Full Terms & Conditions of access and use can be found at

http://www.tandfonline.com/action/journalInformation?journalCode=vjeb20

Download by: [Universitas Maritim Raja Ali Haji] Date: 11 January 2016, At: 20:46

Journal of Education for Business

ISSN: 0883-2323 (Print) 1940-3356 (Online) Journal homepage: http://www.tandfonline.com/loi/vjeb20

Does Participation in a Computer-Based Learning

Program in Introductory Financial Accounting

Course Lead to Choosing Accounting as a Major?

Vincent Owhoso, Charles A. Malgwi & Margaret Akpomi

To cite this article: Vincent Owhoso, Charles A. Malgwi & Margaret Akpomi (2014) Does Participation in a Computer-Based Learning Program in Introductory Financial Accounting Course Lead to Choosing Accounting as a Major?, Journal of Education for Business, 89:7, 367-372, DOI: 10.1080/08832323.2014.915206

To link to this article: http://dx.doi.org/10.1080/08832323.2014.915206

Published online: 29 Sep 2014.

Submit your article to this journal

Article views: 55

View related articles

Does Participation in a Computer-Based Learning

Program in Introductory Financial Accounting

Course Lead to Choosing Accounting as a Major?

Vincent Owhoso

Northern Kentucky University, Highland Heights, Kentucky, USA

Charles A. Malgwi

Bentley University, Waltham, Massachusetts, USA

Margaret Akpomi

River State University of Science and Technology, Port Harcourt, Nigeria

The authors examine whether students who completed a computer-based intervention program, designed to help them develop abilities and skills in introductory accounting, later declared accounting as a major. A sample of 1,341 students participated in the study, of which 74 completed the intervention program (computer-based assisted learning [CBAL]) and the rest did not (no computer-based assisted learning [NoCBAL]). The proportion of students who enrolled in an intermediate course and their mean grade point average, and the proportion that declared accounting as a major, were compared. The results show that a larger proportion of CBAL students declared accounting as a major compared to NoCBAL students.

Keywords: accounting major, computer assisted learning, minority accountants, supplemental instruction, teaching delivery method

Accounting enrollments at universities and four-year col-leges are increasing in the United States (American Institute of Certified Public Accountants [AICPA], 2011). However, the same cannot be said of minority enrollment in account-ing programs at these institutions. This is because minority enrollment in accounting programs has been declining, in spite of the substantial effort by the AICPA and other pro-fessional bodies to diversify the accounting profession (AICPA, 2011). The overall enrollment in accounting pro-grams at universities and four-year colleges in the United States increased 6% between 2007 and 2010; however, minorities’ enrollment in accounting programs has declined over the past decade.

The decline in minority enrollment in accounting pro-grams appears to have also translated into low minority representation in the accounting profession. Minorities

make up only 17% of CPAs at professional accounting firms (Green & Khanna, 2011). As a result, the workforce of tomorrow may not be representative of the marketplace (Hammond & Paige, 1999). The clients in the marketplace consist of members from different ethnicities and back-grounds, and they are demanding a diverse workforce to cater for their needs. With minorities making up 25% of the U.S. population, the workforce in public accounting might not be diversified enough to meet the needs of the multira-cial and multiethnic client base (Hammond & Paige 1999).1 As public accounting firms are looking to enhance staff diversity in their organizations and ways to respond to cli-ents’ expectations, any educational efforts designed to assist students to become accounting major should be of interest to educators, college business deans, and practitioners.

The AICPA has been responding to the decline in minor-ity enrollment in accounting programs for decades by setting aside funds to encourage minority enrollment in accounting. For example, the AICPA recently granted multimillion dol-lar endowment funds to universities to use as schodol-larships to eligible minority accounting students. Similarly, the National Correspondence should be addressed to Vincent Owhoso, Northern

Kentucky University, Department of Accounting, Finance, and Business Law, BC 389 Nunn Dr., Highland Heights, KY 41099, USA. E-mail: [email protected]

ISSN: 0883-2323 print / 1940-3356 online DOI: 10.1080/08832323.2014.915206

Association of Black Accountants (NABA) has designed a career development program, known as Accounting Career Awareness Program (ACAP), which allows minority stu-dents in high schools to participate in an all expense-paid summer residency program and explore careers in account-ing and business.2Together, these efforts by the AICPA and NABA have not translated into higher minority enrollment in accounting programs. Could it be that additional educa-tional learning programs are needed to encourage minority students to consider accounting as a major?

