SKRIPSI

Submitted as Partial Fulfillment of Requirements for the Degree of Sarjana Ekonomi (SE) at the Sebelas Maret University Surakarta

By

Delariza Rika Fasita F 0307036

FACULTY OF ECONOMICS SEBELAS MARET UNIVERSITY

perpustakaan.uns.ac.id digilib.uns.ac.id

perpustakaan.uns.ac.id digilib.uns.ac.id

perpustakaan.uns.ac.id digilib.uns.ac.id

MOTTO

Sungguh bersama kesulitan itu ada kumudahan, karenanya jika kamu telah

selesai (dari suatu urusan) kerjakanlah sungguh-sungguh (urusan yang lain).

Dan kepada Tuhanmulah kamu berharap

(Q.S. Alam Nasyrah: 6-8).

You live you learn, you love you learn, you cry you learn, you lose you learn (Alanis Morisette).

In the middle of difficulty lies opportunity (Albert Einstein).

Only those who dare to fail greatly, can ever achieve greatly

(Robert F. Kennedy).

Hidup itu tak selamanya indah, tapi biarkan yang indah itu tetap

hidup dalam kenangan

perpustakaan.uns.ac.id digilib.uns.ac.id

DEDICATION

This

skripsi

and whatsoever success

that I could achieve is dedicated to

My -greatest - beloved

Papa

and

Mama

If only there is a good enough word to

say my sincerely thanks for you two.

perpustakaan.uns.ac.id digilib.uns.ac.id

2. Drs. Jaka Winarna M.Si., Ak., as the Head of Accounting Department, Sebelas

Maret University, Surakarta.

3. Mr. Santoso Tri Hananto, M.Si,Ak., as my skripsi advisor. Thanks for your advices and support so this skripsi can be done.

4. Mr. Agus Budiatmanto SE., M.Si, Ak., as my academic advisor, thanks for all

your support and advices.

5. My Papa and Mama, thank you for being my greatest parents in the worlds. Thank you for all support and endless love, even we were separated, I know

you always there for me. This English skripsi is dedicated only for you two and also my sister, Rensi.

6. My “dudulz” Dedie Saifullah, thank you for all love, care, understanding, and

all you’ve gave for me for whole time. I always could count on you.

ACKNOWLEDGMENT

Researcher will be grateful to Allah SWT for all the mercy and bless so that

she was able to finish this research well. This Skripsi is proposed to complete all the requirements of achieves the degree of Sarjana Ekonomi of Accounting Department, Sebelas Maret University, Surakarta.

Researcher realizes that she could not have finished this skripsi without the supports and involvement of many parties both directly and indirectly. I owe a very great debt

to:

1. Prof.Dr. Bambang Sutopo, M.Com., Ak., as the Dean of Economics

perpustakaan.uns.ac.id digilib.uns.ac.id

7. Dhinar Adi Nugroho, my best brother, thank you for the story, your support

and care for me.

8. My best friends “LOTIZ”, Dewi Listiani thank you for being my first friend at UNS until now, your trust for always share to me. Noor Anis Meikawati,

thanks for our story together, I will never forget it. Murdiani Agustiati, thank

you for coloring our day with your odd behavior. When we feel down,

remember our heart fight to through all this. Novi Eka Rahmawati, thank you

for your serenity that always make me so calm.

9. My best friends in Bekasi, Febri Alfalina Saputri, Reynaldi Oey, Allert

Benedicto Ieua Noya, Dian Anggraini Kumalasari thanks for our beautiful

relationship.

10. All of my best friends, Ebray, aunt Weny, Fata’s mom for being my great

English editor. Joe, Hadi, Gandi “Tria” for the never ending support.

11. Thanks to pakde Dr. Nur Julianto and Bude Mochdiyati whom I lived with at Solo. My big family, Eyang Imam Soeyitno family and Embah Mochammad Family, thanks for your love, care, and support.

12. My “Agent 007” friends: Ayus, Peka, Irla, Fatania, Dewo, Mba Sri, Oppie,

Nani, Rudi, Rija’, Awang, etc. HMJ Akuntansi friends, Mas Okky, Mba Desta, Mas Dancrut, Mba Ulli, Mas Fijri, Mba tryas, Mba Hanni, Mba Finik, Reza, Abhe, Anes, etc. and all of economic faculty friends for all support in the last

perpustakaan.uns.ac.id digilib.uns.ac.id

13. And for all parties that Researcher could not mention one by one, but you have

already mentioned in my heart.

Researcher realizes that this research is far from being perfect. This research

has a lot of constraint, thus any suggestions and critics are expected for the sake of

improving this research.

As I close this acknowledgment, I expect that this small print writing will be useful

to all parties.

