Full Terms & Conditions of access and use can be found at

http://www.tandfonline.com/action/journalInformation?journalCode=vjeb20

Journal of Education for Business

ISSN: 0883-2323 (Print) 1940-3356 (Online) Journal homepage: http://www.tandfonline.com/loi/vjeb20

Teaching the Indirect Method of the Statement of

Cash Flows in Introductory Financial Accounting: A

Comprehensive, Problem-Based Approach

Daniel R. Brickner & Gary B. Mccombs

To cite this article: Daniel R. Brickner & Gary B. Mccombs (2004) Teaching the Indirect Method

of the Statement of Cash Flows in Introductory Financial Accounting: A Comprehensive, Problem-Based Approach, Journal of Education for Business, 80:1, 41-46, DOI: 10.3200/ JOEB.80.1.41-46

To link to this article: http://dx.doi.org/10.3200/JOEB.80.1.41-46

Published online: 07 Aug 2010.

Submit your article to this journal

Article views: 25

hen teaching the indirect method of the statement of cash flows (SCF) in an introductory financial accounting course, instructors usually focus students’ understanding of (a) how the SCF is constructed and (b) why rec-onciling items are recorded in the oper-ating activities section. Certainly, the SCF is an integral financial statement for financial reporting purposes and an essential one for any business major to understand and interpret. Because of the relative importance of the SCF, we believe that a need exists in the literature for alternative instructional aids related to teaching it, especially in introductory financial accounting courses.

Alternative methods do exist for teach-ing and explainteach-ing the SCF. However, there is a relatively scant amount of liter-ature related to instructional resource materials for the SCF. Before the recent article by Rai (2003), the only other SCF instructional materials that we identified were by Donelan (1993) and Vent and Cocco (1996). In this article, we present a unique approach as an alternative to the strategies illustrated in several commonly used financial accounting textbooks.

Our instructional materials relate to preparing the SCF under the indirect method. Because enrollment in an

intro-ductory financial accounting course fre-quently includes a large number of nonaccounting majors, our school, like many others, adopted a balanced orien-tation between both users and preparers of financial accounting information. Consequently, because a financial state-ment user would need to know how to read and interpret the financial state-ments, emphasizing the indirect method of preparing the SCF in an introductory financial accounting course appears appropriate because most firms employ that approach in practice.

In teaching the indirect method of the SCF in an introductory financial

account-ing course, we first establish the criteria regarding where certain transactions or account changes are reported in the three sections of the statement. Once we have established these criteria, we then present an application of the financial statement by creating and completing a comprehen-sive, in-class example. This example illustrates how the SCF is prepared and enforces the reasons behind the adjust-ments made in the operating activities section under the indirect method.

Our example employs significant account analysis through journal entries or T-accounts for evaluating the impact of transactions on net income or cash. Alter-natively, instructors who de-emphasize or completely avoid the use of journal entries in introductory financial account-ing courses can modify the example by employing the accounting equation for account analysis instead of using journal entries. Our example primarily empha-sizes content from the operating activities section of the SCF. Specifically, our approach entails asking the following two questions to analyze how the trans-action should be treated in that section: (a) What was the transaction’s impact on cash? and (b) What was the transaction’s impact on net income? By correctly answering these two questions, students

Teaching the Indirect Method of the

Statement of Cash Flows in

Introductory Financial Accounting:

A Comprehensive,

Problem-Based Approach

DANIEL R. BRICKNER GARY B. McCOMBS Eastern Michigan University

Ypsilanti, Michigan

W

ABSTRACT.authors provide an instructionalIn this article, the resource for presenting the indirect method of the statement of cash flows (SCF) in an introductory financial accounting course. The authors focus primarily on presenting a comprehen-sive example that illustrates the “why” of SCF preparation and show how journal entries and T-accounts can be used in the analysis of the impact on net income and/or cash for each trans-action in their example. This approach can be viewed as an alternative to the methods illustrated in the accounting education literature and commonly used financial accounting textbooks.should be able to decipher the nature (i.e., positive or negative) and the amount of the adjustment necessary in the reconcil-iation of net income to cash flows in the operating activities section.