Given that introductory accounting courses are part of the core requirements in business schools and they serve as prerequisites to core business courses, students planning to major in accounting must first successfully complete these courses. Introductory accounting courses are also regarded as high-risk courses characterized by a high failure and withdrawal rates (Etter, Burmeister, & Elder, 2000; Wid-mar, 1994).3 The good news is that educational learning models such as tutoring (Merrill, Reiser, and Ranney, 1992), supplemental instruction (Jones & Fields, 2001), and computer-based assisted learning (Malgwi, Owhoso, Brown, & Avery, 2010) exist as pedagogical vehicles through which students can obtain help and complete introductory accounting courses successfully.4Overall, the evidence sug-gests that these learning models are effective in improving students’ performance and in reducing attrition rates (Geiger & Ogilby, 2000; Jones & Fields, 2001; Malgwi et al., 2010). However, these learning models may not be widely available to students at many colleges of business.

The purpose of this study is to examine whether students’ participation in a computer-based assisted learn-ing program (CBAL) in introductory accountlearn-ing course was a catalyst for students seeking a major in accounting. The second purpose of this study is to examine whether stu-dents who participated in the assisted-learning program and who completed intermediate accounting course had equal or better grade point averages (GPAs) than their counter-parts who did not participate in the program. There was no additional help offered to the students taking the intermedi-ate course beyond the intervention program in the first introductory course. The next section presents the back-ground literature and the development of hypotheses. This is followed by the methods and the results sections. The final section then presents the summary and implications.

BACKGROUND LITERATURE AND HYPOTHESES DEVELOPMENT

The success in providing additional tutorials or out of class instructions to students to help them master the course con-tent has been well documented in the literature (see Etter et al., 2001; Jones & Fields, 2001; Malgwi et al., 2010). The underlying theme across these studies is that participat-ing students are able to relate one cue to another, integrate

information that coheres with the learner’s prior knowledge and experiences, comprehend, retrieve, and recall what was learned more effectively (Gensbacher, 1997; Gick & Holy-oak, 1980). In the present study we examined the CBAL model and its participants who later enrolled in intermedi-ate accounting course.

CBAL Model

The CBAL program was an integrated hands-on, online com-puter-based tutoring program in which students learned basic accounting concepts while receiving help from professional accountants from the NABA and other accounting firms. The program, selection of students, and implementation are fully described in Malgwi et al. (2010). The CBAL program was conducted in an accounting lab that was supervised by a full-time accounting professor at a university in the northeast region of the United States. The lab was a state-of-the-art classroom that could hold 35 students. A typical CBAL ses-sion consisted of a dyad group of students having hands-on and one-on-one problem solving exercises using a prese-lected accounting software package and textbook.

Linking CBAL Participation to Choosing Accounting as a Major

The linkage between a successful completion of the intro-ductory accounting courses with the help provided by the CBAL program and declaring a major in accounting can be made. Through the benefits of the CBAL program, a stu-dent can develop and build mental structure for the account-ing concepts beaccount-ing presented.

If a student entered a transaction into the computer sys-tem during the CBAL session, the student would immedi-ately see the outcome of the transaction displayed on the terminal. This showed the students how the outcomes of the transaction were distributed to the various parts of the financial statements. If a student needed further explana-tions about any aspect of the transaction, a lab assistant would provide the necessary assistance and feedback. As the students’ understanding of the accounting concepts increased, their midterm grades would also increase, and this could persuade the students that they could succeed in any accounting course. Further, the presence of the NABA members as lab assistants could provide the students with additional source of confidence and belief that they too can become accountants.