Surakarta, April, 2011

perpustakaan.uns.ac.id digilib.uns.ac.id

TABLE OF CONTENTS

Page

TITLE ... i

ABSTRACT ... ii

ABSTRAK ... iii

PAGE OF ADVISOR’S APPROVAL ... iv

PAGE OF APPROVAL ... v

PAGE OF MOTTO ... vi

PAGE OF DEDICATION ... vii

ACKNOWLEDGEMENT ... viii

TABLE OF CONTENT ... xi

LIST OF TABLES ... ... xiv

LIST OF FIGURE... ... xv

LIST OF APPENDIXES... ... xvi

CHAPTER I. INTRODUCTION A. Background... ... 1

B. Problem Statements ... . 7

C. Research Objectives ... . 7

D. Research Advantages ... 7

perpustakaan.uns.ac.id digilib.uns.ac.id

1. Technology Concepts ... 9

2. Conceptual of Mobile Banking ... 11

3. Technology Accpeted Model (TAM) ... 14

B. Conceptualization and Hypotheses Development ... 23

C. Conceptual Framework ... 26

III. RESEARCH METHODS A. Research Design ... 27

B. Population and Sample ... 27

C. Data Source and Data Collecting Technique ... 28

D. Measurement Items ... 28

E. Data Analyze Technique and Hypotheses Test ... 31

1. Data Test Technique ... 31

2. Model Assumption Test ... 33

IV. DATA ANALYSIS A. Data Collection Analysis ... 39

1. Total Data Collection ... 40

2. Respondents Demography ... 40

B. Data Test Analysis ... 43

1. Normality Test ... 43

2. Outlier Evaluation ... 44

3. Validity Test ... 45

perpustakaan.uns.ac.id digilib.uns.ac.id

C. Model Assumption Test ... 48

1. Godness of Fit Analysis ... 48

2. Model Modification ... 49

D. Hypotheses Analysis ... 51

V. CONCLUSION A. Conclusions ... 57

B. Research Constraints ... 58

C. Research Suggestion ... 59

perpustakaan.uns.ac.id digilib.uns.ac.id

LIST OF TABLES

PAGE

Table III.1 Research Variables 29

Table III.2 Godness of Fit Indices 37

Table IV.1 Data Research Collection 40

Table IV.2 Respondents Age 41

Table IV.3 Respondents Educational Background 42

Table IV. 4 Normality Test 44

Table IV.5 Outliers Data 45

Table IV.6 Validity Test 46

Table IV.7 Reliability Test 47

Table IV.8 Goodness of Fit Model Before Modified 48

Table IV.9 Goodness of Fit Model After Modified 50

Table IV.10 Goodness of Fit Model Summary 51

Table IV.11 Significant Level 51

perpustakaan.uns.ac.id digilib.uns.ac.id

LIST OF FIGURE

PAGE

Figure II.1 Technology Accepted Model by Davis et al. (1989) 17

Figure II.2 Conceptual Framework 26

Figure III.1 TAM with Perceived Mobility Value (PMV) and Perceived

Enjoyment (PE) 38

Figure IV.1 Respondents Gender 41

Figure IV.2 Bank Where The Respondents Save Their Money in 42

perpustakaan.uns.ac.id digilib.uns.ac.id

LIST OF APPENDIXES

Appendix 1 Questionnaire Form

Appendix 2 Respondents Recapitulation

Appendix 3 Research Path Diagram before Modified

Appendix 4 Research Output Path Diagram before Modified

Appendix 5 Normality Test

Appendix 6 Outlier Test

Appendix 7 Validity Test

Appendix 8 Reliability Test

Appendix 9 Goodness of Fit Model before Modified

Appendix 10 Modification Indices before Modified

Appendix 11 Research Path Diagram after Modified

Appendix 12 Goodness of Fit Model after Modified

Appendix 13 Modification Indices after Modified

perpustakaan.uns.ac.id digilib.uns.ac.id

A PERSPECTIVE OF THE EXTENDED TECHNOLOGY ACCEPTED MODEL (TAM) USING PERCEIVED MOBILITY VALUE AND

PERCEIVED ENJOYMENT VARIABLES

DELARIZA RIKA FASITA NIM F0307036

The objective of this research is to examine and verify that the TAM can be employed to explain and predict the acceptance of mobile banking. This study identifies two factors that account for individual differences, i.e. Perceived Mobile Value (PMV) and Perceived Enjoyment (PE) which is adapted from Huang et al. (2006). Population in this research is bank customers who use mobile banking services in Indonesia. A sample of 131 respondents was selected using a purposive sampling method whereby the respondents have to be mobile banking users to be included in the survey. The constructs’ in the model were measured using existing items adapted from some prior TAM research.

The result shows that the data fit the extended TAM well. Furthermore, the result show that perceived enjoyment and perceived mobility can affect individual intention to use mobile banking. Overall, the result support that perceived mobility value and perceived enjoyment may appropriate to use in predicting user acceptance of mobile banking.

PERSPEKTIF DARI PERLUASAN MODEL PENERIMAAN TEKNOLOGI MENGGUNAKAN VARIABEL PERSEPSI NILAI MOBILITAS DAN PERSEPI

KENIKMATAN

DELARIZA RIKA FASITA NIM F0307036

Tujuan penelitian ini adalah untuk menguji dan memverifikasi apakah TAM dapat digunakan untuk menjelaskan dan memprediksi penerimaan pengguna mobile banking. Penelitian ini menggunakan dua faktor yang menjelaskan perbedaan-perbedaan individual, yaitu persepsi nilai mobilitas dan persepsi kenikmatan, yang diadaptasi dari Huang et al. (2006). Populasi pada penelitian ini adalah nasabah bank pengguna jasa mobile banking. Sampel dari 131 responden didapat dengan menggunakan metode purposive sampling di mana kriteria responden adalah pengguna mobile banking. Konstruk yang digunakan dalam model diukur dengan menggunakan item pengukuran yang diadaptasi dari penelitian TAM yang pernah ada.

Hasil menunjukkan bahwa data cocok dengan perluasan model TAM ini dan persepsi nilai mobilitas dan persepsi kenikmatan dapat mempengaruhi niat seseorang untuk menggunakan mobile banking. Secara keseluruhan, persepsi nilai mobilitas dan persepsi kenikmatan dimungkinkan untuk digunakan dalam memprediksi penerimaan pengguna mobile banking.

perpustakaan.uns.ac.id CHAPTER I digilib.uns.ac.id

INTRODUCTORY

A. BACKGROUND

Nowadays technology, provide dynamic collaborative environments that

widely recognized today, becomes an important factor in the future development

(Baten, 2010). Information technology is weakening geographical constraints

and changing the way people communicating to each others (Mazhar, 2006). The

usage of new information technology will also change the individual behaviour

(Hamzah, 2009).

The internet, one of the information technologies, has created an

incredible market space. Same with it, another technology stream has emerged to

play an increasingly important role in business and society: mobile

communications (Feng et al. in Barati and Mohammadi, 2009). Mobile phones

have become an integral part of the 21st century landscape with an expected

penetration of 4.5 billion by 2011. As the number of mobile phone users is

growing, purchasing products and services using mobile phones and other

mobile devices are also increasing (Manochehri and Alhinai in Barati and

Mohammadi, 2009).

The major change has come in the delivery of the content, application,

and services to the mobile communication devices (Sadi et al., 2010). Since the

mid-1990s, there has been a fundamental change in banking delivery channels

perpustakaan.uns.ac.id et al., 2004). Banks began to look at electronic banking (e-banking) as a means digilib.uns.ac.id

to replace some of their traditional branch functions for two reasons. Firstly,

branches were very expensive to set up and maintain due to the large overheads

associated with them. Secondly, e-banking products or services like Automatic

Teller Machine (ATM) and electronic fund transfer were a source of

differentiation for banks that utilised them. Banks can find significant savings by

serving customers in the mobile channel ($0.08) rather than through the contact

centre ($3.75), IVR banking ($1.25), ATM ($0.85) or even online banking

($0.17) (Eads, 2009: 1). Being a tight competitive industry, the ability of banks

to differentiate themselves based on price is limited (Singh et al. in Goi, 2006).

Mobile banking, the lowest cost banking service, is defined as a way for

the customer to perform banking actions on his or her cell phone or other mobile

device (Miller, 2011). Mobile banking is a financial service access from using

Short Message Services (SMS) technology platform for simple transaction as a

customer’s asks (Hristu in Amin et al. 2006) to using Wireless Application

Protocol (WAP) technology for more complex financial information. With

mobile banking services, customers should not go to ATM. In the past, people

were doing their transactions using ATM. This machine gives an enough

solution to customers for paying without stand in a long line, but it still needs the

attendant from the customers to do their transaction.

Although information technology condition in Indonesia leave behind

from other countries (Harmadi and Hermana, 2005), but compared with other

perpustakaan.uns.ac.id rush growth is because mobile banking services, use for different kinds of digilib.uns.ac.id

banking services ranging from bill payment to making investment, can answer

the needs of modern citizens who have a high mobility. Customers are not the

only beneficiary of this new service, commercial banks may greatly increase the

market coverage and better track customer as well (Shao, 2007).

Now on, almost all banks in Indonesia apply this kind of services. The

government hope with this popular channel from banking services will decrease

the used of cash money. A survey research from the International Financial

Institute reveals that 35% from all over the world online housing work chores

will shift to mobile banking services. It predicted that the value of mobile

banking services will increase two times per years and will increase four times

per years after 2011. According to a study conducted by the telecommunications

analyst firm the number of mobile phone banking users will exceed 150 million

globally by 2011.

Based on Indonesia Bank, internet banking user reached about 2,5

million by 2009. It larger than in 2008 where the internet banking user only

reached about 1,5 million (Ismartunun, 2010). The amount of BCA mobile

banking transaction has increased 57%, from Rp. 27,9 billion at the first quarter

by 2009 to Rp. 43,9 billion at the first quarter by 2010 (Ismartunun, 2010).

TELKOMSEL, one of Indonesia’s cellular network provider, has 2,5 million

mobile banking users, with the highest traffic from BCA and Mandiri Bank, and

perpustakaan.uns.ac.id 2007 (Noor in Niagara, 2008: 3). It can conclude that mobile banking users in digilib.uns.ac.id

Indonesia are quite enough perspective.

