Random Effect Model

Additional of dummy in fixed effect can reduce quantity of degree of

freedom. This condition will also reduce efficiency of estimated parameter.

Random effect model can be used to solve this problem. In this model, different

parameter between individual and time is included to error. Random effect model

Yit= Xitβj+ εit

εit = uit+vit+ wit

Where:

uit~ N(0,δu2) = component of cross section error

vit~ N(0,δv2) = component of time series error

wit~ N(0,δv2) = component of combination error

It can also be assumed that individual error and combination error is not

correlated each other. Using of random effect model can reduce using of degree of

freedom. It has implication that estimated parameter will be more efficient.

Nachrowi and Usman (2006) suggested that it is better to use fixed effects

model if we have T (time) bigger than amount of individual. On contrary, if we

have amount of individual is bigger than amount of time, so it would be better if

we use random effects model. Egger (2000) explained that since individual effects

are include in the regressions a decision should be made whether they are treated

as random or fixed. A random effects model can be more appropriate when

estimating the flows of trade between a randomly drawn sample of trading

partners from a large population. A fixed effects model would be a better model

when estimating flows of trade between an ex ante predetermined selection of

countries).

This study deals with the flows of trade between Indonesia and Countries

in European Union which is main importer of Indonesia cocoa. Those are

Germany, France, Netherlands, United Kingdom, Belgium, Italy, Spain, Austria,

35

appropriate model than random specification. The eleven importer countries are

selected for the period 1998 - 2011.

4.4 Model Formulation

There are two codes of cocoa which will be analyzed in this paper. Those

are HS 1801 and HS 1804. Determination of these codes based on the two highest

cocoa export of Indonesia.

4.4.1 Model Formulation of HS 1801 (Cocoa Beans, Whole or Broken, Raw or Roasted)

Analysis used in this research is Gravity Model approach which consists

of Dependent variables and some Independent variables. Independent variables

used are GDP of exporter and importer countries, population of exporter and

importer countries, physical distance, exchange rate and export tax.

We will divide Analysis of code HS 1801 (Cocoa beans, whole or broken,

raw or roasted) into two analyses. Firstly, export tax is treated as dummy variable

and secondly, export tax is analyzed as percentage value. It is intended to know

the effect of the export tax to European Union as whole, before and after export

tax policy and also the effect of export tax (in percentage value) to trade flows

(export value). The model formulation could be written as follows:

ln Yijt = β0+ β1lnGit+β2lnGjt+β3lnSit+β4lnSjt+ β5ln Eijt + β6lnLij+ β7Tt+ ε

where:

β0 = Intercept

β1, β2,β5 = Parameter of each variable which will be tested statistically and

econometrically

i,j = (1,…,N) Bilateraltrades between country i and j

Yijt = Trade flows (Export Values) of Cocoa from country i to j in the

year t

Git = GDP of country i in the year of t

Gjt = GDP of country j in the year of t

Sit = Population of country i in the year t (people)

Sjt = Population of country j in the year t (people)

Eijt = Exchange rate of country i and j in the year t

Lij = The distance between exporter countries and importer countries

(Kilometres)

T = Export Tax (dummy and percentage)

ε = Error

4.4.2 Model formulation of HS 1804 (Cocoa Butter, Fat, and Oil)

In case of cocoa HS 1804, we still use the same variables with cocoa

HS1801. Since there is no export tax imposed on this cocoa code, here we

eliminate export tax variable. Independent variables used are GDP of exporter and

importer countries, population of exporter and importer countries, physical

distance, and exchange rate. The model formulation could be written as follows

Yijt = β0+ β1lnGit+ β2lnGjt+β3lnSit+β4lnSjt+ β5ln Eijt + β6lnLij+ ε

where:

β0 = Intercept

β1, β2,β7 = Parameter of each variable which will be tested statistically and

37

t = (1,…,T) between 1998–2011

i,j = (1,…,N) Bilateral trades between country i and j

Yijt = Trade flows (Export Values) of Cocoa from country i to j in the

year t

Git = GDP of country i in the year of t

Gjt = GDP of country j in the year of t

Sit = Population of country i in the year t (people)

Sjt = Population of country j in the year t (people)

Eijt = Exchange rate of country i and j in the year t (Rp/Euro)

Lij = The distance between exporter countries and importer countries

(Kilometres)

V. DESCRIPTION OF INDONESIA COCOA

5.1 Development of Indonesia Cocoa

Cocoa is a commodity from Amazon River and originated from tropical

forests in Central land South America (Wahyudi et.al, 2008). Cocoa was brought

to Indonesia through North Sulawesi by Spanish in 1560s and it became an

important commodity in Indonesia. Its growth is strongly influenced by climatic

and soil factors which also has implication on its production. Rainfall,

temperature and sunlight are parts of factors that determine climate whereas

chemical and physical properties of the soil will affect root absorption of soil

nutrients.

Generally, there are three types of cocoa that can be grown in tropical

areas. They are Criolo, which is consisted of Criolo from Central and South

America,Forasterowhich is known as bulk or ordinary cocoa andtrinitariowhich

is derived from crossing species between Criolo and Forastero. According to

Supriatna (2004), the most developed cocoa is fine or flavor and bulk cocoa in

Indonesia. Noble cocoa comes from Criolowith red fruit and bulk cocoa from

ForasteroandTrinitariowith green fruit.

5.2 Production of Indonesia Cocoa

Indonesia is the third biggest cocoa producer in the world. The total cocoa

acreage in Indonesia reached 1,563,423 by 2008. This was dominated by

smallholders (93.11 percent),and the number of farmers who are directly involved

are as many as 1,526,271 households. Cocoa evenly spread in almost all the major

Sumatera; 17.3 percent, Java; 5.6 percent, Nusa Tenggara and Bali; 4.1 percent,

Borneo; 3.7 percent, Maluku and Papua for 7.0 percent (Ministry of Agriculture,

2009).

Centrals of Cocoa plantations largely are concentrated in four provinces

namely South Sulawesi, Southeast Sulawesi, West Sulawesi, and Central

Sulawesi. There are three types of ownership of these plantations; government,

private and smallholders.

According to the Ministry of Agriculture (2009), South Sulawesi is a

province with the largest cocoa grower areas in Indonesia, which covers 262,807

ha, followed by Central Sulawesi with of 221,667 ha, and then Southeast Sulawesi

and West Sulawesi with 197,449 ha and 153,043 ha. Although South Sulawesi is

the largest grower of cocoa in Indonesia, but in contrast, it has the lowest

production.

5.3 Cocoa Development Policy in Indonesia

Cocoa in Indonesia began to be developed in 1980. This indicates that

cocoa plans in Indonesia are old now; therefore they need rejuvenation,

rehabilitation and intensification. Due to this condition, government began

running a program related to cocoa production and quality to increase national

income. The total budget spent to perform this program reached 13.7 trillion

41

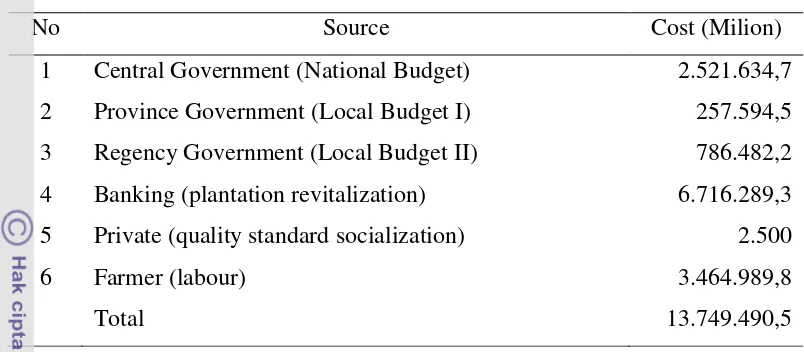

Table 6. Budget recapitulation of cocoa program for three years (2009 - 2011)