Ultimately, a high semester course grade received in the introductory accounting course can be a catalyst for stu-dents to enroll in an upper level accounting course or to seek a major in accounting by those who might not ordinar-ily do so. Malgwi et al. (2010) reported that the mean GPA in the first introductory accounting course for CBAL pro-gram participants was statistically higher than that of NoC-BAL participants (2.79 vs. 2.54). As the CNoC-BAL participants

368 V. OWHOSO ET AL.

saw greater improvements in their course GPA, they may believe that they had mastered the accounting concepts to succeed in other accounting courses. Whether motivated or not, students aspiring to major in accounting would enroll in intermediate accounting courses. Therefore, CBAL par-ticipants are not expected to enroll in intermediate account-ing course at a greater number than the NoCBAL students. Based on this expectation, the following alternate hypothe-sis was tested:

Hypothesis 1 (H1): The proportion of CBAL participants who enrolled in intermediate accounting course would not be significantly different from that of NoCBAL participants.

If the CBAL students master the accounting concepts from the CBAL program, does the knowledge gained from the program last long enough for them to successfully com-plete the intermediate accounting course at the same or bet-ter GPAs as the NoCBAL students? Although the intermediate accounting course is a little more advanced than the introductory accounting course, the content of the two courses are similar in many respects. It is possible that the CBAL participants would apply their knowledge of accounting concepts to complete the intermediate account-ing course successfully, as the NoCBAL participants, even though no additional intervention program was offered dur-ing the intermediate course. Based on these expectations the following hypothesis was tested:

H2: There would be no significant difference in the overall GPA of CBAL and NoCBAL participants who enrolled in the intermediate accounting course.

The students’ academic profile, prior to completing the CBAL program, indicates that many of them were just looking for ways to just pass the introductory accounting course and move on. After successfully completing the first introductory accounting course with a good grade through the help of the intervention program, the CBAL students may be more motivated to seek a major in accounting by enrolling in the intermediate course. Given this expectation, the following hypothesis was tested.

H3: The proportion of CBAL participants choosing accounting as a major would be higher than that of NoCBAL participants.

METHODOLOGY

Participants and Data

The present study shares some data with Malgwi et al. (2010). A sample of 1,341 students participated in the

study. Out of this number, 74 students participated in the CBAL program and 1,267 students did not (NoCBAL). Both groups enrolled in the same sections of the introduc-tory accounting course that participated in the CBAL pro-gram. Fifty-two (70%) of the 74 CBAL participants were minority students while 22 (30%) were majority students. A review of the students’ profile indicates that they were at-risk students because they anticipated difficulty in com-pleting the first introductory accounting course success-fully, they perceived themselves to be weaker in quantitative course materials, and they had lower scholastic aptitude scores than the NoCBAL students as measured by their performance in the SAT test scores. The institutional research office at the participating university provided the detailed enrollment and grade data used in this study.5

Dependent Variable

The dependent variables reported in this study are (a) the proportion of CBAL and NoCBAL participants who enrolled in intermediate accounting course, (b) the GPA received in intermediate accounting course, and (c) the pro-portion of CBAL and NoCBAL participants who declared accounting as a major.

Independent Variables

Three independent variables were examined: enrollment status, program status, and major. Enrollment status describes the participants’ enrollment in intermediate accounting course, and it is manipulated at two levels: yes (enrolled) and no (not enrolled). Program status describes the participants’ prior participation in the intervention pro-gram, and it is manipulated at two levels: CBAL and NoC-BAL. Major is manipulated at two levels: participants who declared accounting as a major and those who did not.

Data Analyses

The analysis was conducted by constructing a 2£2 factor

model of program status and major. The Pearson chi square test of independence, the Mantel-Haenszel chi square, and the generalized linear model tests were employed as the sta-tistical tests of interest.

RESULTS

Descriptive Statistics

Table 1 presents the descriptive statistics for enrollment status, program status, mean GPA, and major. The results show that the proportion of CBAL participants who enrolled in the intermediate accounting course is higher than the proportion of NoCBAL participants. The mean

GPA of the CBAL participants in the intermediate course is less than that of the NoCBAL participants. In addition, the proportion of CBAL participants who declared accounting as a major is larger than the proportion of NoCBAL participants.

