Full Terms & Conditions of access and use can be found at

http://www.tandfonline.com/action/journalInformation?journalCode=vjeb20

Download by: [Universitas Maritim Raja Ali Haji] Date: 11 January 2016, At: 22:27

Journal of Education for Business

ISSN: 0883-2323 (Print) 1940-3356 (Online) Journal homepage: http://www.tandfonline.com/loi/vjeb20

Pretest in an Introductory Finance Course: Value

Added?

Gunita Grover , Jean Heck & Nancy Heck

To cite this article: Gunita Grover , Jean Heck & Nancy Heck (2009) Pretest in an Introductory Finance Course: Value Added?, Journal of Education for Business, 85:2, 64-67, DOI:

10.1080/08832320903252405

To link to this article: http://dx.doi.org/10.1080/08832320903252405

Published online: 07 Aug 2010.

Submit your article to this journal

Article views: 37

View related articles

ISSN: 0883-2323

DOI: 10.1080/08832320903252405

Pretest in an Introductory Finance Course:

Value Added?

Gunita Grover

Villanova University, Villanova, Pennsylvania, USA

Jean Heck

St. Joseph’s University, Philadelphia, Pennsylvania, USA

Nancy Heck

Villanova University, Villanova, Pennsylvania, USA

Performance in finance has previously been shown to be affected by performance in prerequisite courses. In this study, the authors hypothesized that student performance in the introductory finance course would be affected by the knowledge brought to the course as measured on a quantitative pretest given at the beginning of the course. They conclude that performance is a function of the quantitative knowledge brought to the course. The results suggest that pretesting for quantitative knowledge may be a good indicator of performance in the introductory finance course and provide students with information to help them target additional work early in the course to offset such deficiencies.

Keywords: Performance, Prerequisite, Pretest

Educators have long known that students learn more and perform better in many courses when they have completed specific prerequisite courses. For the introductory finance course, earlier research has revealed that students perform better when they have completed course work in mathemat-ics, financial accounting, and economics (Ely & Hittle, 1990; Marcal & Roberts, 2001; Borde, Byrd, & Modani, 1998). In fact, virtually every undergraduate business curriculum re-quires students to complete foundation courses in these three areas prior to taking the introductory finance course.

Undoubtedly, part of the benefit of requiring a number of prerequisites for the introductory finance course comes from the strengthening of students’ analytical skills and study habits through exposure to challenging quantitative courses. It has been our observation that the more prerequisites com-pleted, the better equipped students are to handle the rigors of the principles of finance course. In this paper, however, we were interested in quantifying just how much of the knowl-edge obtained in the prerequisite courses in mathematics,

Correspondence should be sent to Jean Heck, Haub School of Business, St. Joseph’s University, 5600 City Ave., Philadelphia, PA 19131, USA. E-mail: jean.heck@sju.edu

financial accounting, and economics is actually remembered by students when they started the introductory finance course and whether the retention of that knowledge affected perfor-mance in the course.

In this study, students at one university were tested at the beginning of the introductory finance course to assess the level of knowledge retained from the prerequisite courses. These pretest scores were then analyzed against the stu-dents’ performance in the finance course as measured by their course grade. In the following section, we review the literature on predictors of student performance in quantita-tive business courses. We then report on the research design and methodology, results, conclusions, and limitations of this research.

REVIEW OF LITERATURE

Over the years, numerous studies have examined the relation-ship among student performance in accounting, economics, or finance courses and various aptitude variables. The vari-ables studied include cumulative GPA, SAT and ACT scores, performance in prerequisites, completion of similar courses

PRETEST IN AN INTRODUCTORY FINANCE COURSE 65

in high school, number of hours of employment, involve-ment in other activities on campus, age, gender, and number of credits completed. In an earlier study, Bellico (1972) found that performance in advanced economics courses is strongly related to cumulative GPA. Interestingly, he also found that variables measuring students’ verbal ability had a stronger relationship with performance in economics courses than did those measuring the quantitative ability of students.

Schaffer and Calkins (1980) studied the importance of seven course prerequisites to the business finance course: financial accounting, management information systems, business law, business statistics, macroeconomics, microe-conomics, and mathematical analysis. They found that performance in prerequisites was related to performance in the introductory finance course. Specifically, the letter grade received in financial accounting is the most important dis-criminating variable and has the highest predictive power for the finance grade, even greater than the student’s overall GPA. Eskew and Faley (1988) developed a regression model to explain student performance in the first college-level finan-cial accounting course. They found that academic aptitude and effort variables, as measured by SAT scores and partic-ipation in essentially voluntary quizzes, accounted for 54% of the variance in performance in the first accounting course. However, completion of high school accounting classes and cumulative college GPA had significance as well. In a study examining whether a background in mathematics determines performance in upper level courses, Ely and Hittle (1990) found that mathematical courses were an important determi-nant of performance in the managerial economics course but not in the fundamentals of finance course, perhaps because of the greater use of calculus in the managerial economics course.