In this article, we explain our peda-gogical approach related to teaching the SCF in an introductory financial account-ing course and identify how it differs from approaches found in commonly used financial accounting textbooks. We then provide our comprehensive exam-ple, including both the related analysis and solution.

PEDAGOGICAL APPROACH COMPARED WITH FINANCIAL ACCOUNTING TEXTBOOKS

Our teaching approach begins by establishing the purpose and the objec-tives of the SCF. We follow this by clearly indicating in which of the SCF’s three sections those transactions or account changes are reported. After establishing these “prerequisites,” we present a comprehensive example that employs a great deal of account analy-sis, to explain and illustrate both the preparation and the format of the SCF.

Although this approach might appear to be a traditional one for teaching the SCF, we found that the textbooks that we have used over the past several years did not provide a comprehensive problem

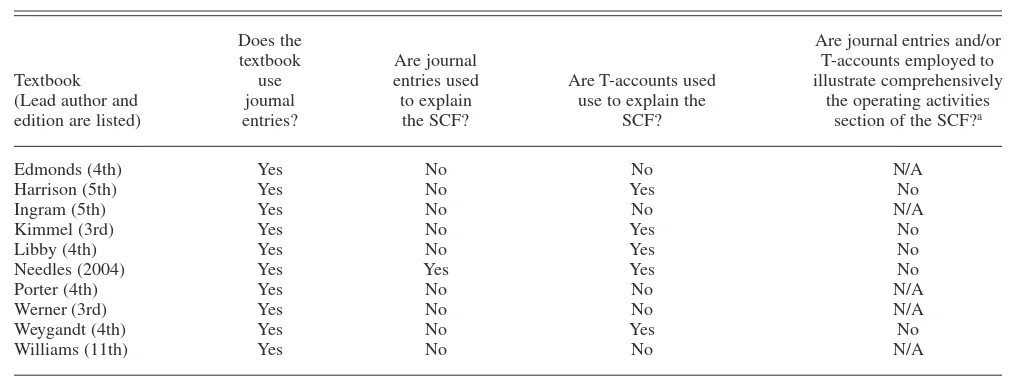

that effectively illustrated and explained how to prepare the SCF. Subsequently, we examined several other textbooks commonly used for introductory finan-cial accounting courses to determine whether a comprehensive illustration was prevalent. To our surprise, we found that all of the textbooks examined were defi-cient in providing a comprehensive example that employed commonly used analysis techniques such as journal entries and T-account analysis. In Table 1, we present a summary of our findings for the 10 textbooks we reviewed.

As shown in Table 1, each of the text-books that we reviewed employed jour-nal entries in some capacity. However, although many of the texts could be classified as either “preparer oriented” or oriented to both the preparer’s and user’s perspectives, only one of the texts (Needles, 2004) employed journal entries in explaining the preparation of the SCF. However, that text did not employ journal entries comprehensively in its illustration. This finding was sur-prising, because we believe that journal entries provide an effective analysis tool for explaining the SCF.

We also believe that T-account analy-sis is effective in explaining the adjust-ments in the operating activities section of the SCF. However, only half of the textbooks that we reviewed employed T-account analysis in explaining the

preparation of the SCF, and none among this subset used T-accounts comprehensively. Specifically, none of the textbooks that we examined employed T-account analysis to explain the adjustment for either the change in inventory or the treatment of gains and losses in the operating activities section of the SCF. We view these adjustments to be conceptually important.

Therefore, we have created an exam-ple that (a) provides analysis and

explains the rationale behind common

adjustments in the operating activities section of the SCF and (b) illustrates how to prepare this financial statement in its entirety. This illustration compre-hensively employs journal entries and T-accounts as analysis tools to aid stu-dent understanding of the SCF.

COMPREHENSIVE EXAMPLE WITH ANALYSIS OF THE SCF UNDER THE INDIRECT METHOD

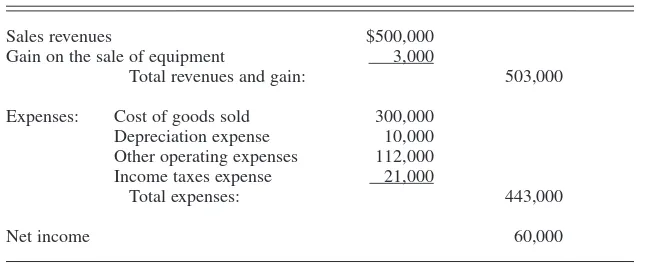

In Table 2, we present the income statement and additional data related to our comprehensive example.