Enrollment Status in Intermediate Accounting

H1predicts that the proportion of CBAL participants who enrolled in intermediate accounting course would not be significantly different from that of the NoCBAL partici-pants. To testH1, a Chi square test was performed. The test was not significant,x2(1,ND171)D0.025,p>.878,

con-sistent with expectation. As shown in Tables 1 and 2, the proportions of the enrollment are 12.16% and 12.79% for CBAL and NoCBAL, respectively. The enrollment rate for CBAL and NoCBAL participants does not differ significantly.

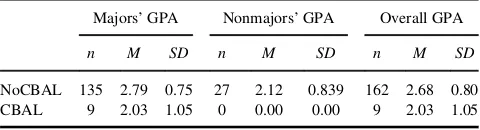

Mean GPA in Intermediate Accounting

H2predicts that the mean overall GPA in the intermediate accounting course for the CBAL and NOCBAL participants would not differ. Although CBAL participants previously outperformed NoCBAL participants in introductory accounting, CBAL participants were expected to perform as or outperform NoCBAL participants in the intermediate accounting course.H2was tested by using the generalized linear models with GPA as the dependent variable and pro-gram status and major as the independent variables. The results, presented in Table 3, show a significant main effect of program status,F(1,168)D7.85,p<.0057, and major,

F(1,168)D16.11;p<.0001.6

An examination of the means in Table 2 shows that the overall mean GPA of the CBAL participants is 2.03

compared to 2.68, the mean GPA for the NoCBAL partici-pants. The difference in the mean GPA is 0.65, suggesting that the CBAL participants significantly underperformed the NoCBAL participants in the intermediate accounting course. The CBAL program may have motivated the CBAL participants to enroll in the intermediate accounting course; however, their performance in the course was much lower.

Declaration of Major in Accounting

H3 predicted that the proportion of CBAL students who took intermediate accounting course and declared account-ing as a major will be higher than that of NoCBAL partici-pants. H3 was tested by using the Mantel-Haenszel chi-square test, controlling for previous participation in the CBAL program. As indicated in Table 1, 100% of CBAL participants who enrolled in the intermediate accounting course also declared accounting as a major, whereas only 83 percent of the NoCBAL participants declared account-ing as a major. The difference is significantx2D74.00,p

>.0001. The result demonstrates that the CBAL program

motivated students to choose accounting as a major.

SUMMARY AND IMPLICATIONS

There are a number of insights into these findings. First, the CBAL program seems to be effective at improving and advancing students’ learning, up to the point of passing the introductory accounting courses. Second, the CBAL pro-gram was effective at motivating at-risk students to declare accounting as their major.7 Third, the knowledge gained through the CBAL program did not sustain the CBAL par-ticipants’ ability to independently learn and succeed in the advanced intermediate accounting course, when the CBAL program was not offered. Thus, the question is no longer whether the number of at-risk students enrolling in account-ing program at universities and four year colleges can be increased. Rather, the question is whether at-risk students completing the first introductory accounting course with the help of the intervention program are mature enough to succeed in advanced accounting courses required for accounting majors.

The apparent failure of the CBAL program in introduc-tory accounting courses to advance students to the level of

TABLE 1

Descriptive Statistics for CBAL Versus NoCBAL Groups: Means for CBAL and NoCBAL Groups by Enrollment Status and Major

Intermediate enrollment Major in accounting

Yes No Yes No

Status n % n % n % n %

NoCBAL 162 12.79 1,105 87.21 135 83.33 27 16.27 CBAL 9 12.16 65 87.84 9 100.00 0 0.00

TABLE 2

Descriptive Statistics for CBAL Versus NoCBAL Groups: Mean GPA of CBAL Versus NoCBAL Groups for Intermediate Accounting

Majors’ GPA Nonmajors’ GPA Overall GPA

n M SD n M SD n M SD

NoCBAL 135 2.79 0.75 27 2.12 0.839 162 2.68 0.80 CBAL 9 2.03 1.05 0 0.00 0.00 9 2.03 1.05

TABLE 3

General Linear Model Test Results for Comparing CBAL and NoCBAL Participants’ GPA in Intermediate Accounting

Source df SS MS F p

CBAL status 1 4.779 4.779 7.85 .0057 Major 1 9.801 9.801 16.11 .0001 Error 168 102.215 .608

Note:SSDsum of squares. MSDmeans of squares.