Using a multiple regression analysis to assess the relative importance of various factors in explaining student perfor-mance in the first two college accounting courses, Doran, Bouillon, and Smith (1991) concluded that the most im-portant determinants of examination performance in both of these courses are academic performance and aptitude, as measured by cumulative GPA and ACT scores. More specifi-cally, they found that students’ performance on the first exam of the semester was the single most important predictor of performance on subsequent tests in both courses.

Von Allmen (1996) found that there is a strong relationship between performance in quantitative prerequisites, specifi-cally calculus courses, and performance in intermediate mi-croeconomics. He found that better grades in calculus lead to significantly better grades in microeconomics. Von Allmen distinguished between students who have taken a standard one-semester calculus course and those who came in with a weaker mathematics background and took a two-semester calculus course with an integrated review sequence. No sig-nificant relationship between these groups and their perfor-mance in microeconomics was found, indicating that students with weak skills can be brought up to the level of students

with stronger backgrounds. Von Allmen also found a positive relationship between students’ GPA and grades in the basic principles of economics course and their performance in the more advanced microeconomics course.

Borde et al. (1998) researched a number of factors, includ-ing gender, age, transfer status (from community college), GPA, membership in student organizations, hours of employ-ment, and performance in prerequisite accounting courses, and looked at their relationship to student performance in introductory corporate finance. They found that high per-formance in accounting prerequisites and a high prior over-all GPA were associated with high performance in finance. Also in 1998, Cohn, Cohn, Hult, Balch, & Bradley looked at the relationship between performance in a principles of macroeconomics course and several student attributes, in-cluding students’ mathematics background as measured by a mathematics skills pretest given at the beginning of the semester. They found a strong relationship between perfor-mance in the macroeconomics course and students’ GPA and SAT scores. However, neither the students’ completion of a calculus course nor their scores on the mathematics skills pretest had significant effect on their performance in the macroeconomics course. The authors suggested that mathe-matics background may be more important for a microeco-nomics course.

Marcal and Roberts (2001) investigated whether complet-ing a statistics prerequisite improves student performance in introductory finance. They found that students who have completed the statistics requirement perform better in finance than otherwise identical students. Additionally, they found that although higher statistics grades lead to better perfor-mance in finance, students who delayed and take finance long after completing statistics did not perform as well. Thus, they concluded that students’ understanding of statistics fades with time, affecting their performance in the introductory finance course.

RESEARCH METHODOLOGY AND RESULTS

Given that earlier studies have shown that performance in accounting, economics, and finance courses is a function of various prerequisite courses, it seems reasonable to assume that students gain knowledge in these prerequisite courses that helps them succeed in future courses. In this study, we hypothesized that student performance in the introductory finance course is a function of the quantitative knowledge brought to the course from mathematics, accounting, and economics prerequisites, as opposed to simply having suc-cessfully completed these prerequisite courses.

To test the hypothesis, a pretest was constructed to de-termine the level of quantitative skills (i.e., the mathemat-ics, accounting, and economics knowledge students have on entering the introductory finance course). A 25-question multiple-choice pretest was administered to students in the

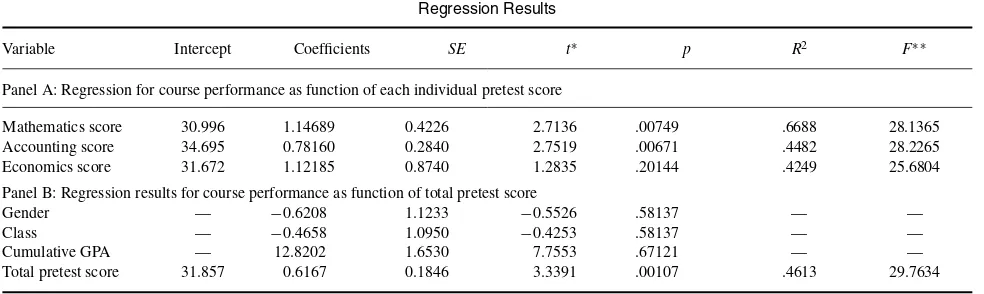

TABLE 1 Regression Results

Variable Intercept Coefficients SE t∗ p R2 F∗∗

Panel A: Regression for course performance as function of each individual pretest score

Mathematics score 30.996 1.14689 0.4226 2.7136 .00749 .6688 28.1365

Accounting score 34.695 0.78160 0.2840 2.7519 .00671 .4482 28.2265

Economics score 31.672 1.12185 0.8740 1.2835 .20144 .4249 25.6804

Panel B: Regression results for course performance as function of total pretest score

Gender — −0.6208 1.1233 −0.5526 .58137 — —

Class — −0.4658 1.0950 −0.4253 .58137 — —

Cumulative GPA — 12.8202 1.6530 7.7553 .67121 — —

Total pretest score 31.857 0.6167 0.1846 3.3391 .00107 .4613 29.7634

∗df=142 for alltvalues;∗∗df=4, 138 for allFvalues.

introductory finance course on the second day of class. Al-though the pretest was given by several different instruc-tors to virtually all students taking principles of finance over 2 semesters, we analyzed the results for just 149 students taught by the same professor. In this way, we controlled for instructor bias in pretest administration and in grading per-formance in the course. In addition to students’ raw scores on the pretest, their current GPA, gender, and year of study were collected. Participants included 74 male (49.6%) and 75 female (50.4%) students; in terms of year of study, there were 105 sophomores (70.5%), 43 juniors (28.9%), and 1 senior (0.6%).