Analysis of Individual Items in Completing the Example

Purchase of Equipment and Recording Depreciation Expense

General concept.As a long-term asset,

TABLE 1. Introductory Textbook Use of Journal Entries and T-Accounts to Explain the Statement of Cash Flows (SCF) (Indirect Method)

Does the Are journal entries and/or textbook Are journal T-accounts employed to Textbook use entries used Are T-accounts used illustrate comprehensively (Lead author and journal to explain use to explain the the operating activities edition are listed) entries? the SCF? SCF? section of the SCF?a

Edmonds (4th) Yes No No N/A Harrison (5th) Yes No Yes No Ingram (5th) Yes No No N/A Kimmel (3rd) Yes No Yes No Libby (4th) Yes No Yes No Needles (2004) Yes Yes Yes No Porter (4th) Yes No No N/A Werner (3rd) Yes No No N/A Weygandt (4th) Yes No Yes No Williams (11th) Yes No No N/A

aWe define comprehensive illustration of the preparation of the SCF as including the following common components found in a company’s operating

activ-ities section of the SCF: changes in accounts receivable, changes in inventory, changes in accounts payable, depreciation, and gains and/or losses.

the purchase of equipment for cash is recorded in the investing activities sec-tion of the statement of cash flows. Depreciation is included in total expens-es to derive net income; however, because it is a noncash expense, the accountant adds it back to net income to compute net cash flows from operating activities.

Example A. At the beginning of the

year, equipment was purchased for $55,000 cash. The equipment had an estimated useful life of 5 years and an estimated residual value of $5,000.

(1) The journal entry to record the equipment purchase would be:

Equipment 55,000

Cash 55,000

(2) The journal entry to record annual

depreciation expense for the equip-ment would be:

Depreciation expense 10,000

Accumulated depreciation 10,000 [Calculated: (55,000 – 5,000)/5 years

= $10,000]

Class discussion question.What was the

impact on both cash flows and net income from the above journal entries?

Answer. The impact on cash was an

out-flow of $55,000 from Transaction 1 and a $10,000 decrease in net income from Transaction 2.

Analysis. Because the $55,000 cash

out-flow in Transaction 1 relates to a pur-chase of a long-term asset, it is reported in the Investing Activities section. How-ever, in Journal Entry 2, because net

income is reduced by the $10,000 of depreciation expense but there was no cash outflow related to recording the expense, one would have to add $10,000 back to net income to derive net cash flows in the Operating Activities sec-tion. (Note: Without this adjustment for depreciation, the statement of cash flows would report a $65,000 total cash outflow related to the equipment for the year, as opposed to the correct amount of the $55,000 purchase price.)

Sale of Equipment for Cash, Resulting in a Gain

General concept. Cash proceeds from

the sale of equipment, a long-term asset, should be reported in the invest-ing activities section of the statement of cash flows. A gain from selling a long-term asset is included in total rev-enues (generally treated as “Other Revenue” on the income statement in deriving net income). Therefore, to prevent “double counting” the gain, the accountant must deduct it from net income to remove it from the operating activities section of the statement of cash flows.

Example B. Assume the equipment

referred to above was sold at the end of the first year for $48,000 (i.e., after $10,000 of depreciation had been record-ed, resulting in a book value of $45,000 and a gain of $3,000 on the disposal).

The journal entry to record the sale of the equipment would be:

Cash 48,000

Accumulated depreciation 10,000

Equipment 55,000

Gain on sale of equipment 3,000

Class discussion question. What was

the impact on both cash flows and net income from the above journal entry?

Answer. The impact on cash was an

inflow of $48,000. Net income increased by the $3,000 gain.