The success of mobile banking usage depends on how users would

achieve the systems (Wijayanti and Akhirson, 2009). Thus, the metaphorical tide

is likely to raise all boats by increasing overall customer comfort with mobile

banking and mobile commerce in general, which will decrease costs and

increasing profits through the new customers and more profitable transactions

(Eads, 2009).

Choosing mobile banking as the object of this study analysis is due to

two particular reasons. First, the need of media for people who has a high

mobility is increasing overtime. Second, mobile banking helps to reduce the

transaction cost and give more value-added for the customers.

Human beings, being creatures of habit, will probably view anything that

is new with caution and suspicion. The same applies to multimedia banking.

However, with the threat of globalization and possible squeezes in margins,

banks are attempting to 'push' clients towards multimedia banking (Vijayan et

al., 2005).

Many research were explained by Harmadi and Hermana (2005) in

Indonesia, Lee et al. (2007) in South Korea, Kripanont (2007) in Thailand,

Wessels and Drennan (2009) in Australia, Sadi et al. (2010) in Sultanate Oman

about determinant adoption of internet banking is no longer generally consistent.

It means that those researches not yet found the exact factors affecting the

perpustakaan.uns.ac.id approach, developed by Davis et al. (1989) based on Theory of Reasoned Action digilib.uns.ac.id

(TRA), used by those researches, which can explain customer acceptance of

information technologies.

TAM consists of six primaries constructs, namely external variables (e.g.

prior experience, voluntariness, compatibility, complexity, etc.), perceived

usefulness, perceived ease of use, attitude, behavioural intention, and actual

usage. It shows that user behaviour is determined by perceptions of usefulness

and the ease of use of the technology (Adams et al., 1992; Davis et al., 1989;

Mathieson, 1991; in Huang et al., 2006). Davis (1989) observed that external

variables enhance the ability of TAM to predict acceptance for future

technology. In other words, the constructs of TAM need to be extended by using

additional factors (Huang et al., 2006).

Many research extended their TAM with external variables in order to

explain further and become the antecedent from perceived usefulness or

perceived ease of use (Jogiyanto, 2008: 124). Choosing additional factors

depends on the target technology, main users, and context (Moon and Kim in

Huang et al., 2006). Wang et al. in Huang et al. (2006) noted that variables relating to individual differences play a vital role in the implementation of

technology. The more accepting of a new information system the users are, the

more willing they are to make changes in their practices and use their time and

effort to actually start using the new information system (Succi and Walter in

Pikkarainen et al., 2004). Usage of a system can be an indicator of information

perpustakaan.uns.ac.id regarded as good or bad depends on how the user feels about the system digilib.uns.ac.id

(Pikkarainen et al., 2004).

Mobile banking services are still in infancy. It has a great deal of room

for improvement. Thus, there is a need to study and understand user’s

acceptance of mobile banking services in order to identify the significant

motivational factors affecting their intention to use mobile banking.

From a marketing perspective the greatest advantage of mobile

communication and mobile commerce is that it offers suppliers a channel of

direct communication with consumers via a mobile device at any time and at any

place (Lubbe and Louw, 2009). How to anticipate customer needs and develop

mobile content services is not easy in a rapidly developing mobile market

(Pihlstrom, 2008: 2). Mobile devices create an opportunity to deliver new

services to existing customers and to attract new ones (Lubbe and Louw, 2009)

and when consumers enjoy positive experience in using mobile banking, they

will increase the amount of transaction (Suki and Suki, 2007). From that

explanation, this study will identify two constructs, which are adopted from

Huang et al. (2006), namely “perceived mobility value”, and “perceived

enjoyment” in order to identify the factors that influencing user acceptance of

perpustakaan.uns.ac.id B. PROBLEM STATEMENTS digilib.uns.ac.id

Previous research, conducted by Huang et al. (2007), explains that user

acceptance of mobile learning can be explained by TAM with two external

variables, i.e. perceived mobility value and perceived enjoyment. Based on the

problem background, the researcher formulates the problems of this research,

using the same model with Huang et al. (2007) but with different object, in

question forms “Are perceived mobility value and perceived enjoyment

variables affecting user acceptance of mobile banking with Technology

Acceptance Model (TAM)?”

C. RESEARCH OBJECTIVES

The objective of this research is to examine and verify that the TAM can be

employed to explain and predict the user acceptance of mobile banking using

two factors that account for individual differences, i.e. Perceived Mobile Value

(PMV) and Perceived Enjoyment (PE).

D. RESEARCH ADVANTAGES

1. Advantages for banking provider

The researcher expects with this research, banking provider would know what

factors affecting their customers using or adopting mobile banking to do their

transaction so that can use for their future strategic plan, substance policy

improving their productivity, and enhance their market section in this

perpustakaan.uns.ac.id 2. Advantages for bank customer digilib.uns.ac.id

This research hopefully can give advantages to the customers, so they can

maximize using mobile banking services. Afterwards, for the customers who

not yet known and not yet use it before will know and use it in their daily life.

3. Advantages for next research

Hopefully, this research can contribute a reference for literature development

and knowledge for next research about mobile banking technology.

perpustakaan.uns.ac.id CHAPTER II digilib.uns.ac.id

THEORETICAL FRAMEWORK

A. Agency Theory

1. Technology Concepts

Nowadays, technology has been being an unearthed part of human life.

There are so many definitions of technology. In Random House Dictionary

quotes from Kumala (2008: 12) technology is defined tightly relating to life,

citizens, and environment. It means that technology will not be a free valuable.

A technology usually started from individual or group imagination using

nature phenomenon and practical needs. From those imaginations, individual

or group developed it to be an invention. According to Galbraith in Niagara

(2008) technology is defined as a systematic application and obtained from

formulation science knowledge concept or knowledge collection that have

certain function in practical human daily live and technology as the activity

that involving organizational activity and system value.

Technology is defined by Goetch in Kumala (2008: 12) as “people

tools, resources, to solve problems or to extend their capabilities”. Pacey in

Kumala (2008: 12) defines technology as “the application or scientific and

other knowledge to the practical task by ordered systems that involve people

and organization, living things and machines”. From those definitions, there

are obtaining some essence: (1) technology related to eternal idea or human

perpustakaan.uns.ac.id technology is the human creation, so it does not come naturally, and it was digilib.uns.ac.id

artificial; (3) technology is set of means, so it can be bordered or it universals,

depends on the analysis side sight; (4) technology is purposing to facilitate

human endeavour, so technology must be able increasing human ability

performance (Kumala, 2008: 12).

Fichman in Stylanou and Jackson (2007) introduced a related argument

by distinguishing between two types of technologies in terms of the main

knowledge that each type determines the user. Type 1 technologies (e.g.

personal computers, word processing packages, graphics software) are

generally independent use technologies that are intended to facilitate

self-contained tasks performed by individual users. These technologies impose a

relatively small main knowledge and typically require only a few hours of

training before users achieve basic proficiency. In contrast, Type 2

technologies (e.g. software development process technologies) involve

significant knowledge barriers to adoption, including a lengthier training

process and a situation where the user ability, not just the willingness to use, is

a determining factor. As such, experience, attitudes, training, and supervisory

desires become valid predictor variables (Lee et al. in Stylanou and Jackson,

2007).

Facts in technology adoption based on the dynamic process, based on

empirical literature in naturally affecting static network (Ryan and Tucker in

Niagara, 2008: 12). The benefits of technology adoption is a beginning to

perpustakaan.uns.ac.id the economic agent of the corporation in the same industry. Decision of digilib.uns.ac.id

adopting technology can also relate to how a corporation developing

information technology innovation. Thus, manager in a corporation must be

prepared for what strategy will be used to adopt information technology that

took by the end user as technology acceptance (Zhu and Weyant, 2000).