370 V. OWHOSO ET AL.

independent learning in advanced courses also raises addi-tional questions. First, since the CBAL participants under-performed the NoCBAL students in the intermediate course, but outperformed the NoCBAL students in the introductory accounting course, could this be attributed to the method of delivery in the advanced accounting courses or the manner in which students’ skills are being developed to facilitate independent learning in advanced courses? Sec-ond, can the allocation of additional resources for interven-tion programs beyond the introductory accounting phase mitigate the CBAL failure? Answers to these questions are explored subsequently.

Delivery Method

The CBAL program used interactive hands-on approach with technology that allowed the students to see how the numbers they entered into the system interacted with each other, as well as the relationships in the financial statements in real time. This hands-on approach might have helped the CBAL students to learn better while taking the first intro-ductory accounting course. On the contrary, intermediate and other advanced courses often use lectures, textbooks, and little or no interactive hands-on activities.

The absence of a hands-on approach and technology use during the intermediate course may be one explanation why the CBAL students underperformed the NoCBAL students in the intermediate course. One remedy is to have a portion of the classroom time in the advanced courses devoted to interactive hands-on and team sessions, including the use of technology. Some universities or colleges may be unable to provide dedicated computer labs; however, university stu-dents are increasingly able to afford individual laptops they could bring to class. Implementing this recommendation may call for faculty development and the rethinking of course delivery methods to serve a new generation of stu-dents who might process and use information differently.

Development of Student Skills Necessary to Succeed in the Classroom and in the Profession

The new generation of students may require different skills to succeed in the classroom and in the profession. For example, in the CBAL program, the focus was on analyzing and understanding accounting concepts presented interac-tively using technology. While working in dyad teams, the students used technology and discussed the accounting issues confronting them before arriving at solutions. These aspects of CBAL might have assisted the students to acquire critical skills that led to building confidence and learning in the introductory accounting course. In contrast, in many advanced courses, the emphasis is generally on lec-ture, and students rely on memorization of course contents to get through the exams. This approach can make the

knowledge gained during the course not to last or be transferable.

It is suggested that the faculty should use or develop activities that will help the students to develop skills neces-sary to succeed in the classroom and in the profession. Such activities may include in-class interactive group assignments using technology, team case analysis, the pre-sentation of present financial events in the classroom, and so on.

Allocation of Additional Resources to Intervention Programs

For more than four decades, the AICPA, NABA, and other educational charity organizations have expended significant amount of resources to increase minority enrollment in accounting programs without success. Some of these efforts have included scholarships and the pairing of faculty with students as mentors. While these efforts are significant, the evidence from the CBAL program suggests that more efforts should be devoted to the development of interven-tion programs that would benefit students in the actual learning process. This can be achieved in a number of ways. First, accounting programs or faculty should be encouraged to develop or implement helpful hands-on pro-grams using technology along with the accounting courses they teach. These programs could be interactive tutorials or supplemental instructions. These programs could be staffed by accounting professionals in the local community who would volunteer to serve as moderators or role models in the actual learning environment. For lower division courses, graduate assistants or students with high GPAs could be recruited to operate the hands-on programs. Sec-ond, some financial support should be provided to support the faculty who develop and implement the helpful hands-on programs as incentives to chands-ontinue to develop and implement these programs.

There is significant merit to the argument that financial support should be provided to encourage faculty to continue to implement the intervention programs. From the findings of the CBAL program, students who enrolled in an inter-vention program would likely be motivated to major in accounting because they felt comfortable in learning and understanding the accounting concepts through the inter-vention programs. When there was no interinter-vention pro-gram, the students’ grades plummeted. Since the AICPA and other professional bodies have allocated significant resources for scholarships and faculty mentorship in the past, without success in increasing minority enrollment, it appears that no amount of scholarships or faculty mentor-ship incentives could replace the students’ experiences with a hands-on intervention program because it can form their decision to declare accounting as major. Therefore, some of the resources should be allocated to the actual learning pro-cess. A by-product of the intervention programs is that as

the news of these helpful learning programs in accounting programs spread to other minorities; the stigma of treating accounting as a high-risk course would be slowly removed, thereby giving rise to increased minority enrollment in accounting courses and in declaring accounting as a major.