Analysis. Because the $48,000 cash

inflow relates to the sale of a long-term asset, it is reported in the “Investing Activities” section. However, because

TABLE 2. Income Statement and Additional Data for the Comprehensive Example

Sales revenues $500,000 Gain on the sale of equipment 3,000

Total revenues and gain: 503,000 Expenses: Cost of goods sold 300,000

Depreciation expense 10,000 Other operating expenses 112,000 Income taxes expense 21,000

Total expenses: 443,000 Net income 60,000

Additional Data

The company purchased equipment at the beginning of the year for $55,000. The equip-ment was sold at the end of the year for $48,000, resulting in a $3,000 gain.

All of the company’s purchases of inventory and sales to customers are on account. The only transactions affecting accounts payable during the year were for purchases of inventory and payments related to those purchases.

Accounts receivable increased during the year by $10,000. (The beginning balance of accounts receivable was $40,000.) Inventory decreased during the year by $50,000.

(The beginning balance of inventory was $75,000.) Accounts payable decreased during the year by $15,000. (The beginning balance of accounts payable was $35,000.)

There were no other changes in noncash current assets and current liabilities. The company issued common stock at par value for $70,000 during the year. A cash dividend of $5,000 was paid to shareholders during the year.

net income was increased by the $3,000 gain, it should be subtracted from net income in the Operating Activities sec-tion in order to prevent “doublecount-ing” it. (Note: Without this adjustment for the gain, the statement of cash flows would report a $51,000 total cash inflow related to the sale of the equipment for the year, as opposed to the correct amount of $48,000.)

Increase in Accounts Receivable

General concept. When accounts

receivable increases during a period, credit sales (which increase total rev-enues, and thus net income) exceed cash collections on account. The accountant deducts the increase in accounts receivable from net income to derive net cash flows from operating activities.

Example C. At the beginning of the

year, the company had a balance of $40,000 for accounts receivable. During the year, they had sales on account for $500,000. Also, they made cash collec-tions on account in the amount of $490,000 during the year.

(1) The summary journal entry for cred-it sales for the year would be:

Accounts receivable 500,000

Sales 500,000

(2) The summary journal entry for cash collections for the year would be:

Cash 490,000

Accounts receivable 490,000

Class discussion question. What was

the impact on both cash flows and net income from the above journal entries?

Answer. The impact on cash was an

inflow of $490,000. Net income increased by the $500,000 increase in sales revenues (ignoring the cost of inventory sold, which is discussed in the next example).

Analysis. The $490,000 cash inflow

relates to revenue transactions; there-fore, it is reported in the Operating Activities section. However, the above transactions increased revenues (and thus net income) by $500,000 (again,

ignoring the cost of inventory sold). Hence, in order to reconcile net income to net cash flows from operating activi-ties, $10,000 should be subtracted from net income. (Note: Without making this adjustment, the statement of cash flows would report a $500,000 cash inflow as opposed to the correct amount of $490,000.)

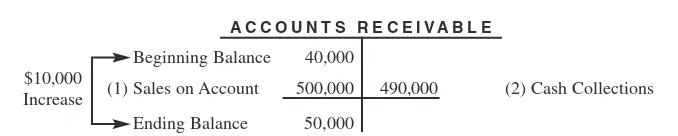

Student tip.Notice that the $10,000

neg-ative adjustment to net income (i.e., it is negative because it is being subtracted from net income) is exactly equal to the increase in accounts receivable during the year, as illustrated in the accounts receivable T-account shown in Figure 1.

Decreases in Both Inventory and Accounts Payable

General concept. The decreases for

these accounts imply that purchases of inventory on account are less than both the cost of inventory sold and cash pay-ments on accounts payable during the year (based on our example’s assump-tion that accounts payable is only affect-ed by purchases of inventory on account and payments on those purchases). Because the cost of goods sold is more than the cost of inventory purchases dur-ing the year, the decrease in inventory is added to net income in order to derive net cash flows from operating activities. Also, because the cash payments on account for inventory exceed the inven-tory purchases on account, the decrease in accounts payable is deducted from net income in deriving net cash flows from operating activities.

Example D. At the beginning of the

year, the company had a $75,000 ance for inventory and a $35,000 bal-ance for accounts payable. During the year, inventory in the amount of $250,000 was purchased on account,

inventory that cost $300,000 was sold, and payments on account amounted to $265,000 during the year.