Innovation in technology information done by vendor can be speed, quality

and flexibility increasing for the end user operating (Steinmueller. 2001;

Callantone, et al. 2006; in Niagara, 2008: 13).

Orlikowski and Iacono in Stylanou and Jackson (2007) point to the fact

that not enough attention is paid to the technology itself as well as to the

tendency to threat technologies as an independent and stable constant despite

the empirical evidence that highlights the impact of system design on

perceptions and use. Adopting the perspective that technology use is a

function of how the technology merges with the social environment, they point

to the silence of cultural, normative, and regulatory influences on the usage

decision (Stylanou and Jackson, 2007).

2. Conceptual of Mobile Banking

Mobile phone is no longer known as it traditional functions, i.e. voice

conversation and Short Message Services (SMS). Nowadays, the mobile

phones even facilitate for a real time teleconference through 3G (Third

Generations). Nonetheless, from the banking perspective, mobile phones

perpustakaan.uns.ac.id demand are keeping on increasing hence entrenched its feasibility as a new digilib.uns.ac.id

media of banking transaction (Amin et al., 2006).

In Barati and Mohammadi (2009), mobile banking is defined as the

“type of execution of financial services which the customer uses mobile

communication techniques in conjunction with mobile devices” (Pousttchi and

Schurig, 2004). It is defined as “a channel whereby the customer interacts with

a bank via a mobile device, such as a mobile phone or personal digital

assistant” (Barness and Corbit, Scornavacca and Barnes, in Barati and

Mohammadi, 2009). According to Amin et al. (2006), mobile banking defines

as the newest channel in electronic banking to provide a convenience way of

performing banking transaction, which is known as "pocket-banking". The

terms m-banking, m-payments, m-transfers, m-payments, and m-finance refer

collectively to a set of applications that enable people to use their mobile

telephones to manipulate their bank store value in an account linked to their

handsets, transfer funds, or even access credit or insurance products (Donner

and Tellez, 2008).

In Amin et al. (2006), Kohli (2004) claimed that the mobile banking service gives customers the convenience of account access information and

real-time transaction capabilities. Hamzah (2005) in Amin et al. (2006) said that "mobile banking" brings the convenience and enhanced value. Riivari

(2005) in Amin et al. (2006) claimed that the opportunity for mobile services is three times as many mobile phone users as those who use online PCs, and they

perpustakaan.uns.ac.id According to Donner (2006) mobile banking services enable consumers, for digilib.uns.ac.id

example, to request their account balance and the latest transactions in their

accounts, to transfer funds between accounts, to make, buy and sell orders, for

the stock exchange and to receive portfolio and price information.

There are a variety of mobile media channels, including, SMS (Short

Message Service), mobile web, mobile client application, phone banking, etc.

Each mobile media channel has its strengths and weaknesses, and it is

important to identify the delivery mode that is most appropriate for each

banking service. According to Rahardjo in Widyastuti (2008: 32), there are

some conditions for mobile banking services: (1) easy use application, (2) the

services can be reached from everywhere and every time, (3) cheap, (4) secure,

and (5) reliable. Mobile banking services generally classified into three type

characteristics (Kumala, 2008: 15), mention as follow.

1) Informational

This type is the simplest of mobile banking. It consists of products and services information from bank provider. The risk is quite low, because this system does not connect to banks’ main server and network, but connects to web hosting server.

2) Communicative

This type is enabling communication between customers and banks systems. It can be account balance information, transaction report, customer data changed, and also member services form. The risk is higher than the first above, because there is an interaction between the customers and some banking network server, which is susceptible with programs that can harm the system such as viruses.

3) Transactional

perpustakaan.uns.ac.id According to Alsindi et al. (2004) in Kumala (2008: 16), mobile digilib.uns.ac.id

banking services have some strengths and weaknesses. The strengths are

mentioned as follow.

1) WAP provides more alternatives to connect with bank customers and to increase the number of customers.

2) Bank customer can reach their banking services anytime and anywhere. 3) It can consider as one of the markets competitive advantage.

4) The used of this technology will decrease the number of customers to visit bank or ATM and also opening new branch.

The weaknesses are mentioned as follow.

1) The number of mobile banking users is very minim.

2) Mobile banking, perhaps, considered by some customers is a complex used of technology.

3) Developing mobile banking services needs a lot of cost because it needs more effort and infrastructure assure the security to do.

4) Limitation of cell phone screen width considered as one of the weaknesses because the information than shown is limited.

Mobile banking is still in development phase which needs more

concerned due to enhance the mobile banking system content to fulfill the

customer needs. When it probably completing the customer needs, the

acceptance of consumer will increase and bank can rise up their profitability.

With driving customer loyalty, engaging new segment, and empowering it own

capability, it also probably gives some opportunities to bank provider.

3. Technology Acceptance Model (TAM)

One of the most utilized models in studying information system

acceptance is the Technology Acceptance Model (TAM) (Davis et al., 1989;

Mathieson, 1991; Davis and Venkatesh, 1996; Gefen and Straub, 2000; Al-

Gahtani, 2001) in which system use (actual behaviour) is determined by

Perceived Usefulness (PU) and Perceived Ease of Use (PEOU) relating to the

perpustakaan.uns.ac.id (Pikkarainen et al., 2004). TAM has become so popular that it has been cited digilib.uns.ac.id

in most of the research that deals with user acceptance of technology (Lee et

al., 2003).

TAM is based on the Theory of Reasoned Action (TRA), which is

concerned with the determinants of consciously intended behaviours (Fishbein

and Ajzen in Pikkarainen et al., 2004). Behavioural intention will determine

individual behavioural. Expression from behavioural intention should be

relating with high accurate prediction of related volitional action (Jogiyanto,

2007: 26). From the information systems' perspective one relevant element of

TRA is its assertion that any other factor that influences behaviour, for

example, systems design variables user, characteristics, task characteristics,

political influences and organizational structure do so only indirectly by

influencing an attitude toward behaviour, subjective norm or their relative

weights (Davis et al. in Pikkarainen et al., 2004).

Since 1967 TRA has been developed, tested and used extensively and

its extension, the Theory of Planned Behaviour (TPB) utilized widely since

1988 by Ajzen. Ajzen included a construct which was not use yet in TRA.

This construct namely perceived behavioural control which is used to control

individual behaviour that is limited by their weaknesses and their boundaries

from lack of sources used to realize their behaviour (Jogiyanto, 2007: 61).

Although the TAM and the TRA share many issues they have some

considerable differences. The first difference is that according to TRA beliefs

perpustakaan.uns.ac.id TAM states that PEOU and PU are issues that affect acceptance of all digilib.uns.ac.id

information systems. The other significant difference is that in TRA all beliefs

are summed together, but in the TAM both beliefs are seen as distinct

constructs. Modelling each belief separately allows researchers to better trace

influences of all the affecting factors on information system acceptance (Davis

et al. in Pikkarainen et al., 2004).