Limitations

One possible limitation of the study is self-selection bias. We did not control for other enrollment motives beside stu-dents being categorized into stustu-dents’ perceived weakness or strengths in accounting or quantitative courses. Also, we did not specifically employ demographic questions that asked the students their reasons for choosing accounting as a major. We imputed that information from the data pro-vided. As a result we do not know how the effect of those questions would have had on the participants. These limita-tions could be of interest to future researchers to include demographic variables. Additionally, a comparative study in which an intervention program was provided to students who enroll in the intermediate course and comparing their GPA performance with those not receiving help would be of significant interest in informing viable policy issues with respect to funding levels for minority enrollment initiatives and delivery methods in accounting.

NOTES

1. It is important to be cautious in interpreting the per-centage of minorities, Hispanics, and Whites. For example, it is possible that some or all Hispanics may select non-White and be included as minorities or as White and be excluded from minorities. 2. Participants in the ACAP are encouraged to attend a

variety of business and college preparatory workshops on accounting, finance, economics, computer technol-ogy, and business management during the program. 3. High-risk courses are those courses in which the risk

of failing the course is generally high, that is, 30% of the students enrolled usually receive a failing or with-drawal grade among academically weak students. 4. See Merrill (1992), Jones and Fields (2001), and

Malgwi et al. (2010) for a comprehensive description of these models.

5. The data included students’ SAT scores, overall pre-GPA before taking the first introductory

accounting, GPA in the first introductory account-ing course in the semester they participated in the CBAL program, GPA for the second introductory accounting course, and GPA for the first interme-diate accounting course, including pass, with-drawal, and failure scores.

6. There was no statistical difference between the CBAL GPAs of minority and majority students in the intermediate course. As a result, the data was com-bined as one unit in the analysis and in reporting the results.

7. It should be noted that Malgwi et al. (2010) described the profiles of the students who participated in the CBAL program as those who would have otherwise failed, withdrawn, or received lower grades in the introductory accounting course.

REFERENCES

Albrecht, W. S., & Sack, R. J. (2000).Accounting education: Charting the course through a perilous future. Accounting Education Series (Vol. 16). Sarasota, FL: American Accounting Association.

American Institute of Certified Public Accountants (AIPCA). (2011).

Trends in the supply of accounting graduates and the demand for public accounting recruits. New York, NY: Author.

Etter, E. R., Burmeister, S. L., & Elder, R. J. (2000). Improving student performance and retention via supplemental instruction. Journal of Accounting Education,18, 355–368.

Geiger, M. A., & Ogilby, S. M. (2000). The first course in accounting: Students’ perceptions and their effect on the decision to major in accounting.Journal of Accounting Education,18, 63–78.

Gick, M. L., & Holyoak, K. J. (1980). Analogical problem solving. Cogni-tive Psychology,12, 306–355.

Green, J. C., & Khanna, M. (2011). Diversity makes for a stronger account-ing profession.Pennsylvania CPA Journal.Retrieved from http://www. picpa.org/content/42217.aspx.

Hammond, T., & Paige, K. (1999). Still seeking the ideal.Journal of Accountancy,188(3), 75–79.

Jones, J. P., & Fields, K. T. (2001). The role of supplemental instruction in the first accounting course.Issues in Accounting Education,16(4), 531–547.

Malgwi, C. A., Owhoso, V. E., Brown, C., & Avery, E. (2010). The effect of computer-based assisted learning on students’ performance and attrition in introductory accounting courses. AIS Education Journal,5, 1–26.

Merrill, D. C., Reiser, B., & Ranney, M. (1992). Effective tutoring techni-ques: A comparison of human tutors and intelligent tutoring systems.

The Journal of the Learning Sciences,2, 277–305.

Widmar, G. (1994). Supplemental instruction: From small beginnings to national program.New Directions for Teaching and Learning,60, 3–10.

372 V. OWHOSO ET AL.