(1) The summary journal entry for inventory purchases would be:

Inventory 250,000

Accounts payable 250,000

(2) The summary journal entry for recording the cost of inventory sold would be:

Cost of goods sold 300,000

Inventory 300,000

(3) The summary journal entry for payments on account would be:

Accounts payable 265,000

Cash 265,000

Class discussion question. What was

the impact on both cash flows and net income from the above journal entries?

Answer. The impact on cash was an

out-flow of $265,000. Net income decreased by the $300,000 increase in cost of goods sold (ignoring the effect of sales revenue, which was discussed in the pre-vious example).

Analysis. The $265,000 cash outflow

relates to expense transactions; therefore, it is reported in the Operating Activities section. However, the above transactions increased expenses (and thus reduced net income) by the $300,000 of cost of goods sold (again, ignoring sales revenues). Hence, to reconcile net income to net cash flows from operating activities, the accountant should add the difference of $35,000 to net income.

Student tips. Notice that the netpositive

adjustment of $35,000 to net income is

exactly equal to the net change in the

inventory and the accounts payable accounts combined. Specifically, inven-tory decreased by $50,000 during the

$10,000 Increase

Beginning Balance (1) Sales on Account

Ending Balance

FIGURE 1. Accounts receivable T-account related to Example C.

year, and accounts payable decreased by $15,000 during the year, as illustrated in the T-accounts presented in Figure 2.

An alternative way to remember the sign of the adjustment for changes in current assets or current liabilities in the operating activities’ reconciliation would be to examine what the change in the account balance implies. For example, if inventory decreases during the period, presumably inventory must have been sold. One would expect that when inventory is sold, cash would be received. Therefore, because there

would be a positive effect on cash when inventory decreases, the sign of the adjustment in the reconciliation related to the decrease in inventory is positive.

Similarly, when accounts payable decreases, the presumption is that account balances have been paid, thus resulting in a decrease in cash. Because there would be a negative effect on cash when accounts payable decreases, the sign of the adjustment in the reconcilia-tion related to the decrease in accounts payable is negative.

Issuance of Stock for Cash

General concept. The issuance of

stock is a source of financing for a cor-poration. Therefore, if cash is received in exchange for the stock, the cash proceeds from the sale are reported as a cash inflow in the financing activi-ties section of the statement of cash flows.

Example E. During the year, the

com-pany sold common stock at par value for $70,000.

The journal entry for the issuance of stock would be:

Cash 70,000

Common stock 70,000

Payment of a Cash Dividend

General concept. A cash dividend

rep-resents a form of return for sharehold-ers. Just as a shareholder’s investment (in the form of the purchase of stock) is reported in the financing activities sec-tion of the statement of cash flows, a return on that investment in the form of a cash dividend also is reported in the financing activities section; however, the cash dividend represents a cash out-flow to the firm.

Example F. During the year, the

com-pany paid a cash dividend of $5,000. The journal entry for the cash dividend would be:

Retained earnings 5,000

Cash 5,000

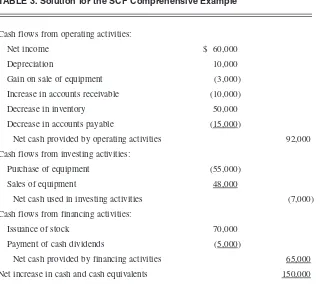

Upon completing the analysis for each item affecting the SCF in the com-prehensive example, the SCF can be prepared in its entirety. The SCF solu-tion for our example is provided in Table 3.

Conclusion

In this article, we presented our classroom approach to teaching the statement of cash flows (SCF) in the introductory financial accounting course. The primary component of our approach is a problem-based, compre-hensive example that employs journal entries and T-accounts as analysis tools to demonstrate how to prepare the SCF

250,000 $50,000

Decrease

Beginning Balance (1) Inventory Purchases

Ending Balance

(2) Cost of Inventory Sold

I N V E N T O R Y

75,000

250,000 300,000 25,000

FIGURE 2. T-accounts related to Example D.