TAM has been tested in many studies (e.g. Davis, 1989; Davis et al.,

1989; Mathieson, 1991; Adams et al., 1992; Davis, 1993; Segars and Grover,

1993; Taylor and Todd, 1995), and it has been found that TAM’s ability to

explain the attitude toward using an information system is better than other

model’s (TRA and TPB) (Mathieson in Taylor and Todd, 1995). In other

words, the use of an information system acts as an indicator for information

system’s acceptance. There are five main constructs used in TAM:

1) perceived usefulness,

2) perceived ease of use,

3) attitude towards behaviour or attitude towards using technology,

4) behavioural intention or behavioural intention to use,

perpustakaan.uns.ac.id Figure II.1 digilib.uns.ac.id

Technology Accepted Model by Davis et al. (1989)

3.1 Perceived Usefulness

Several studies on TAM perceived usefulness as an important

antecedent of computer utilization (Davis et al. and Igbaria et al. in Selamat et al., 2009). Davis (1989) defined PU as the degree to which an

individual believes that using the system will enhance his job

performance (Alrafi, _____). From that definition, it is known that

perceived usefulness as a belief about decision making process

(Jogiyanto, 2007: 114). Many research found strong relationships

between perceived usefulness and technology usage. In the study of

mobile banking acceptance Luarn and Lin (2005) in Selamat et al. (2009)

found that perceived usefulness has a positive impact on the willingness

to use mobile banking. Therefore, it is highly predictable that people use

information technology because they find it useful. Its construct is made

by six items, i.e. work more quickly, job performance, increase

productivity, effectiveness, make job easier, and useful. External

perpustakaan.uns.ac.id 3.2 Perceived Ease of Use (PEOU) digilib.uns.ac.id

Quote from Selamat et al. (2009), PEOU is a major factor that

affects acceptance of an information system (Davis et al., 1989). PEOU

is defined as the degree to which an individual believes that using

computer or computerized system will be free from physical and mental

efforts (Davis in Alrafi, ______). From the definition, it is known that

PEOU also a belief about decision making process (Jogiyanto, 2007:

115).

According to Teo (2001) if a system is easy to use, it requires less

effort on the part of users, thereby increasing the likelihood of adoption

and usage. Conversely, if systems that are complex or difficult to use are

less likely to be adopted, since it requires significant effort and interest

on the user. Franco and Roldan (2005) in Selamat et al. (2009) found the

relationship between PEOU, and PU was significant and positively

related. This means a difficult system is less useful. The construct of

PEOU is formed by many items (Jogiyanto, 2007: 115), i.e. easy of learn,

controllable, clear and understandable, flexible, easy to become skilful,

and easy to use.

3.3 Attitude Towards Using

Attitude toward using the system is defined as the degree of

evaluative affect that an individual associates with using the target

system in his or her job (Davis et al. in Jogiyanto, 2007: 116). It refers to

perpustakaan.uns.ac.id new technology. TAM conceptualizes individual perceptions of digilib.uns.ac.id

usefulness based on instrumentality as being strongly related to attitude

toward technology use. It is also defined by Mathieson (1991) as the

user’s evaluation of the desirability of his or her using the system

(Jogiyanto, 2007: 116). Prior research showed that attitude has positive

influence to the behavioural intention, and some showed negative results.

Thus, some researches do not include this construct (Jogiyanto, 2007:

116).

3.4 Behavioural Intention

The behavioural intent constructs as a proxy to predict the actual

usage had been successful thus far (Ramayah and Ignatius, 2003).

Warshaw and Davis (1985) define behavioural intention as “the degree to

which a person has formulated conscious plans to perform or not perform

some specified future behaviour” (Ramayah and Ignatius, 2003). This is

in line with the Theory of Reasoned Action (Fishbein & Ajzen, 1975)

and its successor Theory of Planned behaviour (Ajzen, 1985), which

contend that behavioural intention is a strong predictor of actual

behaviour. In the application of information systems, the TAM has been

successfull used by many researchers to predict behavioural intent

towards the use of information technology (Ramayah and Jantan, 2003;

Ramayah, Sarkawi and Lam, 2003; Legris, Ingham, and Collerette, 2002;

perpustakaan.uns.ac.id digilib.uns.ac.id

3.5 Behaviour (Actual Usage)

The behavior construct represents a user’s subjective estimate of

the amount of time or frequency that he/she actually spends using the

technology (Stylianou and Jackson, 2007). Igbaria et al. (1995) defined perceived usage as the amount of time interacting with a technology and

the frequency of use (Gardner and Amoroso, 2004). They found strong

relationships with behavioural intent to use the technology. Igbaria et al.

in Gardner and Amoroso (2004) found that individuals are likely to use a

system if they believe it is easy to use and will increase their performance

productivity.

Actual usage, as originally conceptualized in the Davis (1989)

study, was measured by the frequency of use and the length of time of

use (Szajna, 1996). Objective measures of actual use are difficult to

obtain for Internet-based technologies and therefore, many of the TAM

studies either left out usage as a dependent variable, focusing solely on

behavioural intention or else moved to perceived usage. The construct

captures both work and entertainment related use. The mobile banking

conceptualization examines use as a function of the time spent

transaction on the mobile banking. Szajna (1996) recommended the

examination of self-reported usage. Sun (2003) in Gardner and Amoroso

(2004), reports that most TAM studies used a perceptual self-report

perpustakaan.uns.ac.id usage did not fit to the model to their research for mobile banking digilib.uns.ac.id

acceptance.

3.6 External Variables

Although TAM is a model applicable to a variety of technologies

(Adams et al., 1992; Chin and Todd, 1995; Doll et al., 1998), it has been

criticized for not providing adequate information on individuals’

opinions of novel systems (Mathieson, 1991; Moon and Kim, 2001;

Perea y Monsuwe et al., 2004; in Huang et al., 2006). Davis (1989)

observed that external variables enhance the ability of TAM to predict

acceptance of future technology. In other words, the constructs of TAM

need to be extended by incorporating additional factors. Choosing

additional factors depends on the target technology, main users and

context (Moon and Kim in Huang et al., 2006). Wang et al. (2003) in Huang et al. (2006) noted that variables relating to individual differences

play a vital role in the implementation of technology. Additionally,

empirical research based on TAM has discovered strong relationships

between individual differences and information technology acceptance

(Agarwal and Prasad in Venkatesh, 2000).

To understand user perception of mobile banking, this study use

two individual difference variables, namely “perceived mobility value”

and “perceived enjoyment”, into the proposed TAM model. These two

constructs are described as follow. Perceived Mobility Value (PMV)

perpustakaan.uns.ac.id has three different elements, including convenience, expediency and digilib.uns.ac.id

immediacy (Seppala and Alamaki in Huang et al. 2006). Mobility permits users to gain access to service or information anywhere at

anytime via mobile devices. Previous studies found that mobile users

valued efficiency and availability as the main advantages of mobile

banking, and these advantages are a result of the “mobility” of a mobile

device (Chen et al., 2003; Hill and Roldan, 2005; Ting, 2005; in Huang et

al., 2006). From paper build by exploring customer perceived value in the mobile service field, the majority of respondents show positive

critical incidents when users perceived mobile services to be especially

valuable them, description of reasons why and under which condition

they had used the service, and description of consequences of service use

in their own language (Pihlstrom, 2008: 65). Therefore, mobile banking

is valuable because of its mobility. Consequently, the perceived mobility

value is a critical factor of individual differences affecting users’

behaviors (Huang et al., 2006).

Individuals engage in activities because these activities lead to

enjoyment and pleasure (Teo and Lim, 1997). According to Davis et al.

(1992), Perceived Enjoyment (PE) is defined as “the extent to which the

activity of using the technology is perceived to be enjoyable in its own

right, apart from any performance consequences that may be anticipated”

Jogiyanto, 2007: 131). In this study, perceived enjoyment denotes the

perpustakaan.uns.ac.id intrinsically enjoyable or interesting. Perceived enjoyment is seen as an digilib.uns.ac.id

example of intrinsic motivation, and it has been found to influence user

acceptance significantly. Furthermore, research on the role of enjoyment

suggested the importance of enjoyment on users’ attitudes and behaviors

(Igbaria et al., 1995; Teo and Lim, 1997; Wexler, 2001; Yi and Hwang,

2003; in Huang et al. 2006).