Two regression models were estimated using the final course grade as the dependent variable; independent vari-ables included pretest scores (total pretest score in one model and individual mathematics, accounting, and economics scores as separate variables in the second model), GPA, gen-der, and year of study. Results from the first regression model that includes separate scores for mathematics, accounting, and economics are reported in Table 1, panel A. For the mathematics pretest score, the estimated model yielded a beta coefficient of 1.14,t(142)=2.71,p=.0074, which is significant at the.05 level; for the accounting pretest score, the estimated model yielded a coefficient of 0.78 (t=2.75, p=

0.0067), which is significant at the .05 level; and for the eco-nomics pretest score, the estimated model yields a coefficient of 1.12,t(142)=1.28,p=.2014), which is not significant at the.05 level. These results suggest that for each mathematics question answered correctly, there is an estimated increase in the course grade average of 1.1 points (on a scale of 100), whereas for each accounting question answered correctly, there is an estimated increase in course grade average of 0.78 points. Results from the regression model using the total pretest score are shown in Panel B. These results yielded a coefficient on the cumulative pretest score of 0.616,t(142)=

3.33,p=.0010, which is significant at the .05 level. This sug-gests that for each correct answer on the total pretest, there would be an increase of 0.61 points in final course grade.

Because of the likely relatedness of the quantitative vari-ables, there exists the possibility of multicollinearity. To ex-amine this possibility, an analysis of the regression variables for multicollinearity was undertaken. An analysis yielded variance inflation factors (VIF) between 1.0 and 1.5. These VIF values are quite low and support the conclusion that there is no multicollinearity among the pretest subject variables.

CONCLUSIONS

The results of the analysis conducted in this research suggest that the quantitative knowledge that students bring to the in-troductory finance course has an impact on their performance in the course. Thus, pretesting of certain quantitative knowl-edge may help indicate a student’s likely performance in an introductory finance course. Having such pretest knowledge may be useful to certain students by offering them suggested extra work early in the course to make up for any detected quantitative shortcomings.

Mathematics and accounting knowledge appeared to be more important than economics knowledge in affecting per-formance in finance. Cumulative GPA was found to have predictive power, whereas gender and year of study added no explanatory value, which is consistent with prior research. The lack of multicollinearity found suggests that weaknesses in accounting, economics, or mathematics may be targeted for additional preparatory work early in the finance course to offset any such deficiencies.

Because the sample used in this study was obtained from students at one university under one instructor, this research represents only a preliminary attempt at the issue. Adminis-tering the pretest using a larger sample set and with students from different institutions may result in more definitive find-ings. Conducting the test across different universities with different instructors should also provide a much larger data set, although it presents difficulties with controlling for pos-sible professor effects.

PRETEST IN AN INTRODUCTORY FINANCE COURSE 67

REFERENCES

Bellico, R. (1972). Prediction of undergraduate achievement in economics. Journal of Economic Education,2, 54–55.

Borde, S. F., Byrd, A. K., & Modani, N. K. (1998). Determinants of stu-dent performance in introductory corporate finance courses.Journal of Financial Education,24, 23–30.

Cohn, E., Cohn, S., Hult, R. E. Jr., Balch, D. C., & Bradley, J. Jr. (1998). The effects of mathematics background on student learning in principles of economics. Journal of Education for Business, 70, 18–22.

Doran, B. M., Bouillon, M. L., & Smith, C. G. (1991). Determinants of stu-dent performance in accounting principles I and II.Issues in Accounting Education,6, 74–84.

Ely, D. P., & Hittle, L. (1990). The impact of math background on perfor-mance in managerial economics and basic finance courses.Journal of Financial Education,19, 59–61.

Eskew, R. K., & Faley, R. H. (1988). Some determinants of student perfor-mance in the first college-level financial accounting course.The Account-ing Review,63, 137–147.

Marcal, L., & Roberts, W. W. (2001). Business statistics requirements and student performance in financial management.Journal of Financial Edu-cation,27, 29–35.

Schaffer, B. F., & Calkins, D. O. (1980). An appraisal of prerequisites to business finance.Journal of Financial Education,9, 51–55.

Von Allmen, P. (1996). The effect of quantitative prerequisites on perfor-mance in intermediate microeconomics.Journal of Education for Busi-ness,72, 18–22.