$15,000 Decrease Beginning Balance

(1) Inventory Purchases Ending Balance (3) Payments on account

A C C O U N T S P A Y A B L E

35,000 265,000

20,000

TABLE 3. Solution for the SCF Comprehensive Example

Cash flows from operating activities:

Net income $ 60,000 Depreciation 10,000 Gain on sale of equipment (3,000) Increase in accounts receivable (10,000) Decrease in inventory 50,000 Decrease in accounts payable (15,000)

Net cash provided by operating activities 92,000 Cash flows from investing activities:

Purchase of equipment (55,000) Sales of equipment 48,000

Net cash used in investing activities (7,000) Cash flows from financing activities:

Issuance of stock 70,000 Payment of cash dividends (5,000)

Net cash provided by financing activities 65,000 Net increase in cash and cash equivalents 150,000

in its entirety under the indirect method. Our example emphasizes

explaining why adjustments are made

in the operating activities section by analyzing the effect of transactions on net income or cash. The approach that we have presented can be viewed as an alternative to methods illustrated in both commonly used financial account-ing textbooks and the accountaccount-ing edu-cation literature. Because of the impor-tance of a company’s SCF for financial reporting purposes, we hope that other accounting faculty members will find this instructional resource useful for both themselves and their students.

REFERENCES

Donelan, J. G. (1993). An integrated approach to teaching the statement of cash flows. Journal of Education for Business, 68(4), 234–236. Edmonds, T. P., McNair, F. M., Milam, E. E., &

Olds, P. R. (2003). Fundamental financial accounting concepts. New York: McGraw-Hill. Harrison, W. T., Jr., & Horngren, C. T. (2004).

Financial accounting. Upper Saddle River, NJ: Pearson Education.

Ingram, R. W., Albright, T. L., & Baldwin, B. A. (2004).Financial accounting: A bridge to deci-sion making. Mason, OH: South-Western. Kimmel, P. D., Weygandt, J. J., & Kieso, D. E.

(2004). Financial accounting: Tools for busi-ness decision making. New York: Wiley. Libby, R., Libby, P. A., & Short, D. G. (2004).

Financial accounting. New York: McGraw-Hill. Needles, B. E., Jr., & Power, M. (2004). Financial

accounting. Boston, MA: Houghton Mifflin.

Porter, G. A., & Norton, C. L. (2004). Financial accounting: The impact on decision makers. Mason, OH: South-Western.

Rai, A. (2003). Reconciliation of net income to cash flow from operations: An accounting equation approach. Journal of Accounting Edu-cation, 21(1), 17–24.

Vent, G. A., & Cocco, A. F. (1996). Teaching the cash flows from operations section of the state-ment of cash flows under the indirect method: A conceptual framework. Journal of Education for Business, 71(6), 344–347.

Werner, M. J., & Jones, K. H. (2004). Introduction to financial accounting: A user perspective. Upper Saddle River, NJ: Pearson Education. Weygandt, J. J., Kieso, D. E., & Kimmel, P. D.

(2003). Financial accounting. New York: Wiley.

Williams, J. R., Haka, S. F., Bettner, M. S., & Meigs, R. F. (2003). Financial accounting. New York: McGraw-Hill.

Statement of Ownership,Management,andCirculation

1. Publication Title 2. Publication Number 3. Filing Date

4. Issue Frequency 5. Number of Issues Published Annually 6. Annual Subscription Price

8. Complete Mailing Address of Headquarters or General Business Office of Publisher (Not printer)

9. Full Names and Complete Mailing Addresses of Publisher, Editor, and Managing Editor (Do not leave blank) Publisher (Name and complete mailing address)

Editor (Name and complete mailing address)

Managing Editor (Name and complete mailing address)

10. Owner (Do not leave blank. If the publication is owned by a corporation, give the name and address of the corporation immediately followed by the names and addresses of all stockholders owning or holding 1 percent or more of the total amount of stock. If not owned by a corporation, give the names and addresses of the individual owners. If owned by a partnership or other unincorporated firm, give its name and address as well as those of each individual owner. If the publication is published by a nonprofit organization, give its name and address.)