No Source Cost (Milion)

1 Central Government (National Budget) 2.521.634,7

2 Province Government (Local Budget I) 257.594,5

3 Regency Government (Local Budget II) 786.482,2

4 Banking (plantation revitalization) 6.716.289,3

5 Private (quality standard socialization) 2.500

6 Farmer (labour) 3.464.989,8

Total 13.749.490,5

Source: Portal Nasional Republik Indonesia, 2009

According to the General Directorate of Plantations (2009), locations of te

program cover nine provinces in 40 districts, they are:

a. West Sulawesi in five districts: Mamasa, Polewali Mandar, Majene,

Mamuju and North Mamuju.

b. South Sulawesi in 10 districts: Bantaeng, Bone, Soppeng, Wajo,

SindenrengRappang, Pinrang, Enrekang, Luwu, North Luwu.

c. Southeast Sulawesi in five districts:Konawe, Kolaka North, South and

MunaKonawe.

d. Central Sulawesi in eight districts: Donggala, Moutong, Parigi, Poso,

Morowali, Banggai, ToliToli, Buol and Tojo Una-Una.

e. East Nusa Tenggara in Sikka and Ende, Tabanan and Jembrana.

f. Maluku in the District of West Seram and Buru.

g. West Papua in Manokwari and Sorong.

h. Yapen Islands of Papua in Sarmi, Keerom and Jayapura districts.

There are some activities which are conducted in this Production

rejuvenating 70,000 ha plantations, rehabilitating 235.000 ha plantations,

intensification which covered 145,000 ha areas, farmer training for 450,000

people to realize quality improvement.

Supporting activities are training 360 people, constructing sub-station

research, building four units of experimental garden and strengthening seven units

of field laboratories, manufacturing cocoa cultivation technology database

systems, rehabilitating 90 units of UPP, soil and leaf analysis for fertilizer

recommendation, monitoring and evaluating are done by universities.

Cocoa production and quality improvement program involves various

parties to exploit potential available resources. They include central government,

provinces, foreign countries, private companies, banks and farmers with the duties

and responsibilities as follows:

1. Central government: providing financing for planting materials, fertilizers,

rejuvenation, rehabilitation and intensification, labor assistance for farmers,

pest control tools and materials, professional assistants, farmer

empowerment, development of sub-station study, strengthening and

developing labs and field application of quality or socialize the

implementation of quality standards.

2. Provincial government: allocating budget to support program

implementation and cocoa certification and providing land for sub-station

construction.

3. District Government: providing budget to support the program and selecting

43

4. Banking: providing credit to finance revitalization of farm fertilizers,

pesticides, agricultural tools and land certificate.

5. Private: providing financing for SNI Implementation.

6. Farmers: providing shade trees and labor.

The implementation of cocoa production and quality improvement

program will provide these benefits:

1. Increasing cocoa productivity in program location.

2. Increasing cocoa production in program location.

3. Increasing farmer income in program location.

4. Increasing money supply in rural location.

5. Increasing foreign exchange earning in program location.

6. Increasing cocoa quality in accordance with SNI.

7. Fulfilling raw material needs of domestic industry.

In April 2010 Indonesian government started to impose tax policy for

cocoa bean under decree No. 67/2010. The Finance Minister imposed a five

percent tax on exported cocoa beans, and priced ranging from US$ 2000 - 2750

per ton. This tax rate is increased to 10 percent for beans sold for more than $

2750.

This tax policy was aimed to push domestic cocoa downstream industry.

Government considers that the cocoa tax policy will revive the cocoa industry. It

was made to encourage more production of cocoa beans in Indonesia, to improve

the benefit from marketing value-added product for the country. It would benefit

not only the cocoa industry but also cocoa farmers, who currently have more