B. Conceptualization And Hypotheses Development

1. Perceived Mobility Value (PMV)

PMV tested by Huang et al. (2006), it relates to users’ personal

awareness of mobility value. Mobility enables users to receive and transmit

information anytime and anywhere (Huang et al., 2006). The mobility

associated with time-related needs will encourage users to adopt mobile

technology since enhanced accessibility is expected to affect dynamic

interaction and high levels of engagement (Anckar and D’Incau, 2002 in

Huang et al., 2006). Earlier research supports the importance of conditional

value, in that people in general lack motivation to use new mobile services

unless these services create value in situations where mobility really matters

and thereby affect people’s lives positively (Jarvenpaa et al. in Pihlstrom,

2008: 183)

Hence, users who perceive the value of mobility also understand the

uniqueness of mobile banking and have a strong perception of its usefulness.

perpustakaan.uns.ac.id perceived usefulness of mobile banking. Therefore, this work treats perceived digilib.uns.ac.id

mobility value as a direct antecedence of perceived usefulness.

H1: Perceived mobility value has a positive effect on perceived usefulness of mobile banking.

2. Perceived Enjoyment

The concept of perceived enjoyment (PE) adapted from Davis et al.

(1992) means that users feel enjoyable from the instrumental value of using

mobile banking. Prior studies on technology acceptance behaviour examined

the effects of perceived enjoyment on perceived ease of use (Igbaria et al.,

1996; Venkatesh, 2000; Venkatesh et al., 2002; Yiand Hwang, 2003; in

Huang et al., 2006). New technologies that are considered enjoyable are less

likely to be difficult to use. By extending these results to the context of the

mobile banking, we can therefore postulate that perceived enjoyment will

have a positive effect on perceived ease of use.

H2: Perceived enjoyment has a positive effect on perceived ease of use of mobile banking.

There is a causal relationship between perceived enjoyment and

attitudes. When users feel that mobile banking is enjoyable, the stimulus of

happiness in turn enhances their perception of mobile banking. Venkatesh

(2000) found that perceived enjoyment indirectly influences users on

adoption. Another research showed that attitudinal outcomes, such as

happiness, pleasure, and satisfaction, result from the enjoyable experience

perpustakaan.uns.ac.id al., 2005; in Huang et al., 2006). These findings indicate that enjoyment digilib.uns.ac.id

highly correlates with the users’ positive attitudes.

H3: Perceived enjoyment has a positive effect on attitude toward using mobile banking.

3. Perceived Ease of Use, Perceived Usefulness, Attitude, and Behavioural

Intention

Perceived ease of use has been found to influence the usefulness,

attitude intention, and actual use (Chau in Gardner and Amoroso, 2004).

Chau study revealed that perceived ease of use significantly affected

perceived usefulness, but did not significantly affect intention to use. In the

context of the mobile banking, we can postulate positive relationships

between perceived ease of use and two constructs, perceived usefulness of

mobile banking and attitude toward using mobile banking.

H4: Perceived ease of use of the mobile banking has a positive effect on perceived usefulness of mobile banking.

H5: Perceived ease of use of the mobile banking has a positive effect on attitude toward using mobile banking.

Perceived usefulness is the degree to which an individual believes that

using a particular system would enhance his or her performance. Usefulness

has been confirmed to be the most important factor affecting user acceptance

with few exceptions (Sun in Gardner and Amoroso, 2004). Hence, perceived

usefulness of mobile banking is likely to be positively related to attitude

toward using mobile banking.

perpustakaan.uns.ac.id In TAM, behavioural intention is influenced by both perceived digilib.uns.ac.id

usefulness and attitude. This relationship has been examined and supported

by many prior studies (Adams et al., 1992; Davis et al., 1989; Hu et al., 1999;

Venkatesh and Davis, 1996, 2000; in Huang et al., 2006). Therefore, this study presents the following hypotheses.

H7: Perceived usefulness of mobile banking has a positive effect on behavioural intention toward using the mobile banking.

H8: Attitude has a positive effect on behavioural intention toward using the mobile banking.

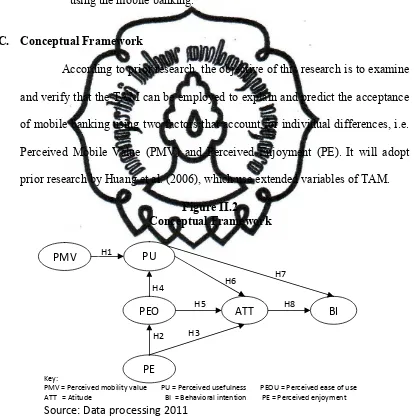

C. Conceptual Framework

According to prior research, the objective of this research is to examine

and verify that the TAM can be employed to explain and predict the acceptance

of mobile banking using two factors that account for individual differences, i.e.

Perceived Mobile Value (PMV) and Perceived Enjoyment (PE). It will adopt

perpustakaan.uns.ac.id CHAPTER III digilib.uns.ac.id

RESEARCH METHODOLOGY

A. Research Design

This research tries to explain an effect of perceived mobile value on

perceived usefulness and perceived enjoyment on attitude towards using mobile

banking and perceived ease of use with TAM model. It uses quantitative research

method with hypothesis test. Sekaran (2000: 108) defines that hypothesis is a

logically conjectured relationship between two or more variables expressed in the

form of a testable statement.

B. Population and Sample

Population in this research is bank customers who use mobile banking

service in Indonesia. The sample is bank customers who use mobile banking

service who stay in Jakarta. Sample size has an important role for SEM

interpretation result. Sample size becomes based on sampling error estimation.

With estimation model using Maximum Likelihood (ML), it requires at least 100

samples. When the sample raises more than 100, the ML sensitivity will increase

to detect differential among data. When sample size become large (400-500

samples), ML will be a very sensitive and will always result in significant

differential so goodness of fit measurement will be poor. Ghozali (2008: 64)

perpustakaan.uns.ac.id C. Data Source and Data Collecting Technique digilib.uns.ac.id

This research will use primary data, which is directly obtained from the

respondents, with purposive convenience sampling technique. Purposive

convenience sampling is collecting information from members of the population

who are conveniently available to provide it. Each respondent will be asked to

give their evaluation about the statements or questions by choosing answers

served with a Likert scale ranging from 1 for totally disagreeing to 4 for totally

agree.

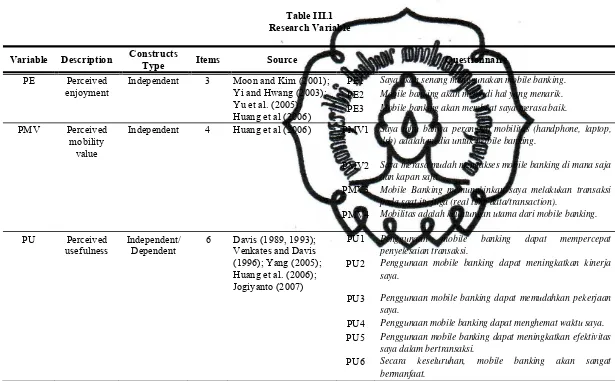

D. Measurement Items

Measurement items used in this research particularly for the core

constructs (six key determinants) of the proposed research model have been

adapted from the measurement items originally used in many theories. All

original measurement items used in measurements of the core constructs of the

theories or models including perceived mobility value, perceived enjoyment,

perceived usefulness, perceived ease of use, attitude toward using, behavioral

intention had statistical explanation and prediction under investigation by

Gardner and Amoroso (2004), Huang et al. (2006), and Jogiyanto (2007). The

29

Type Items Source Questionnaire

PE Perceived

PE1 Saya akan senang menggunakan mobile banking.