11. Known Bondholders, Mortgagees, and Other Security Holders Owning or Holding 1 Percent or More of Total Amount of Bonds, Mortgages, or Other Securities. If none, check box

12. Tax Status (For completion by nonprofit organizations authorized to mail at nonprofit rates) (Check one)

Has Not Changed During Preceding 12 Months

PS Form 3526, October 1999

Has Changed During Preceding 12 Months (Publisher must submit explanation of change with this statement) None

(See Instructions on Reverse) 7. Complete Mailing Address of Known Office of Publication (Not printer) (Street, city, county, state, and ZIP+4)

_

Contact Person

Telephone

The purpose, function, and nonprofit status of this organization and the exempt status for federal income tax purposes:

Full Name Complete Mailing Address

Complete Mailing Address Full Name

United States Postal Service

JOURNAL OF EDUCATION FOR BUSINESS

ISSN: 0883-2323 2 7 8 5 8 0

October 1, 2004

Bi-monthly 6 Institutions $87

Individuals $51

1319 Eighteenth Street NW, Washington DC 20036-1802

Fred Huber

1319 Eighteenth Street NW, Washington DC 20036-1802

202-296-6267

Helen Dwight Reid Educational Foundation 1319 Eighteenth Street NW, Washington DC 20036-1802

Board of Executive Editors

1319 Eighteenth Street NW, Washington DC 20036-1802

Isabella Owen Perelman

1319 Eighteenth Street NW, Washington DC 20036-1802

Helen Dwight Reid Educational Foundation 1319 Eighteenth Street NW, Washington DC 20036-1802

XX

XX

PS Form 3526, October 1999 (Reverse)

Extent and Nature of Circulation Average No. Copies Each IssueDuring Preceding 12 Months No. Copies of Single IssuePublished Nearest to Filing Date

Total Paid and/or Requested Circulation [Sum of 15b. (1), (2),(3),and (4)]

Paid In-County Subscriptions Stated on Form 3541 (Include advertiser's proof and exchange copies)

Free

Total Free Distribution (Sum of 15d. and 15e.)

Total (Sum of 15g. and h.)

17. Signature and Title of Editor, Publisher, Business Manager, or Owner 13. Publication Title

15.

Percent Paid and/or Requested Circulation (15c. divided by 15g. times 100)

Publication required. Will be printed in the ________________________ issue of this publication. Date Free Distribution Outside the Mail

(Carriers or other means)

Total Distribution (Sum of 15c. and 15f)

14. Issue Date for Circulation Data Below

16. Publication of Statement of Ownership b. Paid and/or

Requested Circulation

Copies not Distributed

Paid/Requested Outside-County Mail Subscriptions Stated on Form 3541. (Include advertiser's proof and exchange copies) (1)

(2)

(4)Other Classes Mailed Through the USPS Sales Through Dealers and Carriers, Street Vendors, Counter Sales, and Other Non-USPS Paid Distribution (3)

Outside-County as Stated on Form 3541

In-County as Stated on Form 3541

Other Classes Mailed Through the USPS

e.

1. Complete and file one copy of this form with your postmaster annually on or before October 1. Keep a copy of the completed form for your records.

2. In cases where the stockholder or security holder is a trustee, include in items 10 and 11 the name of the person or corporation for whom the trustee is acting. Also include the names and addresses of individuals who are stockholders who own or hold 1 percent or more of the total amount of bonds, mortgages, or other securities of the publishing corporation. In item 11, if none, check the box. Use blank sheets if more space is required.

3. Be sure to furnish all circulation information called for in item 15. Free circulation must be shown in items 15d, e, and f.

4. Item 15h., Copies not Distributed, must include (1) newsstand copies originally stated on Form 3541, and returned to the publisher, (2) estimated returns from news agents, and (3), copies for office use, leftovers, spoiled, and all other copies not distributed.

5. If the publication had Periodicals authorization as a general or requester publication, this Statement of Ownership, Management, and Circulation must be published; it must be printed in any issue in October or, if the publication is not published during October, the first issue printed after October.

6. In item 16, indicate the date of the issue in which this Statement of Ownership will be published.

7. Item 17 must be signed.

Failure to file or publish a statement of ownership may lead to suspension of Periodicals authorization. I certify that all information furnished on this form is true and complete. I understand that anyone who furnishes false or misleading information on this form or who omits material or information requested on the form may be subject to criminal sanctions (including fines and imprisonme nt) and/or civil sanctions (including civil penalties).

a. Total Number of Copies (Net press run)

JOURNAL OF EDUCATION FOR BUSINESS

XX Sept/Oct 2004