PE2 Mobile banking akan menjadi hal yang menarik.

PE3 Mobile banking akan membuat saya merasa baik.

PMV Perceived mobility

value

Independent 4 Huang et al (2006) PMV1 Saya tahu bahwa perangkat mobilitas (handphone, laptop,

dsb) adalah media untuk mobile banking.

PMV2 Saya merasa mudah mengakses mobile banking di mana saja

dan kapan saja.

PMV3 Mobile Banking memungkinkan saya melakukan transaksi

pada saat itu juga (real time data/transaction).

PMV4 Mobilitas adalah keuntungan utama dari mobile banking.

PU Perceived

PU1 Penggunaan mobile banking dapat mempercepat penyelesaian transaksi.

PU2 Penggunaan mobile banking dapat meningkatkan kinerja saya.

PU3 Penggunaan mobile banking dapat memudahkan pekerjaan saya.

PU4 Penggunaan mobile banking dapat menghemat waktu saya.

PU5 Penggunaan mobile banking dapat meningkatkan efektivitas saya dalam bertransaksi.

30

Source: Adopted from Gardner and Amoroso (2004), Huang et al. (2006), and Jogiyanto (2007)

Variable Description Constructs

Type Items Source Questionnaire

PEOU Perceived

PEOU1 Menggunakan mobile banking merupakan hal yang

mudah bagi saya.

PEOU2 Penggunaaan mobile banking jelas dan mudah dipahami.

Huang et al. (2006); PEOU3 Penggunaan mobile banking fleksibel.

Jogiyanto (2007) PEOU4 Penggunaan mobile banking tidak membutuhkan terlalu

banyak usaha berpikir.

ATT1 Menurut Saya, mobile banking sangat dibutuhkan.

ATT2 Saya mendapat hasil positif dari mobile banking..

ATT3 Saya ingin menggunakan mobile banking.

BI Behavioral intention

Dependent 5 Gardner and Amoroso

(2004):

BI1 Saya memilih menggunakan mobile banking dalam penyelesaian transaksi saya.

Huang et al. (2006); BI2 Saya berencana untuk menggunakan mobile banking

untuk penyelesaian transaksi di masa yang akan dating

Jogiyanto (2007)

BI3 Di masa depan, saya berniat untuk menggunakan mobile banking secara rutin.

perpustakaan.uns.ac.id E. Data Analyze Technique and Hypotheses Test digilib.uns.ac.id

1. Data Test Technique

a. Validity test

Validity is the extent to which the data collected truly reflect the

phenomenon being studied. For the sake of the clarity, Sekaran (2000)

can group validity test under three broad headings: content validity,

criterion-related validity, and construct validity. This research use

construct validity test because this approach is more objectives, simple

and it use in many research.

Construct validity testifies to how well the results obtained from

the use of the measure fit the theories around which the test is designed

(Sekaran, 2000: 208). Any biases could also be detected if the

respondents had tended to respond similarly to all items or stuck to only

certain points on the scale (Sekaran, 2000: 208). To test whether latent

constructs are unidimensional or indicators measurement constructs are

valid. First, we must see whether indicators are statistically significant or

not. Second, we must see convergent validity value or loading factor

value for each indicator. Some established research use 0,70 for good

validity value. While convergent validity 0,50-0,60 still acceptable for

earlier research (Ghozali, 2008: 132).

b. Reliability Test

The reliability of a measure indicates the extent to which the

perpustakaan.uns.ac.id measurement across time and across the various items in the instrument digilib.uns.ac.id

(Sekaran, 2000: 204). According to Ticehurst and Veal (2000) in

Kripanont (2007: 128), reliability is the extent to which research findings

would be the same if the research were to be repeated at a later date, or

with a different sample of subjects. A construct or variable is said reliable,

if the Cronbach’s alphavalue is >0,70 (Ghozali, 2008: 137). According to

Sekaran (2006) in Bhilawa (2010: 33), reliability less than 0.6 is

considered to be poor, those in the 0.7 is acceptable, and those over 0.8 is

good. The closer the reliability coefficient gets to 1.0 is the better.

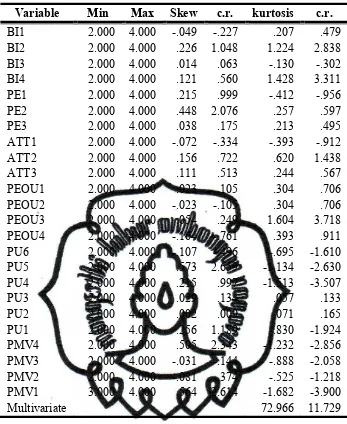

c. Normality Data Assumption

SEM requires normal distribution of data. If data distributes

abnormal, maybe it will influence data analysis resulting to high bias

data. In this research, normality test is counted by using computerized

program, AMOS 18. The postulate used in this research to examine data

normality is the critical ratio (cr) value. The data distribution is normal if

cr skewness value or kurtosis cr value is between -2,58 and +2,58

(Wijaya, 2009: 134). Curran et al. in Bhilawa (2010: 34) divides

normality data level into three parts, they are:

• normal, if z statistic value (critical ratio or c.r.) skewness < 2 and

c.r. kurtosis value is < 7,

• moderately non-normal, if c.r skewness is between 2 to 3 and c.r

perpustakaan.uns.ac.id • extremely non-normal, if c.r. skewness is >3 and c.r. kurtosis is> digilib.uns.ac.id

21.

d. Outlier Evaluation

Outlier is the observation that appears with extremely values,

which have a unique different characteristic from other observation, and

it appears on extreme value, whether it on one variable or combination

variables (Hair et al. in Bhilawa, 2010: 33). Outlier can be handled with

erasing one or some data which far from the certain spot center.

Test to multivariate outliers is done using Mahalanobis Distance

criteria at the level p<0,001. Mahalanobis Distance evaluated using χ2 at

free degree as big as variables sum, which is used in research (Ferdinand

in Bhilawa, 2010: 33). This outlier evaluation is done with computer’s

software, AMOS 18.

2. Model Assumption Test

This research uses Structural Equation Modeling (SEM) multivariate

analyzing to examine hypotheses using AMOS 18 software. SEM is a

statistical model that provides approximate calculation of the strength of the

hypothesis on the relationship between variables in a theoretical model, either

directly or through intervening variables (Maruyama in Wijaya, 2009: 1).

SEM refers to the relationship between endogenous variables and exogenous

variables, which is the variable can not be observed or calculated directly

perpustakaan.uns.ac.id AMOS 18 used to examine whether the estimated model has goodness of fit digilib.uns.ac.id

and has causality relation as hypothesized. The test consists of:

a. Goodness of Fit Measurement

Structural model categorized as “good fit” if it fulfills these conditions

below.

1)Chi-Square (χ2) Measurement Statistic (CMIN)

This analysis is purposing to develop and examine a model

which appropriate with the data. Chi's square is so sensitive to very

small sample as well as to very large sample. Thus, this examination

needs to complete with another examine the instrument (Ghozali,

2008: 130). CMIN shows the likelihood ratio chi-square statistic for

each fitted model (tested against the saturate model). If the p value for

each model is greater than 0.05, this means that the data do not depart

significantly from the model.

Furthermore, if at each step up the hierarchy from the

unconstrained model to the measurement residuals model, the increase

in chi-square is never much larger than the increase in degrees of

freedom (a non-significant chi-square, p value greater than 0.05), the

model up the hierarchy is preferable otherwise, the model up the

hierarchy is worse (a significant chi-square, p value less than 0.05)

perpustakaan.uns.ac.id 2)Minimum Probability Value Level digilib.uns.ac.id

P value is the probability of getting as large a discrepancy as

occurred with the present sample under appropriate distributional

assumptions and assuming a correctly specified model. So P is a “p value” for testing the hypothesis that the model fits perfectly in the population. Therefore, this is a method to select the model by testing

the hypothesis to eliminate any models that are inconsistent with the

available data (Kripanont, 2007: 192). The minimum probability value

level that needs is 0,1 or 0,2, but for probability level about 0,05 is

still able. (Hair et al. in Bhilawa, 2010: 36). 3)Normed Chi-Square (CMIN/DF)

This index is chi square value divided with degree of freedom.

According to Wheaton et al. (1977), ratio value ≤ 5 is a reasonable

measurement. Other researchers such as Byrne (1988) suggest to this

value ratio < 2 is a fit measurement (Ghozali, 2008: 67). CMIN/DF

(χ2 / df) is the minimum discrepancy divided by its degrees of

freedom; the ratio should be close to 1 for correct models. Although

Arbuckle (2005) claimed that it is not clear how far from 1 we should

let the ratio get before concluding that a model is unsatisfactory. In

contrast, Byrne (2006) suggested that ratio should not exceed 3 before

it cannot be accepted. Since the chi-square statistic (χ2) is sensitive to

sample size it is necessary to look at others that also support goodness

perpustakaan.uns.ac.id 4)Measures Based on the Population Discrepancy digilib.uns.ac.id

The Root Mean Square of Approximation (RMSEA) indicates

expected goodness of fit if the model estimated in population.

Recommended RMSEA acceptant value is ≤ 0,08 (Wijaya, 2009: 7).

According to Ghozali (2008: 67), RMSEA value between 0,05 to 0,08

is acceptable.

5)Goodness of Fit Index (GFI)

GFI is a goodness- of- fit index for ML (Maximum likelihood)

and ULS (Unweighted Least Squares) estimation (Kripanont, 2007:

193). GFI is used to calculate the weighted proportion of the variance

in the sample covariance matrix described by the covariance matrix in

estimated population (Wijaya, 2009: 8). Recommended acceptant

level by GFI is ≥ 0,90 (Ghozali, 2008: 67).

6)Adjusted Goodness of Fit Index (AGFI)

AGFI is GFI development, adjusted with degree of freedom

that is available to test whether the model accepted. Recommended

value is > 0,90 (Ghozali, 2008: 67). Wijaya (2009: 8) also

recommends AGFI value for at least equals or greater than 0,90.

7)Tucker Lewis Index (TLI)

TLI is an incremental fit index alternative that compares a

tested model against a baseline model (Wijaya, 2009: 8). TLI is a

index fit measure that less influenced by sample size. Recommended

perpustakaan.uns.ac.id 8)Comparative Fit Index (CFI) digilib.uns.ac.id

CFI is also known as Bentler Comparative Index. CFI is

incremental fit index which also compares the tested model with null

model (Wijaya, 2009: 8). This index is quite good for measuring the

goodness of fit because it is not influenced by sample size.

Recommended value by CFI is ≥ 0,90 (Wijaya, 2009: 9).

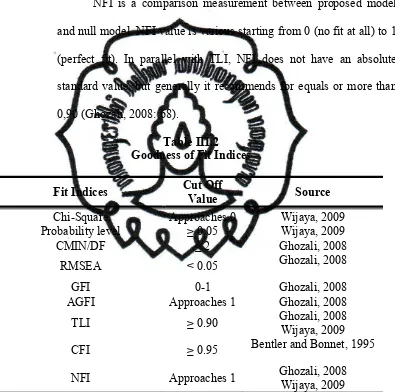

9)Normed Fit Index (NFI)

NFI is a comparison measurement between proposed model

and null model. NFI value is various starting from 0 (no fit at all) to 1

(perfect fit). In parallel with TLI, NFI does not have an absolute

standard value, but generally it recommends for equals or more than

0,90 (Ghozali, 2008: 68).

Table III.2 Goodness of Fit Indices

Fit Indices Cut Off

Value Source

Chi-Square Approaches 0 Wijaya, 2009

Probability level ≥ 0.05 Wijaya, 2009

NFI Approaches 1 Ghozali, 2008

perpustakaan.uns.ac.id Figure III.1 digilib.uns.ac.id

TAM with Perceived Mobility Value (PMV) and Perceived Enjoyment (PE)

3CHAPTER III

perpustakaan.uns.ac.id CHAPTER IV digilib.uns.ac.id

DATA ANALYSIS

This chapter will describe the data analysis and research results about mobile

banking acceptance with external variables using perceived mobility value variable

and perceived enjoyment variable with Technology Accepted Model (TAM). It will

be divided into three parts: (1) describing about data research collection and

respondents demographic descriptions, (2) data test analysis, (3) model assumption

analysis, and (4) hypotheses test.

A. Data Collection Analysis

1. Total Data Collection

Data collected from 80 questionnaires were directly distributed to

respondents and 110 questionnaires were distributed by email. Based on the

sample criteria discussed above, this study has obtained 67 respondents by

direct distribution and 65 respondents by email distribution, so 132 samples

total are obtained. From table IV.1 we can see that level of returned

questionnaires is 69.47% from 190 distributed questionnaires which one of

them can not be processed. So, there are 131 questionnaires that can use for

perpustakaan.uns.ac.id Table IV.1 digilib.uns.ac.id

Data Research Collection

Source: Primary data processing (2011)

2. Respondents Demography

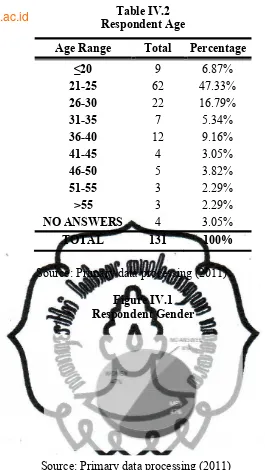

a. Respondents Characteristics

From table IV.2 we can see that majority of respondents’ age range

between 21-25 years old with 62 respondents (47.33%), and the second

majority is between 26-30 years old with 22 respondents (16.79%). It

shows that there are much more productive respondents than

unproductive respondents. The minority respondents’ age is between

51-55 years old and >51-55 years old (2.29%). Researcher has the youngest

respondent with 19 years old and the oldest with 83 years old.

b. Respondent Gender

Based on data collection, respondent gender characteristic describes

as follows. There are 62 men respondents (47%), 62 women respondents

(47%), and seven respondents did not answer it (6%).

DESCRIPTION TOTAL PERCENTAGE

Questionnaire distributed 190 100%

Questionnaires returned 132 69.47%

Questionnaire which can not be processed 1 0.76%

perpustakaan.uns.ac.id Table IV.2 digilib.uns.ac.id

Respondent Age

Source: Primary data processing (2011)

Figure IV.1 Respondent Gender

c. Respondent Educational Background

Based on data collection, respondent educational background

characteristic describes as follows. There are 81 S1 graduates as majority educational background (61.83%). Second, 30 respondents are D3

graduates (22.9%). Then 10 respondents are SLTA or equals graduates Age Range Total Percentage

≤20 9 6.87%

21-25 62 47.33%

26-30 22 16.79%

31-35 7 5.34%

36-40 12 9.16%

41-45 4 3.05%

46-50 5 3.82%

51-55 3 2.29%

>55 3 2.29%

NO ANSWERS 4 3.05%

TOTAL 131 100%